Eurodough SAS Bundle

How Does Eurodough SAS Thrive in the Ready-to-Bake Dough Market?

Cérélia SA, formerly known as Eurodough SAS, is a dominant force in the rapidly growing ready-to-bake chilled dough sector. This French company has expanded beyond its origins, establishing a strong presence across Europe and beyond. Offering a diverse product portfolio, from pie dough to pastries, Eurodough business model caters to both retail and major food companies.

The strategic shift from Eurodough SAS to Cérélia SA reflects its commitment to innovation and market adaptation. Understanding the Eurodough SAS SWOT Analysis is crucial for investors and industry observers. This in-depth analysis will explore the Eurodough company's core processes, revenue streams, and competitive advantages within the bakery supplies sector, providing a clear view of its potential.

What Are the Key Operations Driving Eurodough SAS’s Success?

The core operations of Eurodough SAS, a French company, revolve around the production and distribution of ready-to-bake chilled dough products. This includes a wide range of doughs for pies, pizzas, pastries, and cake mixes. Eurodough's business model is designed to serve both individual consumers through retail channels and large international food companies via contract-packing services, showcasing the flexibility of its SAS company structure.

Eurodough SAS creates value through a vertically integrated and highly efficient operational model. This model starts with sourcing high-quality raw materials, ensuring consistency and adherence to food safety standards. Advanced manufacturing facilities, equipped with specialized chilling and packaging technologies, are crucial for maintaining the freshness and integrity of the dough products. The company's supply chain is a critical component, ensuring timely and efficient delivery across various European countries.

Eurodough's dual focus on branded retail products and a strong contract-packing business allows for economies of scale and diversified revenue streams, which is a key aspect of its value proposition. Continuous investment in research and development for new product formulations and packaging innovations translates into convenience, consistent quality, and a wide variety of ready-to-bake solutions. This approach allows Eurodough to cater to modern dietary habits and busy lifestyles, enhancing customer loyalty and market differentiation. For more insights, consider reading about the Target Market of Eurodough SAS.

Eurodough SAS meticulously sources high-quality raw materials to ensure product consistency. Advanced manufacturing facilities are equipped with specialized chilling and packaging technologies. The company focuses on maintaining the freshness and integrity of its ready-to-bake dough products.

Eurodough SAS has a robust logistics and distribution network. This network ensures timely and efficient delivery across France, Italy, Spain, and other European countries. Partnerships with major retailers and food companies are foundational to its market reach.

Eurodough SAS offers a wide array of doughs for pies, pizzas, pastries, and cake mixes. Continuous investment in research and development leads to new product formulations. The company adapts its product offerings to regional tastes and market demands.

Eurodough SAS provides convenience, consistent quality, and a wide variety of ready-to-bake solutions. The company's operational flexibility and diversified revenue streams enhance its market position. It caters to modern dietary habits and busy lifestyles, increasing customer loyalty.

Eurodough SAS's operations are characterized by its dual focus on branded retail products and contract-packing, allowing for economies of scale. The company's ability to adapt to regional tastes and market demands enhances its differentiation.

- Vertically integrated model ensures quality control from sourcing to distribution.

- Strong supply chain and distribution network for efficient delivery.

- Continuous innovation in product formulations and packaging.

- Flexible business model serving both retail and contract-packing clients.

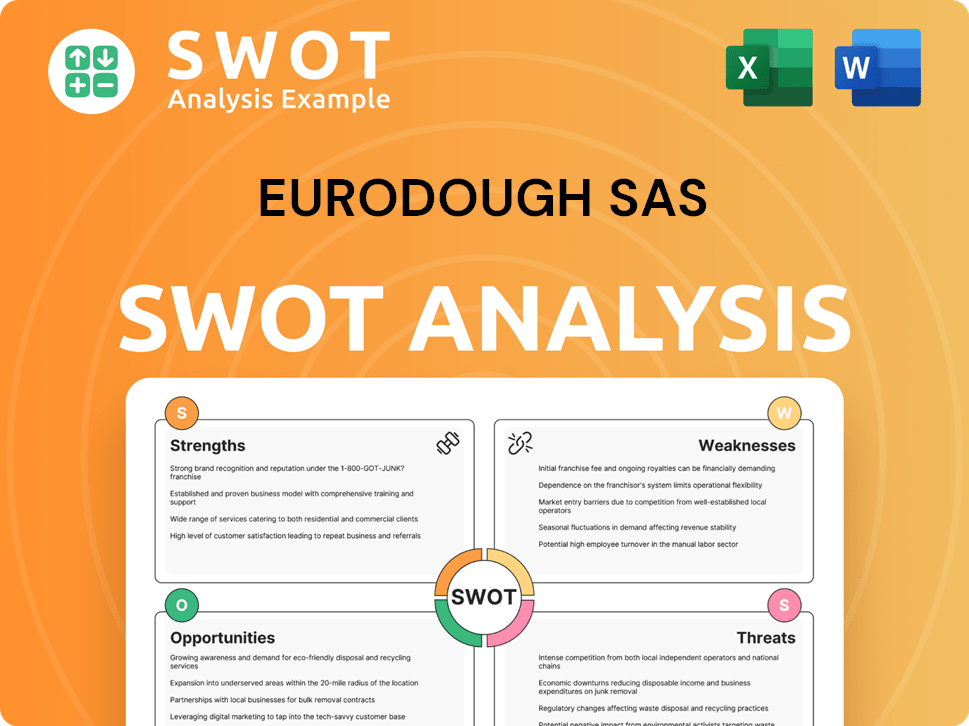

Eurodough SAS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Eurodough SAS Make Money?

The Eurodough SAS company, a French company, generates revenue primarily through the sale of its ready-to-bake chilled dough products. Its revenue streams are diversified, focusing on direct sales to retail consumers and contract-packing services for major international food companies. This dual approach allows the Eurodough business to maintain stability and capitalize on different market segments.

Retail sales encompass a wide range of branded products available in supermarkets and hypermarkets across Europe, including pie crusts, pizza doughs, puff pastries, and various sweet doughs. The contract-packing segment involves manufacturing private-label or co-branded dough products for other food companies, leveraging Eurodough's production capabilities and expertise. This strategy allows the company to monetize its manufacturing capacity and supply chain efficiency beyond its own branded products.

While specific recent financial data for 2024-2025 detailing the precise percentage contribution of each revenue stream is not publicly available, the company's business model suggests a significant contribution from both segments. The company also employs strategies such as product diversification and innovation to drive sales, regularly introducing new dough variations and healthier options to capture evolving consumer preferences. For more insights into their strategic moves, consider reading about the Growth Strategy of Eurodough SAS.

The Eurodough company utilizes several key strategies to generate revenue and maintain profitability:

- Direct Retail Sales: Sales of branded products in supermarkets and hypermarkets.

- Contract-Packing Services: Manufacturing private-label products for other food companies.

- Product Innovation: Regularly introducing new dough variations and healthier options.

- Geographical Expansion: Entering new markets to broaden its customer base.

- Pricing Strategies: Implementing tiered pricing based on product type, volume, and customer segment.

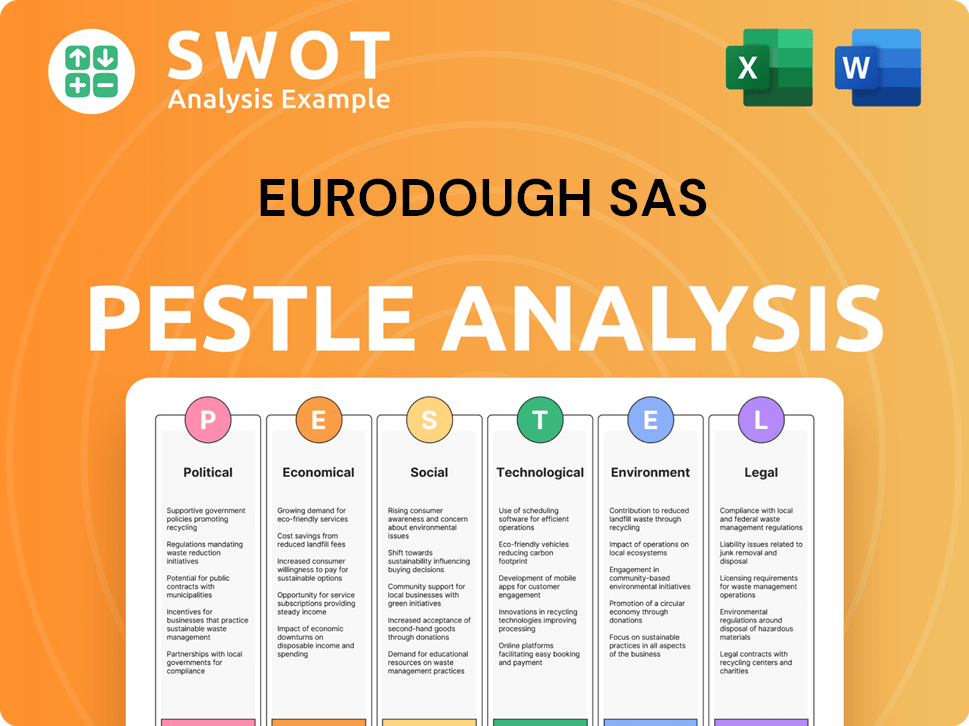

Eurodough SAS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Eurodough SAS’s Business Model?

Cérélia SA, formerly known as Eurodough SAS, has marked significant milestones that have reshaped its operational and financial strategies. The rebranding to Cérélia SA represented a strategic shift, broadening its market reach and vision. This move was instrumental in facilitating substantial international expansion, particularly within key European markets, which significantly enhanced its customer base and revenue potential.

Strategic partnerships with major retailers and international food companies have been vital for scaling operations and fortifying its market position. The company has consistently invested in its manufacturing capabilities, adopting advanced chilling and packaging technologies to ensure product quality and extend shelf life, crucial in the chilled food segment. Managing complex international supply chains and adapting to fluctuating raw material costs have been addressed through robust logistical planning and diversified sourcing strategies.

Cérélia's competitive advantages are multifaceted, including strong brand recognition and a reputation for consistent product quality. Technological leadership in dough production and chilling processes allows for efficient manufacturing and product innovation. Furthermore, economies of scale, driven by large production volumes, provide a cost advantage over smaller competitors. Cérélia's ability to quickly adapt to consumer trends and navigate evolving regulatory landscapes underscores its resilience and forward-thinking approach in a dynamic industry.

The rebranding from Eurodough SAS to Cérélia SA marked a significant shift, expanding market presence. This transition facilitated international expansion, particularly in key European markets. Strategic partnerships with major retailers and food companies have been crucial for growth.

The company has consistently invested in manufacturing capabilities, adopting advanced technologies. Robust logistical planning and diversified sourcing strategies have been implemented. Continuous investment in R&D ensures the company remains competitive.

Strong brand recognition and consistent product quality foster customer loyalty. Technological leadership in dough production and chilling processes enables efficient manufacturing. Economies of scale provide a cost advantage over smaller competitors.

Cérélia's ability to adapt to new consumer trends, such as the increasing demand for healthier or plant-based options, is a key strength. The company navigates evolving regulatory landscapes effectively. Continuous investment in R&D ensures it remains at the forefront of product development.

While specific financial data for 2024-2025 is not available, Cérélia SA's strategic moves and market positioning suggest robust financial health. The company's focus on innovation and expansion has likely contributed to sustained revenue growth. The Owners & Shareholders of Eurodough SAS have benefited from the company's strategic direction.

- Cérélia SA's market share in the chilled dough sector is significant, reflecting its strong brand presence.

- Continuous investment in R&D and technology has enhanced operational efficiency.

- Strategic partnerships have facilitated market penetration and distribution.

- The ability to adapt to changing consumer preferences has solidified its competitive advantage.

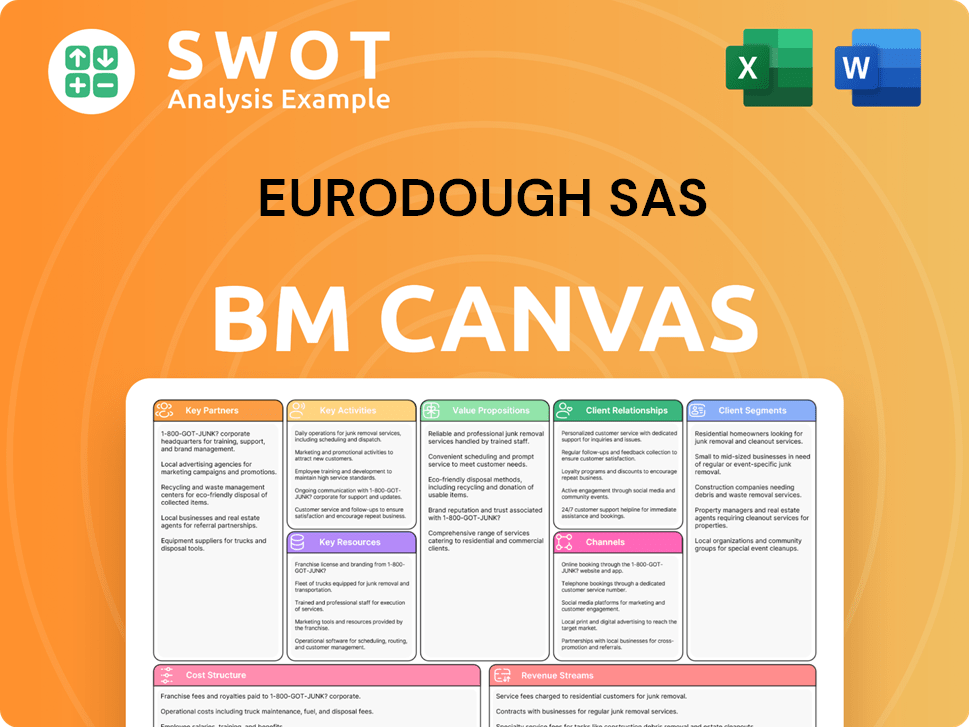

Eurodough SAS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Eurodough SAS Positioning Itself for Continued Success?

The industry position, risks, and future outlook of the Eurodough SAS company are crucial for understanding its potential. Eurodough, a French company, operates within the competitive bakery supplies sector. Evaluating its market standing, potential challenges, and growth prospects provides a comprehensive view of its business.

Eurodough SAS, with its SAS company structure, faces various factors influencing its trajectory. Examining its current market position, potential risks, and future outlook is essential for a complete understanding of the company. This analysis will explore the company's strengths, weaknesses, and strategic direction.

Eurodough SAS holds a significant position in the European ready-to-bake chilled dough market. Its presence in key European countries, such as France, positions it as a leading player. The company's dual business model, encompassing retail sales and contract-packing, strengthens its market penetration.

Eurodough SAS faces risks including raw material price fluctuations and regulatory changes. Competition and evolving consumer preferences, like the shift towards scratch baking, pose challenges. The company actively mitigates these risks through product innovation and supply chain optimization.

The future outlook for Eurodough SAS appears positive, with continued investment in R&D and strategic market penetration. This strategy aims to sustain and expand its profitability and market dominance. The company is focused on sustainable practices and technological advancements.

Specific market share percentages for Eurodough SAS in 2024-2025 are not readily available. However, its consistent growth and expansion efforts suggest a dominant standing. The company's strong distribution networks contribute to its market presence.

Eurodough SAS focuses on several strategic initiatives to maintain its competitive edge. These include continuous product innovation to meet evolving consumer demands. Optimization of its supply chain for greater resilience is also a key focus, along with geographical expansion.

- Product Innovation: Developing new products to meet consumer preferences.

- Supply Chain Optimization: Improving the efficiency and resilience of the supply chain.

- Geographical Expansion: Entering new markets to increase market share.

- Sustainability: Implementing sustainable practices to meet environmental standards.

Eurodough SAS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Eurodough SAS Company?

- What is Competitive Landscape of Eurodough SAS Company?

- What is Growth Strategy and Future Prospects of Eurodough SAS Company?

- What is Sales and Marketing Strategy of Eurodough SAS Company?

- What is Brief History of Eurodough SAS Company?

- Who Owns Eurodough SAS Company?

- What is Customer Demographics and Target Market of Eurodough SAS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.