AstraZeneca Bundle

How Does AstraZeneca Thrive in the Pharmaceutical World?

AstraZeneca, a global powerhouse in the pharmaceutical industry, is constantly reshaping the landscape of medical innovation. With a remarkable $45.81 billion in total revenue in 2023, this AstraZeneca SWOT Analysis reveals the company's strategic prowess. Its focus on oncology, CVRM, and R&I underscores its commitment to addressing critical health challenges. Understanding how AstraZeneca company operates is key to grasping its impact on global healthcare.

Delving into the operational intricacies of How AstraZeneca works, from its drug development pipeline to its global commercialization strategies, provides invaluable insights. The company's significant financial performance and commitment to research and development highlight its pivotal role in the biotechnology sector. Exploring AstraZeneca's history, including its vaccine development process and the The core operations of the AstraZeneca company revolve around the discovery, development, manufacturing, and commercialization of prescription medicines. This pharmaceutical company focuses on key therapeutic areas, including oncology, cardiovascular, renal & metabolism (CVRM), and respiratory & immunology (R&I). Their products are designed to treat a variety of conditions, serving a global patient population. How AstraZeneca works involves an extensive and integrated operational process. This starts with rigorous research and development (R&D), where scientific teams identify potential drug candidates and conduct preclinical and clinical trials. The company's global manufacturing facilities produce these medicines, adhering to stringent quality control standards. They also manage the sourcing of raw materials through a complex global supply chain, emphasizing resilience and ethical practices. Distribution networks, often involving third-party logistics providers and partnerships with healthcare systems, ensure medicines reach patients worldwide. The company's unique operational effectiveness stems from its deep scientific expertise, significant investment in R&D, and a highly collaborative approach with academic institutions and other biopharmaceutical companies. This translates into customer benefits through the availability of innovative, life-saving medicines and market differentiation through a strong pipeline of novel therapies and a focus on specialized disease areas with high unmet needs. AstraZeneca concentrates on oncology, CVRM, and R&I. Key products include Tagrisso, Imfinzi, and Lynparza in oncology. Farxiga is a significant product in CVRM, and Fasenra targets severe asthma in R&I. These products form the core of their value proposition, addressing significant medical needs globally. The company invests heavily in research and development, with total R&D expense reaching $9.9 billion in 2023. Manufacturing processes adhere to strict quality control standards across global facilities. This commitment to R&D and quality ensures the delivery of effective and safe medicines. AstraZeneca's global reach is supported by extensive distribution networks and partnerships with healthcare systems. Collaborations with academic institutions and other biopharmaceutical companies enhance its operational effectiveness. This collaborative approach ensures that innovative medicines reach patients worldwide. The value proposition of AstraZeneca is centered on delivering innovative, life-saving medicines. They focus on specialized disease areas with high unmet needs. This approach, combined with a strong pipeline of novel therapies, differentiates the company in the market. The operational processes of the AstraZeneca company are highly integrated, starting with R&D and extending through manufacturing and distribution. This includes drug discovery, clinical trials, and supply chain management. They also focus on building strong partnerships. Understanding the financial operations of the AstraZeneca company involves examining its revenue streams and monetization strategies. The AstraZeneca company, a prominent pharmaceutical company, primarily generates revenue through the sale of its prescription medicines. This approach is central to its business model, with revenue streams categorized by therapy area and specific product sales. In 2023, AstraZeneca reported total revenue of $45.81 billion, reflecting a 15% increase at constant exchange rates. This growth underscores the company's successful commercialization efforts and the demand for its products. The company's ability to monetize its intellectual property and global commercialization capabilities is crucial to its financial success. AstraZeneca's monetization strategies are built around its intellectual property and global commercialization capabilities. This includes direct sales to healthcare providers and licensing agreements. The company also uses tiered pricing strategies to ensure broader access to its medicines while maintaining profitability. The AstraZeneca company has expanded its revenue sources through strategic acquisitions, such as the acquisition of Alexion Pharmaceuticals in 2021, which diversified its portfolio into rare diseases and added a new, high-growth revenue stream. Read more about the Marketing Strategy of AstraZeneca. AstraZeneca's revenue is primarily derived from its pharmaceutical products, with a significant portion coming from oncology. The company has strategically diversified its portfolio through acquisitions and collaborations to reduce reliance on a single therapy area. This diversification is key to sustaining long-term growth and mitigating risks associated with patent expirations and market changes. The journey of the AstraZeneca company has been marked by significant milestones and strategic shifts that have shaped its operations and financial results. A pivotal moment was the acquisition of Alexion Pharmaceuticals in 2021, a deal valued at approximately $39 billion, which expanded AstraZeneca's presence in the rare disease market. This move diversified its portfolio and fueled new growth opportunities. The successful launch and commercialization of key oncology drugs such as Tagrisso, Imfinzi, and Lynparza have also been critical, establishing AstraZeneca as a leader in cancer treatment. In response to operational challenges, including supply chain disruptions, especially during global events, AstraZeneca has invested in strengthening its manufacturing and logistics networks to ensure a consistent supply of medicines. Navigating regulatory hurdles is a continuous process, managed through robust clinical development programs and strong engagement with regulatory bodies worldwide. These strategic actions highlight AstraZeneca's commitment to innovation and resilience in the dynamic pharmaceutical company landscape. AstraZeneca's competitive advantages are multifaceted, supporting its position in the drug development sector. Its strong brand reputation, built on decades of scientific innovation and patient trust, provides a significant edge. Technological leadership, particularly in genomics and precision medicine, allows the company to develop targeted therapies with higher efficacy. While not always achieving economies of scale on par with generic manufacturers, AstraZeneca benefits from scale in its R&D investments and global commercial infrastructure, enabling large-scale clinical trials and market launches. To further understand how AstraZeneca competes, you can explore the Competitors Landscape of AstraZeneca. The Alexion Pharmaceuticals acquisition in 2021 for $39 billion was a major milestone. The successful launch of oncology drugs like Tagrisso, Imfinzi, and Lynparza has been instrumental. Investments in manufacturing and logistics have strengthened supply chains. Focus on expanding into the rare disease market through acquisitions. Strengthening manufacturing and logistics networks to ensure consistent supply. Robust clinical development programs and regulatory engagement. Strong brand built on scientific innovation and patient trust. Technology leadership in genomics and precision medicine. Robust pipeline of novel drugs and continued R&D investment. In 2023, total revenue increased by 3% at constant exchange rates. Oncology sales grew by 20%, driven by strong performance of key drugs. R&D expenditure was approximately $7.5 billion in 2023. AstraZeneca's competitive edge is sustained by its robust pipeline of novel drugs, a testament to its continued investment in R&D. The company continues to explore AI and machine learning to accelerate drug discovery and development, ensuring it remains at the forefront of pharmaceutical innovation. The AstraZeneca company holds a prominent position within the global biopharmaceutical industry. It consistently ranks among the top pharmaceutical companies, demonstrating its strong market presence. Its focus on key therapeutic areas, such as oncology and cardiovascular, contributes to its leadership in specific segments, driving customer loyalty through effective medicines and patient support programs. Its operations span over 100 countries, reflecting its extensive global reach. However, the AstraZeneca company faces several risks. Regulatory changes, particularly regarding drug pricing, could impact revenue. Competition from biosimilars and novel therapies poses a constant threat to market share. Technological advancements and changing consumer preferences also require continuous adaptation to maintain a competitive edge. For example, the company's reliance on specific blockbuster drugs makes it vulnerable to patent expirations and the emergence of competing treatments. The AstraZeneca company is a leading player in the pharmaceutical industry. It is known for its strong presence in oncology and cardiovascular disease treatments. Its global reach and diverse product portfolio contribute to its significant market share and revenue generation. The company faces risks from regulatory changes and market competition. Patent expirations and the rise of biosimilars can impact sales. Technological advancements and evolving patient preferences necessitate continuous innovation and adaptation to stay competitive. The future outlook for AstraZeneca is shaped by its strategic initiatives and R&D investments. The company focuses on precision medicine and advanced therapies. It aims to expand its presence in oncology and rare diseases, ensuring continued growth and profitability. The company emphasizes R&D, particularly in precision medicine. It focuses on expanding its presence in oncology and rare diseases. The company plans to bring new medicines to market and explore new therapeutic areas to ensure future growth. The AstraZeneca company is focused on sustainable growth through strategic initiatives. These initiatives include expanding its presence in key therapeutic areas and investing heavily in research and development. The company's strategy also involves the development of new drugs and exploring new markets.

What Are the Key Operations Driving AstraZeneca’s Success?

Key Therapy Areas

R&D and Manufacturing

Global Reach and Partnerships

Value Proposition

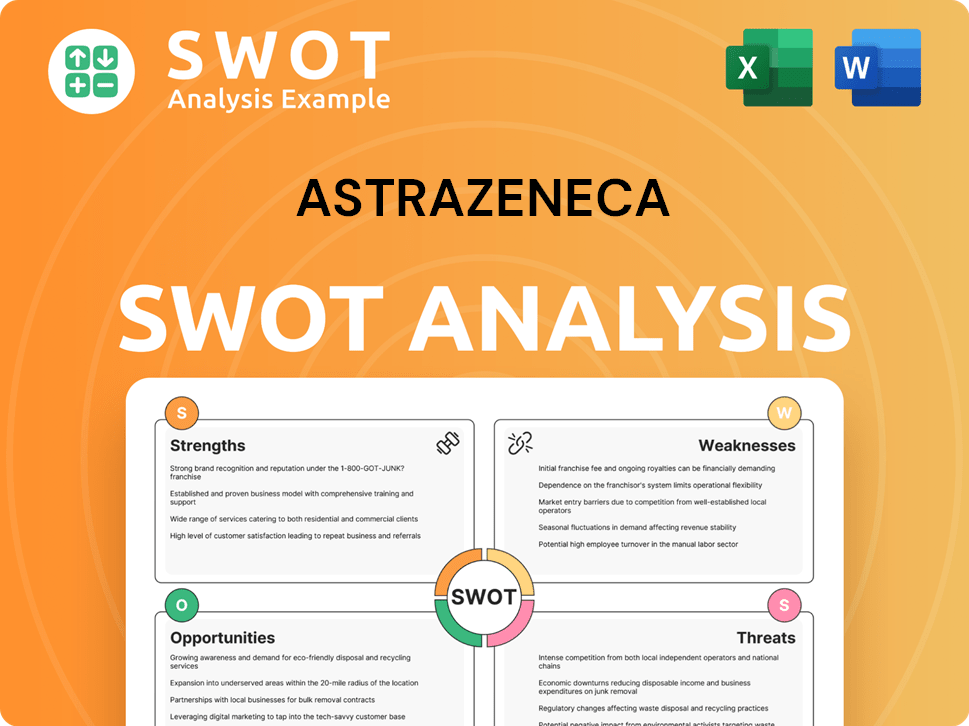

AstraZeneca SWOT Analysis

How Does AstraZeneca Make Money?

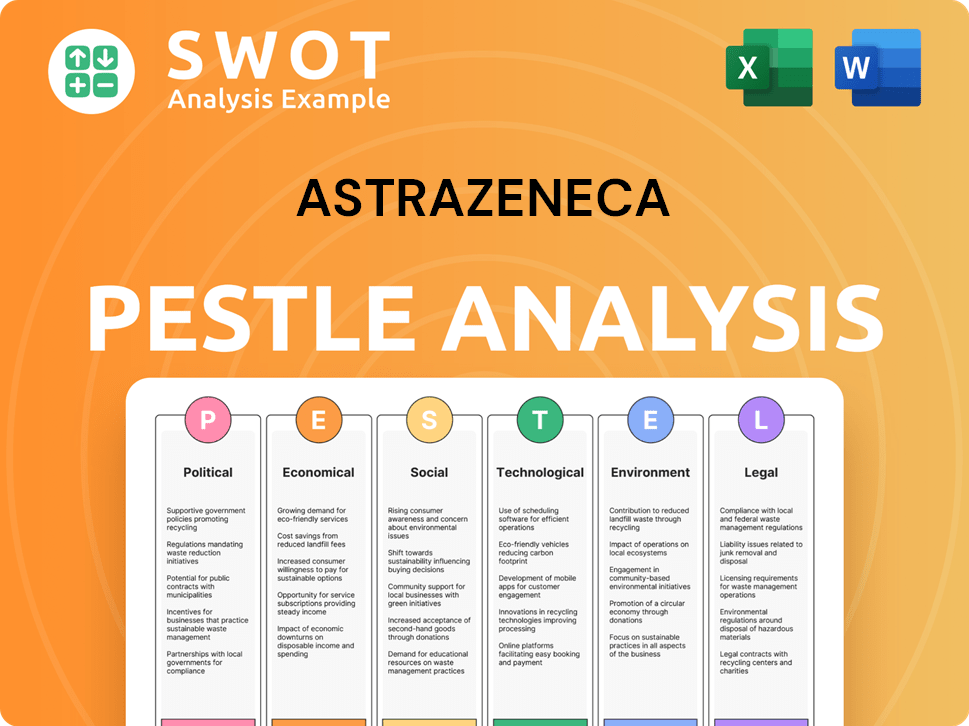

AstraZeneca PESTLE Analysis

Which Strategic Decisions Have Shaped AstraZeneca’s Business Model?

Key Milestones

Strategic Moves

Competitive Edge

Financial Performance

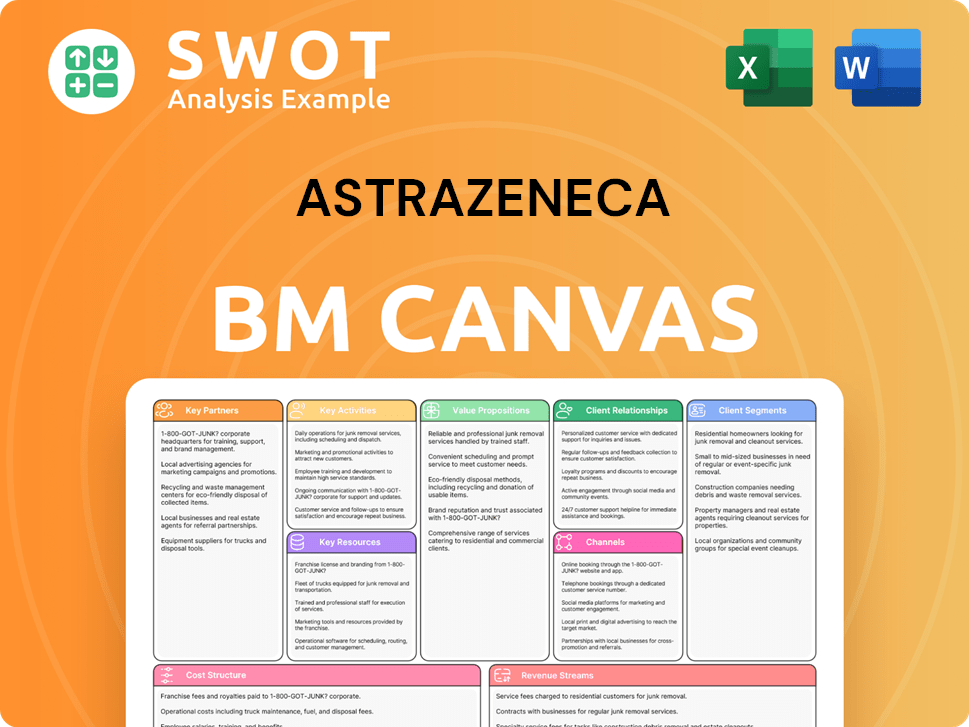

AstraZeneca Business Model Canvas

How Is AstraZeneca Positioning Itself for Continued Success?

Industry Position

Key Risks

Future Outlook

Strategic Initiatives

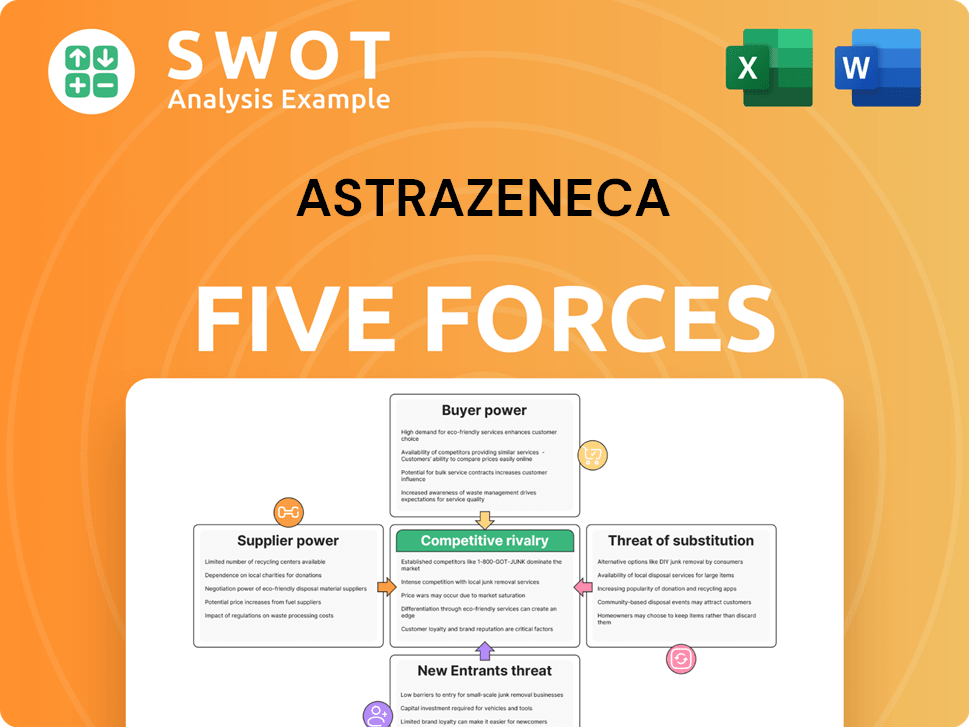

AstraZeneca Porter's Five Forces Analysis

Related Blogs

- What are Mission Vision & Core Values of AstraZeneca Company?

- What is Competitive Landscape of AstraZeneca Company?

- What is Growth Strategy and Future Prospects of AstraZeneca Company?

- What is Sales and Marketing Strategy of AstraZeneca Company?

- What is Brief History of AstraZeneca Company?

- Who Owns AstraZeneca Company?

- What is Customer Demographics and Target Market of AstraZeneca Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.