Atlas Energy Solutions Bundle

How Does Atlas Energy Solutions Thrive in the Permian Basin?

Atlas Energy Solutions Inc. is making waves in the energy sector, particularly within the vital Permian Basin. With a 72.0% sales increase to $1.1 billion in 2024, the Atlas Energy Solutions SWOT Analysis reveals a company experiencing remarkable growth. Discover how this Energy Solutions Company leverages its strategic focus on proppant and advanced logistics to support modern hydraulic fracturing operations.

Atlas Energy's integrated approach, encompassing proppant production and a robust logistics network, is designed to boost efficiency for oil and gas operators. Understanding the inner workings of Atlas Energy Solutions is essential for anyone interested in the Oil and Gas Services industry. This deep dive will explore the company's value creation, revenue streams, and strategic advantages, offering valuable insights into its impressive financial performance and future prospects.

What Are the Key Operations Driving Atlas Energy Solutions’s Success?

Atlas Energy Solutions creates and delivers value by integrating proppant production with logistics solutions, specifically for the oil and gas industry in the Permian Basin. The company focuses on mining and processing high-quality frac sand (proppant) and providing advanced logistics and transportation solutions. This approach aims to increase efficiency and reduce costs for oil and gas operators by ensuring a reliable, low-cost supply of proppant directly to the wellsite.

The operational processes are vertically integrated and technologically advanced. Atlas Energy operates multiple fixed plants and mobile mines, with a total annual production capacity of 29 million tons. The company's logistics infrastructure includes the Dune Express, a fully electrified overland conveyor system, and a fleet of over 120 trucks. This infrastructure aims to reduce reliance on truck transportation and its associated costs and environmental impacts.

The company's strategic positioning within the Permian Basin offers basin-wide reach and access to the Pecos Valley Aquifer for cost-effective dredging and washing of sand. Their focus on technology, automation, and remote operations, including the use of AI and digital infrastructure, drives efficiencies, improves cost structure, and contributes to beneficial environmental and community impacts. The acquisition of Moser Energy Systems further diversifies their offerings into distributed power generation, adding approximately 225 MW of existing power generation capacity and expanding their integrated approach to serving energy producers across the entire well lifecycle. This vertical integration and commitment to innovation translate into customer benefits through reduced operational costs, improved supply chain reliability, and enhanced environmental performance.

Atlas Energy Solutions offers frac sand (proppant) production and advanced logistics solutions. These services are tailored for the oil and gas industry, particularly in the Permian Basin. The focus is on providing a reliable and cost-effective supply chain.

The company operates fixed plants and mobile mines with a total annual production capacity of 29 million tons. The Dune Express conveyor system and a fleet of over 120 trucks enhance logistics. This infrastructure supports efficient and environmentally conscious operations.

Atlas Energy benefits from its Permian Basin presence and access to the Pecos Valley Aquifer. Technological advancements and the integration of distributed power generation through Moser Energy Systems further enhance its capabilities. This approach provides a competitive edge.

Customers experience reduced operational costs and improved supply chain reliability. Enhanced environmental performance is another key benefit. This integrated approach supports the entire well lifecycle.

Atlas Energy Solutions leverages vertical integration and technological innovation to serve the oil and gas industry. This includes frac sand production, advanced logistics, and distributed power generation. The company focuses on efficiency and sustainability.

- Vertical Integration: Combining proppant production with logistics.

- Technological Advancement: Utilizing AI and digital infrastructure.

- Strategic Location: Operating within the Permian Basin.

- Acquisition: Integrating Moser Energy Systems for power generation.

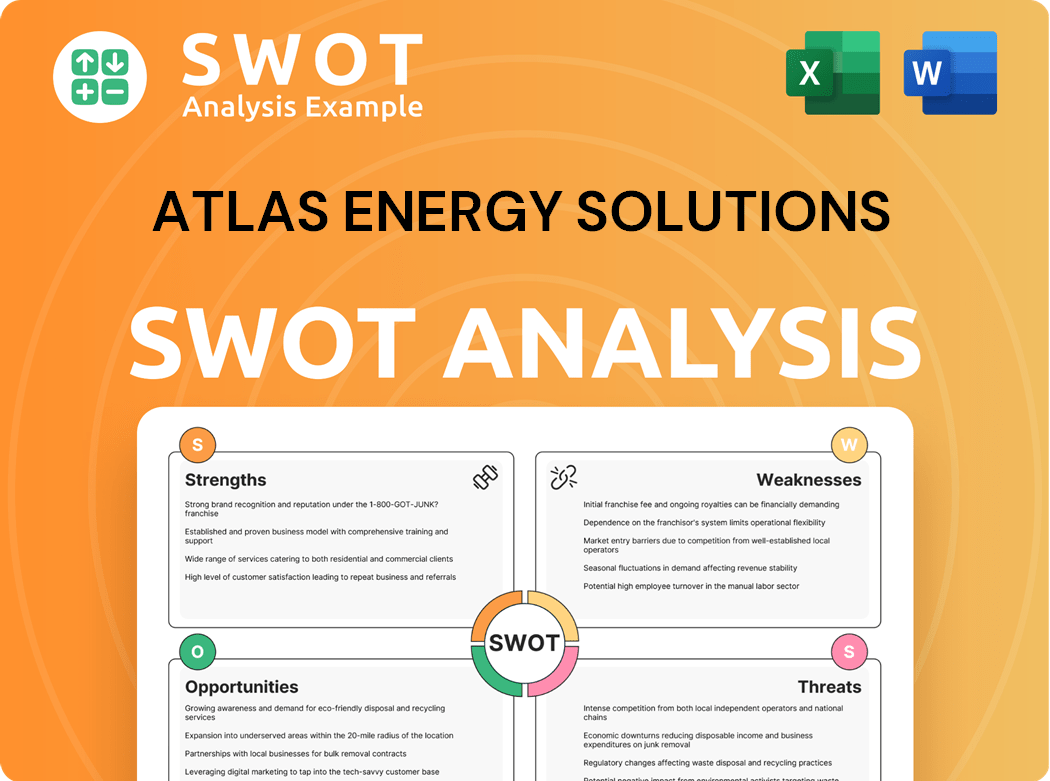

Atlas Energy Solutions SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Atlas Energy Solutions Make Money?

Atlas Energy Solutions, a key player in the oil and gas sector, generates revenue through its Sand and Logistics, and Power segments. The company's financial performance reflects robust growth, driven by increased demand for its services and strategic acquisitions. Understanding its revenue streams and monetization strategies is crucial for assessing its market position and future prospects.

In 2024, the company reported total sales of $1.1 billion, marking a significant increase. This growth underscores the effectiveness of its operational strategies and its ability to capitalize on market opportunities. The company's integrated approach and cost efficiencies are central to its financial success.

The company's strategy focuses on providing comprehensive solutions to energy producers, leveraging its integrated service model and cost advantages. This approach allows it to offer competitive pricing and reliable delivery, enhancing its market position and driving revenue growth. For a deeper look into the company's marketing approaches, see the Marketing Strategy of Atlas Energy Solutions.

The Sand and Logistics segment is a primary revenue driver for Atlas Energy Solutions. It focuses on proppant production and sales, along with related transportation services. This segment's growth is fueled by the increasing demand for well completion services.

Product sales in the Sand and Logistics segment for the year ended December 31, 2024, reached $515.4 million, up $47.3 million. Service sales, including logistics and transportation, surged to $540.5 million, an increase of $394.7 million. The company anticipates selling over 25 million tons of proppant in 2025.

The Power segment provides distributed power solutions, significantly boosted by the acquisition of Moser Energy Systems in February 2025. This segment utilizes natural gas-powered generators to meet energy needs. The acquisition is expected to contribute significantly to the company's EBITDA.

The Moser Energy Systems acquisition is projected to generate $40-45 million in Adjusted EBITDA in 2025, based on a 10-month contribution. Atlas currently operates over 900 natural gas-powered generators with approximately 225 MW of existing capacity. This expansion strengthens Atlas's position in the energy infrastructure market.

Atlas Energy Solutions employs an integrated service model and cost efficiencies to monetize its offerings. The company utilizes its low-cost structure, including the Dune Express conveyor system and autonomous trucking. The company's focus on integrated solutions aims to optimize customer costs.

Atlas is committed to returning capital to shareholders through dividends. The company increased its quarterly dividend to $0.25 per share, payable in February and May 2025. This reflects the company's financial strength and confidence in its future performance.

The company's financial performance in 2024 and early 2025 demonstrates strong growth and strategic execution. This success is driven by increased demand for its services and strategic acquisitions, positioning the company for continued expansion in the Oil and Gas Services sector.

- Total sales for 2024 reached $1.1 billion, a 72.0% increase.

- Proppant sales increased to $515.4 million.

- Service sales, including logistics, reached $540.5 million.

- Q1 2025 total sales were $297.6 million.

- The company anticipates selling over 25 million tons of proppant in 2025.

- The Moser Energy Systems acquisition is expected to generate $40-45 million in Adjusted EBITDA in 2025.

- The quarterly dividend increased to $0.25 per share.

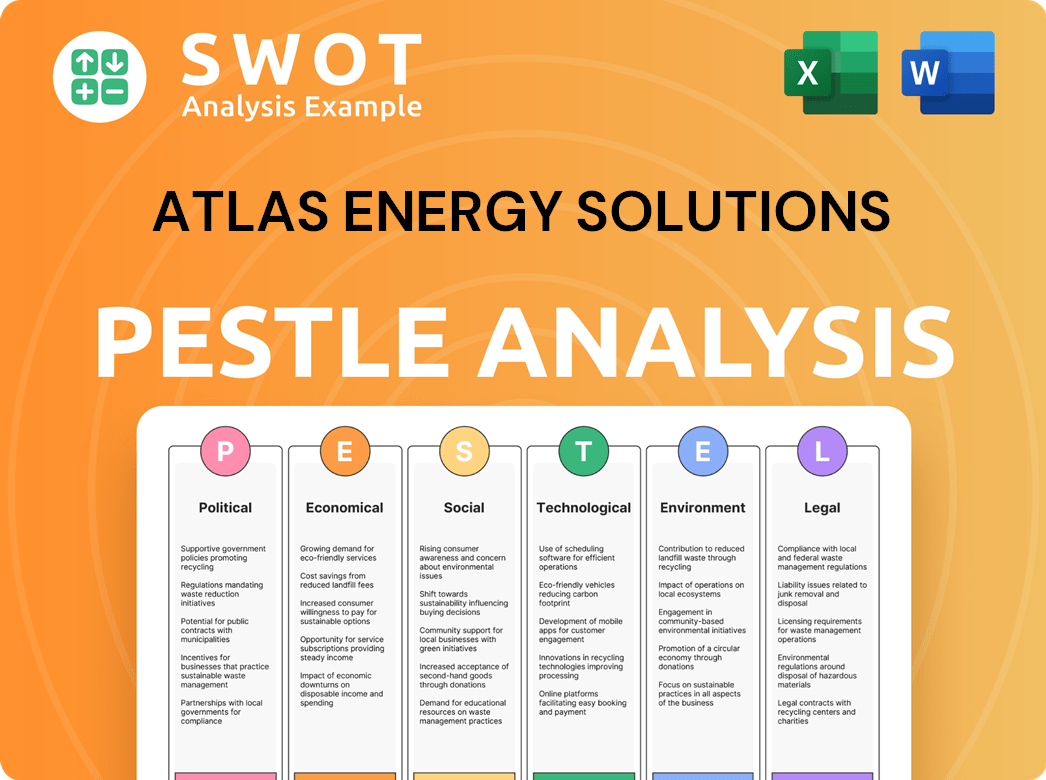

Atlas Energy Solutions PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Atlas Energy Solutions’s Business Model?

The journey of Atlas Energy Solutions has been marked by significant strategic moves and operational milestones that have reshaped its business model and market position. From its Initial Public Offering (IPO) in 2023 to major acquisitions and technological integrations, the company has consistently aimed to enhance its capabilities and expand its market reach. These strategic decisions have been crucial in navigating the dynamic landscape of the oil and gas industry and positioning the company for sustained growth.

A key aspect of Atlas Energy's evolution involves its focus on operational efficiency and technological advancements. The commissioning of the Dune Express conveyor system and the deployment of autonomous trucking capabilities are prime examples of how the company leverages innovation to reduce costs and improve logistics. Despite facing operational challenges, the company has demonstrated resilience by implementing strategic initiatives to enhance financial performance and adapt to market fluctuations.

The competitive edge of Energy Solutions Company stems from its comprehensive resource base, technological innovations, and strategic acquisitions. The company's commitment to being a low-cost producer and a reliable partner, combined with its focus on in-house manufacturing and technological integration, provides a distinct advantage in the market. These factors have been instrumental in shaping its financial performance and market standing.

The Initial Public Offering (IPO) in 2023 marked a significant financial milestone for Atlas Energy Solutions. The acquisition of Hi-Crush in March 2024 expanded its proppant production capacity. The completion of the Moser Energy Systems acquisition in February 2025 diversified its offerings into distributed power generation.

The acquisition of Hi-Crush in March 2024, integrated with Pronghorn's logistics, made Atlas Energy the largest proppant producer. The commissioning of the Dune Express conveyor system in late 2024 and the deployment of autonomous trucking capabilities are key strategic moves. These moves enhanced logistics and reduced operational costs.

Atlas Energy Solutions benefits from a long-term resource base, projected at 75 years, and control over prime dune areas. Cost-effective water access and automated plant designs enhance operational efficiency. The Dune Express and autonomous delivery systems provide a unique logistical advantage, reducing costs and emissions.

Despite strong revenue, Atlas Energy experienced significant margin pressure in Q1 2025. Higher operating expenses in 2024, due to issues like the Kermit feed system rebuild, impacted financial results. The company is focused on operational improvements and strategic acquisitions to mitigate volatility.

The Dune Express conveyor system, expected to be fully operational in 2025, is designed to take thousands of trucks off public roads, significantly improving logistics. Autonomous trucking capabilities, initiated in July 2024, further solidify its position in oilfield logistics innovation. The company's strategic acquisitions, such as Moser Energy Systems, demonstrate its commitment to diversification and expansion within the energy sector.

- The acquisition of Hi-Crush expanded proppant production capacity.

- The Dune Express conveyor system is a significant logistical advancement.

- Autonomous trucking capabilities enhance operational efficiency.

- The company's focus on being a low-cost producer provides a competitive edge.

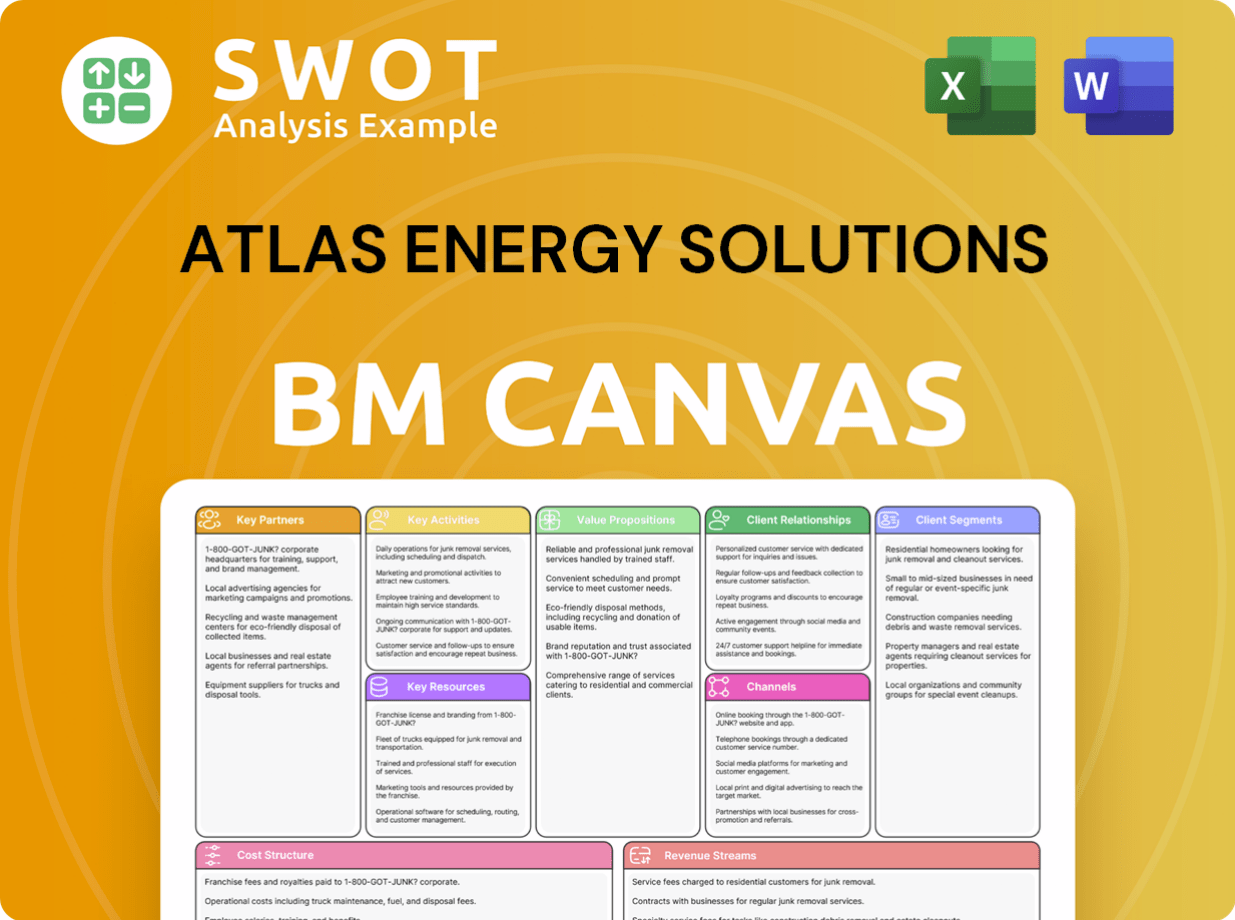

Atlas Energy Solutions Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Atlas Energy Solutions Positioning Itself for Continued Success?

Atlas Energy Solutions has established itself as a key player in the proppant and proppant logistics sector, notably within the Permian Basin. It is the largest frac sand provider in the region. Strategic acquisitions, such as Hi-Crush in March 2024, have strengthened its market position and operational efficiency. The company's extensive resources, including 14 production facilities and the 42-mile Dune Express, highlight its significant presence and operational capabilities. Atlas Energy aims to be the 'reliable partner of choice' for top operators in the Permian Basin.

However, Atlas Energy Solutions faces several challenges. These include commodity price volatility, especially in oil, which can affect customer spending and demand for its services. Market uncertainty, supply chain issues, and intense competition in the energy services sector also pose ongoing risks. Operational challenges, such as not meeting projected output targets for the Dune Express, have put pressure on margins. Downward revisions in earnings expectations by analysts for 2025 reflect these pressures.

Atlas Energy Solutions is the leading frac sand provider in the Permian Basin. Its strategic assets, including production facilities and the Dune Express, support its strong market presence. The company focuses on being a reliable partner to major operators, aiming for customer loyalty within the Oil and Gas Services sector.

The company faces risks from fluctuating oil prices, which can impact customer spending. Market uncertainty, supply chain disruptions, and competition in the energy services industry are also challenges. Operational issues, such as meeting output targets, can pressure margins and affect financial performance. The Target Market of Atlas Energy Solutions is greatly affected by these factors.

Atlas Energy is focused on initiatives to boost revenue. The company anticipates strong market fundamentals in the Permian Basin, with increasing proppant demand. The full operational ramp-up of Dune Express in 2025 is expected to improve financial results. Expansion into distributed power solutions through the Moser Energy Systems acquisition is a key diversification strategy.

Atlas Energy Solutions projects its Adjusted EBITDA to exceed $400 million in 2025. The company plans to sell over 25 million tons of proppant. Investments in technologies like autonomous trucking and artificial intelligence are aimed at driving efficiencies and improving its cost structure. These efforts are designed to ensure continued leadership and profitability in the evolving energy landscape.

Atlas Energy Solutions is implementing several key strategies to sustain and expand its operations. These include leveraging strong market fundamentals in the Permian Basin and optimizing the Dune Express. The company is also diversifying into distributed power solutions and investing in leading-edge technologies.

- Full ramp-up of Dune Express operations in 2025 to improve financial performance.

- Expansion into distributed power solutions through the Moser Energy Systems acquisition.

- Investment in technologies like autonomous trucking and artificial intelligence.

- Focus on increasing proppant demand and overall basin demand.

Atlas Energy Solutions Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Atlas Energy Solutions Company?

- What is Competitive Landscape of Atlas Energy Solutions Company?

- What is Growth Strategy and Future Prospects of Atlas Energy Solutions Company?

- What is Sales and Marketing Strategy of Atlas Energy Solutions Company?

- What is Brief History of Atlas Energy Solutions Company?

- Who Owns Atlas Energy Solutions Company?

- What is Customer Demographics and Target Market of Atlas Energy Solutions Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.