Want Want China Holdings Bundle

Can Want Want China Holdings Maintain Its Market Dominance?

Founded in 1962, Want Want China Holdings has evolved from a rice cracker producer into a food and beverage giant, particularly in the China market. Under the leadership of Chairman and CEO Tsai Eng-Meng, the company has built a robust network and a portfolio of successful products, including its iconic Hot-Kid milk. This Want Want China Holdings SWOT Analysis will explore the company's journey and future trajectory.

This analysis will dissect Want Want China Holdings' growth strategy, examining its expansion plans and innovative approaches within the competitive landscape. We'll explore the company's financial performance, assess its market share, and delve into the future prospects for long-term growth. Understanding these elements is crucial for anyone evaluating the investment potential of Want Want China Holdings and its ability to navigate market trends.

How Is Want Want China Holdings Expanding Its Reach?

Want Want China Holdings is strategically expanding its operations through both geographical diversification and product portfolio enhancement. This dual approach is designed to capitalize on emerging market opportunities and strengthen its position in the competitive landscape. The company's focus on both expanding its geographical footprint and diversifying its product offerings demonstrates a proactive approach to achieving sustainable growth.

A core element of its international expansion strategy involves deepening its presence in Southeast Asia. The company is leveraging the growing economies and young populations in this region to drive future growth. This strategic move underscores the company's commitment to adapting to evolving market dynamics and consumer preferences.

The company's overseas expansion plans include a strong focus on Southeast Asia. The company anticipates significant potential in this region due to its growing economies and young populations. This strategic move is a key driver in its long-term growth strategy, aiming for breakthrough growth in overseas markets within the next three to five years.

The company established its first manufacturing facility outside China and Taiwan in Vietnam in 2022. This facility produces popular products like rice crackers, fried snacks, Baby Mum Mum, QQ Gummies, and OPAO drinks. The output value of the Vietnam facility is approximately US$150 million.

Subsidiaries have been established in Thailand, Singapore, and Indonesia to enhance market penetration. These subsidiaries streamline product distribution, ensuring products reach consumers efficiently. This strategic move supports the company's broader goal of increasing its market share in the region.

The company is exploring investment opportunities in Malaysia, viewing it as a gateway to both the local market and the broader halal market. Malaysia's strategic location and market potential make it an attractive investment destination. This expansion aligns with the company's goal of broadening its reach and catering to diverse consumer segments.

The company continues to explore new product launches to diversify its offerings. While rice crackers and snack foods contributed 49% of the group's revenue, and dairy products and beverages contributed 51% in FY2024, the company is actively seeking to introduce new products. The introduction of the Hot-Kid milk-flavored drink in Malaysia is a strategic example of this.

The company emphasizes brand differentiation and product diversification as key strategies for growth. This includes exploring new channels like content e-commerce to reach consumers. This approach helps the company stay competitive and meet evolving consumer preferences.

- The company is focused on expanding its presence in Southeast Asia.

- Product diversification is a key strategy, with new product launches planned.

- Exploring new channels like content e-commerce is a priority.

- The company aims for breakthrough growth in overseas markets within the next three to five years.

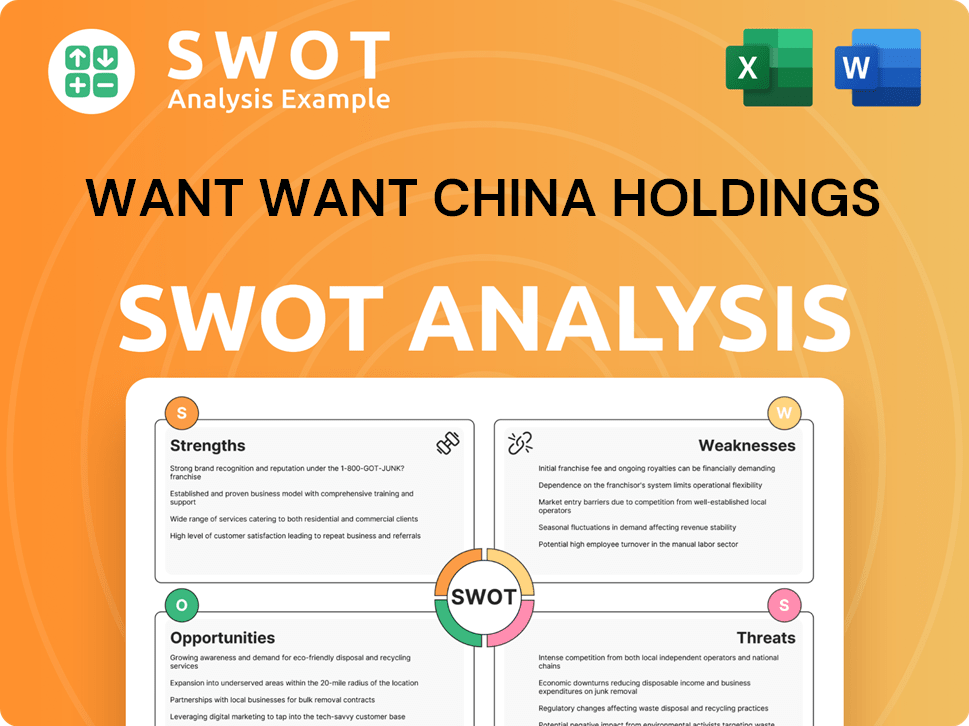

Want Want China Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Want Want China Holdings Invest in Innovation?

The innovation and technology strategy of Want Want China Holdings is primarily focused on integrating advancements into product development and operational efficiency. While specific details on research and development (R&D) investments or the adoption of cutting-edge technologies such as artificial intelligence (AI) or the Internet of Things (IoT) are not extensively disclosed in recent reports, the company's approach appears to be geared towards incremental improvements within its existing framework. This strategy aims to maintain market leadership and enhance profitability through optimized processes.

A key aspect of Want Want China's innovation strategy involves enhancing operational efficiency, as evidenced by the expansion of its gross profit margin to 46.6% in fiscal year 2024, a 2.7 percentage point increase from the previous year. This suggests an ongoing effort to refine production processes and potentially automate certain aspects of its operations. The company's ability to maintain high margins compared to domestic peers indicates effective utilization of its vast distribution network and optimized production processes, which often involve technological advancements.

Furthermore, Want Want China's move towards 'content e-commerce' highlights its interest in leveraging digital platforms for sales and marketing. This aligns with the broader industry trend of digital transformation, allowing the company to reach new customers and adapt to evolving consumer behaviors. The company's commitment to product innovation, particularly in flagship products like Hot-Kid milk and various rice crackers, which remain market leaders, also demonstrates a commitment to staying relevant in a competitive China market.

Want Want China Holdings focuses on integrating technology to improve operational efficiency and maintain its market position. This includes optimizing production labor strategies and leveraging digital platforms for sales and marketing. The company's financial performance, including its gross profit margin, reflects these efforts.

- The gross profit margin increased to 46.6% in FY2024, up 2.7 percentage points from the previous year.

- The company is exploring 'content e-commerce' to expand its digital presence and reach new customers.

- Product innovation remains a key focus, with flagship products like Hot-Kid milk and rice crackers continuing to lead the market.

- Want Want China's approach to technology is integrated into its product development and operational efficiency.

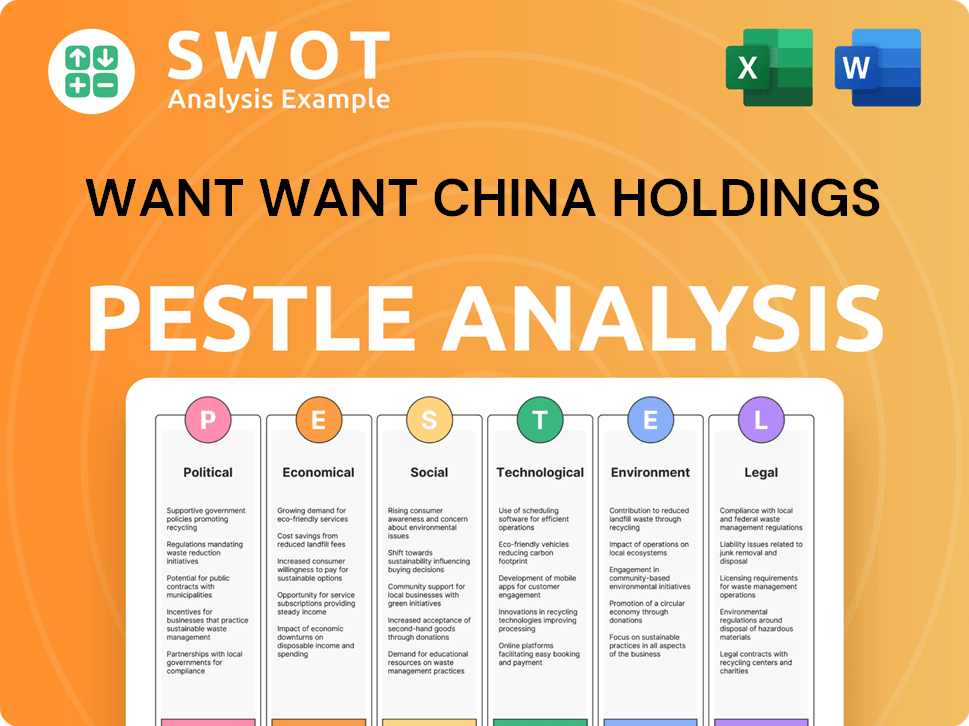

Want Want China Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Want Want China Holdings’s Growth Forecast?

The financial performance of Want Want China Holdings reflects a solid foundation and strategic execution. For the fiscal year ending March 31, 2024, the company demonstrated resilience, with revenue reaching RMB23.59 billion (CN¥23.19 billion). This growth, coupled with improved margins, underscores the company's ability to navigate the dynamic China market.

The company's profitability also saw a significant boost. Profits attributable to equity holders surged by 18.4% to RMB3.99 billion (CN¥4.1 billion). This increase in profitability, along with an expanded gross profit margin of 46.6%, highlights effective cost management and operational efficiency. These factors are critical for assessing the financial performance and overall business analysis of the company.

Looking ahead, analysts project continued growth for Want Want China Holdings. Revenue for fiscal year 2025 is estimated at CN¥23.9 billion, representing a 3.0% increase. Furthermore, the company's spokesperson has expressed optimism for mid-single-digit revenue growth in the coming years, which is in line with its historical performance, indicating a robust long-term growth strategy. For more insight into the company's consumer base, explore the Target Market of Want Want China Holdings.

Want Want China Holdings reported a 2.9% increase in revenue for the fiscal year ending March 2024, reaching RMB23.59 billion. Analysts forecast a 3.0% revenue increase for fiscal year 2025, projecting revenues of CN¥23.9 billion, indicating continued growth in the China market.

The company's profits attributable to equity holders jumped by 18.4% to RMB3.99 billion in FY2024. The gross profit margin expanded to 46.6%, driven by lower costs and optimized production strategies. The net profit margin stood at 17.77% as of September 2024.

As of March 2024, Want Want China held a net cash position with a net gearing ratio of -0.65 times. The company's strong financial position supports its capacity for future investments and expansion plans.

Want Want China paid out RMB2.89 billion in dividends for FY2024, with a payout ratio of 70%. The return on common equity averaged 25.1% from March 2020 to 2024, peaking at 27.6% in September 2024, demonstrating strong shareholder value.

Analysts anticipate earnings per share to increase by 2.5% to CN¥0.36 for fiscal year 2025. The company is expected to release its next earnings report on June 23, 2025, which will provide further insights into the financial statements.

The company aims for a mid-single-digit percentage compound annual growth rate in revenue over the next three to five years. This Growth Strategy is supported by its strong brand and market position, which is crucial for its future outlook.

Want Want China maintains a significant market share in its product categories. The competitive landscape includes various players, but the company's strong brand and distribution network provide a competitive advantage, influencing its Want Want China Holdings market share.

The company's diverse product portfolio, including rice crackers, dairy products, and beverages, contributes to its revenue streams. Continuous innovation and adaptation to consumer behavior are key to maintaining its market position.

Potential risk factors include fluctuations in raw material costs, changes in consumer preferences, and regulatory changes. Effective risk management strategies are essential for sustained growth and stability.

Given its financial performance, growth projections, and strong market position, Want Want China Holdings presents a positive investment potential. Investors should consider the company's financial performance and stock analysis.

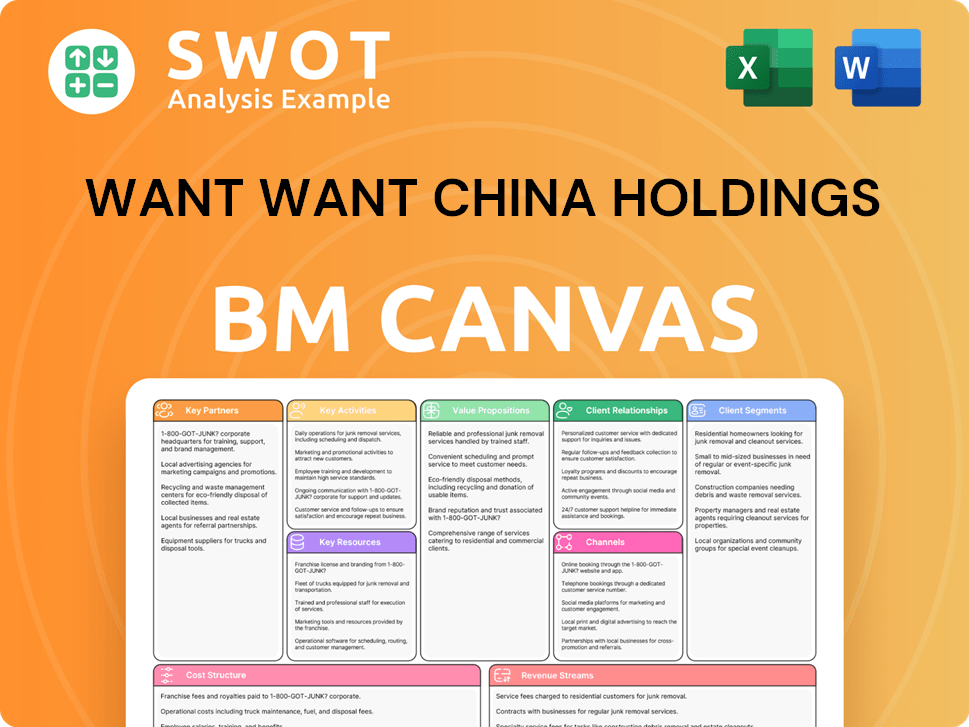

Want Want China Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Want Want China Holdings’s Growth?

The Want Want China Holdings faces various risks that could impact its Growth Strategy and future performance. These challenges stem from market competition, regulatory changes, supply chain vulnerabilities, and the need to adapt to technological advancements. Understanding these potential obstacles is crucial for evaluating the company's Future Prospects.

The company's ability to navigate these challenges will be critical to its success. Its strategic responses, including diversification and international expansion, will be key in mitigating risks. This analysis provides a comprehensive overview of the potential hurdles and how Want Want China Holdings aims to address them.

The food and beverage industry is highly competitive, placing constant pressure on companies like Want Want China Holdings. The company competes with major players in the China Market. The rise of e-commerce and digital marketing also presents a challenge, requiring continuous investment in these areas to stay relevant.

Want Want China Holdings operates in a competitive market alongside companies like China Feihe, Tingyi (Cayman Islands) Holding, Uni-President China Holdings, and WH Group. Emerging brands are gaining traction through digital channels, which could impact market share. The company's success depends on its ability to maintain its brand strength and adapt to changing consumer preferences.

Changes in food safety regulations, labeling requirements, and import/export policies in China and other markets pose risks. Such changes could require adjustments to production, distribution, and product offerings. These adjustments may lead to additional costs or limit market access, affecting Financial Performance.

Supply chain disruptions, exacerbated by geopolitical tensions and cyber threats, present a significant risk. These disruptions can affect the availability and cost of essential ingredients and packaging. The company's lack of proactive measures regarding forced labor risks in its supply chains also poses a reputational risk.

The rapid evolution of e-commerce and digital marketing requires continuous investment and strategic adjustments. Internal resource constraints, particularly in talent and capital allocation for innovation, could hinder growth. Adapting to these technological shifts is crucial for maintaining market relevance and achieving Business Analysis.

Limited resources in talent and capital allocation can hinder the company's ability to innovate and adapt. The company needs to effectively manage its resources to support its Growth Strategy. This includes making strategic investments in technology, marketing, and product development.

Heightened geopolitical tensions and economic instability in China could impact trade and overall economic stability. These factors can create uncertainty and affect consumer confidence, potentially influencing Want Want China Holdings' future trajectory. The company must monitor these risks and adjust its strategies accordingly.

Want Want China Holdings employs diversification of its product portfolio to mitigate reliance on a single market or product category. International expansion, such as its move into Southeast Asia, aims to tap into new customer bases and diversify revenue streams. The company's sustained profitability and strong cash position suggest a degree of financial resilience, as highlighted in Owners & Shareholders of Want Want China Holdings.

Overcoming obstacles is inherent in business, and Want Want's long history and market leadership demonstrate its ability to navigate various challenges. The company's ability to adapt to changing market conditions and consumer preferences will be crucial for its Long-Term Growth Strategy. The company's future success depends on its capacity to effectively manage these risks.

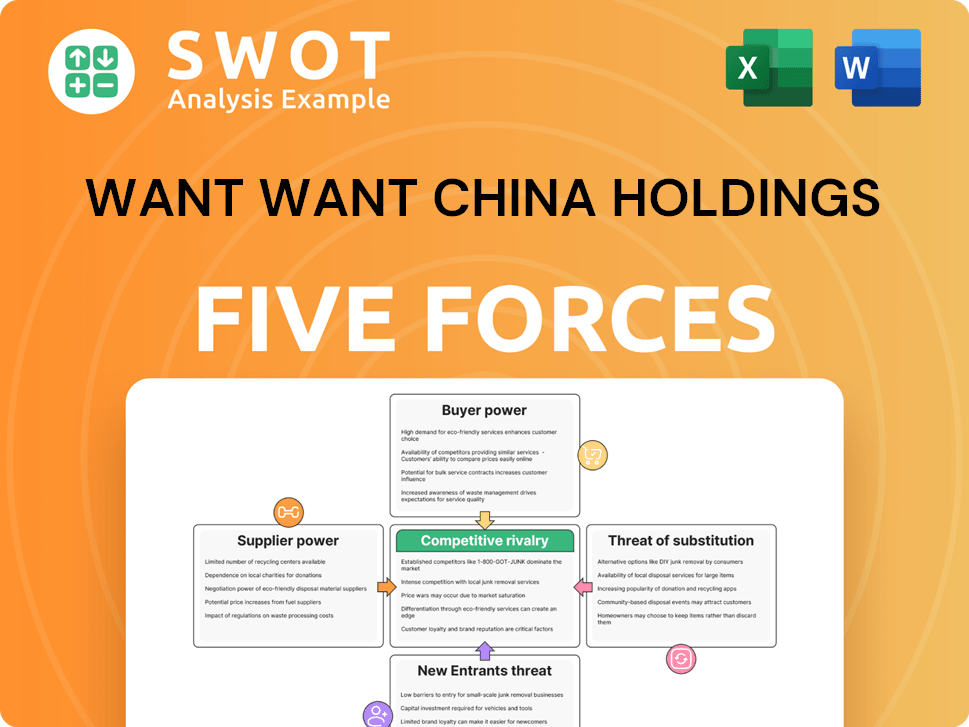

Want Want China Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Want Want China Holdings Company?

- What is Competitive Landscape of Want Want China Holdings Company?

- How Does Want Want China Holdings Company Work?

- What is Sales and Marketing Strategy of Want Want China Holdings Company?

- What is Brief History of Want Want China Holdings Company?

- Who Owns Want Want China Holdings Company?

- What is Customer Demographics and Target Market of Want Want China Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.