WW International Bundle

Can WW International Thrive in the Evolving Wellness Landscape?

From its inception as Weight Watchers in 1963, WW International (WW) has navigated a complex market, evolving from a weight-loss support group to a comprehensive wellness provider. The company's strategic shift towards a broader wellness focus, encompassing mental health, fitness, and lifestyle improvements, marks a pivotal moment in its WW International SWOT Analysis. This transformation raises critical questions about its growth strategy and ability to capitalize on future opportunities.

This exploration delves into the future prospects of WW International, examining its business strategy and how it plans to navigate the competitive health and wellness market. We'll analyze its digital transformation, expansion plans, and ability to adapt to challenges like the impact of GLP-1 drugs, providing a detailed market analysis of its position. Understanding the WW International growth strategy 2024 and the future of Weight Watchers stock is crucial for investors and strategists alike.

How Is WW International Expanding Its Reach?

WW International's expansion strategy focuses on scaling its clinical business and enhancing its digital and member experience. This strategic direction is significantly influenced by the increasing use of GLP-1 medications and the evolving weight-loss market. The company is actively integrating clinical and behavioral solutions to meet the changing needs of its members.

The company's approach includes strategic partnerships and digital transformation to support its growth initiatives. These efforts aim to broaden its market reach and improve member engagement, enhancing its competitive position in the weight-loss industry. The company is focused on capturing a larger share of the market through these initiatives.

In Q4 2024, WW International reported 92,000 clinical subscribers, marking a 37.8% year-over-year increase. Clinical subscription revenues grew by 57.9% to $20.5 million. This positive trend continued into Q1 2025, with clinical subscribers reaching 135,000, and clinical subscription revenues increasing by 57.1% to $29.5 million. These figures highlight the strong performance of the clinical business segment.

WW International is forming strategic partnerships to support its expansion. In May 2025, the company announced a partnership with CheqUp in the UK. This collaboration aims to enhance GLP-1 medication-based weight loss services. The partnership combines CheqUp's clinical support and health coaching with WW's GLP-1 Companion Programme.

The company is expanding its reach across multiple countries. WW aims to increase international market penetration, projecting that 40% of its total subscriber base will be international in 2024. The digital transformation strategy has already boosted international revenue, reaching $176.5 million in 2023.

WW International's growth strategy is centered on clinical solutions, digital enhancements, and strategic partnerships. These initiatives are designed to address the evolving needs of its members and capitalize on market trends. The company is positioning itself for long-term success in the weight loss industry.

- Focus on clinical business expansion to integrate with GLP-1 medication usage.

- Enhance digital and member experience through technology and personalized support.

- Form strategic partnerships to broaden service offerings and market reach.

- Expand into new international markets to increase subscriber base.

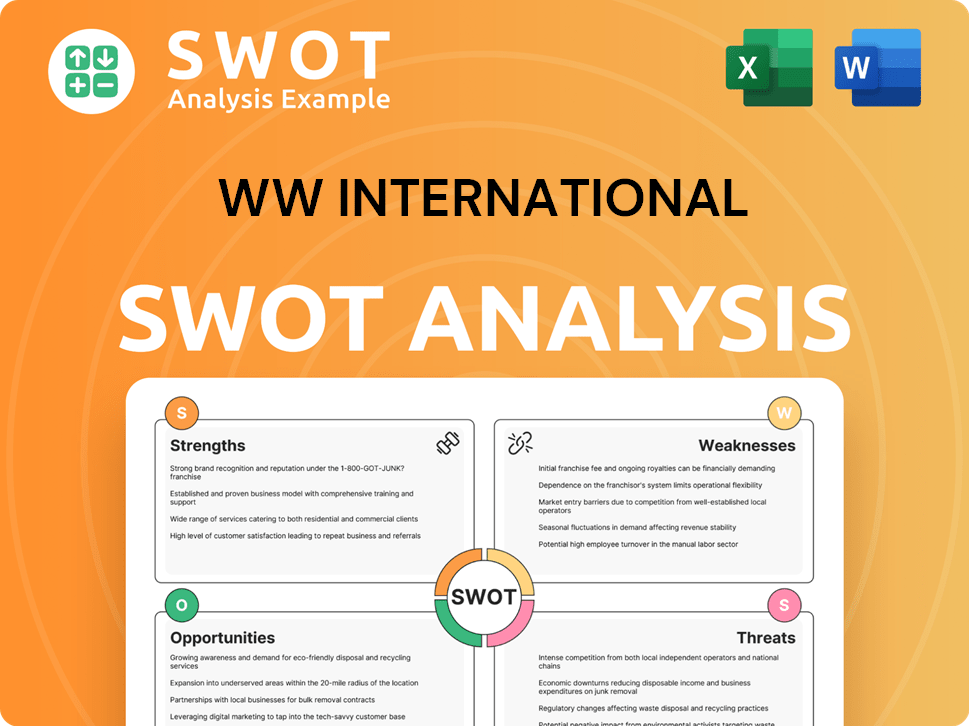

WW International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does WW International Invest in Innovation?

The growth strategy of WW International hinges significantly on innovation and technology, particularly in its digital transformation efforts. The company is focused on leveraging technology to personalize user experiences and enhance its offerings in the competitive weight loss market. This approach is crucial for sustaining growth and adapting to evolving customer needs and market dynamics.

WW International's strategic focus on digital solutions and technology integration has been vital for penetrating new markets and evolving its business model. This shift is designed to create a more engaging and unified experience for members, ultimately driving brand revitalization and customer loyalty. The company's investments in technology reflect its commitment to staying at the forefront of the health and wellness industry.

In 2024, WW International invested $45 million in AI-driven personalization platforms. This investment aims to refine its personalization algorithms, providing more tailored and effective wellness plans, exemplified by features like the 'PersonalPoints' program, which allows members to customize dietary plans based on individual needs and preferences. This investment demonstrates the company's commitment to using technology to enhance its offerings and improve user outcomes.

WW International utilizes AI and machine learning to customize wellness plans. These algorithms analyze user data to provide personalized recommendations.

Digital subscriptions are a key revenue driver for WW International. Approximately 65% of subscribers engage through digital platforms.

The company strives to deliver a seamless and engaging experience across all platforms. This includes integrating various features and services.

WW International is focused on revitalizing its brand through digital innovation. This involves updating its image and offerings to stay relevant.

Digital solutions have been crucial for penetrating new markets. This has allowed WW International to expand its reach and customer base.

The company is evolving its business model to adapt to changing consumer preferences. This includes a shift towards digital platforms and services.

The company's focus on digital transformation and personalized solutions is a key component of its marketing strategy. This strategy is designed to enhance user engagement and drive long-term growth. The integration of AI-powered personalization and machine learning algorithms allows for more tailored and effective wellness plans, such as the 'PersonalPoints' program. This program enables members to customize their dietary plans based on individual needs and preferences, leading to better outcomes and increased customer satisfaction.

WW International's technology initiatives are designed to enhance user experience and drive growth. These initiatives include AI-driven personalization, digital platform optimization, and strategic partnerships.

- AI-Driven Personalization: Utilizing machine learning to create customized wellness plans.

- Digital Platform Optimization: Enhancing the user experience on digital platforms to increase engagement.

- Strategic Partnerships: Collaborating with other companies to expand offerings and reach new audiences.

- Data Analytics: Using data to understand user behavior and improve program effectiveness.

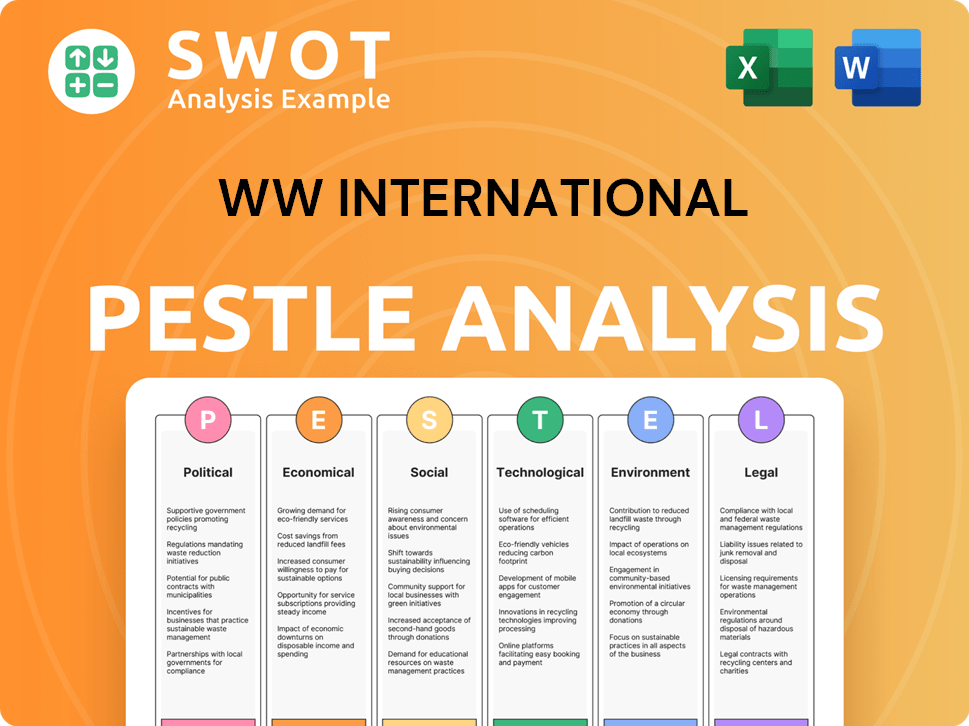

WW International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is WW International’s Growth Forecast?

The financial outlook for WW International (formerly Weight Watchers) in 2024 and 2025 reflects a strategic shift towards its clinical business and a focus on cost management. The company is navigating a challenging market environment while aiming to strengthen its financial position. This involves adapting its business strategy to meet evolving consumer needs and competitive pressures.

In 2024, WW International reported revenues of $785.9 million, with subscription revenues decreasing year-over-year. However, the clinical subscription revenues showed significant growth, indicating a positive trend in a key segment. The company is also implementing cost-saving measures to improve its financial performance and achieve long-term sustainability.

The company's adjusted gross margin in fiscal 2024 was 68.5%, benefiting from cost actions. Despite an operating loss, adjusted operating income was positive, demonstrating the effectiveness of some strategic initiatives. The company is focused on eliminating debt and improving its financial health.

For the full fiscal year 2024, WW International reported revenues of $785.9 million. Clinical subscription revenues reached $78.0 million, showing growth. The company's gross margin was 67.8%, and adjusted gross margin was 68.5%.

WW aims to achieve $100 million in run-rate cost savings by the end of 2025. The company maintained its guidance for 2024, projecting at least $770 million in revenue and adjusted operating income of at least $100 million. The company is focused on its Competitors Landscape of WW International.

In Q1 2025, revenues were $186.6 million, down 9.7% year-over-year. Clinical subscription revenues grew by 57.1% to $29.5 million. The adjusted gross margin in Q1 2025 was 71.0%.

WW announced strategic actions to eliminate $1.15 billion of debt as of May 6, 2025. This move aims to strengthen its financial position for long-term growth and profitability. Analysts have an average price target of $2.58 for WW stock.

The financial outlook for WW International is shaped by several key factors, including revenue trends, cost management, and strategic initiatives. Here's a summary:

- Revenue: Total revenue in 2024 was $785.9 million, with a decline in subscription revenue.

- Clinical Growth: Clinical subscription revenues showed strong growth, reaching $78.0 million in 2024.

- Margins: Adjusted gross margin was 68.5% in 2024, and 71.0% in Q1 2025.

- Cost Savings: Aiming for $100 million in run-rate cost savings by the end of 2025.

- Debt Reduction: Announced plans to eliminate $1.15 billion of debt.

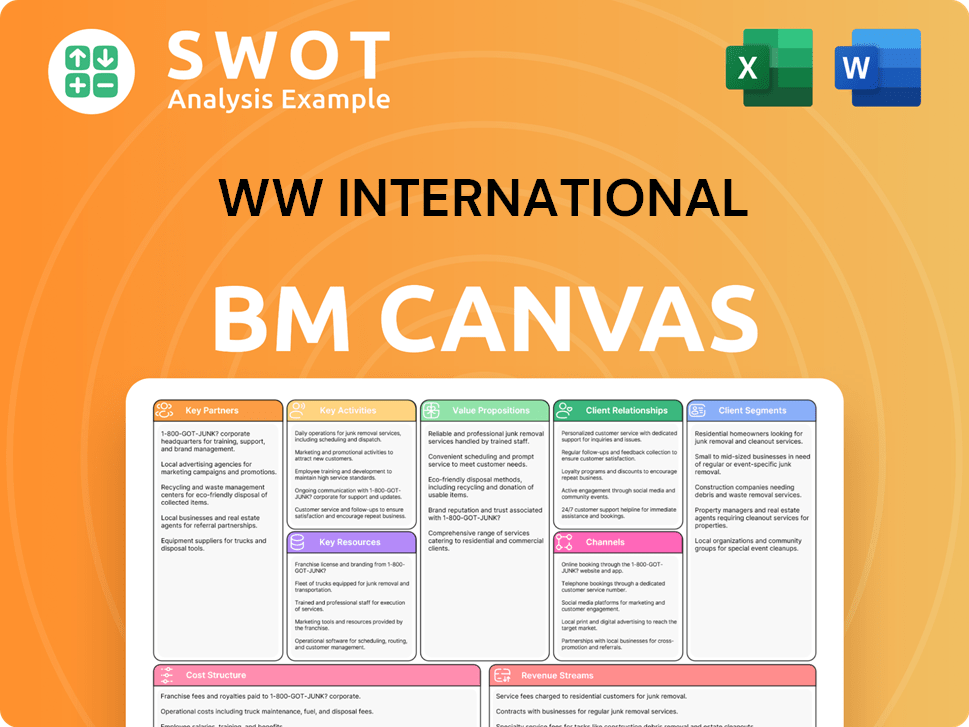

WW International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow WW International’s Growth?

The WW International faces several significant risks and obstacles that could impact its future growth. The weight management market is highly competitive, and the emergence of new weight loss solutions, such as GLP-1 medications, presents a major challenge. Moreover, the company's financial health, including substantial debt, adds further complexity to its strategic outlook.

Intense competition and technological disruptions are key factors influencing WW International's ability to execute its growth strategy. Regulatory changes and macroeconomic conditions also play a role in shaping consumer spending and the demand for weight management programs. The company's focus on cost reduction and integrating clinical and traditional solutions is crucial for navigating these challenges.

The competitive landscape in the weight management sector has intensified, particularly with the rising popularity of GLP-1 medications. This has led to increased customer acquisition costs for WW International, which rose by 30% year-over-year in Q3 2024. The company is also dealing with a decline in subscribers, with a 9% drop year-over-year in Q3 2024, and total subscribers reaching 3.3 million in Q4 2024, a 12.2% decrease from the prior year.

The weight management market is highly competitive, with the rise of GLP-1 medications like Ozempic posing a significant challenge. This increased competition impacts customer acquisition costs and overall subscriber numbers for WW International.

The company experienced a decline in subscribers, with a 9% drop year-over-year in Q3 2024, and total subscribers reaching 3.3 million in Q4 2024, a 12.2% decrease from the prior year. This trend reflects the challenges in retaining customers amidst the competitive environment.

WW International is burdened by a significant debt load, exceeding $1.6 billion, which has led to discussions about potential restructuring with bondholders. This financial pressure is a major risk factor that could affect the company's strategic flexibility.

Regulatory changes and macroeconomic conditions can influence consumer spending and the demand for weight management solutions. These external factors introduce uncertainty and require WW International to adapt its business strategy accordingly.

Management is focusing on cost reduction initiatives, aiming for $100 million in run-rate savings by the end of 2025. These measures are crucial for improving financial performance and navigating the challenging market conditions.

The company has recorded substantial non-cash impairment charges, including $315.0 million in fiscal year 2024. This reflects the difficulties in its operating environment and the need for strategic adjustments.

The increasing use of GLP-1 medications, like Ozempic, poses a significant challenge to traditional weight loss programs. These drugs offer an alternative approach to weight management, potentially impacting WW International's market share. This shift in the market requires the company to adapt its offerings and strategies to remain competitive.

WW International's substantial debt, exceeding $1.6 billion, is a critical concern. The company is exploring options, including potential restructuring, to manage its financial obligations. The outcome of these discussions will be crucial for the company's long-term viability and its ability to execute its growth strategy.

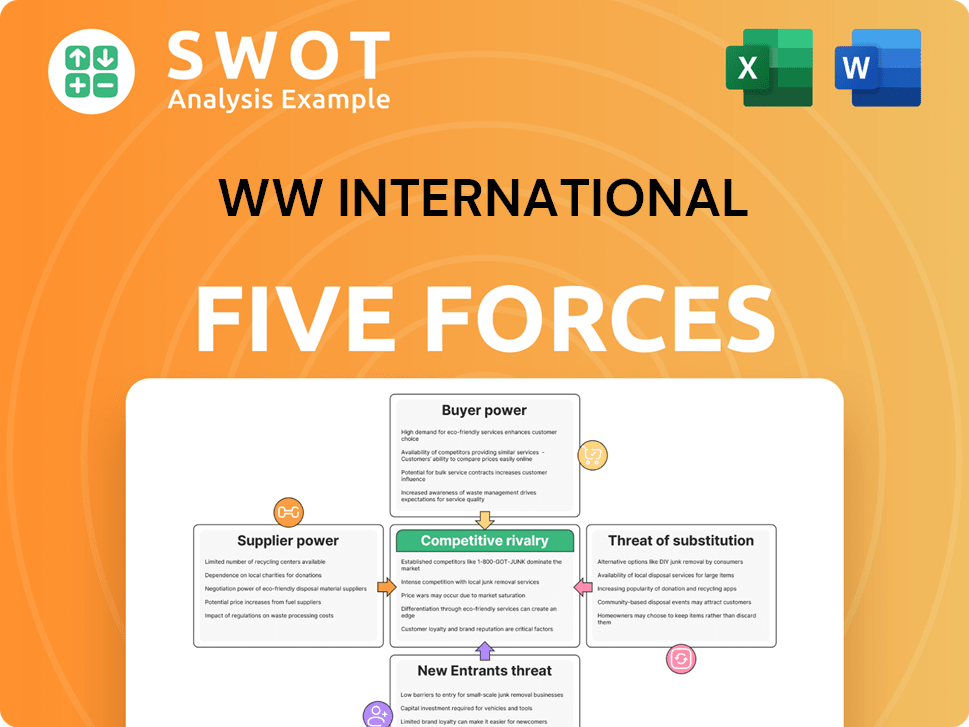

WW International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of WW International Company?

- What is Competitive Landscape of WW International Company?

- How Does WW International Company Work?

- What is Sales and Marketing Strategy of WW International Company?

- What is Brief History of WW International Company?

- Who Owns WW International Company?

- What is Customer Demographics and Target Market of WW International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.