The Buckle Bundle

How Does the Buckle Company Thrive in Today's Retail Market?

The Buckle, Inc. (NYSE: BKE) has consistently demonstrated its ability to adapt and succeed in the ever-evolving retail sector. With a focus on curated apparel, especially denim, the company has maintained a strong presence, even achieving impressive financial results recently. This analysis explores the inner workings of The Buckle, revealing the strategies behind its enduring appeal and financial performance.

To truly understand The Buckle's success, it's essential to dissect its business model, from its The Buckle SWOT Analysis to its customer service. The Buckle store offers a unique shopping experience, focusing on a mix of popular brands and its exclusive Buckle brand clothing. Whether you're looking for Buckle jeans for men or women, or simply curious about how the Buckle company makes money, this examination provides valuable insights.

What Are the Key Operations Driving The Buckle’s Success?

The Buckle Company operates by offering a curated selection of apparel, footwear, and accessories, with a strong focus on denim. The company caters to a fashion-conscious customer base, primarily young adults aged 18-34. Core products include denim, fashion tops, casual bottoms, sportswear, outerwear, accessories, and footwear, featuring both national brands and exclusive private labels.

The operational model involves sourcing merchandise from approximately 60-75 specialized denim and apparel manufacturers. The company maintains long-term relationships with many of these manufacturers. The Buckle utilizes a multi-sourcing strategy, covering a significant portion of its product lines across multiple countries to mitigate risk.

Distribution and sales channels include a network of physical retail stores and a growing e-commerce platform. The company emphasizes personalized customer service, offering amenities like free hemming and a private label credit card. This focus on an 'unforgettable experience' and curated merchandise selection differentiates the Buckle from its competitors.

The Buckle sources from approximately 60-75 specialized manufacturers. Top suppliers account for 40-50% of total apparel sourcing. Long-term relationships are maintained with 22-28 established manufacturers, with an average duration of 7-9 years. The company employs a multi-sourcing strategy across four countries.

The company operates through physical retail stores and an e-commerce platform. As of late 2024, there were 438 stores across 42 states. The company focuses on personalized customer service, including free hemming and a private label credit card.

The Buckle's operational efficiency is highlighted by disciplined inventory management. Inventory levels dropped to $120.8 million in Q4 2024, reflecting a focus on reducing excess stock and accelerating turnover. The company's strategy includes offering a wide range of Buckle clothing, including Buckle jeans for both men and women.

- The Buckle store locations are primarily in mid-tier markets.

- The company focuses on providing an 'unforgettable experience' to its customers.

- The e-commerce platform is a growing sales channel for the Buckle brand.

- The company's return policy and other customer service details can be found by searching for information about the Buckle Company.

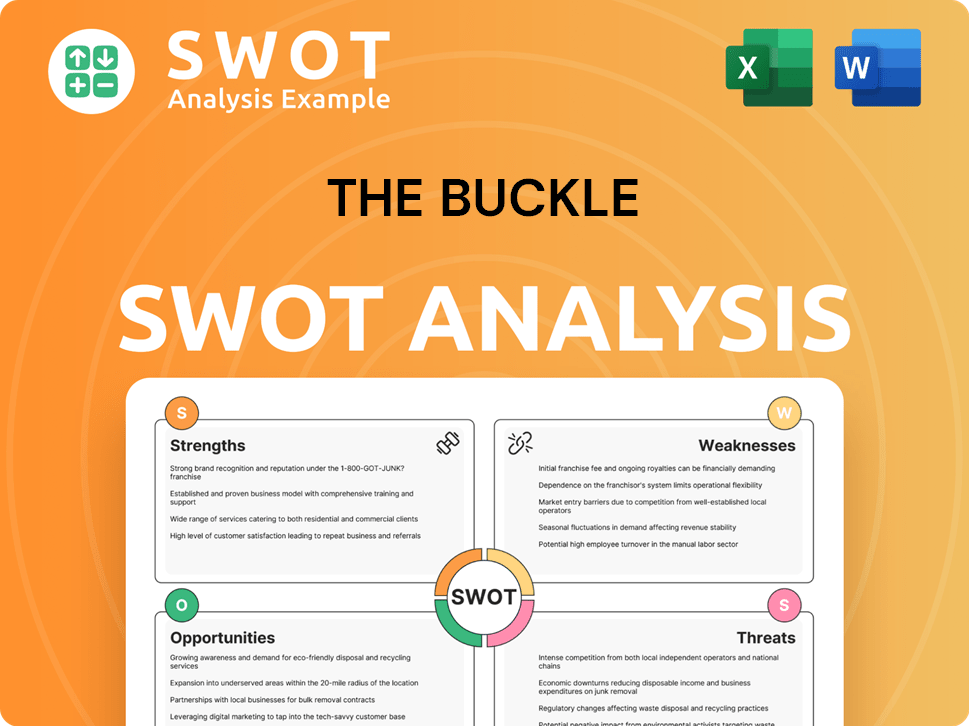

The Buckle SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does The Buckle Make Money?

The primary revenue stream for the company stems from selling apparel, footwear, and accessories. The company's financial performance demonstrates its ability to generate substantial sales, with a focus on direct sales through retail locations and online channels. The company's strategies include a private label credit card and a guest loyalty program.

For the fiscal year ending February 1, 2025, the company reported total net sales of $1.218 billion. This indicates a robust and consistent revenue stream. The company's online sales are also a significant contributor to the overall revenue, demonstrating the importance of its digital presence.

In the first quarter of fiscal 2025 (ended May 3, 2025), net sales increased by 3.7% year-over-year to $272.1 million. This growth reflects the company's ability to adapt to market trends and consumer preferences. Furthermore, the company's focus on private label brands and customer retention strategies contributes to its financial success.

The company's monetization strategies are multifaceted, focusing on direct sales, online growth, and customer loyalty. The company's approach to revenue generation is designed to maximize profitability through various channels. The company's ability to maintain strong gross profit margins, which were 46.7% in Q1 2025, further demonstrates its effective monetization strategies and cost management. To learn more about the company's approach, check out the Marketing Strategy of The Buckle.

- Direct Sales: The company primarily generates revenue through its retail stores, offering a wide selection of apparel, footwear, and accessories.

- Online Sales: The company has significantly grown its online sales, with online sales increasing by 6.4% to $69.7 million in Q4 2024, representing approximately 18.4% of quarterly revenue. In Q1 2025, online sales grew 4.5% to $46.4 million.

- Private Label Brands: Private label brands, including the premium Buckle Black Label line, are a significant revenue source, surging to 47.5% of total sales in Q1 2025, up from 46%.

- Customer Retention: The company employs strategies such as offering a private label credit card and a guest loyalty program to foster customer retention and encourage repeat purchases.

- Women's Apparel: The women's apparel segment is a key driver of sales, contributing 50% of total sales in Q1 2025, up from 47% in 2024, fueled by an 11% jump in denim sales and a 5% increase in average unit prices.

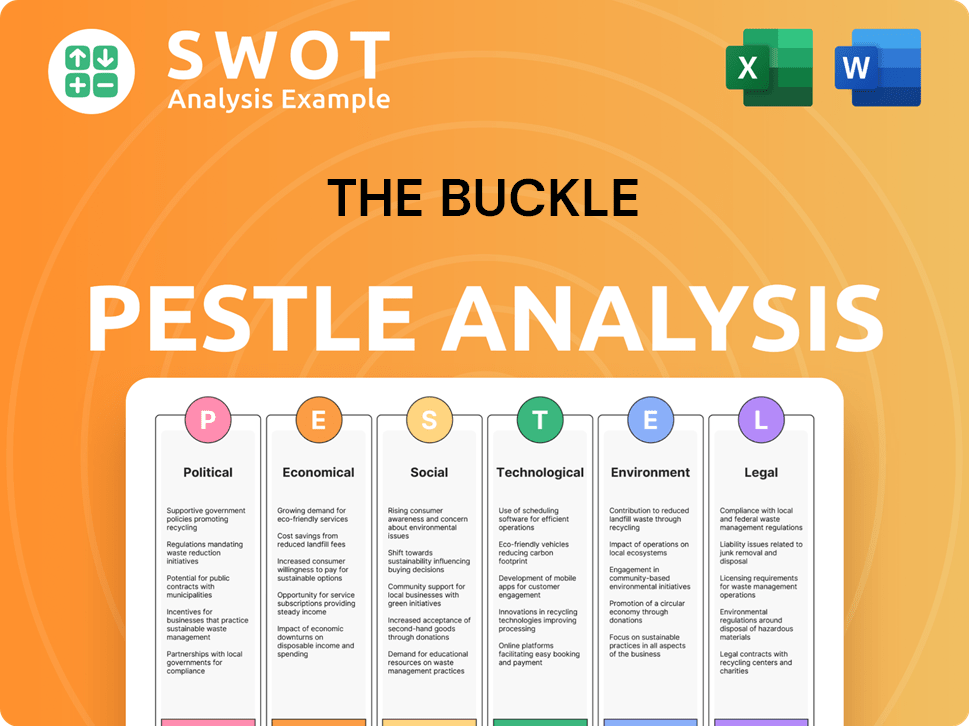

The Buckle PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped The Buckle’s Business Model?

The evolution of The Buckle, from its origins as Mills Clothing, Inc. in 1948 to its current status, showcases a history of strategic adaptation. The company's transformation from a men's clothing store to a jeans-focused retailer in the early 1970s, and the subsequent inclusion of women's apparel in 1977, highlights its responsiveness to market trends. The official name change to The Buckle, Inc. in 1991 further solidified its brand identity.

Recent strategic moves by The Buckle include optimizing its store footprint. The company has selectively closed underperforming locations while relocating stores to high-traffic areas. This approach, alongside the opening of new stores and remodeling existing ones, demonstrates a proactive strategy to enhance store productivity and customer accessibility. The company's focus on adapting to changing consumer preferences is evident in its product offerings and sales trends.

The Buckle's competitive edge is rooted in its strong brand recognition and commitment to customer service. Its curated merchandise selection, especially as a 'denim destination', and personalized customer experiences, such as free hemming, set it apart. The growth of its private label offerings, which now account for a significant portion of sales, provides greater control over design and margins, further enhancing its competitive position. For more insights, see Growth Strategy of The Buckle.

Founded as Mills Clothing, Inc. in 1948, initially a men's clothing store. Transitioned to a jeans store in the early 1970s, and expanded to include women's apparel in 1977. Officially changed the corporate name to The Buckle, Inc. in 1991, marking a key branding milestone.

Focused on optimizing store footprint by closing underperforming locations and relocating to high-traffic areas. Opened 8 new stores, completed 18 full-store remodels and/or relocations, and closed 11 stores in fiscal 2024. Anticipates opening 7 new stores and completing approximately 18-22 store remodels and/or relocations in fiscal 2025.

Strong brand recognition, particularly as a 'denim destination', and a curated merchandise selection. Emphasis on personalized customer service, including free hemming and gift-packaging. The growth of its private label offerings, which now account for 47.5% of total sales, enhances control over design and margins.

Consistent profitability and disciplined inventory management, with inventory levels dropping 4.3% year-over-year to $120.8 million in Q1 2025. Debt-free status provides a stable financial foundation. Women's apparel sales increased by 11.5% year-over-year in Q1 2025, and online sales grew by 6.4% in Q4 2024.

The Buckle's ability to adapt to changing consumer preferences is a key factor in its success. This is demonstrated by the strong growth in women's apparel sales and the expansion of its online sales. This adaptability helps the Buckle brand stay relevant in a competitive retail environment.

- Focus on denim and curated merchandise.

- Personalized customer service.

- Strategic store location and footprint optimization.

- Strong financial discipline and debt-free status.

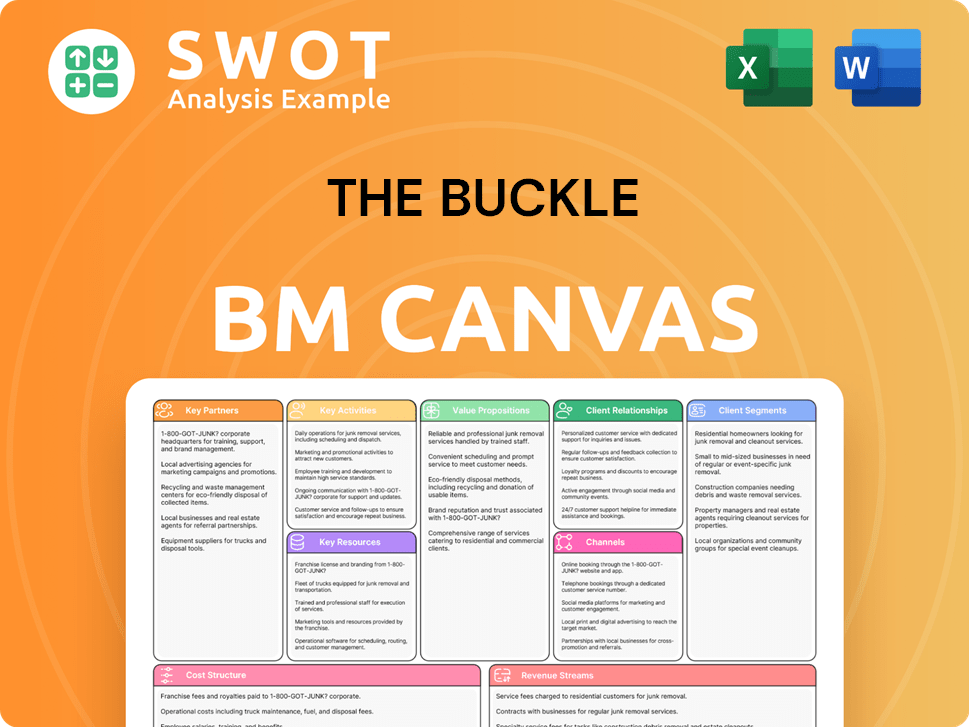

The Buckle Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is The Buckle Positioning Itself for Continued Success?

The Owners & Shareholders of The Buckle maintains a distinct market position as a specialty retailer. It focuses on casual apparel, footwear, and accessories, particularly denim, targeting young adults aged 15-34. The company has demonstrated resilience in the competitive apparel retail sector.

The company operates approximately 438 retail stores across 42 states, with customer loyalty fostered through personalized service. Despite its strengths, the company faces risks like shifting consumer preferences and macroeconomic uncertainties. Strategic initiatives are focused on sustained profitability.

The Buckle store is a specialty retailer focused on casual apparel, footwear, and accessories, with a strong emphasis on denim. It targets young adults aged 15-34. The company's consistent performance and strategic adaptations indicate its resilience.

The apparel retail sector faces shifting consumer preferences and macroeconomic uncertainties. Potential risks include online sales stagnation, consumer spending shifts, tariff costs, regulatory changes, and cybersecurity threats. These factors could impact the Buckle brand.

The focus is on sustaining and expanding profitability through strategic initiatives. This includes physical footprint expansion, enhancing digital capabilities, and elevating the product mix, especially private labels. The company aims to maintain operational efficiency.

The company has a strong cash balance of $266.9 million and no long-term debt, offering financial flexibility. Strategic store optimization, including relocations to high-traffic areas, is expected to boost profitability. Analysts project a future return on equity of 44.6% over the next three years.

The company is focused on growth through strategic initiatives and maintaining financial health. Ongoing initiatives include store optimization and enhancing digital capabilities. The Buckle company aims to improve operational efficiency and inventory control.

- Expansion of physical stores and online presence.

- Enhancing digital capabilities to improve the customer experience.

- Elevating the product mix, particularly through private labels.

- Maintaining operational efficiency and strong inventory management.

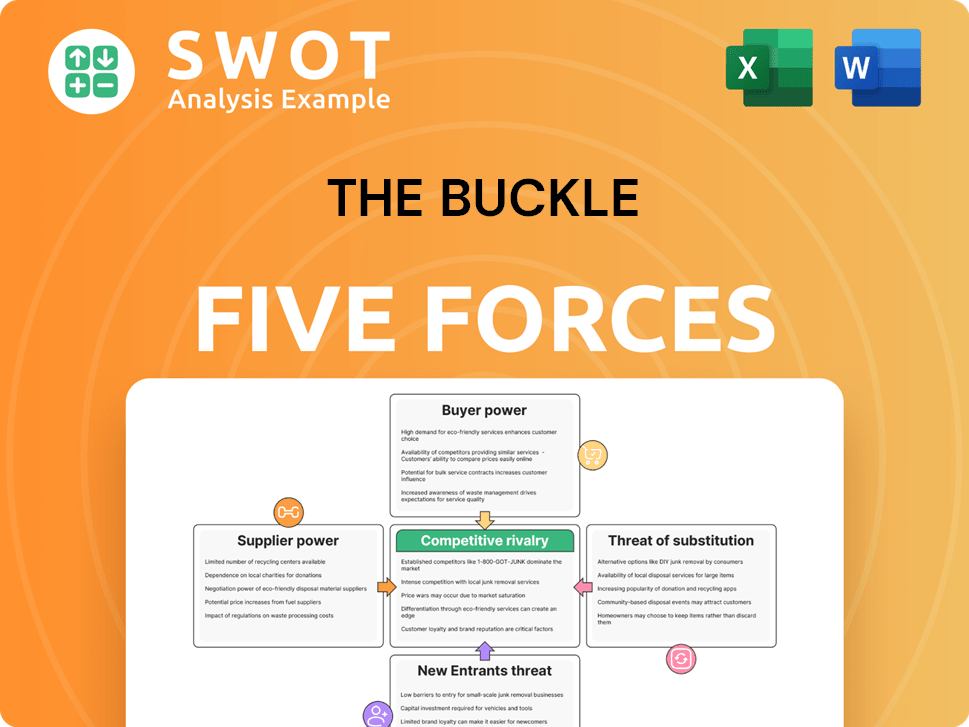

The Buckle Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of The Buckle Company?

- What is Competitive Landscape of The Buckle Company?

- What is Growth Strategy and Future Prospects of The Buckle Company?

- What is Sales and Marketing Strategy of The Buckle Company?

- What is Brief History of The Buckle Company?

- Who Owns The Buckle Company?

- What is Customer Demographics and Target Market of The Buckle Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.