Videlio Bundle

Can Videlio Maintain Its Growth Trajectory?

Videlio, a leading provider of audiovisual solutions, is on a path of significant expansion. From its inception in 1983 to its current global presence, Videlio has consistently adapted and innovated within the AV solutions market. This analysis dives deep into Videlio's Videlio SWOT Analysis, exploring its growth strategy and future prospects.

With a strong foundation serving major corporations and a turnover of €368 million in 2024, Videlio's business model is poised for further success. We will explore Videlio's expansion plans, assess its competitive advantages, and analyze its financial performance to understand how it plans to navigate the rapidly evolving audiovisual technology trends and achieve its long-term vision. The company's response to industry challenges and its investment in R&D will also be examined.

How Is Videlio Expanding Its Reach?

The Videlio growth strategy is significantly focused on expansion initiatives, primarily through strategic acquisitions and broadening its international presence. This approach is designed to strengthen its position in the AV solutions market and capitalize on audiovisual technology trends. These initiatives are key to achieving its long-term vision and enhancing its Videlio business model.

A core element of Videlio's future prospects involves mergers and acquisitions to expand its geographical footprint and service offerings. These moves are carefully planned to increase Videlio market share analysis and solidify its competitive advantages. The company is also committed to innovation in AV and adapting to technological changes, ensuring its continued relevance and growth.

The recent acquisition of Team Office, announced on May 27, 2025, is a prime example of this strategy. This move is a strategic step in Videlio's expansion plans 2024, enhancing its presence in key markets and diversifying its revenue streams. This acquisition aligns with the company's goal to become a leading European audiovisual player, demonstrating Videlio's strategic acquisitions.

Videlio is actively expanding its geographical presence through strategic acquisitions. The acquisition of Team Office in Italy is a key example, strengthening its footprint in a significant European market. This expansion is crucial for enhancing its Videlio's growth in specific regions.

Beyond acquisitions, Videlio focuses on enhancing its service offerings and partnerships. Collaborations, such as the one with Interra Systems, aim to provide advanced quality control solutions. These initiatives demonstrate Videlio's innovation in AV and commitment to delivering high-value services.

Strategic partnerships are a key part of Videlio's growth strategy. The collaboration with Interra Systems aims to strengthen its market position and provide advanced solutions. These partnerships are essential for maintaining its competitive edge and adapting to industry changes.

By expanding its geographical reach and enhancing service offerings, Videlio aims to grow its customer base. The acquisition of Team Office provides access to new customers and diversifies revenue streams. This focus on customer acquisition is crucial for Videlio's customer base analysis.

Videlio's expansion strategy involves both acquisitions and strategic partnerships to drive growth and market share. These initiatives are designed to enhance its service offerings and broaden its geographical reach. This approach helps Videlio maintain its position at the forefront of the industry and respond to Videlio's response to industry challenges.

- Acquisition of Team Office to strengthen its presence in Italy.

- Strategic partnership with Interra Systems to enhance service offerings.

- Focus on adapting to technological changes and industry trends.

- Continuous investment in research and development.

The strategic moves, such as the acquisition of Team Office, are designed to improve Videlio financial performance review. These actions demonstrate a proactive approach to the evolving market, ensuring Videlio's long-term vision is achieved. You can learn more about the company's core values and mission in Mission, Vision & Core Values of Videlio.

Videlio SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Videlio Invest in Innovation?

The core of the company's growth strategy is its unwavering focus on innovation and technology, particularly in digital transformation and cutting-edge solutions. This commitment is evident in its diverse offerings, which span across various sectors, including workplaces, entertainment venues, and media broadcasting. This comprehensive approach allows the company to design, integrate, and manage tailored professional audio and video communication solutions, enhancing collaboration and immersive experiences.

The company's longevity in the audiovisual sector, with over 35 years of experience, underscores its dedication to pushing technological boundaries. Strategic partnerships, like the one with Interra Systems in 2024, highlight its reliance on external innovators to deliver advanced quality control solutions, especially for broadcast and post-production. This collaborative approach ensures that the company remains at the forefront of media production and distribution standards.

The company's involvement in major events, such as the Olympics contract for the Paris Summer Games in 2024 and its support for events like the Super Bowl 2025 and the Academy Awards, showcases its capacity to implement and manage complex audiovisual systems. Its focus on digitalizing professional environments and providing comprehensive managed services, from engineering to maintenance, reflects its commitment to delivering end-to-end solutions.

The company prioritizes digital transformation across all its services, offering comprehensive solutions that integrate the latest technologies. This includes advanced audiovisual systems for workplaces, entertainment venues, and media broadcasting, ensuring clients benefit from cutting-edge communication and collaboration tools.

Collaborations are key to the company's innovation strategy. For example, the partnership with Interra Systems in 2024 enhances its ability to provide advanced quality control and analysis solutions, particularly in broadcast and post-production. These partnerships ensure access to the latest technological advancements.

The company's involvement in high-profile events, such as the Paris Summer Games in 2024, and support for events like the Super Bowl 2025 and the Academy Awards, demonstrates its capability to manage complex audiovisual systems. These projects showcase the company's expertise and technological prowess on a global stage.

The company offers comprehensive managed services, from engineering to maintenance, reflecting its commitment to providing end-to-end solutions. This approach ensures that clients receive complete support throughout the lifecycle of their audiovisual systems, enhancing operational efficiency and performance.

The company is actively adapting to technological changes by investing in new technologies and forming strategic partnerships. This includes focusing on digitalizing professional environments and offering innovative solutions that meet the evolving needs of its clients. The company's ability to adapt is crucial for its long-term success.

While specific R&D investment details are not available, the company's commitment to innovation is evident through its continuous efforts to leverage technology. This focus on research and development is essential for staying ahead in the competitive AV solutions market.

The company's innovation strategy is multifaceted, focusing on digital transformation, strategic partnerships, and end-to-end solutions. This approach enables the company to maintain a competitive edge in the AV solutions market and drive future growth. The company's commitment to innovation is crucial for its long-term success, as highlighted in this Owners & Shareholders of Videlio article.

- Digital Transformation: Implementing advanced audiovisual solutions to enhance collaboration and communication in professional environments.

- Strategic Partnerships: Collaborating with technology providers like Interra Systems to deliver cutting-edge solutions for media production and distribution.

- Major Event Involvement: Leveraging expertise to manage complex audiovisual systems for high-profile events, showcasing technological capabilities.

- Comprehensive Managed Services: Offering end-to-end solutions, including engineering and maintenance, to ensure client satisfaction and system efficiency.

- Market Adaptation: Continuously adapting to technological changes and investing in new technologies to meet evolving client needs.

Videlio PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Videlio’s Growth Forecast?

As of May 20, 2025, the financial outlook for Videlio indicates a positive growth trajectory. The company's Discounted Cash Flow (DCF) analysis suggests a fair value of $4.62 per share. This represents a potential upside of 77.7% from its current market price of $2.60. This valuation highlights the potential for significant growth and investment return.

Revenue projections show a steady increase over the next decade. The company is expected to grow from $201 million in December 2020 to $295 million by December 2030. This represents a compound annual growth rate (CAGR) of approximately 3.9%. The growth is driven by the increasing demand in the AV solutions market and Videlio's strategic positioning.

Specifically, Videlio's revenue is forecasted to reach $228 million in 2024 and $238 million in 2025. This translates to a 2% and 5% growth, respectively, for those years. These figures demonstrate a consistent, albeit moderate, expansion in the company's revenue stream. The company's ability to adapt to audiovisual technology trends will be critical for sustaining this growth.

Profitability is expected to improve, with the net profit margin increasing from -1% in December 2020 to 3% by December 2030. This improvement is attributed to operational efficiencies and economies of scale. The Videlio business model is designed to enhance profitability.

For 2024, the net profit is projected to be $5 million, with a 2% profit margin. In 2025, the net profit is expected to increase to $6 million, with a 3% profit margin. These figures indicate a steady improvement in financial performance.

Capital expenditures are projected to remain at approximately 1% of revenue. The 5-year average capital expenditure is about $3 million. This demonstrates a focus on controlled spending and efficient resource allocation.

Net working capital is expected to gradually increase, impacting free cash flow. Careful management of net working capital is crucial for maintaining financial stability. This aspect is key to Videlio's financial performance review.

The financial projections suggest a stable growth path, with a focus on improving profitability over the long term. Videlio's long-term vision includes expanding its market share. This strategy is designed to ensure sustainable growth and adaptability.

While specific quarterly or annual reports were unavailable, the financial analyses indicate a strategic approach. The company is focusing on adapting to industry challenges and leveraging its competitive advantages. This strategy is detailed in a comprehensive Videlio company analysis.

Videlio Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Videlio’s Growth?

The path of growth for a company like Videlio is not without its hurdles. Several risks and obstacles could potentially impact the company's strategic objectives and overall financial performance. A thorough understanding of these challenges is essential for investors and stakeholders.

The competitive landscape, technological advancements, and internal operational issues all present significant challenges. Addressing these potential risks requires proactive strategies, including robust risk management and continuous adaptation to market dynamics. The ability to navigate these challenges is critical for long-term success.

Videlio's Videlio growth strategy faces challenges from intense competition. Key competitors in the AV solutions market include established players, making it vital for Videlio to differentiate itself through innovation and customer service. The market is dynamic, requiring continuous adaptation to stay competitive.

The AV solutions market is highly competitive, with companies like Tribe Home, TouchTunes Interactive Networks, and StarMaker Interactive vying for market share. Increased competition necessitates a strong focus on innovation and customer retention.

Rapid advancements in audiovisual and communication technologies, including AI and IoT, pose a constant threat. Continuous investment in R&D and digital transformation is crucial to stay ahead of the curve and maintain Videlio's competitive advantages.

Unpredictability in the availability and cost of industrial inputs, along with geopolitical risks, can impact operations. Videlio's expansion plans 2024 should include robust supply chain risk management strategies.

Resource limitations, including human resource risks such as employee turnover or lack of training, can affect operational efficiency. Addressing these internal challenges is crucial for sustainable growth.

Evolving digital domains require adaptive strategies to comply with changing regulations. Staying compliant is essential for avoiding legal and operational issues.

The shift to remote work has reshaped the demand for AV solutions. Companies like Videlio must adapt to these new needs to maintain relevance and capture market opportunities. How Videlio adapts to technological changes will be crucial.

Diversification, robust risk management frameworks, and scenario planning are key strategies. Scenario analysis helps in anticipating future risks and identifying potential mitigation alternatives. Implementing integrated technology platforms and regular audits can also enhance resilience and supply chain visibility.

Investments in R&D and digital transformation are vital to adapt to audiovisual technology trends. Staying ahead of technological changes requires continuous innovation. This is a key element of Videlio's long-term vision.

Maintaining strategic stock levels and diversifying suppliers are essential for supply chain resilience. Regular audits and integrated technology platforms are crucial for enhancing visibility within the supply chain. Effective supply chain management is critical for Videlio's business model.

A thorough Videlio financial performance review is essential for understanding the impact of these risks. Regular financial analysis helps in making informed decisions and adapting to market changes. For further insights, consider reading the Brief History of Videlio.

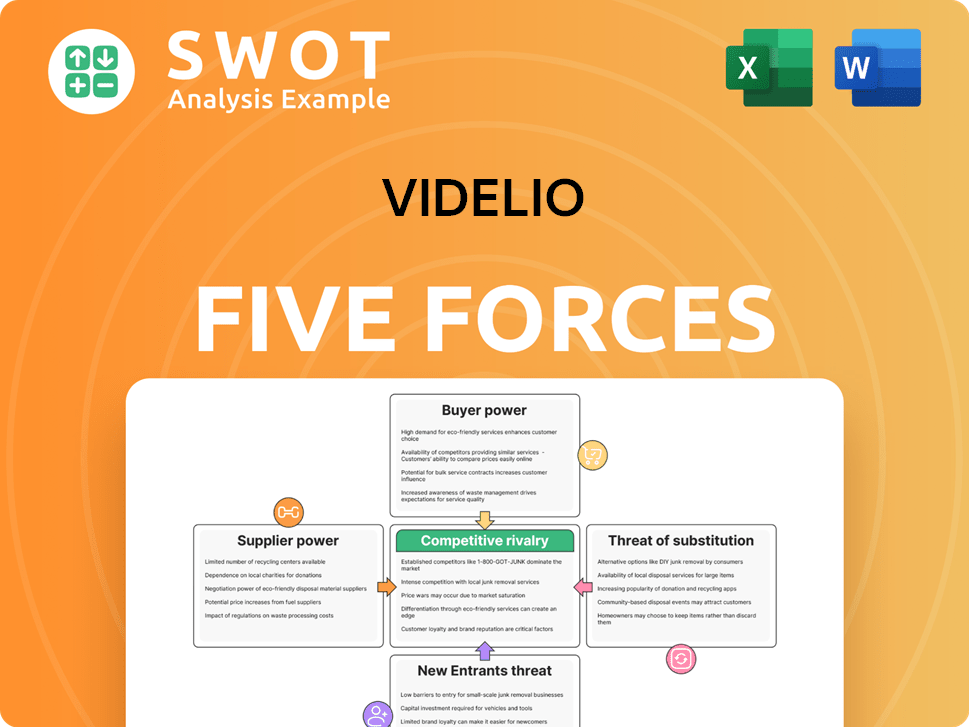

Videlio Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Videlio Company?

- What is Competitive Landscape of Videlio Company?

- How Does Videlio Company Work?

- What is Sales and Marketing Strategy of Videlio Company?

- What is Brief History of Videlio Company?

- Who Owns Videlio Company?

- What is Customer Demographics and Target Market of Videlio Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.