Hippo Insurance Services Bundle

Decoding Hippo Insurance: How Does It Revolutionize Home Protection?

Hippo Insurance Services has rapidly gained traction in the home insurance market by embracing technology and customer-centric strategies. This innovative approach aims to simplify the often complex insurance process, making it more efficient and tailored to the needs of today's homeowners. Its focus on leveraging data analytics and smart home technology sets Hippo apart, challenging traditional insurance models with a fresh perspective.

This exploration into Hippo Insurance Services SWOT Analysis will uncover how this insurtech company operates, from its core insurance coverage offerings to its revenue-generating strategies. Investors, homeowners, and industry analysts alike will benefit from understanding the inner workings of Hippo home insurance, including its unique value proposition and competitive advantages. Discover how Hippo Insurance is reshaping the landscape of the insurance company, offering potentially lower premiums and a more proactive approach to home protection.

What Are the Key Operations Driving Hippo Insurance Services’s Success?

Hippo Insurance, a tech-driven insurance company, focuses on providing homeowners insurance with a modern approach. Their core value lies in offering a streamlined, efficient, and proactive insurance experience, differentiating itself through the integration of smart home technology.

The company's primary offering is homeowners insurance, designed for modern homeowners seeking a more responsive and user-friendly insurance solution. By leveraging technology, Hippo aims to simplify the insurance process, from obtaining a quote to managing claims, making it more accessible and transparent for its customers.

Hippo Insurance services are built around a digital-first model, emphasizing ease of use and customer convenience. This approach allows for efficient policy management and quick access to information, setting it apart from traditional insurance providers. Owners & Shareholders of Hippo Insurance Services benefit from this innovative model.

Hippo utilizes advanced data analytics to assess risk and determine premiums. This involves analyzing various data points to provide accurate and personalized insurance coverage. This approach allows for more precise risk assessment compared to traditional methods.

A user-friendly digital platform is central to Hippo's operations, allowing customers to manage their policies and file claims easily. The platform offers a seamless experience, simplifying complex insurance processes. The focus is on providing a convenient and efficient customer journey.

Hippo integrates smart home devices, such as leak detectors and smoke alarms, to mitigate risks and potentially lower premiums. This proactive approach helps prevent damage and offers customers added value. This technology-driven approach is a key differentiator.

The company primarily uses a direct-to-consumer sales model through its online platform, complemented by partnerships and independent agents. This multi-channel approach ensures broad reach and accessibility for potential customers. This strategy helps expand the customer base.

Hippo Insurance offers several advantages, including potentially lower premiums, faster claims processing, and a more personalized insurance experience. These benefits are a direct result of their technology-driven and proactive approach. They focus on providing a superior customer experience.

- Lower Premiums: Smart home technology and data analytics can lead to reduced insurance costs.

- Faster Claims: The digital platform and streamlined processes expedite claim resolution.

- Proactive Risk Management: Smart home devices help prevent damage and reduce potential losses.

- Personalized Experience: Tailored coverage options and customer service enhance satisfaction.

Hippo Insurance Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hippo Insurance Services Make Money?

The primary revenue stream for Hippo Insurance Services is generated through insurance premiums. As a property insurance provider, the company's financial health is largely dependent on the premiums collected from homeowners for their home insurance policies. These premiums are the core of its monetization strategy.

While specific figures are subject to market disclosures, the majority of the company's income stems from these premiums. The business model is centered on assessing risk and setting premiums that reflect that risk. This approach allows the company to offer insurance coverage while ensuring profitability.

Beyond standard premiums, Hippo utilizes technology to potentially reduce claims costs, which indirectly boosts profitability. By offering smart home devices, Hippo aims to prevent incidents like water damage or fires, reducing the frequency and severity of claims. This proactive risk mitigation can lead to a more favorable loss ratio, enhancing the profitability of its underwriting activities.

Hippo Insurance's approach to revenue generation and profitability involves several key strategies.

- Insurance Premiums: The main source of revenue comes from premiums paid by policyholders for their home insurance.

- Smart Home Technology: Offering smart home devices to policyholders helps reduce claims by preventing incidents, leading to a more favorable loss ratio.

- Risk Mitigation: Proactive measures, such as smart home devices, help reduce the frequency and severity of claims, which in turn enhances the profitability of underwriting.

- Data and Partnerships: Hippo may explore opportunities for data monetization or partnerships related to its smart home ecosystem, though the primary focus remains on insurance premium generation.

Hippo Insurance Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Hippo Insurance Services’s Business Model?

Hippo Insurance has achieved several key milestones that have significantly shaped its trajectory and financial performance. A notable strategic move was its decision to go public through a SPAC merger in 2021, which provided a substantial influx of capital for expansion and enhanced market visibility. The company has consistently focused on launching new products and entering new markets, expanding its geographic footprint across various U.S. states to broaden its customer base. Strategic partnerships, particularly with builders and real estate professionals, have been crucial in integrating Hippo's insurance offerings early in the homeownership journey.

Operational and market challenges have included navigating the complexities of the insurance regulatory landscape in different states and managing claims during periods of increased catastrophic weather events. Hippo has responded by investing in its technology platform to enhance claims processing efficiency and refine its underwriting models to better assess and price risk. The company's competitive advantages stem from its technology leadership, particularly its data-driven underwriting and the integration of smart home devices for proactive risk mitigation. This technological edge allows Hippo to offer more personalized policies and potentially lower premiums, differentiating it from traditional insurers.

Hippo continues to adapt to new trends, such as the increasing demand for personalized digital services and the growing adoption of smart home technology, by continually innovating its product offerings and enhancing its customer experience. Understanding the Competitors Landscape of Hippo Insurance Services is crucial for evaluating its position in the market.

Hippo Insurance's journey includes significant milestones, such as its SPAC merger in 2021, which provided capital for expansion. The company's growth has been marked by strategic product launches and geographic expansion across the U.S. Hippo has also formed crucial partnerships, particularly with builders and real estate professionals, to integrate its services early in the homeownership process.

A key strategic move for Hippo was the decision to go public, which fueled its expansion efforts. The company has focused on new product launches and market entries to broaden its reach. Strategic partnerships have been instrumental in integrating Hippo's insurance offerings early in the homeownership journey, providing a competitive advantage.

Hippo's competitive edge lies in its technology leadership, particularly its data-driven underwriting and the integration of smart home devices. This technological advantage allows for personalized policies and potentially lower premiums. The company continues to adapt to changing trends by innovating its product offerings and enhancing the customer experience, ensuring it remains competitive in the home insurance market.

Hippo has faced challenges, including navigating insurance regulations and managing claims during catastrophic events. In response, the company has invested in its technology platform to enhance claims processing and refine its underwriting models. These efforts aim to improve efficiency and better assess and price risk, ensuring sustainable growth.

Hippo Insurance offers a range of features designed to provide comprehensive home insurance coverage. These features include smart home device integration and data-driven underwriting, which help in proactive risk mitigation and personalized policy offerings. The company's focus on technology and customer experience sets it apart in the competitive home insurance market.

- Data-driven underwriting for accurate risk assessment.

- Integration of smart home devices for proactive risk mitigation.

- Personalized policies tailored to individual homeowner needs.

- Efficient claims processing through advanced technology.

Hippo Insurance Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Hippo Insurance Services Positioning Itself for Continued Success?

Let's examine the industry position, risks, and future outlook for the insurance company, focusing on its unique approach to homeowners insurance. The company, a prominent player in the insurtech sector, distinguishes itself through its technology-driven strategy, aiming to disrupt the traditional home insurance market. It emphasizes proactive risk management and a streamlined digital experience, setting it apart from established insurance providers.

The company's success hinges on its ability to offer convenience, personalized coverage, and potentially lower premiums to tech-savvy homeowners. As it expands its geographic reach across the United States, the company's market penetration increases, positioning it for further growth. This expansion is crucial for increasing its customer base and solidifying its market presence.

The company operates within the competitive insurtech landscape, focusing on homeowners insurance. It differentiates itself through technology and proactive risk management. The company's customer loyalty is built on convenience and personalized coverage.

The company faces intense competition from both traditional insurers and other insurtech startups. Regulatory changes and the inherent risks of property insurance, especially in areas prone to natural disasters, pose challenges. Economic downturns and changing consumer preferences could also impact sales.

Strategic initiatives include continued investment in its technology platform and market expansion. The company aims to deepen its integration of smart home devices to enhance risk prevention. The company focuses on growing its policyholder base and improving loss ratios.

The company aims to sustain and expand its ability to make money by continuing to grow its policyholder base and improve loss ratios. The company is exploring new revenue streams related to its smart home ecosystem and data capabilities. The company's financial health depends on its ability to manage risk and attract customers.

The company's strategic focus includes technological advancements and market expansion. A key aspect is the integration of smart home devices to enhance risk prevention, which is a core element of their service. The company aims to leverage data to provide a superior customer experience.

- Continued investment in its technology platform.

- Further expansion into new markets across the U.S.

- Deepening the integration of smart home devices.

- Focus on data-driven underwriting and customer experience.

The company faces several risks, including competition from established insurance providers and other insurtech companies. Regulatory changes across various states could impact its operating model, and the inherent risks associated with underwriting property insurance, particularly in areas prone to natural disasters, are significant. Economic downturns or changes in consumer preferences could also affect policy sales. For example, in 2024, the home insurance market saw increased volatility due to severe weather events, impacting loss ratios across the industry. The company’s ability to manage these risks will be crucial for its long-term success. To understand more about the company's approach to marketing, you can read about the Marketing Strategy of Hippo Insurance Services.

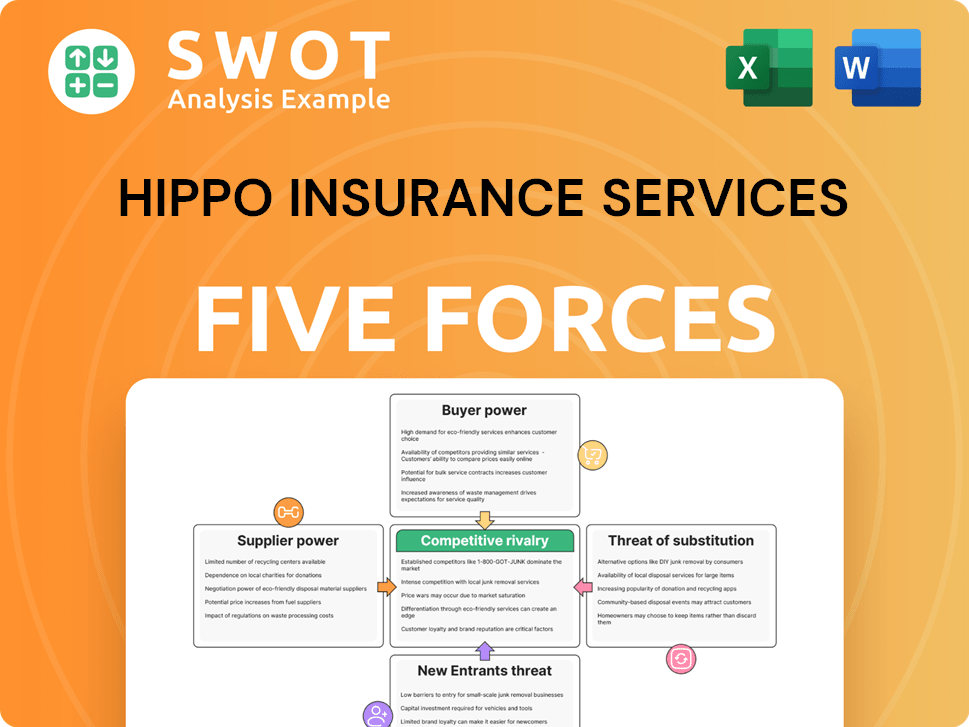

Hippo Insurance Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hippo Insurance Services Company?

- What is Competitive Landscape of Hippo Insurance Services Company?

- What is Growth Strategy and Future Prospects of Hippo Insurance Services Company?

- What is Sales and Marketing Strategy of Hippo Insurance Services Company?

- What is Brief History of Hippo Insurance Services Company?

- Who Owns Hippo Insurance Services Company?

- What is Customer Demographics and Target Market of Hippo Insurance Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.