C.H. Robinson Worldwide Bundle

How Does C.H. Robinson Thrive in the Global Logistics Arena?

In a world increasingly reliant on seamless supply chains, C.H. Robinson Worldwide (CHRW) stands as a titan, constantly adapting and innovating. Witnessing a remarkable surge in earnings in early 2025, the company's resilience is undeniable, even when facing market headwinds. But how does C.H. Robinson, one of the largest third-party logistics providers, actually operate and generate its impressive results?

C.H. Robinson's success hinges on its ability to connect over 83,000 customers with a vast network of carriers, managing millions of shipments annually. This C.H. Robinson Worldwide SWOT Analysis can help to understand their strategies. This overview will explore the core of C.H. Robinson logistics operations, from freight forwarding to supply chain management, and reveal how it maintains its competitive edge in the dynamic world of transportation services.

What Are the Key Operations Driving C.H. Robinson Worldwide’s Success?

C.H. Robinson Worldwide creates value by acting as a crucial intermediary in the logistics ecosystem. It connects shippers with a vast network of carriers to optimize freight movement and improve supply chain efficiency. This role is central to its core operations, providing essential services in the global marketplace.

The company's core offerings include a wide array of transportation services. These range from North American Surface Transportation (NAST), which covers truckload and less-than-truckload (LTL) services, to Global Forwarding, providing ocean and air freight services. They also offer customs brokerage through its international network, showcasing a comprehensive approach to supply chain management.

Additionally, C.H. Robinson provides managed transportation and supply chain consulting. These services offer integrated solutions for complex logistics challenges. This comprehensive approach allows the company to meet diverse customer needs, solidifying its position in the industry.

C.H. Robinson offers a broad spectrum of services, including freight forwarding, supply chain management, and transportation services. They handle various modes of transport, such as truckload, LTL, ocean, and air freight. Their global network supports international shipping and customs brokerage, providing end-to-end solutions.

In 2024, C.H. Robinson managed approximately 37 million shipments for 83,000 customers. They utilized over 450,000 contract carriers on its platform. The company's asset-light model allows it to adapt to market fluctuations effectively.

C.H. Robinson's asset-light model and technological prowess are key differentiators. This enables dynamic pricing and efficient capacity procurement, which translates into improved service and reduced costs for customers. The company's focus on continuous improvement also sets it apart.

- Improved service and reduced costs.

- Enhanced supply chain visibility.

- Reliable transportation solutions even during market volatility.

- Competitive advantages through disciplined execution.

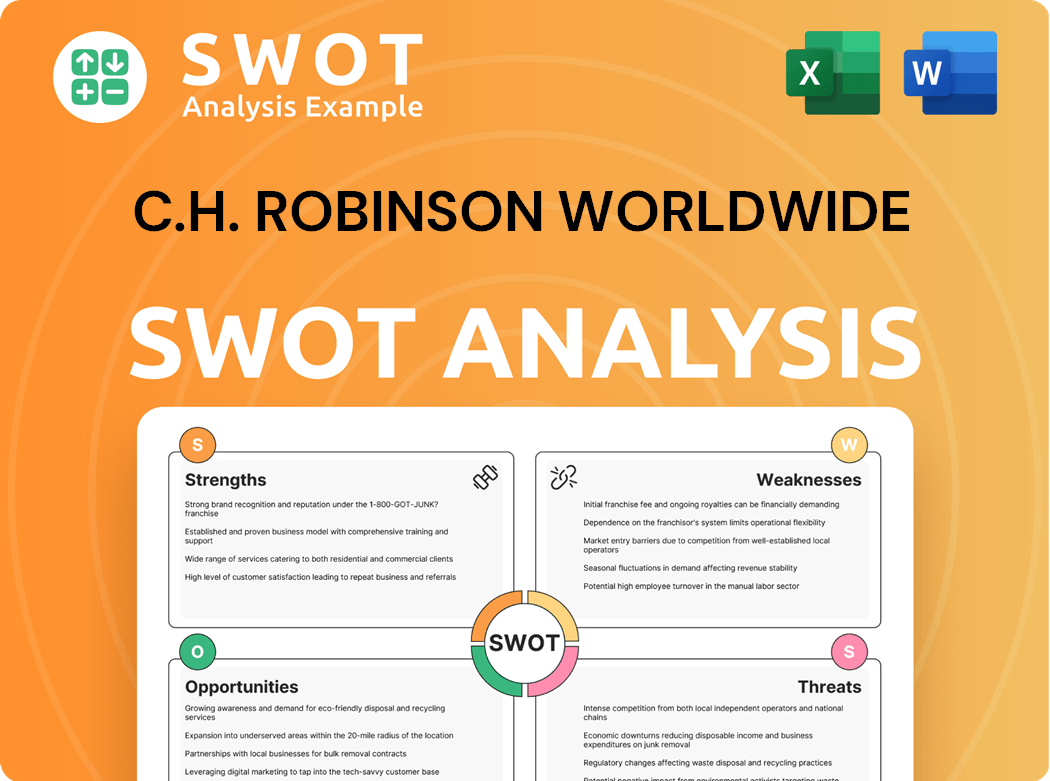

C.H. Robinson Worldwide SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does C.H. Robinson Worldwide Make Money?

C.H. Robinson Worldwide generates revenue primarily through its freight transportation and logistics services. These services are categorized into North American Surface Transportation (NAST) and Global Forwarding. In 2024, the company's total revenues were $17.725 billion, a slight increase from the previous year.

The company's revenue streams are diverse, encompassing various transportation and logistics solutions. In the first quarter of 2025, total revenue decreased by 8.3% to $4.05 billion, mainly due to lower truckload volume in North America and reduced pricing in ocean services. This was partially offset by the divestiture of its Europe surface transportation business.

C.H. Robinson's monetization strategies involve connecting shippers with carriers and optimizing transportation networks without owning extensive physical assets. This asset-light model enables them to generate revenue by facilitating freight movement and offering value-added services. The company's focus on productivity improvements and cost optimization is also a key element of its financial strategy.

NAST provides truckload and less-than-truckload (LTL) brokerage services across North America. In Q1 2025, revenues decreased by 4.4% to $2.87 billion due to lower truckload volume. Despite this, adjusted gross profits increased by 5.3% to $418.3 million.

This segment offers ocean freight, air freight, and customs brokerage through an international network. In Q1 2025, revenues decreased by 9.8% to $774.9 million, primarily due to lower pricing in ocean services. However, adjusted gross profits increased by 2.5% to $184.6 million.

Robinson Fresh focuses on integrated supply chain solutions. In Q1 2025, adjusted gross profits increased by 11.6% to $37.7 million, driven by integrated supply chain solutions for retail and foodservice customers.

Launched in November 2024, C.H. Robinson Managed Solutions™ offers 4PL services, 3PL, managed transportation, and TMS technology. This expansion provides seamless access to comprehensive supply chain solutions.

C.H. Robinson's asset-light model allows it to connect shippers with carriers and optimize transportation networks. Dynamic pricing and capacity procurement efforts improve adjusted gross profit per transaction. The company also focuses on productivity improvements and cost optimization; operating expenses decreased by 4.7% in Q1 2025.

As a leading provider of freight forwarding services, C.H. Robinson leverages its extensive global network. This network supports its ability to offer a wide range of transportation services, including ocean freight, air freight, and customs brokerage, contributing to its revenue streams.

The primary revenue drivers for C.H. Robinson are its transportation services, including truckload, LTL, ocean freight, and air freight. These services are essential for supply chain management. The company's ability to manage and optimize these services directly impacts its revenue and profitability.

- North American Surface Transportation (NAST): Truckload and LTL services.

- Global Forwarding: Ocean and air freight services.

- Robinson Fresh: Integrated supply chain solutions.

- Managed Solutions: 4PL and 3PL services.

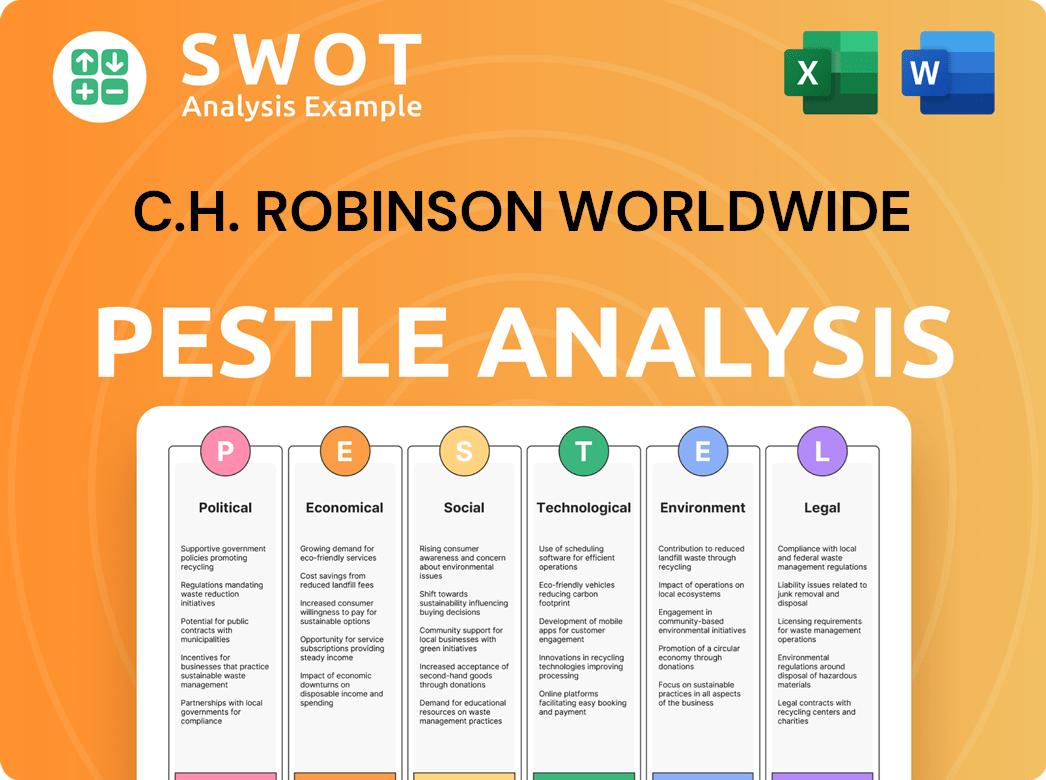

C.H. Robinson Worldwide PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped C.H. Robinson Worldwide’s Business Model?

C.H. Robinson Worldwide has evolved significantly, adapting to the complexities of the global logistics landscape. Key milestones include strategic shifts in operational models and asset management. These moves have positioned the company to capitalize on market opportunities and enhance its service offerings in freight forwarding and supply chain management.

A notable strategic move was the implementation of a new operating model, starting in January 2024, based on Lean methodology. This initiative aimed to improve execution and profitability. The company's focus on streamlining operations, including the divestiture of non-core assets, reflects a commitment to core logistics services and efficiency.

The company's Q4 2024 results showcase the early success of its strategic initiatives. Income from operations increased by 71.1% to $183.8 million, and gross profits rose by 10.4% to $672.9 million, demonstrating the positive impact of the new operating model. These improvements highlight C.H. Robinson's ability to adapt and thrive in a dynamic market.

C.H. Robinson has achieved several key milestones, including the implementation of a new operating model rooted in Lean methodology in January 2024. This model aims to enhance operational efficiency and improve financial performance. The company has also focused on managing its capital structure through strategic divestitures.

Strategic moves include the adoption of a new operating model and divestiture of non-core assets. These actions are designed to streamline operations and sharpen the company's focus on core logistics services. These moves support the company's commitment to providing comprehensive transportation services.

C.H. Robinson's competitive advantages include an extensive global network and technological leadership. The company leverages its vast network of customers and carriers, alongside investments in digital transformation, to enhance its market position. These elements are key to the company’s success in freight forwarding.

The company's financial health, with a manageable total debt load, supports its ability to invest in growth and navigate market fluctuations. This financial stability allows C.H. Robinson to continue providing reliable supply chain solutions. The company's financial strength is crucial for sustained growth.

C.H. Robinson's competitive edge stems from its extensive global network, technology investments, and financial strength. The company's large network, including over 83,000 customers and 450,000 contract carriers, provides significant economies of scale. Technology leadership, particularly in areas like generative AI and machine learning, has improved operational efficiency.

- Extensive global network offers broad reach and scale.

- Technology investments drive operational efficiencies and enhance customer experiences.

- Financial strength supports investment and resilience through market cycles.

- Focus on disciplined pricing and cost optimization.

- Diversification of global trade lanes and innovative payment solutions.

The company faces challenges such as excess carrier capacity and competitive pricing. Despite these, C.H. Robinson continues to adapt by focusing on disciplined pricing, capacity procurement, and cost optimization. The company also diversifies its global trade lanes and invests in innovative payment solutions. For more insights into how C.H. Robinson operates, consider reading about the Growth Strategy of C.H. Robinson Worldwide.

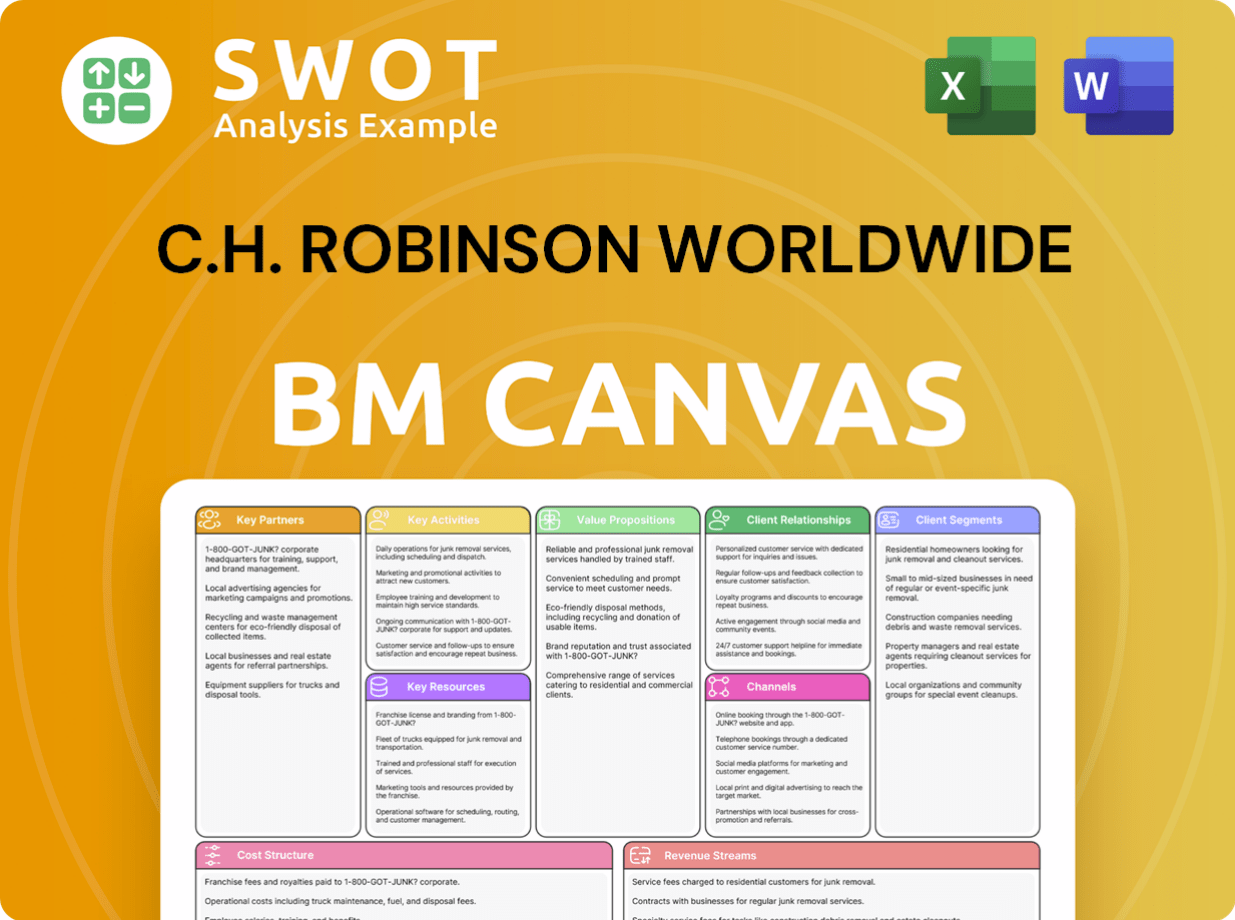

C.H. Robinson Worldwide Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is C.H. Robinson Worldwide Positioning Itself for Continued Success?

C.H. Robinson Worldwide, a leading player in the global logistics sector, holds a significant position as one of the largest third-party logistics (3PL) providers worldwide. The company's extensive network and service offerings solidify its standing in the industry. Its ability to adapt and grow, even amidst challenging market conditions, underscores its resilience and strategic focus.

The company's competitive landscape involves various risks, including economic downturns, operational challenges, and technological disruptions. Understanding these factors is key to evaluating C.H. Robinson's long-term prospects and strategic direction. Moreover, geopolitical factors and regulatory changes constantly influence the global forwarding market, impacting operations and financial performance.

C.H. Robinson is a major 3PL provider, serving approximately 83,000 customers and collaborating with over 450,000 contract carriers globally. The company demonstrates its market strength through consistent financial performance and market share gains in key areas like North American Surface Transportation (NAST). C.H. Robinson focuses on customer loyalty through its extensive network and diverse services.

The company faces economic risks from recessions and industry fluctuations, as seen in the prolonged freight recession. Operational risks include carrier price fluctuations and fuel costs. Technological advancements and cybersecurity threats also pose challenges. Regulatory changes and geopolitical factors add complexity to international operations.

C.H. Robinson is focused on strategic initiatives to sustain and expand its profitability, including capital expenditures of approximately $75 million to $85 million in 2025. The company plans to leverage technology, data-driven insights, and AI to improve efficiency and customer service. Disciplined capital management and diversification of trade lanes are also key strategies.

C.H. Robinson aims to grow market share and expand margins, regardless of market conditions. This includes optimizing its capital structure through potential share repurchases and maintaining its quarterly dividend. Diversifying global trade lanes and investing in core capabilities are crucial for sustained market leadership. Read more about the Growth Strategy of C.H. Robinson Worldwide.

C.H. Robinson is prioritizing digital transformation and operational efficiency. The company is also focused on disciplined capital management, including share repurchases and dividend maintenance, to optimize its financial structure. Diversification of global trade lanes is a key strategy to reduce dependency on specific routes and enhance business resilience.

- Investing in technology and AI to enhance efficiency and customer service.

- Disciplined capital management, including potential share repurchases.

- Diversifying global trade lanes to reduce risk.

- Focus on market share growth and margin expansion.

C.H. Robinson Worldwide Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of C.H. Robinson Worldwide Company?

- What is Competitive Landscape of C.H. Robinson Worldwide Company?

- What is Growth Strategy and Future Prospects of C.H. Robinson Worldwide Company?

- What is Sales and Marketing Strategy of C.H. Robinson Worldwide Company?

- What is Brief History of C.H. Robinson Worldwide Company?

- Who Owns C.H. Robinson Worldwide Company?

- What is Customer Demographics and Target Market of C.H. Robinson Worldwide Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.