Bang & Olufsen Bundle

How Does Bang & Olufsen Thrive in the Luxury Audio Market?

Bang & Olufsen, the iconic Danish brand, continues to redefine the luxury audio experience. With a focus on exquisite design and cutting-edge technology, B&O has maintained a strong presence in the competitive high-end electronics sector. Recent financial reports reveal impressive growth, but what are the core strategies driving Bang & Olufsen's success?

This exploration will dissect Bang & Olufsen's operational model, revealing how it generates revenue and navigates market challenges. We'll examine its Bang & Olufsen SWOT Analysis, key milestones, and competitive advantages. Whether you're curious about the Bang & Olufsen speaker price, seeking a B&O Beoplay review, or simply interested in the brand's design philosophy, this analysis offers valuable insights into the future of this luxury audio leader.

What Are the Key Operations Driving Bang & Olufsen’s Success?

Bang & Olufsen (B&O) centers its operations on designing, developing, and manufacturing premium audio and video equipment. This includes a range of products from music systems and loudspeakers to television sets, catering to a clientele that values both technological innovation and aesthetic design. The company's commitment to quality is evident in its meticulous manufacturing processes and the use of high-grade materials.

The company's value proposition lies in its ability to combine technological excellence with emotional appeal, crafting products that offer an immersive sound experience and distinctive design. This approach allows B&O to differentiate itself in the competitive luxury audio market. B&O's strategy involves a global presence, reaching customers through branded stores, multi-brand retailers, and online platforms.

Operational processes involve careful manufacturing and sourcing, with a strong emphasis on quality and design. While specific details on internal manufacturing versus outsourced production are not extensively detailed, the emphasis on quality and design suggests a tightly controlled production process. Technology development is paramount, with a continuous focus on innovation in sound technology and user experience. For instance, Bang & Olufsen is taking over direct operation of its Tmall online flagship store in China.

B&O emphasizes meticulous manufacturing and sourcing to ensure the use of high-quality materials. The company's production process is tightly controlled, focusing on quality and design. This approach allows B&O to maintain its reputation for premium products.

Technology development is a core focus, with continuous innovation in sound technology and user experience. B&O invests in research and development to stay at the forefront of the luxury audio market. This commitment to innovation drives the company's product offerings.

B&O utilizes a global distribution network, reaching customers through various channels. These include branded stores, multi-brand retailers, and digital platforms. The company is also taking over direct operation of its Tmall online flagship store in China.

B&O is committed to longevity and circularity in product design, creating products designed to last. This includes modularity, repairability, and upgradeability. The Beosound Level, for example, has received Cradle to Cradle certification, reflecting B&O's dedication to sustainability.

Bang & Olufsen's operations are unique due to their focus on longevity and circularity. They design products for a long lifespan, emphasizing modularity, repairability, and upgradeability. This commitment to sustainable design provides customers with extended product lifespans and the ability to upgrade components. For more information on how B&O has positioned itself in the market, read about the Marketing Strategy of Bang & Olufsen.

- Emphasis on sustainable design and product longevity.

- Partnerships, such as with Scuderia Ferrari and Riva, enhance brand positioning.

- Continuous innovation in sound technology and user experience.

- Global presence through various sales channels.

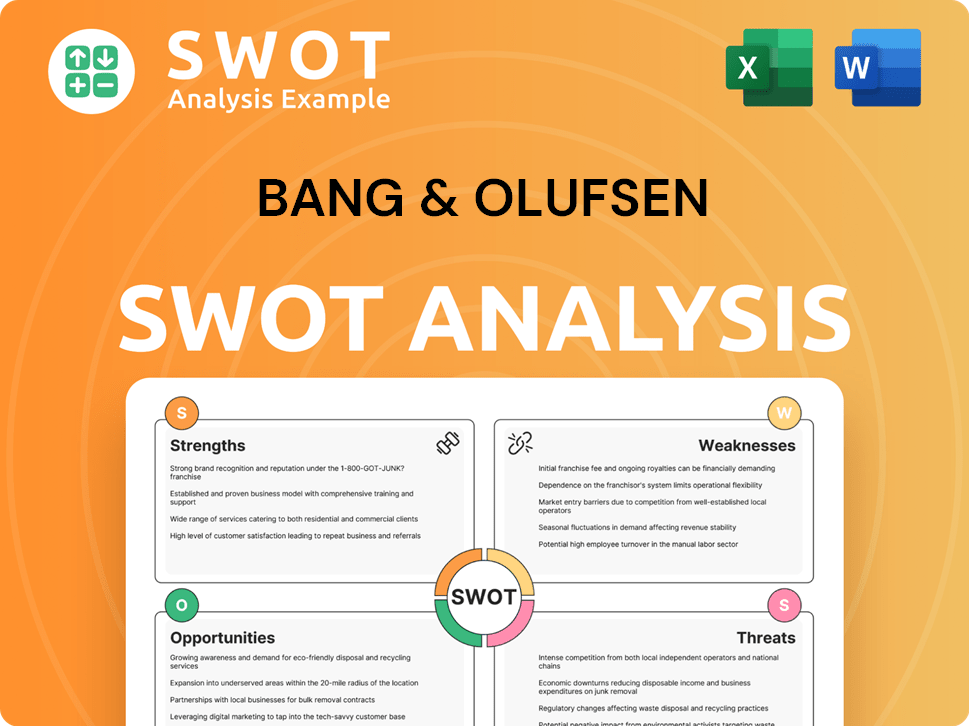

Bang & Olufsen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bang & Olufsen Make Money?

The primary revenue streams for Bang & Olufsen (B&O) are derived from the sale of its luxury audio products, televisions, and telephones. The company focuses on a high-end market, which influences its pricing strategy and overall financial performance. This approach is central to its brand identity and profitability.

In Q3 2024/25, Bang & Olufsen saw a 2% increase in group revenue in local currencies, reaching DKK 631 million (approximately EUR 84.6 million). This is a positive shift compared to the DKK 614 million (approximately EUR 82.4 million) in Q3 2023/24. Revenue from branded channels specifically grew by 6% (5% in local currencies) during the same period, indicating strong performance in its core business.

Beyond product sales, Bang & Olufsen also generates revenue through 'Brand Partnering & other activities.' This segment saw a significant increase in the 2022/23 financial year, but experienced a decline in 2023/24, primarily due to reduced license income. This diversification strategy is a key element of B&O's broader monetization efforts.

B&O's monetization strategies are centered around its luxury positioning and a strong pricing focus, which contribute to improved gross margins. This approach is supported by several initiatives:

- High Gross Margin: In Q3 2024/25, the gross margin hit a record high of 55.4%, up from 53.2% in Q3 2023/24, driven by normalized costs and favorable product mix.

- Customization: The company offers custom-made products through initiatives like Bang & Olufsen Atelier, allowing for personalized items.

- Retail Network Optimization: B&O is optimizing its retail network by reducing the number of monobrand partners and focusing on key cities.

- Strategic Investments: The recent capital raise of DKK 217 million in December 2024 is aimed at supporting a three-year growth plan, indicating further strategic monetization efforts.

For more insights, you can explore the Competitors Landscape of Bang & Olufsen.

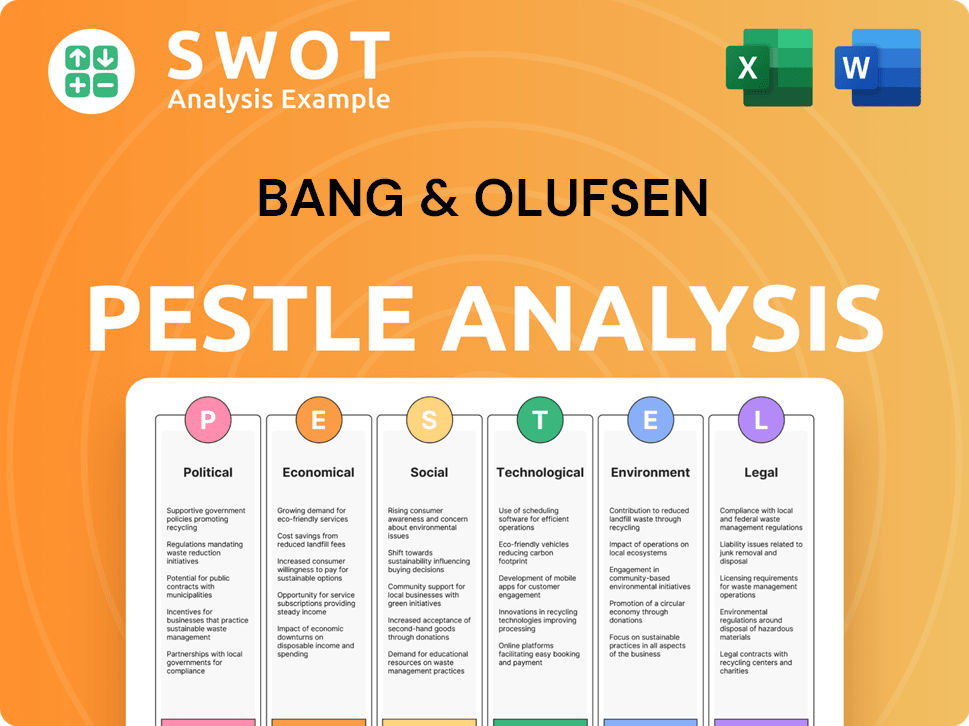

Bang & Olufsen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Bang & Olufsen’s Business Model?

Navigating recent market dynamics, Bang & Olufsen has demonstrated strategic agility, marked by key milestones and responses to market challenges. A central strategic move is the consistent implementation of its 'Luxury Timeless Technology' strategy. This focuses on enhancing customer experience across branded channels, strengthening its luxury positioning, and delivering product excellence. This approach has contributed to a record-high gross margin of 55.4% in Q3 2024/25, marking eight consecutive quarters with margins above 50%.

Product launches remain a vital part of their strategy, with recent introductions including the Beolab 8 and Beosound Theatre, both of which have received Cradle to Cradle certification, demonstrating a commitment to sustainable design. The launch of Bang & Olufsen Atelier in Q3 2024/25, offering custom-made products, signifies a move towards greater personalization and luxury. Strategic partnerships, such as the renewal with Scuderia Ferrari for the 2024 and 2025 seasons, and a collaboration with Antolini®, further bolster brand presence and market reach. The company also successfully completed a directed share issue in November 2024, raising DKK 228 million in gross proceeds to fund a three-year growth plan.

Operational and market challenges have included slower-than-expected macroeconomic conditions in key European markets and China, impacting sales. In response, Bang & Olufsen adjusted its full-year revenue outlook for 2023/24 to a decline of -8% to -5% in local currencies. Despite these headwinds, the company has maintained positive earnings, with an EBIT margin before special items of 3.8% in Q3 2024/25.

The company has focused on enhancing the customer experience through branded channels. New product launches such as the Beolab 8 and Beosound Theatre have been introduced. The launch of Bang & Olufsen Atelier offering custom-made products, signifies a move towards greater personalization and luxury.

Strategic partnerships, like the renewal with Scuderia Ferrari, are key. A directed share issue in November 2024 raised DKK 228 million. The company is adapting to regional e-commerce trends by directly operating its Tmall online flagship store in China.

Bang & Olufsen's competitive advantage stems from its strong brand heritage and luxury positioning. It is renowned for its distinctive design and high-quality sound. The company is committed to longevity and circularity, with ambitious climate goals.

Slower-than-expected macroeconomic conditions in key European markets and China have impacted sales. The company adjusted its full-year revenue outlook for 2023/24. Despite these headwinds, the company has maintained positive earnings.

Bang & Olufsen's competitive advantages include a strong brand heritage and luxury positioning. The company is known for its distinctive design and high-quality sound. They are adapting to new trends by enhancing their product portfolio and expanding their retail presence in 'win-cities'.

- Strong Brand Heritage and Luxury Positioning.

- Distinctive Design and High-Quality Sound.

- Commitment to Longevity and Circularity.

- Expansion of Retail Presence in Key Cities.

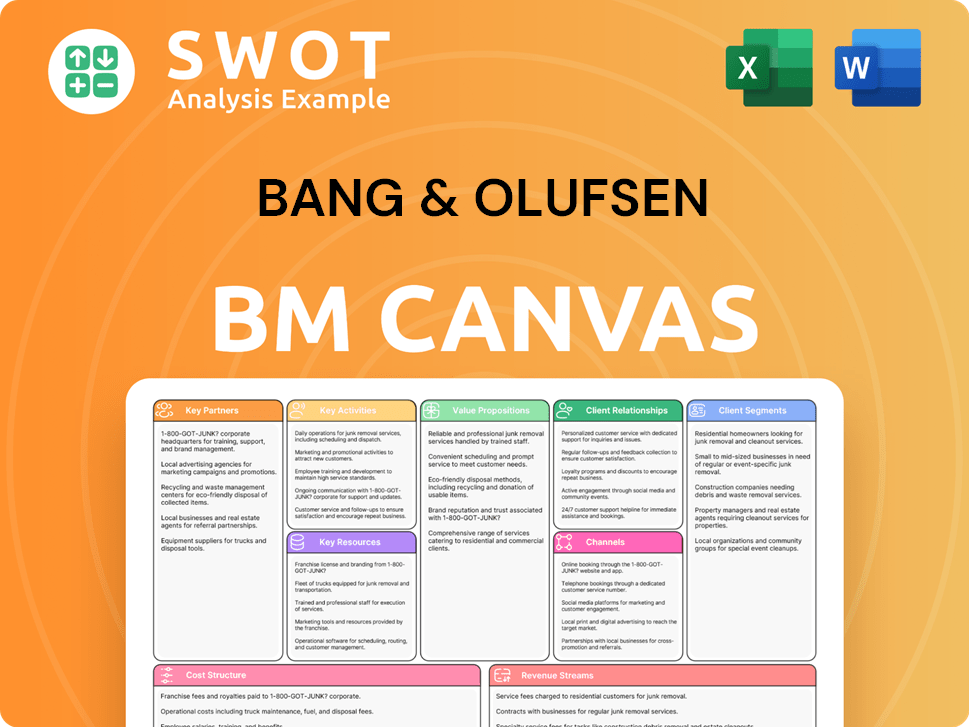

Bang & Olufsen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Bang & Olufsen Positioning Itself for Continued Success?

Bang & Olufsen (B&O) holds a distinct position in the luxury audio market, known for its premium pricing, design-led products, and acoustic heritage. Its focus on high-end offerings and a strong brand experience distinguishes it from competitors. The company's strategy emphasizes a 'Luxury Timeless Technology' approach, aiming to sustain profitability through product enhancements, strategic store openings, and increased brand awareness.

However, Bang & Olufsen faces several risks, including macroeconomic conditions, geopolitical uncertainties, and rapid technological changes. These factors impact sales and necessitate continuous innovation. Despite these challenges, the company is focused on strategic initiatives to drive growth, including investments in product development and expansion into key markets. The company is also focused on improving profitability and building a more resilient business model.

Bang & Olufsen competes in the luxury audio market, setting itself apart through premium pricing and design. It reported a 19% growth in its customer base in 2023/24, with a 14% increase in customers owning multiple products. This indicates strong customer loyalty within its niche. Its global reach extends across EMEA, Americas, and APAC, with a focus on key 'win cities' like London and New York.

Macroeconomic conditions, particularly in Europe and China, impact sales, leading to an adjusted revenue outlook for the financial year 2023/24 with an expected decline of -8% to -5% in local currencies. Geopolitical uncertainties, including announced tariffs, pose a risk, with an estimated direct impact of around DKK 70 million annually. Technological disruption and changing consumer preferences present challenges.

Bang & Olufsen is focused on a 'Luxury Timeless Technology' strategy, enhancing its product portfolio and expanding its presence in key cities. The company is investing the proceeds from its recent capital raise, DKK 217 million (net), in future profitable growth. Innovation roadmaps include continued focus on Cradle to Cradle certified products, with a target to certify several products by June 2025.

For the financial year 2024/25, the company has narrowed its outlook for revenue growth in local currencies to between -3% and 3%. The EBIT margin before special items is expected between -2% and 1%, and free cash flow between DKK -100m and DKK 0m. This indicates a continued focus on strategic transition and building a more resilient business model. To learn more about the company's plans, read about the Growth Strategy of Bang & Olufsen.

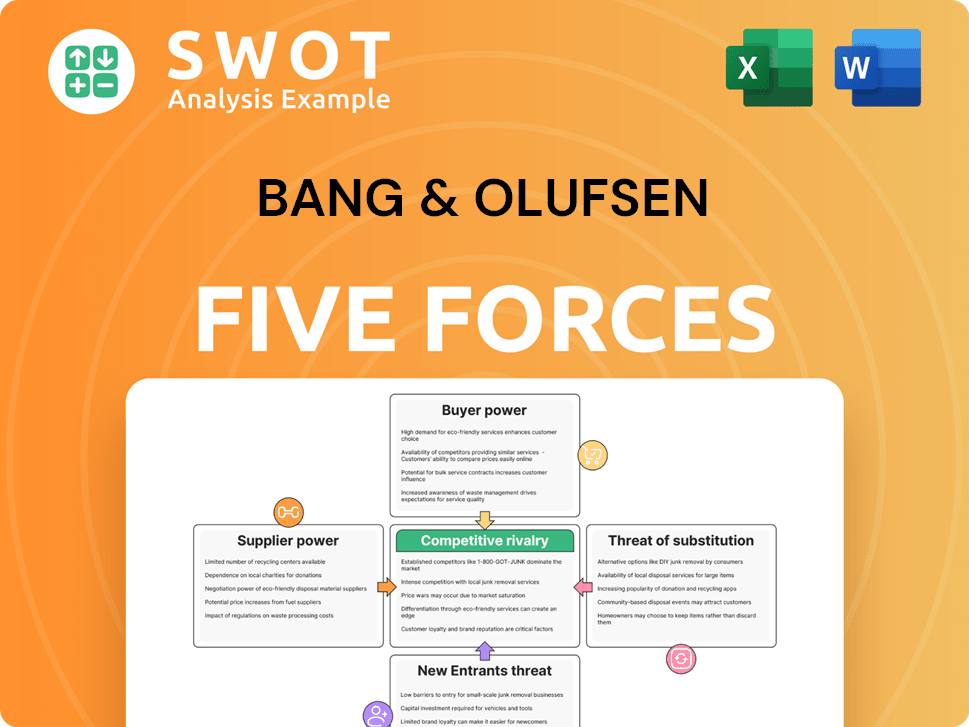

Bang & Olufsen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bang & Olufsen Company?

- What is Competitive Landscape of Bang & Olufsen Company?

- What is Growth Strategy and Future Prospects of Bang & Olufsen Company?

- What is Sales and Marketing Strategy of Bang & Olufsen Company?

- What is Brief History of Bang & Olufsen Company?

- Who Owns Bang & Olufsen Company?

- What is Customer Demographics and Target Market of Bang & Olufsen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.