Zurel Group B.V Bundle

Can Zurel Group B.V. Bloom in the Competitive Leisure Sector?

Founded in 1910, Zurel Group B.V. has evolved from its roots in the flower and plant trade to become a key player in recreational accommodations. This strategic shift highlights the company's ability to adapt and identify new avenues for growth. With a current workforce of 160 employees, Zurel Group B.V. is now focused on providing diverse lodging options and services for tourists and vacationers.

This article provides a comprehensive analysis of Zurel Group B.V.'s Zurel Group B.V SWOT Analysis, exploring its growth strategy, expansion initiatives, and financial outlook. We'll delve into the company's strategic planning, examining its potential for future growth within the leisure sector. Furthermore, we will evaluate the market analysis to understand the challenges and opportunities that Zurel Group B.V. faces, providing insights for investors and stakeholders interested in the future of Zurel Company Prospects and its business development.

How Is Zurel Group B.V Expanding Its Reach?

The Growth Strategy Zurel for Zurel Group B.V. involves expanding its presence within the leisure sector. This is primarily achieved through the development and management of recreational accommodations and holiday parks. The company's approach focuses on adapting to evolving trends to capitalize on opportunities within the tourism and leisure industries.

Zurel Company Prospects are closely tied to its ability to innovate and respond to market demands. The firm's historical adaptability suggests a forward-thinking approach. This includes a commitment to enhancing its portfolio and attracting a broader customer base through diverse lodging options.

Business Development for Zurel Group B.V. is likely to involve strategic planning and market analysis. The company seems poised to leverage these strategies to grow its market share. This is especially true in light of the increasing demand for sustainable and digitally advanced leisure options.

Zurel Group B.V. may explore new geographical markets for its holiday parks and accommodations. This could involve entering regions with high tourism potential or areas with underserved leisure markets. The company could also focus on expanding its existing operations within the Netherlands.

Innovation in lodging types and amenities is a key aspect of Zurel Group B.V.'s expansion. This might include developing new types of accommodations, such as eco-friendly cabins or luxury villas. The company could also introduce new services and amenities to enhance the guest experience and attract a wider audience.

Zurel Group B.V. might forge strategic partnerships with other companies in the leisure and tourism sectors. These partnerships could involve collaborations with tour operators, travel agencies, or other accommodation providers. Such alliances could help the company expand its reach and access new markets.

The company may invest in sustainable practices to attract environmentally conscious travelers. This could involve using renewable energy sources, implementing waste reduction programs, and promoting eco-friendly activities. Such initiatives can enhance the company’s brand image and appeal to a growing segment of the market.

To understand the Zurel Group B.V growth strategy analysis more deeply, consider the broader industry trends. The leisure sector is seeing significant investment in sustainable solutions and digital transformation. For instance, in 2024, there was a 25% increase in revenue from sustainable solutions within the broader industry. Moreover, many entities are exceeding their 2025 emission reduction targets. This suggests that Zurel Group B.V. may be pursuing initiatives that align with these trends, such as developing eco-friendly accommodations or integrating smart technologies into its holiday parks. For more details on the company's financial structure, you can review Revenue Streams & Business Model of Zurel Group B.V.

Zurel Group B.V. is likely to focus on several key areas for expansion. These include geographical expansion, product innovation, strategic partnerships, and sustainability initiatives. These efforts are designed to enhance its market position and appeal to a wider customer base.

- Expanding into new geographical markets to increase its footprint.

- Introducing innovative lodging options and amenities to attract new customers.

- Forming strategic partnerships to enhance its market reach and capabilities.

- Implementing sustainable practices to align with industry trends and attract eco-conscious travelers.

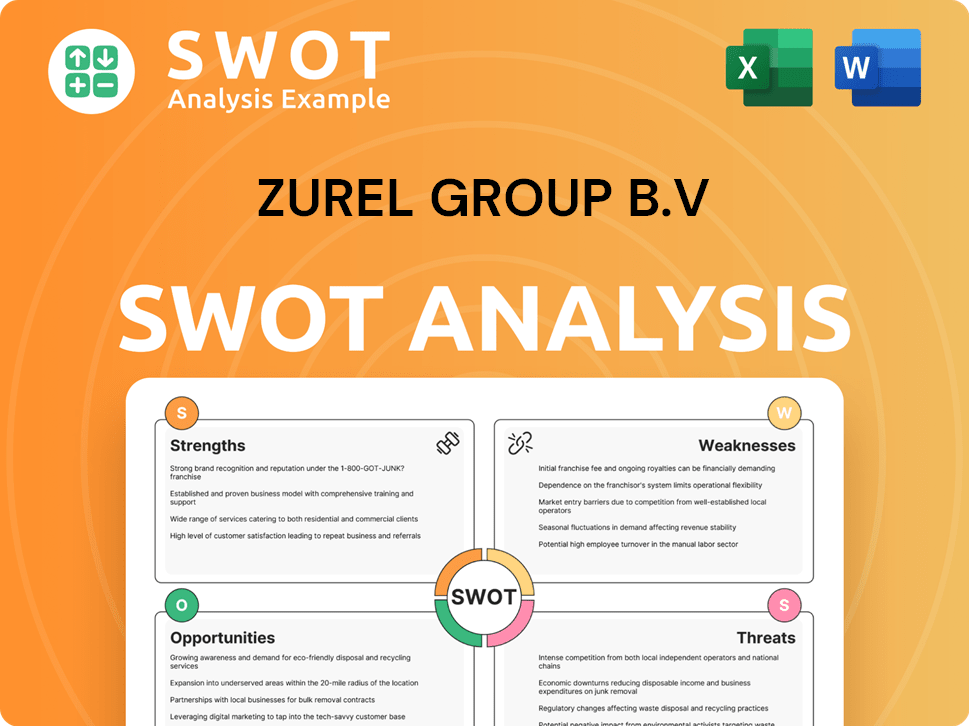

Zurel Group B.V SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Zurel Group B.V Invest in Innovation?

Understanding the innovation and technology strategy of Zurel Group B.V requires considering the evolving landscape of the leisure sector. This sector is increasingly driven by digital transformation, with a focus on enhancing customer experiences and operational efficiency. The company's approach to growth strategy Zurel likely involves leveraging technology to meet these demands.

While specific details about Zurel Company prospects and its internal R&D investments are not publicly available, industry trends offer insights. The leisure industry is seeing significant changes, including the integration of digital platforms and the implementation of AI solutions. This shift suggests that Zurel Group B.V is likely exploring similar avenues to stay competitive and meet the changing needs of its customers.

Furthermore, sustainability is becoming a key focus. Companies are setting ambitious emission reduction targets and increasing revenue from sustainable solutions. For Zurel Group B.V, this could involve investments in sustainable building materials and energy solutions, aligning with broader industry goals.

The leisure sector is undergoing a digital revolution. This includes the adoption of digital platforms for booking and customer service. The use of AI is also growing rapidly to improve performance and streamline customer interactions.

AI solutions are being implemented to enhance various aspects of the business. This includes customer service, property maintenance, and personalized guest experiences. Automation streamlines operations, improving efficiency and reducing costs.

Sustainability is becoming a core focus for many companies. This involves setting emission reduction targets and investing in sustainable solutions. This trend is crucial for long-term growth and attracting environmentally conscious customers.

Smart park management systems are being adopted to improve operational efficiency. These systems help optimize resource allocation, enhance guest experiences, and streamline maintenance. They also improve security.

Personalization is key to enhancing customer satisfaction. This involves using data analytics to tailor services and offers to individual guest preferences. This can include customized booking options and targeted marketing.

The use of sustainable building materials reduces environmental impact. This also helps to attract environmentally conscious customers. Sustainable practices are becoming increasingly important for long-term viability.

Zurel Group B.V can focus on several key areas to drive innovation and growth. These include digital platforms, AI-powered customer service, and sustainable practices. These strategies are essential for adapting to industry trends and meeting customer expectations.

- Digital Platforms: Developing user-friendly booking systems and mobile apps.

- AI-Powered Customer Service: Implementing chatbots and AI-driven support systems.

- Smart Property Management: Using technology for efficient property maintenance.

- Personalized Guest Experiences: Tailoring services based on guest preferences.

- Sustainable Solutions: Investing in green building materials and energy-efficient systems.

- Data Analytics: Leveraging data to improve decision-making and optimize operations.

To understand how Zurel Group B.V is approaching its market, it is useful to consider their Marketing Strategy of Zurel Group B.V. This can provide insights into how the company is positioning itself in the market and using technology to achieve its business goals.

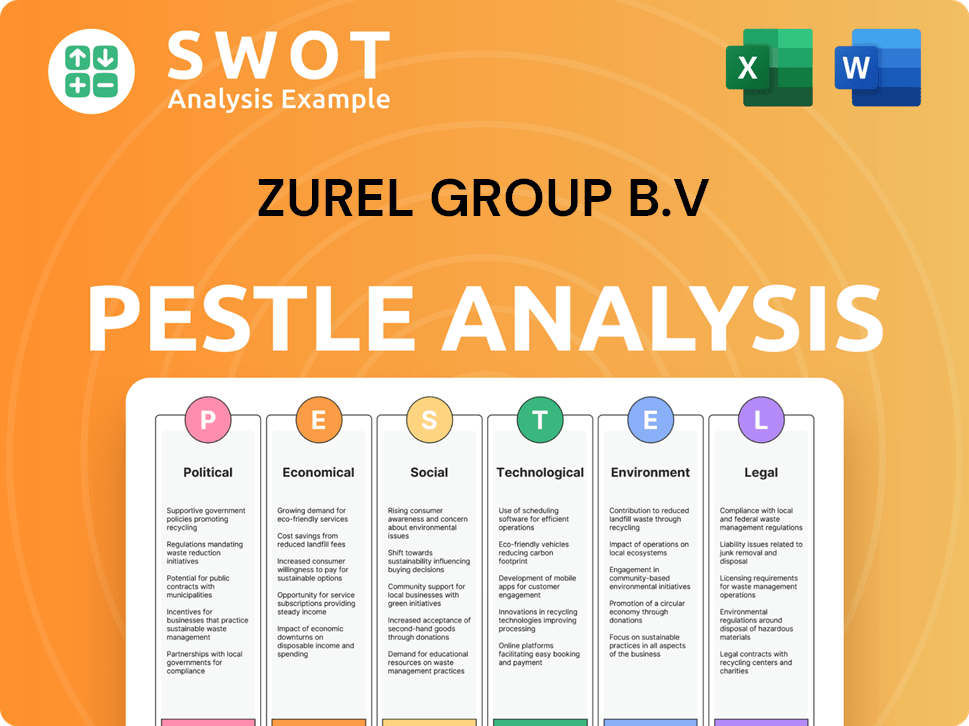

Zurel Group B.V PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Zurel Group B.V’s Growth Forecast?

Analyzing the Zurel Group B.V financial outlook requires considering both the broader economic environment and the company's specific industry dynamics. While direct financial reports for 2024 and 2025 are unavailable, the general trends and forecasts offer valuable insights into the potential financial performance of Zurel Group B.V. Understanding the Growth Strategy Zurel and the Zurel Company Prospects is crucial for assessing its future.

In 2024, several companies have reported positive financial results. For instance, one group saw a 16% increase in net revenue, reaching DKK 15,036 million, with an organic growth of 6%. Additionally, the EBIT increased by 20% to DKK 1,968 million. Another financial institution reported a Swiss Solvency Test (SST) ratio of 253% as of December 31, 2024, up from 234% the previous year. These figures reflect a generally favorable economic climate for some sectors.

Looking ahead to 2025, the economic outlook is characterized by uncertainty due to geopolitical issues, inflation, and changing trade policies. Despite these challenges, some companies anticipate continued growth. One company projects net revenue growth between 5-7% and EBIT growth between 7-13% for 2025. The leisure sector, where Zurel Group B.V operates, is sensitive to consumer spending on tourism and recreation, making its financial performance closely tied to economic conditions.

Zurel Group B.V's financial success depends on several factors, including its ability to attract and retain customers within the competitive leisure market. Effective Business Development and Strategic Planning are essential for navigating the economic uncertainties of 2025. The company's strategic decisions will play a key role in its financial outcomes.

To enhance Zurel Company Prospects, evaluating its competitive advantages is essential. This includes assessing the quality of its recreational accommodations and holiday parks, and the effectiveness of its management. Examining how Zurel Group B.V adapts to changing market conditions will be critical.

Zurel Group B.V's performance is influenced by Industry Trends, such as consumer preferences and travel patterns. Understanding these trends is vital for Market Analysis. Staying informed about the latest developments will help shape the company's Growth Strategy Zurel.

Assessing the Zurel Group B.V investment potential involves evaluating its ability to generate revenue and profits. The company's ability to adapt to market changes and implement Sustainable Growth Strategies will be key. Understanding the Zurel Group B.V financial performance forecast is crucial for investors.

Several factors influence Zurel Group B.V's financial performance. These include consumer spending, operational efficiency, and the ability to manage Challenges and Opportunities. The company's Long-Term Goals will be critical in shaping its financial future.

- Economic conditions and their impact on tourism.

- Operational efficiency and cost management.

- Customer satisfaction and retention rates.

- Strategic partnerships and Market Expansion Opportunities.

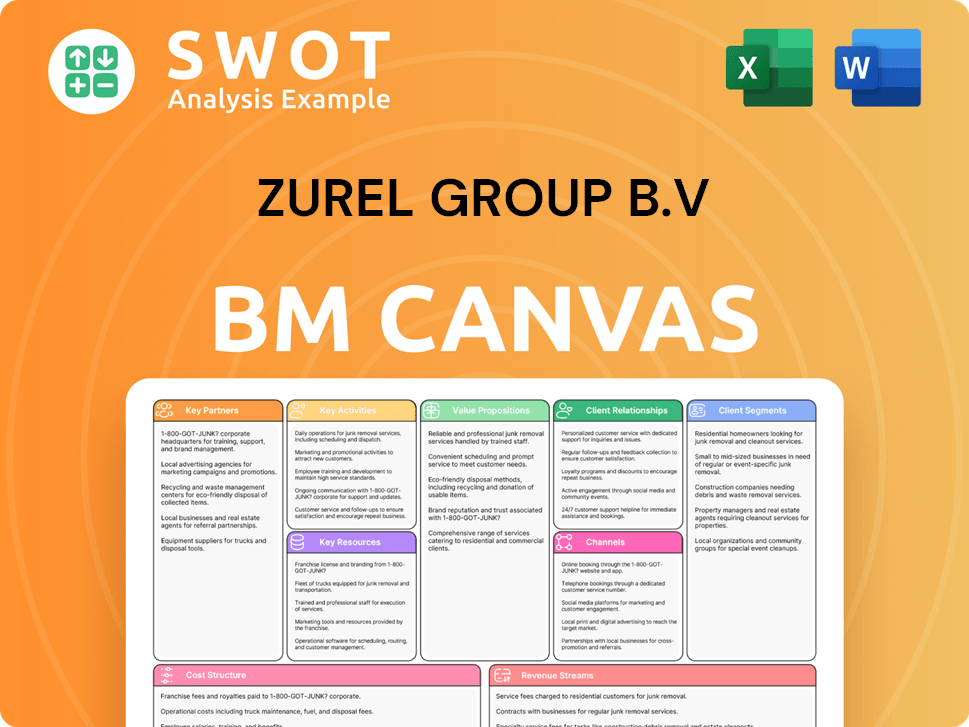

Zurel Group B.V Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Zurel Group B.V’s Growth?

The Zurel Group B.V, operating within the leisure sector, faces several potential risks and obstacles that could affect its Growth Strategy Zurel and future prospects. The leisure and hospitality industry is competitive, with various accommodation providers. Regulatory changes, especially concerning environmental standards, could impose new compliance costs.

Supply chain vulnerabilities, although perhaps less pronounced than in manufacturing, could still affect the procurement of goods and services necessary for maintaining and developing recreational facilities. Technological disruption, such as AI and digital platforms, necessitates significant investment to keep pace with evolving customer expectations and operational efficiencies. Internal resource constraints, like securing skilled labor, could also hinder growth.

To navigate these challenges, understanding the Target Market of Zurel Group B.V is crucial. The company must adapt through strategic planning and agile operations.

The leisure and hospitality industry is intensely competitive. Zurel Group B.V must differentiate itself from large hotel chains and smaller independent holiday parks. This requires continuous Business Development and innovation to maintain a competitive edge.

Regulatory changes, particularly concerning environmental standards and land use, pose a risk. Compliance costs and restrictions on development opportunities can impact Zurel Company Prospects. Companies are preparing for new CSR disclosure mechanisms, which could become mandatory by 2026.

Supply chain issues can affect the procurement of goods and services. While less significant than in manufacturing, any disruptions could impact recreational facility maintenance and development. Strategic Planning is essential to mitigate these risks.

Rapid advancements in technology, including AI and digital platforms, present a risk. Keeping pace with these changes requires significant investment to meet evolving customer expectations. Many industries implemented hundreds of AI solutions in 2024.

Securing skilled labor and managing capital for expansion can hinder growth. These constraints can limit Market Analysis and the ability to capitalize on opportunities. Companies often employ diversification strategies and robust risk management frameworks.

Companies often use diversification strategies and risk management frameworks. Some organizations updated corporate strategy risks in 2024 with Board approval. An increase in sustainability efforts, including improving environmental data management systems and setting measurable goals for 2025, suggests a proactive approach to addressing environmental and social risks.

Zurel Group B.V Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zurel Group B.V Company?

- What is Competitive Landscape of Zurel Group B.V Company?

- How Does Zurel Group B.V Company Work?

- What is Sales and Marketing Strategy of Zurel Group B.V Company?

- What is Brief History of Zurel Group B.V Company?

- Who Owns Zurel Group B.V Company?

- What is Customer Demographics and Target Market of Zurel Group B.V Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.