Elbit Systems Bundle

How Does the Israeli Defense Giant, Elbit Systems, Thrive?

Elbit Systems, a leading Israeli defense company, is making waves with its impressive financial performance, highlighted by a 22% surge in Q1 2025 revenue to $1.9 billion. This growth, fueled by a record order backlog of $23.1 billion, underscores the increasing global demand for its advanced military technology. With a diverse portfolio spanning aerospace, land, and naval systems, Elbit company continues to solidify its position in the defense industry.

The Elbit Systems SWOT Analysis reveals a company deeply entrenched in the global defense landscape. Its success is driven by strategic investments in cutting-edge technologies and its ability to adapt to evolving geopolitical dynamics. This analysis will explore Elbit operations, revenue streams, and future outlook, providing a comprehensive understanding of this key player in the military technology sector and its significant impact on the Israeli defense company.

What Are the Key Operations Driving Elbit Systems’s Success?

Elbit Systems, an Israeli defense company, creates value by offering a wide array of solutions for defense, homeland security, and commercial aviation customers worldwide. Its core operations are centered around developing and delivering advanced military technology. This includes everything from aircraft systems to unmanned systems and cyber solutions, catering to the needs of military forces and government agencies globally.

The company's value proposition lies in providing comprehensive, integrated solutions that enhance security and operational effectiveness. This is achieved through a combination of technological innovation, strategic partnerships, and a global presence. Elbit Systems' focus on research and development, along with its ability to adapt to evolving security needs, positions it as a key player in the defense industry.

Elbit Systems operates through a vertically integrated structure, managing technology development, manufacturing, and customer service. They focus on research and development to stay at the forefront of military technology. In 2024, Elbit invested $466 million in R&D and $215 million in capital expenditures, driving innovation in areas like precision-guided munitions.

Elbit Systems provides advanced systems for military aircraft and helicopters, enhancing their operational capabilities. These systems include avionics, electronic warfare, and mission management solutions. The company's offerings improve aircraft performance and survivability in various combat scenarios.

The company also serves the commercial aviation sector, offering systems and aerostructures. These products include flight control systems and structural components. Elbit Systems' solutions contribute to the safety and efficiency of commercial aircraft operations.

Elbit Systems develops and provides unmanned aircraft systems (UAS), also known as drones, for various military and security applications. These systems offer intelligence, surveillance, and reconnaissance (ISR) capabilities. UAS are crucial for modern military and homeland security operations.

Elbit Systems manufactures electro-optic and night vision systems, enhancing situational awareness. These systems are used in various platforms, including aircraft, land vehicles, and naval vessels. They improve the effectiveness of operations in low-light conditions.

Elbit Systems employs a 'glocal' strategy, balancing global reach with local presence. This approach helps the company secure contracts and build relationships. The company has a strong presence in the U.S. through Elbit Systems America, with 3,300 employees across 10 states.

- Vertically Integrated Operations: Managing all aspects from technology development to customer service.

- R&D Focus: Continuous investment in research and development to maintain a competitive edge.

- Global Presence: Operating worldwide, with significant presence in key markets like the U.S. and Europe.

- Strategic Partnerships: Collaborating with major defense contractors to expand market reach.

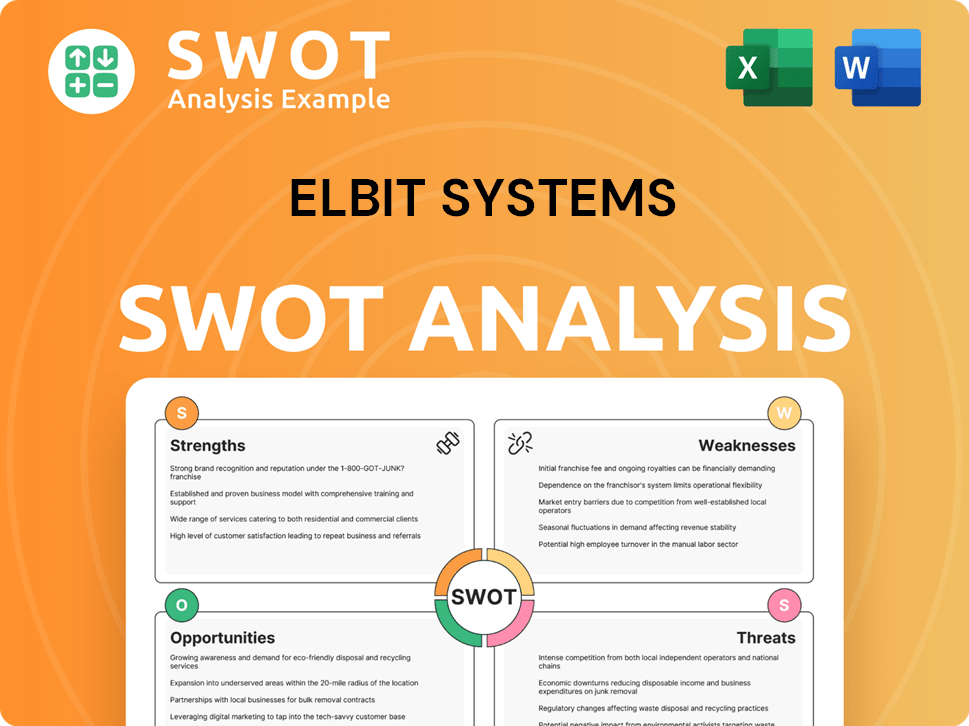

Elbit Systems SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Elbit Systems Make Money?

Elbit Systems, a leading Israeli defense company, generates revenue primarily through the design, development, and supply of advanced defense, security, and aerospace systems. The company's operations are global, serving governments and various organizations worldwide with a diverse portfolio of products and services. Elbit Systems' financial performance reflects its strong market position and ability to secure significant contracts.

The company's revenue streams are diversified across business segments and geographic regions, showcasing its resilience and strategic market positioning. Elbit Systems' approach to monetization involves securing long-term contracts and providing ongoing support services, contributing to a stable and growing revenue base. For those interested in understanding the company's customer base, an article about the Target Market of Elbit Systems provides further insights.

In 2024, Elbit Systems reported total revenues of $6.8 billion, a 14% increase from $6.0 billion in 2023. The first quarter of 2025 saw a 22% year-over-year revenue increase to $1.9 billion. This growth highlights the company's strong performance and the increasing demand for its military technology and defense industry solutions.

Elbit Systems' revenue is segmented across various business areas and geographic regions. The Aerospace segment was the largest contributor in 2024, accounting for 27% of revenue ($2,036 million). The company's record order backlog, reaching $23.1 billion as of March 31, 2025, is a key indicator of future revenue potential.

-

Business Segment Revenue Breakdown (2024):

- Aerospace: 27% ($2,036 million)

- Land: 23% ($1,679 million)

- Elbit Systems America: 21% ($1,586 million)

- ISTAR & EW: 18% ($1,318 million)

- C4I & Cyber: 11% ($800 million)

-

Geographic Revenue Breakdown (2024):

- Israel: 29%

- Europe: 27%

- North America: 22%

- Asia-Pacific: 17%

- Other Regions: Remaining percentage

- Monetization Strategies: Securing large, long-term contracts; Platform modernization programs; Providing support services, including training and simulation systems.

- Approximately 65% of the backlog is attributable to orders from outside of Israel.

- About 57% of the total work in the backlog is scheduled to be performed during 2025 and 2026.

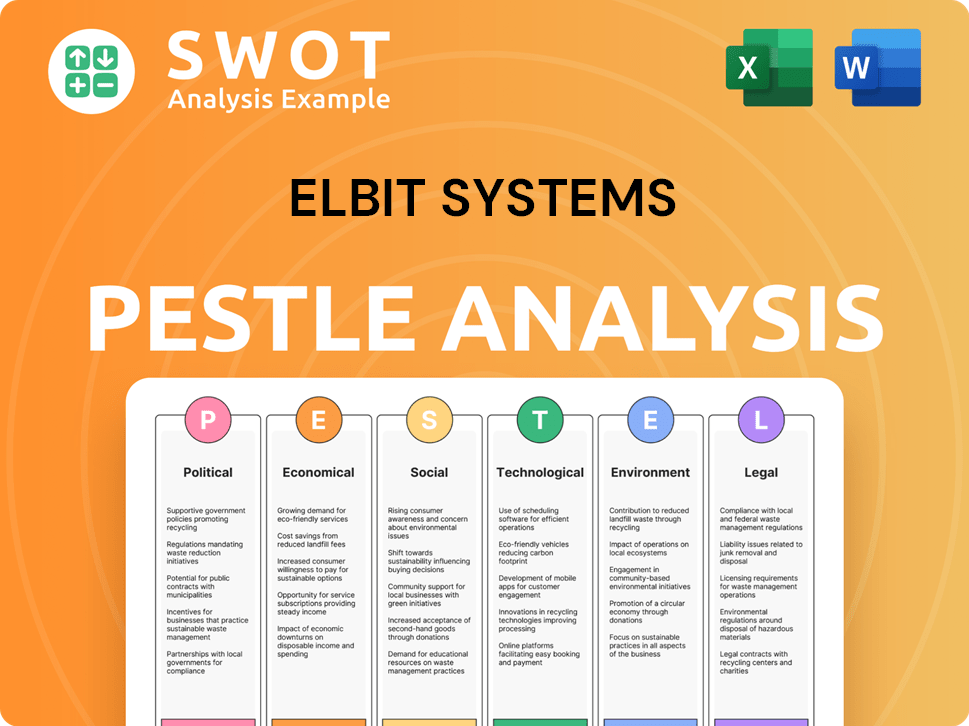

Elbit Systems PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Elbit Systems’s Business Model?

Elbit Systems, a prominent Israeli defense company, has achieved significant milestones that have shaped its operations and financial performance. The company's strategic moves and technological advancements have solidified its position in the global defense industry. Understanding these elements provides insight into Elbit's competitive edge and future prospects.

A crucial strategic move was the acquisition of Israeli Military Industries (IMI Systems) in 2018, which significantly broadened Elbit's portfolio. The company has also expanded through multiple acquisitions of companies specializing in electro-optics, unmanned aerial vehicles (UAVs), and communication systems. These actions have transformed Elbit into a comprehensive defense solutions provider.

Elbit Systems' commitment to innovation and strategic expansion has positioned it as a key player in the military technology sector. Its ability to adapt to evolving defense needs and maintain a strong global presence underscores its long-term growth potential. For more details about the company's ownership, you can read this article: Owners & Shareholders of Elbit Systems.

Elbit Systems has achieved notable milestones, including the acquisition of IMI Systems in 2018, which expanded its capabilities. The company has also launched innovative products and secured significant contracts, such as the one for the IronBeam laser interception system. These milestones reflect Elbit's growth and its ability to adapt to changing market demands.

Strategic moves include acquisitions in electro-optics, UAVs, and communication systems, broadening its product offerings. Elbit's investment in the IronBeam laser system, expected to be operational by the end of 2025, demonstrates its commitment to advanced technologies. These moves enhance Elbit's position in the defense industry.

Elbit Systems maintains a strong competitive edge through technological innovation and a diversified product portfolio. Its global presence and focus on customer needs also contribute to its advantage. The company's commitment to R&D, with investments of $466 million in 2024, ensures it stays ahead of technological advancements.

Elbit has demonstrated impressive financial performance, with a 10% revenue CAGR and a 20% backlog CAGR from 2020 to 2024. This growth trajectory highlights the company's ability to secure contracts and expand its market share. Elbit's financial health is supported by its strategic investments and operational efficiency.

Elbit has faced challenges, including supply chain disruptions due to export limitations and transportation issues. Despite these challenges, the company has increased monitoring of global supply chains and maintained increased inventories. These proactive measures demonstrate Elbit's resilience and adaptability.

- Increased monitoring of global supply chains.

- Maintaining increased inventories to mitigate disruptions.

- Adapting to geopolitical uncertainties and evolving customer demands.

- Investing in R&D to stay ahead of technological advancements.

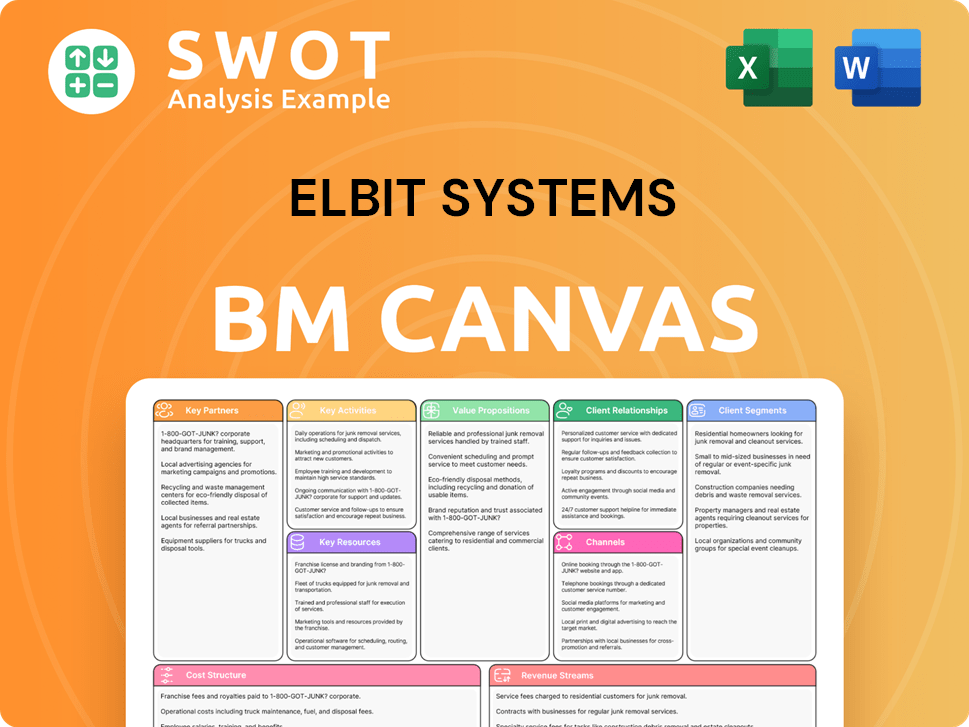

Elbit Systems Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Elbit Systems Positioning Itself for Continued Success?

The Elbit Systems holds a significant position in the global defense and aerospace industry. It is a key player, recognized as the 22nd largest defense company in the world in 2024. As an Israeli defense company, it is the primary provider of land-based equipment and unmanned aerial vehicles for the Israeli military, and it has a strong global presence with operations across several continents.

Despite its strong industry position, Elbit Systems faces several risks. Geopolitical uncertainties, supply chain disruptions, and regulatory changes are ongoing challenges. The company has also experienced scrutiny and divestment actions from international investment firms due to its involvement in conflicts. Technical failures and allegations of corruption also pose risks to its reputation and operations.

Elbit Systems is a major player in the defense industry. It is the primary provider of land-based equipment for the Israeli military. The company operates globally, with a 'glocal' strategy to secure contracts and build relationships.

The

Elbit anticipates continued growth in defense spending globally. The company plans to increase capital expenditures to around $250 million. It is focused on advancing its IronBeam laser defense system, expected to be operational by the end of 2025.

Elbit's improved financial position provides flexibility for investments. The Net Debt/EBITDA ratio decreased from 1.6 in 2023 to 0.9 in 2024. The company aims to sustain its ability to make money through strategic initiatives.

Elbit Systems, a major Israeli defense company, is well-positioned for future growth. The company is focused on innovation and strategic initiatives. Elbit Systems faces risks related to geopolitical issues and operational challenges.

- Strong global presence and significant market share.

- Challenges include geopolitical risks and supply chain disruptions.

- Focus on innovation and strategic investments for future growth.

- Improved financial position provides flexibility for investments.

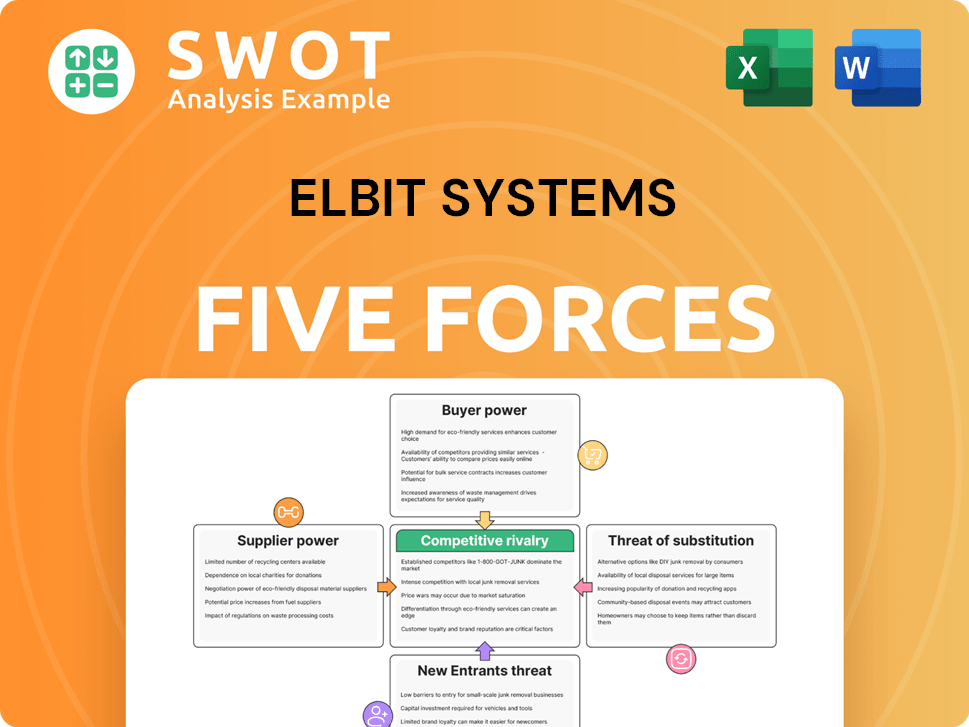

Elbit Systems Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Elbit Systems Company?

- What is Competitive Landscape of Elbit Systems Company?

- What is Growth Strategy and Future Prospects of Elbit Systems Company?

- What is Sales and Marketing Strategy of Elbit Systems Company?

- What is Brief History of Elbit Systems Company?

- Who Owns Elbit Systems Company?

- What is Customer Demographics and Target Market of Elbit Systems Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.