Hermès International Bundle

Unveiling the Secrets of Hermès International: How Does It Thrive?

Hermès International, a name synonymous with luxury, consistently captivates the global market with its enduring appeal and impressive financial performance. In 2023, the French company reported a remarkable revenue surge, demonstrating its unwavering influence within the luxury goods sector. This success story, built on iconic products and meticulous craftsmanship, demands a closer look at the inner workings of this fashion brand.

From its iconic leather goods to its diverse range of offerings, understanding Hermès's operational strategies is key. This exploration will unravel the company's core operations, revenue streams, and market positioning. For those seeking deeper insights, a detailed Hermès International SWOT Analysis can provide a comprehensive view of its strengths, weaknesses, opportunities, and threats, further enhancing your understanding of this luxury powerhouse and its enduring success in the competitive landscape.

What Are the Key Operations Driving Hermès International’s Success?

The core operations of Hermès International are carefully designed to create and deliver exceptional value through its range of luxury goods. The company's primary value proposition is its commitment to unparalleled craftsmanship, superior quality materials, and timeless design, catering to an affluent global clientele. Its core products include leather goods and saddlery, ready-to-wear and accessories, silk and textiles, perfumes and beauty, watches, jewelry, and Hermès Maison (home furnishings).

The operational processes behind these offerings are deeply rooted in artisanal expertise and vertical integration. Manufacturing mainly occurs in France, emphasizing traditional techniques and highly skilled artisans. For instance, leather goods production involves meticulous handcrafting, often by a single artisan, ensuring unique quality and attention to detail. Sourcing of raw materials, particularly exotic leathers, is subject to stringent quality controls and ethical considerations. The company maintains tight control over its supply chain, fostering long-term relationships with suppliers to secure the finest materials. Sales channels are primarily through its extensive network of directly operated stores, which numbered 300 worldwide as of December 31, 2023, allowing for direct engagement with customers and control over the brand experience.

Hermès International's main product categories include leather goods and saddlery, ready-to-wear and accessories, silk and textiles, perfumes and beauty, watches, jewelry, and Hermès Maison. Leather goods and saddlery consistently contribute the most to revenue. The company's product range reflects its dedication to luxury and craftsmanship.

Manufacturing is primarily based in France, emphasizing traditional techniques and highly skilled artisans. Leather goods are often handcrafted by a single artisan, ensuring unique quality. This focus on craftsmanship is a key differentiator for the Hermès International brand.

Hermès maintains tight control over its supply chain to secure the finest materials. Sourcing of raw materials, especially exotic leathers, is subject to stringent quality controls and ethical considerations. The company's long-term relationships with suppliers are crucial for maintaining its high standards.

The company's primary sales channels are its directly operated stores, which numbered 300 worldwide by the end of 2023. These stores allow for direct customer engagement and control over the brand experience. A selective e-commerce presence complements its physical retail footprint.

Hermès's operational uniqueness stems from its dedication to artisanal heritage, scarcity management, and a long-term strategic vision. Unlike many luxury brands, Hermès prioritizes controlled growth and maintaining exclusivity, creating a sense of rarity and desirability. These operational strengths translate into significant customer benefits.

- Products of enduring quality that often appreciate in value.

- A highly personalized shopping experience.

- The prestige associated with owning a piece of Hermès craftsmanship.

- The company's operational discipline and commitment to its founding principles are key differentiators in the luxury market.

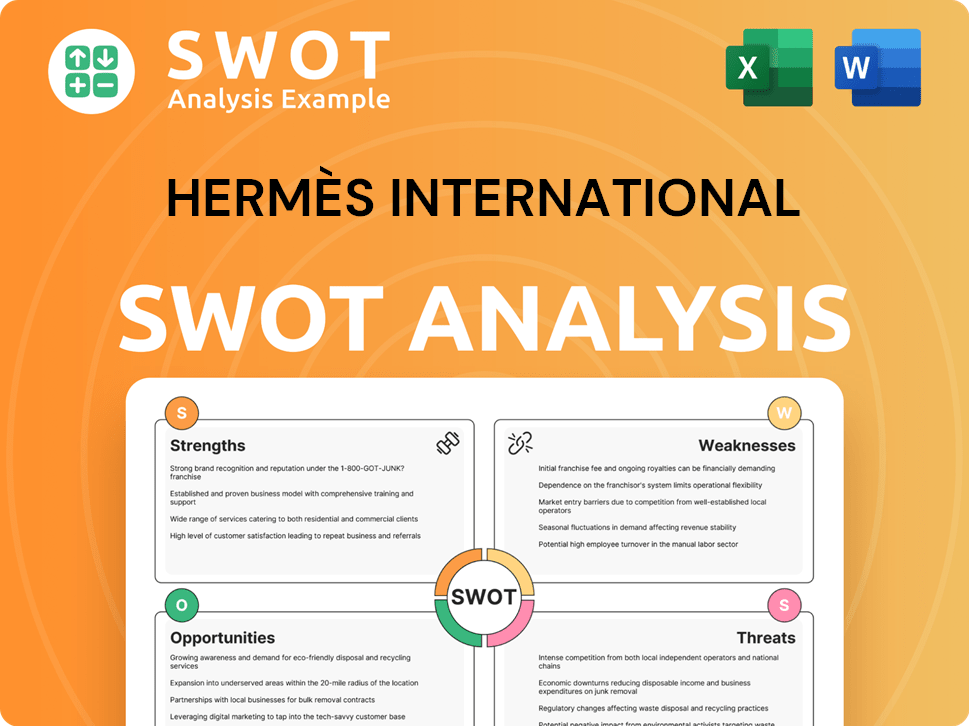

Hermès International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hermès International Make Money?

The business model of Hermès International revolves around the sale of luxury goods, with a focus on high-quality craftsmanship and exclusivity. The French company generates revenue through various product categories, primarily selling directly to consumers through its own stores. Its monetization strategies emphasize direct retail sales, wholesale, and licensing agreements, with direct retail being the most significant.

Hermès International has a well-defined revenue model, primarily driven by its diverse product portfolio. The company's ability to maintain brand value and customer loyalty is central to its financial success. This approach allows the company to maintain control over its brand image and customer experience.

Hermès's revenue streams are diverse, with leather goods and saddlery being the most significant contributor. Other key categories include ready-to-wear and accessories, silk and textiles, perfumes and beauty, watches, jewelry and Hermès Maison, and other products. The company's financial performance reflects the strength of its brand and its ability to attract and retain high-end consumers.

This is the largest revenue stream for Hermès, driven by iconic handbags and other leather products. In 2023, this category accounted for €5.515 billion, representing 40.9% of total revenue. The enduring demand for these items underscores the brand's heritage and investment value.

This segment includes clothing, footwear, and accessories. It generated €3.987 billion in 2023, contributing 29.6% of total revenue. This category reflects the brand's expansion beyond its core leather goods.

Scarves, ties, and other textile accessories contributed €1.073 billion in 2023, accounting for 8.0% of total revenue. These items are popular for their design and brand recognition.

This segment includes fragrances, makeup, and skincare products. Revenue from this category was €0.474 billion in 2023, representing 3.5% of total revenue. This category allows Hermès to reach a broader customer base.

Sales of Hermès timepieces contributed €0.627 billion in 2023, or 4.7% of total revenue. The watch category reflects the brand's focus on craftsmanship and luxury.

This combined category, encompassing fine jewelry and home furnishings, generated €0.556 billion in 2023, making up 4.1% of total revenue. This segment extends the brand's presence in the luxury market.

This smaller category accounted for €0.126 billion in 2023, or 0.9% of total revenue. This includes a variety of products that complement the core offerings.

Hermès primarily monetizes through its directly operated stores, which accounted for approximately 83% of total revenue in 2023. This strategy allows the company to control pricing, brand presentation, and customer experience. The remaining revenue comes from wholesale activities and licensing agreements.

- Direct Retail: The company's own stores are the primary channel, ensuring control over brand image and customer experience.

- Wholesale: Sales to department stores and other authorized retailers contribute to revenue.

- Licensing: Licensing agreements, primarily for eyewear, represent a smaller portion of revenue.

- Controlled Supply and Scarcity: Hermès employs this strategy, particularly for its most coveted items, to fuel demand and maintain high price points.

- Product Category Expansion: The brand has strategically expanded into categories like beauty and home furnishings to diversify its revenue base.

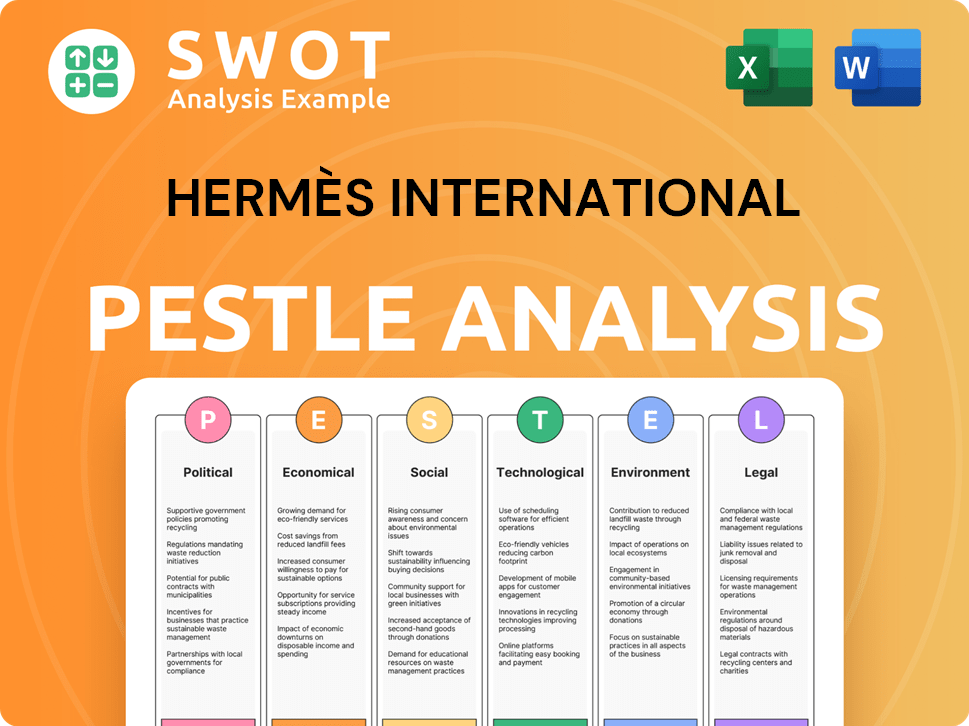

Hermès International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Hermès International’s Business Model?

The story of Hermès International is marked by significant milestones and strategic decisions that have shaped its operational and financial success. A key ongoing strategy involves the continuous expansion and renovation of its global retail network, particularly in key luxury markets. This includes opening new stores and refurbishing existing ones to enhance its direct-to-consumer reach and brand experience. The company has consistently demonstrated strong revenue growth across various regions and product categories, showcasing its resilience and the increasing global demand for its products.

Hermès Company has navigated operational challenges, such as supply chain disruptions, by leveraging its vertically integrated manufacturing and long-standing supplier relationships. Its focus on in-house production, primarily in France, provides greater control over quality and lead times, mitigating external dependencies. The company's ability to maintain its unique identity and product integrity stems from its strategic focus on organic growth and a cautious approach to expansion, rather than aggressive acquisitions. This approach has allowed it to maintain its unique identity and product integrity.

Hermès International has a multifaceted competitive edge deeply rooted in its business model. Its brand strength and heritage, cultivated over nearly two centuries, evoke a sense of timeless luxury, exclusivity, and prestige. This strong brand equity allows Hermès to command premium pricing and fosters exceptional customer loyalty. The brand's commitment to artisanal craftsmanship, with many products handmade by skilled artisans, ensures superior quality and durability, differentiating it from mass-produced luxury goods. This emphasis on craftsmanship also contributes to the perceived scarcity of its products, particularly iconic items like the Birkin and Kelly bags, which often have extensive waiting lists.

Consistent double-digit revenue growth across various regions and product categories. In 2023, all regions posted strong growth, with Asia excluding Japan up 19%, Japan up 26%, America up 20%, and Europe excluding France up 18%. The opening or renovation of several stores, including a new flagship store in Chengdu, China, and significant renovations in cities like New York and Paris, enhancing its direct-to-consumer reach and brand experience.

Continuous expansion and renovation of its global retail network, particularly in key luxury markets. Leveraging vertically integrated manufacturing and long-standing relationships with suppliers to navigate operational challenges. Strategic focus on organic growth and a cautious approach to expansion, maintaining its unique identity and product integrity.

Unparalleled brand strength and heritage, evoking timeless luxury and prestige. Commitment to artisanal craftsmanship, ensuring superior quality and durability. Highly controlled distribution network, primarily through directly operated stores, enabling stringent brand management and personalized customer service.

Hermès has consistently demonstrated strong revenue growth. In 2023, the company reported a revenue increase across all regions. For example, Asia excluding Japan saw a 19% increase, Japan saw a 26% increase, America saw a 20% increase, and Europe excluding France saw an 18% increase. The company's financial success is also reflected in its ability to maintain premium pricing and high customer loyalty.

Hermès operates with a business model centered on exclusivity, craftsmanship, and direct-to-consumer retail. The company's operations are characterized by in-house production, primarily in France, ensuring control over quality and lead times. This approach supports the brand's premium positioning and allows for a high degree of brand management.

- Vertically integrated manufacturing, primarily in France.

- Emphasis on artisanal craftsmanship and high-quality materials.

- Controlled distribution through directly operated stores.

- Strategic focus on organic growth and cautious expansion.

For more insights into the ownership structure and key stakeholders, you can explore the details in the article about Owners & Shareholders of Hermès International.

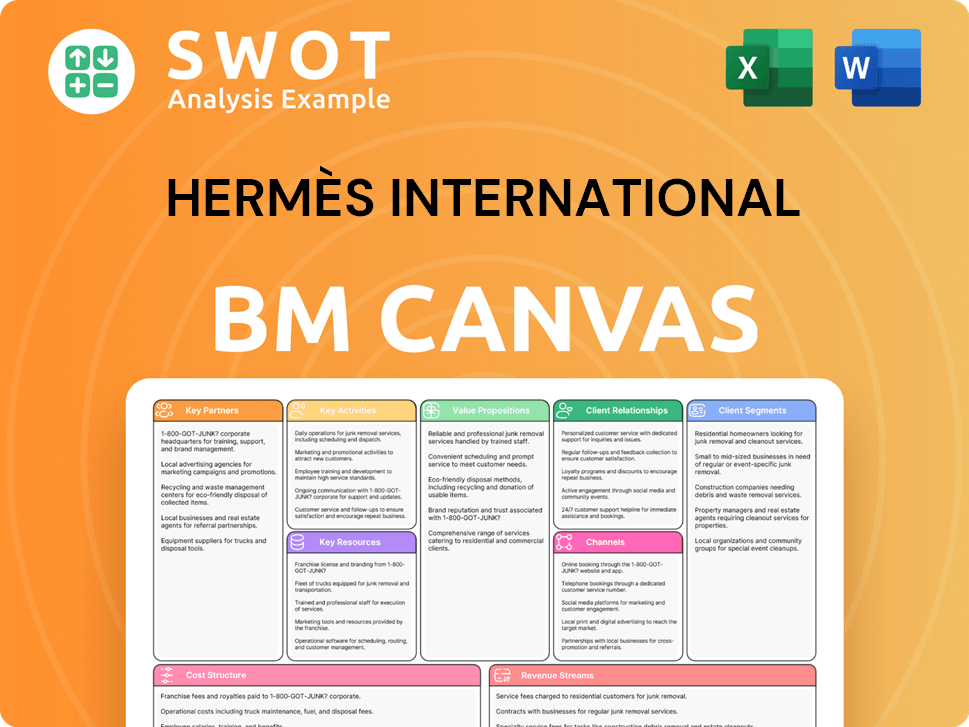

Hermès International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Hermès International Positioning Itself for Continued Success?

Hermès International holds a distinguished position within the global luxury goods market, recognized for its exclusivity, craftsmanship, and brand appeal. While specific market share percentages are not always publicly detailed, the company is a significant player in the ultra-luxury sector, particularly in leather goods. Hermès demonstrates strong customer loyalty and global reach, with approximately 300 directly operated stores worldwide as of December 31, 2023, strategically located in prime luxury shopping destinations.

Despite its strong market position, Hermès faces risks, including economic downturns, regulatory changes, and evolving consumer preferences. Technological disruptions and geopolitical tensions also pose ongoing challenges to its international operations and financial performance. However, the company’s focus on long-term value creation and responsible growth helps mitigate these risks.

Hermès is a leading luxury goods brand, particularly in leather goods. Its products are known for their high quality and are in high demand. The company's global presence is substantial, with a significant number of directly operated stores worldwide.

Economic downturns and regulatory changes pose risks to Hermès. Changing consumer preferences and technological disruptions can also affect the company. Geopolitical tensions and currency fluctuations are additional concerns.

Hermès is focused on sustained growth and innovation. The company is investing in its manufacturing capabilities and plans to open new leather goods workshops. Hermès aims to maintain its appeal to its discerning clientele.

The company is expanding its beauty and home collections. It is investing in digital platforms to enhance the online customer experience. Hermès is committed to long-term value creation and responsible growth.

Hermès is focused on expanding its production capacity and maintaining its commitment to craftsmanship. The company's innovation roadmap includes subtle evolutions in product design and an enhanced online customer experience. Hermès aims to sustain its ability to make money through timeless products and exceptional quality.

- Investment in manufacturing capabilities, including new workshops in France.

- Expansion of product offerings, including beauty and home collections.

- Enhancement of digital platforms to improve the online customer experience.

- Commitment to long-term value creation and responsible growth.

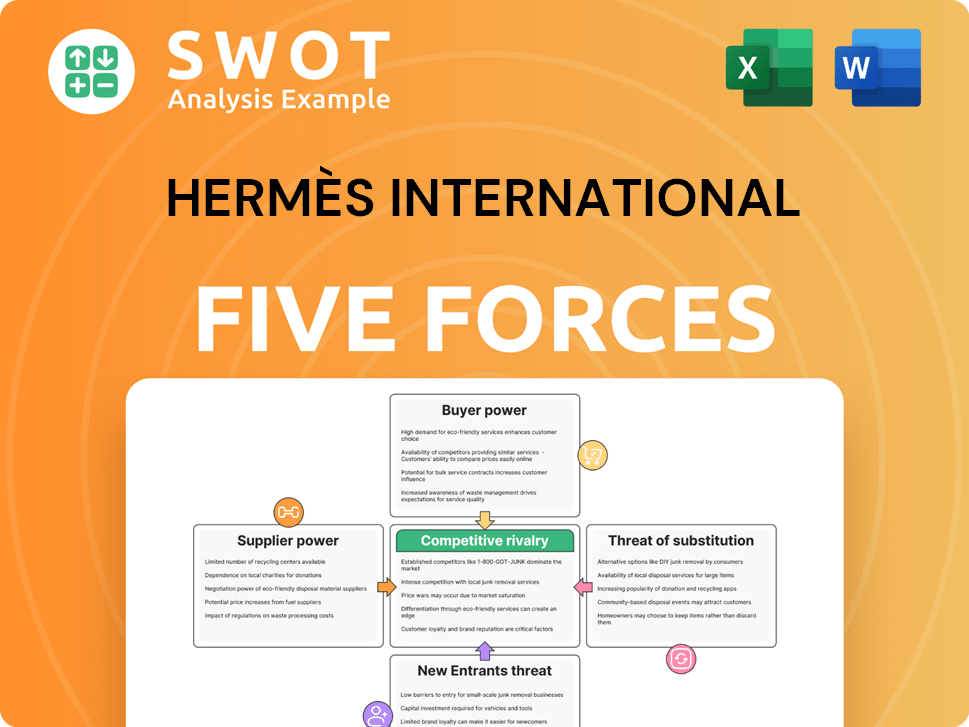

Hermès International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hermès International Company?

- What is Competitive Landscape of Hermès International Company?

- What is Growth Strategy and Future Prospects of Hermès International Company?

- What is Sales and Marketing Strategy of Hermès International Company?

- What is Brief History of Hermès International Company?

- Who Owns Hermès International Company?

- What is Customer Demographics and Target Market of Hermès International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.