Kingsoft Bundle

How Does Kingsoft Thrive in the Tech Arena?

Kingsoft Company, a powerhouse in the Chinese tech landscape, recently celebrated a monumental achievement, exceeding RMB 10 billion in revenue for the first time in 2024. This remarkable feat highlights the company's significant growth and influence. With a diverse portfolio spanning office productivity, security software, and online gaming, Kingsoft is a key player in the global market.

Delving into the operational intricacies of Kingsoft SWOT Analysis, we uncover the secrets behind its success. The company's dual-core strategy, blending enterprise solutions with a thriving gaming division, offers a fascinating case study for investors and analysts alike. Explore the inner workings of Kingsoft software, its strategic advantages, and its future trajectory to gain a comprehensive understanding of this dynamic tech giant. Learn about Kingsoft products, Kingsoft features, and how Kingsoft WPS Office works.

What Are the Key Operations Driving Kingsoft’s Success?

The core operations of the Kingsoft Company revolve around two main segments: office software and services, and online games and others. This structure allows Kingsoft to deliver value through a diverse range of products and services, catering to both professional and entertainment needs. The company's strategy focuses on continuous innovation and expansion within these key areas.

The Kingsoft value proposition is centered on providing efficient, intelligent office solutions and high-quality gaming experiences. This is achieved through significant investment in research and development, particularly in areas like AI and collaboration for its office software, and the development of engaging content and platforms for its gaming segment. This dual approach ensures that Kingsoft remains competitive in the market.

Kingsoft leverages its expertise in both software and gaming to create a strong market presence. The office software segment, driven by Kingsoft Office Group, focuses on enhancing its offerings with AI and collaboration features. Simultaneously, the online games segment, with titles like JX3 Online, capitalizes on established intellectual property and explores new genres to expand its reach.

This segment, led by Kingsoft Office Group, offers the WPS Office suite, WPS 365, and WPS AI. These products are designed for individual users, enterprises, and government bodies. The focus is on continuous innovation, particularly in AI and collaboration features, to meet evolving user needs.

This segment focuses on the development, operation, and distribution of PC and mobile games. Key titles include JX3 Online and Snowbreak: Containment Zone. The company emphasizes classic wuxia IP and explores new gaming experiences to engage a broad audience.

Kingsoft focuses on several key strategies to drive growth and maintain its market position. These include continuous innovation in both office software and gaming, strategic partnerships, and a strong emphasis on localization to expand its global presence.

- Innovation: Continuous development of new features, particularly AI and collaboration tools, to enhance the WPS Office suite.

- IP Management: Leveraging established intellectual property in the gaming segment while exploring new genres.

- Localization: Strengthening its presence in government and key industries by assisting clients in building secure, self-sufficient digital offices.

- Market Expansion: Expanding its user base through targeted marketing and strategic partnerships.

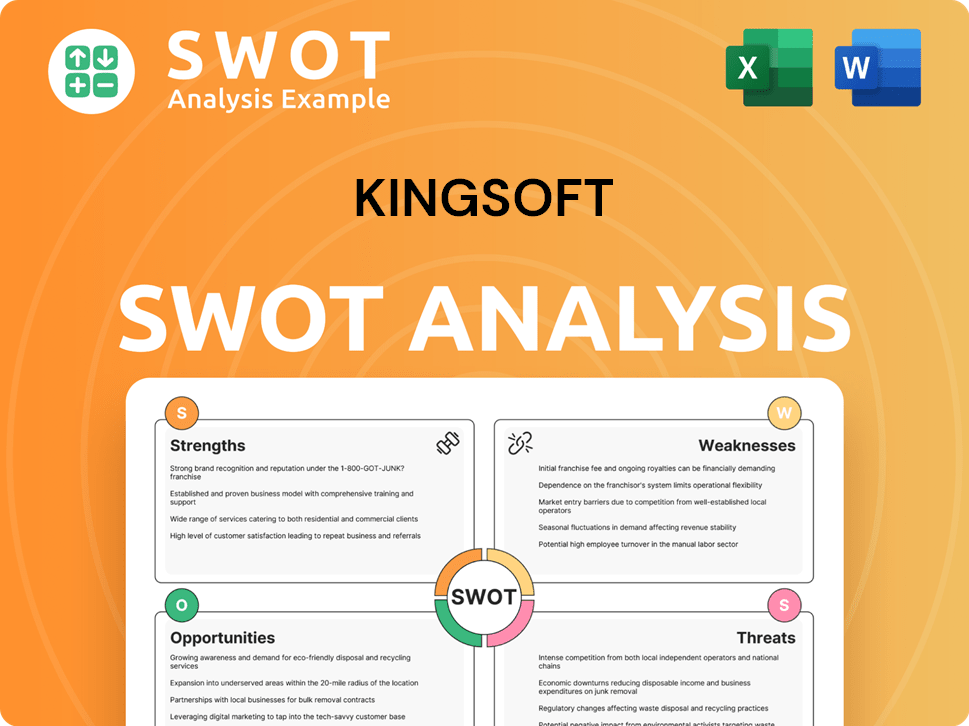

Kingsoft SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kingsoft Make Money?

The Kingsoft Company generates revenue through a diversified strategy, primarily focusing on office software and online gaming. This approach allows the company to tap into different markets and revenue streams, ensuring a balanced financial performance. In 2024, the company achieved a notable increase in overall revenue, reflecting the success of its diverse business model.

The company's revenue streams are broadly categorized into office software and services, and online games and others. These segments contribute roughly equally to the total revenue, indicating a well-distributed business portfolio. The Kingsoft software has shown consistent growth, driven by both its office software and gaming divisions.

For those interested in the origins, you can find more information in this Brief History of Kingsoft.

The office software and services segment is a significant revenue driver for Kingsoft. This segment includes various offerings, such as the WPS individual business, WPS 365 business, and traditional software sales. The company continually innovates its Kingsoft products to enhance user experience and drive revenue growth.

- In 2024, this segment generated RMB 5,121.1 million, a 12% year-on-year increase.

- The WPS individual business saw an 18.00% year-on-year increase, reaching RMB 3,283.29 million, thanks to improved conversion rates.

- The enterprise-focused WPS 365 business experienced a substantial 149.33% year-on-year increase, reaching RMB 437 million.

- Traditional software sales decreased by 8.56% year-on-year to RMB 1,268 million.

- Other businesses saw a 37.17% year-on-year decrease, totaling RMB 132 million.

The online games and others segment is another key revenue source for Kingsoft. This segment benefits from popular titles and continuous content updates. The company's monetization strategies in gaming include direct game sales and in-game purchases.

- This segment recorded RMB 5,196.8 million in revenue for 2024, a robust 31% year-on-year increase.

- Key titles like JX3 Online and Snowbreak: Containment Zone drove this growth.

- Monetization strategies include direct game sales and in-game purchases.

In the first quarter of 2025, Kingsoft demonstrated continued growth. The company's performance highlights its ability to adapt and thrive in a competitive market.

- Total revenue for Q1 2025 was RMB 2,338.0 million, a 9% year-on-year increase.

- The office software and services sector generated RMB 1,301.5 million, a 6% year-on-year increase.

- Online games and other businesses contributed RMB 1,036.5 million, a 14% year-on-year growth.

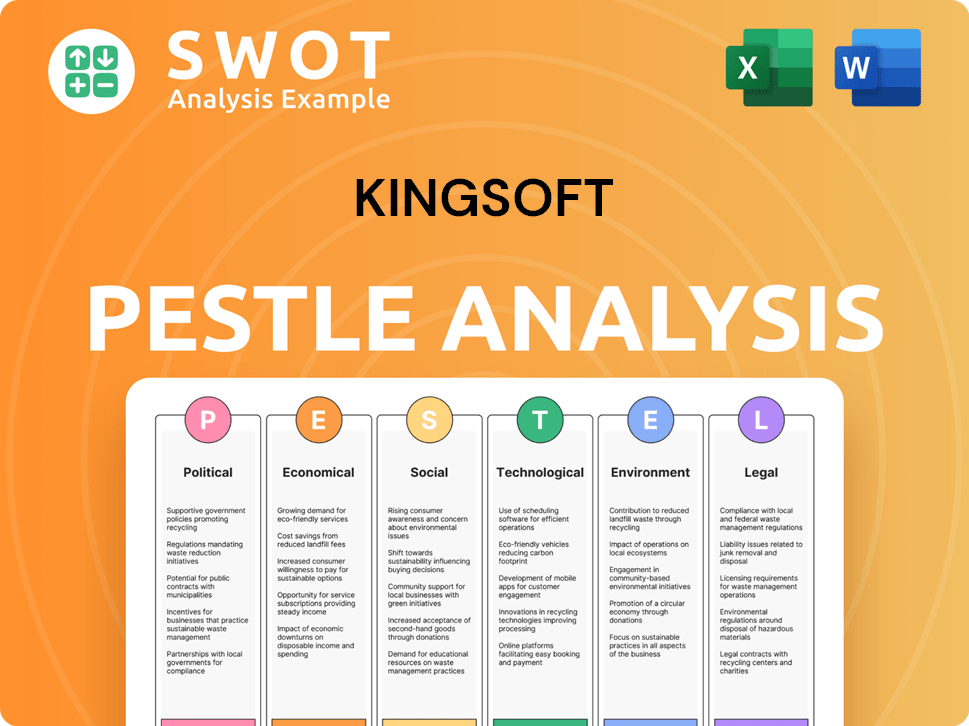

Kingsoft PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Kingsoft’s Business Model?

The Kingsoft Company has achieved significant milestones, strategic shifts, and competitive advantages. These elements have collectively shaped its operational and financial growth. The company's journey involves key achievements, including financial targets and product innovations. Strategic moves, such as integrating Artificial Intelligence (AI), have been pivotal in enhancing its market position.

Kingsoft's strategic focus on AI and its 'prime games' strategy in online gaming has been notable. These moves have been crucial in driving revenue growth and strengthening its market position. The company's competitive edge stems from its strong brand recognition, particularly with WPS Office, and technological leadership in AI integration. The company continues to adapt by focusing on product iteration and expanding global market reach.

The financial performance of Kingsoft has been impressive, with total revenue surpassing RMB 10 billion for the first time in 2024, reaching RMB 10,317.9 million. This represents a 21% year-on-year increase, driven by strong growth in office software, services, and online games. This financial success underscores the company's robust market position and effective strategic execution.

A major milestone was achieving over RMB 10 billion in total revenue in 2024, marking a significant financial achievement. This growth was primarily fueled by the office software and online games sectors. The company's ability to adapt and innovate has been crucial to its success.

Kingsoft has strategically integrated AI across its product lines, exemplified by WPS AI 2.0 and WPS AI Enterprise Edition. The company also launched intelligent solutions for government clients. These moves aim to enhance productivity and collaboration, driving growth within the WPS individual and WPS 365 businesses.

Kingsoft benefits from strong brand recognition, especially with WPS Office in China, and technological leadership in AI integration. Continuous investment in R&D, particularly in collaboration and AI, strengthens its market competitiveness. The company also leverages an ecosystem effect, expanding its presence in government and key industries.

In 2024, Kingsoft's online games revenue increased by 31% year-on-year. Despite rising R&D costs, which increased by 60% year-on-year in Q1 2025 to RMB 828 million, the company continues to adapt. The company focuses on product iteration and expanding its global market reach for its office products.

Kingsoft's strategic focus on AI integration and its 'prime games' strategy has significantly boosted its market position. The company's commitment to innovation, especially in AI, has enhanced its productivity tools. The successful launch of JX3 Ultimate in 2024, with full platform data inheritance, significantly boosted player engagement.

- WPS AI 2.0 launch with new AI office assistants.

- Focus on 'prime games' strategy in online gaming.

- Continuous investment in R&D for AI and collaboration.

- Expansion into government and key industries.

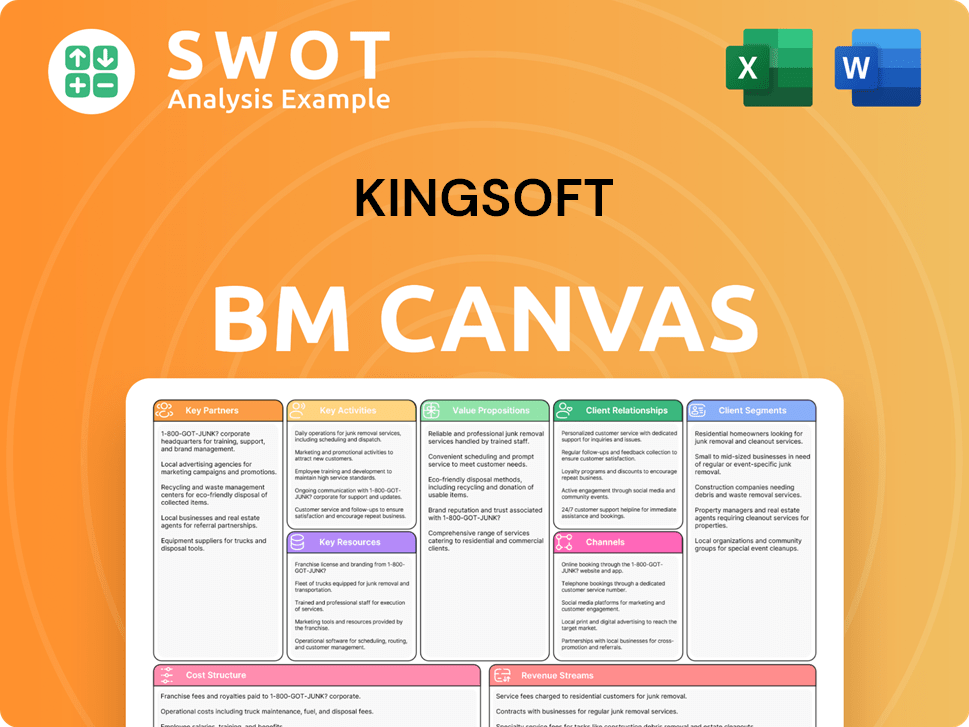

Kingsoft Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Kingsoft Positioning Itself for Continued Success?

The Kingsoft Company holds a significant position in China's software and internet services industry, particularly in office productivity and online gaming. In 2024, the company demonstrated its strong market presence by achieving record highs in both revenue and profitability. The company's diversified business model, with its office software and services, and online games segments each contributing approximately 50% to the total revenue, underscores its resilience and strategic balance.

Despite its strong market position, Kingsoft faces several challenges. These include intense competition in both the software and gaming sectors, the need for continuous innovation to keep pace with rapid technological advancements, and potential regulatory changes in China's internet and software industries. The company's ability to adapt to these challenges will be critical to its long-term success. For more details on Kingsoft's strategic direction, consider reading about the Growth Strategy of Kingsoft.

In 2024, Kingsoft achieved a total revenue of RMB 10,317.9 million, marking a 21% year-on-year increase. Its office software and services, and online games segments each contributed approximately 50% to total revenue. This balanced approach highlights its strong market presence and diversified income streams.

Increased R&D costs, which rose by 60% year-on-year in Q1 2025 for Kingsoft Office Group, reflect the significant investment required to stay competitive. Kingsoft Cloud, a related entity, reported a 10.9% year-on-year revenue increase in Q1 2025, but also noted a sequential decrease due to seasonality. The company faces intense competition in both the software and gaming sectors.

Kingsoft plans to continue iterating on its core products and technologies, particularly deepening AI adoption in office productivity and strengthening WPS 365's capabilities. The company aims to expand its global market reach for its office products and focus on prime games while exploring new genres in online gaming. Leadership emphasizes technology empowerment and strengthening core capabilities.

The 2025 action plan for Kingsoft Office focuses on 'improving quality, efficiency, and return,' with continued investment in AI and collaboration to create a product system that better meets user needs. This forward-looking perspective, coupled with a focus on core business growth and AI innovation, positions Kingsoft to navigate future market dynamics.

Kingsoft's strategic focus includes expanding its global market reach for office products and exploring new game genres. The company is committed to continuous innovation, particularly in AI and collaboration, to enhance its product offerings and maintain its competitive edge. The company is positioned to sustain profitability by leveraging its core strengths and adapting to market dynamics.

- Continued investment in AI and collaboration.

- Expansion of global market reach for Kingsoft products.

- Focus on prime games and exploring new genres.

- Emphasis on technology empowerment and strengthening core capabilities.

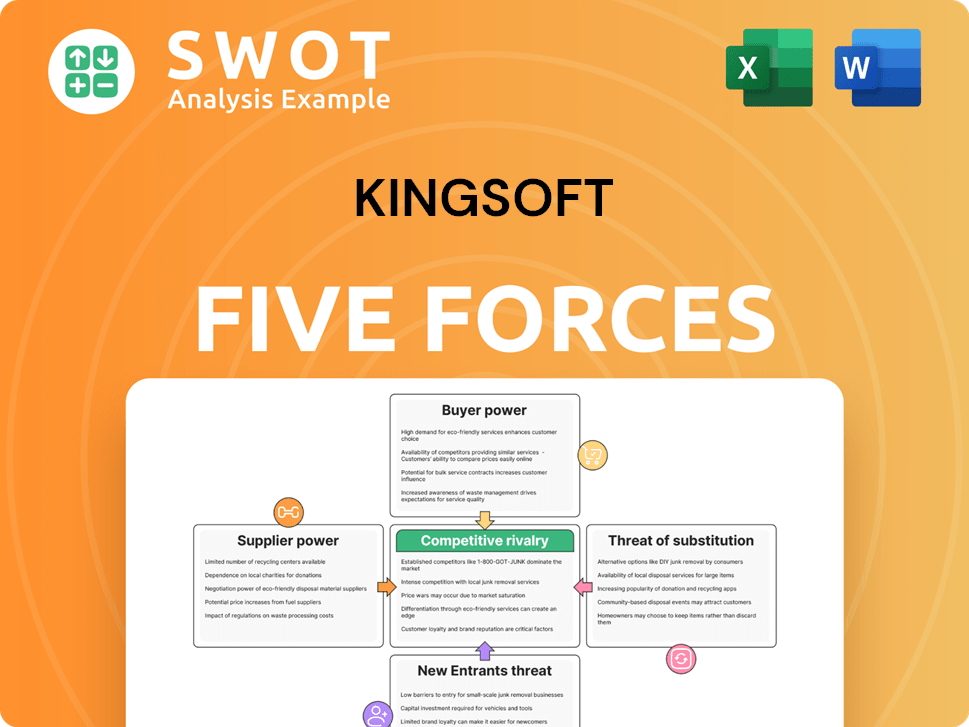

Kingsoft Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kingsoft Company?

- What is Competitive Landscape of Kingsoft Company?

- What is Growth Strategy and Future Prospects of Kingsoft Company?

- What is Sales and Marketing Strategy of Kingsoft Company?

- What is Brief History of Kingsoft Company?

- Who Owns Kingsoft Company?

- What is Customer Demographics and Target Market of Kingsoft Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.