EssilorLuxottica Bundle

How Does EssilorLuxottica Dominate the Eyewear Industry?

EssilorLuxottica, a titan in the EssilorLuxottica SWOT Analysis, generated a staggering €27.5 billion in revenue in 2023, showcasing its unparalleled strength in the eyewear industry. This optical company, home to iconic brands like Ray-Ban and Oakley, impacts millions globally with its innovative products and vision solutions. But how does this global powerhouse, born from the merger of Essilor and Luxottica, actually work?

Understanding the inner workings of the EssilorLuxottica company is vital for anyone looking to understand the dynamics of the eyewear market. This exploration will dissect its complex business model, from manufacturing glasses to its vast retail network. By examining its strategic initiatives and operational efficiencies, we'll uncover the secrets behind its sustained financial performance and market leadership, offering valuable insights for investors and industry enthusiasts alike.

What Are the Key Operations Driving EssilorLuxottica’s Success?

The EssilorLuxottica company operates through a vertically integrated business model, controlling the entire eyewear value chain. This approach spans design, manufacturing, wholesale, and retail distribution, allowing for comprehensive control over quality and cost. Their core offerings include ophthalmic lenses, frames, and sunglasses, serving diverse consumer segments from those needing vision correction to fashion-conscious individuals.

How EssilorLuxottica works is centered around sophisticated operational processes. These include advanced research and development for lens technology, precision manufacturing of frames and lenses, and a robust global supply chain. Strategic partnerships and a vast distribution network, including wholesale channels and extensive retail locations, are key to their success. As of December 31, 2023, the company had approximately 18,000 stores globally.

The company's focus on innovation in lens technology and its diverse brand portfolio are crucial. EssilorLuxottica's products, such as Crizal coatings and Transitions lenses, offer superior visual acuity, comfort, and style. This integration of technology and brand equity reinforces market differentiation and customer loyalty, making them a leader in the eyewear industry.

The business model is built on vertical integration, ensuring control over the entire value chain. This allows for efficient operations and responsiveness to market demands. The company's approach combines manufacturing with direct-to-consumer reach, optimizing costs and maintaining quality.

Key products include ophthalmic lenses (Essilor, Varilux), frames (Ray-Ban, Oakley, Persol), and sunglasses. These brands cater to a wide range of consumers, from those needing vision correction to fashion enthusiasts. The diverse portfolio allows the company to capture a broad market share.

The supply chain is a key differentiator, enabling efficient sourcing and timely delivery. EssilorLuxottica leverages strategic partnerships and a vast distribution network. This includes wholesale channels and approximately 18,000 retail stores globally, enhancing market reach.

Innovation in lens technology is a core focus, with products like Crizal coatings and Transitions lenses. This integration of cutting-edge technology enhances customer benefits, including improved visual acuity and comfort. This focus on R&D solidifies its market position.

EssilorLuxottica's integrated approach provides significant customer benefits, including superior visual acuity, comfort, and style. Their strong brand equity and innovative products reinforce market differentiation. The company's global presence and diverse offerings contribute to its leading position within the optical company landscape.

- Vertical Integration: Controls the entire value chain.

- Brand Portfolio: Diverse brands catering to varied consumer preferences.

- Technological Innovation: Focus on advanced lens technology.

- Global Reach: Extensive retail and distribution networks.

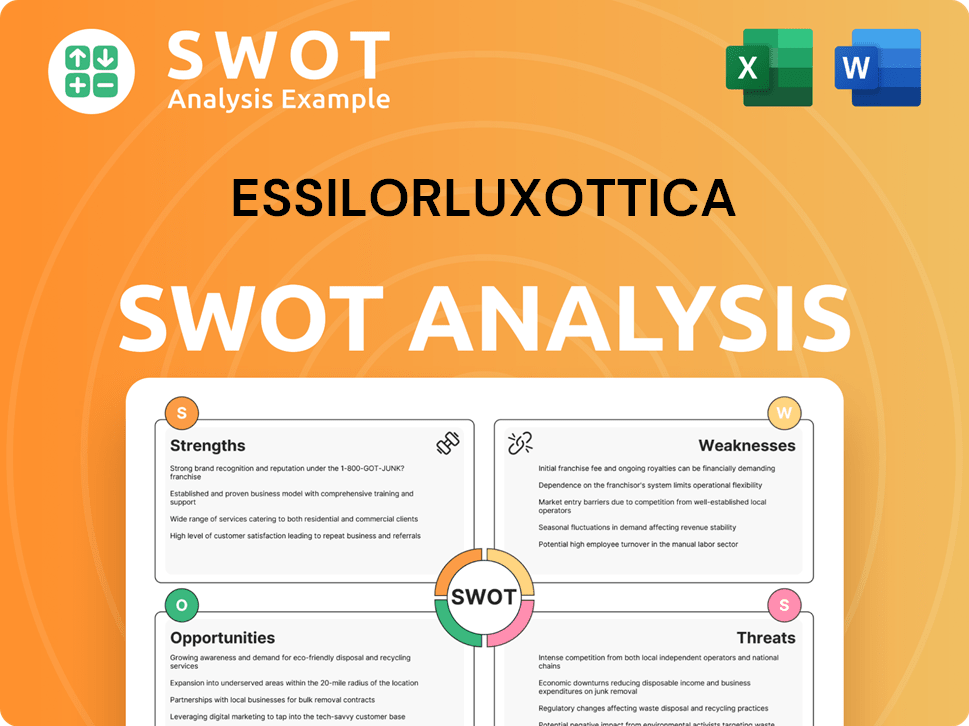

EssilorLuxottica SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does EssilorLuxottica Make Money?

The EssilorLuxottica company generates revenue through a multifaceted approach, primarily focusing on two key segments: Professional Solutions and Direct to Consumer. This dual strategy allows the optical company to capture value across the entire value chain, from manufacturing to retail. Understanding these revenue streams is crucial for grasping How EssilorLuxottica works and its overall financial performance.

The company's business model is designed to leverage its extensive global presence and brand portfolio. This approach ensures a diversified revenue base and resilience in the dynamic eyewear industry. The EssilorLuxottica merger has significantly shaped its current structure, influencing how it monetizes its products and services.

In 2023, the Professional Solutions segment, which caters to eyecare professionals, accounted for approximately 42% of the total revenue, reaching €11.6 billion. This segment includes ophthalmic lenses, optical instruments, and wholesale frames. The Direct to Consumer segment, encompassing retail stores and e-commerce, contributed approximately 58% of the total revenue, amounting to €15.9 billion in the same year.

Beyond direct sales, EssilorLuxottica employs several innovative monetization strategies. These strategies include bundled services and brand licensing agreements. These strategies enhance customer value and diversify revenue streams. For an in-depth look at their growth approach, you can explore the Growth Strategy of EssilorLuxottica.

- Bundled Services: Offering complete eyewear solutions that include frames, lenses, and coatings.

- Brand Licensing: Leveraging brand power through agreements with fashion and luxury brands.

- Tiered Pricing: Utilizing different levels of lens technologies to cater to various consumer budgets.

- Direct-to-Consumer Expansion: Increasing focus on retail and e-commerce channels to capture a larger share of the retail value chain.

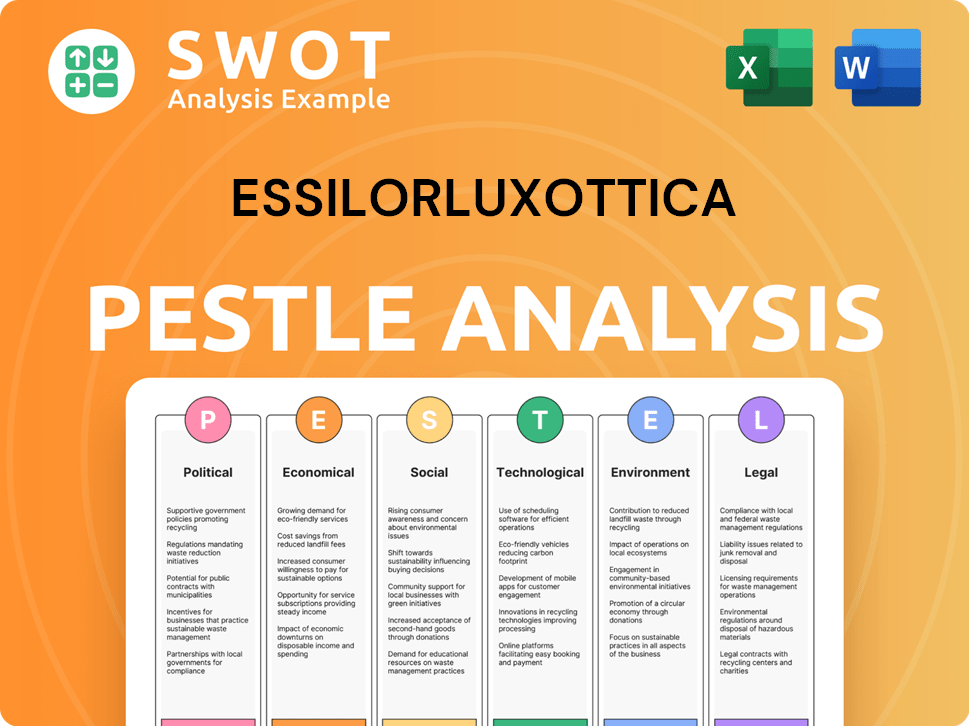

EssilorLuxottica PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped EssilorLuxottica’s Business Model?

The EssilorLuxottica company stands as a global leader in the eyewear industry, its operations shaped by strategic milestones and a focus on innovation. The merger of Essilor and Luxottica in 2018 was a pivotal moment, creating a vertically integrated entity that combines lens manufacturing with frame design and retail distribution. This integration has allowed EssilorLuxottica to leverage synergies and strengthen its market position.

The EssilorLuxottica business model is characterized by a blend of organic growth and strategic acquisitions, expanding its global footprint. The company continuously invests in research and development, driving innovation in lens technology and addressing evolving consumer needs. This commitment to innovation and expansion is central to how EssilorLuxottica works, enabling it to maintain a competitive edge in a dynamic market.

The EssilorLuxottica organizational structure is designed to support its diverse operations, from manufacturing to retail. The company's ability to navigate challenges, such as supply chain disruptions, and adapt to changing consumer preferences highlights its resilience and strategic foresight. The company's focus on sustainability and smart eyewear further demonstrates its commitment to long-term growth and relevance in the eyewear industry.

The merger of Essilor and Luxottica in 2018 was a transformative event, creating a vertically integrated eyewear giant. This strategic move combined Essilor's expertise in ophthalmic lenses with Luxottica's strength in frames and retail. Post-merger, the company focused on integration and synergy realization, aiming for annual synergies.

EssilorLuxottica has expanded its global presence through strategic acquisitions and partnerships, such as the 2022 acquisition of Giorgio Fedon & Figli S.p.A. The company continues to invest in research and development, with innovations like Stellest lenses for myopia management. These moves enhance supply chain capabilities and address global health concerns.

The company's competitive advantages include strong brand recognition with names like Ray-Ban and Oakley, technological leadership in lens innovation, and significant economies of scale. Its extensive global retail footprint provides direct consumer access and market insights. The company adapts to trends, such as sustainability and smart eyewear.

In 2023, EssilorLuxottica reported revenues of €25.4 billion, reflecting strong organic growth. The company's adjusted operating profit reached €4.7 billion, demonstrating robust profitability. The company's focus on innovation and strategic acquisitions continues to drive its financial performance.

The EssilorLuxottica company maintains a competitive edge through several key factors. Its unparalleled brand strength, with iconic brands like Ray-Ban and Oakley, provides a significant advantage in the market. Technological leadership in lens innovation is also a core strength, driving product differentiation and meeting evolving consumer needs. These advantages are further supported by a strong global retail presence.

- Strong Brand Portfolio: Iconic brands like Ray-Ban and Oakley drive consumer demand and brand loyalty.

- Innovation in Lens Technology: Continuous investment in R&D leads to advanced lens solutions.

- Global Retail Footprint: Extensive retail network provides direct access to consumers and market insights.

- Economies of Scale: Large-scale manufacturing and distribution networks drive cost efficiencies.

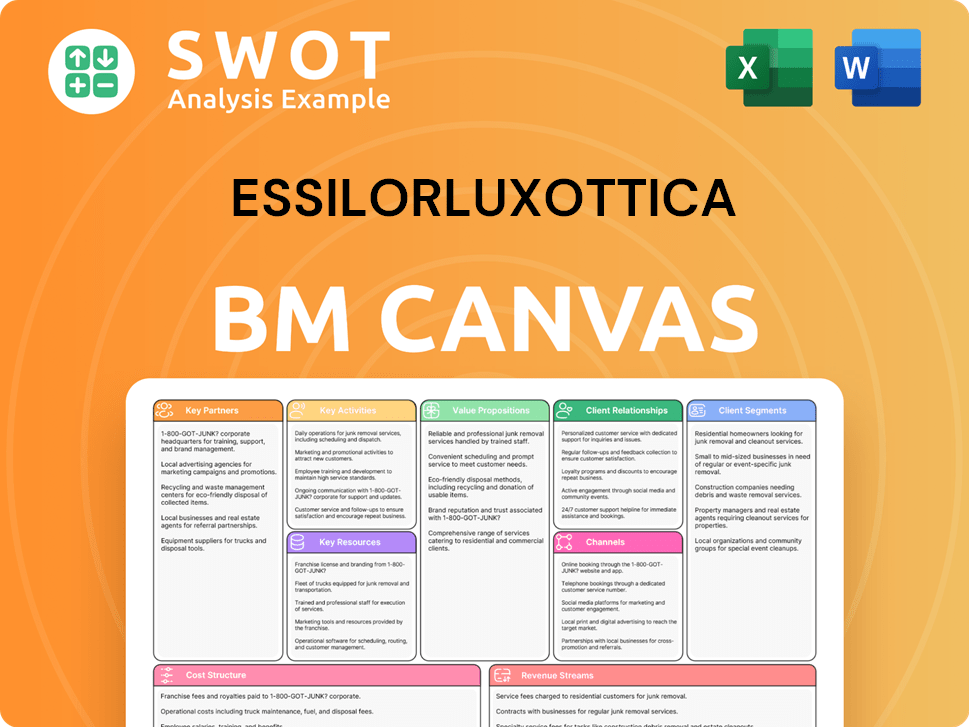

EssilorLuxottica Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is EssilorLuxottica Positioning Itself for Continued Success?

The EssilorLuxottica company holds a dominant position in the global eyewear industry, significantly outpacing many competitors due to its integrated business model and extensive brand portfolio. Its market share is substantial across both ophthalmic lenses and frames, underpinned by strong customer loyalty to its well-established brands. The company's global reach is unparalleled, with operations spanning numerous countries and a vast retail network that provides broad consumer access.

Despite its strong position, EssilorLuxottica faces several key risks. Regulatory changes regarding vision care products and services in different countries could impact its operations and profitability. New competitors, particularly agile direct-to-consumer eyewear brands, could disrupt market share, though EssilorLuxottica’s scale provides a significant barrier to entry. Technological disruption, such as advancements in corrective eye surgery or alternative vision correction methods, could also pose a long-term risk. Additionally, changing consumer preferences, including a shift towards more affordable eyewear options or increased demand for personalized products, require continuous adaptation.

EssilorLuxottica is a leader in the eyewear industry, holding a substantial market share globally. The company's integrated model covers design, manufacturing, and distribution, giving it a competitive advantage. Its extensive brand portfolio and wide retail network enhance its market presence.

EssilorLuxottica faces risks including regulatory changes and competition from new eyewear brands. Technological advancements in vision correction could also impact its market position. Adapting to changing consumer preferences is crucial for sustained success.

The company focuses on innovation, direct-to-consumer channels, and data-driven customer experiences. EssilorLuxottica aims to strengthen sustainability efforts, aligning with growing consumer and regulatory demands. The commitment to 'improving lives by improving sight' drives commercial growth and market leadership.

Strategic initiatives include R&D investment for lens technology and smart eyewear. Expanding direct-to-consumer channels and leveraging data for personalized experiences are key. Sustainability efforts across the value chain are also a priority for EssilorLuxottica.

EssilorLuxottica is investing heavily in research and development, with R&D expenses reaching approximately €700 million in 2023, focusing on innovation in lens technology and smart eyewear. The company is expanding its direct-to-consumer channels, aiming to capture a larger share of the growing online eyewear market. Sustainability is a major focus, with targets set for reducing carbon emissions and promoting circular economy practices.

- R&D Investment: Approximately €700 million in 2023.

- Sustainability Goals: Reducing carbon emissions and promoting circular economy.

- Market Share: Significant market share in both ophthalmic lenses and frames.

- Retail Network: Extensive global retail presence.

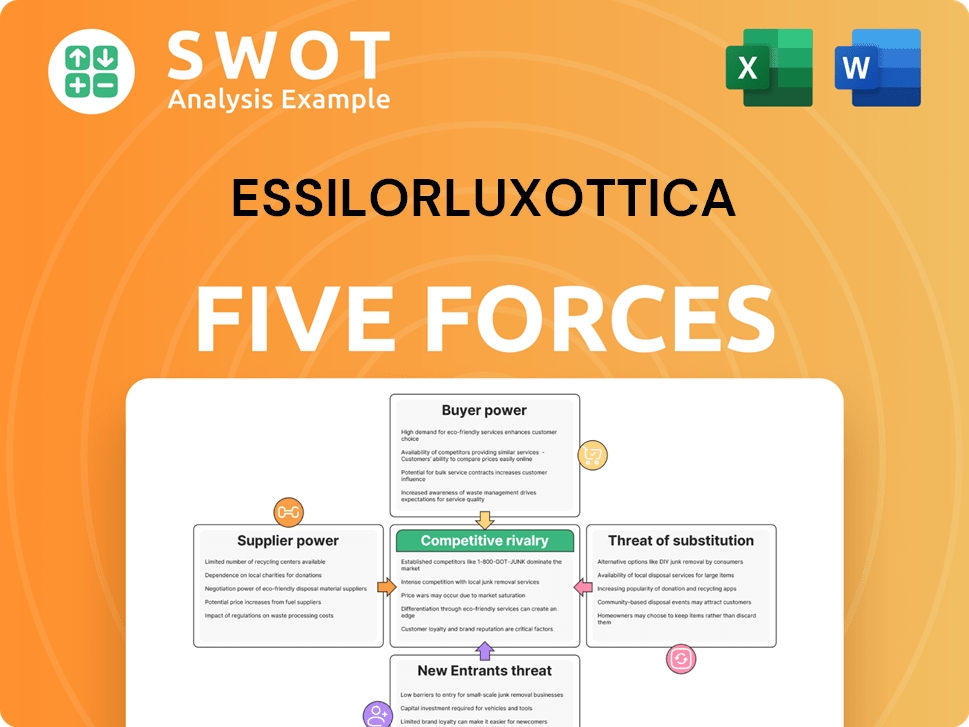

EssilorLuxottica Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EssilorLuxottica Company?

- What is Competitive Landscape of EssilorLuxottica Company?

- What is Growth Strategy and Future Prospects of EssilorLuxottica Company?

- What is Sales and Marketing Strategy of EssilorLuxottica Company?

- What is Brief History of EssilorLuxottica Company?

- Who Owns EssilorLuxottica Company?

- What is Customer Demographics and Target Market of EssilorLuxottica Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.