Castellum Bundle

Unveiling Castellum: How Does This Real Estate Giant Thrive?

Castellum Company, a prominent player in the Nordic real estate market, offers a compelling case study in strategic property management. With a focus on adaptable workplaces and logistics properties across key Nordic cities, Castellum has carved a niche for itself. This exploration dives into the Castellum SWOT Analysis, its operational framework, and its commitment to sustainability.

Understanding the Castellum SWOT Analysis is crucial for anyone seeking to understand the company's strengths, weaknesses, opportunities, and threats. This in-depth look at Castellum's business model will illuminate its core operations, including its approach to property development and management. By examining Castellum's history, leadership, and strategic initiatives, we'll gain a comprehensive view of its impact on the commercial real estate landscape and its future prospects.

What Are the Key Operations Driving Castellum’s Success?

The core of the Castellum Company's operations centers around the ownership, management, and development of adaptable workplaces and logistics properties. This involves a diverse portfolio including office buildings, warehouses, and industrial facilities. The company serves a wide range of customers, from large corporations to small and medium-sized enterprises, across various industries, ensuring efficient space utilization and responsiveness to tenant needs.

The Castellum business model focuses on high-quality property management, which includes robust maintenance, proactive tenant relationship management, and continuous development to meet market demands and sustainability standards. Strategic partnerships with local municipalities and service providers are integral to operational efficiency and expansion. Properties are strategically located in growth regions of Sweden, Copenhagen, and Helsinki, ensuring accessibility for tenants.

The company's value proposition emphasizes sustainability and adaptability. Castellum Company is a leader in sustainable property management, aiming for high environmental certifications. Its focus on adaptable workplaces allows for flexible lease agreements and customizable office solutions, providing significant benefits to tenants seeking agility.

The company offers a diverse portfolio of office buildings, warehouses, and industrial facilities. These properties cater to a wide array of customer segments. The company's offerings are designed to meet the evolving needs of various businesses.

Operational processes are meticulously designed for high-quality property management. This includes efficient space utilization and responsiveness to tenant needs. The company focuses on robust property maintenance and proactive tenant relationship management.

Castellum places a strong emphasis on sustainability and adaptability. The company aims for high environmental certifications for its buildings. This approach reduces operational costs and appeals to environmentally conscious tenants.

Customers benefit from reduced operational overheads and access to modern facilities. They also gain the flexibility to scale operations as needed. This fosters long-term tenant relationships and market differentiation.

The company's focus on sustainability and adaptable workplaces sets it apart. This approach leads to reduced operational costs and appeals to environmentally conscious tenants. The company's strategy is further detailed in Growth Strategy of Castellum.

- Emphasis on sustainable property management.

- Adaptable workplaces with flexible lease agreements.

- Strategic locations in growth regions.

- Focus on tenant needs and long-term relationships.

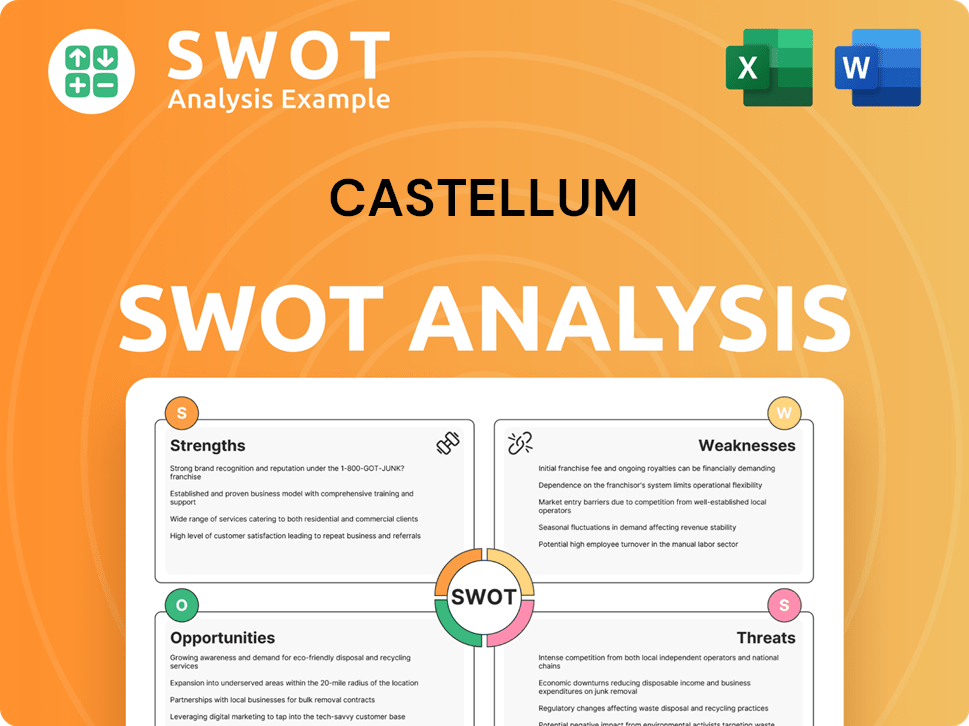

Castellum SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Castellum Make Money?

The core of the Castellum Company's revenue generation revolves around its real estate portfolio. This strategy ensures a steady income stream, primarily through leasing out commercial properties to various tenants. The business model is designed to provide a predictable financial foundation.

The company's monetization strategies extend beyond basic rental income. Castellum leverages additional revenue streams, including property-related services and development projects. This diversified approach supports overall profitability and adaptability in the market.

Castellum's focus on strategic property locations and high occupancy rates further enhances its revenue capabilities. The emphasis on sustainable and adaptable properties allows for potentially higher rental yields, contributing to the company's financial performance.

The primary revenue stream for Castellum is rental income derived from its commercial properties, which include office spaces and logistics properties. The company also generates revenue through property-related services.

- In 2024, Castellum reported a rental income of SEK 7,370 million.

- Service charges, such as heating and maintenance, also contribute to overall profitability.

- Long-term lease agreements provide a stable income flow.

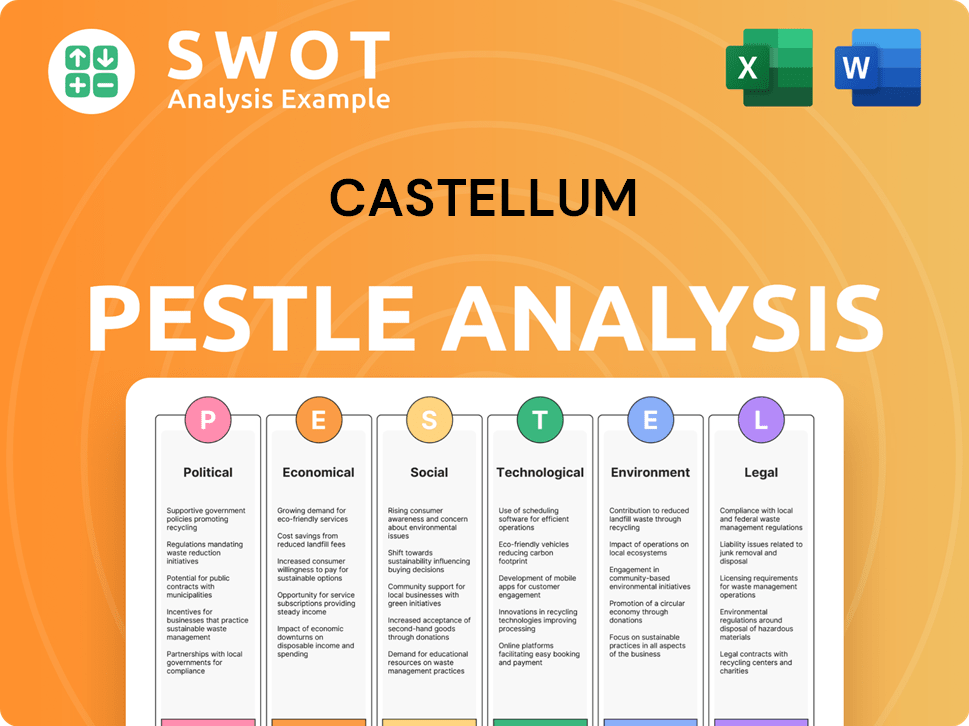

Castellum PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Castellum’s Business Model?

The journey of the Castellum Company has been marked by significant milestones and strategic shifts that have shaped its operational and financial performance. A key strategic focus has been continuous portfolio optimization. This is evident in its acquisitions and divestments, aimed at concentrating on prime growth regions and modern, sustainable properties. The Castellum business model has evolved to adapt to market changes, ensuring its relevance and resilience.

In 2024, Castellum continued to refine its portfolio through strategic divestments, aiming to bolster its financial position and concentrate on core assets. Simultaneously, the company has demonstrated a strong commitment to sustainability. It consistently achieves high rankings in global sustainability indices, which serves as a significant competitive advantage. This attracts environmentally conscious tenants and investors.

Operationally, Castellum has navigated market challenges, such as fluctuating interest rates and economic uncertainties, by maintaining a strong focus on cost control and efficient property management. The company's ability to adapt its properties to evolving tenant needs, particularly in the context of hybrid work models, has been crucial in maintaining high occupancy rates and tenant satisfaction. Understanding the Castellum operations is key to appreciating its adaptability.

Over the years, Castellum has achieved several milestones. These include strategic acquisitions that have expanded its portfolio and geographical presence. The company has also focused on developing sustainable properties. This has improved its market position and appeal to environmentally conscious investors.

Strategic moves by Castellum have included portfolio optimization through acquisitions and divestments. The company has also invested in sustainable development. This has enhanced its competitive advantage. These moves are designed to improve financial performance and market positioning.

The company's competitive edge stems from its strong brand in the Nordic real estate market. Its extensive, well-located property portfolio provides a barrier to entry. Commitment to sustainable practices and high-quality development further differentiates it. This attracts tenants prioritizing environmental responsibility.

Recent financial data shows Castellum's resilience. In 2024, the company reported stable occupancy rates. It also showed consistent revenue from its core operations. These figures demonstrate the company's ability to manage its portfolio effectively. This is despite economic uncertainties.

The company's competitive advantages are multifaceted. These include brand strength, a well-located property portfolio, and a commitment to sustainability. Its economies of scale, as one of the largest listed property companies in Sweden, allow for efficient operations. This also provides better access to financing. To learn more about the Castellum Company, you can read the Owners & Shareholders of Castellum.

- Strong Brand and Market Position: Castellum benefits from a strong brand within the Nordic real estate market. This enhances its ability to attract and retain tenants and investors.

- Sustainable Practices: The company's focus on sustainable practices and high-quality property development differentiates it. This appeals to a growing segment of tenants prioritizing environmental responsibility.

- Economies of Scale: As one of the largest listed property companies in Sweden, Castellum benefits from economies of scale. This allows for more efficient operations and better access to financing.

- Adaptability and Innovation: Castellum continues to adapt to new trends by investing in smart building technologies and exploring innovative solutions for flexible workspaces. This ensures its business model remains robust and relevant in a dynamic market.

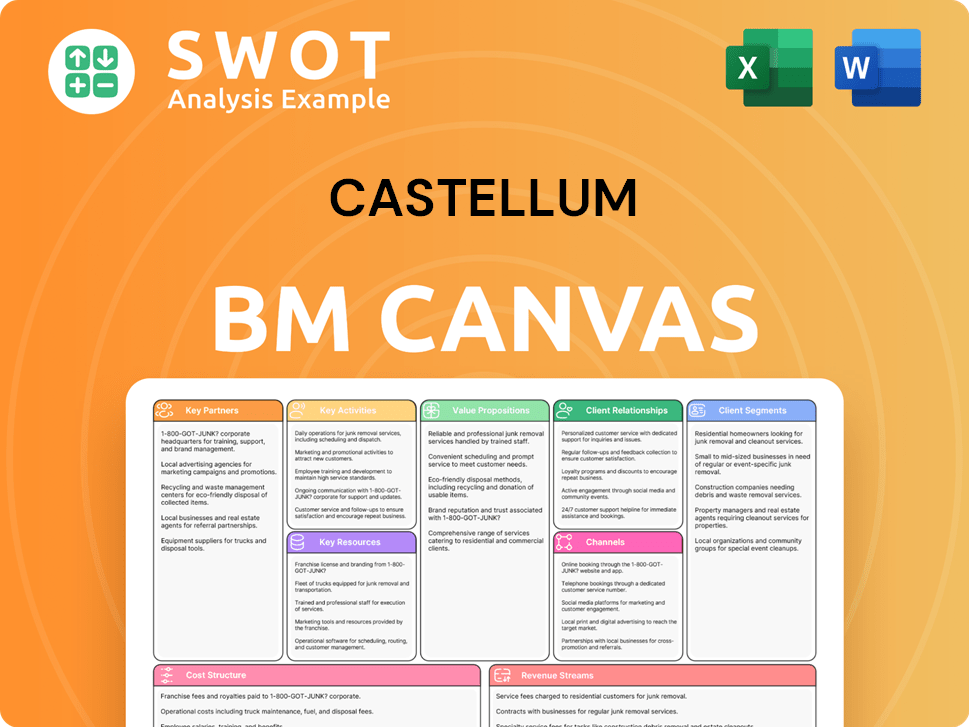

Castellum Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Castellum Positioning Itself for Continued Success?

The Castellum Company holds a significant position in the Nordic real estate market. It operates as one of the largest listed property companies in Sweden and has a substantial presence in key growth regions, including Copenhagen and Helsinki. The company's diverse portfolio, which includes adaptable workplaces and logistics properties, contributes to its considerable market share within its segments.

Despite its strong market position, Castellum faces several risks. These include potential impacts from regulatory changes, increased competition, and technological disruptions that could affect demand for office spaces. Furthermore, evolving consumer preferences toward more flexible and sustainable workspaces present challenges that require continuous innovation.

Castellum's strong market position is supported by its extensive portfolio and customer loyalty. The company focuses on sustainable property management and responsive tenant services. Its global reach, concentrated in the Nordic region, places it strategically within a stable economic bloc.

Key risks for Castellum include regulatory changes, increased competition, and technological disruptions. Changing consumer preferences towards flexible and sustainable workspaces also pose a risk. These factors could impact development projects, operational costs, and demand for office spaces.

Castellum's future outlook is shaped by its strategic initiatives, including portfolio optimization and sustainability leadership. The company aims to generate revenue through investments in modern, energy-efficient properties. Leadership emphasizes long-term value creation through high-quality assets and a resilient business model.

The Castellum business model centers on acquiring, developing, and managing commercial properties, primarily in the Nordic region. Its core operations include leasing office spaces, logistics facilities, and other commercial properties to a diverse range of tenants. The company also focuses on sustainable property management and tenant services to maintain strong customer relationships.

Castellum's strategy includes portfolio optimization, sustainability leadership, and expansion in growth regions. The company is focused on investing in modern, energy-efficient properties. These initiatives aim to enhance rental income and property values, ensuring long-term shareholder value.

- Focus on high-quality assets.

- Strategic divestments of non-strategic assets.

- Investments in attractive segments like logistics and modern offices.

- Emphasis on sustainable property management and tenant services.

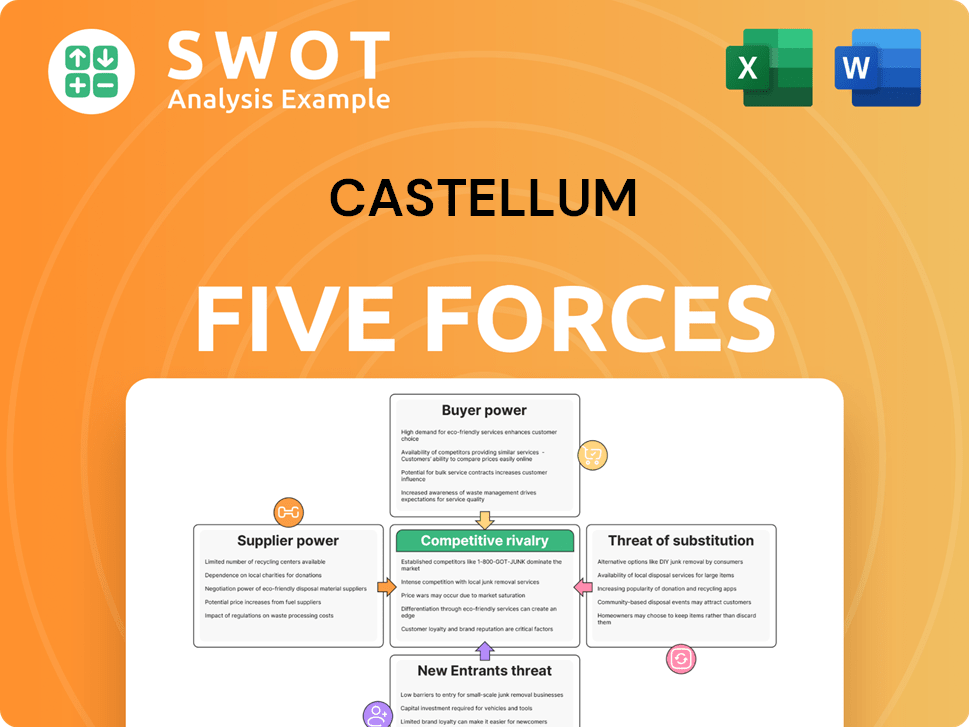

Castellum Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Castellum Company?

- What is Competitive Landscape of Castellum Company?

- What is Growth Strategy and Future Prospects of Castellum Company?

- What is Sales and Marketing Strategy of Castellum Company?

- What is Brief History of Castellum Company?

- Who Owns Castellum Company?

- What is Customer Demographics and Target Market of Castellum Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.