Kingspan Group PLC Bundle

How Does Kingspan Group PLC Thrive in the Global Construction Market?

Kingspan Group PLC, a titan in advanced insulation and building solutions, has consistently demonstrated impressive financial performance, achieving a 6% revenue increase to €8.6 billion in 2024 and a further 9% rise in Q1 2025. This sustained growth, driven by strategic acquisitions and a strong focus on sustainability, makes Kingspan a compelling case study for investors and industry analysts alike. The company's dedication to energy-efficient solutions positions it at the forefront of the green building movement.

With operations spanning over 80 countries, and a workforce exceeding 22,000, understanding the Kingspan Group PLC SWOT Analysis is crucial. The Kingspan company's commitment to innovation and its diverse range of Kingspan products, from insulated panels to insulation boards, further solidify its market position. This article will explore the Kingspan business, its operations, revenue streams, and strategic advantages, providing insights into its role in sustainable building and its future outlook. This in-depth analysis will cover how Kingspan manufactures insulation, its global presence, and its impact on the construction industry, offering a comprehensive understanding of this industry leader.

What Are the Key Operations Driving Kingspan Group PLC’s Success?

Kingspan Group PLC creates value by manufacturing and supplying high-performance insulation and building envelope solutions for the construction industry. The Kingspan company focuses on energy efficiency and sustainability, offering products like insulated panels and insulation boards. Their customer base includes architects, developers, and government bodies, all committed to green building practices.

Kingspan's business model is built on extensive manufacturing capabilities, with over 210 factories globally. Their supply chain prioritizes sustainable raw materials. They have made significant strides in bio-based insulation with their BioKor® brand and have acquired a majority stake in Steico, a leader in wood fiber insulation. Logistics and distribution are facilitated by a vast network, operating in over 70 countries with more than 200 distribution outlets.

The company's focus on innovation and sustainability is integrated into its product development. The IKON Global Innovation Centre, launched in 2019, enhances innovation capabilities, while the Kingspan Fire Engineering Research Centre accelerates product testing. This commitment translates into customer benefits through offerings like QuadCore® LEC Panels and PowerPanel®, addressing the growing demand for sustainable construction. To learn more about the company, you can read the Brief History of Kingspan Group PLC.

Kingspan offers a range of products, including insulated panels, insulation boards, and other building materials. These products are designed to improve energy efficiency and reduce environmental impact. The company's diverse product portfolio caters to various construction needs.

Kingspan serves architects, developers, and government bodies. These customers are committed to sustainable building practices. The company's solutions align with the growing demand for green building.

Kingspan operates over 210 factories worldwide, ensuring a robust supply chain. The company focuses on sourcing sustainable raw materials and expanding its sustainable product range. Partnerships with distributors facilitate efficient delivery.

The IKON Global Innovation Centre enhances the company's innovation capabilities. The Kingspan Fire Engineering Research Centre accelerates product testing and certification. This focus on innovation leads to energy-efficient and lower-carbon building solutions.

Kingspan provides high-performance, energy-efficient, and lower-carbon building solutions. The company differentiates itself by offering a comprehensive portfolio of sustainable construction products. This approach addresses the increasing market demand for environmentally friendly building materials.

- Energy-efficient products that reduce carbon emissions.

- Sustainable materials and manufacturing processes.

- Innovation through research and development.

- Comprehensive product portfolio to meet diverse construction needs.

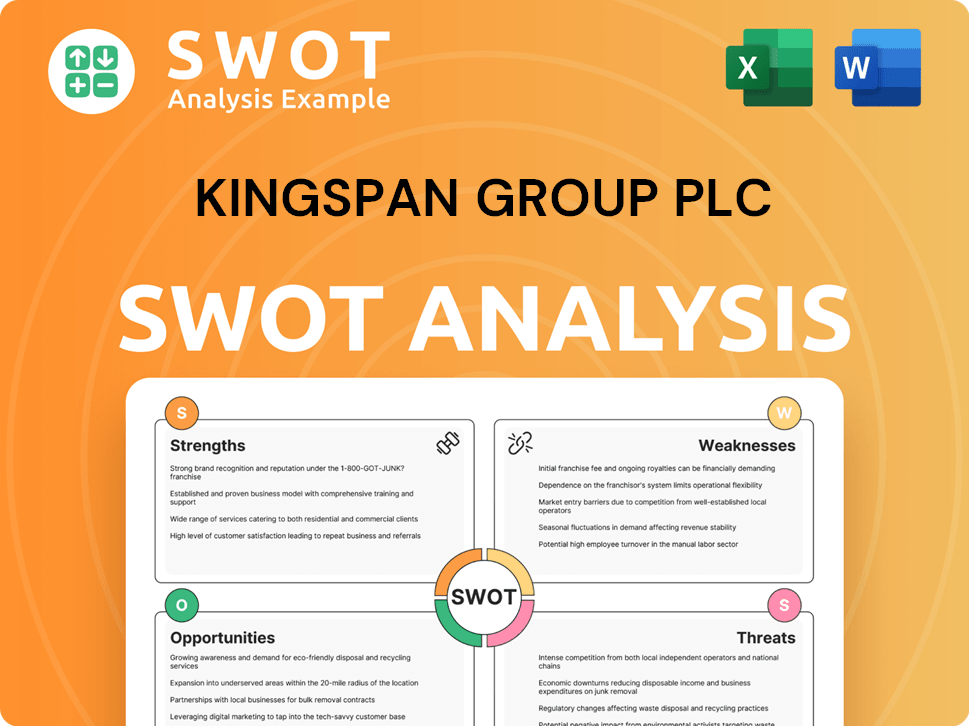

Kingspan Group PLC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kingspan Group PLC Make Money?

The Kingspan Group PLC generates revenue primarily through the sale of its diverse building materials and solutions. This revenue is driven by product sales across six main divisions, including Insulated Panels, Insulation, Light & Air, Water & Energy, Data & Flooring, and Roofing & Waterproofing. The company's financial success is closely tied to its ability to innovate and expand its market reach through strategic acquisitions.

In 2024, the Kingspan company reported a total revenue of €8.6 billion. Each division contributes to this overall revenue, with product sales forming the backbone of the business. The company's global presence, with significant operations in Europe and the Americas, further diversifies its revenue streams and mitigates regional economic impacts.

The Kingspan business also employs various monetization strategies, including strategic acquisitions to expand its product offerings and market reach. These acquisitions have significantly contributed to sales growth and trading profit. The company's focus on innovative and sustainable solutions allows for premium pricing and strong market positioning, driving profitability and long-term value.

Product sales are the main revenue source for Kingspan products, with each division contributing to the overall financial performance. Strategic acquisitions are a key part of Kingspan's growth strategy, expanding its product portfolio and market presence. The company's focus on sustainable solutions, such as its QuadCore® LEC Panels and PowerPanel®, allows for premium pricing and strong market positioning.

- Insulated Panels sales were broadly in line with the prior year in 2024, with strong performance in the Americas. In Q1 2025, Insulated Panels sales were up 4%.

- The Insulation division saw a significant increase in category breadth in 2024, with sales up 4% in Q1 2025.

- Data Solutions experienced a breakthrough year in 2024 with sales up 36%, and continued this momentum in Q1 2025 with sales up 37%.

- The Roofing + Waterproofing division saw sales grow by 55% in Q1 2025, boosted by acquisitions.

- Acquisitions contributed 8% to sales growth and 5% to trading profit growth in 2024.

- In 2024, Western and Southern Europe accounted for 42.8% of net sales, Central and Northern Europe 27.3%, and the Americas 22.3%. Understanding the Owners & Shareholders of Kingspan Group PLC helps to understand the financial strategies.

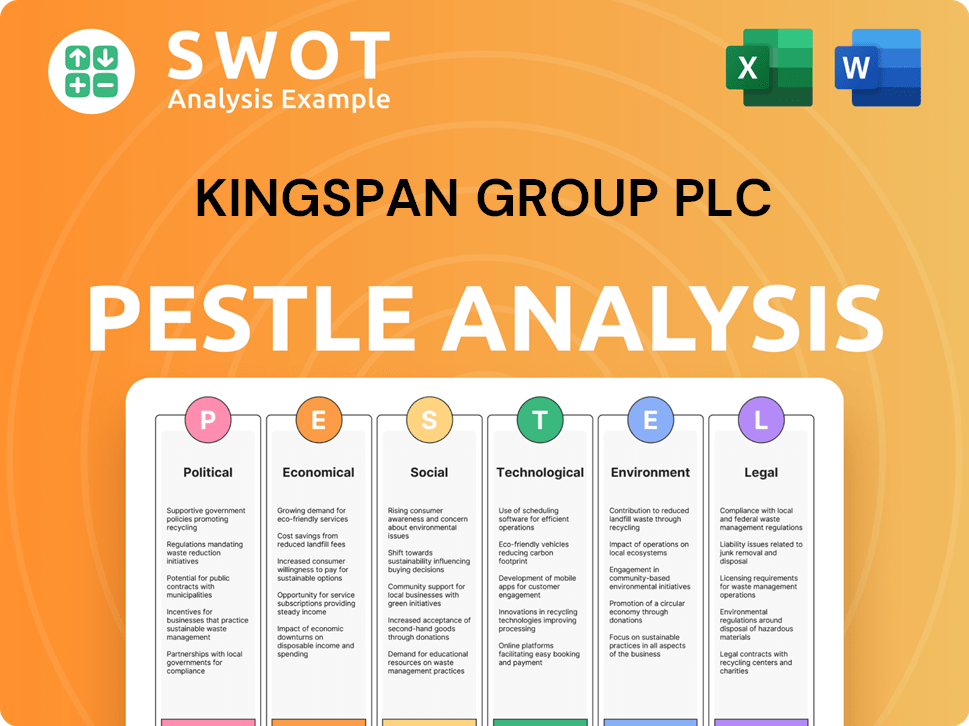

Kingspan Group PLC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Kingspan Group PLC’s Business Model?

The trajectory of Kingspan Group PLC has been marked by significant milestones and strategic maneuvers, particularly in recent years. In 2024, the Kingspan company achieved record revenue and profitability despite challenging market conditions, demonstrating its resilience and adaptability. These achievements highlight the company's robust operational strategies and its ability to navigate economic fluctuations effectively.

A key strategic move in 2024 was the substantial investment in acquisitions and capital expenditure. This included a controlling stake in Steico, a global leader in wood fiber insulation, and an increased stake in Nordic Waterproofing. These acquisitions expanded the Kingspan business's product portfolio and market presence, especially in natural insulation and waterproofing sectors. Furthermore, the commissioning of new facilities across Europe, the US, APAC, and LATAM during 2024 further solidified its global footprint.

Kingspan has demonstrated a strong ability to adapt to changing market dynamics. Despite varying market conditions across regions in 2024, with strong performance in the Americas offsetting more subdued activity in some European markets, the company showed robust order intake towards the end of the year, indicating growing demand. In Q1 2025, while sales in the US were seasonally slow, order intake surged to record levels, signaling strong future demand for Kingspan products.

In 2024, Kingspan achieved record revenue and profitability. The company invested €1.2 billion in acquisitions and capital expenditure. New facilities were commissioned across multiple continents.

Acquisitions included a controlling stake in Steico and an increased stake in Nordic Waterproofing. The company expanded its product portfolio and geographical presence. The focus was on strengthening its position in key markets.

Kingspan's brand strength is underpinned by innovation and sustainability. It launched 12 Lower Embodied Carbon (LEC) products in 2024. The company operates over 210 factories across 80 countries.

Strong order intake towards the end of 2024 signaled growing demand. In Q1 2025, order intake surged to record levels. The company's financial performance reflects its strategic agility.

Kingspan's competitive advantages are multifaceted, stemming from its focus on innovation, sustainability, and global presence. The company's commitment to reducing Scope 1 and 2 GHG emissions by 80% from 2020 levels by the end of 2024 (excluding acquisitions, and 61% including acquisitions) strengthens its market position. The 'Completing the Envelope' strategy enhances its ecosystem effect.

- Innovation: Launch of 12 LEC products in 2024, including KILON LEC daylighting and SFS LEC.

- Global Presence: Operating over 210 factories across 80 countries ensures widespread product availability.

- Sustainability: Commitment to reducing GHG emissions enhances its appeal in an eco-conscious market.

- Market Adaptation: Demonstrated ability to navigate regional market variations effectively.

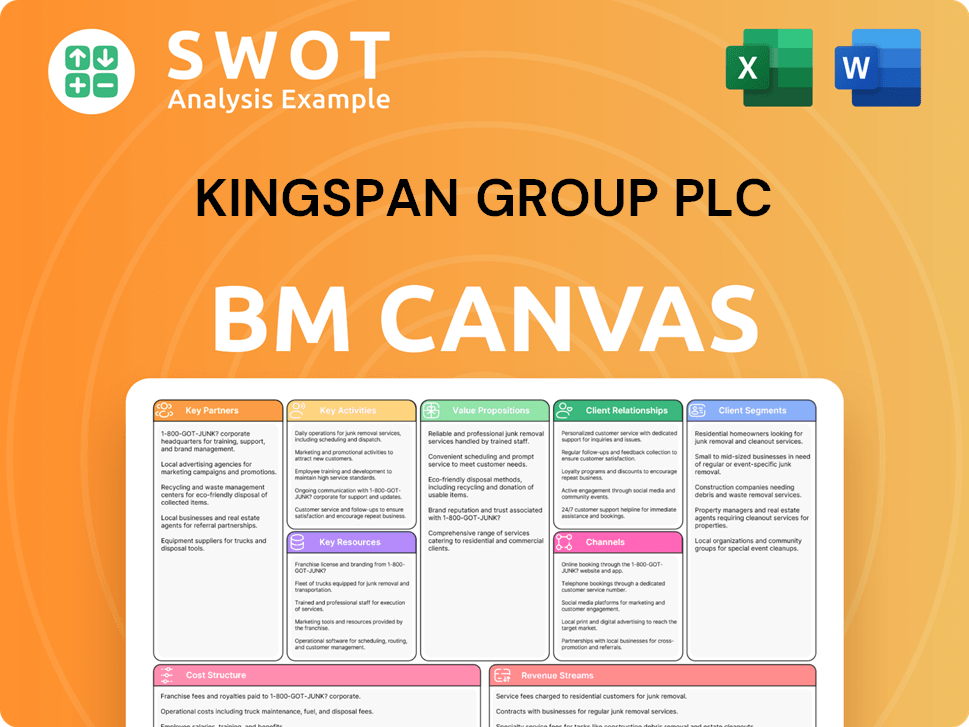

Kingspan Group PLC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Kingspan Group PLC Positioning Itself for Continued Success?

Kingspan Group PLC, a global leader, holds a strong industry position in high-performance insulation and building envelope solutions. The company's extensive global reach, operating in over 80 countries with manufacturing sites worldwide, underpins its significant market presence. Its focus on energy-efficient and sustainable solutions strengthens customer loyalty, aligning with increasing regulatory demands and consumer preferences. The company's consistent revenue growth, with a 6% increase in 2024 to €8.6 billion, demonstrates a robust standing against competitors.

Despite its strong position, Kingspan faces several key risks, including regulatory changes, new competitors, and technological disruptions. The US housing market's sensitivity to interest rates could impact demand. The company's reliance on commodity inputs exposes it to price swings. The risk of changing customer behavior towards seeking lower embodied carbon building products is also a substantive concern, with a potential revenue risk of over €1 billion if not addressed. To understand the broader market dynamics, consider the Competitors Landscape of Kingspan Group PLC.

Kingspan's broad product portfolio and global presence, trading in over 80 countries, highlight its significant market presence. Strategic acquisitions, such as Steico and Nordic Waterproofing, enhance market share and diversify offerings. Customer loyalty is likely bolstered by its focus on energy-efficient and sustainable solutions, aligning with increasing regulatory requirements.

Key risks include regulatory changes, new competitors, and technological disruption. Sensitivity to interest rates in the US housing market could impact demand. Reliance on commodity inputs like polyurethane foam exposes the company to price swings. Changing customer behavior towards lower embodied carbon building products poses a risk.

Kingspan is pursuing strategic initiatives to expand revenue, including a $1 billion investment in the US for the Roofing + Waterproofing sector. Innovation is driven by performance, solutions, sustainability, and digitalization. Analysts project a 4.2% rise in net income for 2025 to €666 million, with EPS growing to €3.92.

The company is investing heavily in the US, including new brownfield sites in Oklahoma and Maryland. It's exploring entry into the residential asphalt shingle market. Ambitious goals include a 90% absolute reduction in Scope 1 and 2 GHG emissions by 2030 and recycling 1 billion PET bottles annually by 2025.

Kingspan's strong order book, particularly in the US, and contributions from acquisitions and its innovation pipeline, position it for continued trading profit growth in the second half of 2025. The company aims to accelerate a net-zero emissions built environment.

- 2024 Revenue: €8.6 billion

- Q1 2025 Sales Rise: 9%

- Projected 2025 Net Income: €666 million

- Projected 2025 EPS: €3.92

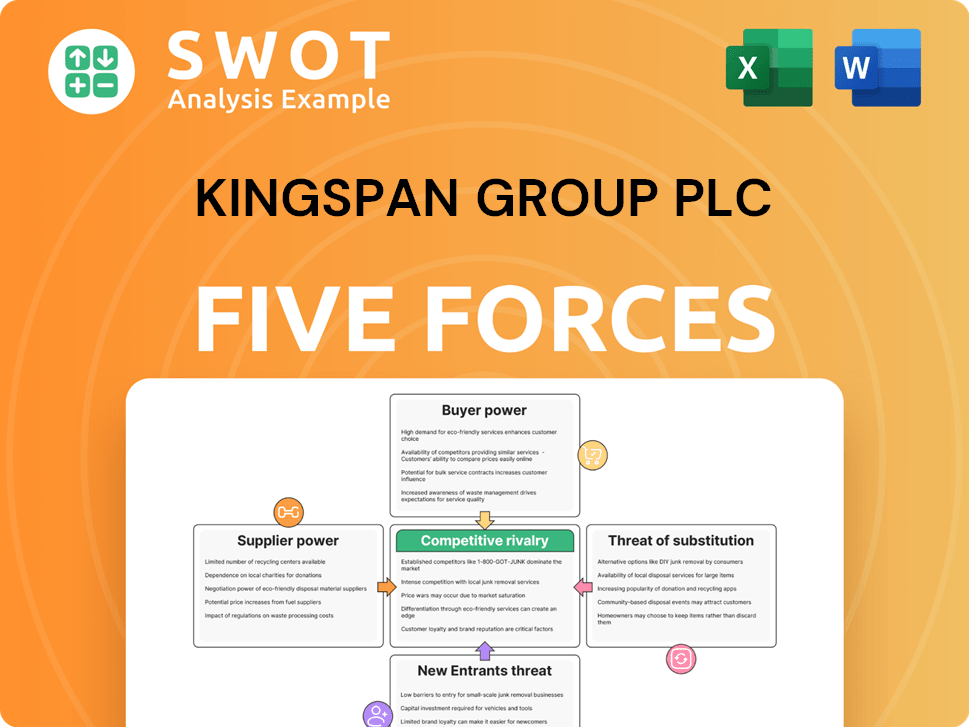

Kingspan Group PLC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kingspan Group PLC Company?

- What is Competitive Landscape of Kingspan Group PLC Company?

- What is Growth Strategy and Future Prospects of Kingspan Group PLC Company?

- What is Sales and Marketing Strategy of Kingspan Group PLC Company?

- What is Brief History of Kingspan Group PLC Company?

- Who Owns Kingspan Group PLC Company?

- What is Customer Demographics and Target Market of Kingspan Group PLC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.