IDFC First Bank Bundle

Decoding IDFC First Bank: How Does It Thrive?

Ever wondered how a major player like IDFC First Bank navigates the complex world of Indian finance? This in-depth analysis unveils the inner workings of IDFC First Bank, exploring its strategic shifts and impressive growth trajectory. We'll dissect its core IDFC First Bank SWOT Analysis to understand its strengths, weaknesses, opportunities, and threats.

From understanding IDFC First Bank operations to examining its diverse

What Are the Key Operations Driving IDFC First Bank’s Success?

IDFC First Bank operates by providing a wide array of financial products and services designed for individuals, businesses, and institutions across India. Their core offerings include savings and current accounts, loans (personal, home, business, vehicle, gold, education, and microfinance), wealth management, investment options, insurance solutions, and digital payment platforms like FASTag. This comprehensive approach allows IDFC First Bank to serve a diverse customer base, including retail clients, small and medium enterprises (SMEs), and those in rural and self-employed sectors.

Operationally, IDFC First Bank leverages technology to enhance its services and streamline processes. They have developed a modern technology stack that includes an advanced mobile app with over 250 features. This facilitates seamless digital banking experiences for its customers. The bank's digital initiatives have significantly increased transaction volumes, aiming for 90% of transactions to be digital by the end of 2024. Customer service initiatives, such as a 24/7 helpline and personalized financial advisory services, have led to a 20% increase in service engagement compared to 2023.

A key element of IDFC First Bank's value proposition is its 'Zero Fee Banking' for savings accounts, which eliminates charges for fund transfers and ATM withdrawals, attracting customers and boosting transaction volumes. The bank also focuses on financial inclusion, with a goal of increasing lending to SMEs by 20% annually. Furthermore, IDFC First Bank is actively involved in green financing, leading in electric two-wheeler financing and supporting renewable energy projects and green-certified infrastructure. As of March 2024, the bank had financed nearly 200,000 electric two-wheelers. The bank's extensive network of 971 branches across 60,000 locations, combined with its digital-first approach, makes its operations unique and effective compared to competitors. Learn more about their growth strategy in this article: Growth Strategy of IDFC First Bank.

IDFC First Bank offers a wide range of financial products. These include savings accounts, current accounts, various loan options (personal, home, business, vehicle, gold, education, and microfinance), wealth management services, investment options, insurance solutions, and digital payment platforms.

IDFC First Bank emphasizes digital banking. They have a modern technology stack, including a mobile app with over 250 features. The bank aims for 90% of transactions to be digital by the end of 2024, enhancing customer experience and operational efficiency.

IDFC First Bank provides 24/7 customer support. They offer personalized financial advisory services to enhance customer engagement. These initiatives have led to a 20% increase in service engagement compared to 2023, improving customer satisfaction.

IDFC First Bank focuses on financial inclusion by increasing SME lending by 20% annually. They are also involved in green financing, leading in electric two-wheeler financing. As of March 2024, they financed nearly 200,000 electric two-wheelers, supporting sustainable initiatives.

IDFC First Bank distinguishes itself through several key operational features, including its extensive branch network and digital-first approach. This combination allows the bank to serve a broad customer base effectively.

- Zero Fee Banking: No charges for fund transfers or ATM withdrawals on savings accounts.

- Digital Focus: Advanced mobile app and a target of 90% digital transactions.

- Customer Service: 24/7 helpline and personalized financial advisory services.

- Green Financing: Leading in electric two-wheeler financing and supporting renewable energy projects.

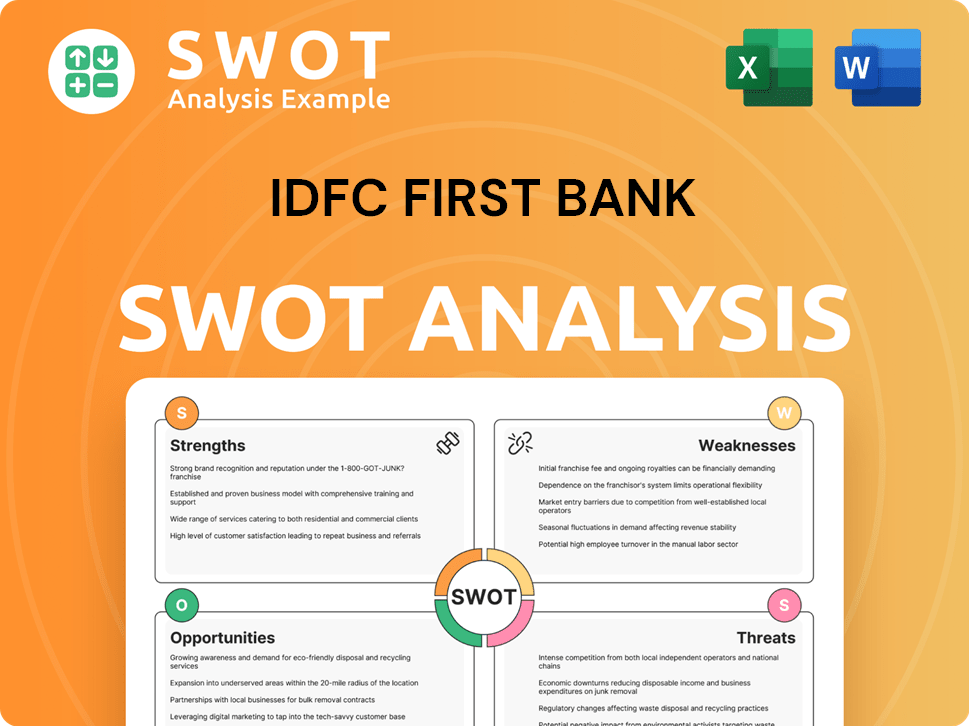

IDFC First Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does IDFC First Bank Make Money?

The revenue streams and monetization strategies of IDFC First Bank are designed to leverage its diverse financial product offerings and customer-centric approach. The bank generates income primarily through interest earned on loans and investments, alongside fees and other income derived from various services. This approach allows IDFC First Bank to cater to a wide range of financial needs, from retail banking to specialized financial solutions.

The bank's financial performance is driven by its ability to effectively manage its assets and liabilities, as well as its success in cross-selling various financial products. The bank focuses on expanding its loan book and increasing its fee-based income to drive revenue growth. By understanding how IDFC First Bank operations work, one can appreciate its financial strategies.

For the full year FY25, IDFC First Bank's Net Interest Income (NII) grew by 17.3% year-on-year to ₹19,292 crore. In Q4 FY25, NII increased by 9.8% year-on-year, reaching ₹4,907 crore. Fee and other income also contributed positively, growing by 5.7% year-on-year to ₹1,702 crore in Q4 FY25, and by 15.2% for the full year FY25. Total income for Q4 FY25 grew to ₹11,308 crore, up from ₹9,861 crore a year earlier.

The bank employs several monetization strategies to maximize revenue and enhance customer engagement. These strategies include growing its loan book, expanding its wealth management services, and leveraging its digital platforms. Understanding these strategies is crucial to understanding how IDFC First Bank works.

- Interest income is derived from a growing loan book, which as of March 31, 2025, increased by 20.4% year-on-year to ₹2,41,926 crore. The retail, rural, and MSME loan book grew by 18.6% year-on-year to ₹1,97,568 crore.

- Assets Under Management (AUM), including deposit balances, grew by 27% year-on-year to ₹42,665 crore, boosting income from wealth management services.

- The bank has issued over 3.5 million credit cards, contributing to fee income and transaction volumes. The bank's 'Zero Fee Banking' model attracts customers and boosts transaction volumes.

- The SaaS marketplace offers exclusive discounts on over 60 leading SaaS tools, which drives higher transaction volumes and increases the use of its corporate payment solutions, reinforcing its position in SME-focused banking. To understand the bank's customer base, read about the Target Market of IDFC First Bank.

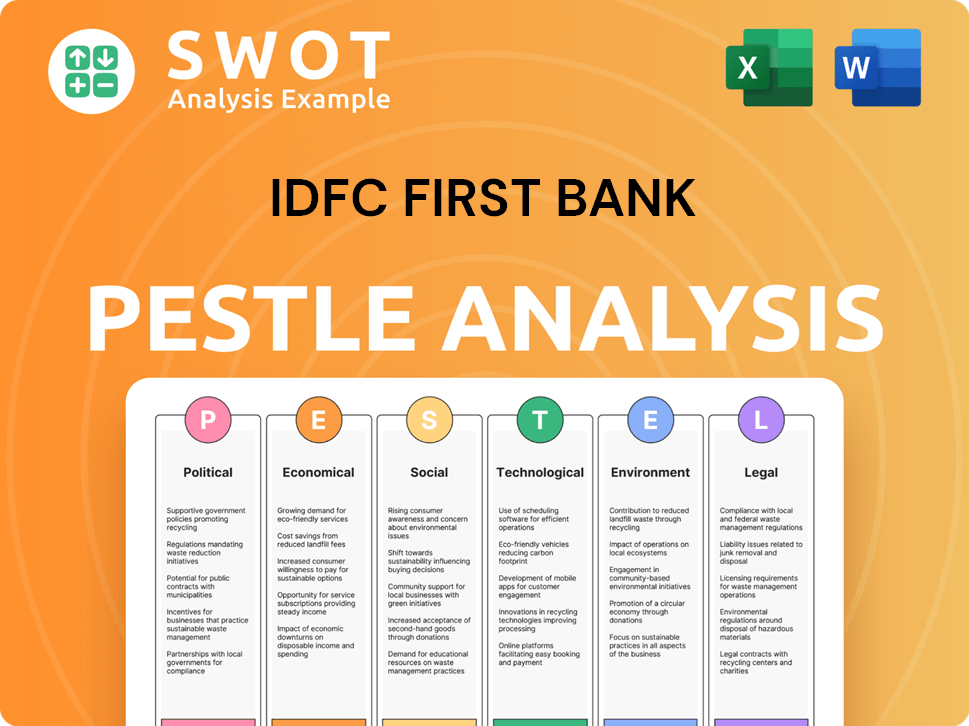

IDFC First Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped IDFC First Bank’s Business Model?

The journey of IDFC First Bank has been marked by significant milestones and strategic moves that have shaped its operations and financial performance. A pivotal moment was the merger of IDFC Bank with Capital First in December 2018, which fundamentally shifted its focus from infrastructure finance to a universal bank with a strong emphasis on retail banking. This strategic shift allowed the bank to diversify its loan book and deposit base, leading to the launch of numerous new products and services.

Since the merger, IDFC First Bank has expanded its offerings across retail, MSME, rural, corporate, wealth management, and payment solutions. This diversification is a key element of its business model, enabling it to cater to a wide range of customer needs and market segments. The bank's ability to adapt and innovate has been crucial in navigating the dynamic financial landscape and maintaining a competitive edge.

In terms of operational and market challenges, the bank has navigated industry-wide issues, particularly in the microfinance sector, which impacted its profitability in Q4 FY25, with net profit declining by 48.4% year-on-year to ₹304 crore. However, the bank has responded by closely tracking this business and has seen core operating profit (excluding microfinance business) grow by 19.9% year-on-year in Q4 FY25. The bank's gross slippages for the microfinance business increased to ₹572 crore in Q4 FY25, but without the microfinance business, gross slippages for the rest of the loan book improved.

The bank prioritizes customer satisfaction, evidenced by a 92% customer satisfaction score in 2024. This is achieved through personalized services, a 24/7 helpline, and a new digital banking platform. This focus on customer experience is a key differentiator in the competitive banking sector.

IDFC First Bank has invested heavily in digital technologies, including an AI-driven loan assessment tool that reduced loan approval times by 40% in 2024. The adoption of blockchain technology for secure transactions resulted in a 50% reduction in fraud cases. In December 2024, it unveiled an AI-powered interactive avatar of its brand ambassador, Amitabh Bachchan, to enhance customer engagement.

The bank offers a wide range of products, including digital and wealth management offerings, with digital initiatives driving growth in 2024. This diversification helps the bank cater to various customer segments and market trends.

The bank adheres to a 'Near and Dear' test, ensuring products are customer-friendly, and emphasizes ethical income generation. This commitment to ethical practices enhances customer trust and brand reputation.

In April 2025, the bank approved a preferential issue of equity capital amounting to approximately ₹7,500 crore to Warburg Pincus LLC and Abu Dhabi Investment Authority (ADIA). This strategic move is expected to increase its overall capital adequacy from 16.1% to 18.9%, strengthening its balance sheet for future growth. The bank's robust capital position supports its ability to invest in growth opportunities and navigate economic uncertainties.

- The bank is focusing on digital transformation, expanding its product portfolio, and enhancing its distribution network.

- It is also a proactive financier of India's green transition, with a significant portfolio in electric vehicle (EV) financing and support for renewable energy.

- For more insights, you can read about the Marketing Strategy of IDFC First Bank.

- These initiatives reflect the bank's commitment to sustainable practices and its ability to adapt to evolving market dynamics.

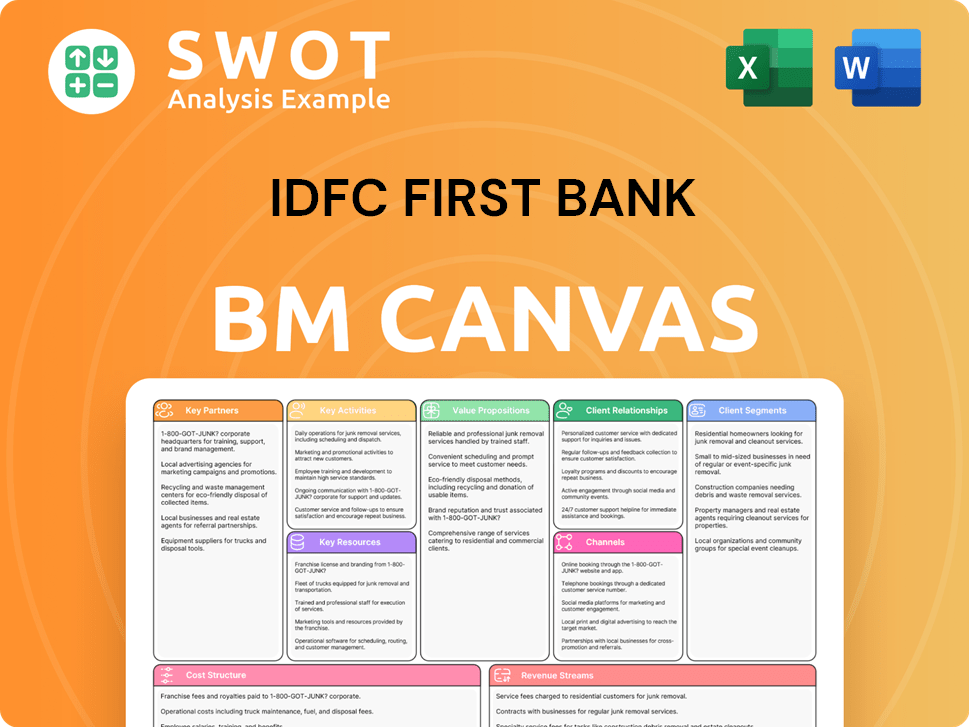

IDFC First Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is IDFC First Bank Positioning Itself for Continued Success?

As a prominent private sector bank in India, IDFC First Bank has established a strong market presence, recognized for its customer-centric approach and digital innovation. Its market share as of March 31, 2024, was 1.20% of total bank credit. The bank operates through an extensive network and digital-first strategy, which includes 971 branches across 60,000 locations.

The bank faces several risks, including challenges in the microfinance sector and increased provisions for bad loans. Regulatory changes and intense competition also pose ongoing challenges. Despite these headwinds, IDFC First Bank is focused on strategic initiatives and has a positive outlook for sustained growth.

IDFC First Bank has a significant presence in the Indian banking sector. Its customer deposits grew by 25.2% year-on-year to ₹2,42,543 crore as of March 31, 2025. Retail deposits constitute 79% of total customer deposits, highlighting its strong retail focus.

The bank faces risks from the microfinance sector, leading to a decrease in net profit in Q4 FY25. Provisions for bad loans nearly doubled to ₹1,440.47 crore in Q4 FY25. The stress in the microfinance portfolio is expected to persist in the near term.

The bank aims for sustained growth, with a focus on expanding its retail loan book. A recent capital raise of ₹7,500 crore will strengthen its balance sheet. Management anticipates a recovery in profitability and margins after FY25 and FY26.

IDFC First Bank is committed to digital transformation, with AI-powered initiatives and a high-rated mobile app. The bank focuses on ethical banking and financing India's green transition. Core operating profit grew 19.9% year-on-year in Q4 FY25.

IDFC First Bank is navigating both challenges and opportunities in the dynamic Indian banking landscape. The bank's commitment to digital innovation and customer-centric services supports its strategic goals. To learn more about the bank's history, consider reading this article: Brief History of IDFC First Bank.

- Market share of 1.20% of total bank credit as of March 31, 2024.

- Customer deposits increased by 25.2% year-on-year to ₹2,42,543 crore as of March 31, 2025.

- Capital adequacy ratio increased to 18.9% after recent capital raise.

- Analysts expect a strong 20-24% CAGR in credit and deposit growth over FY25-27E.

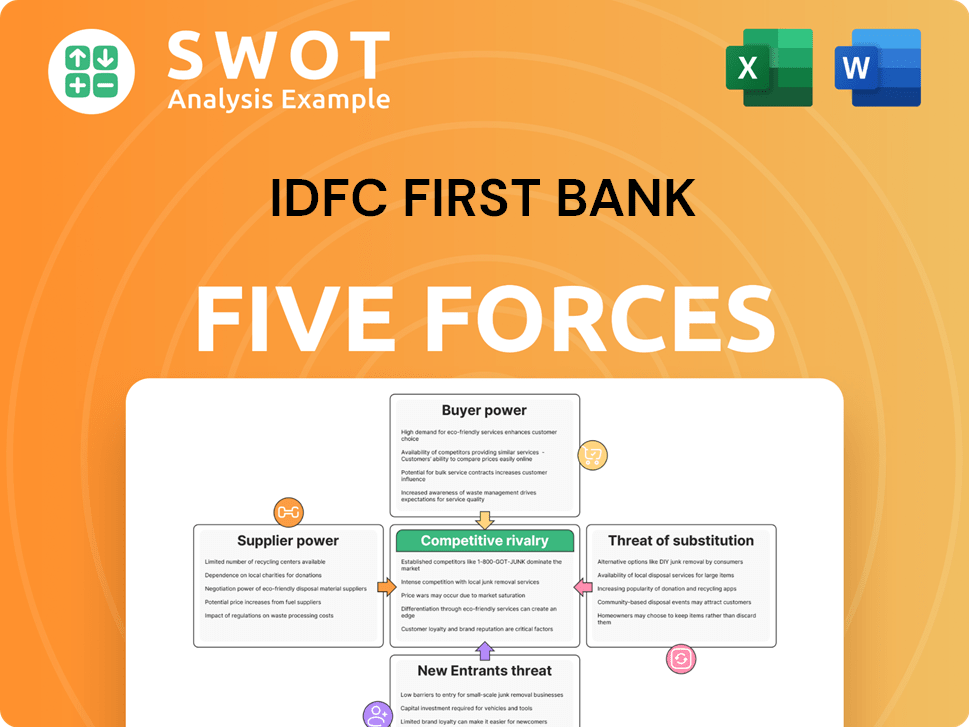

IDFC First Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of IDFC First Bank Company?

- What is Competitive Landscape of IDFC First Bank Company?

- What is Growth Strategy and Future Prospects of IDFC First Bank Company?

- What is Sales and Marketing Strategy of IDFC First Bank Company?

- What is Brief History of IDFC First Bank Company?

- Who Owns IDFC First Bank Company?

- What is Customer Demographics and Target Market of IDFC First Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.