APA Bundle

How Does APA Company Power Australia?

APA Group stands as a cornerstone of Australia's energy infrastructure, but how does this APA SWOT Analysis shape its success? This leading Australian energy infrastructure business operates a vast network of natural gas pipelines, delivering essential energy to millions. But beyond pipelines, what other facets define the APA Company and its integral role in the nation's energy landscape? This deep dive explores the intricacies of APA operations and its impact.

Understanding the APA business model is key for investors, customers, and industry watchers alike. This exploration will uncover how APA Company generates revenue, its strategic positioning, and the vital APA services it provides. We'll also touch upon its APA structure, APA management, and future plans, offering a comprehensive overview of this critical player in Australia's energy transition.

What Are the Key Operations Driving APA’s Success?

The core operations of the APA Company revolve around its extensive natural gas pipeline network. This network is the backbone of its value proposition, providing essential energy transportation services across Australia. The company's primary function is to move natural gas from production basins to demand centers, serving various customer segments.

The APA business model focuses on delivering reliable and efficient energy delivery to gas retailers, industrial users, power generators, and residential consumers. Operational processes involve meticulous pipeline integrity management, gas compression, and remote monitoring to ensure continuous and safe gas flow. This also includes significant capital expenditure on network expansion and upgrades to meet growing demand and regulatory requirements.

Beyond gas transmission, APA Company creates value through its investments in gas storage facilities and gas-fired power stations. The company is also expanding its renewable energy assets, supporting Australia's transition to a lower-carbon economy. APA operations are unique due to its vast, interconnected pipeline system, which provides significant economies of scale and a high barrier to entry for competitors. Long-term contracts with customers provide stable revenue streams.

APA provides critical infrastructure for natural gas transportation. This includes pipeline networks, gas storage, and power generation facilities. The company's services ensure the reliable delivery of energy to various customers across Australia.

The company's structure is centered around its pipeline assets, which are strategically located across Australia. APA also has investments in gas storage and power generation. This diversified structure supports its core business of energy transportation.

APA's management focuses on operational efficiency, safety, and strategic growth. The management team oversees the maintenance and expansion of the company's infrastructure. They also manage customer relationships and ensure regulatory compliance.

APA generates revenue primarily through the transportation of natural gas via its pipeline network. Revenue is also generated from gas storage services and power generation. Long-term contracts with customers provide a stable revenue base.

APA's operations are characterized by their scale and strategic importance. The company's extensive pipeline network is critical to Australia's energy infrastructure. The company's focus is on providing reliable and efficient energy solutions.

- Pipeline Integrity Management: Ensuring the safety and reliability of the pipeline network.

- Gas Compression: Maintaining gas flow through the pipelines.

- Remote Monitoring: Continuously monitoring the network for optimal performance.

- Network Expansion: Investing in new infrastructure to meet growing demand.

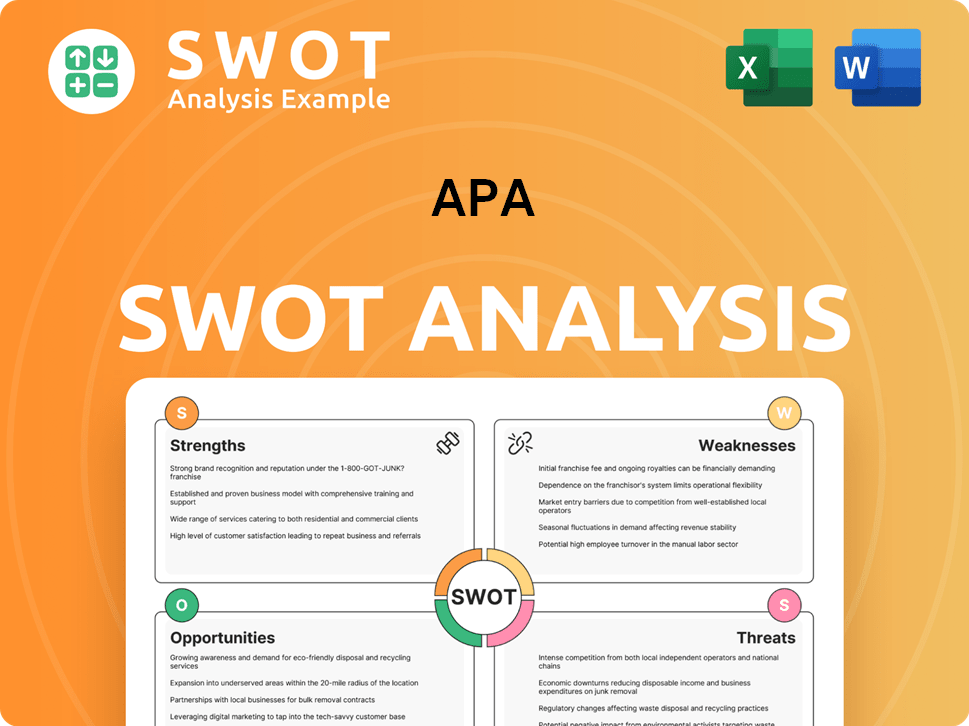

APA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does APA Make Money?

The APA Company primarily generates revenue through regulated tariffs for gas transmission and distribution. These tariffs are typically secured via long-term contracts, providing a stable and predictable income stream. This structure is a key component of the APA business model, ensuring financial stability.

In the first half of the 2024 financial year, the APA Company reported a statutory net profit after tax of $164.7 million. Revenue from continuing operations reached $1,475.2 million, demonstrating a strong financial performance. The company's operating cash flow for the same period was $738.5 million, highlighting its robust cash generation capabilities.

Beyond its core business, the APA operations also include gas storage services, gas-fired power generation, and renewable energy projects. These diverse revenue streams contribute to the company's overall financial resilience and growth potential. The company's monetization strategies focus on long-term infrastructure investments, which minimize exposure to short-term commodity price fluctuations.

The company's revenue streams are diversified, supporting its financial stability. The APA services extend beyond gas transmission and distribution to include gas storage, power generation, and renewable energy. This diversification is a key aspect of the APA structure.

- Regulated Tariffs: Long-term contracts with fixed and variable components provide a stable revenue base.

- Gas Storage Services: Offering flexibility and security to gas market participants.

- Gas-Fired Power Generation: Contributing to the National Electricity Market (NEM).

- Renewable Energy Portfolio: Power purchase agreements (PPAs) are a growing source of revenue.

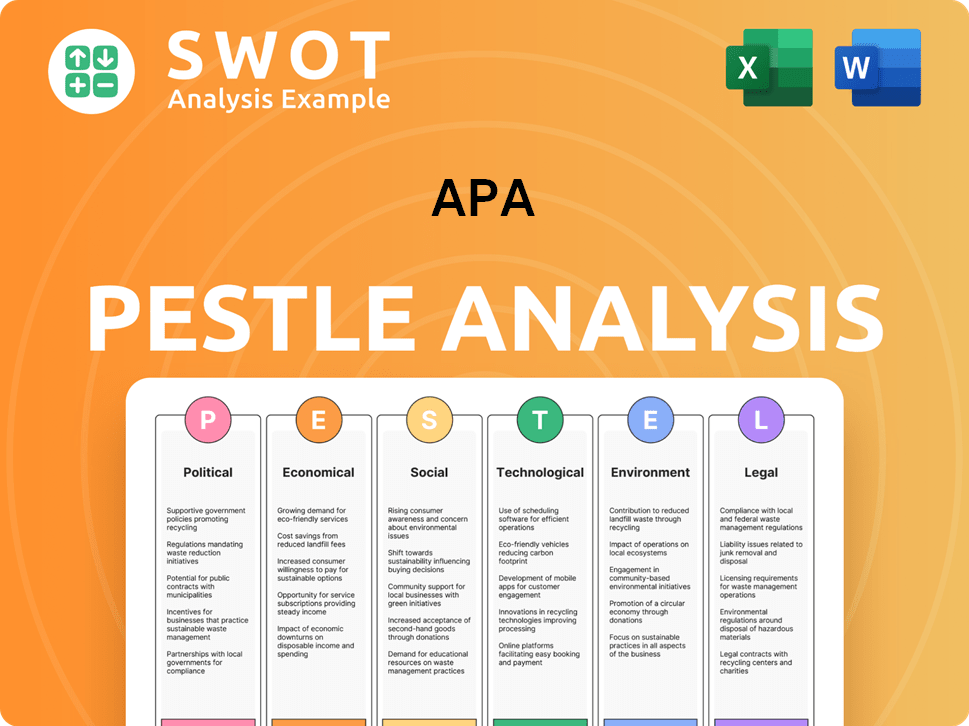

APA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped APA’s Business Model?

The APA Company has consistently demonstrated its market leadership through strategic milestones and operational excellence. The company's journey has been marked by significant investments in expanding and integrating its pipeline network, creating a robust national grid. These strategic moves have enhanced its capacity and connectivity, solidifying its position in the energy market. The company has also adapted to regulatory changes and evolving energy policies, showcasing its resilience and forward-thinking approach.

A key aspect of the APA Company's success is its ability to adapt to the changing energy landscape. This includes investing in major pipeline projects and exploring opportunities in renewable energy, hydrogen, and carbon capture technologies. These initiatives demonstrate a commitment to sustainability and innovation, ensuring long-term growth and relevance. The company's strategic focus on these areas positions it well for future market opportunities.

The APA business model is built on a foundation of extensive assets, long-term contracts, and operational expertise. This structure provides a competitive edge, making it difficult for new entrants to compete effectively. The company's strong relationships with energy producers and consumers further reinforce its market position. These factors contribute to the company's ability to generate consistent revenue and maintain a strong financial performance.

Significant investments in pipeline infrastructure, such as the Orbost Gas Processing Plant, have enhanced capacity and connectivity. The company has consistently expanded its pipeline network. These expansions have been crucial for meeting the growing energy demands.

Adaptation to regulatory changes and evolving energy policies. Strategic investments in renewable energy projects and exploring opportunities in hydrogen and carbon capture technologies. These moves demonstrate a commitment to sustainability and innovation.

Extensive and geographically diverse asset base provides economies of scale. Long-term contracts with customers provide revenue certainty. Strong relationships with energy producers and consumers reinforce market position.

Continued investment in renewable energy projects. Exploration of opportunities in hydrogen and carbon capture technologies. These initiatives are crucial for long-term growth and sustainability.

The APA Company's competitive advantages are multifaceted, ensuring its strong market position and financial stability. These advantages stem from its extensive asset base, long-term contracts, and operational expertise, which collectively create significant barriers to entry for potential competitors. The company’s strategic approach to adapting to the evolving energy landscape further enhances its resilience and future growth prospects.

- Extensive, geographically diverse asset base providing economies of scale.

- Long-term contracts with customers, often underpinned by regulated asset bases, provide revenue certainty.

- Operational expertise in managing complex pipeline infrastructure.

- Strong relationships with energy producers and consumers.

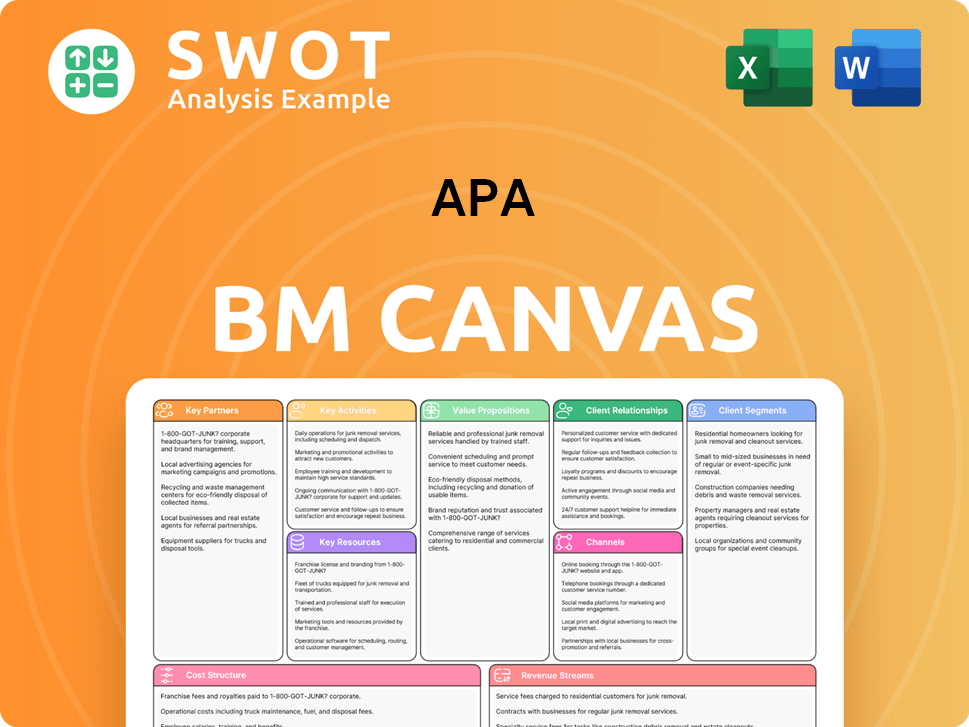

APA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is APA Positioning Itself for Continued Success?

The company holds a strong position in the Australian energy infrastructure market. Its extensive gas transmission network is a significant competitive advantage. The company benefits from high barriers to entry, and customer loyalty is high due to the essential nature of its services.

However, the company faces risks such as regulatory changes and the transition to renewable energy sources. Geopolitical events and global energy market fluctuations can also influence gas prices and demand. Looking ahead, the company is strategically positioned to capitalize on Australia's energy transition. The company's future outlook involves continued investment in its gas infrastructure, alongside significant expansion into renewable energy generation and transmission.

The company operates the largest gas transmission network in Australia. This extensive pipeline network, combined with gas storage and power generation assets, provides a strong market position. High barriers to entry due to capital expenditure, regulatory approvals, and long lead times further solidify its position.

Regulatory changes, particularly concerning gas pipeline access and pricing, could impact revenue. The shift to renewable energy presents both opportunities and risks. Geopolitical events and global energy market fluctuations can influence gas prices and demand.

The company is strategically positioned to capitalize on Australia's energy transition. Future plans include continued investment in gas infrastructure and significant expansion into renewable energy generation and transmission. The company aims to diversify its asset base and play a crucial role in developing future energy solutions.

The APA business model focuses on owning and operating energy infrastructure. This includes gas pipelines, storage facilities, and power generation assets. The company's APA services are essential for transporting and storing natural gas, providing energy security across Australia.

The company's growth strategy involves diversifying its asset base and expanding into renewable energy. This includes investments in solar and wind projects, as well as exploring opportunities in hydrogen transportation infrastructure. The company's APA Company's focus is on sustaining and expanding revenue-generating capabilities.

- Investment in Renewables: The company is actively investing in renewable energy projects to diversify its portfolio and reduce its carbon footprint.

- Infrastructure Expansion: Continuous upgrades and expansions of existing gas pipeline networks to meet increasing energy demands.

- Hydrogen Initiatives: Exploring and investing in hydrogen transportation infrastructure to support future energy solutions.

- Strategic Partnerships: Forming alliances with other energy companies to enhance market presence and capabilities.

For more details on the company's strategic direction, consider reading about the Growth Strategy of APA.

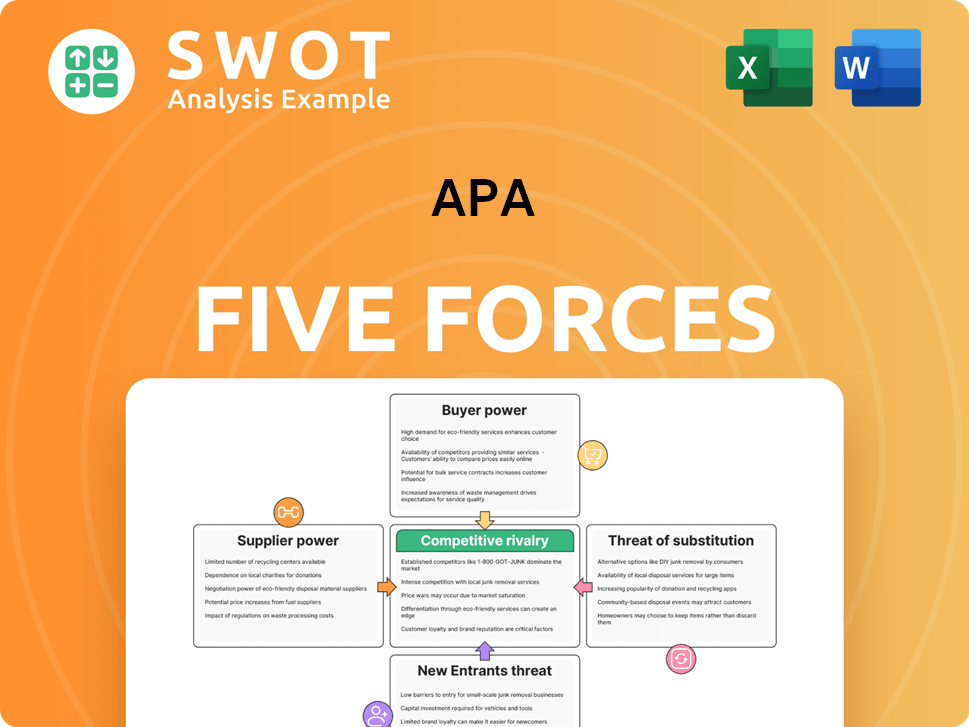

APA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of APA Company?

- What is Competitive Landscape of APA Company?

- What is Growth Strategy and Future Prospects of APA Company?

- What is Sales and Marketing Strategy of APA Company?

- What is Brief History of APA Company?

- Who Owns APA Company?

- What is Customer Demographics and Target Market of APA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.