Highland Homes Holdings Bundle

Unveiling the Inner Workings of Highland Homes?

Ever wondered how a leading homebuilder like Highland Homes Company thrives in today's dynamic real estate market? Founded in 1985, Highland Homes has become a major player in the new home construction sector, especially in Florida and Texas. This exploration dives deep into their operations, revealing the strategies behind their impressive growth and consistent customer satisfaction.

From its humble beginnings, Highland Homes Holdings has expanded to become a significant force in the industry, consistently ranked among the best. Understanding the Highland Homes Holdings SWOT Analysis can provide valuable insights into their strategic approach and competitive advantages. This analysis will explore their financial performance, business model, and future prospects, offering a comprehensive view for anyone interested in the real estate developer's success.

What Are the Key Operations Driving Highland Homes Holdings’s Success?

Highland Homes Company, a prominent homebuilder, creates value by constructing and selling single-family homes. They offer a diverse range of home designs, with over 50 unique floor plans available in 2024, and provide extensive personalization options. This approach caters to various buyer preferences, enhancing customer satisfaction and expanding market reach. The company focuses on rapidly growing areas like Central Florida, Tampa Bay, and key Texas markets such as Dallas-Fort Worth, Houston, Austin, and San Antonio.

Operationally, Highland Homes emphasizes strategic locations within high-growth markets, leveraging existing infrastructure within master-planned communities. Their strategic shift towards increased land development allows them to control the supply of lots, stabilize costs, and improve project timelines. This focus on supply chain control reduces dependency on external suppliers and allows for better adaptation to changing consumer preferences. They also simplify the homebuying process by offering financing options through lender partnerships, assisting buyers in understanding mortgages and exploring various choices.

Highland Homes' value proposition is built on quality, value, and a strong reputation. Their positive customer reviews and high-quality construction are actively utilized in marketing campaigns, contributing to increased lead generation and sales. Furthermore, the company's 100% employee-owned structure cultivates a committed workforce, potentially boosting efficiency and profitability. To learn more about their expansion strategies, consider reading about the Growth Strategy of Highland Homes Holdings.

Highland Homes offers a wide variety of home designs, with over 50 unique floor plans. They also provide extensive personalization options to cater to diverse buyer preferences. This strategy enhances customer satisfaction and broadens their market reach.

The company concentrates on rapidly growing areas such as Central Florida, Tampa Bay, and key Texas markets. This includes Dallas-Fort Worth, Houston, Austin, and San Antonio. This targeted approach allows for efficient resource allocation and market penetration.

Highland Homes emphasizes strategic land acquisition and development within master-planned communities. This approach allows for better control over the supply chain and project timelines. They also streamline the homebuying process with financing options.

As a 100% employee-owned company, Highland Homes fosters a committed workforce. Companies with employee ownership saw an average of a 5% increase in productivity in 2024. This structure contributes to a strong company culture and better customer service.

Highland Homes distinguishes itself through its reputation for quality and value, which is supported by positive customer reviews and construction quality. This favorable image is leveraged in marketing to drive sales. Their employee-owned model further enhances their market position.

- Focus on high-growth markets

- Emphasis on quality and value

- Employee-owned structure

- Strategic land development

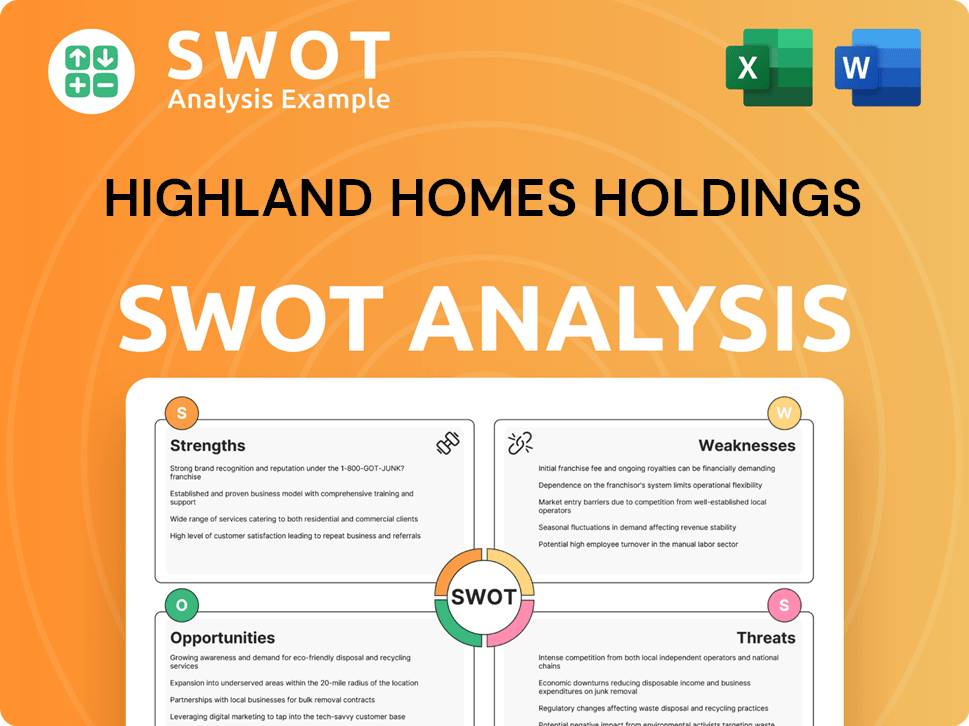

Highland Homes Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Highland Homes Holdings Make Money?

Highland Homes Company generates revenue primarily through the direct sales of single-family homes. The company's strategic focus on master-planned communities in high-growth regions significantly contributes to its sales volume. In 2024, the company's revenue reached $2.5 billion, demonstrating its strong market presence. The company's strategic approach focuses on key locations to drive sales and maintain a competitive edge in the new home construction sector.

A key aspect of Highland Homes Holdings' monetization strategy involves offering diverse home designs and personalization options. This approach allows for premium pricing, with customized homes seeing a 15% higher average selling price in 2024. The company also leverages land development, which accounted for 15% of their revenue in 2024, showcasing a strategic shift towards controlling lot supply and stabilizing costs. This diversification enhances profitability and supports long-term growth.

Highland Homes also utilizes strategic partnerships to boost sales. For example, their collaboration with Generac to offer backup power in Texas homes addresses growing consumer demand, differentiating Highland Homes in the market. Furthermore, they recognize the importance of realtor partnerships, with approximately 87% of home sales facilitated by real estate agents. You can learn more about the Target Market of Highland Homes Holdings to understand their consumer base.

Highland Homes' financial success is built on several key strategies that drive revenue and enhance profitability.

- Direct Home Sales: The primary revenue stream comes from selling single-family homes, with a focus on master-planned communities in high-growth areas. In 2024, the company closed 3,876 homes.

- Customization and Premium Pricing: Offering diverse home designs and personalization options allows for premium pricing. Customized homes have a 15% higher average selling price.

- Land Development: Land development accounted for 15% of revenue in 2024, demonstrating a strategic move to control lot supply and manage costs.

- Strategic Partnerships: Collaborations, such as the one with Generac, differentiate offerings and attract buyers. Realtor partnerships also play a significant role, with realtor referrals accounting for about 30% of sales.

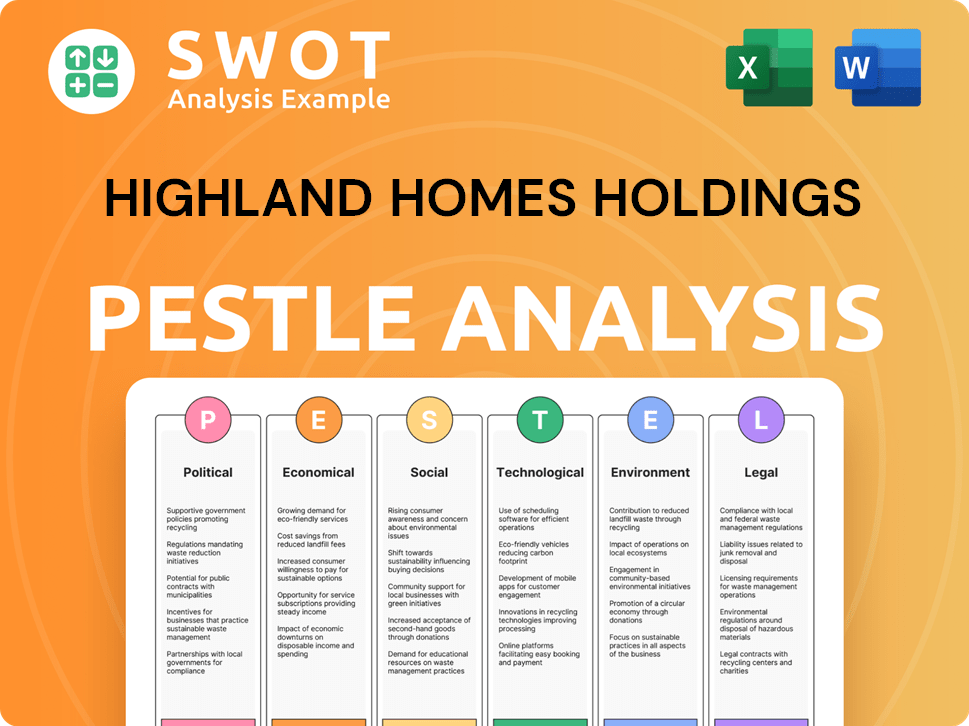

Highland Homes Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Highland Homes Holdings’s Business Model?

Founded in 1985, Highland Homes has established itself as a significant player in the homebuilding industry. The company's trajectory reflects a commitment to growth and adaptation. A key milestone was reached by 1992, with the company closing approximately 1,000 homes annually.

A defining strategic move occurred in 2015 when founders Rod Sanders and Jean Ann Brock transitioned the company to 100% employee ownership through an Employee Stock Ownership Plan (ESOP). This decision aimed to maintain a customer-centric culture and provide employees with financial benefits. This transition has reportedly had a minimal impact on company culture, reinforcing their dedication to customers.

Highland Homes has consistently adjusted to market dynamics and challenges. For instance, in response to rising interest rates, they offered buyer incentives like a 1-0 buydown rate on select homes in Houston, where rates were 4.875% in April 2024 for the first year. The company also faces challenges from supply chain disruptions and rising construction costs. Despite these hurdles, Highland Homes continues to meet demand, with new home sales rising by 8.8% year-over-year in Q1 2024.

Highland Homes reached a significant milestone by 1992, closing around 1,000 homes annually. The company's growth reflects its ability to adapt to market changes and customer needs. This early success set the stage for future expansion and strategic decisions.

A pivotal strategic move was the 2015 transition to 100% employee ownership through an ESOP. This decision underscores a commitment to customer satisfaction and employee engagement. This model has helped the company maintain its focus on quality and service.

Highland Homes' competitive advantages include a strong brand reputation and established presence in high-growth markets. The employee ownership model fosters a committed workforce, enhancing productivity and customer service. Their focus on diverse home designs and personalization options also sets them apart.

In response to rising interest rates, Highland Homes offered buyer incentives. They also manage challenges from supply chain disruptions and rising construction costs. Despite these hurdles, they continue to meet demand, with new home sales increasing.

Highland Homes' competitive edge stems from its strong brand reputation and strategic market positioning. Their commitment to quality and customer satisfaction is evident in their high customer satisfaction rates. The company's employee ownership model further strengthens its competitive position.

- Strong brand reputation, backed by a 95% customer satisfaction rate.

- Established presence in high-growth markets, such as Central Florida and Dallas-Fort Worth.

- Employee ownership model, fostering a committed workforce and better customer service.

- Focus on diverse home designs and personalization options, potentially increasing sales volume by 10-15%.

- Offering buyer incentives, like a 1-0 buydown rate, to counter market challenges.

For further insights into the company's growth trajectory, you can explore the Growth Strategy of Highland Homes Holdings.

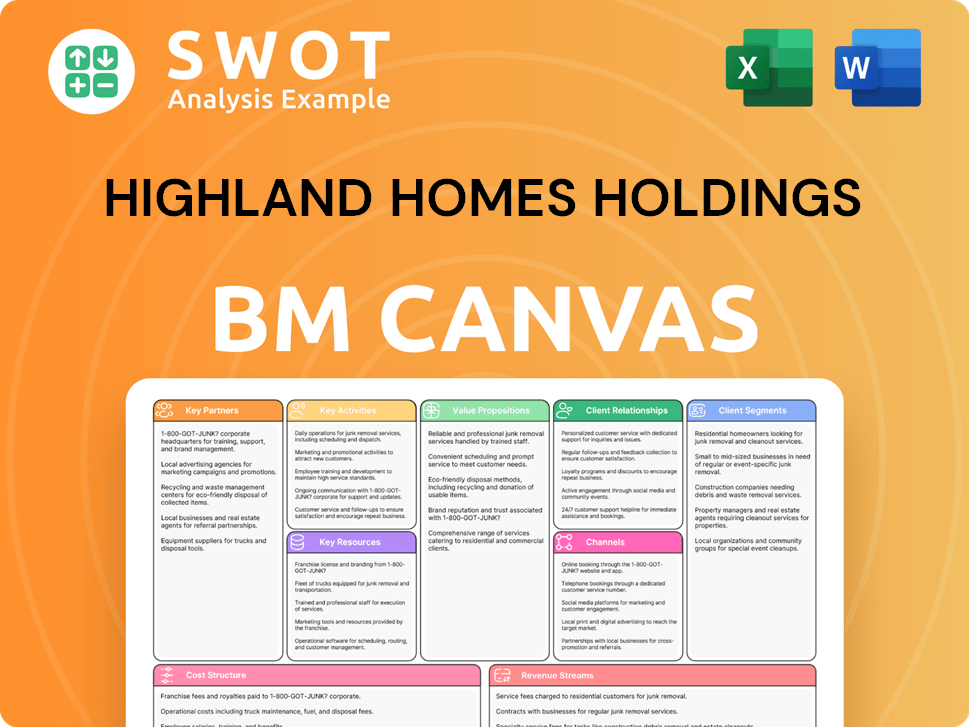

Highland Homes Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Highland Homes Holdings Positioning Itself for Continued Success?

Highland Homes, a major player in the homebuilding sector, holds a strong position in the U.S. market. The company has consistently ranked among the top homebuilders, demonstrating a solid foundation for growth. Its presence in high-growth areas and a focus on customer satisfaction further solidify its market standing. To understand the company's operations better, consider exploring the Marketing Strategy of Highland Homes Holdings.

However, Highland Homes faces risks common to the real estate industry. These include fluctuating interest rates, supply chain issues, labor shortages, and increasing competition. These factors can impact profitability and project timelines, requiring strategic adaptation to maintain a competitive edge.

Highland Homes is a prominent Homebuilder, consistently ranking among the top 30 in the U.S. since 2008. The company benefits from its presence in high-growth markets like Dallas-Fort Worth and Central Florida. A strong brand reputation and a 95% customer satisfaction rate enhance its market position.

Key risks include rising interest rates, with the average 30-year fixed mortgage rate around 7.1% in early 2024, impacting affordability. Supply chain disruptions and material cost volatility, such as a 15% increase in lumber prices in Q1 2024, pose challenges. Labor shortages and increased competition in growth markets add further pressure.

Highland Homes plans to capitalize on continued demand in its core markets. The company aims to open over 60 model homes and sell 4,000 homes in Texas in 2025. Strategic initiatives include increased land development and expansion into adjacent markets.

Focus on land development to control costs, which accounted for 15% of revenue in 2024. Expansion into new markets with similar growth potential. Investment in smart home technology, with approximately $15 million allocated in 2024, and partnerships like the one with Generac for backup power, demonstrate its commitment to innovation.

Highland Homes' future depends on navigating market challenges and leveraging growth opportunities. The company's ability to manage costs, adapt to changing consumer preferences, and maintain customer satisfaction will be critical.

- Monitor interest rate trends and their impact on demand.

- Manage supply chain risks and material cost fluctuations.

- Focus on labor force management and cost control.

- Continue to innovate with smart home technology and sustainable practices.

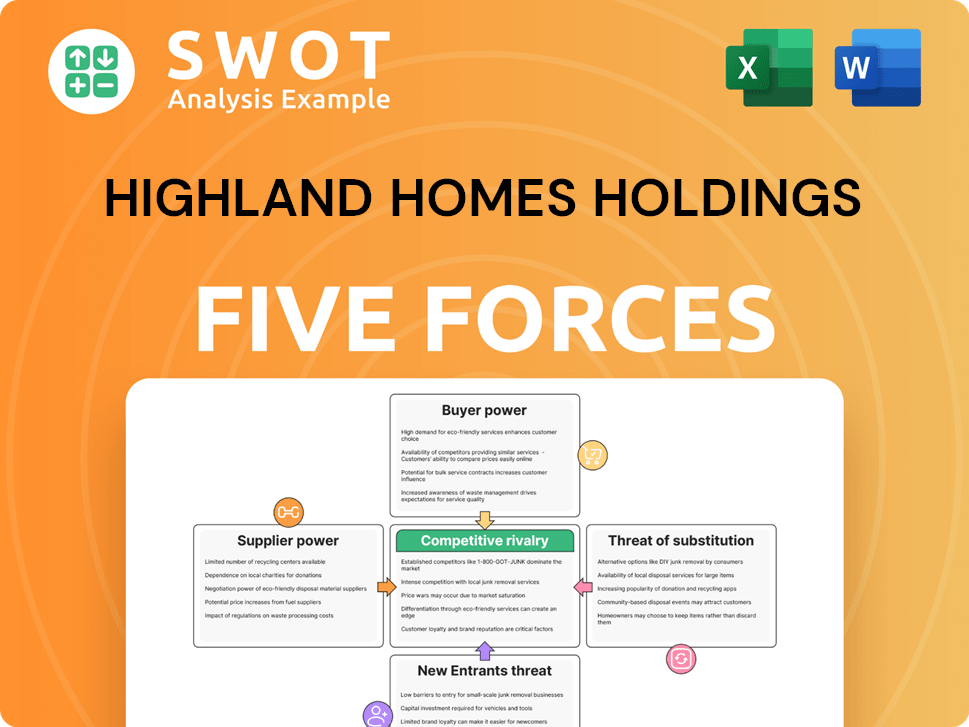

Highland Homes Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Highland Homes Holdings Company?

- What is Competitive Landscape of Highland Homes Holdings Company?

- What is Growth Strategy and Future Prospects of Highland Homes Holdings Company?

- What is Sales and Marketing Strategy of Highland Homes Holdings Company?

- What is Brief History of Highland Homes Holdings Company?

- Who Owns Highland Homes Holdings Company?

- What is Customer Demographics and Target Market of Highland Homes Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.