Carta Holdings Bundle

How Does Carta Holdings Thrive in the Digital Age?

Carta Holdings, a leading internet company, has become a cornerstone of the digital marketing and advertising world. Its comprehensive suite of solutions is essential for businesses aiming to thrive in today's digital landscape. With a focus on innovation and market adaptation, Carta Holdings continuously refines its offerings to meet evolving consumer demands.

Carta Holdings excels in ad platform development, offering robust marketing support and efficient media operations. This allows businesses to amplify their online presence and optimize advertising spend. For a deeper dive, explore the Carta Holdings SWOT Analysis to understand its strengths, weaknesses, opportunities, and threats. Understanding the Carta platform and its impact on equity management, cap tables, and private company operations is key for investors and businesses alike.

What Are the Key Operations Driving Carta Holdings’s Success?

Carta Holdings, a prominent player in the financial technology sector, delivers value through its comprehensive equity management solutions. The company's core focus revolves around providing a centralized platform for managing equity, cap tables, and valuations for private companies. This is achieved through a combination of technological innovation and strategic partnerships.

The value proposition of Carta Holdings lies in its ability to streamline complex financial processes, offering efficiency and transparency to its clients. By providing a single source of truth for equity data, Carta helps companies, investors, and employees make informed decisions. This includes facilitating fundraising, managing stock options, and preparing for potential liquidity events, such as an IPO. The Brief History of Carta Holdings demonstrates the company's evolution and commitment to serving the needs of the private market.

Carta's services support a wide range of financial activities, from cap table management to secondary market transactions. This integrated approach positions Carta as a key partner for companies throughout their lifecycle, offering tools and insights that drive growth and success.

The Carta platform offers a suite of features designed to simplify equity management. These include cap table management, stock option administration, and valuation tools. The platform also facilitates secondary transactions and provides data insights for informed decision-making.

Carta primarily serves private companies, venture capital firms, and investors. The platform is designed to meet the needs of startups, growth-stage companies, and established private entities. Its tools are also beneficial for employees managing stock options.

Carta's operational processes involve data management, platform maintenance, and customer support. The company invests in technology to ensure data security and accuracy. Customer support teams assist clients with platform usage and technical issues.

Carta offers a centralized platform that streamlines equity management, providing efficiency and transparency. The platform reduces administrative burdens and offers data-driven insights. This helps companies make informed decisions, manage fundraising, and prepare for liquidity events.

Carta provides numerous benefits to its users, including improved efficiency, reduced administrative costs, and enhanced transparency. The platform offers a centralized view of equity data, making it easier to manage and track ownership.

- Streamlined Cap Table Management: Automates the process of managing and updating cap tables, reducing errors and saving time.

- Improved Data Accuracy: Ensures that all equity data is accurate and up-to-date, providing a reliable source of information.

- Enhanced Compliance: Helps companies meet regulatory requirements by providing detailed records of equity transactions.

- Better Decision-Making: Offers data-driven insights that enable companies to make informed decisions about equity, fundraising, and other financial matters.

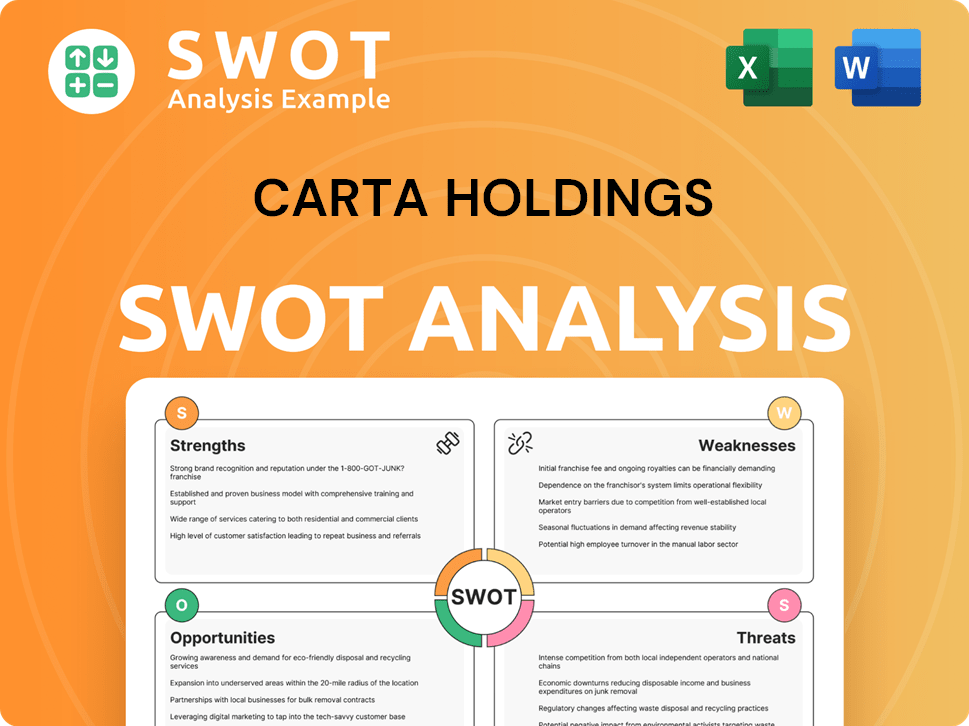

Carta Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Carta Holdings Make Money?

Carta Holdings, a company focused on equity management, generates revenue through several key streams. These streams are primarily centered around its digital marketing and advertising services. The company's financial model is designed to capture value from various aspects of its operations, including platform usage, marketing support, and media services.

The main revenue sources for Carta Holdings include fees from its ad platform, charges for marketing support, and commissions or fees from media operations. While exact figures aren't publicly available, the business model indicates a strong reliance on recurring service fees and performance-based compensation from advertising campaigns. This diversified approach allows Carta Holdings to capture value from different stages of the advertising lifecycle.

Carta Holdings employs several monetization strategies to generate revenue. These include subscription-based models for access to its proprietary ad platforms, tiered pricing for marketing support based on the scope of work, and transaction fees or commissions on advertising spend managed through its media operations. For example, clients might pay a base fee plus a percentage of their ad spend for ad platform services. For marketing support, project-based fees or retainer agreements are common. For media operations, Carta Holdings could earn a percentage of the media budget it manages for clients.

Carta Holdings uses a multi-faceted approach to generate revenue, including subscription models, tiered pricing, and commission-based structures. This approach allows the company to cater to various client needs and revenue streams. The company's ability to adapt and expand its revenue streams has been crucial for its growth in the competitive market.

- Subscription-Based Models: Access to the Carta platform, often a core offering, is likely provided through subscriptions.

- Tiered Pricing: Marketing support services are probably offered at different price points based on the complexity and scope of the project.

- Commission and Transaction Fees: Revenue is generated through commissions on advertising spend managed via media operations.

- Data Monetization: Within the bounds of privacy regulations, there may be opportunities for data monetization.

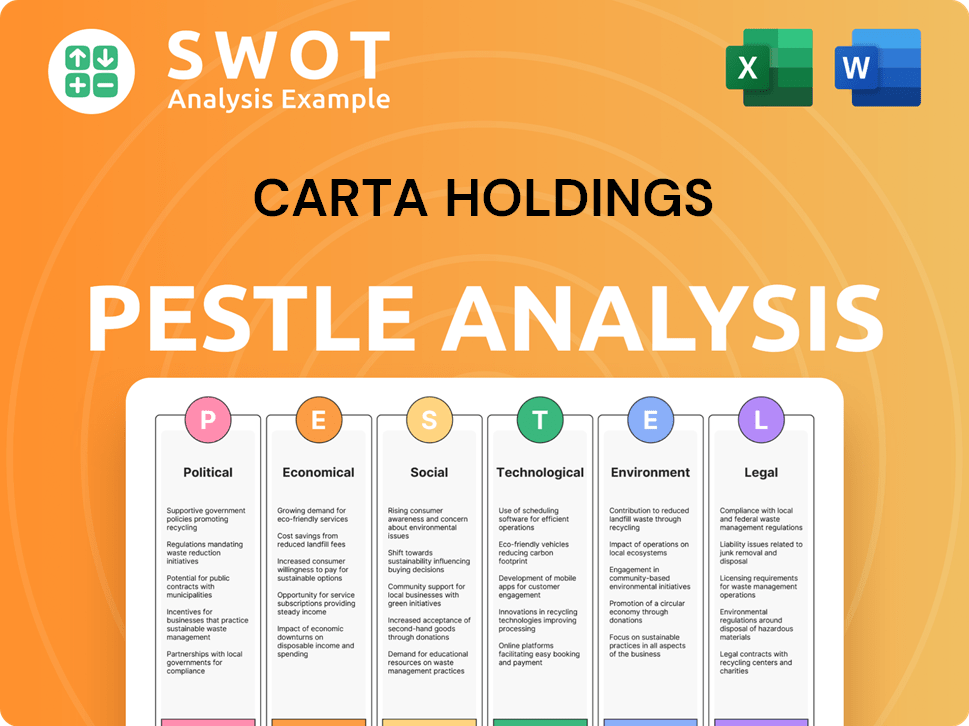

Carta Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Carta Holdings’s Business Model?

Carta Holdings, a key player in the equity management sector, has achieved significant milestones that have shaped its trajectory. These include the development of its Carta platform, strategic partnerships, and successful market entries. The company has consistently adapted to the evolving landscape of equity management, data privacy regulations, and competitive pressures, ensuring its continued relevance.

Strategic moves by Carta Holdings have been crucial to its growth. These include continuous innovation in its Carta platform, diversification of service offerings, and expansion into new geographical regions. The company's ability to navigate operational challenges, such as the rapidly evolving digital advertising landscape, has been key to its success. Marketing Strategy of Carta Holdings has played a pivotal role in its growth.

Carta Holdings' competitive edge is rooted in its technological leadership, robust brand recognition, and economies of scale. The company's ecosystem effect, where its various services complement each other, creates a strong customer base. Carta Holdings continually adapts to new trends, such as the increasing importance of first-party data and the integration of AI in marketing, ensuring its sustained relevance and competitive edge in a dynamic industry.

Carta Holdings has seen rapid growth, with over $1 trillion in assets managed on its platform. They have expanded their services to include cap table management, 409A valuations, and liquidity solutions. The company has facilitated over $100 billion in secondary transactions.

Carta has focused on strategic acquisitions to enhance its platform capabilities. It has expanded its services to include fund administration and venture capital services. The company has also emphasized international expansion, with a growing presence in Europe and Asia.

Carta's competitive advantage lies in its comprehensive platform, which offers a one-stop solution for equity management. Its strong network effects, with a large user base of private companies and investors, create significant value. They have a high customer retention rate, demonstrating strong client satisfaction.

Carta holds a significant market share in the equity management space. The company has a strong reputation for innovation and customer service. It continues to attract new clients, including both startups and established companies.

In 2024, Carta continues to innovate, focusing on AI-driven insights and enhanced user experiences. They have been expanding their offerings to include more sophisticated analytics tools for private companies and investors. Recent data shows a 20% increase in platform usage among existing clients.

- Carta has raised over $800 million in funding to date.

- The company has a valuation exceeding $7.4 billion as of early 2024.

- Carta's platform supports over 1 million users and manages equity for over 40,000 companies.

- They have expanded their services to include fund administration and venture capital services.

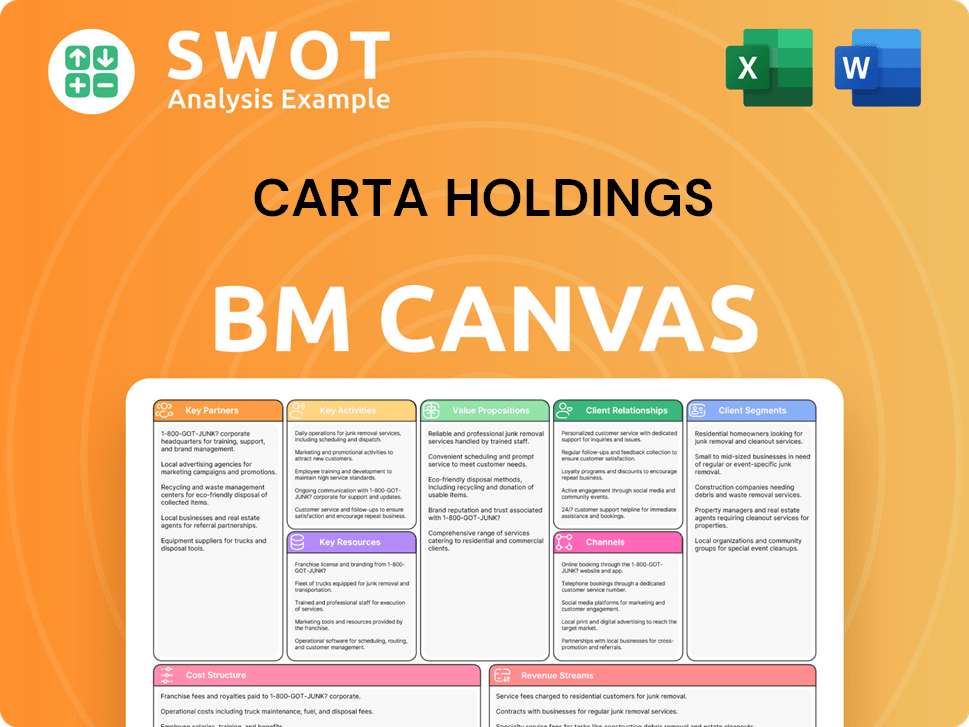

Carta Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Carta Holdings Positioning Itself for Continued Success?

The position of Carta Holdings within the digital marketing and advertising industry is strong, marked by a significant market share and a loyal customer base. The company's reach is global, with expansion likely as digital advertising transcends geographical limits. However, the digital landscape is dynamic, and understanding the interplay of market position, potential risks, and future prospects is essential for a comprehensive view of the company.

Carta Holdings navigates several risks, including regulatory changes impacting data privacy and online advertising, the rise of new competitors offering niche solutions, and technological disruptions. Furthermore, shifts in consumer preferences regarding ad formats and privacy could influence its operations and revenue. Addressing these challenges and pursuing growth requires strategic agility.

Carta Holdings holds a significant position in the digital marketing and advertising sector. The company's success is tied to its ability to adapt and innovate within a rapidly changing market. Understanding the competitive landscape is crucial for assessing its long-term viability. The Target Market of Carta Holdings includes various stakeholders in the financial and tech industries.

Key risks for Carta Holdings involve regulatory changes, especially those related to data privacy and online advertising practices. The emergence of new competitors and technological disruptions pose additional challenges. Changes in consumer behavior and ad preferences could also impact the company's performance. Understanding these risks is vital for investors and stakeholders.

Carta Holdings is likely investing in AI-driven marketing solutions and expanding into emerging digital channels. Strengthening data analytics capabilities is also a priority. Leadership focuses on innovation, client success, and sustainable growth. The company aims to maintain its market position through continuous innovation and strategic acquisitions.

Carta Holdings is likely focused on several strategic initiatives to drive growth and maintain its competitive edge. These include investments in research and development for AI-driven marketing solutions, expansion into emerging digital channels, and strengthening data analytics. These initiatives are designed to provide more precise targeting and measurement for clients.

Carta Holdings is likely focused on several key strategies to ensure its continued success. These strategies encompass innovation, client relationship management, and strategic acquisitions. The company's ability to adapt and evolve will be crucial in a dynamic market.

- Innovation: Continuous development of its ad tech stack to stay ahead of industry trends.

- Client Relationships: Fostering deeper relationships through value-added services.

- Strategic Acquisitions: Broadening market presence and technological capabilities through acquisitions.

- Data Analytics: Leveraging data to improve targeting and client outcomes.

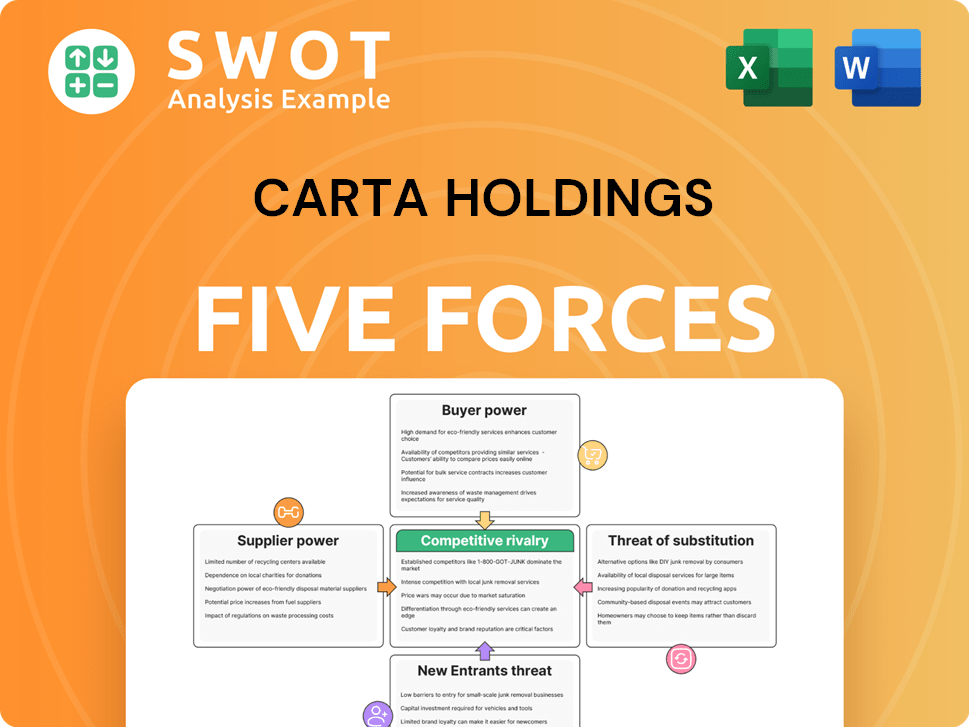

Carta Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Carta Holdings Company?

- What is Competitive Landscape of Carta Holdings Company?

- What is Growth Strategy and Future Prospects of Carta Holdings Company?

- What is Sales and Marketing Strategy of Carta Holdings Company?

- What is Brief History of Carta Holdings Company?

- Who Owns Carta Holdings Company?

- What is Customer Demographics and Target Market of Carta Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.