Fletcher Building Bundle

How Does Fletcher Building Shape Our World?

Fletcher Building Company, a titan in the construction and building materials sector, is a name synonymous with progress in New Zealand and Australia. From skyscrapers to suburban homes, their impact is everywhere. But how does this industry leader actually work, and what makes it tick?

Fletcher Building's influence extends far beyond just construction; understanding its Fletcher Building SWOT Analysis is crucial for anyone seeking to understand the complexities of the ANZ construction sector. Its operations encompass a broad spectrum, from manufacturing essential building products to undertaking massive construction projects. This integrated approach allows Fletcher Building to control key aspects of the construction lifecycle, impacting its financial performance and market share. Delving into the Fletcher Building business model reveals how the company generates revenue and navigates the dynamic construction landscape, making it a compelling subject for investors and industry observers alike.

What Are the Key Operations Driving Fletcher Building’s Success?

Fletcher Building, a prominent player in the construction and building materials sector, operates through a vertically integrated model. This approach encompasses manufacturing, distribution, and construction services, allowing the company to offer a comprehensive suite of products and services. The company serves a diverse customer base, ranging from individual homeowners and small builders to large commercial developers and infrastructure projects. The core of the company's operations lies in its ability to manage the entire lifecycle of building projects, from the sourcing of raw materials to the final construction phase.

The company's value proposition centers on providing integrated solutions that streamline the building process. By controlling various aspects of the supply chain, Fletcher Building aims to deliver consistent product quality, efficient project execution, and a single point of contact for a wide array of building needs. This integrated approach is a key differentiator in a competitive market. This comprehensive capability translates into customer benefits such as consistent product quality, efficient project execution, and a single point of contact for a wide range of building needs, ultimately differentiating it in a competitive market.

Fletcher Building's core offerings include a wide array of building materials such as concrete, steel, timber, insulation, and plasterboard. In addition to these materials, the company provides design, construction, and project management services for both residential and commercial ventures. The company's strategic focus on operational efficiency and customer satisfaction has enabled it to maintain a strong market position. The company's history is detailed in Brief History of Fletcher Building.

Fletcher Building's operations are structured around a vertically integrated business model. This model includes manufacturing, distribution, and construction services. The company's key offerings span various building materials and construction services, catering to a broad customer base.

The value proposition focuses on integrated solutions, ensuring consistent product quality and efficient project execution. It offers a single point of contact for various building needs. This approach streamlines the building process, providing a competitive advantage.

Fletcher Building's product range includes concrete, steel, timber, insulation, and plasterboard. It also provides design, construction, and project management services. These offerings cater to both residential and commercial projects.

Operational processes are meticulously managed, starting from sourcing raw materials. Manufacturing facilities are strategically located across New Zealand and Australia. A robust logistics and distribution network ensures timely delivery to construction sites.

Fletcher Building's integrated supply chain provides greater control over quality, cost, and delivery schedules. This comprehensive capability translates into customer benefits such as consistent product quality and efficient project execution.

- Enhanced Control: The integrated model allows for better management of the entire process.

- Cost Efficiency: Streamlined operations help in reducing costs.

- Quality Assurance: Consistent product quality is a key focus.

- Customer Satisfaction: Efficient project execution leads to higher customer satisfaction.

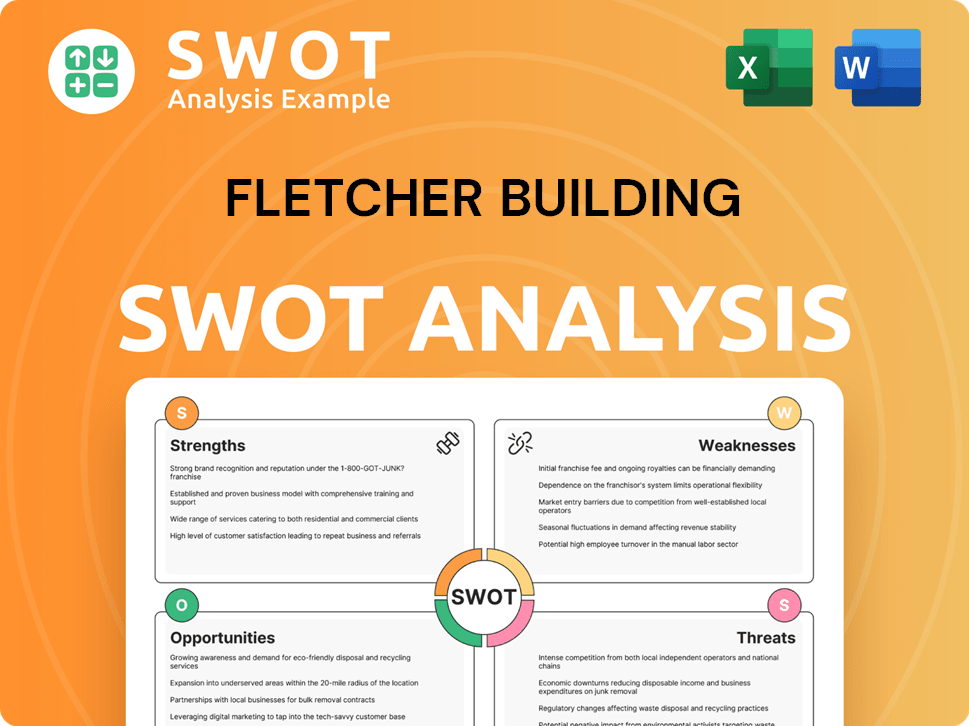

Fletcher Building SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Fletcher Building Make Money?

Fletcher Building Company, a major player in the construction and building materials sector, generates revenue through a multifaceted approach. Its revenue streams are primarily divided between product sales and construction project revenue, reflecting its integrated business model. The company's financial performance highlights the significance of these diverse income sources.

The company's financial results for the first half of the 2024 financial year demonstrate its revenue-generating capacity. Total revenue reached NZ$4,286 million, showcasing the scale of its operations and market presence. This figure is a crucial indicator of the company's financial health and its ability to capitalize on market opportunities.

Fletcher Building's revenue streams are diversified, with product sales and construction services contributing significantly. The building products division, including segments like Concrete and Infrastructure, and Materials and Distribution, is a key revenue driver. The company also leverages various monetization strategies to optimize its financial performance.

Product sales form a significant portion of Fletcher Building's revenue. This includes a wide array of building materials. For instance, in the first half of FY24, the Materials and Distribution segment achieved NZ$1,732 million in revenue.

Revenue is also generated from large-scale construction projects. These projects involve providing project management, design, and construction services. The revenue from these projects fluctuates based on the market and project pipelines.

The Concrete and Infrastructure division is a key segment, contributing substantially to revenue. In the first half of FY24, this division recorded NZ$936 million in revenue. This highlights the importance of infrastructure projects.

The Materials and Distribution segment is another major contributor to revenue. This segment's strong performance reflects the demand for building materials. The segment achieved NZ$1,732 million in revenue in the first half of FY24.

Fletcher Building employs various monetization strategies. These include tiered pricing, cross-selling, and leveraging its distribution network. These strategies help maximize reach and sales.

The company continuously evaluates its revenue mix to adapt to market demands. This includes a focus on improving profitability across different segments. This ensures the company remains competitive.

Fletcher Building’s business model is supported by its diverse revenue streams. The company's ability to generate revenue from both product sales and construction projects showcases its resilience. For more insights, consider exploring the Competitors Landscape of Fletcher Building.

Fletcher Building's financial performance is largely driven by its product sales and construction revenue. The company's strategic approach to revenue generation includes tiered pricing, cross-selling, and an extensive distribution network.

- Product Sales: Building materials contribute significantly.

- Construction Projects: Large-scale projects generate revenue.

- Tiered Pricing: Pricing varies based on volume.

- Cross-selling: Offering multiple materials to clients.

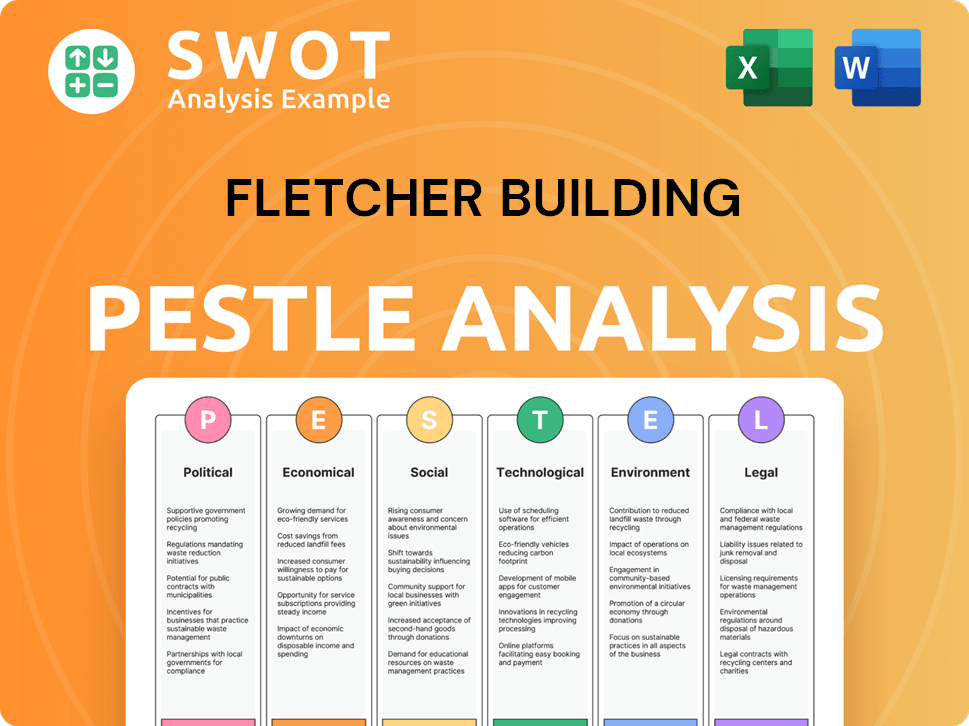

Fletcher Building PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Fletcher Building’s Business Model?

Fletcher Building Company has navigated a complex industry landscape, marked by significant milestones and strategic shifts. The company's operations have been influenced by external factors like adverse weather and fluctuating market conditions, particularly in the Australian residential sector. Despite these challenges, Fletcher Building has focused on enhancing operational efficiency and project delivery, demonstrating adaptability in a dynamic environment.

A key strategic move for Fletcher Building has been its focus on improving operational efficiency and project delivery. In the first half of FY24, the Australian Construction division reported a profit after tax of NZ$14 million, a notable turnaround from a loss in the prior comparable period. This improvement reflects successful strategic adjustments and a commitment to financial resilience. Furthermore, the company has addressed challenges in its New Zealand Construction division by implementing a new operating model to improve project performance and mitigate risks.

Fletcher Building's competitive edge is rooted in its strong brand recognition, extensive product portfolio, and integrated operational model. The company's ability to manufacture, distribute, and construct provides a unique end-to-end solution, fostering economies of scale and control over the supply chain. Its long-standing presence in New Zealand and Australia has also built significant customer loyalty and an established distribution network. For more insights into the company's strategic direction, consider reading about the Growth Strategy of Fletcher Building.

Fletcher Building's history includes significant milestones, such as expansions and strategic acquisitions. The company has adapted to changing market demands and economic cycles. These key milestones have shaped Fletcher Building's current operational structure and market position.

Strategic moves include adjustments to operational models and responses to market challenges. The company has focused on improving operational efficiency and project delivery. These moves are aimed at enhancing profitability and maintaining a competitive edge in the construction industry.

Fletcher Building's competitive advantages include brand recognition and an integrated operational model. The company's ability to manufacture, distribute, and construct provides a unique end-to-end solution. This integrated approach fosters economies of scale and control over the supply chain.

Fletcher Building is adapting to new trends, such as sustainability in construction. The company is developing and promoting environmentally friendly building materials and practices. This focus on sustainability helps to meet evolving market demands and competitive pressures.

In the first half of FY24, the Australian Construction division reported a profit after tax of NZ$14 million, a significant improvement. The company continues to focus on operational improvements and strategic management of its diverse portfolio. These efforts are aimed at sustaining its business model amidst evolving market demands and competitive pressures.

- The company's strong brand recognition and extensive product portfolio contribute to its market position.

- Fletcher Building's integrated operational model, encompassing manufacturing, distribution, and construction, sets it apart.

- The company's long-standing presence in New Zealand and Australia has built customer loyalty.

- Fletcher Building is committed to sustainability, developing environmentally friendly building materials.

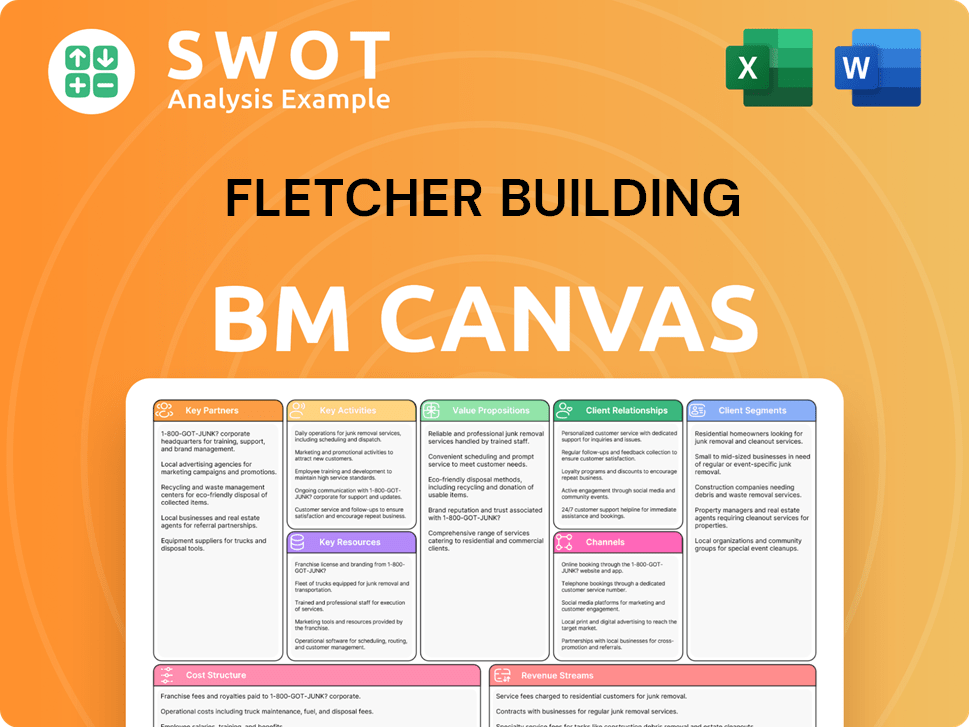

Fletcher Building Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Fletcher Building Positioning Itself for Continued Success?

Fletcher Building Company holds a significant industry position within the construction and building materials sectors across New Zealand and Australia. Its market dominance is reflected in its substantial market share in key building material segments and its involvement in major construction projects. The company's integrated business model and established relationships contribute to its strong customer loyalty, making it a key player in the region.

However, this position is not without its challenges. The company faces risks associated with the cyclical nature of the construction industry, including economic downturns, interest rate fluctuations, and changes in government policies. Supply chain disruptions, rising material costs, and labor shortages also pose ongoing hurdles. Furthermore, the emergence of new technologies and innovative materials from competitors could disrupt traditional market dynamics, impacting the company's future outlook.

Fletcher Building is a dominant player in the building materials and construction sectors across New Zealand and Australia. Its integrated business model and long-standing relationships contribute to its strong market position. The company's comprehensive offering and substantial market share in key segments underscore its influence.

The construction industry's cyclical nature, economic downturns, and interest rate fluctuations pose significant risks. Supply chain disruptions, rising material costs, and labor shortages add to the challenges. Regulatory changes and the emergence of new technologies also present ongoing hurdles for the company.

Fletcher Building is focused on enhancing profitability and operational efficiency across its divisions. The company aims to improve performance in its Australian businesses and is implementing a new operating model in New Zealand Construction. The future depends on effective market volatility management and strategic investments.

The company is committed to sustainable practices and leveraging its integrated model for growth. It is strategically focused on areas that will sustain its competitive edge and expand its revenue-generating capabilities. This involves adapting to market changes and capitalizing on infrastructure and commercial construction opportunities.

Fletcher Building is actively working on several fronts to navigate the current market conditions and secure its future. The company is prioritizing operational excellence and strategic investments. These efforts are designed to improve project delivery and enhance overall financial performance. For more insights, see the Growth Strategy of Fletcher Building.

- Improving project delivery in the New Zealand Construction division.

- Enhancing operational efficiency across all business units.

- Focusing on sustainable practices and environmental standards.

- Leveraging its integrated business model for future growth.

Fletcher Building Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fletcher Building Company?

- What is Competitive Landscape of Fletcher Building Company?

- What is Growth Strategy and Future Prospects of Fletcher Building Company?

- What is Sales and Marketing Strategy of Fletcher Building Company?

- What is Brief History of Fletcher Building Company?

- Who Owns Fletcher Building Company?

- What is Customer Demographics and Target Market of Fletcher Building Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.