Covetrus Bundle

How Does the Covetrus Company Revolutionize Animal Healthcare?

Covetrus, a global leader in animal-health technology and services, has become a cornerstone in the veterinary industry since its inception in 2019. Serving over 100,000 veterinary customers worldwide, the Covetrus SWOT Analysis reveals the company's strategic positioning. With a vast array of offerings, including software and supply chain solutions, Covetrus is reshaping how veterinary practices operate.

The recent launch of the Covetrus Platform at the VMX 2025 Conference underscores the company's commitment to innovation. This platform, along with the VetSuite network, aims to boost productivity and profitability for veterinary clinics. Understanding how Covetrus works, from its business model to its services for vets, is key to grasping its impact on the animal health and pet care markets.

What Are the Key Operations Driving Covetrus’s Success?

The core operations of the Covetrus company revolve around providing an integrated platform for veterinary practices. This platform includes software, supply chain solutions, and prescription management tools designed to streamline workflows and improve efficiency. The company's mission is to connect veterinarians with the products, insights, and services they need to enhance both the health and financial well-being of their practices.

Covetrus serves a broad customer segment within the veterinary industry, including veterinarians, animal clinics, and pet owners globally. Their approach focuses on integrating technology and services to offer a holistic solution. This includes access to a wide range of products and services, as well as support to help independent veterinary practices navigate competitive pressures and rising costs.

The company's value proposition is centered on improving productivity, increasing profit margins, and enhancing competitiveness for veterinary practices. This is achieved through streamlined workflows, cost savings on essential supplies, and options like competitive prescriptions and home delivery. The company's focus on innovation, including AI-powered tools, further enhances its offerings, allowing veterinarians to focus on patient care.

Covetrus provides access to over 22,000 competitively priced products, including pharmaceuticals, equipment, and supplies. The company has expanded its distribution capabilities, such as opening a new distribution center in Grimes, Iowa, in May 2024. This expansion supports its ability to serve veterinarians across a wider geographic area, including 17 states.

The company offers veterinary software systems like Covetrus Pulse, RxWorks, and VisionVPM. These systems streamline workflows and optimize practice revenue. Covetrus integrates AI and other advanced tools into its platform, such as AI-powered workflow automation and treatment board capabilities, to assist veterinarians.

Covetrus leverages its VetSuite network, described as the first and largest practice improvement network. This network helps independent veterinary practices address competitive pressures and rising costs. This is a key component of the company's 'tech-enabled practice improvement' model.

Covetrus aims to improve productivity, increase profit margins, and enhance competitiveness for veterinary practices. This includes streamlining workflows, offering cost savings on supplies, and providing competitive prescription options. The company's services are designed to support the financial health of veterinary practices.

The company's operations are built on a foundation of integrated technology, supply chain efficiency, and practice improvement services. This approach allows Covetrus to provide a comprehensive suite of solutions tailored to the needs of veterinary practices. For more details about how Covetrus company operates, you can read about it by visiting Owners & Shareholders of Covetrus.

- Veterinary Software: Systems like Covetrus Pulse, RxWorks, and VisionVPM.

- Supply Chain: Access to over 22,000 products.

- VetSuite Network: Practice improvement services.

- AI Integration: AI-powered workflow automation and treatment board capabilities.

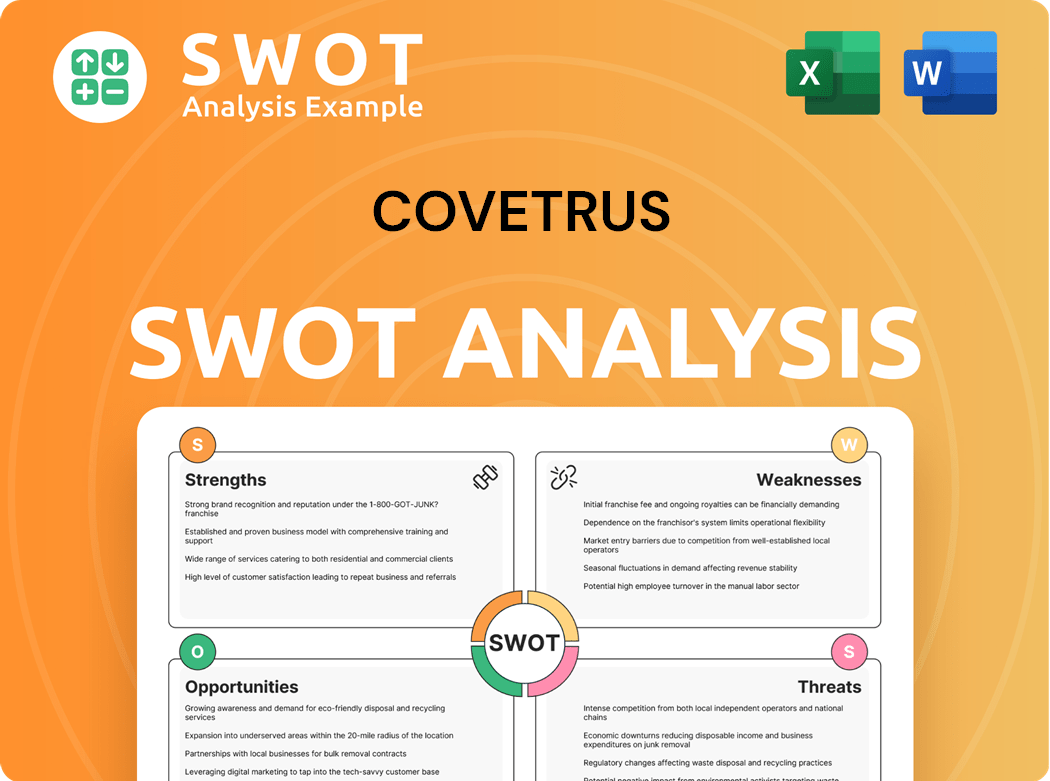

Covetrus SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Covetrus Make Money?

The Covetrus company generates revenue through a multifaceted approach, primarily centered on the animal health sector. Their business model combines product distribution, software solutions, and prescription management services to cater to the needs of veterinary practices. This integrated strategy allows them to capture value across various touchpoints within the veterinary industry.

How Covetrus works involves a blend of product sales and recurring revenue streams. The company's focus on providing comprehensive solutions aims to enhance operational efficiency and increase revenue for veterinary practices. This strategy is supported by a strong emphasis on customer retention and the expansion of service offerings.

Covetrus reported revenues of $4.9 billion in 2024. The company's revenue streams are diversified, with the majority coming from the distribution of animal health products. Software subscriptions and prescription management services also contribute significantly to the overall financial performance.

The primary revenue streams for Covetrus include product distribution, software subscriptions, and prescription management services. The company's financial success is driven by a combination of product sales and recurring revenue models, ensuring a stable financial outlook. The company's approach to the animal health market is designed to provide value across multiple areas.

- Product Distribution: Approximately 86% of revenue comes from distributing animal health products to veterinarians, including both their own and third-party products.

- Software Solutions: Subscription-based revenue from software platforms like Covetrus Pulse. The software arm has a 96% renewal rate.

- Prescription Management: Fees generated from prescription management services, including competitive prescription and home delivery options.

- Private Label Products: Expansion of private label product lines, which grew by 15% in 2024, offering more choices and revenue potential for practices.

Covetrus employs several monetization strategies to maximize revenue and customer value. These strategies focus on providing integrated solutions, driving cost savings for practices, and expanding service offerings. The company leverages its comprehensive approach to build strong customer relationships and generate recurring revenue.

- Integrated Solutions: Offering a comprehensive suite of products and services to meet the diverse needs of veterinary practices.

- Cost Savings: Helping practices reduce costs on medications, supplies, and equipment.

- Revenue Enhancement: Increasing practice revenue through competitive prescription and home delivery options.

- Recurring Revenue: The e-commerce division has a 50% auto-shipping enrollment rate, contributing to a steady revenue stream.

- Cross-selling: Expanding its services by cross-selling pharmacy management and practice management software to existing distribution customers. Read more about the Marketing Strategy of Covetrus.

Covetrus PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Covetrus’s Business Model?

The formation of Covetrus in 2019 through the merger of Henry Schein's animal health division and Vets First Choice was a pivotal moment, establishing a comprehensive platform for the veterinary channel. This strategic move created a robust supply chain infrastructure. In early 2025, Covetrus unveiled the Covetrus Platform at the VMX 2025 Conference, aiming to boost productivity and profitability for veterinary practices in the U.S. and U.K.

A key strategic focus for Covetrus has been on enhancing its technological offerings. In March 2024, Covetrus launched vRxPro, a next-generation online prescription management solution. By December 2024, the company expanded its pharmaceutical compounding facility in Phoenix, Arizona, demonstrating its commitment to advanced solutions. The company continues to adapt by leveraging data and insights to refine communications and enhance client engagement, and by expanding its product and service offerings, particularly in surgical and pharmacy areas.

Despite facing industry challenges, Covetrus maintains several competitive advantages. Its integrated platform streamlines veterinary workflows, and it holds a strong market position with brand recognition. The company's dedication to practice enhancement, coupled with its investment in AI, further strengthens its competitive edge. For more details on Covetrus's mission, check out this article: Growth Strategy of Covetrus.

The merger in 2019 created a major platform for the veterinary channel. The launch of vRxPro in March 2024 showed the company’s focus on prescription management. Expansion of the Phoenix facility in December 2024 highlighted investment in advanced solutions.

The Covetrus Platform launch in early 2025 aimed to increase veterinary practice productivity. Restructuring in June 2024, including layoffs, was intended to improve customer experience. The company focuses on data-driven communication and expanding product offerings.

Covetrus's integrated platform enhances veterinary workflows. Strong market position and brand recognition provide a competitive advantage. Investment in AI and technology strengthens its position in the animal health market.

The veterinary industry has seen lowered visit trends since 2021. Competitive pricing among animal health distributors poses a challenge. Restructuring costs have impacted financial performance.

In March 2024, Covetrus' North American subsidiary faced a $23 million penalty for misbranding veterinary drugs. The company continues to adapt by leveraging data and insights to refine communications and enhance client engagement, and by expanding its product and service offerings, particularly in surgical and pharmacy areas.

- The Covetrus Platform launch in early 2025 is a key initiative.

- Over 12,000 veterinary practices use the vRxPro platform.

- The company is focused on enhancing its technology offerings.

- Restructuring efforts were implemented in June 2024.

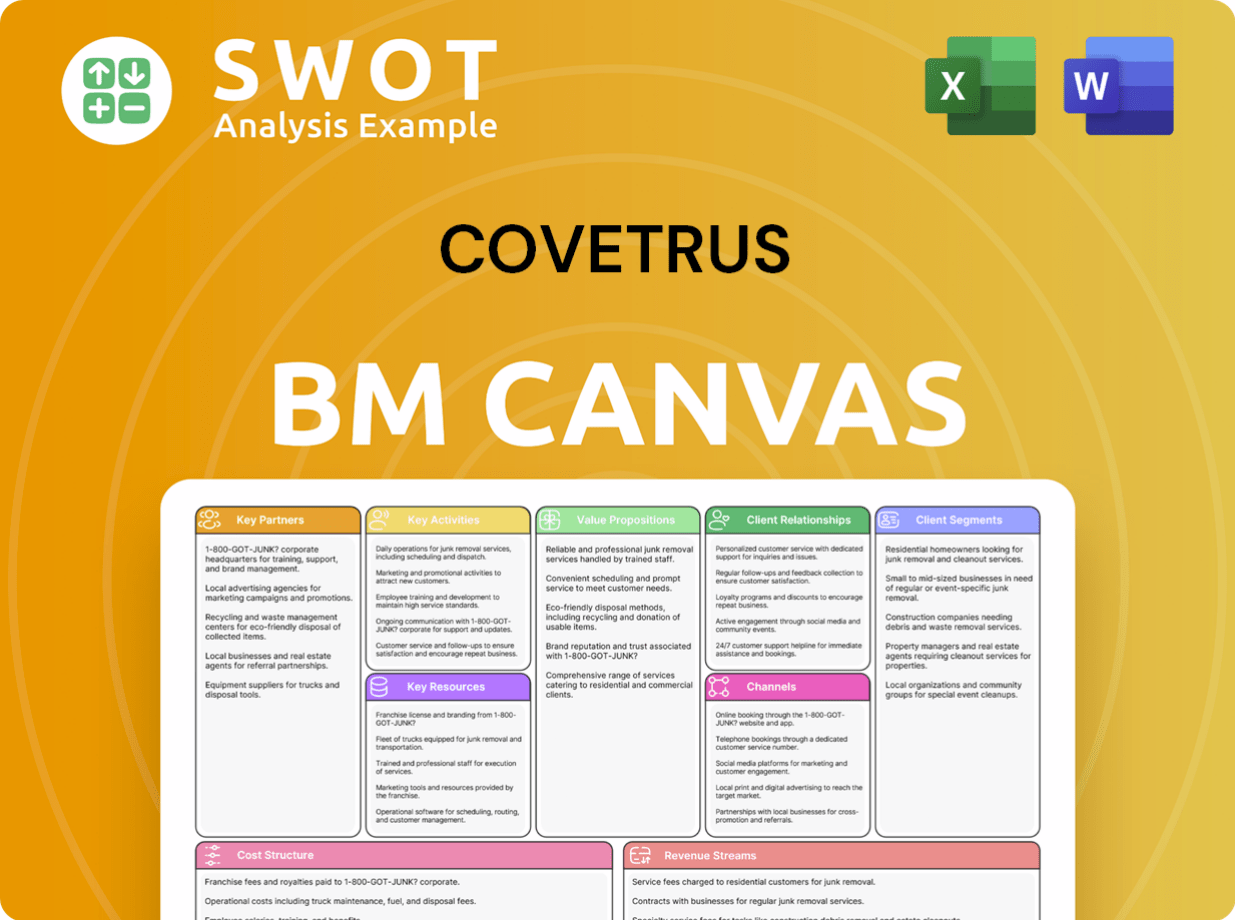

Covetrus Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Covetrus Positioning Itself for Continued Success?

The Covetrus company holds a significant position in the animal health technology and services sector. It serves over 100,000 veterinary customers globally, leveraging an integrated platform to provide comprehensive offerings. This strong market presence, however, is challenged by a competitive landscape that includes companies like Zoetis, Vetsource, and Elanco.

The veterinary industry faces several headwinds, and the Covetrus company is no exception. Key risks include macroeconomic factors impacting pet-related spending, increased competition, and challenges such as veterinary shortages and staff burnout. Regulatory changes, like those related to misbranded drugs, also pose risks. These factors contribute to sustained pressure on gross margins and projected cash flow deficits.

Covetrus is a major player in the animal health sector, serving a vast network of veterinary practices. Its integrated platform offers a wide array of services and products. The company competes with several established firms in the animal health market, impacting its overall market share.

Macroeconomic conditions, including inflation, affect pet care spending. Veterinary shortages and staff burnout present operational challenges. Regulatory changes and increased competition also pose risks to the company's operations and financial performance.

Covetrus is focused on strategic initiatives to improve its financial standing and foster growth. The company plans to enhance its platform and invest in technology, including AI. These initiatives are designed to address industry challenges and improve outcomes for veterinary practices.

The company expects its S&P Global Ratings-adjusted EBITDA margins to return to the high-3% area in 2025, improving from the low-3% area in 2024. Investments in R&D, accounting for 3.5% of revenue in 2024, support its focus on innovation.

To sustain growth, Covetrus is concentrating on strategic initiatives. These include enhancing the Covetrus Platform and VetSuite network to empower veterinarians, improve productivity, and increase profit margins. The company is also investing in research and development, with R&D spending representing 3.5% of its revenue in 2024. These efforts, combined with a focus on integrated solutions and technology, aim to address competitive pressures and improve clinical and financial outcomes for veterinary practices. For more detailed insights, you can read about the company's business model in this article about Covetrus. The company is also managing its cost profile to offset industry headwinds in the second half of 2024 and into 2025.

Covetrus is implementing several key strategies to navigate the challenges and capitalize on opportunities within the animal health market.

- Enhancing the Covetrus Platform and VetSuite network to improve productivity and margins.

- Investing in R&D, with a focus on AI and other technologies.

- Managing its cost profile to offset industry headwinds.

- Expanding offerings to meet evolving market demands.

Covetrus Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Covetrus Company?

- What is Competitive Landscape of Covetrus Company?

- What is Growth Strategy and Future Prospects of Covetrus Company?

- What is Sales and Marketing Strategy of Covetrus Company?

- What is Brief History of Covetrus Company?

- Who Owns Covetrus Company?

- What is Customer Demographics and Target Market of Covetrus Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.