Bharat Electronics Limited Bundle

How Does Bharat Electronics Limited Drive India's Defense?

Bharat Electronics Limited (BEL), a key player in India's defense sector, achieved a record turnover exceeding Rs 19,700 crore in fiscal year 2023-24, demonstrating significant growth. With an order book exceeding Rs 75,900 crore as of April 1, 2024, BEL's financial health underscores its crucial role in national security. Understanding the inner workings of BEL operations is vital for anyone interested in defense electronics and public sector undertakings.

This article provides a comprehensive look into Bharat Electronics Limited SWOT Analysis, examining its core value proposition, revenue streams, and strategic initiatives. We'll explore how BEL, a leading BEL company, manufactures advanced electronic products, including radar and communication systems, and its impact on India's technological advancement. Whether you're an investor, industry observer, or simply curious, this analysis offers critical insights into BEL's operations and future outlook, helping you understand its contribution to the "Make in India" initiative and beyond.

What Are the Key Operations Driving Bharat Electronics Limited’s Success?

Bharat Electronics Limited (BEL) is a key player in the defense electronics sector, focusing on design, development, and manufacturing. Its core operations revolve around providing advanced electronic products primarily for the Indian defense forces, while also serving civilian markets and exports. The company's value proposition lies in its ability to deliver customized, cutting-edge solutions tailored to the specific needs of its customers, ensuring operational effectiveness and strategic advantage.

BEL's operations are vertically integrated, covering research and development, design, manufacturing, testing, and field support. This integrated approach allows for greater control over quality and innovation. BEL's strong R&D focus enables it to offer specialized solutions, strengthening its market position.

The company's product range includes radar systems, communication systems, electronic warfare systems, and naval systems. BEL serves a diverse customer base, including the Indian Army, Navy, Air Force, and paramilitary forces, as well as civilian sectors. Its commitment to indigenization, through a vast network of domestic and international vendors, reduces reliance on foreign sources.

BEL manufactures a wide array of products, including radar systems, communication systems, and electronic warfare systems. These products are crucial for defense and homeland security. BEL also offers services such as system integration and life cycle support, ensuring the optimal performance of its products.

The primary customer base of BEL includes the Indian Army, Navy, and Air Force. BEL also serves paramilitary forces and civilian sectors. The company's focus on the defense sector makes it a critical supplier for national security. For more details on the target market, see Target Market of Bharat Electronics Limited.

BEL operates state-of-the-art manufacturing facilities across India, utilizing advanced technologies. The company invests heavily in research and development to stay at the forefront of technological advancements. This focus on innovation allows BEL to meet the evolving needs of its customers.

BEL collaborates with global defense majors and academic institutions for technology transfer and joint development. These partnerships enhance BEL's capabilities and market reach. Strategic alliances are crucial for sustaining innovation and competitiveness in the defense electronics industry.

BEL's strong R&D capabilities and commitment to quality set it apart in the market. The company's focus on indigenization and strategic partnerships further enhance its competitive advantage. BEL's ability to provide customized solutions tailored to specific customer requirements strengthens its position.

- Strong R&D focus, enabling customized solutions.

- Commitment to quality and reliability.

- Vertical integration of operations.

- Strategic partnerships for technology transfer.

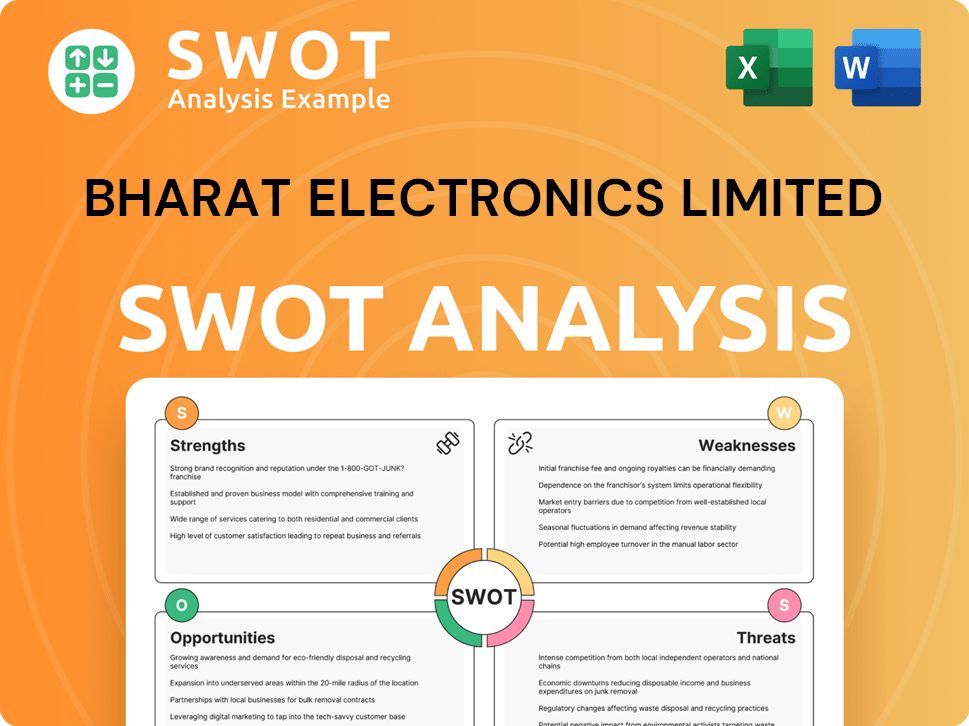

Bharat Electronics Limited SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bharat Electronics Limited Make Money?

Bharat Electronics Limited (BEL) primarily generates revenue through the sale of its advanced electronic products and systems. These products are mainly supplied to the defense sector. The company's financial success is closely tied to its ability to secure and fulfill contracts within this sector.

BEL also earns revenue from providing repair, maintenance, and upgrade services for its installed base of equipment. This ensures long-term support for its customers. Additionally, the company is strategically diversifying its revenue streams by venturing into non-defense areas.

Exports are another growing monetization strategy, with BEL actively pursuing opportunities in international markets. The company aims for export sales to reach 15% of its total turnover in the next 3-5 years. This expansion into new segments and geographies represents a key strategy to mitigate risks.

The main revenue stream for BEL is the sale of equipment and systems to the Indian Ministry of Defence. This includes radar systems, communication equipment, electronic warfare systems, and naval systems. For the financial year 2023-24, BEL achieved a record turnover of over Rs 19,700 crore.

BEL provides repair, maintenance, and upgrade services for its installed base of equipment. This ensures long-term support for its customers. While specific percentage contributions for each revenue stream are not always separately disclosed, product sales form the overwhelming majority.

BEL is diversifying its revenue streams by venturing into non-defense areas. These areas include smart cities, homeland security solutions, and railway signaling systems. This diversification helps to reduce reliance on a single customer segment.

Exports are a growing monetization strategy for BEL. The company is actively pursuing opportunities in international markets. BEL aims for export sales to reach 15% of its total turnover in the next 3-5 years.

BEL's expansion into new segments and geographies is a key strategy. This helps to mitigate risks associated with reliance on a single customer segment. It also capitalizes on its technological expertise in broader markets.

The revenue mix for BEL includes product sales, service revenue, and revenue from non-defense sectors. The company is working to balance its revenue streams. This strategy helps to ensure financial stability and growth.

BEL, a prominent defense electronics company and public sector undertaking, relies on several key revenue streams to sustain its operations. These streams are crucial for the company's financial health and growth. For more insights, you can read about the Growth Strategy of Bharat Electronics Limited.

- Sales of BEL products to the Indian Ministry of Defence.

- Revenue from repair, maintenance, and upgrade services.

- Ventures into non-defense sectors like smart cities and homeland security.

- Export of defense and non-defense products to international markets.

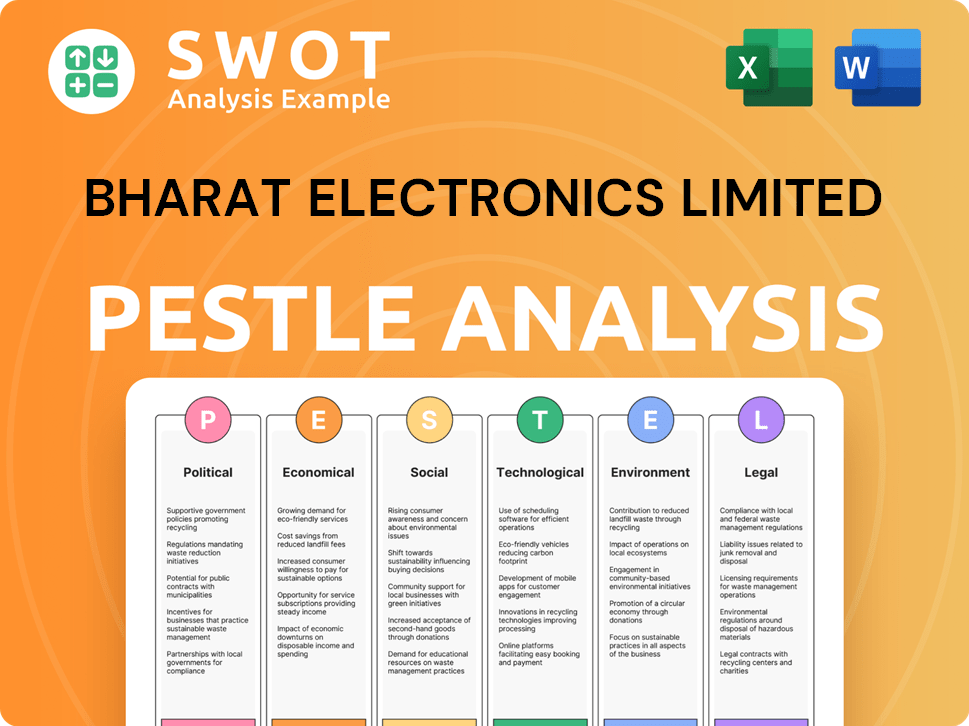

Bharat Electronics Limited PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Bharat Electronics Limited’s Business Model?

Bharat Electronics Limited (BEL) has marked significant milestones, especially with its consistent growth in recent years. The company's strategic moves, particularly its focus on indigenous defense electronics, have been pivotal. BEL's robust order book, exceeding Rs 75,900 crore as of April 1, 2024, demonstrates its successful product development and market penetration.

Operationally, BEL has navigated challenges such as global supply chain disruptions, especially regarding semiconductors and electronic components. The company has responded by strengthening its vendor base and emphasizing domestic sourcing. Its competitive advantages stem from strong brand trust, technological leadership, and economies of scale.

BEL's deep integration within the Indian defense ecosystem provides a unique edge. The company continues to adapt to emerging trends like artificial intelligence and cybersecurity by investing in these areas. For more insights, you can explore the Growth Strategy of Bharat Electronics Limited.

BEL has achieved several key milestones, including the development and production of critical defense systems. The company has consistently expanded its product portfolio. Its financial performance has shown steady growth, reflecting successful project execution and market expansion.

A major strategic move has been BEL's focus on indigenization, aligning with the 'Make in India' initiative. This has reduced import dependency and strengthened national security. BEL has also invested in R&D to enhance its technological capabilities and develop next-generation products.

BEL's competitive edge comes from its strong brand reputation and decades of experience as a reliable defense supplier. It benefits from significant technological leadership through continuous R&D. The company's large-scale manufacturing capabilities provide economies of scale.

BEL's financial performance is marked by a robust order book and consistent revenue growth. The company's ability to secure large-scale orders for sophisticated defense equipment showcases its market strength. BEL's focus on cost management and operational efficiency contributes to its profitability.

BEL faced challenges like supply chain disruptions, particularly affecting semiconductors. The company has responded by strengthening its vendor base and emphasizing domestic sourcing. BEL is also exploring alternative component solutions to ensure production continuity.

- Strengthening Vendor Base: Expanding and diversifying its network of suppliers.

- Domestic Sourcing: Prioritizing components and materials from within India.

- Alternative Solutions: Identifying and utilizing alternative components.

- R&D Investments: Focusing on research and development to enhance technological capabilities.

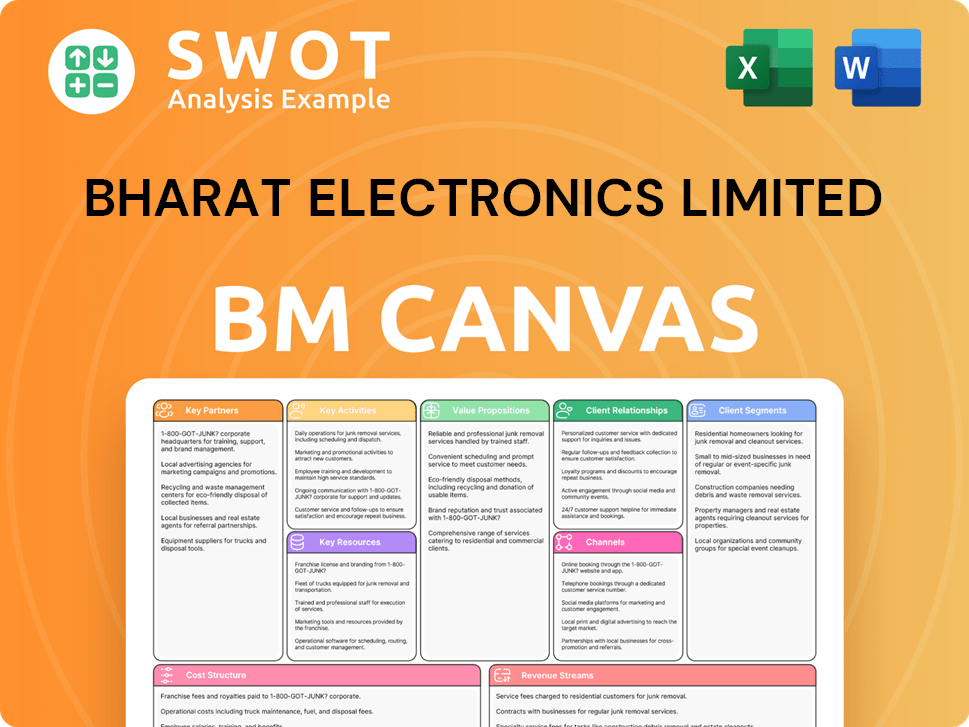

Bharat Electronics Limited Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Bharat Electronics Limited Positioning Itself for Continued Success?

The company, a key player in India's defense electronics sector, holds a dominant position as a primary supplier to the Ministry of Defence. Its strong market share in crucial defense electronic segments is supported by its status as a public sector undertaking and long-standing relationships with the armed forces. The company consistently demonstrates its leadership through record-breaking turnover and a robust order book.

The company also benefits from customer loyalty due to its specialized products, customized solutions, and after-sales support. It is expanding globally, with a strategic focus on increasing exports to friendly foreign countries. However, it faces risks such as cyclical defense spending, procurement delays, and competition.

The company holds a significant market share in the Indian defense electronics market. Its status as a public sector undertaking gives it a strategic advantage. The company consistently achieves high turnover figures, reflecting its strong market presence.

Key risks include dependence on defense budgets and potential procurement delays. Competition from private players and international contractors is a factor. Geopolitical uncertainties and technological advancements pose challenges.

The company is focused on diversifying its product portfolio and expanding into non-defense sectors. It aims to increase exports, targeting 15% of its turnover from exports in the next 3-5 years. Investments in emerging technologies are a key strategy.

The company is increasing its presence in non-defense sectors like smart cities and e-mobility. It is investing heavily in AI, quantum computing, and unmanned systems. These initiatives support sustainable revenue and profit growth.

The company's growth is driven by increasing indigenization in Indian defense and strong R&D capabilities. Strategic diversification efforts are also important. These factors contribute to sustained revenue and profit expansion.

- Focus on indigenization to reduce reliance on imports.

- Investments in R&D to develop cutting-edge technologies.

- Expansion into non-defense sectors like smart cities and e-mobility.

- Aggressive pursuit of export opportunities.

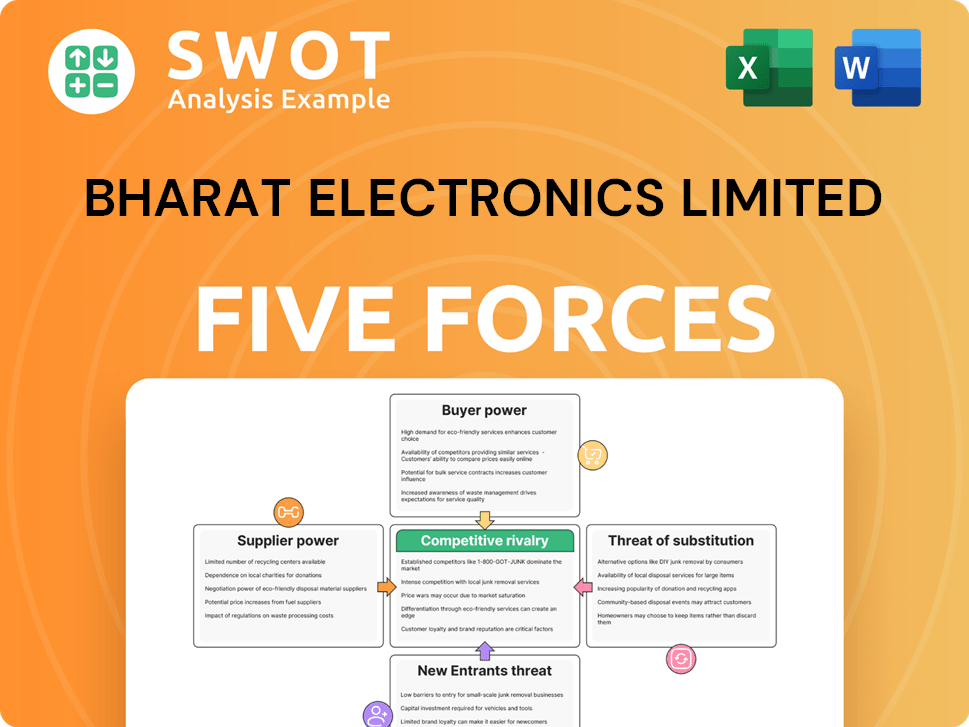

Bharat Electronics Limited Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bharat Electronics Limited Company?

- What is Competitive Landscape of Bharat Electronics Limited Company?

- What is Growth Strategy and Future Prospects of Bharat Electronics Limited Company?

- What is Sales and Marketing Strategy of Bharat Electronics Limited Company?

- What is Brief History of Bharat Electronics Limited Company?

- Who Owns Bharat Electronics Limited Company?

- What is Customer Demographics and Target Market of Bharat Electronics Limited Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.