Eurowag Bundle

How Does Eurowag Company Revolutionize Commercial Road Transport?

Eurowag has emerged as a key player in the European logistics sector, offering integrated payment and technology solutions designed to streamline operations. This company's comprehensive services, including fuel cards and fleet management tools, are tailored to enhance efficiency for transport businesses. With a strong presence across Europe, Eurowag simplifies the complexities of managing transportation expenses.

To truly grasp the impact of Eurowag SWOT Analysis, one must understand its operational framework and revenue strategies. This examination will provide valuable insights for investors and industry observers. Understanding how Eurowag works is crucial for anyone seeking to navigate the evolving landscape of payment solutions and fleet management. The company's innovative approach to fuel cards and toll payment solutions makes it a compelling case study in the B2B market.

What Are the Key Operations Driving Eurowag’s Success?

The core of how the Eurowag company operates centers around providing an integrated platform designed to meet the diverse needs of commercial road transport companies. This involves a suite of services, including fuel management, electronic toll payments, VAT and excise duty refunds, telematics for fleet optimization, and financial services tailored to the transport sector. These offerings are designed to cater to a broad customer base, from individual owner-operators to large logistics enterprises, all aimed at enhancing operational efficiency and reducing costs.

The operational processes are highly integrated and technology-driven. For example, fuel cards are supported by an extensive network of accepting stations, with transaction management and detailed reporting. Toll payments utilize specialized on-board units and agreements with toll authorities. VAT refund services involve expert knowledge of complex tax regulations and efficient processing to recover eligible funds for clients. Telematics solutions use GPS and sensor technology to provide real-time data on vehicle location, fuel consumption, and driver behavior. The company's proprietary IT infrastructure and data analytics capabilities are central to developing and delivering these services, ensuring seamless integration and user-friendly interfaces.

The value proposition of Eurowag lies in its ability to consolidate multiple essential services into a single ecosystem, eliminating the need for transport companies to manage multiple vendors and disparate systems. This integrated approach offers significant administrative savings and operational synergies. The core capabilities in technology development, regulatory expertise, and customer-centric service translate directly into tangible customer benefits, such as reduced fuel costs, streamlined toll payments, accelerated VAT refunds, improved fleet utilization, and enhanced financial liquidity, thereby differentiating it significantly from competitors offering fragmented solutions. This makes the Eurowag company a comprehensive solution for transport businesses.

Offers fuel cards accepted across a vast network, providing detailed transaction reports and analytics. This helps businesses control fuel expenses and monitor usage. The system allows for real-time tracking and management of fuel consumption, helping to optimize fuel efficiency.

Provides electronic toll payment solutions through on-board units and agreements with toll authorities across various European countries. This simplifies cross-border travel and reduces administrative burdens. These solutions ensure compliance with toll regulations and offer efficient payment processing.

Offers VAT and excise duty refund services, leveraging expertise in complex tax regulations to recover eligible funds for clients. This service helps transport companies reclaim taxes paid on fuel, tolls, and other expenses. The process is designed to be efficient, ensuring timely refunds and maximizing financial returns.

Utilizes advanced GPS and sensor technology to provide real-time data on vehicle location, fuel consumption, driver behavior, and maintenance needs. This allows for improved fleet utilization, reduced fuel costs, and enhanced driver safety. The data-driven insights help optimize fleet performance and reduce operational inefficiencies.

The Eurowag company distinguishes itself through its integrated platform, which consolidates multiple essential services into a single ecosystem. This approach provides significant administrative savings and operational synergies for transport companies. Eurowag's focus on technology development, regulatory expertise, and customer-centric service translates directly into tangible customer benefits.

- Reduced fuel costs through competitive pricing and efficient management tools.

- Streamlined toll payments, simplifying cross-border travel and reducing administrative burdens.

- Accelerated VAT refunds, improving cash flow and financial liquidity.

- Improved fleet utilization through real-time data and optimization tools.

Eurowag SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Eurowag Make Money?

The Eurowag company generates revenue through a multifaceted approach, primarily centered on providing integrated payment and technology solutions tailored for commercial road transport. Its revenue streams are diverse, stemming from transaction fees, service charges, and subscription fees associated with its various offerings. While specific figures for 2024-2025 are not publicly available, the company's financial model is designed to capture value across multiple touchpoints within the commercial transport ecosystem.

A significant portion of Eurowag's revenue comes from its fuel card services. The company earns a margin on fuel purchases made through its network, often incorporating a small transaction fee per liter or a percentage of the transaction value. Toll payment solutions also contribute to revenue through transaction fees, either as a fixed charge per toll event or a percentage of the toll amount. Furthermore, VAT and excise duty refund services generate revenue through a commission charged on the refunded amount.

Telematics services typically operate on a subscription model, with recurring fees for access to the platform and its features, often tiered based on the number of vehicles or the level of functionality desired. Financial services, such as working capital solutions or factoring, generate interest income or service fees based on the financing provided. This comprehensive approach allows Eurowag to cater to a wide range of needs within the commercial transport sector, optimizing revenue generation through diverse service offerings.

The monetization strategies of Eurowag are characterized by a focus on value-added services and bundled offerings. The company employs tiered pricing for its telematics and financial services, allowing clients to choose packages that best suit their operational scale and needs. Cross-selling is a key strategy, encouraging existing clients to adopt additional services from the Eurowag ecosystem, thereby increasing customer lifetime value. For instance, a client using fuel cards might be encouraged to also utilize toll payments and telematics for a more integrated solution.

- Tiered Pricing: Offers various service packages to match different customer needs and scales.

- Cross-Selling: Encourages clients to use multiple services, increasing customer lifetime value.

- Data-Driven Optimization: Leverages data insights to tailor solutions and refine pricing strategies.

- Recurring Revenue: Emphasizes subscription and service fees for a more predictable business model.

The company also leverages its extensive data insights to offer tailored solutions and optimize pricing, further enhancing its revenue potential. Changes over time have seen an increasing emphasis on recurring revenue streams from subscriptions and service fees, reflecting a shift towards a more predictable and scalable business model, alongside the traditional transaction-based revenue from fuel and toll payments. For more information on the company's structure, you can read about the Owners & Shareholders of Eurowag.

Eurowag PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Eurowag’s Business Model?

The journey of the Eurowag company has been marked by significant milestones that have shaped its operations and financial performance. Strategic moves, such as continuous expansion across Europe, both organically and through acquisitions, have been crucial. The company's initial public offering (IPO) on the Prague Stock Exchange in 2021 provided substantial capital for further expansion and technological development.

Eurowag's operational challenges have included navigating diverse regulatory landscapes and managing a vast fuel station network. The company has invested heavily in regulatory expertise and developed robust IT platforms to adapt to various national requirements. Its competitive advantages stem from its comprehensive, integrated platform, which offers a 'one-stop shop' for transport companies.

Eurowag leverages its extensive data on fuel consumption, routes, and vehicle performance to provide valuable insights and predictive analytics to its clients, enhancing its value proposition. The company continues to adapt to new trends, such as the increasing adoption of electric vehicles in commercial fleets, by exploring and developing solutions for charging infrastructure payments and related services.

A key milestone for Eurowag was its IPO in 2021, which provided capital for expansion. Another significant move was the acquisition of Sygic in 2023, enhancing its telematics and fleet management capabilities. These moves have helped Eurowag strengthen its position in the market.

Eurowag's strategic moves include continuous expansion across Europe, both organically and through acquisitions. The acquisition of Sygic in 2023 is a prime example of this strategy. These moves have allowed Eurowag to offer a wider range of services and increase its market reach.

Eurowag's competitive edge comes from its comprehensive, integrated platform. This 'one-stop shop' approach reduces administrative burdens and optimizes operational efficiency for transport companies. The company’s focus on data-driven insights further enhances its value.

Operational challenges include navigating diverse regulatory landscapes and managing a vast fuel station network. Eurowag addresses these challenges by investing in regulatory expertise and developing adaptable IT platforms. This allows them to maintain a strong presence across Europe.

Eurowag's integrated platform offers a 'one-stop shop' for transport companies, providing fuel cards, fleet management, and payment solutions. This comprehensive approach simplifies operations and enhances efficiency. The platform's design creates strong customer stickiness, as clients benefit from the synergy of interconnected services. For more details on the company's background, check out the Brief History of Eurowag.

- Fuel Cards: Providing access to a vast network of fuel stations.

- Fleet Management: Offering telematics and route optimization.

- Payment Solutions: Streamlining toll payments and VAT refunds.

- Data Analytics: Delivering insights on fuel consumption and vehicle performance.

Eurowag Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Eurowag Positioning Itself for Continued Success?

The company, a key player in the European commercial road transport sector, holds a strong market position. It offers integrated payment and fleet management solutions, competing with specialized providers and larger financial or logistics technology firms. Its comprehensive platform boosts customer loyalty, providing multiple essential services from a single source. The company's global reach, especially in Central and Eastern Europe, strengthens its standing.

However, the company faces risks like regulatory changes in fuel taxation, toll systems, and payment regulations. New competitors and technological disruptions, such as autonomous vehicles, pose constant threats. Economic downturns and fuel price fluctuations can also impact its clients' profitability, affecting revenue streams. The company's future is shaped by innovation and expansion strategies.

The company is a leading provider of integrated payment and fleet management solutions in the European commercial road transport sector. It competes with specialized providers of fuel cards and telematics, as well as larger financial and logistics technology firms. Its comprehensive platform fosters customer loyalty by offering multiple essential services.

Regulatory changes in fuel taxation, toll systems, and cross-border payment regulations pose a risk. The emergence of new competitors with innovative solutions is a constant threat. Technological advancements, such as autonomous vehicles, could require significant investment. Economic downturns and fuel price fluctuations can also directly impact the company's revenue streams.

The company is focused on innovation and expansion through its strategic initiatives. It continues to invest in telematics and data analytics to provide clients with more sophisticated insights. Expansion into new geographic markets, particularly Western Europe, remains a key strategic objective. The company aims to further digitalize the transport industry.

The company provides fuel cards, fleet management, and payment solutions for commercial road transport. These services streamline operations, reduce costs, and improve efficiency for businesses. Its integrated platform simplifies various aspects of fleet management, from fuel purchases to toll payments. To learn more about the Target Market of Eurowag, you can explore additional resources.

The company is focused on expanding its telematics and data analytics capabilities to offer more sophisticated insights. It aims to expand into new geographic markets, particularly in Western Europe. The company is committed to further digitalizing the transport industry, providing more seamless solutions.

- Investment in R&D for new technologies.

- Expansion of service offerings.

- Deepening integration with client operations.

- Focus on electromobility and sustainable logistics.

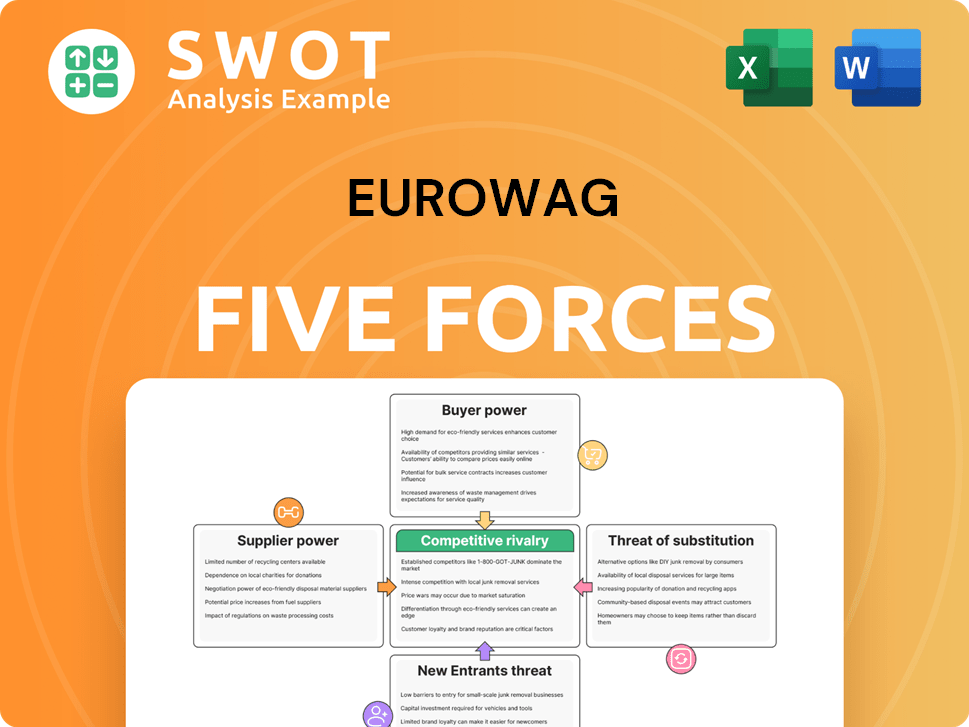

Eurowag Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Eurowag Company?

- What is Competitive Landscape of Eurowag Company?

- What is Growth Strategy and Future Prospects of Eurowag Company?

- What is Sales and Marketing Strategy of Eurowag Company?

- What is Brief History of Eurowag Company?

- Who Owns Eurowag Company?

- What is Customer Demographics and Target Market of Eurowag Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.