Humana Bundle

How Does Humana Thrive in Today's Healthcare Market?

In the ever-evolving healthcare sector, understanding the operational dynamics of major players like the Humana company is crucial. Humana, a leading health and well-being company, significantly impacts the lives of millions through its diverse range of Humana services. Its focus on government-sponsored programs, especially Medicare Advantage, has cemented its position in the market. This analysis will delve into How Humana works, exploring its business model and key strategies.

To truly grasp the complexities of the healthcare industry, it's important to dissect Humana's operations. From Humana insurance offerings to the intricacies of its Humana plans, this exploration provides a comprehensive overview. Considering the recent financial performance, understanding Humana's strategies is more relevant than ever. For an in-depth look at the company's strengths and weaknesses, consider the Humana SWOT Analysis.

What Are the Key Operations Driving Humana’s Success?

The Humana company creates and delivers value by offering comprehensive health and well-being services. It serves a diverse customer base, including employer groups, government-sponsored programs like Medicare and Medicaid, and individuals. The core offerings include a wide array of Humana insurance plans, such as medical, dental, vision, and supplemental benefits.

Beyond traditional insurance, Humana services extend to pharmacy services through Humana Pharmacy Solutions, home-based care via CenterWell Home Health, and clinical care through CenterWell Primary Care. This integrated approach aims to improve health outcomes and manage costs effectively for its members. This integrated approach is a key differentiator, focusing on improving health outcomes and managing costs more effectively for its members.

Operational processes involve extensive technology for claims processing, member management, and data analytics to support value-based care initiatives. Humana's supply chain includes partnerships with a vast network of healthcare providers, hospitals, and pharmacies. Distribution networks primarily include direct sales, brokers, and digital platforms. A focus on preventive care and chronic condition management, especially within its Medicare Advantage plans, enhances member satisfaction and retention.

Humana offers a variety of health benefit plans, including medical, dental, and vision coverage. They also provide supplemental benefits. Beyond insurance, they offer pharmacy services, home-based care, and clinical care through their CenterWell brand.

Humana's integrated approach is a key differentiator. It focuses on improving health outcomes and managing costs effectively for its members. This is achieved through a combination of insurance plans and healthcare services.

Humana uses technology for claims processing, member management, and data analytics. They have partnerships with a vast network of healthcare providers. Distribution channels include direct sales, brokers, and digital platforms.

Humana focuses on preventive care and chronic condition management. This leads to better health outcomes, personalized care, and lower out-of-pocket costs. The CenterWell brand enhances the healthcare experience.

Humana's focus on integrated care and preventive services translates to tangible benefits for its members. These include better health outcomes, personalized care experiences, and, often, reduced out-of-pocket expenses, leading to higher satisfaction and retention rates.

- Improved health outcomes through proactive care.

- Personalized care plans tailored to individual needs.

- Potential for lower healthcare costs.

- Enhanced member satisfaction and loyalty.

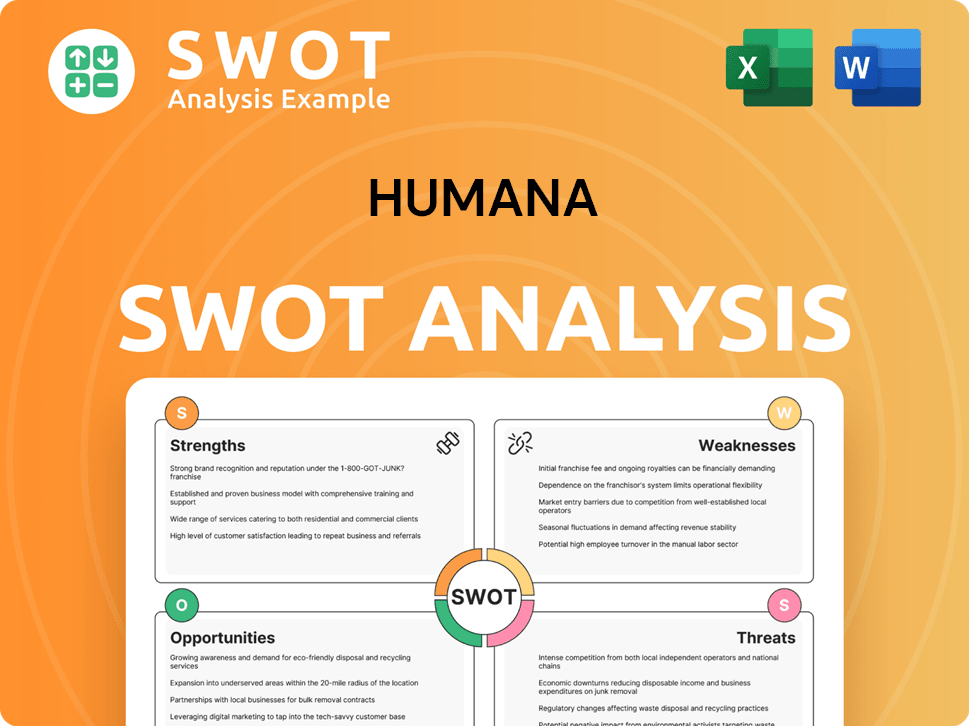

Humana SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Humana Make Money?

The Humana company generates revenue primarily through health insurance premiums. A significant portion of its revenue comes from government-sponsored programs, particularly Medicare Advantage plans. Understanding how Humana works involves examining its diverse revenue streams and monetization strategies.

In the first quarter of 2025, Humana reported total revenues of approximately $30.0 billion. This reflects the substantial financial scale of the Humana company and its ability to generate significant income from its core business operations. The majority of this revenue comes from its Insurance segment, which includes its Medicare Advantage, Medicaid, and commercial group and individual plans.

Humana's monetization strategies are multifaceted, encompassing premium collection, co-pays, deductibles, and co-insurance from its members. For its government-sponsored programs, the company receives capitated payments from the government based on the number of enrolled members and their health risk scores. The company also employs tiered pricing for certain Humana plans and offers bundled Humana services to enhance member value and encourage enrollment. To learn more about Humana's overall approach, consider the Growth Strategy of Humana.

Humana insurance generates revenue through several key channels, ensuring a diversified income base. Understanding these methods is crucial for grasping how Humana works. The company's approach includes:

- Premiums: Revenue is primarily generated from premiums paid by members for their Humana plans.

- Medicare Advantage: Capitated payments from the government based on enrolled members and their health risk scores.

- Co-pays, Deductibles, and Co-insurance: Members contribute through these out-of-pocket expenses.

- Value-Based Care: Sharing savings from improved health outcomes and reduced costs with providers.

- Tiered Pricing and Bundled Services: Offers various Humana plans with different pricing structures and bundled service packages.

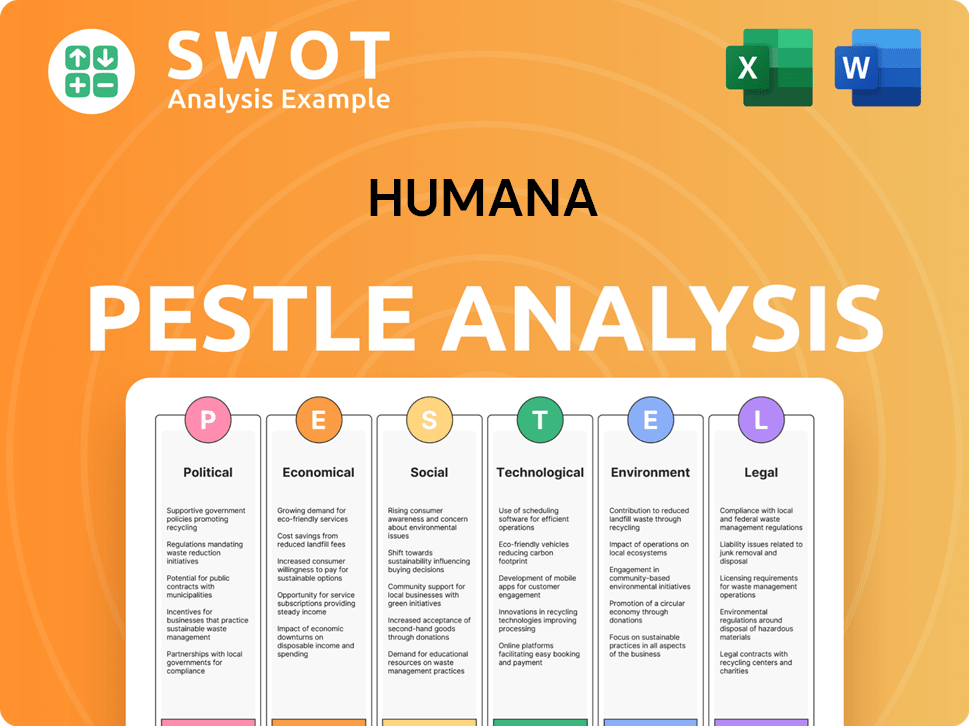

Humana PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Humana’s Business Model?

The journey of the Humana company has been marked by significant milestones and strategic shifts that have shaped its operations and financial performance. A key strategic move has been its aggressive expansion in the Medicare Advantage market, a cornerstone of its business. This focus aligns with the aging U.S. population and the government's emphasis on managed care solutions. The establishment and expansion of its CenterWell brand, integrating primary care, home health, and pharmacy services, represents a key operational pivot toward a more holistic, value-based care model.

Operational challenges have included navigating evolving healthcare regulations, managing rising healthcare costs, and adapting to competitive pressures from other large insurers. Humana has responded by investing heavily in technology and data analytics to optimize care delivery and by forming strategic partnerships with providers to expand its network and promote coordinated care. The company's competitive advantages include its strong brand recognition, particularly among seniors, its extensive provider network, and its expertise in managing complex government healthcare programs. Furthermore, its integrated care model through CenterWell provides a unique competitive edge by offering a seamless and comprehensive healthcare experience.

Humana continues to adapt to new trends such as telehealth expansion and personalized medicine, leveraging its data capabilities to tailor services and maintain its market leadership. This approach helps in providing better Humana services and Humana plans to its members. For more insights into the company's growth trajectory, consider exploring the Growth Strategy of Humana.

Humana has consistently expanded its Medicare Advantage offerings, becoming a leader in this market. The introduction and growth of the CenterWell brand, integrating various healthcare services, is a major milestone. Strategic partnerships and acquisitions have broadened its service offerings and geographic reach.

Focus on Medicare Advantage has been a core strategic move, capitalizing on the aging population. Investments in technology and data analytics to improve care delivery and efficiency are ongoing. The development of the CenterWell model represents a shift towards integrated, value-based care.

Strong brand recognition, especially among seniors, provides a significant advantage. Its extensive provider network ensures broad access to care. Expertise in managing government healthcare programs, like Medicare, is a key differentiator.

In 2024, Humana reported substantial revenue from its Medicare Advantage plans, reflecting its market leadership. The company's financial health is closely tied to its ability to manage healthcare costs effectively. Investments in technology and care models are aimed at improving profitability and member outcomes.

Humana faces challenges like managing rising healthcare costs and adapting to regulatory changes. The company responds by leveraging technology and data analytics to optimize care delivery and forming strategic partnerships with providers. These efforts aim to improve efficiency and enhance the member experience.

- Investment in telehealth and virtual care to improve accessibility.

- Focus on value-based care models to control costs and improve outcomes.

- Strategic partnerships to expand provider networks and service offerings.

- Continuous adaptation to evolving healthcare regulations and market dynamics.

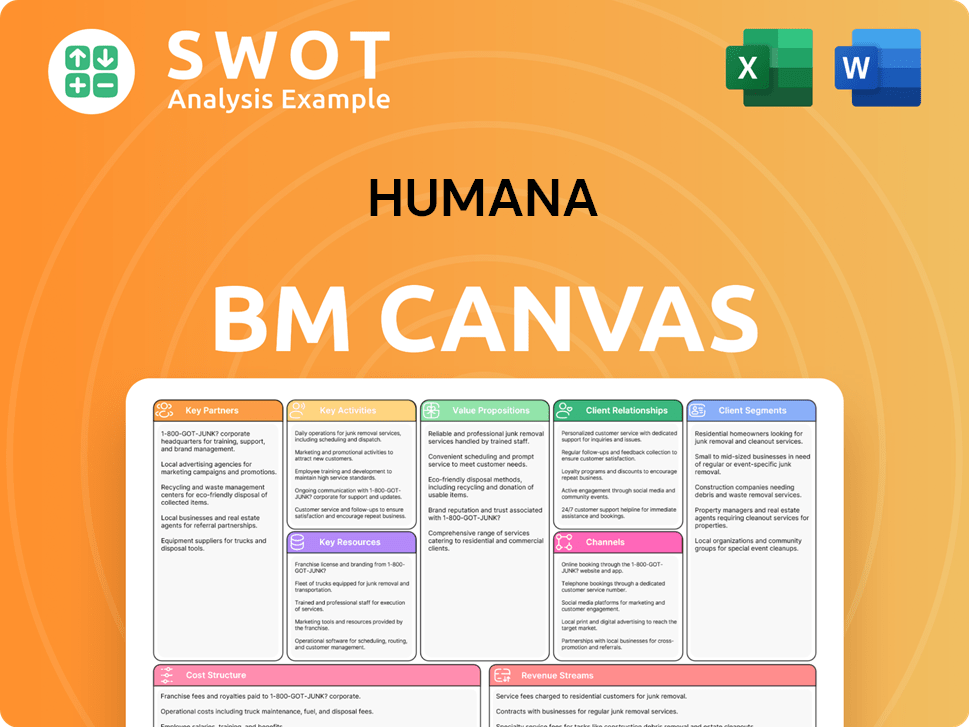

Humana Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Humana Positioning Itself for Continued Success?

Let's explore the industry position, risks, and future outlook of the Humana company. As a major player in the healthcare industry, Humana holds a strong position, especially in the Medicare Advantage market. Understanding these aspects is crucial for anyone looking into Humana insurance, Humana services, or Humana plans.

Humana faces various challenges and opportunities that could affect its operations and financial performance. These include regulatory changes, competition, rising healthcare costs, and the evolving preferences of consumers. An analysis of these factors is essential for grasping the company's potential and the dynamics of the health insurance sector.

Humana is a significant player in the health insurance market, particularly in Medicare Advantage. It competes with other major insurers like UnitedHealth Group and Elevance Health. Its focus on customer satisfaction and coordinated care enhances member loyalty, which is a key factor in their success. You can learn more about the Humana target market by reading this article.

Humana faces risks such as regulatory changes, especially in Medicare Advantage reimbursement. Competition from new entrants and technological disruptions also pose threats. Additionally, rising healthcare costs and changing consumer preferences create challenges. These factors can impact Humana's ability to make money.

Humana's future relies on its strategic initiatives, including investments in its integrated care model through CenterWell. The company plans to grow its Medicare Advantage membership and enhance its digital capabilities. The focus on the senior market and holistic health solutions shows Humana's commitment to long-term growth.

In 2024, Humana reported revenues of approximately $106.2 billion. Medicare Advantage membership continues to be a significant driver of revenue, with enrollment figures steadily increasing. The company's strategic investments in value-based care and digital health solutions are expected to contribute to future financial performance. The company's adjusted EPS was $26.09 for the full year 2024.

Humana is focused on expanding its value-based care arrangements and leveraging data analytics. These initiatives aim to improve health outcomes and operational efficiency. The company is also enhancing its digital capabilities to provide convenient healthcare services.

- Expansion of CenterWell services to provide integrated care.

- Continued investment in data analytics for personalized care.

- Focus on growing Medicare Advantage membership.

- Enhancing digital platforms for better member experience.

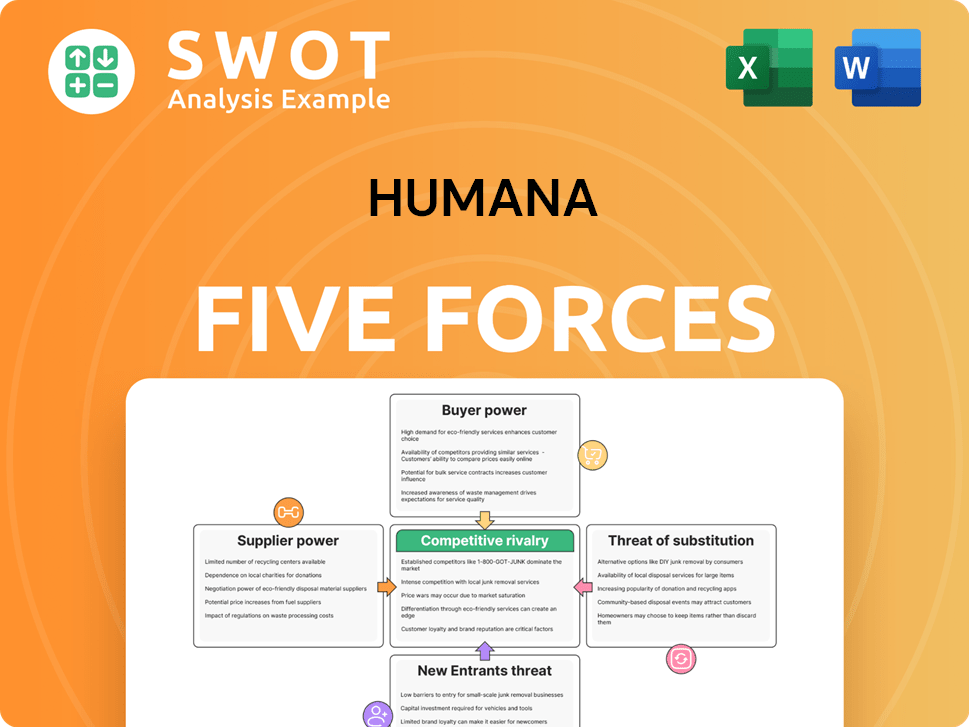

Humana Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Humana Company?

- What is Competitive Landscape of Humana Company?

- What is Growth Strategy and Future Prospects of Humana Company?

- What is Sales and Marketing Strategy of Humana Company?

- What is Brief History of Humana Company?

- Who Owns Humana Company?

- What is Customer Demographics and Target Market of Humana Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.