Flight Centre Bundle

How Does Flight Centre Thrive in the Travel Industry?

Flight Centre Travel Group, a global leader in travel, has strategically navigated the turbulent times to re-establish its dominance in the revitalized travel sector. As the travel industry rebounds, understanding the inner workings of Flight Centre is crucial for anyone looking to invest or simply understand the current market. This analysis delves into Flight Centre's operational model and revenue streams, offering a comprehensive view of its resilience and future prospects.

Flight Centre's extensive network of retail locations and online platforms provides a wide array of services, including Flight Centre SWOT Analysis, flights, accommodation, and more. This diverse offering, coupled with its multi-channel distribution, positions the Flight Centre company as a key player in the travel ecosystem. Examining its business model reveals valuable insights into its ability to adapt and thrive in a competitive market. Whether you're interested in booking flights, exploring holiday packages, or understanding the intricacies of a leading travel agency, this exploration is essential.

What Are the Key Operations Driving Flight Centre’s Success?

The Flight Centre company operates as a comprehensive travel intermediary, connecting consumers with a wide range of travel products and services. It caters to both leisure and corporate clients, offering flights, accommodations, packaged tours, cruises, car rentals, and travel insurance. This multifaceted approach allows the company to serve a diverse customer base, from individual travelers to large corporations with complex travel needs.

Its core operations blend human expertise with technological platforms. This hybrid model, combining the personalized service of traditional travel agencies with the efficiency of online platforms, is a key differentiator. The company sources competitive travel deals from various suppliers, leveraging strong relationships and purchasing power to provide value to its customers.

Customer service is a key pillar, with dedicated travel consultants providing pre-trip advice, booking assistance, and post-trip support. The company's supply chain relies on direct contracts with numerous travel providers globally, enabling a vast selection of offerings. Partnerships with major airlines, hotel chains, and tour operators are crucial to its distribution network.

Flight Centre provides a diverse range of travel products including flights, accommodation, packaged tours, cruises, car rentals, and travel insurance. These offerings cater to various travel needs, ensuring customers have comprehensive options. This variety helps the company meet the diverse demands of its customer base, from individual travelers to corporate clients.

The company utilizes a multifaceted distribution strategy, including physical retail stores, online platforms, and mobile applications. Physical stores offer personalized consultation, while online platforms provide self-service booking capabilities. This omnichannel approach ensures accessibility and convenience for customers, enhancing their overall experience.

Dedicated travel consultants offer pre-trip advice, booking assistance, and post-trip support. This personalized service enhances customer satisfaction and loyalty. The availability of expert advice and support differentiates the company in a competitive market, ensuring customers feel supported throughout their travel journey.

The company maintains direct contracts with thousands of travel providers globally, offering a vast selection of options. Partnerships with major airlines, hotel chains, and tour operators are crucial. These relationships enable the company to secure competitive deals and provide comprehensive travel solutions.

Flight Centre's value proposition centers on expert advice, access to exclusive deals, comprehensive trip planning, and reliable support. This combination of services differentiates it in a competitive market. The company aims to provide a seamless and valuable travel experience for its customers.

- Expert Advice: Providing personalized travel recommendations and assistance.

- Exclusive Deals: Offering competitive pricing and special offers through strong supplier relationships.

- Comprehensive Planning: Assisting with all aspects of travel, from flights and accommodation to activities and insurance.

- Reliable Support: Ensuring customer satisfaction with dedicated support before, during, and after travel.

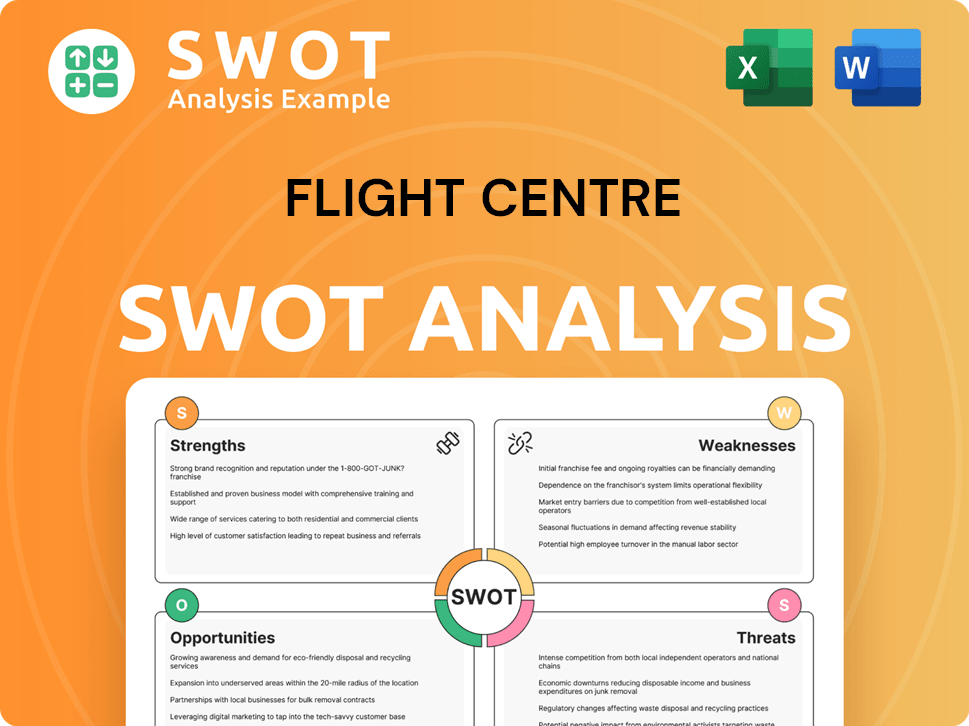

Flight Centre SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Flight Centre Make Money?

The Flight Centre Travel Group generates revenue mainly through commissions and service fees from selling travel products and services. Their main income sources include commissions from airline ticket sales, hotel bookings, tour packages, cruises, car rentals, and travel insurance. They also earn revenue by managing corporate travel services for businesses.

For the first half of the 2024 financial year, Flight Centre reported a total transaction value (TTV) of $13.2 billion, which is a 16.7% increase compared to the previous year. The underlying EBITDA for the same period was $106 million. This indicates strong sales across all segments.

Flight Centre uses various strategies to make money, such as bundling services and offering different prices for corporate clients based on the level of service. They also use preferred supplier agreements to get higher commissions and cross-sell, for example, offering travel insurance or car rentals with flight and accommodation bookings. You can learn more about the company's ownership through this article: Owners & Shareholders of Flight Centre.

The company's revenue mix varies by region, with some areas focusing more on leisure travel and others on corporate travel. They also expand revenue by providing extra services and technology solutions, aiming to diversify beyond just commissions.

- Commissions from airline tickets, hotels, tours, cruises, car rentals, and travel insurance.

- Management fees from corporate travel services.

- Bundling services to increase sales.

- Tiered pricing for corporate clients.

- Preferred supplier agreements for higher commissions.

- Cross-selling travel insurance and car rentals.

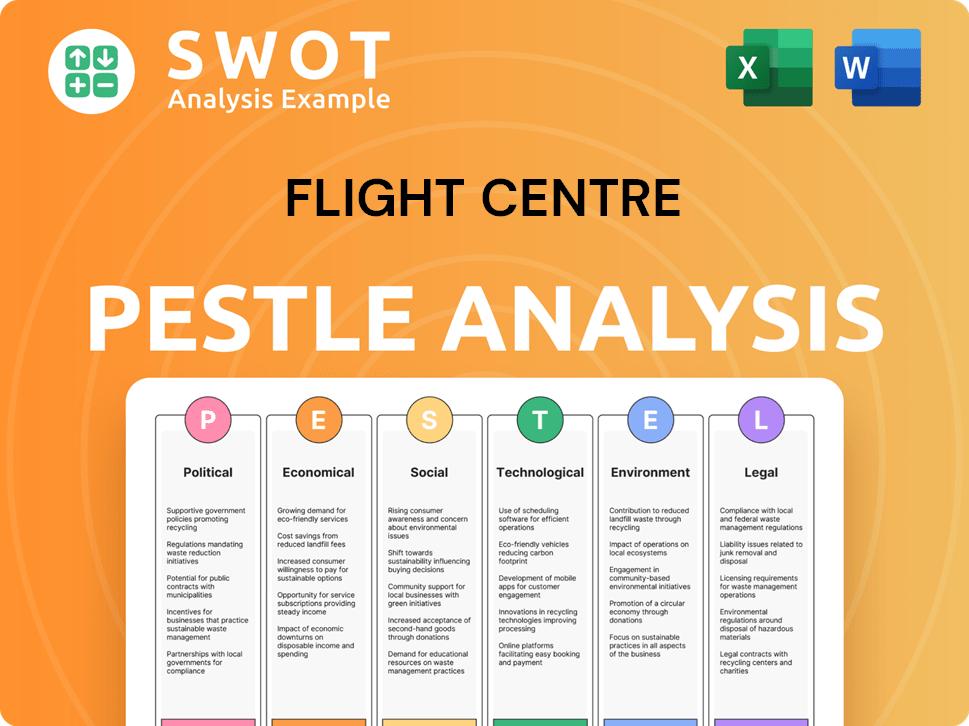

Flight Centre PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Flight Centre’s Business Model?

Flight Centre Travel Group has a rich history marked by significant milestones, strategic shifts, and the navigation of economic challenges. The company’s journey reflects its adaptability and resilience in the dynamic travel industry. Its evolution showcases a commitment to innovation and customer service, solidifying its position as a leading travel agency.

A key strategic move for Flight Centre was its expansion into corporate travel management. This diversification helped to balance its revenue streams, reducing reliance on leisure travel. The company also invested heavily in digital transformation, recognizing the shift in consumer behavior towards online booking platforms and mobile applications. This strategic foresight has been crucial in maintaining its competitive edge.

The COVID-19 pandemic presented an unprecedented challenge. Flight Centre responded by implementing cost-cutting measures, restructuring operations, and focusing on retaining key talent. These actions positioned the company for recovery as travel restrictions eased and demand began to rebound. Flight Centre's ability to adapt and innovate has been critical to its survival and future growth.

Flight Centre's key milestones include its initial public offering, global expansion, and significant acquisitions. These moves have broadened its market reach and service offerings. The company has consistently adapted to changing market conditions, ensuring its long-term viability.

Strategic moves include the diversification into corporate travel, digital transformation, and cost management during the pandemic. Flight Centre has also focused on sustainable travel options and data analytics. These moves have helped the company stay ahead of the competition and meet evolving customer expectations.

Flight Centre’s competitive edge stems from its strong brand recognition, extensive global network, and expert travel consultants. Its significant purchasing power with suppliers allows for competitive pricing. The hybrid model, combining personalized service with digital efficiency, provides a unique value proposition.

In recent financial reports, Flight Centre has shown signs of recovery, driven by increased travel demand. The company's focus on cost efficiency and strategic investments has supported its financial stability. Flight Centre's ability to adapt to market changes has been key to its financial performance.

Flight Centre continues to adapt by focusing on sustainable travel, leveraging data analytics for personalized experiences, and exploring new technologies. These initiatives aim to enhance operational efficiency and customer engagement. The company is committed to staying relevant and competitive in the evolving travel market.

- Focus on sustainable travel options to meet growing customer demand.

- Leveraging data analytics for personalized customer experiences.

- Exploring new technologies to enhance operational efficiency.

- Investing in employee training to maintain service quality.

Flight Centre's success is also influenced by its ability to navigate the competitive landscape. Understanding the Competitors Landscape of Flight Centre is crucial for assessing its market position and strategic choices. The company's focus on customer service, coupled with its global presence and digital investments, positions it well for future growth.

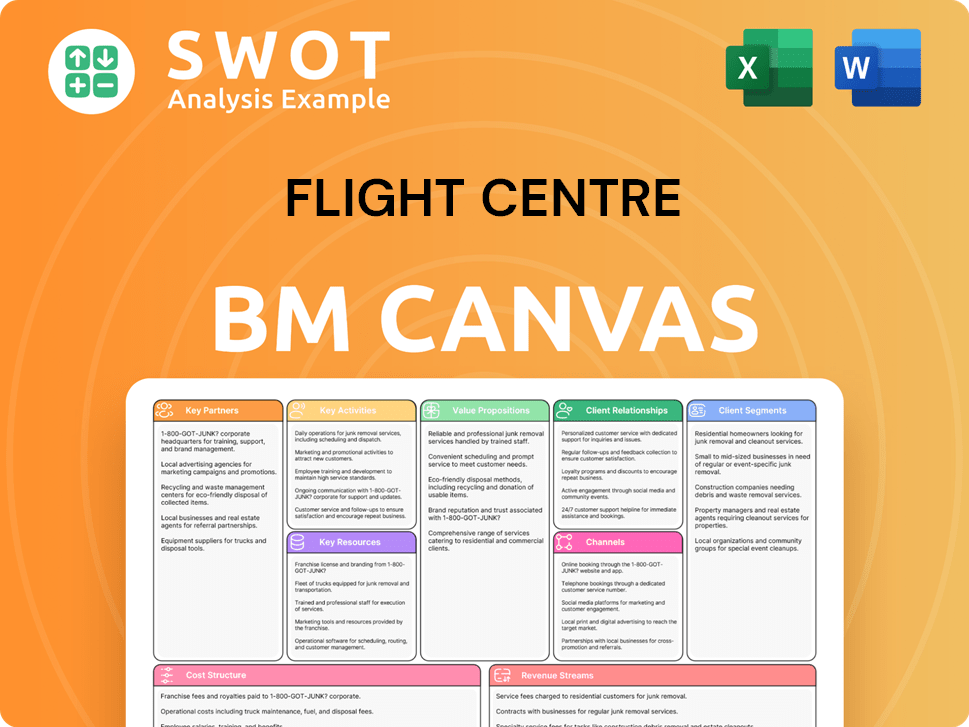

Flight Centre Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Flight Centre Positioning Itself for Continued Success?

Flight Centre Travel Group holds a strong position in the global travel industry, with a significant presence in key markets such as Australia, New Zealand, the UK, and North America. It competes with online travel agencies (OTAs), traditional agencies, and direct booking channels. The company's brand recognition and customer loyalty, especially in the leisure and SME corporate travel sectors, are key strengths.

The company faces risks like geopolitical instability, economic downturns, and competition from OTAs. Regulatory changes and the emergence of new technologies also pose challenges. Flight Centre focuses on technology investments, expanding corporate travel services, and optimizing its retail network to provide a seamless customer experience across online and offline channels.

Flight Centre operates in a competitive travel market, facing rivals such as Expedia and Booking.com. Strong brand recognition and a hybrid model, combining online and offline services, help it maintain a competitive edge. The company's global reach provides a diversified revenue base, mitigating risks associated with regional economic fluctuations.

Key risks include geopolitical instability, economic downturns affecting travel spending, and competition from OTAs. Regulatory changes and technological disruptions also pose challenges. Intense competition puts pressure on margins, requiring continuous innovation and efficiency improvements.

Flight Centre aims to capitalize on the continued recovery of global travel, expand into new markets, and diversify its offerings. Strategic initiatives include further investment in technology and expanding its corporate travel management services. The company's focus is on sustainable growth, customer-centricity, and operational efficiency.

The company is investing in technology to improve its digital platforms and enhance customer experience. Expanding its corporate travel management services globally is another key focus. Optimizing its retail network to provide a seamless hybrid experience is also a priority. These initiatives aim to drive future growth and profitability.

In the first half of fiscal year 2024, Flight Centre reported a total transaction value (TTV) of $10.5 billion, a 20.6% increase compared to the prior corresponding period. The company's underlying profit before tax reached $100 million, demonstrating a strong recovery. Flight Centre's focus on cost management and operational efficiency is crucial for maintaining profitability. The company is expected to continue its growth trajectory by leveraging its strong market position and strategic initiatives.

- Flight Centre's strong performance reflects the ongoing recovery in the travel sector.

- The company's investments in technology and expansion of corporate travel services are key drivers.

- Focus on customer-centricity and operational efficiency supports sustainable growth.

- The company's diversified revenue base helps mitigate risks.

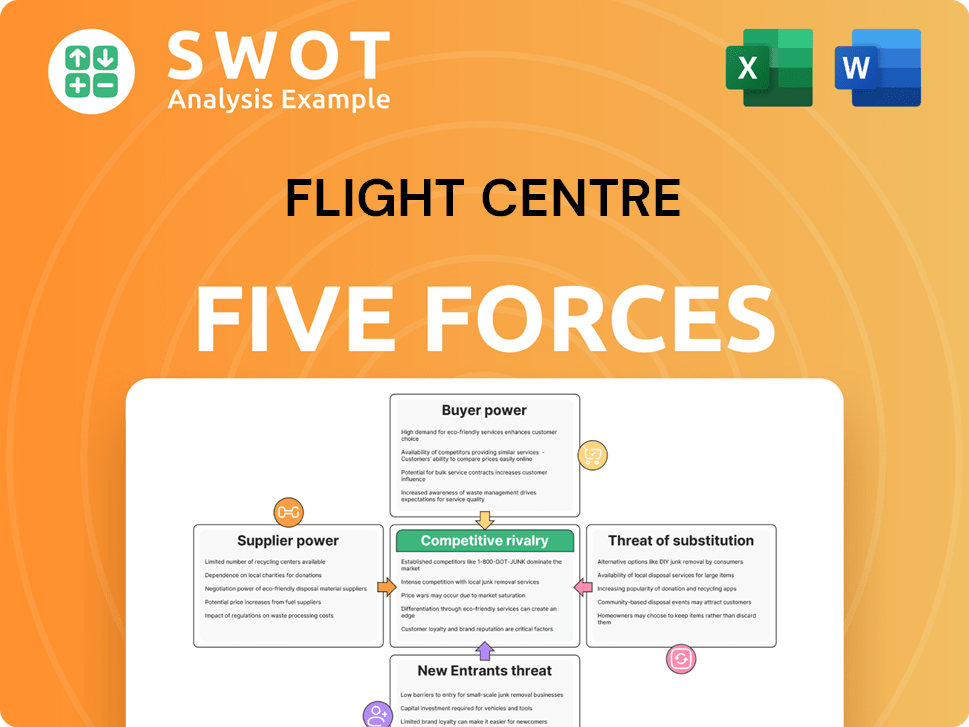

Flight Centre Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Flight Centre Company?

- What is Competitive Landscape of Flight Centre Company?

- What is Growth Strategy and Future Prospects of Flight Centre Company?

- What is Sales and Marketing Strategy of Flight Centre Company?

- What is Brief History of Flight Centre Company?

- Who Owns Flight Centre Company?

- What is Customer Demographics and Target Market of Flight Centre Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.