Uline Bundle

Can Uline Maintain Its Dominance in the Face of Evolving Market Dynamics?

Uline, a name synonymous with shipping and industrial supplies, has carved a significant niche in the business-to-business sector. Founded in 1980, the company's journey from a basement startup to a nationwide distribution powerhouse is a testament to its customer-centric approach. But what strategies will propel Uline forward in an increasingly competitive landscape?

This deep dive into the Uline SWOT Analysis will explore the Uline growth strategy, examining its market share and Uline future prospects. We'll dissect its business model, analyze Uline's expansion plans for 2024, and assess the company's ability to navigate industry trends, including its supply chain strategy and sustainable packaging initiatives. Understanding Uline's market position and competitive advantages is crucial for anyone considering Uline investment opportunities or simply interested in the company's long-term goals.

How Is Uline Expanding Its Reach?

The Owners & Shareholders of Uline focus on strategic expansion and diversification to drive growth. The company's strategy involves significant investments in infrastructure and product offerings. This approach is designed to enhance market share and solidify its position in the industrial and e-commerce supply sectors.

A key aspect of the Uline growth strategy is its commitment to expanding its operational footprint. This includes the establishment of new distribution centers and the enhancement of existing facilities. These efforts are aimed at improving delivery times, reducing shipping costs, and increasing overall customer satisfaction.

Furthermore, Uline's business model emphasizes continuous product diversification. The company is broadening its catalog to include a wider array of products. This strategy aims to meet a greater range of customer needs and capture a larger share of the market.

Uline's expansion plans in 2024 included the addition of new distribution centers across North America. This expansion is a direct response to the increasing demand from both industrial and e-commerce customers. The strategic placement of these centers is crucial for reducing shipping times and enhancing service capabilities.

Beyond its core packaging and shipping supplies, Uline is actively diversifying its product offerings. This includes expanding into safety supplies, material handling equipment, and janitorial products. This diversification strategy aims to cater to a broader customer base and increase revenue streams.

The company continues to invest heavily in its e-commerce platform and digital catalog. These investments are designed to improve the online customer experience and streamline the ordering process. This strategy is essential for reaching a wider customer base and maintaining a competitive edge in the market.

Uline is focused on optimizing its supply chain to improve efficiency and reduce costs. This includes streamlining logistics and enhancing inventory management practices. These improvements support the company's ability to meet customer demands promptly and efficiently.

Uline's expansion initiatives are multifaceted, focusing on geographical growth, product diversification, and digital enhancements. These strategies are designed to strengthen its market position and drive revenue growth. The company's ability to adapt to changing market demands is crucial for its long-term success.

- Expanding distribution centers to improve delivery times and reduce shipping costs.

- Diversifying product offerings to cater to a wider range of customer needs.

- Enhancing the e-commerce platform and digital catalog for improved customer experience.

- Optimizing the supply chain to improve efficiency and reduce operational costs.

Uline SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Uline Invest in Innovation?

The company strategically uses innovation and technology to boost operational efficiency, improve customer experiences, and support its sustained growth. This approach is crucial for maintaining its competitive edge within the industry. Understanding the technological advancements is key when considering the Uline growth strategy and its Uline future prospects.

Significant investments in automation within its distribution centers are a core part of the company's strategy. This includes advanced robotics and automated systems for picking, packing, and sorting. These systems increase throughput, minimize errors, and reduce labor costs. These improvements are vital for meeting customer demands and maintaining the ability to provide same-day shipping, especially as order volumes increase.

The company also focuses on digital transformation to streamline internal processes and improve its customer-facing platforms. This includes continuous improvements to its e-commerce website, mobile applications, and customer relationship management (CRM) systems. These enhancements provide a seamless and intuitive ordering experience. For a deeper understanding of the company's core principles, you can explore Mission, Vision & Core Values of Uline.

The company invests heavily in automation, including robotics and automated systems. These technologies increase efficiency and reduce labor costs. This is a key component of the Uline supply chain strategy.

The company continuously improves its e-commerce platforms. This includes the website, mobile applications, and CRM systems. These improvements provide a better customer experience, crucial for Uline customer acquisition strategies.

The company focuses on digital transformation to streamline internal processes. This improves efficiency and supports the company's long-term goals. Digital transformation is essential for maintaining Uline market share.

The company consistently introduces new product lines. It also emphasizes supply chain optimization through technology. This focus supports its Uline product diversification efforts.

Technological advancements help the company maintain its competitive edge. This is essential for meeting the growing demands of the modern business environment. This is a key factor in Uline's competitive advantages.

The company focuses on supply chain optimization through technology. This supports its ability to provide efficient and timely deliveries. This is a critical element of the Uline business model.

The company's investments in technology drive efficiency and enhance customer experience. These investments are crucial for the company's growth and market position. The company's commitment to technology is a key aspect of its Uline company analysis.

- Automation in distribution centers using robotics and automated systems.

- Continuous improvements to e-commerce platforms, including the website and mobile applications.

- Digital transformation to streamline internal processes and enhance customer relationship management.

- Emphasis on supply chain optimization through technology to improve efficiency.

Uline PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Uline’s Growth Forecast?

As a privately held company, detailed financial data for the company is not publicly available. However, the company's strategic moves and market position offer insights into its financial health. The company's consistent investment in expanding its distribution network, product catalog, and operational capabilities suggests a solid financial foundation.

The company's growth strategy is closely tied to the packaging and industrial supply sectors, which have experienced sustained demand, especially with the rise of e-commerce. This sustained demand, coupled with the company's operational efficiency, is likely driving strong revenue generation. The company's focus on reinvesting profits into the business indicates a commitment to long-term growth and market penetration. For a deeper understanding of the competitive environment, consider exploring the Competitors Landscape of Uline.

The company's ability to fund large-scale expansion projects internally indicates a positive financial outlook. While specific revenue figures are not disclosed, the company's continued market leadership and strategic investments point to a healthy financial performance. The company's business model emphasizes reinvestment to fuel further growth and market penetration, positioning it well for future success. The company's financial outlook is positive, driven by its market position and strategic investments.

While precise figures are undisclosed, the company's continuous expansion and market dominance suggest consistent revenue growth. The company's strategic investments in distribution centers and product offerings support this trend. The sustained demand in packaging and industrial supplies further boosts revenue potential.

The company's operational efficiency, driven by significant automation and a streamlined supply chain, likely contributes to healthy profit margins. Investments in technology and logistics optimize operations. The company's focus on cost management and efficiency supports strong profitability.

The company's continuous investment in new distribution centers and its vast inventory suggest a robust financial position and a commitment to long-term growth. These investments enhance the company's distribution network. Expansion plans, including new facilities, are key to the company's strategy.

The company's ability to fund large-scale expansion projects internally indicates a strong financial position. This financial stability allows the company to pursue strategic initiatives. Reinvesting profits back into the business supports sustained growth.

Uline Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Uline’s Growth?

The trajectory of the company, like any major player in the distribution sector, is subject to various risks and obstacles. Understanding these potential challenges is crucial for assessing the company's long-term viability and strategic positioning. A thorough Revenue Streams & Business Model of Uline analysis is key to understanding these factors.

One of the primary concerns is the intense competition within the packaging and shipping supplies market. The company faces pressure from both established distributors and smaller, specialized competitors. Furthermore, the rise of direct-from-manufacturer sales channels poses a challenge to maintaining market share and profitability.

Another significant risk lies in supply chain vulnerabilities. Disruptions to the supply chain, such as raw material shortages, transportation issues, or geopolitical events, can impact product availability and lead times. Efficiently managing these risks is critical for maintaining customer satisfaction and revenue streams.

The company faces intense competition from both large distributors and smaller, niche players. The increasing prevalence of direct-from-manufacturer sales further intensifies the competitive landscape. This competition can put pressure on pricing and profit margins, requiring constant innovation and efficiency.

Changes in regulations related to shipping, environmental standards, or labor laws could impact operations and increase compliance costs. Adapting to these changes and ensuring compliance is essential for avoiding penalties and maintaining a positive reputation. Staying ahead of these changes is crucial.

Supply chain vulnerabilities, including raw material shortages and transportation issues, pose a significant risk. Geopolitical events can also disrupt the supply chain. The company mitigates these risks through a diversified supplier network and strategic inventory management.

The rapid pace of technological change, especially in logistics and e-commerce, necessitates continuous investment in innovation. Failure to adapt to these advancements could lead to obsolescence. The company's private ownership can provide an advantage in making long-term strategic decisions.

Economic downturns can affect demand for packaging and shipping supplies. Changes in consumer spending and business investment can directly impact the company's revenue. Diversification and strategic planning are essential to navigate these fluctuations.

The continuous evolution of e-commerce requires the company to adapt its strategies to meet changing customer expectations. Developing a robust e-commerce strategy is essential for staying competitive. This includes improving online platforms and enhancing customer service.

The company has been expanding its distribution network. The company's expansion plans include new distribution centers and increased product offerings. These expansions aim to improve service and increase market share. The company's strategy focuses on both geographic and product diversification.

The company's competitive advantages include a large distribution network and a wide product range. Strong customer service and efficient logistics are also key strengths. The company's focus on customer satisfaction helps maintain market share. These advantages are crucial in a competitive market.

The company’s supply chain strategy involves a diversified supplier network and strategic inventory management. This strategy helps mitigate risks associated with disruptions. Efficient supply chain management ensures timely delivery and customer satisfaction. The company continually optimizes its supply chain for efficiency.

The company's revenue growth forecast depends on several factors, including market trends and economic conditions. Factors such as e-commerce growth and expansion plans are important. The company's long-term goals include sustainable growth. The company's financial performance is closely monitored.

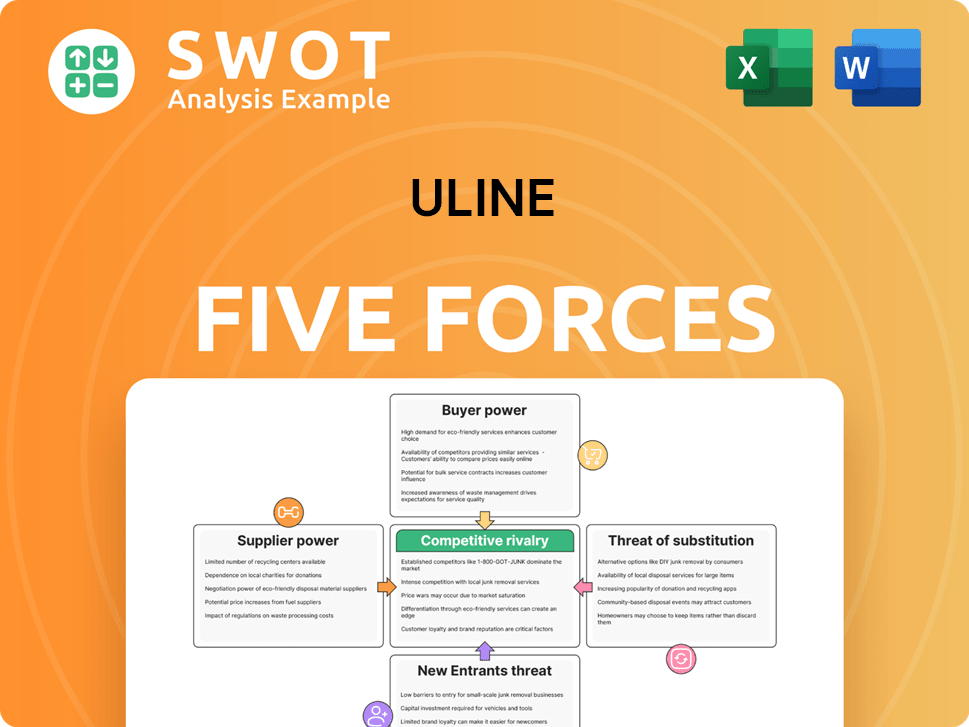

Uline Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Uline Company?

- What is Competitive Landscape of Uline Company?

- How Does Uline Company Work?

- What is Sales and Marketing Strategy of Uline Company?

- What is Brief History of Uline Company?

- Who Owns Uline Company?

- What is Customer Demographics and Target Market of Uline Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.