Elektroimportøren Bundle

How is Elektroimportøren Dominating the Norwegian Electrical Market?

Elektroimportøren, a leading Norwegian electrical retailer, is making waves with its impressive growth. Q1 2025 saw group revenue surge to NOK 396 million, a significant 13.1% increase, despite economic headwinds. This performance highlights Elektroimportøren company's robust market position and strategic prowess.

Operating through an omnichannel model, Elektroimportøren offers a vast selection of electrical supplies, catering to both professionals and consumers. To understand their success, explore the Elektroimportøren SWOT Analysis, which details their strengths, weaknesses, opportunities, and threats. This Elektroimportøren review will delve into the company's operations, providing crucial insights for investors and industry observers seeking a deeper understanding of this Norwegian electrical retailer.

What Are the Key Operations Driving Elektroimportøren’s Success?

The Elektroimportøren company creates value by offering a wide array of electrical equipment and supplies, catering to both consumers (B2C) and professionals (B2B). Their core offerings include electro materials, lighting, heating and ventilation solutions, electrical household appliances, power tools, hand tools, and various cable types. This comprehensive product range positions Elektroimportøren as a one-stop shop for electrical needs.

Their operational model is built on a successful omnichannel strategy, blending a popular webshop with a network of physical stores. As of March 31, 2025, the company operates a total of 31 stores, with 30 located in Norway and one in Sweden. This dual approach allows Elektroimportøren to serve customers through both online and in-person channels, enhancing accessibility and convenience.

A key element of their operations is their presence across the entire electrical equipment value chain, including product development and manufacturing under their private label, Namron. This vertical integration allows for greater control over product quality, pricing, and innovation, contributing to their competitive advantage. You can learn more about their approach in this article: Marketing Strategy of Elektroimportøren.

Elektroimportøren offers a broad spectrum of electrical products, covering everything from basic components to advanced solutions. This extensive range includes electro materials, lighting, heating and ventilation systems, electrical appliances, power tools, and various cables.

Their omnichannel approach integrates a user-friendly webshop with a network of physical stores. This strategy allows customers to shop online or visit a store, providing flexibility and convenience. The company had 31 stores as of March 2025.

Namron, established in 2007, is the company's private label, offering a wide array of products in lighting, electrical equipment, cables, heating, and smart home solutions. This private label contributes significantly to their sales, accounting for more than one-third of total sales in 2024.

SpotOn connects electric installers and consumers, providing fixed-cost, standardized installations. This platform simplifies the installation process, offering convenience and transparency for customers. SpotOn enhances the overall customer experience.

Elektroimportøren utilizes advanced supply chain solutions, such as RELEX, to enhance operational efficiency and improve product availability. This includes demand forecasting, automated replenishment, allocations, and space optimization.

- Supply Chain Efficiency: RELEX solutions enhance demand forecasting and inventory management.

- Customer Service: 72% of customers perceive employees as highly skilled.

- Private Label Success: Namron accounted for over one-third of total sales in 2024.

- Store Network: Operates 31 stores as of March 2025.

Elektroimportøren SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Elektroimportøren Make Money?

The revenue streams and monetization strategies of the Elektroimportøren company are multifaceted, primarily centered on the sale of electrical products. This is achieved through a blend of physical stores and a robust e-commerce platform, catering to both consumer (B2C) and business (B2B) segments. The company's approach is geared towards maximizing sales across various channels and customer types.

Elektroimportøren's financial performance in Q1 2025 highlights its successful revenue generation. The company's strategy includes leveraging its private label, Namron, and expanding service offerings through SpotOn. This diversification supports its financial growth and market position.

The company's focus on both online and in-store sales, coupled with strategic initiatives like category and campaign management, has driven significant revenue increases. This integrated approach ensures sustained growth and profitability.

Elektroimportøren generates revenue mainly through the sale of electrical products, offering a wide range of items. Sales occur through a network of physical stores and an e-commerce platform.

In Q1 2025, the company's group revenue reached NOK 396 million, marking a 13.1% increase from NOK 350 million in Q1 2024. This growth reflects strong performance across online and store sales.

Norway's online sales grew by 13.2%, and store sales increased by 12.6%. Sweden showed even stronger results, with online sales up 15.7% and store sales surging by 38.4% in Q1 2025.

Both B2C and B2B segments contributed significantly to revenue, with increases of 13.5% and 12.8%, respectively, in Q1 2025. This indicates a balanced revenue stream from both consumer and business clients.

The private label, Namron, is a major revenue driver, accounting for over one-third of total sales in 2024. Sales of services through SpotOn increased by 25.2% to NOK 42 million in 2024.

The gross margin improved to 36.0% in Q1 2025, up from 34.7% in Q1 2024. This improvement was driven by better category and campaign management in Norway and Sweden.

Elektroimportøren uses several strategies to monetize its operations and maximize revenue. This includes a focus on both online and in-store sales, with significant growth in both channels. The company's strategies also involve a strong private label brand and expanding service offerings.

- Multi-Channel Sales: Utilizing both physical stores and an e-commerce platform to reach a wider customer base.

- Private Label Products: Leveraging the Namron brand to capture a significant portion of sales, contributing over one-third of total sales in 2024.

- Service Expansion: Increasing revenue through services like SpotOn, which saw a 25.2% increase in sales for the full year 2024.

- Strategic Management: Implementing improved category and campaign management to boost gross margins, as seen in Q1 2025.

- B2C and B2B Focus: Catering to both consumer and business clients, ensuring diverse revenue streams.

For a deeper dive into the company's strategic approach, consider reading about the Growth Strategy of Elektroimportøren.

Elektroimportøren PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Elektroimportøren’s Business Model?

The Elektroimportøren company has demonstrated strategic prowess and resilience through key milestones and competitive advantages. A significant move was the acquisition of Elbutik Scandinavia AB in 2022, which expanded its market reach into Sweden. This expansion, along with other strategic initiatives, has shaped the company's trajectory and financial performance. The company's focus on innovation and customer service continues to drive its growth.

Strategic decisions, such as warehouse automation and service engine integration, are designed to enhance operational efficiency and customer satisfaction. The company's omnichannel model and private label Namron contribute to its competitive edge. These initiatives are part of a broader strategy to adapt to market changes and maintain a strong position in the electrical supplies market.

The Elektroimportøren review reveals a company that has successfully navigated challenges and capitalized on opportunities. The company’s ability to adapt to market dynamics and focus on customer needs has been crucial to its success. This adaptability, combined with strategic investments, positions the company for continued growth.

The acquisition of Elbutik Scandinavia AB in 2022 marked a significant expansion into the Swedish market, tripling the total addressable market. Despite initial challenges in Sweden, Elbutik achieved EBITDA profitability in Q3-Q4 2024. In Q1 2025, Elbutik's revenue increased by 21.1% to NOK 40 million, achieving a positive EBITDA of NOK 1 million. The opening of the 30th store in Lillehammer in March 2025 expanded the company's physical retail footprint.

Warehouse automation with AutoStore has significantly increased turnover and improved logistical efficiency. The integration of SpotOn as the service engine is progressing as planned, with expected cost savings in the second half of 2025. The company is exploring three new store locations in Norway for 2025, further expanding its market presence. The company has demonstrated an ability to adapt to changing market conditions.

The omnichannel model allows customers to shop online and in physical stores, providing flexibility and convenience. The presence across the entire value chain through the private label Namron offers control over product quality and pricing. A focus on being a specialist with highly skilled employees ensures expert advice and service. The company's adaptability to market changes, such as the downturn in the housing market, further strengthens its competitive position.

Elbutik's return to profitability in Q3-Q4 2024 contributed to the company's overall financial health. The positive EBITDA of NOK 1 million in Q1 2025 for Elbutik, compared to a NOK 3 million loss in Q1 2024, indicates improved performance. The company's strategic moves and focus on efficiency are expected to drive continued financial success. For more insights into the company's ownership and structure, you can read about Owners & Shareholders of Elektroimportøren.

Elektroimportøren Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Elektroimportøren Positioning Itself for Continued Success?

The Elektroimportøren company holds a significant position within the Norwegian electrical retail and wholesale sector. Its strength lies in its omnichannel approach, serving both business-to-consumer (B2C) and business-to-business (B2B) customers. The company's presence across the entire value chain, combined with its private label, Namron, contributes to its market standing. For a detailed look at their customer base, consider reading about the target market of Elektroimportøren.

In Q1 2025, Elektroimportøren demonstrated robust performance, with a 13.1% increase in group revenue, reaching NOK 396 million. This growth reflects a strong market presence, despite facing economic headwinds. Customer loyalty is a key asset, with 72% of customers perceiving the company's employees as highly skilled.

Elektroimportøren operates in the Norwegian electrical retail and wholesale market. Their omnichannel model, serving both B2C and B2B clients, supports their strong market position. The company's private label, Namron, contributes to its market presence.

Key risks include market uncertainty and low consumer confidence, as observed in Q1 2025. The downturn in the housing market and reduced refurbishment activities present challenges. Regulatory changes and competition are also ongoing concerns.

The company maintains a cautiously optimistic outlook, focusing on strategic initiatives. These include expanding as a total electrical equipment provider, developing own brands, and capitalizing on market opportunities. The turnaround of Swedish operations is a key focus.

Analysts anticipate Elektroimportøren to grow earnings and revenue by 32.9% and 8.9% per annum, respectively. EPS is expected to grow by 33.1% per annum. Expanding into energy-efficient solutions and smart home products is also a focus for future growth.

Elektroimportøren is focused on becoming a total provider of electrical equipment, strengthening its specialist position, and developing its own brands. They are also expanding into energy-efficient solutions and smart home products to drive future growth.

- Opportunistic rollouts of new stores in Norway.

- Focus on the turnaround of their Swedish operations, which achieved positive EBITDA in Q1 2025.

- Integration of SpotOn is expected to yield cost savings in the latter half of 2025.

- Expansion into energy-efficient solutions and smart home products.

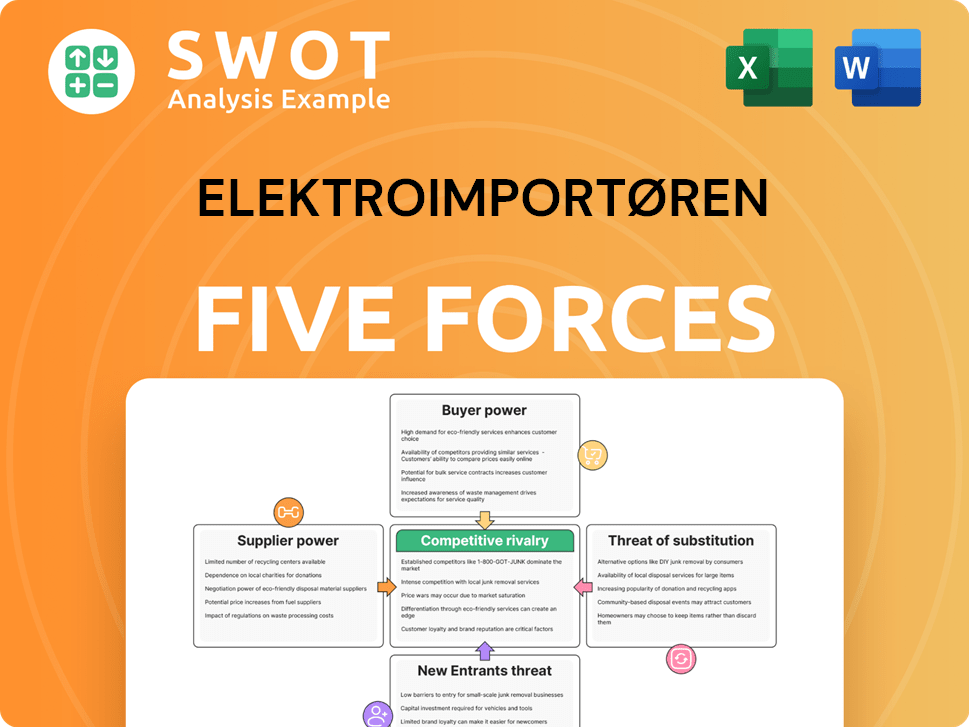

Elektroimportøren Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Elektroimportøren Company?

- What is Competitive Landscape of Elektroimportøren Company?

- What is Growth Strategy and Future Prospects of Elektroimportøren Company?

- What is Sales and Marketing Strategy of Elektroimportøren Company?

- What is Brief History of Elektroimportøren Company?

- Who Owns Elektroimportøren Company?

- What is Customer Demographics and Target Market of Elektroimportøren Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.