Gerdau (Cosigua) Bundle

How Does Gerdau Cosigua Forge Its Path in the Steel Industry?

Gerdau S.A., a major player in the global steel arena, consistently demonstrates its significant influence. With a market capitalization of $5.55 billion as of April 2025, and impressive shareholder returns in 2024, the Gerdau (Cosigua) SWOT Analysis reveals a company that has proven its resilience in the face of dynamic market conditions. Gerdau, a leading steel producer in the Americas, plays a crucial role in industries like construction and manufacturing.

This exploration into Gerdau Cosigua will illuminate how the company operates within the Brazilian steel industry and beyond. Understanding Gerdau's operations, from its steel production processes to its financial performance, is key for investors and industry watchers. We'll uncover the company's core strategies, key milestones, and competitive advantages, providing a comprehensive view of its market position and future outlook. Discover how Gerdau utilizes recycled steel and its impact on the local economy.

What Are the Key Operations Driving Gerdau (Cosigua)’s Success?

Gerdau's core operations center on transforming iron ore and steel scrap into a wide array of steel products. This process serves various customer segments across the construction, manufacturing, and agricultural sectors globally. The company's extensive product portfolio includes long steel, flat steel, specialty steel, and semi-finished products.

The operational processes are robust and integrated, with Gerdau operating a significant number of mills worldwide. A key aspect of Gerdau's operations is its commitment to sustainability, particularly its high rate of steel production from recycled scrap. This focus not only supports environmental stewardship but also provides a strategic input source.

Gerdau's value proposition lies in its ability to provide high-strength, ductile, and weldable steel products. Its integrated supply chain, encompassing raw material sourcing, manufacturing, and distribution, contributes to its operational effectiveness. Technology development, including digitalization and automation, further enhances efficiency and production capabilities.

The process involves melting iron ore and steel scrap in electric arc furnaces or integrated blast furnaces. The molten steel is then refined, cast into various shapes, and rolled into finished products. This process ensures the production of high-quality steel products.

Gerdau operates a network of mills across North America, Brazil, and other countries. This global presence allows the company to serve a diverse customer base. The company's extensive reach is a key factor in its market position.

Gerdau is committed to sustainable practices, with a significant portion of its steel produced from recycled scrap. This approach reduces environmental impact and supports a circular economy. The company's sustainability efforts are a key part of its operations.

Gerdau offers consistent product quality, reliable supply, and tailored solutions for specific industry needs. These capabilities are crucial for meeting customer demands. The company's focus on customer satisfaction is a key element of its value proposition.

Gerdau operates 29 mills globally, with a significant presence in North America and Brazil. The company's production structure includes 75% electric arc furnaces and 25% integrated blast furnaces. Gerdau's commitment to sustainability is evident in its use of recycled scrap, making it the largest scrap recycler in Latin America.

- Gerdau produces a wide range of steel products, including long steel, flat steel, and specialty steel.

- The company has a strong focus on technological advancements, including digitalization and automation.

- Gerdau's integrated supply chain enhances operational efficiency and product quality.

- Gerdau's operations contribute significantly to the Target Market of Gerdau (Cosigua).

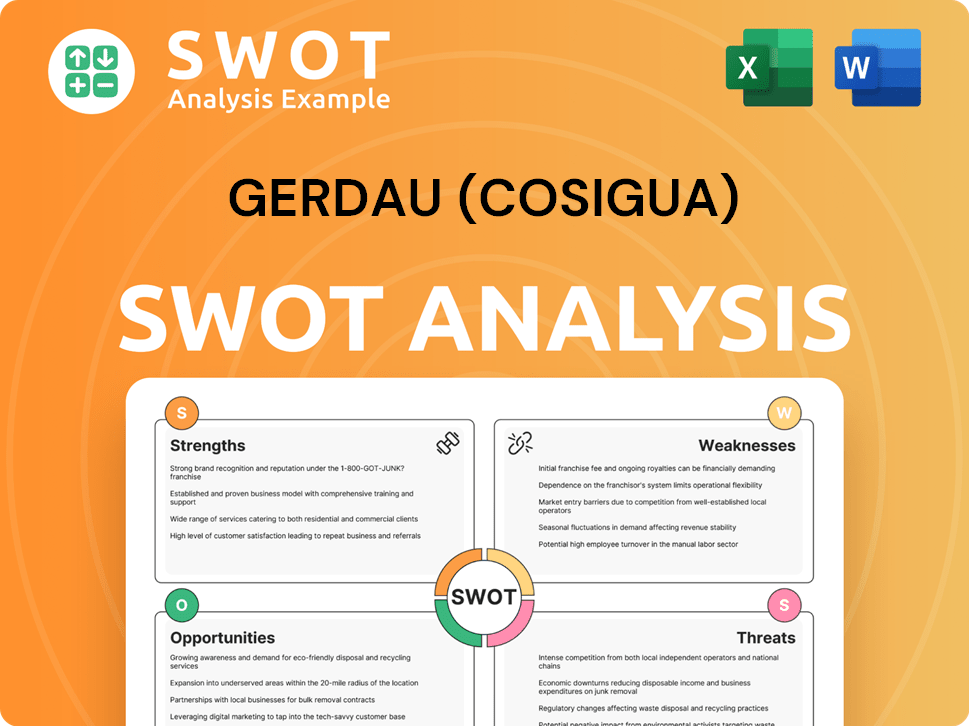

Gerdau (Cosigua) SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Gerdau (Cosigua) Make Money?

Gerdau, including its subsidiary Cosigua, primarily generates revenue through the sale of its steel products. These products serve various sectors, including construction, manufacturing, and agriculture. The company's focus on steel production is central to its revenue model, driving its financial performance.

The company's revenue is geographically diversified, with significant contributions from North America and Brazil. Gerdau's operations are strategically positioned to capitalize on market demands and economic trends in these regions. The company's financial strategies are designed to maximize profitability and maintain a competitive edge in the steel industry.

For fiscal year 2024, Gerdau reported a revenue of approximately $15 billion. In the first quarter of 2025, net sales revenues increased by 7.19% to BRL 17.375 billion. This growth reflects the company's strong market position and effective operational strategies, as discussed in the Marketing Strategy of Gerdau (Cosigua).

Gerdau employs several monetization strategies to enhance its financial performance. These strategies include direct product sales, capacity expansion, and cost-cutting initiatives. Strategic investments in higher value-added steel production and operational efficiency are key components of Gerdau's approach.

- Product Sales: Primary revenue stream through the sale of steel products to various sectors.

- Geographic Diversification: Revenue mix is geographically diversified, with North America and Brazil as key contributors. In Q1 2025, North America accounted for 50% of the group's net sales, while Brazil was responsible for 43%, and South America (excluding Brazil) for 7%.

- Capacity Expansion: Strategic investments in capacity expansion and modernization to increase the volume of higher value-added steel production, such as the new hot-rolled coil mill expansion at Ouro Branco, Minas Gerais.

- Cost Optimization: Focus on cost-cutting initiatives and optimizing its operational footprint to improve margins.

- Strategic Investment: Significant capital expenditure, with R$6 billion planned for 2025, focused on maintenance and competitiveness initiatives to support revenue growth.

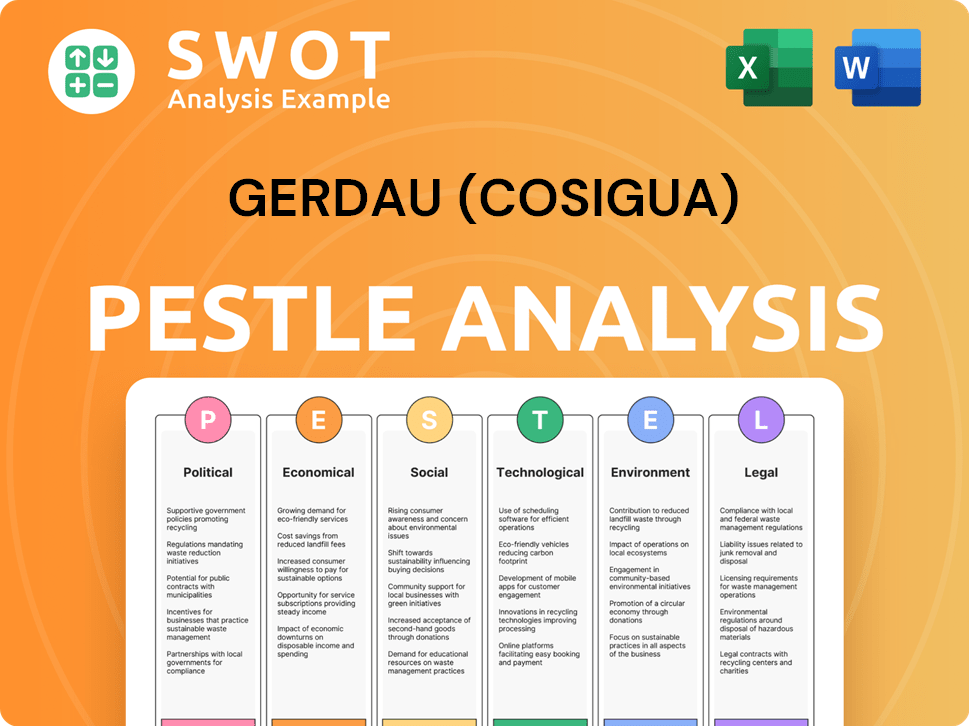

Gerdau (Cosigua) PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Gerdau (Cosigua)’s Business Model?

Gerdau's journey, particularly that of Gerdau Cosigua, is marked by key milestones and strategic shifts that have significantly shaped its operational and financial landscape. Founded in 1901, the company entered steel production in 1967 with the acquisition of Siderúrgica Riograndense. This initial step was crucial, setting the stage for subsequent expansions and solidifying its presence in the steel industry.

The 1980s saw the beginning of its international expansion, a move that eventually led to a strong presence in North America with the 1999 acquisition of AmeriSteel. Further highlighting its commitment to sustainability, Gerdau became the largest recycler in Latin America in 2006. These strategic moves demonstrate the company's adaptability and forward-thinking approach to growth and market demands.

The Gerdau Cosigua has faced several operational and market challenges, including fluctuations in raw material prices and increased competition from imports. In Q1 2025, the Brazilian domestic market experienced a significant impact from high imported steel penetration. Imports of rolled steel were 34.0% higher compared to Q1 2024. In response, Gerdau has implemented cost-cutting measures, optimized its operational footprint, revised logistics networks, and modernized its industrial processes to enhance its competitive position.

Gerdau entered steel production in 1967. International expansion began in the 1980s. The acquisition of AmeriSteel in 1999 marked a significant presence in North America. Gerdau became the largest recycler in Latin America in 2006.

Cost-cutting initiatives and operational footprint optimization. Revised logistics networks and modernization of industrial processes. A significant capital expenditure plan of approximately R$6 billion per year. Share buyback programs to manage shareholder value.

Strong brand and extensive operational footprint across the Americas. Investments in digitalization and automation for enhanced efficiency. Economies of scale from a large production capacity of over 15 million tons of crude steel annually. Emphasis on using recycled scrap metal for 70% of its steel production.

Ongoing capital expenditure plan of approximately R$6 billion per year, focusing on new iron ore treatment plants in Brazil. Expansion of capacity at the Midlothian plant in the U.S. Expansion of hot-rolled coil steel and rolling mill capacity. New share buyback program approved in January 2025 to acquire up to 64.5 million shares.

Gerdau Cosigua maintains a competitive edge through several key factors. Its brand strength and extensive operational footprint across the Americas provide significant market reach. Technology leadership, evidenced by investments in digitalization and automation, enhances efficiency and steel production. Economies of scale, derived from its large production capacity, contribute to cost competitiveness.

- The company's focus on using recycled scrap metal, accounting for 70% of its steel production, provides a 'green advantage' and aligns with sustainability trends.

- Strategic moves in 2024-2025 include a significant capital expenditure plan of approximately R$6 billion per year.

- Gerdau actively manages shareholder value through share buyback programs, with a new program approved in January 2025 to acquire up to 64.5 million shares.

- These initiatives are crucial for maintaining and improving Gerdau's operations in the dynamic Brazilian steel industry.

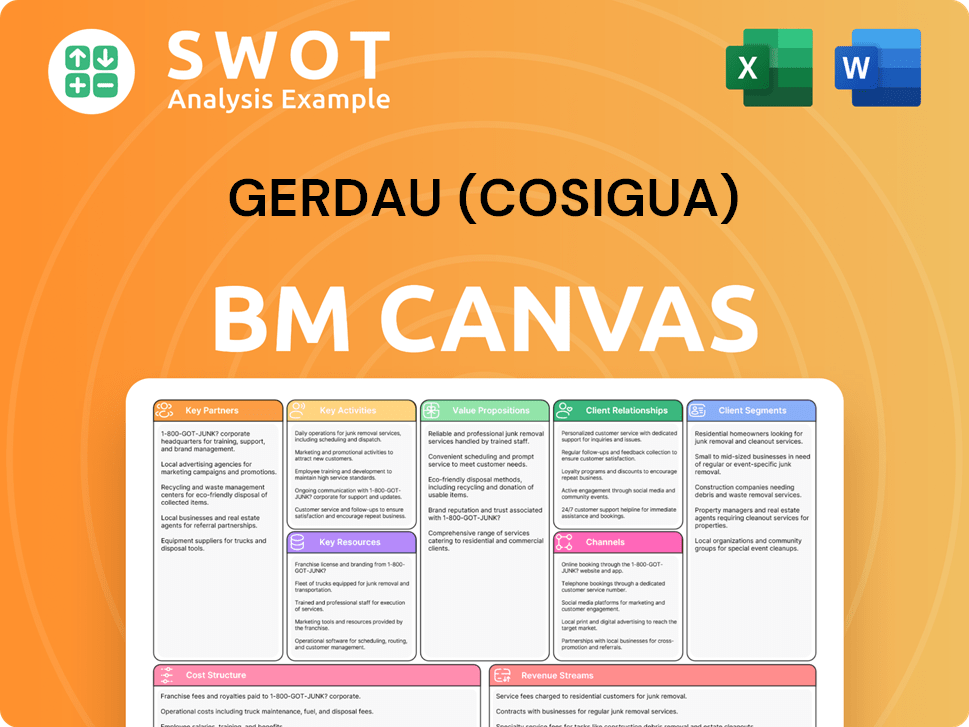

Gerdau (Cosigua) Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Gerdau (Cosigua) Positioning Itself for Continued Success?

Gerdau S.A., including its Cosigua operations, holds a strong position in the steel industry. It is a major player in the Americas and a significant global supplier of long steel products. In Q1 2025, the company's net sales were primarily driven by North America and Brazil, representing 50% and 43% of sales, respectively. This diversification helps to stabilize cash flow by reducing the impact of downturns in any single market.

However, Gerdau faces challenges. Fluctuating steel prices and raw material costs can significantly affect revenue and profitability. Increased import volumes, particularly in Brazil, and regulatory changes, such as potential U.S. tariffs, create market uncertainty. Understanding these factors is crucial for assessing the future of Gerdau and its subsidiaries like Cosigua. For more insights, consider exploring the Competitors Landscape of Gerdau (Cosigua).

Gerdau is one of the largest steel producers in the Americas. It is a key global supplier of long steel products. Its diversified asset portfolio helps to mitigate the impact of economic downturns in specific markets, supporting stable cash flow.

Gerdau faces risks from volatile global steel prices and raw material costs. Increased import volumes, especially in Brazil, and regulatory changes, such as tariffs, can also influence demand and supply dynamics. These factors can affect profitability and market competitiveness.

Gerdau plans a R$6.0 billion investment for 2025, focusing on maintenance and competitiveness initiatives. The company is also investing in decarbonization efforts and aims to become one of the safest, most profitable, and admired steel companies globally within 10 years.

Key initiatives include expanding hot-rolled coil capacity for higher-value steel production. Gerdau is also focused on reducing its reliance on fossil fuels through acquisitions like hydroelectric plants and optimizing its operational footprint.

Gerdau's future is shaped by its strategic initiatives and innovation roadmaps. The company's focus includes investments in production capacity, decarbonization, and operational efficiency, aiming for sustained profitability and shareholder returns.

- R$6.0 billion investment planned for 2025.

- Focus on expanding hot-rolled coil capacity.

- Emphasis on decarbonization and ESG compliance.

- Goal to be a leading steel company in safety, profitability, and admiration.

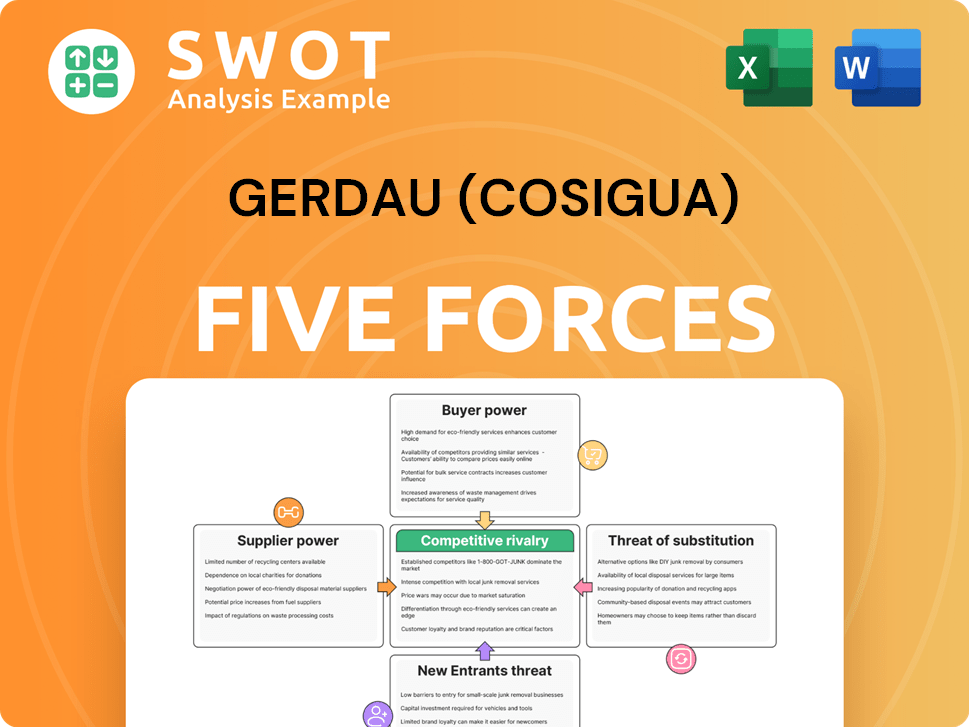

Gerdau (Cosigua) Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Gerdau (Cosigua) Company?

- What is Competitive Landscape of Gerdau (Cosigua) Company?

- What is Growth Strategy and Future Prospects of Gerdau (Cosigua) Company?

- What is Sales and Marketing Strategy of Gerdau (Cosigua) Company?

- What is Brief History of Gerdau (Cosigua) Company?

- Who Owns Gerdau (Cosigua) Company?

- What is Customer Demographics and Target Market of Gerdau (Cosigua) Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.