Citi Trends Bundle

How Does Citi Trends Thrive in the Discount Fashion Arena?

Citi Trends, a leading value-priced retailer, has built a strong presence in the urban fashion market, offering a diverse selection of apparel, shoes, accessories, and home décor. This Citi Trends SWOT Analysis can provide a comprehensive understanding of the company's strengths, weaknesses, opportunities, and threats. The company's strategy of providing affordable fashion has resonated with budget-conscious consumers, particularly in underserved communities across the United States.

Understanding the operational model of a Citi Trends store is crucial for investors, customers, and industry analysts alike. The company's success is rooted in its ability to offer discount fashion, maintain a broad retail store footprint, and adapt to the ever-changing demands of the urban clothing market. From Citi Trends near me to online shopping and store hours, this analysis will provide insights into how this retailer continues to capture market share.

What Are the Key Operations Driving Citi Trends’s Success?

The core operations of the Citi Trends company are designed to provide value-priced urban fashion and home décor. Their value proposition centers on offering a wide variety of merchandise at significantly reduced prices. This strategy targets budget-conscious consumers in urban and underserved communities.

Their product range includes apparel for men, women, and children, along with shoes, accessories, and home goods. They carry well-known brands and private label items. The operational process begins with a strong sourcing strategy that acquires merchandise at favorable costs, often through closeout purchases and direct relationships with manufacturers.

The company's supply chain and distribution network are optimized for efficiency, ensuring rapid movement of merchandise from vendors to distribution centers and then to individual stores. This rapid inventory turnover is critical to their business model, allowing them to constantly refresh their product assortment and respond quickly to fashion trends. Citi Trends leverages a decentralized store management approach, empowering store managers to tailor merchandise assortments to local customer preferences.

The company excels in sourcing merchandise at competitive prices. This includes closeout purchases and opportunistic buys. These strategies help maintain low prices for consumers.

Their supply chain ensures quick movement of goods from vendors to stores. Rapid inventory turnover allows for constant product refreshment. This responsiveness is key to meeting customer demand.

Citi Trends uses a decentralized store management approach. Store managers have autonomy to tailor merchandise to local preferences. This strategy enhances customer satisfaction.

Their focus on the target demographic is a key differentiator. They curate a relevant product mix to maintain customer loyalty. This operational agility translates into affordable pricing.

The sales channels are primarily brick-and-mortar stores, strategically located in accessible urban areas. What makes Citi Trends' operations unique is its deep understanding of its target demographic, enabling them to curate a highly relevant product mix and maintain strong customer loyalty. This operational agility and focus on value translate directly into customer benefits through affordable pricing and a constantly evolving selection of fashionable goods, differentiating them from traditional full-price retailers. For more insights into their target audience, check out this article on the Target Market of Citi Trends.

The company focuses on value, offering discount fashion to a specific demographic. This includes a wide range of urban clothing options.

- Strategic store locations in urban areas.

- Rapid inventory turnover to keep merchandise fresh.

- Decentralized store management for local relevance.

- Strong sourcing to maintain competitive pricing.

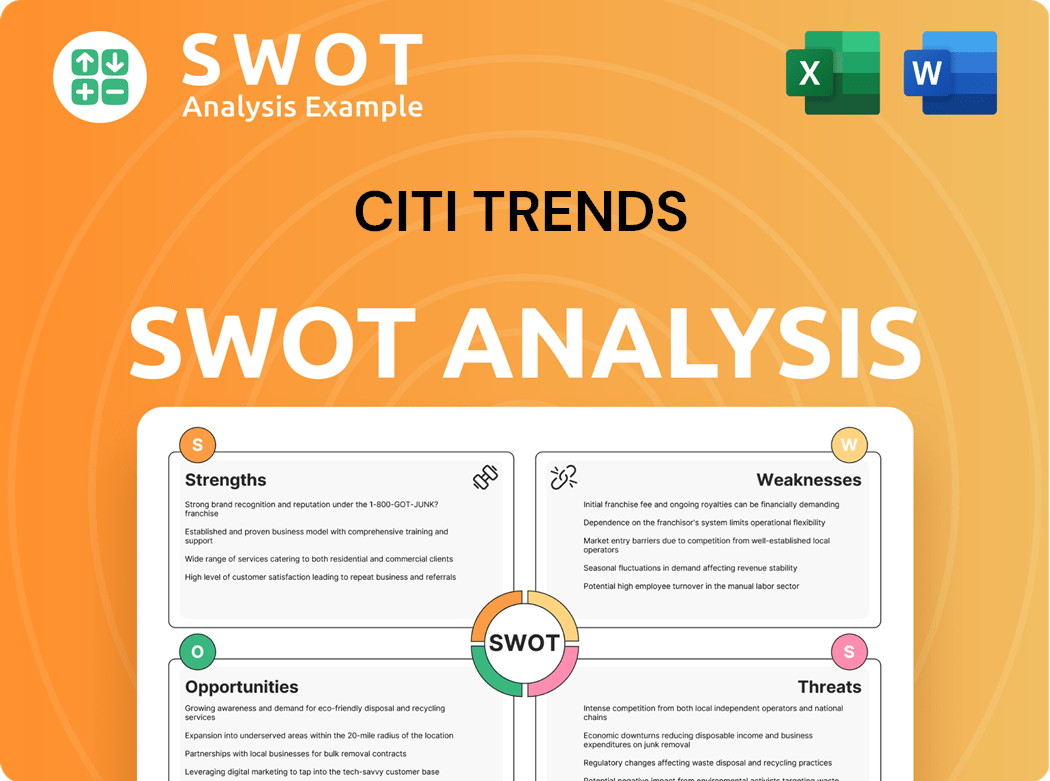

Citi Trends SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Citi Trends Make Money?

The primary revenue stream for the Citi Trends company is the direct sale of merchandise to customers. This includes a variety of products such as urban fashion apparel, shoes, accessories, and home décor. The business model focuses on offering value pricing to drive high sales volumes.

Citi Trends store generates revenue by selling discounted fashion items. Apparel typically makes up the largest portion of sales, followed by shoes, accessories, and home décor. The company's financial success is directly linked to its ability to sell merchandise effectively.

The monetization strategy of Citi Trends centers on providing value through discounted prices on both branded and private label goods. They aim to attract customers to their physical stores by consistently offering new and desirable merchandise at competitive prices. Their financial performance is closely tied to store sales and the effectiveness of their merchandising and promotional activities.

Citi Trends focuses on maximizing gross profit margins through efficient sourcing and inventory management. The company acquires merchandise at low costs to enable competitive pricing while maintaining profitability. Changes in revenue sources have primarily come from expanding their store footprint and refining their merchandise mix.

- Value Pricing: Offering discounted prices on a wide range of products to attract customers.

- Merchandise Mix: Curating a selection of urban fashion apparel, shoes, accessories, and home décor to meet customer needs.

- Store Footprint Expansion: Growing the number of physical Citi Trends locations to increase sales opportunities.

- Efficient Sourcing: Acquiring merchandise at low costs to maintain profitability.

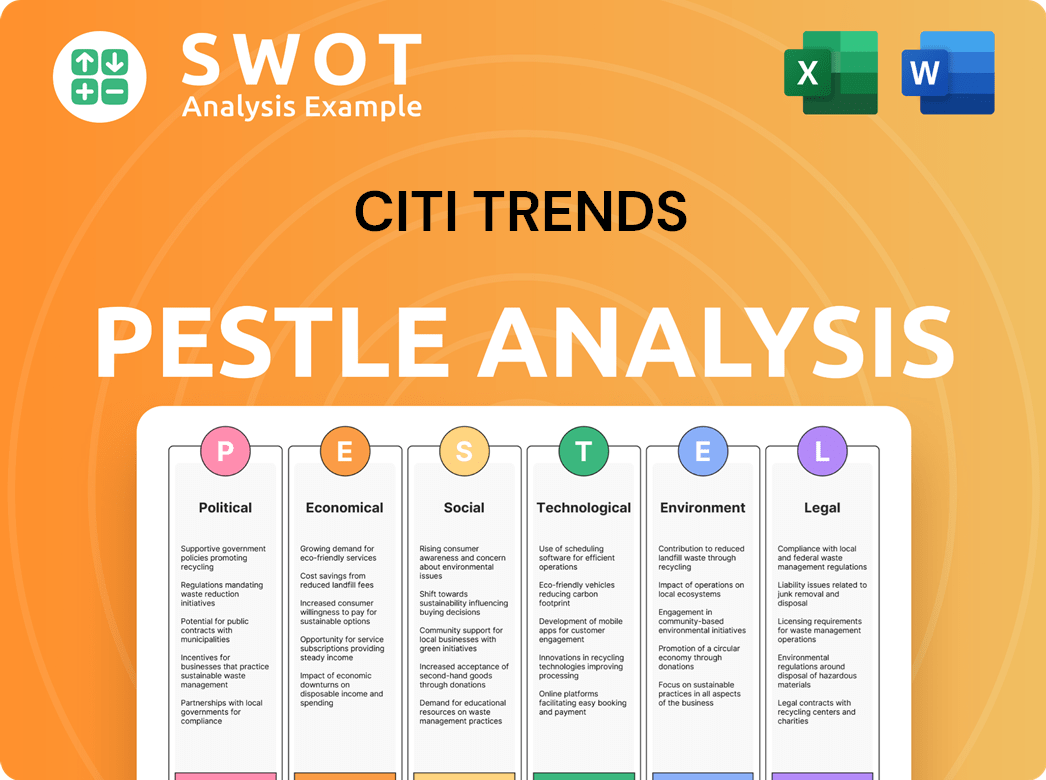

Citi Trends PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Citi Trends’s Business Model?

Navigating the retail landscape, the Growth Strategy of Citi Trends has been marked by strategic expansions and adaptations. Key milestones often involve significant store growth and refinements in their merchandising approach. Their ability to cater to urban and underserved markets has been a crucial driver of their expansion, allowing them to reach a wider customer base. The company has shown resilience in responding to market challenges, emphasizing value and adjusting inventory to match demand.

The company's competitive advantages are rooted in its strong brand recognition, efficient sourcing, and understanding of its target customer. Offering branded and private label merchandise at reduced prices is a key differentiator. A localized merchandising approach, allowing stores to tailor offerings to community preferences, fosters customer loyalty. They continuously adapt to fashion cycles and consumer preferences, ensuring their merchandise remains relevant. Their physical footprint serves communities with limited access to value-priced fashion, solidifying their market position.

The company's strategy focuses on providing value-priced fashion, accessories, and home goods, primarily targeting urban and underserved communities. This approach is supported by efficient supply chain management and a deep understanding of its core customer base. The company's success is reflected in its ability to maintain a strong presence in a competitive market by consistently offering attractive deals and adapting to changing consumer preferences.

Expansion into new urban and underserved markets has been a critical driver of growth for the

The company emphasizes its value proposition and adjusts inventory to align with demand, demonstrating resilience during economic downturns. This adaptability ensures that

The company's competitive edge stems from its brand recognition, efficient sourcing, and understanding of its target customer. Their localized merchandising approach, allowing stores to tailor offerings to community preferences, fosters customer loyalty.

The company leverages its established physical footprint to serve communities with limited access to value-priced fashion options, solidifying its market position. This strategic focus allows them to maintain a strong presence in a competitive market. They consistently offer attractive deals and adapt to changing consumer preferences, ensuring their continued success.

The company focuses on providing value-priced fashion, accessories, and home goods, primarily targeting urban and underserved communities. This approach is supported by efficient supply chain management and a deep understanding of its core customer base.

- Efficient Supply Chain: Streamlined operations to reduce costs and improve product availability.

- Targeted Marketing: Focused campaigns to reach specific demographics and promote

and . - Store Expansion: Strategic growth in areas with high potential for customer acquisition, increasing

. - Customer Loyalty Programs: Initiatives to retain customers and drive repeat business, enhancing the overall

.

Citi Trends Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Citi Trends Positioning Itself for Continued Success?

Let's explore the industry position, key risks, and future outlook for the company. The company occupies a specific niche within the discount retail sector, focusing on urban fashion. It competes with other off-price retailers and fast-fashion brands, while its market share is concentrated on its target demographic and geographic locations. Customer loyalty is built through consistent value and culturally relevant products.

The company operates primarily in the domestic market, with a significant presence across various states. Its strategic focus involves optimizing its store network, enhancing merchandise, and improving operational efficiency. The company's future likely includes refining its value-driven model and potentially exploring omnichannel capabilities to expand its reach. Data analytics will be crucial in understanding and serving its customer base better.

The company specializes in discount fashion, specifically targeting the urban clothing market. It differentiates itself from larger retailers by focusing on a niche demographic. This allows the company to build a strong customer base through culturally relevant product offerings.

The company faces risks such as shifts in consumer spending habits and economic downturns. Competition from both brick-and-mortar and online retailers also poses a challenge. Supply chain disruptions can impact inventory flow and pricing, affecting profitability.

The company's future outlook involves refining its value-driven model and potentially expanding its online presence. Leveraging data analytics to understand and serve customers better will be key to sustaining and expanding profitability. The company aims to adapt to the evolving retail landscape.

As of early 2024, the company operated approximately 600 stores across the United States. The company's financial performance in 2023 showed a net sales decrease compared to the previous year, influenced by macroeconomic challenges. The company continues to focus on strategic initiatives to improve profitability.

The company's strategic initiatives focus on enhancing its merchandise assortment and improving operational efficiencies. This includes optimizing the store fleet and leveraging data analytics to better understand customer preferences. The company is also exploring ways to enhance its online presence.

- Improving supply chain management to mitigate disruptions.

- Enhancing the online shopping experience.

- Refining marketing strategies to attract and retain customers.

- Exploring new store formats and locations.

Citi Trends Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Citi Trends Company?

- What is Competitive Landscape of Citi Trends Company?

- What is Growth Strategy and Future Prospects of Citi Trends Company?

- What is Sales and Marketing Strategy of Citi Trends Company?

- What is Brief History of Citi Trends Company?

- Who Owns Citi Trends Company?

- What is Customer Demographics and Target Market of Citi Trends Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.