Altus Intervention AS Bundle

How Does Altus Intervention AS Drive Value in the Oil and Gas Sector?

Dive into the world of Altus Intervention AS SWOT Analysis and discover how this key player in the oil and gas industry is revolutionizing well services. Acquired by Baker Hughes, Altus Intervention leverages over 40 years of experience to provide cutting-edge well intervention and downhole technology solutions. Explore the company's integral role in maximizing production and optimizing well performance within the dynamic energy landscape.

With the global well intervention market booming, understanding Altus Intervention's operations is more critical than ever. This company, now part of Baker Hughes, is at the forefront of innovation, offering specialized expertise in subsea intervention and advanced technology. Learn how Altus Intervention's focus on efficiency and technological advancements positions it for continued success in the oil and gas industry, supported by the financial strength of Baker Hughes.

What Are the Key Operations Driving Altus Intervention AS’s Success?

Altus Intervention, also known as Altus AS, specializes in well intervention services and downhole technology solutions, primarily for the oil and gas sector. Their core operations focus on maximizing production, optimizing well performance, and extending the lifespan of oil and gas wells. The company offers a range of services, including wireline tractor service, horizontal conveyance, and coiled tubing and pumping, among others.

The company's operations are supported by a skilled workforce and a modern asset fleet. Innovation is a key focus, with significant investment in electromechanical intervention and fiber optic sensing systems. These technologies help improve safety, efficiency, and sustainability for clients. Altus Intervention's supply chain relies on specialized equipment and technology suppliers, alongside logistics and transportation providers to deliver equipment and personnel globally, including to remote offshore sites.

Altus Intervention's value proposition centers on providing integrated solutions that combine services and technology to tackle complex well challenges. This approach boosts efficiency and hydrocarbon recovery. Their focus on 'making intervention smarter' through proprietary technology and a commitment to innovation is a key differentiator. This translates into increased production, potential cost reductions, and enhanced well lifespan and performance for their customers. Their established industry relationships, fostered by over 40 years of experience and the backing of Baker Hughes, provide a reliable foundation for consistent contract opportunities within the global oil and gas market, which is projected to reach $$5.2 trillion by 2025.

Altus Intervention provides a variety of well services. These include well intervention, integrity, and production solutions. They offer services like wireline tractor service, horizontal conveyance, barriers and isolation, coiled tubing and pumping, perforation and ballistics, precision cleanout, and cased-hole logging.

The company emphasizes technology development, particularly in electromechanical intervention and fiber optic sensing systems. These technologies contribute to safer, more efficient, and more sustainable solutions for clients. This focus helps them stay competitive in the Competitors Landscape of Altus Intervention AS.

Altus Intervention offers integrated solutions that combine services and technology. This approach boosts efficiency and hydrocarbon recovery. The focus on 'making intervention smarter' through proprietary technology and innovation provides increased production, potential cost reductions, and enhanced well lifespan.

Established industry relationships, fostered by over 40 years of experience and the backing of Baker Hughes, provide a reliable foundation. This supports consistent contract opportunities within the global oil and gas market. The global oil and gas market is projected to reach $5.2 trillion by 2025.

Altus Intervention's operations involve a skilled workforce and a modern asset fleet. The company focuses on innovative technology development, particularly in electromechanical intervention and fiber optic sensing systems. These technologies are experiencing rapid adoption. The company's supply chain relies on specialized equipment and technology suppliers.

- Well intervention services are a core offering.

- Technology development enhances efficiency and safety.

- Supply chain management ensures global service delivery.

- Focus on integrated solutions for complex well challenges.

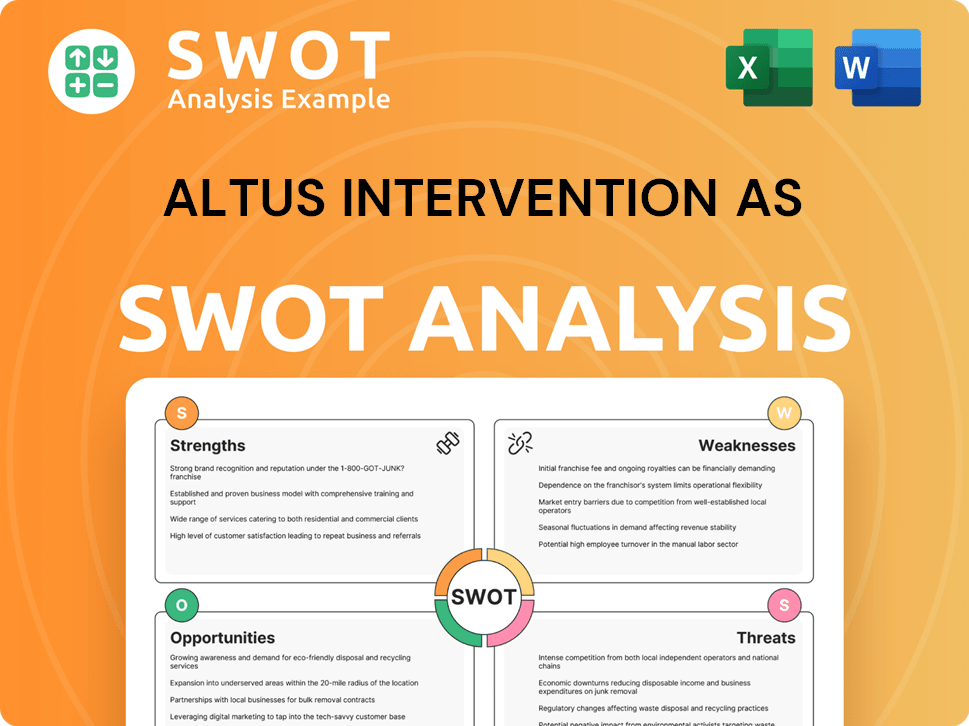

Altus Intervention AS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Altus Intervention AS Make Money?

The primary revenue streams for Altus Intervention, now part of Baker Hughes, stem from its comprehensive well intervention services and proprietary downhole technology. These services are crucial for the oil and gas industry, focusing on enhancing well performance and extending well life. The company's financial performance is closely tied to the broader oilfield services market, with an emphasis on innovative solutions.

Altus Intervention's monetization strategies are centered on providing value-based solutions that enhance well performance and extend well life. This includes offerings like well intervention to maximize production, integrity solutions, and production optimization services. The demand for these services is consistent, fueled by the ongoing need to boost production in aging oil fields and the rising global energy demand. Altus Intervention’s emphasis on efficiency and sustainability in its marketing also attracts eco-conscious operators.

The global well intervention market, a direct indicator of Altus's addressable market, was valued at $6.2 billion in 2024 and is expected to grow to $10.7 billion by 2025, indicating a robust market for its services. The company's approach focuses on efficiency and sustainability, attracting operators seeking eco-friendly solutions. The demand for sustainable oilfield services increased by 15% in 2024.

Following its acquisition by Baker Hughes, Altus Intervention's services are likely integrated into Baker Hughes' broader pricing structures, potentially leading to new bundled offerings. This integration leverages Baker Hughes' extensive global network and resources, enhancing market reach and project capabilities. The company's focus on innovative technologies, such as electromechanical intervention and fiber optic sensing systems, which are projected to see significant market growth, also contributes to its revenue potential by offering advanced, high-value solutions.

- The Oilfield Services segment of Baker Hughes, which includes Altus Intervention, reported $25 billion in revenue in 2023.

- The well intervention market is expected to grow significantly, with a valuation of $10.7 billion by 2025, up from $6.2 billion in 2024.

- Demand for sustainable oilfield services is rising, increasing by 15% in 2024.

- Altus Intervention's services are integrated into Baker Hughes' broader offerings, enhancing market reach.

- For more insights into the ownership and structure of the company, you can refer to the article on Owners & Shareholders of Altus Intervention AS.

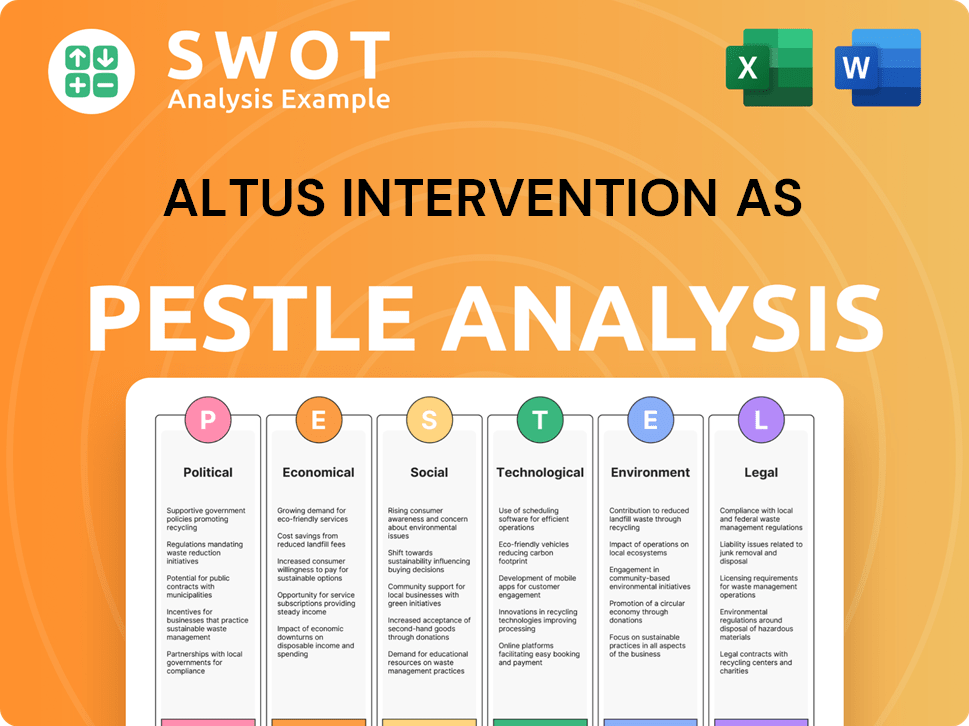

Altus Intervention AS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Altus Intervention AS’s Business Model?

The acquisition of Altus Intervention by Baker Hughes in 2022 marked a pivotal moment, integrating its well intervention expertise into a larger service portfolio. This strategic move significantly enhanced Baker Hughes' offerings in the oilfield services sector. Before the acquisition, Altus Intervention had established a strong reputation over approximately four decades, known for delivering safe and value-adding solutions within the well intervention market.

Another key strategic decision was the 2018 acquisition of industry-leading thru-tubing products and services. This move aimed to meet the growing demand for cost-effective tubing solutions, particularly in mature oil fields. The company also navigated regulatory challenges, with the UK's competition regulator clearing the Baker Hughes acquisition after steps were taken to address concerns, including the sale of coil tubing and pumping services in the UK.

Altus Intervention's competitive edge is built on several pillars. Their specialized expertise in well intervention and proprietary downhole technology are crucial for boosting production and extending well life. A global presence, spanning regions like the UK, West Africa, Norway, and the Americas, allows for market diversification. Established industry relationships, including those fostered through the Baker Hughes acquisition, also provide a solid foundation for business operations.

The acquisition by Baker Hughes in 2022 was a major milestone, integrating Altus Intervention's services into a larger organization. The company had built a strong reputation over approximately 40 years. The acquisition of thru-tubing products in 2018 was another significant strategic move.

Acquiring thru-tubing products and services in 2018 addressed the need for cost-effective solutions in mature oil fields. The Baker Hughes acquisition enhanced the company's service offerings. Addressing regulatory scrutiny, such as the UK competition review, was also a key strategic action.

Specialized well intervention expertise and proprietary technology are key differentiators. A global presence and established industry relationships provide a strong market position. The focus on innovation and sustainability, supported by significant R&D investment, further strengthens their competitive advantage.

The global oil and gas market is projected to reach $5.2 trillion by 2025. Baker Hughes invested $1 billion in R&D in 2024, supporting technological advancements. The industry's shift towards greener practices and digitalization is influencing service improvements.

Altus Intervention's strengths include specialized well intervention expertise and a global presence. Their focus on innovation and technology, backed by Baker Hughes' R&D, provides a competitive edge. The company continues to adapt to industry trends, emphasizing efficiency and sustainability.

- Specialized expertise in well intervention and proprietary downhole technology.

- Global presence, allowing access to diverse markets and reduced regional reliance.

- Established industry relationships, including those from the Baker Hughes acquisition.

- Focus on innovative technology, supported by significant R&D investments.

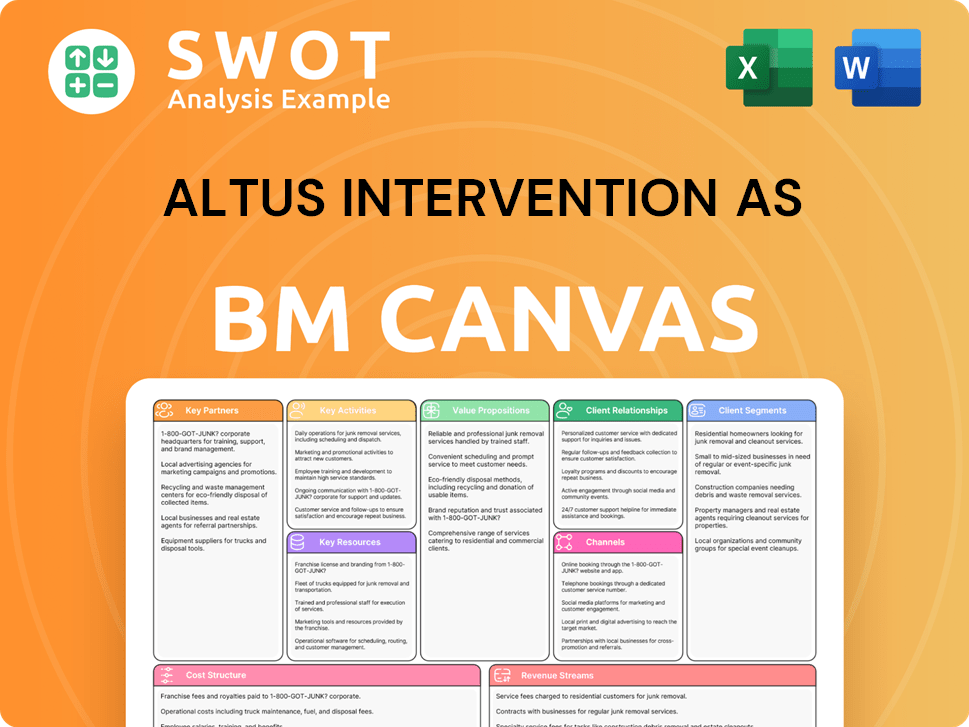

Altus Intervention AS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Altus Intervention AS Positioning Itself for Continued Success?

In the specialized well intervention sector, particularly in regions like the North Sea, Altus Intervention holds a strong market position. The company's integration into Baker Hughes boosts its standing, using Baker Hughes' extensive resources and global network. The global well intervention market was valued at $6.2 billion in 2024, with projections to reach $10.7 billion by 2025, indicating growing demand for Altus's core services.

Despite its strong position in the oil and gas sector, Altus Intervention faces several key risks. These risks include the volatile nature of the oil and gas industry, the shift towards renewable energy, and potential challenges from integration with Baker Hughes. Competition and regulatory changes also pose challenges.

As a market leader in the well intervention sector, Altus Intervention benefits from its integration with Baker Hughes, leveraging its global reach and resources. The well services market is growing, with a projected value of $10.7 billion by 2025. The company faces competition from major players like Halliburton and Schlumberger.

The oil and gas sector's volatility and the shift towards renewable energy pose significant risks to Altus Intervention. Integration challenges with Baker Hughes and fierce market competition can impact profitability. Regulatory changes and potential patent disputes also present challenges for the company.

Altus Intervention is well-positioned to capitalize on the growing well intervention market, with a focus on technological advancements. The company's strategic initiatives include investing in digitalization and automation. Its global presence and established relationships are expected to provide a stable foundation.

The well intervention market is expected to reach $10.7 billion by 2025, indicating strong growth potential. Altus Intervention is focused on enhancing technological capabilities, providing high-efficiency solutions, and emphasizing safety and sustainability. For more insights, explore the Growth Strategy of Altus Intervention AS.

Altus Intervention is focusing on several key areas to drive future growth and maintain its competitive edge. These include technological advancements, enhancing operational efficiency, and expanding its global footprint.

- Investment in digitalization and automation to improve service delivery and reduce downtime.

- Focus on providing higher-efficiency solutions to customers, improving operational capabilities.

- Emphasis on safety, efficiency, and sustainability to align with industry trends and regulations.

- Leveraging its global presence and established relationships within the oil and gas sector.

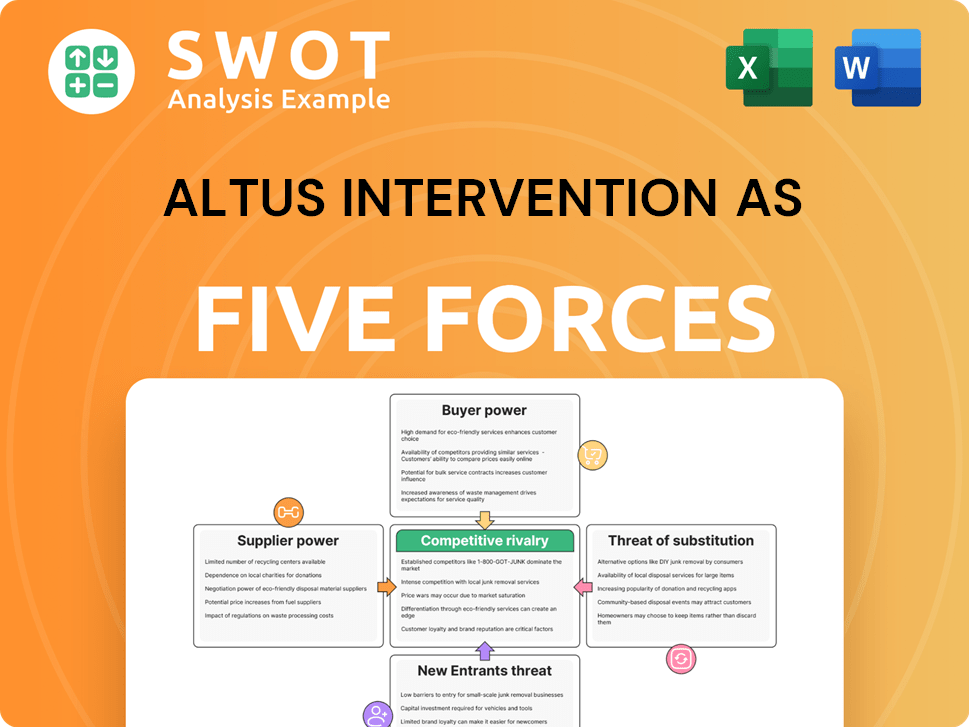

Altus Intervention AS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Altus Intervention AS Company?

- What is Competitive Landscape of Altus Intervention AS Company?

- What is Growth Strategy and Future Prospects of Altus Intervention AS Company?

- What is Sales and Marketing Strategy of Altus Intervention AS Company?

- What is Brief History of Altus Intervention AS Company?

- Who Owns Altus Intervention AS Company?

- What is Customer Demographics and Target Market of Altus Intervention AS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.