Toyota Tsusho Bundle

Can Toyota Tsusho Company Maintain Its Momentum?

Founded in 1948, Toyota Tsusho has transformed from a trading arm supporting Toyota's automotive business into a global powerhouse. Today, this diversified conglomerate operates across numerous sectors, showcasing its impressive scale and market position. A key strategic move, the March 2025 acquisition of Radius Recycling Inc., highlights its commitment to the circular economy and resource security.

This article dives deep into the Toyota Tsusho SWOT Analysis, exploring the company's ambitious Toyota Tsusho Growth Strategy and Toyota Tsusho Future Prospects. We'll analyze its strategic initiatives, including recent Toyota Tsusho Investments, and examine how it navigates the complexities of the global market to ensure sustained Toyota Tsusho Performance. Discover how Toyota Tsusho plans to achieve its vision of being an indispensable partner, focusing on its Toyota Tsusho Business and expansion plans, including projects in Africa, and its approach to Toyota Tsusho supply chain management and Toyota Tsusho renewable energy projects.

How Is Toyota Tsusho Expanding Its Reach?

The Toyota Tsusho Growth Strategy is marked by significant expansion across various sectors and regions. This strategy is designed to boost its Toyota Tsusho Business and secure its Toyota Tsusho Future Prospects. The company is actively pursuing new ventures and investments to diversify its revenue streams and adapt to changing market conditions, as highlighted in a recent article discussing Mission, Vision & Core Values of Toyota Tsusho.

A key focus of Toyota Tsusho Company is strengthening its automotive value chain. This is evident through strategic acquisitions and investments aimed at enhancing its presence in key markets. Furthermore, the company is heavily investing in renewable energy projects and expanding its geographic footprint, particularly in Africa.

These initiatives demonstrate Toyota Tsusho's commitment to sustainable growth and addressing social issues while expanding its global presence. The company's approach includes a combination of organic growth and strategic acquisitions, positioning it for long-term success. The company's focus on strategic initiatives is aimed at adapting to market changes and ensuring long-term growth.

The acquisition of Carpaydiem in March 2025, a used car export and sales business, significantly boosts Toyota Tsusho's automotive sector. This move enhances its presence in the used car market, particularly for exports to Africa and other regions. This expansion aligns with the Toyota Tsusho automotive industry outlook, aiming to capitalize on growing demand.

The integration of Terras Energy Corporation and Eurus Energy Holdings Corporation, effective April 1, 2025, is a major push into renewable energy. This integration creates Japan's leading wind and solar power company. This strategic move is expected to drive significant Toyota Tsusho revenue growth forecast.

Africa remains a high-growth market for Toyota Tsusho, with several ongoing projects. AEOLUS SAS, a joint venture, is accelerating growth in Africa's renewable energy sector. Participation in IPP projects in Tunisia further solidifies its commitment to the continent. These Toyota Tsusho expansion plans Africa are part of a broader strategy.

Investment in LOGIQUEST INCORPORATED enhances Toyota Tsusho's presence in the 'last mile delivery' category. A partnership with Kujukuri Town in Chiba Prefecture promotes agriculture and regional revitalization. These initiatives demonstrate a commitment to both market diversification and addressing social issues, contributing to Toyota Tsusho's sustainability initiatives.

Toyota Tsusho's expansion strategy is multifaceted, focusing on key areas to drive growth. The company is actively involved in renewable energy projects, particularly wind and solar power, with plans to expand capacity. Strategic acquisitions, such as Carpaydiem, are enhancing its presence in the automotive sector.

- Acquisition of Carpaydiem to strengthen automotive value chain.

- Integration of Terras Energy Corporation and Eurus Energy Holdings Corporation to create a leading renewable energy company.

- Expansion of wind power plant in Egypt to build Africa's largest wind power facility (654 MW).

- Investment in logistics and regional revitalization projects.

Toyota Tsusho SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Toyota Tsusho Invest in Innovation?

The Toyota Tsusho Growth Strategy is heavily reliant on technological innovation and strategic investments to ensure a strong Toyota Tsusho Future Prospects. The company is actively pursuing digital transformation, AI, and sustainability to enhance its market position. This approach is designed to meet evolving customer needs and preferences in a rapidly changing global environment.

Toyota Tsusho Company is focusing on leveraging these technological advancements to create new business opportunities and improve operational efficiency. This includes exploring quantum computing and AI applications across various sectors. These efforts are supported by substantial investments and strategic partnerships aimed at driving long-term growth and value creation.

The company's commitment to sustainability is another key element of its growth strategy. Toyota Tsusho is investing in renewable energy projects and green infrastructure, reflecting its dedication to environmental stewardship and sustainable business practices. This commitment aligns with the increasing global demand for eco-friendly solutions and positions the company for future success.

Toyota Tsusho is investing approximately 53 billion yen in digital transformation (DX) projects. This investment spans the three years from the current fiscal year to the fiscal year ending March 31, 2026. The goal is to streamline management and enhance customer value.

As of March 2023, Toyota Tsusho had 696 DX projects in progress. These projects are implemented across various departments and business units within the company. This demonstrates a broad commitment to digital transformation.

In February 2025, Toyota Tsusho partnered with ORCA Computing. The aim is to provide ORCA's PT Series quantum computing systems to customers in Japan and the Asia Pacific region. This is to leverage quantum-enhanced approaches.

In April 2025, IonQ and Toyota Tsusho announced an agreement to advance quantum computing opportunities in Japan. This involves introducing IonQ's quantum computing and networking technologies to Japanese enterprises. This will help to advance Toyota Tsusho Business.

Five Toyota Group companies, including Toyota Tsusho, are accelerating skill development and innovation in AI and software. This was announced in May 2025. The aim is to improve Toyota Tsusho Performance.

In February 2025, Toyota Tsusho received the highest rating of 'A List Company' for 'CDP Climate Change,' 'CDP Forests,' and 'CDP Water Security'. This recognizes its environmental leadership. This is a part of Toyota Tsusho Sustainability Initiatives.

Toyota Tsusho is actively engaged in various sustainability projects to support its long-term growth strategy. These initiatives demonstrate the company's commitment to environmental responsibility and innovation. These are part of Toyota Tsusho Strategic Initiatives.

- Pilot project for bio-methane production from sugarcane waste in Brazil, launched in February 2025.

- Design and verification for commercialization of hydrogen supply infrastructure in the Port of Nagoya, commenced in May 2025.

- These projects highlight Toyota Tsusho's dedication to technological innovation and its role in fostering a sustainable future.

- For more insights into the company's market focus, consider reading about the Target Market of Toyota Tsusho.

Toyota Tsusho PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Toyota Tsusho’s Growth Forecast?

The financial outlook for Toyota Tsusho Company is robust, reflecting a strategic focus on growth and shareholder value. The company's performance in the fiscal year ended March 31, 2025, demonstrates this strength, with increased revenue and profit. This positive trajectory is supported by ambitious targets outlined in the Medium-term Management Plan.

Toyota Tsusho's financial strategy emphasizes consistent returns to shareholders and strategic investments in growth areas. The company's commitment to increasing the dividend payout ratio and implementing a stock split underscores its dedication to providing value to investors. These initiatives are designed to enhance the company's appeal in the market.

The company's financial health is further evidenced by its solid balance sheet, with a healthy equity ratio and positive free cash flow. These financial metrics provide a strong foundation for future growth. The company's strategic initiatives and investments are designed to capitalize on opportunities in various sectors.

For the fiscal year ended March 31, 2025, Toyota Tsusho reported revenue of 10,309.55 billion yen, a 1.2% increase year-on-year. The profit attributable to owners of the parent was 362.506 billion yen, reflecting a 9.4% increase year-on-year. Basic earnings per share were 343.40 yen.

Toyota Tsusho anticipates a profit attributable to owners of the parent of 340.0 billion yen for the fiscal year ending March 31, 2026. This forecast indicates continued profitability and stability. The company's strategic investments and initiatives support this outlook.

The Medium-term Management Plan (FY2025-FY2027) targets a net income of 400 billion yen and a Return on Equity (ROE) of 13% or more by FY2027. Over these three years, the company plans to invest over 1 trillion yen. These investments are designed to drive sustainable growth.

Starting in fiscal year 2025, the dividend payout ratio has increased to a minimum of 40%. The company aims to distribute 300 yen per share annually by FY2025, up from 280 yen per share in FY2024. A three-for-one stock split in July 2024 aims to attract income-focused investors.

These financial strategies are detailed in a recent market analysis report, providing investors with a comprehensive view of the company's performance and future prospects. The company's commitment to shareholder returns, coupled with strategic investments, positions it well for long-term growth. The projected dividend yield is expected to rise to 4.3% by 2025, making the company an attractive option for investors. For more details, you can refer to this article about Toyota Tsusho's strategic initiatives.

As of March 31, 2025, consolidated assets totaled 7,057.4 billion yen. The equity ratio stood at 37.2%, and the net debt/equity ratio was 0.4. The company's strong financial position supports its growth initiatives.

Free cash flow was a positive 388.0 billion yen, an increase of 65.4 billion yen from the previous fiscal year. This strong cash flow provides flexibility for investments and shareholder returns. The positive cash flow indicates efficient operations.

Analysts project the dividend yield to rise to 4.3% by 2025. This increase makes the company an attractive option for income-focused investors. The rising dividend yield reflects the company's commitment to shareholder value.

The company plans to invest over 1 trillion yen over three years (FY2025-FY2027). These investments are aimed at driving growth and expanding the company's presence in key markets. The strategic investments will focus on key growth areas.

A three-for-one stock split was implemented in July 2024. This split aims to make the stock more accessible to a wider range of investors. The stock split is part of the company's strategy to attract more investors.

The company aims to achieve a Return on Equity (ROE) of 13% or more by FY2027. This target reflects the company's commitment to profitability and efficient use of capital. The ROE target is a key performance indicator.

Toyota Tsusho Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Toyota Tsusho’s Growth?

The Toyota Tsusho Company, despite its diversified business model and ambitious Toyota Tsusho Growth Strategy, faces several potential risks and obstacles that could impact its Toyota Tsusho Future Prospects. These challenges span market competition, fluctuating economic conditions, regulatory changes, and the rapid pace of technological advancements. Navigating these complexities requires strategic agility and robust risk management practices.

One of the primary concerns is market competition across its diverse business segments, including automotive, metals, and renewable energy. The company's profitability is also vulnerable to volatile market conditions, especially in sectors like metals, as seen with the performance of Radius Recycling. Furthermore, geopolitical tensions and regulatory changes pose significant risks, particularly in regions where Toyota Tsusho has a strong presence, such as Africa.

Supply chain vulnerabilities, especially within the automotive sector, can significantly impact operations. The stagnation of domestic production figures due to vehicle certification issues and plant suspensions highlights ongoing supply chain risks. To mitigate these challenges, Toyota Tsusho must maintain a proactive approach to supply chain management and adapt to changing market dynamics.

Toyota Tsusho Business operates in highly competitive markets. This competition can squeeze profit margins and demand continuous innovation. The automotive, metals, and renewable energy sectors all present unique competitive pressures.

Fluctuating market conditions, particularly in the metals sector, can significantly affect profitability. The performance of acquired businesses, like Radius Recycling, can be influenced by these economic shifts. Economic downturns can reduce demand and lower revenue.

Regulatory changes and geopolitical tensions can disrupt supply chains and trade agreements. The company's presence in Africa and other regions exposes it to these risks. Political instability can create uncertainty and hinder expansion plans.

Supply chain disruptions, especially in the automotive industry, can impact operations. Vehicle certification scandals and plant suspensions can restrict production. Effective Toyota Tsusho supply chain management is essential to mitigate these risks.

The rapid pace of technological advancements requires continuous adaptation and significant investment. Toyota Tsusho Investments in digital transformation and new technologies are crucial. Internal resource constraints can hinder the adoption of new technologies.

Developing human resources with the necessary skills for digital transformation is a key challenge. Dedicated programs are in place to address this. Skill gaps can limit the company's ability to capitalize on new opportunities.

Toyota Tsusho employs a comprehensive approach to mitigate these risks, including diversification across various business segments and geographical regions. The company aims to stabilize and improve profitability in acquired businesses by creating more stable business models and leveraging complementary relationships within the Toyota Tsusho Group. These initiatives are part of their Toyota Tsusho strategic initiatives.

The company's Toyota Tsusho Performance is influenced by various factors, including market conditions and strategic decisions. For example, Radius Recycling's net income loss for the fiscal year ended August 31, 2024, illustrates the impact of deteriorating market conditions. A thorough Toyota Tsusho market analysis report is essential for making informed decisions.

Toyota Tsusho has a significant Toyota Tsusho global presence, including substantial operations in Africa. The company's Toyota Tsusho expansion plans Africa are crucial for its long-term growth. Geopolitical risks and supply chain disruptions can impact these plans.

The Toyota Tsusho automotive industry outlook and its investments in Toyota Tsusho renewable energy projects are key to its future. Technological advancements and changing consumer preferences are shaping the automotive sector. The company's sustainability initiatives are also becoming increasingly important.

Understanding Toyota Tsusho investment opportunities and the Toyota Tsusho long term growth strategy is crucial. The company's ability to adapt to challenges will determine its success. For more insights, consider exploring the Competitors Landscape of Toyota Tsusho.

Toyota Tsusho challenges and opportunities are intertwined. While risks exist, the company's diversification and strategic initiatives position it for growth. Continuous adaptation and proactive risk management are essential for navigating the evolving business environment. The Toyota Tsusho revenue growth forecast depends on these factors.

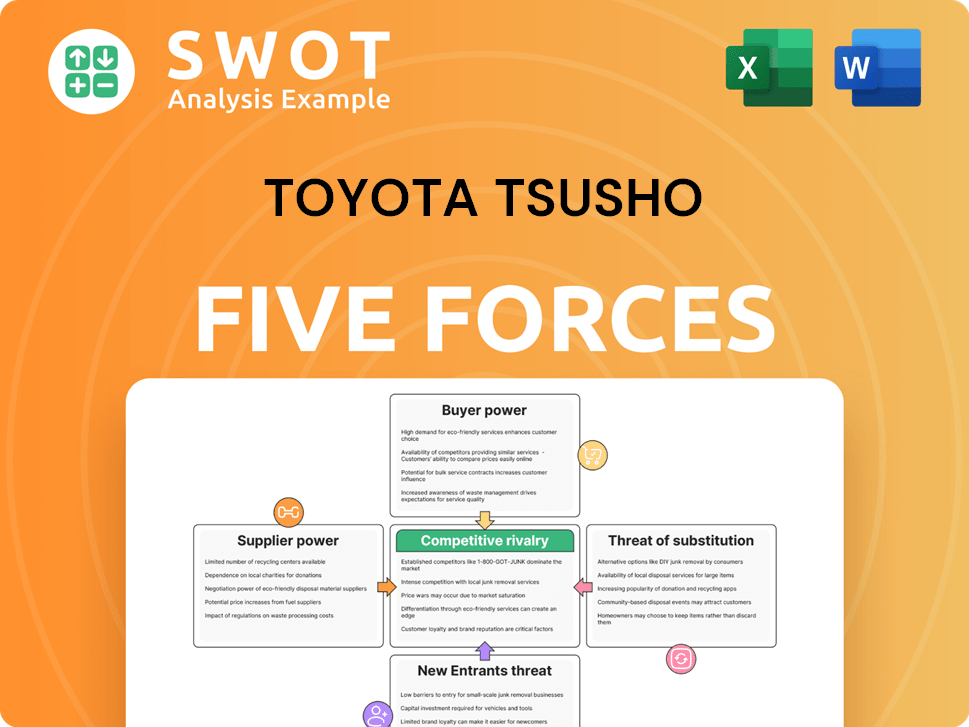

Toyota Tsusho Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Toyota Tsusho Company?

- What is Competitive Landscape of Toyota Tsusho Company?

- How Does Toyota Tsusho Company Work?

- What is Sales and Marketing Strategy of Toyota Tsusho Company?

- What is Brief History of Toyota Tsusho Company?

- Who Owns Toyota Tsusho Company?

- What is Customer Demographics and Target Market of Toyota Tsusho Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.