Kordsa Bundle

How Does Kordsa Shape the Future of Materials?

Founded in 1973, Kordsa, a Sabancı Holding subsidiary, has become a global leader in reinforcement technologies, impacting industries worldwide. From reinforcing one in three automobile tires to two in three airplane tires, Kordsa's influence is undeniable. But how does this Kordsa SWOT Analysis reveal the secrets behind its success?

This deep dive into the Kordsa company explores its strategic diversification beyond tire reinforcement, encompassing composite and construction materials. We will explore Kordsa's operations, including its commitment to sustainability and innovative 'Innovate Everywhere' vision, which is supported by its global footprint and substantial financial performance, including the trailing 12-month revenue of $925 million as of December 31, 2024. Understanding Kordsa's business model is essential for anyone seeking to understand the advanced materials sector and its sustainable future.

What Are the Key Operations Driving Kordsa’s Success?

The core operations of the Kordsa company revolve around the creation and production of high-tenacity yarns, fabrics, and innovative reinforcement solutions. These Kordsa products are essential for strengthening tires, composite materials, and concrete, enhancing their durability and performance. The company's focus on innovation and quality positions it as a key player in multiple industries, contributing to advancements in transportation, aerospace, and construction.

Kordsa's business model encompasses manufacturing, sourcing, technology development, logistics, and sales. With 11 production facilities across seven countries, including Turkey, Brazil, and the USA, Kordsa operations are globally diversified. This strategic footprint allows for efficient supply chain management and adaptability to market changes, supporting its commitment to providing high-quality products and services worldwide.

Kordsa aims to 'Reinforce Life' by developing innovative products that promote sustainability and performance. In the tire industry, Kordsa products help reduce fuel consumption and improve wet grip. For the composite industry, they enable lighter vehicles with lower emissions. In construction, Kordsa offers durable reinforcement solutions, improving concrete durability and reducing costs. This approach highlights Kordsa's dedication to innovation and its commitment to providing value to its customers.

Kordsa operates 11 production facilities globally, ensuring a robust manufacturing base. These facilities are strategically located to serve key markets and manage supply chains efficiently. The company's commitment to quality and innovation drives its manufacturing processes.

With a presence in seven countries, Kordsa's global footprint enhances its ability to meet customer needs. This widespread presence enables the company to adapt to market dynamics and manage risks effectively. Kordsa's international operations are a key element of its success.

Kordsa invests heavily in R&D to develop cutting-edge reinforcement technologies. These innovations contribute to lighter, more fuel-efficient vehicles and more durable construction materials. Kordsa's commitment to innovation drives its market leadership.

Kordsa collaborates with leading universities and research institutions to foster innovation. These partnerships enhance Kordsa's capabilities and accelerate the development of new technologies. The Composite Technologies Center of Excellence is a prime example of this collaboration.

Kordsa provides value by developing innovative products that enhance performance and sustainability. Their reinforcement solutions improve the efficiency and durability of tires, composite materials, and concrete. This focus on innovation drives its market leadership and customer satisfaction.

- Tire Industry: Products that reduce fuel consumption and improve grip.

- Composite Industry: Technologies for lighter vehicles and reduced emissions.

- Construction: Durable and cost-effective reinforcement solutions.

- Sustainability: Focus on environmentally friendly products and processes.

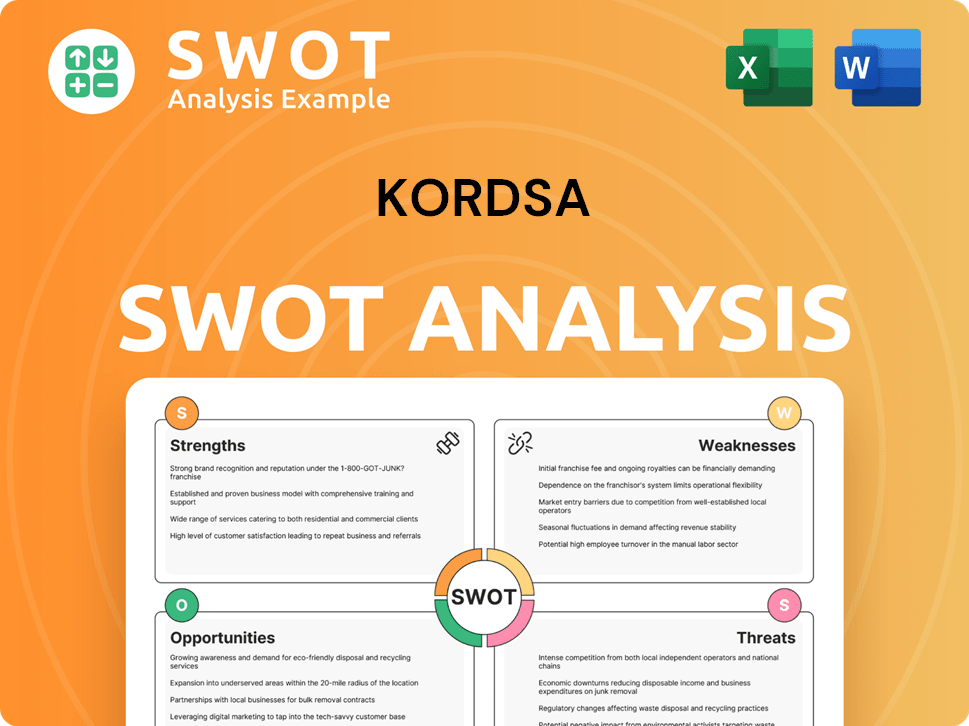

Kordsa SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kordsa Make Money?

The Kordsa company generates revenue mainly from selling reinforcement materials across its key business units. These units include Tire Reinforcement, Composite Reinforcement, Construction Reinforcement, and Compounding. The Kordsa business model focuses on providing high-performance products and solutions.

As of December 31, 2024, Kordsa Teknik Tekstil AS reported a trailing 12-month revenue of $925 million. Historically, the tire reinforcement segment has been the primary revenue driver. The company's strategic moves include innovation and expansion into sustainable products.

Kordsa's monetization strategies are centered on providing high-performance, value-added products and solutions. The company's focus on innovative and sustainable products, such as its REV Technologies for electric vehicles, contributes to its revenue generation by meeting evolving market demands. Additionally, Kordsa's expansion into compounding, utilizing 100% recycled PA66 granules for low-carbon-footprint products, represents a growing revenue stream aligned with global sustainability trends.

In the first quarter of 2025, the tire reinforcement segment generated $163 million in revenue, though this represented an 8% decline year-over-year due to production issues and market competition. The composite technologies segment saw revenue of $48 million, a 4% decrease, influenced by slower wide-body aircraft program recovery. The construction reinforcement segment generated $1.1 million in the first quarter of 2025.

- The company is actively involved in strategic acquisitions to expand product lines and market presence.

- An example is the 60% stake in Microtex Composites S.r.l., which cost €24.6 million, targeted at the super-luxury automotive and motorsports composite sectors in Europe.

- The company's focus on sustainable products, such as those using recycled materials, supports its revenue generation.

- For more insights, consider reading about the Competitors Landscape of Kordsa.

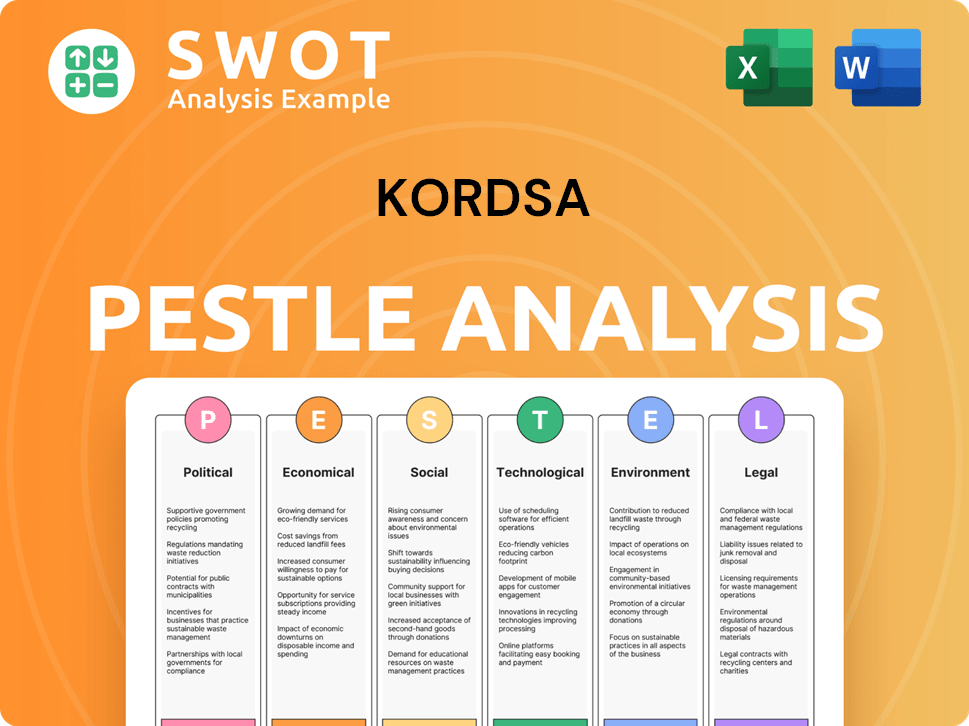

Kordsa PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Kordsa’s Business Model?

The journey of the Kordsa company has been marked by significant milestones and strategic moves, shaping its operations and financial performance. A key strategic move was the diversification from solely tire reinforcement into composite and construction reinforcement, leveraging its expertise in advanced materials. This expansion has allowed the Kordsa business to tap into new markets and reduce its reliance on the tire industry.

In 2014, Kordsa established the Composite Technologies Center of Excellence in collaboration with Sabancı University, which became active in 2016. This center is an innovation hub for R&D and production, fostering an open innovation concept. The Kordsa products have evolved to meet the changing demands of various industries, including aviation and automotive.

Kordsa's strategic moves have included acquisitions and partnerships to strengthen its market position and expand its product offerings. These initiatives have helped the Kordsa company stay competitive and adapt to industry changes. The company's focus on innovation and sustainability is evident in its recent developments, such as the REV Technologies for electric vehicles, which debuted in 2024.

In 2018, Kordsa expanded its composite business with the acquisition of Fabric Development Inc. and Textile Products Inc. in the U.S. for $100 million. In 2022, Kordsa completed the acquisition of a 60% stake in Italian Microtex Composites S.r.l. for €24.6 million. These acquisitions have helped Kordsa expand its global footprint and product offerings.

In July 2024, Kordsa partnered with the Sustainable Composite Materials and Manufacturing (SCMM) Innovation Centre at the Luxembourg Institute of Science and Technology (LIST) for a three-year collaboration focused on sustainable composite solutions. Also in 2024, Kordsa opened the new Kordsa Advanced Materials Technical Center, reinforcing its commitment to global innovation, especially in mobility, aviation, and space technology.

Kordsa maintains its competitive advantages through technology leadership, a strong global footprint, and long-standing relationships with leading global tire manufacturers. The company reinforces one in every three automobile tires and two in every three airplane tires globally. Its geographical diversification provides flexibility against market dynamics and currency fluctuations.

Kordsa is focused on sustainable products, including R-PET products and recycled polyester yarn for tires. The REV Technologies for electric vehicles, which debuted in 2024, demonstrate Kordsa's commitment to innovation and environmental responsibility. These initiatives are crucial for the long-term success of the Kordsa business.

Kordsa's global footprint and focus on innovation are key to its success. The company's investments in R&D and partnerships, such as the collaboration with LIST, underscore its commitment to staying at the forefront of the industry. For more details about the company's financial structure and ownership, you can read more at Owners & Shareholders of Kordsa.

- Kordsa operates in multiple countries, providing flexibility against market changes.

- The company's focus on sustainable products and technologies positions it well for future growth.

- Kordsa's strategic acquisitions and partnerships have expanded its market reach and product offerings.

- The new Kordsa Advanced Materials Technical Center reinforces its commitment to innovation.

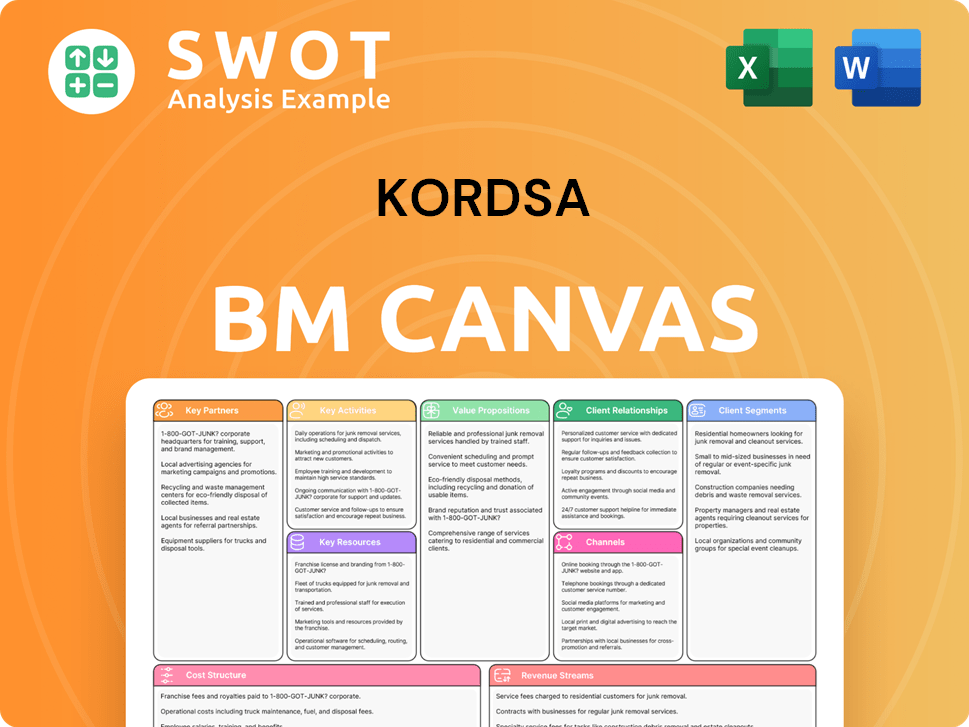

Kordsa Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Kordsa Positioning Itself for Continued Success?

The Kordsa company holds a prominent position in the global tire reinforcement market, a key segment within the broader materials industry. With a strong global footprint and significant market share, Kordsa is a major player in the production of nylon and polyester cord fabric. This dominance is supported by long-standing relationships with key customers and a focus on providing comprehensive solutions.

Despite its strong market position, Kordsa business faces several challenges. These include competitive pressures within the tire reinforcement sector and fluctuations in the civil aviation industry, which impacts its composite sales. The company also navigates regulatory changes and potential disruptions from new technologies. Financial performance in 2024 and early 2025 reflects these pressures, with the company reporting a net loss for the full year 2024 and the first quarter of 2025.

Kordsa is a leading manufacturer in the tire reinforcement market, particularly in the Europe-Middle East-Africa region. It holds the second-largest position in the Asia Pacific region. Its presence in the market is strengthened by its ability to supply a substantial portion of global automobile and airplane tires.

The company faces risks from price and volume competition and a slower recovery in the civil aviation sector. Regulatory changes and the emergence of new technologies also pose challenges. The company reported a net loss of TRY 1,096.13 million for the full year ended December 31, 2024, and a net loss of $8 million in the first quarter of 2025.

Kordsa is focused on strategic initiatives to sustain profitability, including innovation and sustainability. The company aims to achieve 40% sustainable products by 2030 and 100% by 2050. R&D and digital transformation are also key areas of focus, along with exploring projects in sustainable composite materials.

Kordsa is investing in R&D and digital transformation to enhance its business operations. The company is exploring high-potential projects in sustainable composite materials, especially for automotive and aerospace industries. The company plans to enhance its product portfolio in construction reinforcement and compounding.

To ensure future growth, Kordsa products are focusing on innovation and sustainability. The company is aiming to expand its market presence through strategic partnerships and investments in R&D. The global tire reinforcement market is expected to grow at a CAGR of approximately 5% from 2022 to 2028, which supports Kordsa's core business.

- Focus on sustainable products and materials.

- Investment in R&D and digital transformation.

- Expansion into new markets and product lines.

- Leveraging partnerships for innovation.

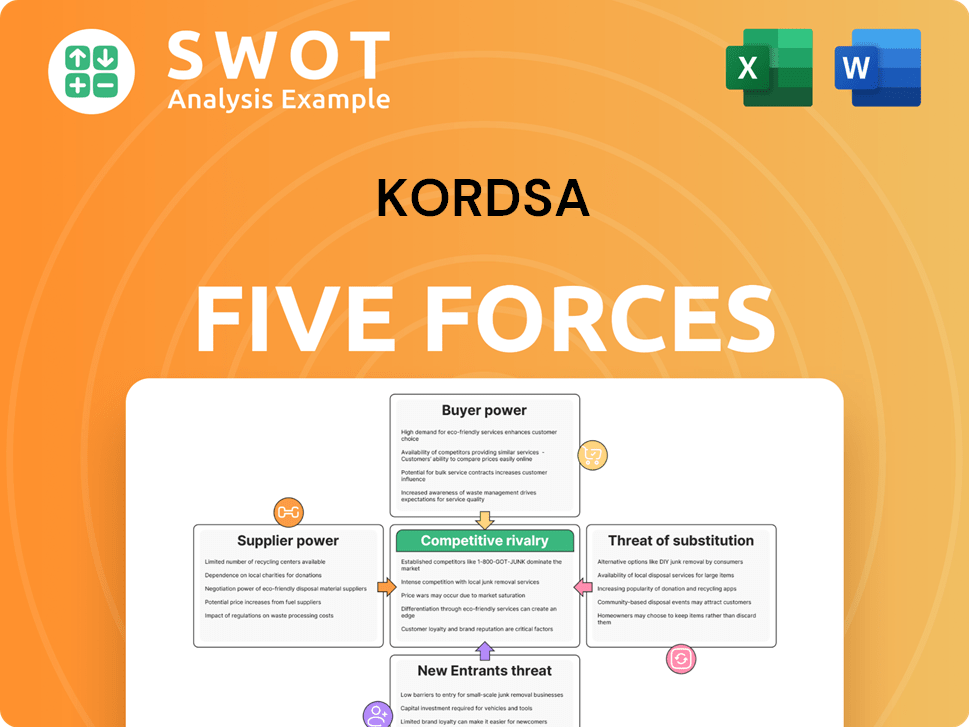

Kordsa Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kordsa Company?

- What is Competitive Landscape of Kordsa Company?

- What is Growth Strategy and Future Prospects of Kordsa Company?

- What is Sales and Marketing Strategy of Kordsa Company?

- What is Brief History of Kordsa Company?

- Who Owns Kordsa Company?

- What is Customer Demographics and Target Market of Kordsa Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.