Eletrobrás Bundle

How Does Eletrobrás Work?

Eletrobras, a cornerstone of Brazil's energy infrastructure, is a major player in the Brazilian energy sector. This prominent electric power holding company is deeply involved in power generation, energy distribution, and transmission across the nation. Understanding How Eletrobrás works is crucial for anyone interested in the Brazilian economy and the future of energy.

In Q1 2025, Eletrobras demonstrated its financial resilience with stable regulatory net operating revenue, despite market fluctuations. As the company adapts to new technologies and evolving regulations, a comprehensive understanding of its operations becomes increasingly important. For those seeking deeper insights, consider exploring the Eletrobrás SWOT Analysis to gain a strategic perspective on the company's strengths, weaknesses, opportunities, and threats, and to understand its impact on the environment.

What Are the Key Operations Driving Eletrobrás’s Success?

The Eletrobrás company plays a crucial role in the Brazilian energy sector, creating and delivering value through its integrated operations. It focuses on the generation, transmission, and distribution of electricity across Brazil, catering to a broad customer base. As of Q2 2024, the company's installed capacity reached 44,359 MW, with a physical guarantee of 21,915 MW, demonstrating its significant infrastructure and ability to meet energy demands.

Its core offerings serve a wide array of customer segments, from large industrial consumers to residential users. Eletrobrás's operational model is designed to ensure a reliable supply of electricity, which is a key aspect of its value proposition. The company's extensive network and strategic initiatives support its commitment to providing essential energy services throughout Brazil. To understand its customer base, you can read more about the Target Market of Eletrobrás.

The company's operations are supported by strategic initiatives aimed at optimizing capital allocation and liability management. Eletrobrás is also actively exploring new business areas, such as green hydrogen initiatives and battery storage, demonstrating its adaptation to emerging clean energy trends.

Eletrobrás manages a diversified generation portfolio, with a significant portion of its capacity exposed to hydrological risks. Its supply chain involves sourcing and managing resources for its power plants and transmission infrastructure.

Eletrobrás's core capabilities translate into customer benefits through reliable electricity supply. The company's vast reach and ongoing efforts in energy transition and decarbonization contribute to market differentiation.

What makes Eletrobrás's operations unique is its position as Brazil's largest integrated electricity utility, giving it significant economies of scale. The company is also actively exploring new business areas, such as green hydrogen initiatives and battery storage.

Its core capabilities translate into customer benefits through reliable electricity supply and contribute to market differentiation by its vast reach and ongoing efforts in energy transition and decarbonization.

Eletrobrás's operations include a significant focus on power generation, with a large portion derived from hydroelectric sources. The company operates a vast transmission network and is involved in energy distribution across various regions.

- Manages a diversified generation portfolio.

- Operates a vast network of approximately 74,000 kilometers of transmission lines.

- Actively exploring new business areas, such as green hydrogen and battery storage.

- Focus on optimizing capital allocation and liability management.

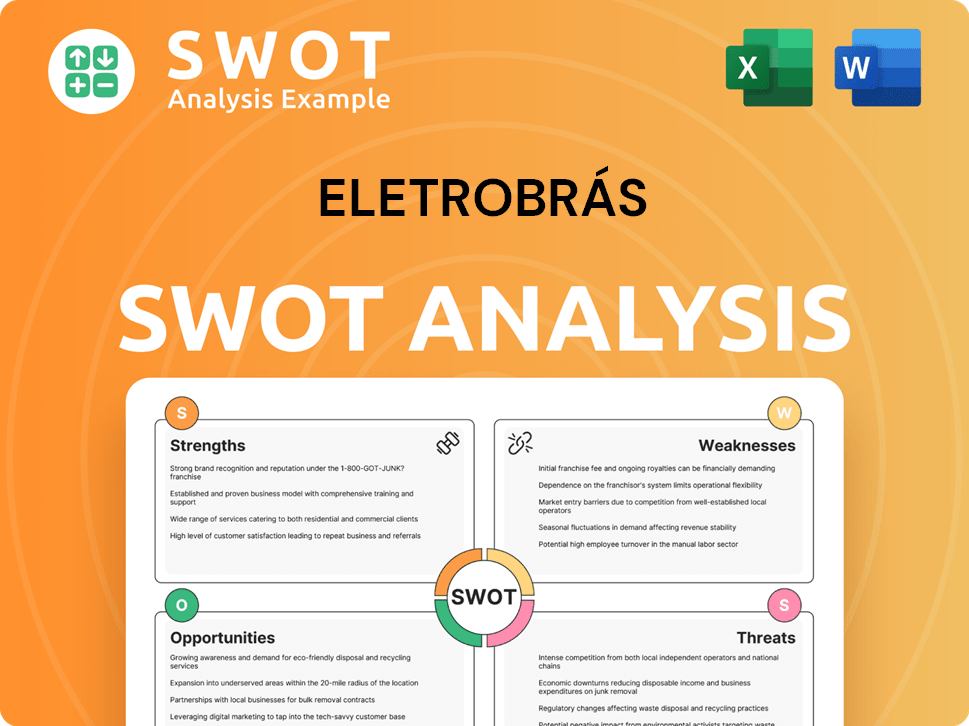

Eletrobrás SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Eletrobrás Make Money?

The Eletrobrás company generates revenue mainly through its electricity generation, transmission, and distribution activities, playing a crucial role in the Brazilian energy sector. Its financial performance reflects its operational scope and strategic initiatives. Understanding its revenue streams and monetization strategies is key to assessing its overall financial health and market position.

For the trailing twelve months ending March 31, 2025, Eletrobrás reported a revenue of $7.46 billion. The company's annual revenue for 2024 was $7.45 billion, showing a slight increase of 0.09% from 2023. In the quarter ending March 31, 2025, the company had a revenue of BRL 10.41 billion, with a 19.45% growth.

The company's revenue streams are influenced by various factors, including electricity prices, volumes, and regulatory tariff reviews. For instance, a reduction in Annual Permitted Revenue due to the 2024 Periodic Tariff Review impacted Q1 2025 results. The company also explores new business opportunities in green hydrogen and battery storage, which could diversify its revenue sources in the future.

Eletrobrás employs various monetization strategies. The company sells energy in both the free contracting environment and the regulated contracting environment and engages in energy trading. The company is strategically accelerating its sales in the free market, observing price dynamics and volatility in the futures market. For a deeper dive into the company's growth approach, consider exploring the Growth Strategy of Eletrobrás.

- Energy sales in free and regulated markets.

- Energy trading activities.

- Focus on reducing contingent liabilities, such as compulsory loan payments, which have decreased significantly.

- Exploring new business opportunities in green hydrogen and battery storage.

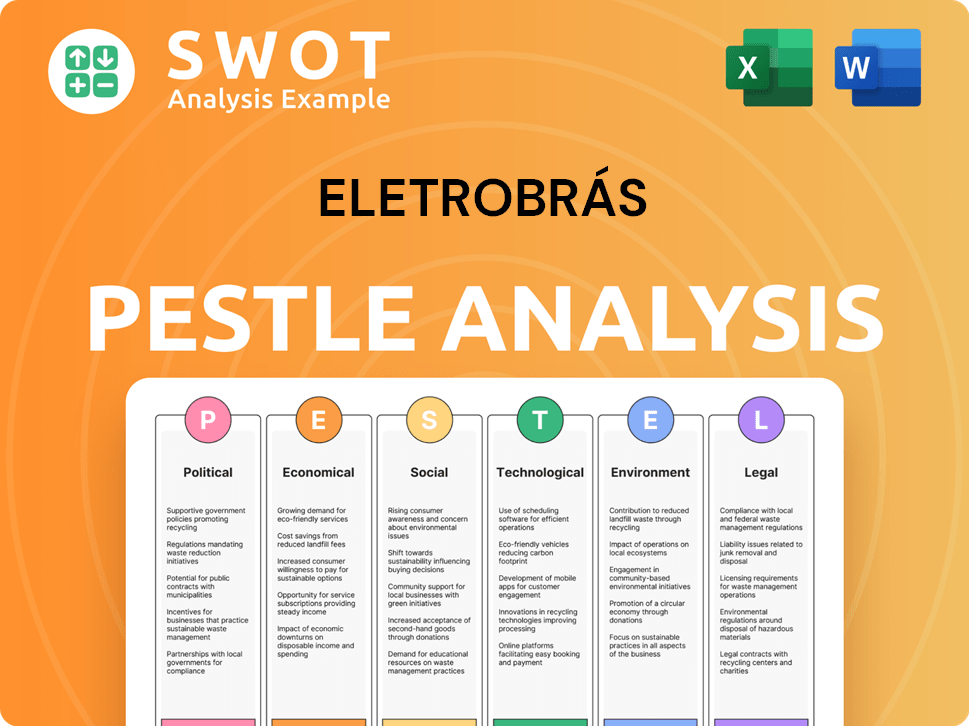

Eletrobrás PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Eletrobrás’s Business Model?

The Eletrobrás company has undergone significant transformations, particularly after its privatization in June 2022. This pivotal shift reduced the Brazilian government's control, altering the company's structure and strategic direction. Post-privatization, the focus has been on streamlining operations and reducing financial risks.

Strategic moves and operational adjustments have been central to the company's recent activities. These actions include cost-cutting measures and portfolio optimization, aiming to enhance efficiency and adapt to the evolving energy landscape. The company's focus on renewable energy and infrastructure projects further shapes its competitive positioning.

Eletrobrás's competitive edge is built on its substantial infrastructure and its ability to adapt to new energy trends. The company's extensive installed capacity and transmission network give it a strong foothold in the Brazilian energy sector. Furthermore, its exploration of green hydrogen and battery storage positions it to capitalize on emerging opportunities.

The privatization of Eletrobrás in June 2022 was a major turning point. The government's voting rights decreased from 72% to 10%, and total shares fell from 61% to approximately 42%. This move significantly altered the company's governance structure and strategic direction.

Eletrobrás has focused on corporate simplification, aimed at reducing costs and de-risking its operations. By March 2025, compulsory loans were reduced to BRL 13.1 billion from BRL 26.2 billion in June 2022. The company also incorporated Furnas Centrais Elétricas S.A. in July 2024 for synergies and tax optimization.

Eletrobrás has implemented significant cost-cutting measures. Personnel, material, services, and other expenses in 2024 totaled BRL 7.6 billion, a 24% decrease from BRL 10.0 billion in 2022. Further reductions of 7% are expected by 2026, indicating ongoing efforts to streamline operations.

Eletrobrás's competitive advantages stem from its position as the largest electricity utility in Brazil. Its diversified asset base helps mitigate operational and regulatory risks. The company has an installed capacity of 44 GW and 74,000 km of transmission lines, solidifying its market presence.

Eletrobrás is exploring green hydrogen and synthetic fuels, partnering with Suzano to study green hydrogen development in July 2024. The company is also preparing for upcoming battery storage tenders, demonstrating its commitment to renewable energy. Despite facing regulatory hurdles and market fluctuations, Eletrobrás's focus on efficiency and strategic portfolio optimization supports its business model.

- The agreement with the federal government in February 2025 secured three seats on Eletrobrás's board in exchange for no further capital injection into the Angra 3 nuclear power plant.

- Eletrobrás's ongoing efforts in efficiency gains and strategic portfolio optimization contribute to its sustained business model.

- Eletrobrás is preparing for upcoming battery storage tenders.

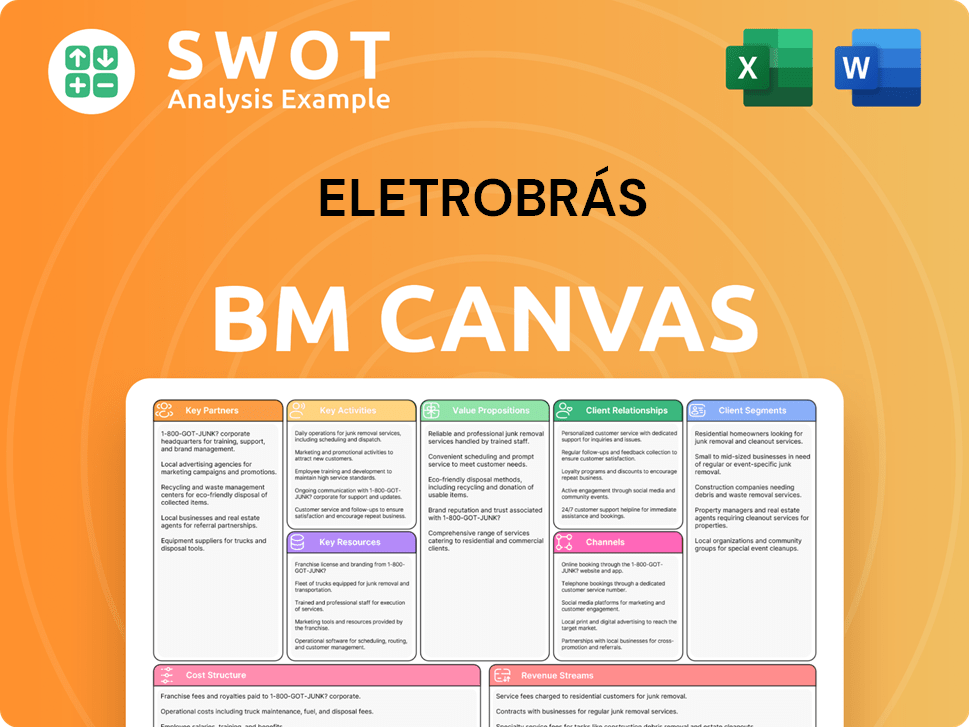

Eletrobrás Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Eletrobrás Positioning Itself for Continued Success?

The Eletrobrás company holds a dominant position in the Brazilian energy sector, functioning as the largest integrated electricity utility in Brazil. With a substantial installed generation capacity of 44 GW and 74,000 km of transmission lines, Eletrobrás plays a crucial role in power generation and energy distribution across the country. Despite its strong market presence, the company faces challenges related to financial performance and regulatory adjustments.

The Eletrobrás company has a diversified business profile. However, the company's return on equity in 2024 was around 8%, which was less than Brazil's Selic policy rate of 13.25%. This was due to outdated contracts that required selling energy below market prices, a situation it is gradually exiting by 2026. This highlights the dynamic nature of the energy market and the importance of strategic adaptation for sustained success.

Eletrobrás is the biggest integrated electricity utility in Brazil. It has a significant market share and a diversified business profile. The company's operations span generation, transmission, and distribution, making it a key player in the Brazilian energy sector.

Key risks include economic, regulatory, and political conditions in Brazil and abroad. Variations in interest rates, inflation, and the value of the Brazilian Real also pose risks. Hydrological risks, due to the reliance on hydroelectric power, impact generation capacity.

Eletrobrás has a strategic plan for 2024-2028, focused on maximizing results and operational efficiency. Investments of approximately R$40 billion are planned by 2025, with significant allocations to both transmission and generation projects. The company is also pursuing decarbonization goals.

Moody's expects Eletrobrás to maintain substantial liquidity to support its investments. Fitch projects the company's net adjusted financial leverage to range between 3.5x-4.0x until 2028, with 3.9x in 2025 and 3.5x in 2026. These projections indicate a focus on financial stability.

The Eletrobrás company is actively working on several strategic initiatives. These include completing the Angra 3 nuclear power plant, rationalizing its participation in SPEs, and exploring green hydrogen production and battery storage solutions. Furthermore, the company is focused on maintaining and expanding profitability.

- Addressing debt, with 73% tied to foreign currency, to mitigate exchange rate risks.

- Adapting to regulatory changes, such as ANEEL's new tariff model effective July 2025.

- Facing potential competition from new entrants in the Brazilian energy sector.

- Investing in power generation and energy distribution infrastructure.

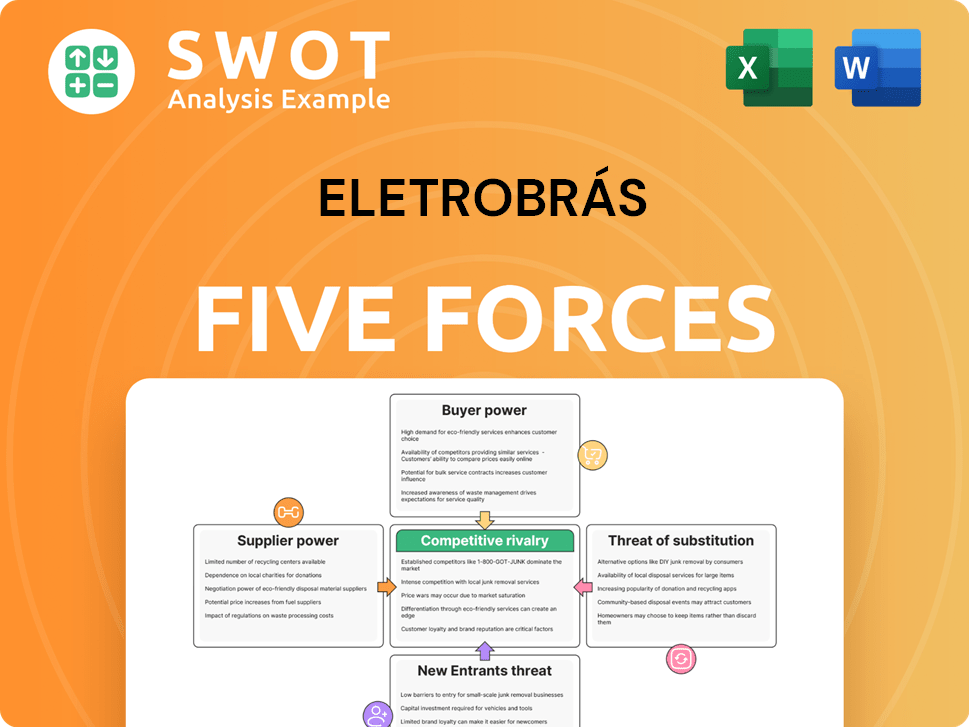

Eletrobrás Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Eletrobrás Company?

- What is Competitive Landscape of Eletrobrás Company?

- What is Growth Strategy and Future Prospects of Eletrobrás Company?

- What is Sales and Marketing Strategy of Eletrobrás Company?

- What is Brief History of Eletrobrás Company?

- Who Owns Eletrobrás Company?

- What is Customer Demographics and Target Market of Eletrobrás Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.