J&J Snack Foods Bundle

How Does J&J Snack Foods Company Thrive in a Competitive Market?

J&J Snack Foods Corp. (NASDAQ: JJSF) is a powerhouse in the snack food and beverage industry, boasting a portfolio of well-known brands. The company's impressive fiscal year 2024 performance, marked by record sales and adjusted EBITDA, highlights its resilience. But how does J&J Snack Foods consistently deliver such results, even amid economic shifts?

From iconic brands like SUPERPRETZEL and ICEE to its diverse distribution channels, J&J Snack Foods SWOT Analysis reveals the strategies behind its success. Understanding the J&J Snack Foods business model and its ability to adapt is crucial for anyone interested in the food industry. This article will explore the operational framework and revenue generation strategies that have solidified J&J Snack Foods' position in the market, providing valuable insights for investors and industry watchers.

What Are the Key Operations Driving J&J Snack Foods’s Success?

J&J Snack Foods Company creates and delivers value by offering a wide range of branded snack foods and frozen beverages. The company serves both the foodservice and retail supermarket sectors. Its core offerings include soft pretzels, frozen beverages, handhelds, and various bakery goods like churros and funnel cakes. The J&J Snack Foods business model focuses on a diverse product portfolio and extensive distribution network.

The company’s products are available in various locations, including snack bars, food stands, fast-food restaurants, stadiums, theme parks, movie theaters, and supermarkets. This broad distribution network allows J&J Snack Foods to reach a wide customer base. The company's operational strategy emphasizes efficient manufacturing, marketing, and distribution to maintain its market position.

J&J Snack Foods has invested heavily in its supply chain and distribution networks. This includes opening new regional cold storage distribution facilities. These strategic locations enhance logistics and reduce shipping costs. The company leverages automation in its production lines to improve efficiencies and output. As of August 2024, a significant portion of the company's orders were being shipped from the new distribution network.

J&J Snack Foods focuses on manufacturing a wide variety of snack foods and beverages. The company uses automation in its production lines for pretzels, pretzel dogs, churros, and frozen novelties. This helps improve efficiency and increase output, supporting the company's ability to meet demand.

The company has invested in its distribution network, including opening new regional cold storage facilities. These facilities are strategically located to enhance logistics and reduce shipping costs. As of August 2024, 85% of the food maker's orders were shipped from the new distribution network, a significant improvement from the previous year.

J&J Snack Foods offers a diverse product portfolio, including soft pretzels, frozen beverages, handhelds, and various bakery goods. This variety allows the company to cater to different consumer preferences and market segments. The wide range of J&J products contributes to its market presence.

J&J Snack Foods serves a broad customer base, including snack bars, food stands, fast-food restaurants, stadiums, theme parks, and supermarkets. This wide reach ensures that the company's products are available in numerous locations. The company's ability to serve various channels is key to its success.

J&J Snack Foods differentiates itself through operational efficiency, a diverse product portfolio, and strong brand recognition. The company’s investment in its supply chain and distribution networks, along with automation in production, allows it to provide consistent value to its customers. You can learn more about the competitive landscape by reading about the Competitors Landscape of J&J Snack Foods.

- Strategic cold storage facilities in Texas (July 2023), New Jersey (January 2024), and Arizona (May 2024).

- Increased shipping efficiency and reduced costs through strategic distribution locations.

- Focus on automation in production lines to improve output and efficiency.

- Diverse product offerings to meet various consumer demands.

J&J Snack Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does J&J Snack Foods Make Money?

The revenue streams and monetization strategies of J&J Snack Foods Company are centered around the sale of branded snack foods and frozen beverages. These products are distributed through two main channels: foodservice and retail supermarkets. The company's financial performance reflects its success in these areas, with record net sales reported for fiscal year 2024.

J&J Snack Foods has demonstrated its ability to adapt and grow within the food and beverage industry. Understanding its revenue breakdown is crucial for investors and anyone interested in the J&J Snack Foods business model. The company's strategic focus on both foodservice and retail channels allows it to reach a wide consumer base.

The company's financial results show a dynamic business, with fluctuations in different segments. For those interested in the company's financial health, exploring the J&J Snack Foods financial performance offers insights into its operational efficiency and market position.

This segment includes sales of soft pretzels, frozen beverages, and other items to venues like stadiums and movie theaters. In fiscal 2024, foodservice sales saw a modest increase, driven by specific product categories. In Q4 fiscal 2024, foodservice sales reached $262.2 million.

This segment focuses on selling products like soft pretzels and frozen novelties to supermarket chains. The retail segment experienced growth in fiscal 2024, though Q4 fiscal 2024 saw a decline. The retail segment sales grew 4.4% in fiscal 2024, adjusted for an extra week in the prior year.

This segment includes brands like ICEE and SLUSH PUPPIE, along with revenue from machine sales and services. Frozen beverage sales were flat in Q4 fiscal 2024 compared to the previous year. For the full fiscal year 2024, frozen beverage sales increased.

In Q1 fiscal 2025, total revenue increased 4.1% to $362.6 million, a Q1 record. However, in Q2 fiscal 2025, net sales declined 1.0% to $356.1 million. The company's free cash flow in the recent quarter was $8.94 million.

The company's performance highlights the importance of understanding its diverse revenue streams. For a deeper dive into the consumer base, consider exploring the Target Market of J&J Snack Foods. These insights are crucial for anyone looking to understand how J&J Snack Foods works and its position in the market. The company's ability to adapt and grow within the food and beverage industry is a key factor in its success.

J&J Snack Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped J&J Snack Foods’s Business Model?

J&J Snack Foods Company (J&J Snack Foods) has a history marked by strategic acquisitions and operational adjustments. The company's approach involves both organic growth and strategic acquisitions to broaden its product portfolio and market reach. A key element of its strategy is adapting to evolving consumer preferences and market trends, as seen with the acquisition of the 'better-for-you' cookie brand, Thinsters, in April 2024.

The company has faced challenges, including disruptions from transitioning to new enterprise resource planning (ERP) systems. Despite these hurdles, J&J Snack Foods has shown resilience by enhancing operational efficiencies and improving margins. The company's ability to innovate and maintain a strong distribution network has been crucial to its sustained performance. This includes the expansion of its product offerings and the optimization of its supply chain.

J&J Snack Foods focuses on maintaining a strong presence in key distribution channels. The company continues to drive incremental opportunities through new innovations like Brauhaus pretzels and Bavarian pretzel sticks. This strategy is supported by a robust distribution network and investments in supply chain optimization.

J&J Snack Foods acquired Thinsters in April 2024, expanding its cookie and baked goods portfolio. The company faced a $20 million revenue loss (likely in 2022) due to ERP system issues. The company has consistently adapted to market changes and consumer preferences through product innovation and strategic acquisitions.

The acquisition of Thinsters in 2024 is a strategic move to expand its product offerings. Investments in supply chain optimization, including new regional distribution centers, have improved efficiency. J&J Snack Foods focuses on gaining incremental placements of products like Bavarian pretzel bites.

J&J Snack Foods benefits from strong brand recognition with names like SUPERPRETZEL and ICEE. Its extensive distribution network reaches over 57,000 grocery stores and 82,000 foodservice establishments in 2024. The company's ability to innovate and adapt to market trends contributes to its competitive advantage.

The company has navigated dynamic consumer and economic environments, impacting traffic in key channels. J&J Snack Foods faced a revenue loss due to ERP system transitions. Despite challenges, the company has focused on improving operational efficiencies and margins.

J&J Snack Foods strategically expands its product portfolio through acquisitions like Thinsters. The company has a strong distribution network and invests in supply chain optimization. For more insights into the company's growth, consider reading Growth Strategy of J&J Snack Foods.

- Strategic acquisitions drive portfolio expansion.

- Extensive distribution network enhances market reach.

- Adaptation to market trends and consumer preferences is critical.

- Operational efficiency and margin improvement are key focus areas.

J&J Snack Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is J&J Snack Foods Positioning Itself for Continued Success?

The J&J Snack Foods Company holds a significant position within the consumer staples sector, particularly in niche snack foods and frozen beverages. Its established brands, such as SUPERPRETZEL and ICEE, provide strong market presence across the United States, Mexico, and Canada. The company's distribution network reaches diverse customer segments, including restaurants, stadiums, and supermarkets. Understanding the dynamics of J&J Snack Foods business model is crucial for investors and stakeholders.

However, the company faces various risks, including economic conditions, evolving consumer preferences, and nutritional concerns. Fluctuations in food distribution channels, input cost inflation, and competition within the snack food industry also pose challenges. These factors can impact the company's financial performance and strategic initiatives.

The company operates within the consumer staples sector, focusing on niche markets like snack foods and frozen beverages. Its strong brand recognition and extensive distribution network provide a competitive edge. The company's products are sold in various channels, including retail and foodservice, reaching a broad consumer base.

The company faces risks such as economic downturns, changing consumer preferences, and nutritional concerns. Input cost inflation, particularly for ingredients, impacts gross margins. Competition within the snack food industry and potential supply chain disruptions also pose challenges.

The company is optimistic about growth, focusing on core product expansion and new launches. Strategic initiatives include expanding production capacity and pursuing contract manufacturing opportunities. The company aims to improve its gross margin and anticipates growth in the retail segment.

As of Q1 fiscal 2025, the company had approximately $74 million in cash and no long-term debt. A new $50 million stock repurchase authorization supports future growth initiatives. The company's financial position is strong, enabling investments and strategic expansions.

For fiscal 2025, the company plans to improve its gross margin to over 31%, with a medium-term goal to reach the mid-30% range. It projects the potential to double sales in the retail segment, especially with Dippin' Dots and new product offerings. The company is expanding production capacity and introducing new products to drive growth.

- Expanding production capacity.

- Introducing new products.

- Pursuing contract manufacturing opportunities.

- Focusing on core channel improvements.

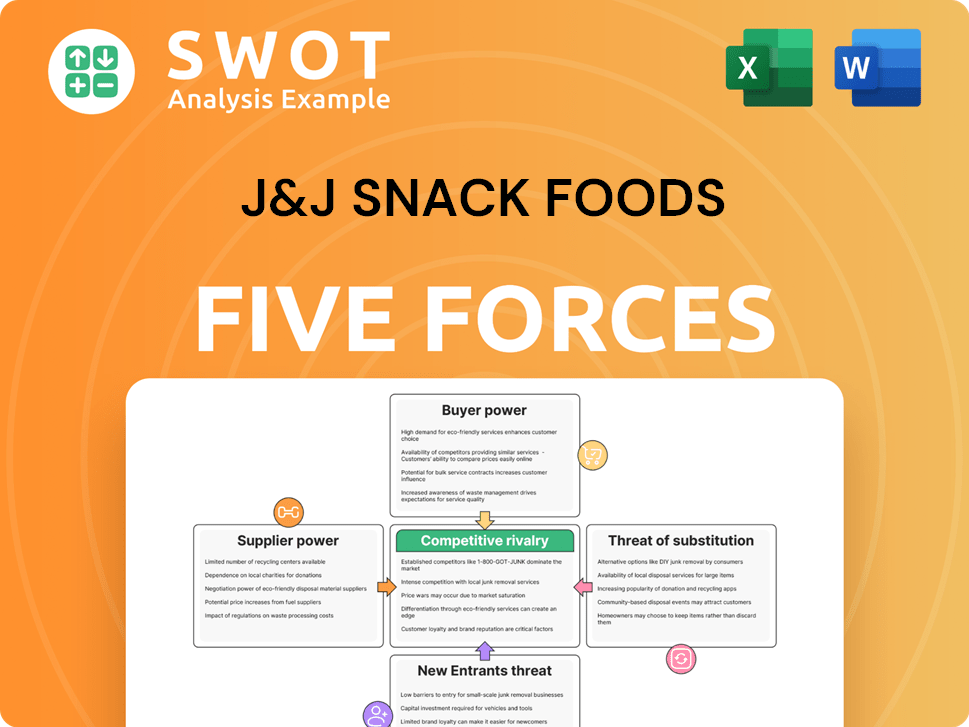

J&J Snack Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of J&J Snack Foods Company?

- What is Competitive Landscape of J&J Snack Foods Company?

- What is Growth Strategy and Future Prospects of J&J Snack Foods Company?

- What is Sales and Marketing Strategy of J&J Snack Foods Company?

- What is Brief History of J&J Snack Foods Company?

- Who Owns J&J Snack Foods Company?

- What is Customer Demographics and Target Market of J&J Snack Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.