Andersons Bundle

How Does Andersons Inc. Thrive in the Agricultural Sector?

Founded in 1947, Andersons, Inc. (ANDE) has grown from a family-owned grain elevator into a publicly traded powerhouse in North America's agricultural landscape. This diversified company plays a critical role in the agricultural supply chain, offering essential products and services that feed a growing global population. Recent financial results highlight its resilience, even amidst fluctuating commodity prices.

To truly understand the Andersons SWOT Analysis, one must first grasp the intricacies of its operations. This deep dive will explore how Andersons Company generates revenue through commodity merchandising, renewables, and plant nutrient sectors. We'll examine its strategic approach to navigating market dynamics, its competitive advantages, and its future outlook, providing a comprehensive view of the Andersons business model and how it makes money. The Andersons Inc. continues to be a key player in the industry.

What Are the Key Operations Driving Andersons’s Success?

The Andersons Inc creates and delivers value through its core operations, primarily focusing on the agricultural and energy sectors. This is achieved through three main segments: Trade (formerly Agribusiness), Renewables, and Nutrient & Industrial. Each segment contributes to the company's overall value proposition by offering specialized services and products that meet the needs of its diverse customer base.

The company's business model is built on a foundation of operational efficiency, strategic partnerships, and a commitment to sustainability. By integrating its operations across the agricultural supply chain, Andersons business is able to manage risks, capitalize on market opportunities, and maintain a competitive edge. This approach allows the company to adapt to changing market conditions and deliver consistent value to its stakeholders.

For a deeper understanding of how this company evolved over time, you can explore the Brief History of Andersons.

The Trade segment, a key component of Andersons operations, focuses on grain merchandising across North America, the U.K., and Switzerland. It involves purchasing, handling, processing, storing, and selling commodities like corn, soybeans, and wheat. This segment also provides essential risk management and logistics services to its customers.

The Trade segment operates approximately 130 facilities. It has a substantial grain storage capacity of around 290 million bushels, demonstrating its significant role in the agricultural supply chain. The segment's ability to navigate market uncertainties underscores its operational effectiveness.

The Renewables segment is a major producer of ethanol and its co-products, with four plants located in Indiana, Iowa, Michigan, and Ohio. The company focuses on efficient plant performance and process enhancements to improve co-product yields and lower the carbon intensity of ethanol production. This segment also merchandises vegetable oils and provides services to ethanol plants.

The Renewables segment boasts a combined annual ethanol production volume of 506 million gallons. The focus on sustainable energy solutions and efficient production methods gives the company a competitive advantage in the energy market. This segment contributes significantly to Andersons services and overall business strategy.

The Nutrient & Industrial segment formulates and distributes plant nutrients, specialty products, and industrial inputs. It operates through approximately 50 facilities across the U.S. This segment serves thousands of growers and provides essential inputs like nitrogen, phosphate, and potash, supporting agricultural productivity.

- This segment is a major manufacturer and marketer of premium products.

- It utilizes next-generation technologies for professional turf maintenance, agriculture, and horticulture.

- The integrated supply chain and strategic partnerships ensure efficient distribution.

- The segment's diversified portfolio allows adaptation to various market conditions.

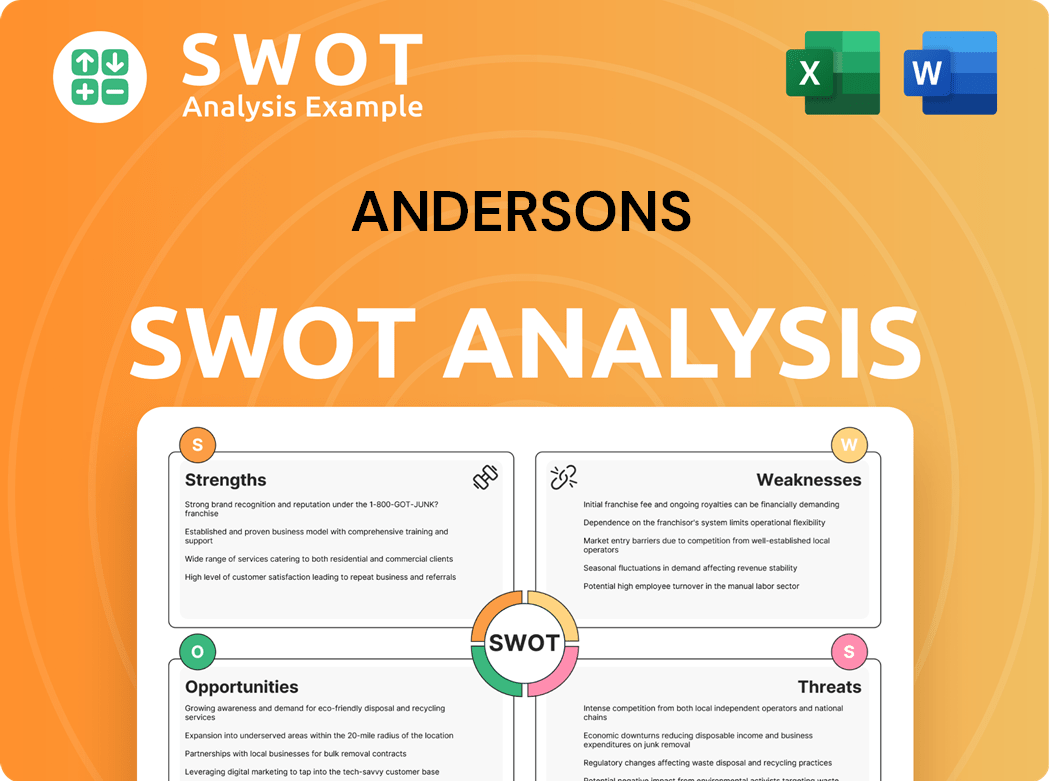

Andersons SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Andersons Make Money?

The Andersons Inc. generates revenue through a diversified business model, primarily focusing on trade, renewables, and nutrient & industrial segments. The company's ability to adapt to market fluctuations and manage operational efficiencies is key to its financial performance. Understanding the revenue streams and monetization strategies of The Andersons is crucial for investors and stakeholders.

In the first quarter of 2025, The Andersons reported total sales and merchandising revenues of $2.66 billion. This demonstrates the company's ongoing ability to generate substantial revenue. For the full year 2024, total sales and merchandising revenues reached $11.26 billion, highlighting the scale of their operations.

The company's financial success is driven by its strategic focus on key sectors. For a deeper dive into their growth strategies, consider reading this article about the Growth Strategy of Andersons.

The Trade segment is a significant contributor to The Andersons' revenue, primarily through grain merchandising and related services. This segment demonstrated strong performance, with a record pretax income of $54 million in the fourth quarter of 2024.

Revenue in the Trade segment is generated through buying, storing, and selling grains. The company also provides risk management and logistics services, contributing to its diverse revenue streams. Adjusted EBITDA for Trade was $161 million for the full year 2024.

The Renewables segment, focused on ethanol production and co-products, is another key revenue source for The Andersons. In Q1 2025, this segment reported a pretax income of $25 million, showcasing its profitability. The first quarter 2025 adjusted EBITDA was $37 million.

Revenue in the Renewables segment comes from the sale of ethanol and co-products like distillers dried grains (DDGS) and corn oil. For the full year 2024, Renewables' adjusted EBITDA was $189 million, demonstrating significant financial contribution.

The Nutrient & Industrial segment focuses on the formulation and distribution of plant nutrients and other industrial products. This segment recorded pretax attributable earnings of $19 million and EBITDA of $57 million for the full year 2024.

Revenue in this segment is generated through product sales, including fertilizers, control products, and soil enhancers. These products serve agricultural, turf, and ornamental markets. Despite a slight decline in overall revenues in Q1 2025, the company continues to focus on operational efficiency.

The Andersons' revenue streams are diversified across Trade, Renewables, and Nutrient & Industrial segments. The company's strategic focus on operational efficiency and acquisitions, such as Skyland Grain, LLC, supports its financial performance. Here are some key points:

- The Trade segment benefits from grain merchandising and related services.

- The Renewables segment profits from ethanol production and co-products.

- The Nutrient & Industrial segment generates revenue from plant nutrients and industrial products.

- The company faced a slight decline in overall revenues in Q1 2025 due to lower commodity prices.

- Strategic investments are aimed at enhancing future results and diversifying revenue streams.

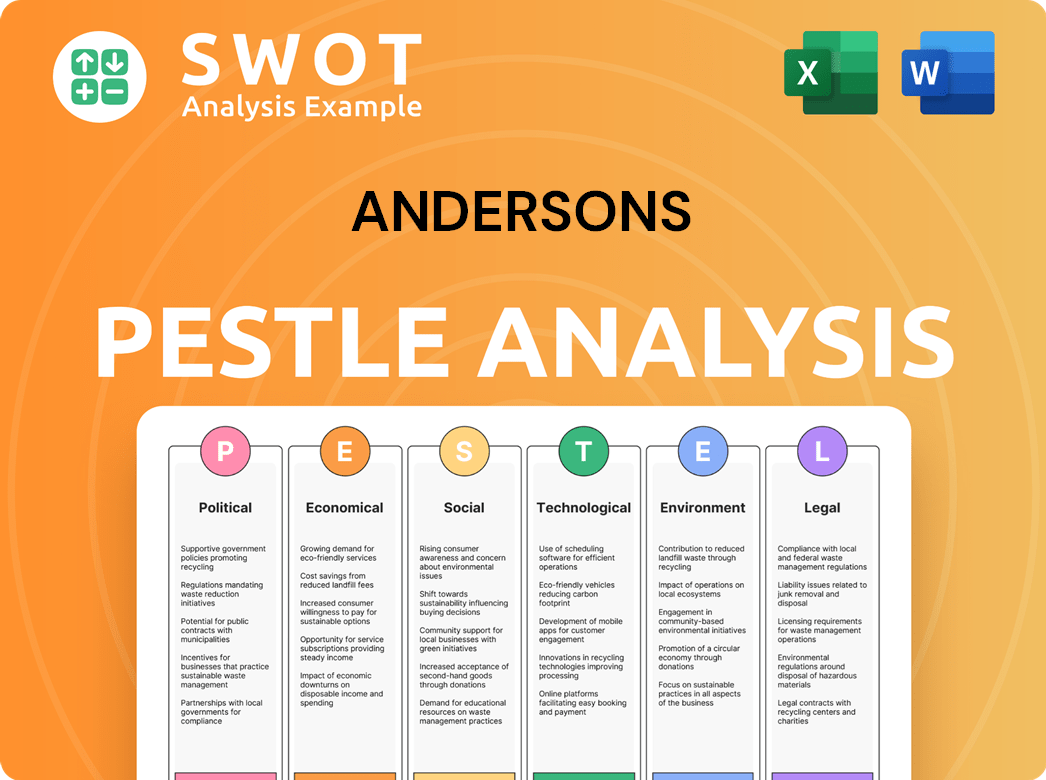

Andersons PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Andersons’s Business Model?

The story of the Andersons Company is one of strategic evolution and adaptation. Starting as a grain elevator in 1947, the company has broadened its scope significantly, including its listing on NASDAQ in 1996. Key moves, such as entering the ethanol business in the 2000s, have been pivotal in its growth. These decisions have positioned the company to capitalize on emerging market opportunities.

A significant strategic decision was the sale of its railcar leasing business in 2021 for roughly $550 million. This move allowed the company to concentrate on its core agricultural segments, specifically grain and fertilizer. In 2024, the company announced significant growth projects, including an investment in Skyland Grain, LLC, which is expected to boost its farm center agronomy business.

The Andersons' operations are marked by a diversified approach, focusing on grain merchandising, renewables, and plant nutrients. This diversification provides resilience against market volatility. The company's extensive network of grain storage facilities and its strategic locations across the U.S. and Canada offer logistical advantages. The company’s history and strategic moves have been shaped by its ability to adapt to market changes and capitalize on emerging opportunities, as further detailed in Target Market of Andersons.

Founded in 1947 as a grain elevator, The Andersons has a rich history. Significant milestones include its NASDAQ listing in 1996 and the expansion into the ethanol business in the 2000s. The company has consistently adapted to market dynamics, ensuring its relevance and growth in the agricultural sector.

A key strategic move was entering the ethanol business, capitalizing on the demand for renewable fuels. The 2021 sale of the railcar leasing business for $550 million allowed a focus on core agricultural segments. The 2024 investment in Skyland Grain, LLC, aims to enhance its asset portfolio and expand its agronomy business.

The company's diversified portfolio across grain merchandising, renewables, and plant nutrients provides resilience. Its extensive grain storage capacity, approximately 290 million bushels, and strategic locations offer logistical advantages. Operational efficiency and continuous improvement in ethanol production contribute to its competitive edge.

The Andersons faces challenges from global trade uncertainties and fluctuating ethanol margins. Despite these headwinds, the company adapts by focusing on operational efficiency and strategic acquisitions. Long-term capital investments are also key to enhancing future results and maintaining its market position.

The Andersons' financial performance and operational strategies are crucial for its success. The company's strong balance sheet and disciplined approach to capital spending support its growth. The company focuses on operational efficiency and strategic acquisitions to enhance future results.

- The grain storage capacity is approximately 290 million bushels, offering significant logistical advantages.

- The sale of the railcar leasing business in 2021 for approximately $550 million.

- The company's diversified portfolio provides resilience against market volatility.

- The company is adapting to challenges through operational efficiency and strategic acquisitions.

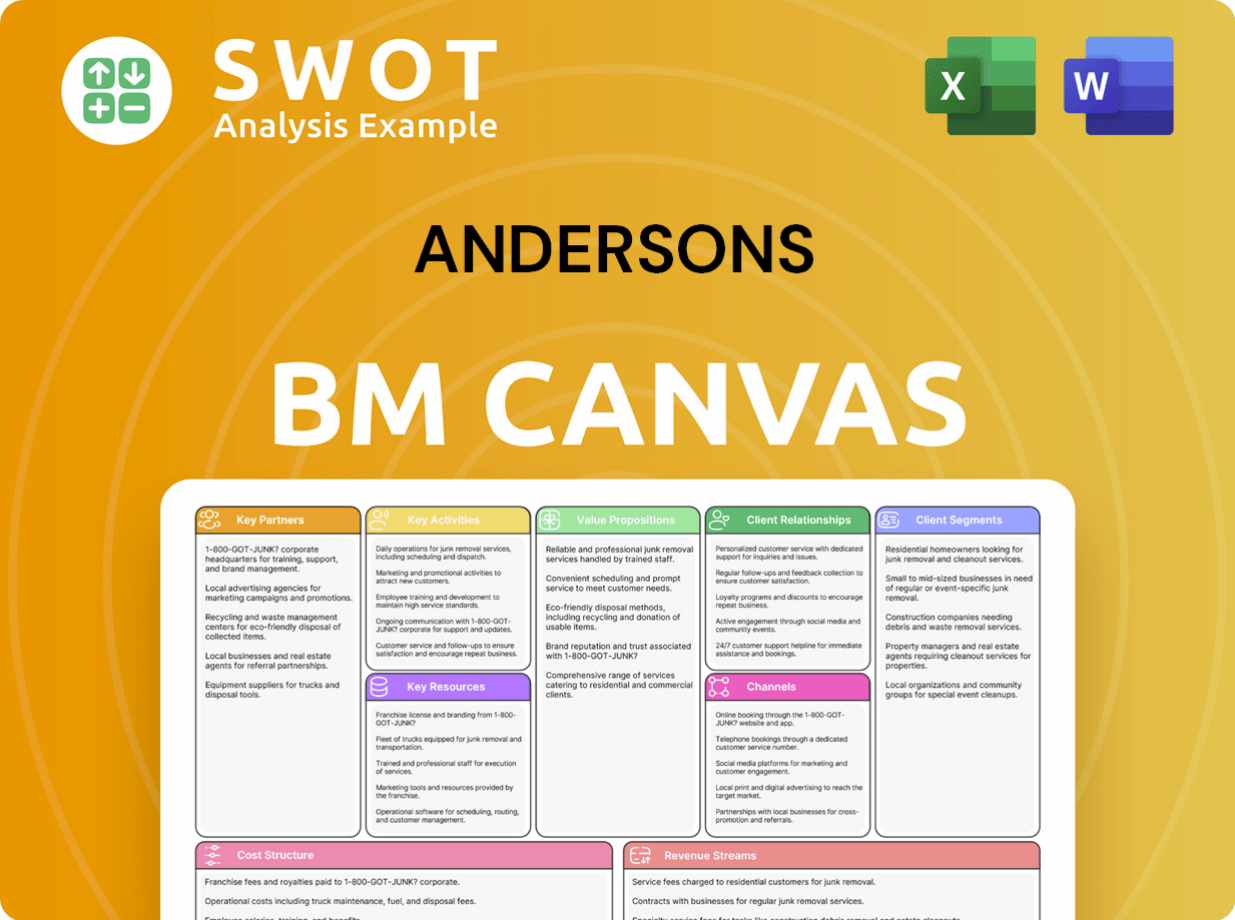

Andersons Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Andersons Positioning Itself for Continued Success?

The Andersons Inc. holds a prominent position in the agricultural sector, recognized as a major player in grain handling and ethanol production. With a vast network of facilities, the company manages significant grain volumes and operates multiple ethanol plants, showcasing its substantial market presence. The company is focused on providing excellent service and has built a strong reputation for integrity, fostering customer loyalty.

However, the Andersons business faces risks from global trade uncertainties, fluctuating commodity values, and ethanol margin volatility. Macroeconomic pressures and regulatory changes also pose challenges. Competition from other agricultural giants further influences the business environment. Despite these challenges, the company is optimistic about its future, focusing on strategic initiatives and capital investments to drive growth.

The Andersons Company is a key player in North America's agricultural sector, with a significant presence in grain handling and ethanol production. It operates across the U.S., Canada, Switzerland, and the U.K. The company's grain storage capacity is about 290 million bushels and merchandises over 28 million tonnes of grain annually.

The Andersons operations face risks from global trade uncertainties, potential tariffs, and fluctuating commodity values. Ethanol margin fluctuations and corn yield variations also pose challenges. Furthermore, macroeconomic pressures and regulatory changes influence future earnings. For example, in Q1 2025, global trade uncertainties impacted commodity values.

The Andersons anticipates strong performance in its Renewables segment and stable ethanol exports. The company projects a rise in planted corn acres in 2025, which could boost merchandising. Strategic initiatives include focusing on operational efficiency and making capital investments. Capital investments are expected to reach approximately $175-200 million in 2025.

The company is focused on enhancing the operational efficiency of its ethanol plants and making ongoing capital investments. The Andersons is also actively pursuing growth in the Renewables sector by lowering the carbon intensity of its ethanol plants and assessing expansion and acquisition opportunities. To learn more about the company's structure, consider reading the article: Owners & Shareholders of Andersons.

Andersons Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Andersons Company?

- What is Competitive Landscape of Andersons Company?

- What is Growth Strategy and Future Prospects of Andersons Company?

- What is Sales and Marketing Strategy of Andersons Company?

- What is Brief History of Andersons Company?

- Who Owns Andersons Company?

- What is Customer Demographics and Target Market of Andersons Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.