Ubiquiti Bundle

Can Ubiquiti Continue Its Ascent in the Networking World?

Ubiquiti, a disruptor in the networking industry since 2005, has carved a significant niche by offering cost-effective solutions and fostering a strong community. With a current market capitalization of $23.79 billion as of May 2025, the company's influence spans over 200 countries, providing essential networking infrastructure. This analysis delves into the Ubiquiti SWOT Analysis to uncover the company's strategies for future success.

Ubiquiti's impressive Ubiquiti financial performance, with approximately $1.9 billion in revenue for fiscal year 2024, underscores its robust Ubiquiti market share and ability to compete effectively. This report explores the Ubiquiti growth strategy focusing on expansion, innovation, and financial planning, including how Ubiquiti plans to diversify revenue streams and expand its UniFi platform. Furthermore, we will examine Ubiquiti's future prospects, including its integration of AI-driven products and its potential in the wireless market, offering insights into its long-term growth strategies and competitive landscape.

How Is Ubiquiti Expanding Its Reach?

The expansion initiatives of Ubiquiti are centered on entering new markets, launching innovative products, and diversifying its revenue streams. A key focus is the ongoing development of the UniFi platform, which provides unified IT management solutions. This strategy includes integrating AI-driven products to capture emerging opportunities, which is crucial for the company's future outlook. The company's focus on the UniFi ecosystem is a vital aspect of its growth strategy.

Ubiquiti's strategy involves enhancing its product offerings to meet evolving customer needs. This includes entering the Internet of Things (IoT) space with products like smart door access systems and electric vehicle (EV) chargers. This diversification helps expand its addressable market. Ubiquiti continues to expand its product lines and invest in research and development to support product innovation and market expansion. This approach is essential for its long-term growth strategies.

Ubiquiti's expansion relies on a global network of over 100 distributors and online retailers to sell its products in over 75 countries. This distribution model minimizes traditional sales force costs and enables competitive pricing. The company's ability to maintain a lean operational structure is a key factor in its financial performance.

Ubiquiti is actively expanding its UniFi platform, which offers unified IT management. This expansion includes integrating AI-driven products to capture new opportunities. The UniFi ecosystem is a key area of focus for Ubiquiti's future prospects.

The company is entering the Internet of Things (IoT) space with products such as smart door access systems and electric vehicle (EV) chargers. These new product launches help diversify revenue streams and expand the addressable market. This is part of Ubiquiti's expansion into new markets.

Ubiquiti continues to expand its product lines, including UniFi for enterprise networking, AmpliFi for consumer mesh Wi-Fi, and airMAX for wireless networking. These products cater to various customer segments globally. This strategic approach is crucial for Ubiquiti's market share.

Ubiquiti relies on a global network of over 100 distributors and online retailers to sell its products in over 75 countries. This minimizes traditional sales force costs and enables competitive pricing. This efficient distribution model supports Ubiquiti's financial performance.

Ubiquiti's expansion initiatives are multifaceted, focusing on product innovation, market diversification, and strategic partnerships. These strategies are designed to drive revenue growth and enhance the company's market position. For more insights into the company's ownership structure, you can read the article about Owners & Shareholders of Ubiquiti.

- Entering new markets with innovative products.

- Expanding the UniFi platform with AI-driven features.

- Diversifying revenue streams through IoT and other product categories.

- Leveraging a global distribution network for efficient market reach.

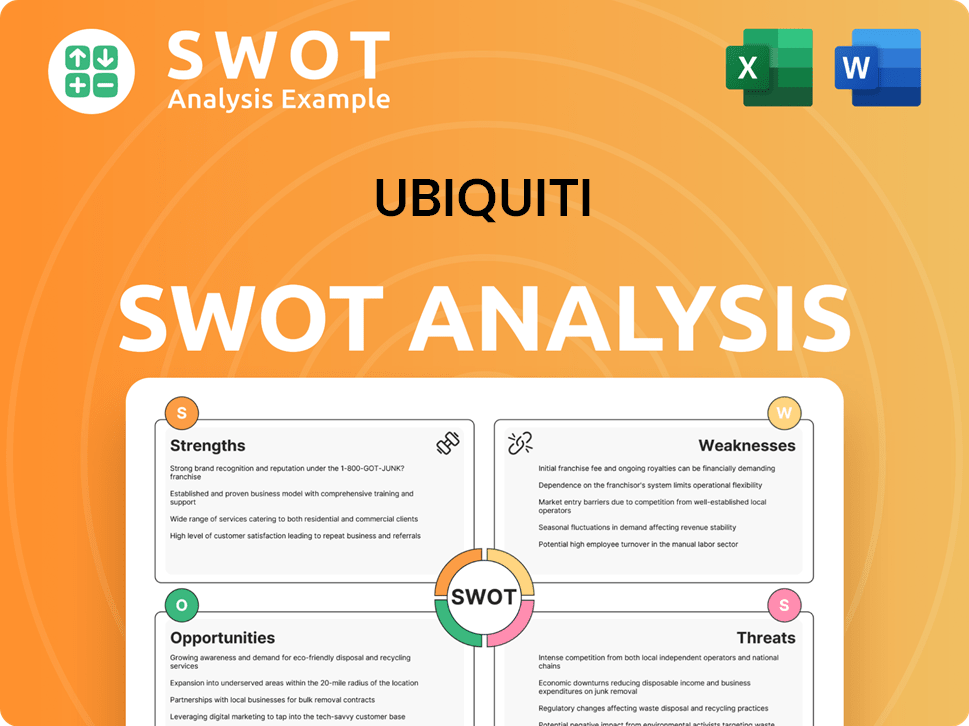

Ubiquiti SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ubiquiti Invest in Innovation?

The company's approach to innovation and technology is central to its long-term Marketing Strategy of Ubiquiti and future growth. Ubiquiti consistently invests in research and development to maintain its competitive edge in the networking solutions market. This focus allows the company to develop cutting-edge products and expand its market reach.

Ubiquiti's commitment to technological advancement is evident in its financial investments. The company strategically allocates resources to R&D, ensuring a pipeline of innovative products. This strategy is crucial for staying ahead in the rapidly evolving technology landscape and driving sustainable growth.

Ubiquiti's innovation strategy includes integrating AI-driven products and expanding its UniFi platform. This approach broadens its market and enhances its offerings. The company's focus on proprietary software, firmware expertise, and hardware design differentiates it from competitors, supporting its long-term growth strategies.

Ubiquiti's R&D expenses were $159.8 million in fiscal year 2024, an increase from $145.2 million in fiscal year 2023. This reflects the company's dedication to product development and innovation, which is a key driver for Ubiquiti growth strategy.

In fiscal year 2024, R&D expenses reached $233.8 million, representing 12.8% of total revenue. This significant investment underscores Ubiquiti's commitment to technological advancement and its focus on Ubiquiti future prospects.

Ubiquiti is integrating AI-driven products and expanding its UniFi platform. This includes products like smart door access systems and EV chargers. These initiatives are part of Ubiquiti's expansion plans and are designed to broaden its addressable market.

Ubiquiti differentiates itself through proprietary software, firmware expertise, and hardware design. This approach allows the company to maintain a strong market position and drive innovation in networking solutions.

Ubiquiti utilizes a community-driven model and direct/online distribution. This strategy helps minimize sales and marketing expenses, allowing the company to focus resources on product innovation and maintain its competitive edge.

Ubiquiti anticipates increasing its R&D personnel and expenses over time. This continued investment is crucial for sustaining its leadership in networking technology and achieving its long-term growth strategies.

Ubiquiti's approach to innovation is multifaceted, focusing on both technological advancements and strategic market expansion. The company leverages its strengths in proprietary design and community engagement to drive growth.

- R&D Investment: Consistent investment in research and development, with a focus on increasing R&D spending over time.

- AI Integration: Integrating AI-driven products into its portfolio, such as smart door access systems and EV chargers.

- UniFi Platform Expansion: Expanding the UniFi platform to broaden its addressable market and enhance its product offerings.

- Proprietary Design: Leveraging proprietary software, firmware expertise, and hardware design capabilities to differentiate itself.

- Direct Distribution: Utilizing a community-driven model and direct/online distribution to optimize resource allocation.

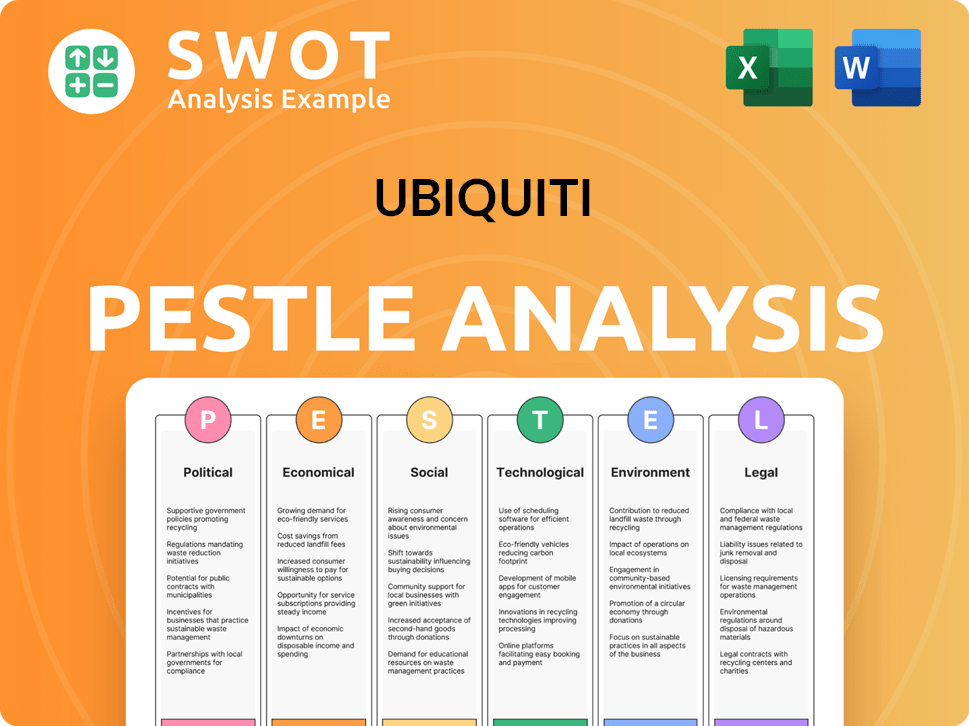

Ubiquiti PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Ubiquiti’s Growth Forecast?

The financial outlook for Ubiquiti showcases robust performance and promising growth trajectories for fiscal years 2024 and 2025. The company's strategic focus on innovation and market expansion is evident in its financial results. This performance underscores the effectiveness of its growth strategy and its strong position in the networking solutions market.

Ubiquiti's financial success is driven by strong demand in its enterprise technology and service provider technology segments. The company's ability to consistently increase revenue and profitability highlights its competitive advantage. This financial health supports Ubiquiti's ability to invest in future growth and maintain its market share.

For the second quarter of fiscal 2025, Ubiquiti reported revenues of approximately $600 million, marking a 29% year-over-year increase. GAAP net income for the same period surged 67% to $137 million, with GAAP earnings per share (EPS) climbing to $2.28. In the third quarter of fiscal 2025, revenues reached $664.2 million, a 34.7% increase from the prior year, primarily due to growth in the Enterprise Technology platform. GAAP diluted EPS for Q3 fiscal 2025 was $2.98, an increase of 136.5%.

Ubiquiti's revenue growth is primarily driven by strong demand in its enterprise technology and service provider technology segments. The company's continuous innovation in networking solutions and expansion into new markets also contribute significantly. This growth is a testament to Ubiquiti's effective market strategies.

Ubiquiti holds a strong market position, benefiting from its innovative networking solutions and competitive pricing. Its focus on the enterprise technology and service provider segments allows it to capture significant market share. The company's growth strategy supports its market dominance.

For the full fiscal year 2024, Ubiquiti reported revenues of $1.9 billion and a net income of $350.0 million. The gross profit margin was 44%, demonstrating strong profitability. This financial performance highlights the company's ability to manage costs effectively while driving revenue growth.

For the trailing 12 months ending March 31, 2025, Ubiquiti's gross profit margin was 42.16%, a 9.09% increase year over year. The company's net profit margin for the quarter ending March 31, 2025, was 23.65%, while the average net profit margin for 2024 was 19.13%. These margins reflect the company's operational efficiency and pricing strategies.

Analysts forecast Ubiquiti's revenue to grow by 1.7% per annum on average during the next two years, compared to a 7.3% growth forecast for the Communications industry in the US. EPS is expected to grow by 12.34% next year, from $7.21 to $8.10 per share. Ubiquiti's financial outlook indicates continued expansion, supported by its innovative technology and strong market position. The company's revenue streams and business model contribute to its sustained financial health.

Ubiquiti's Board of Directors has consistently declared a $0.60 per share cash dividend, demonstrating its commitment to shareholder value. The company also repaid $155.6 million under its credit facilities during the three months ended September 30, 2024, and plans to continue its debt reduction strategy.

Ubiquiti's strong financial performance and growth prospects make it an attractive investment. The expected EPS growth of 12.34% next year, from $7.21 to $8.10 per share, indicates positive investment potential. Investors should consider the company's strategic initiatives and market position.

Ubiquiti aims to continue its growth trajectory by leveraging its strong financial position and innovative technology solutions. The company's expansion into new markets and its focus on customer acquisition and retention are key strategies. These initiatives support long-term growth.

Ubiquiti faces both challenges and opportunities in the competitive networking market. Its ability to innovate and adapt to changing market dynamics will be crucial. The company's focus on technology and customer satisfaction positions it well for future growth.

A competitive analysis reveals Ubiquiti's strengths in terms of innovation, pricing, and market position. The company's strategies for customer acquisition and retention are key to maintaining its competitive edge. Ubiquiti's market position compared to competitors is strong.

Ubiquiti's long-term growth strategies include continuous innovation in networking solutions and expansion into new markets. The company's focus on the Internet of Things (IoT) and new product launches will drive future revenue. These strategies support Ubiquiti's long-term success.

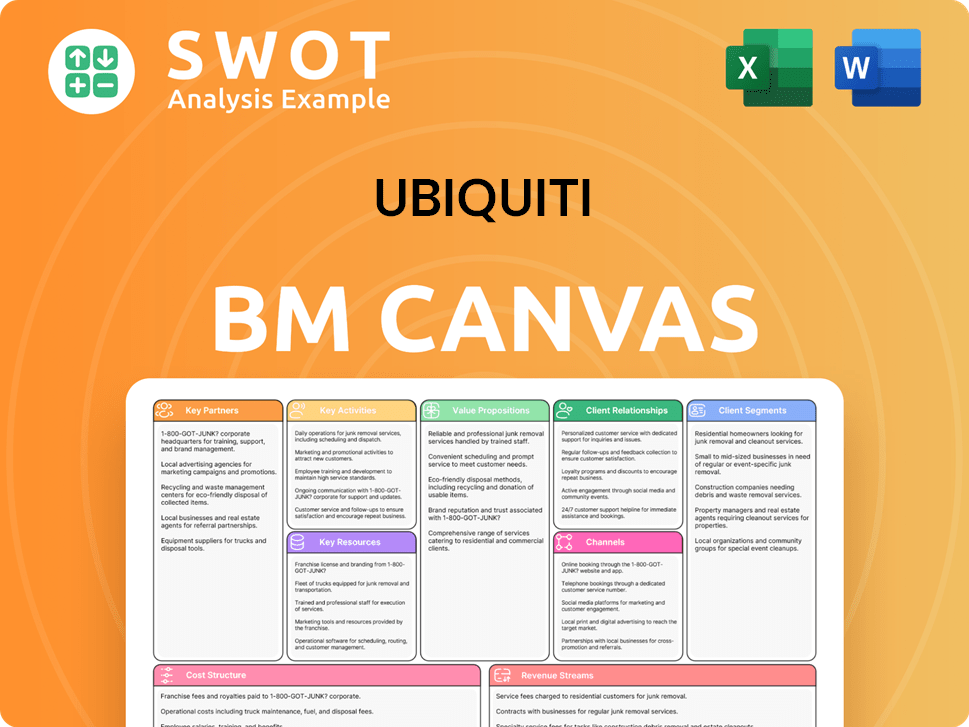

Ubiquiti Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Ubiquiti’s Growth?

The company, like any other, faces several potential risks that could impact its Ubiquiti growth strategy and overall performance. These challenges range from market competition and supply chain issues to technological disruptions and cybersecurity threats. Understanding these risks is crucial for assessing the company's Ubiquiti future prospects and making informed decisions.

One of the primary obstacles is the competitive nature of the networking solutions market. The company operates in a space where innovation is constant, and maintaining a competitive edge requires continuous investment in research and development. Furthermore, the company's reliance on specific suppliers and manufacturing locations creates vulnerabilities, particularly concerning supply chain disruptions.

The company’s Ubiquiti company analysis reveals that it must navigate these challenges strategically to achieve its growth objectives. Mitigation strategies, such as diversifying revenue streams and investing in R&D, are essential for long-term sustainability and success.

The networking market is highly competitive, with numerous established players and emerging companies vying for market share. The company must continuously innovate and improve its offerings to stay ahead. For insights into the competitive landscape, consider reading Competitors Landscape of Ubiquiti.

Reliance on a limited number of suppliers and contract manufacturers, primarily in Vietnam and China, creates supply chain risks. Disruptions from natural disasters, geopolitical tensions, or public health crises could significantly impact the company's ability to manufacture and deliver products. Supply constraints have led to increased component and shipping costs.

Rapid technological advancements in the industry require continuous innovation. Failure to adapt to new technologies and market trends could result in the company losing its competitive advantage. Keeping pace with these developments is essential for long-term success.

Cyberattacks and security vulnerabilities pose significant risks, potentially leading to data breaches, financial losses, and reputational damage. For example, a vulnerability (CVE-2025-23091) affecting UniFi OS devices was discovered in January 2025. Vigilance and proactive security measures are essential.

Geopolitical tensions, such as those between China and Taiwan, and the conflict between Russia and Ukraine, can affect operations. Tariffs, particularly those imposed by the U.S. on China, have impacted operating results and margins. These factors can lead to higher logistics and production costs.

While the company believes its current financial resources are sufficient, economic downturns or unexpected expenses could strain its financial position. The ability to secure and maintain adequate funding is crucial for supporting R&D and expansion plans. The company's Ubiquiti financial performance is closely tied to its ability to manage these financial risks effectively.

The company employs several strategies to mitigate these risks. These include diversifying revenue streams to reduce reliance on any single product or market, and investing in R&D to maintain technological competitiveness. It also monitors geopolitical tensions and trade policies to anticipate and respond to potential disruptions. The company is also actively working on its Ubiquiti networking solutions to enhance its product offerings.

The company's financial health is crucial for navigating these challenges. It believes its existing cash and credit facilities are sufficient for near-term needs. Continued investment in R&D is planned to support innovation and market expansion. The company's Ubiquiti market share and overall success depend on its ability to effectively manage its finances.

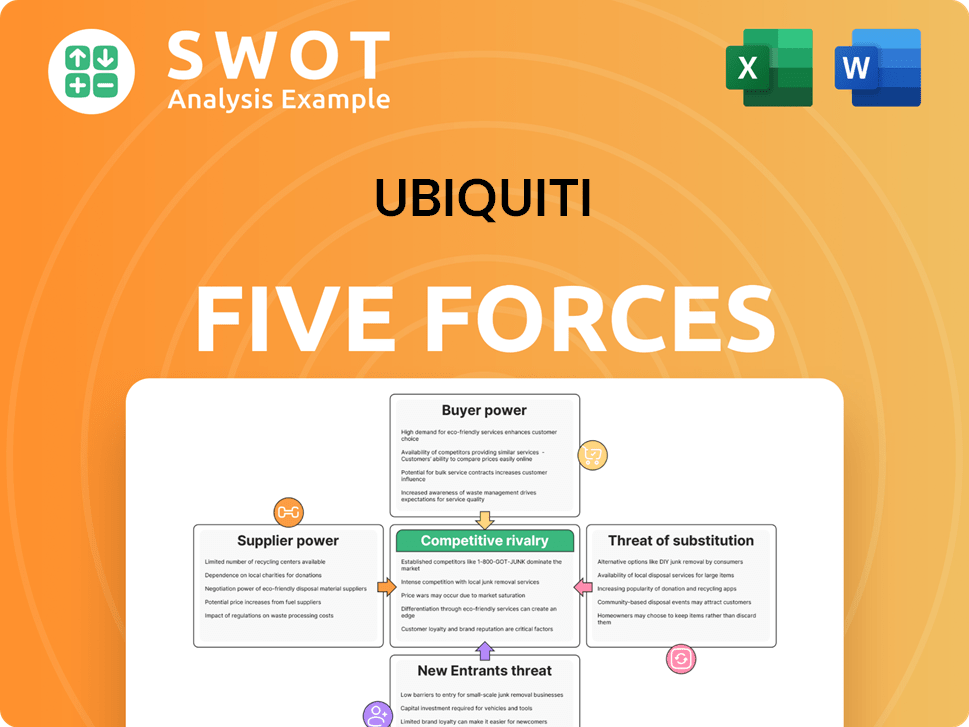

Ubiquiti Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ubiquiti Company?

- What is Competitive Landscape of Ubiquiti Company?

- How Does Ubiquiti Company Work?

- What is Sales and Marketing Strategy of Ubiquiti Company?

- What is Brief History of Ubiquiti Company?

- Who Owns Ubiquiti Company?

- What is Customer Demographics and Target Market of Ubiquiti Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.