Lam Research Bundle

How Does Lam Research Power the Tech Revolution?

Lam Research Corporation stands at the forefront of the semiconductor industry, a critical enabler of the advanced technologies shaping our world. With nearly $15 billion in revenue for fiscal year 2024 and a strong start to fiscal year 2025, the company's financial health reflects its vital role. Its cutting-edge equipment and services are integral to the production of nearly every advanced chip, making it a key player to watch.

As a global leader in Lam Research SWOT Analysis, Lam Research's impact on the semiconductor manufacturing landscape is undeniable. Its technology, focused on processes like deposition, etch, and clean, is essential for the creation of modern electronics. The company's robust performance and strategic investments, including nearly $2 billion in R&D, position it for continued growth in a rapidly expanding market. Understanding the inner workings of Lam Research is crucial for anyone invested in the future of technology.

What Are the Key Operations Driving Lam Research’s Success?

Lam Research Corporation (LRCX) creates value by providing essential wafer fabrication equipment and services for semiconductor manufacturing. Their core operations center around advanced deposition, etch, and clean processes, which are critical steps in building modern chips. These processes are fundamental for producing smaller, more powerful chips used in memory, foundry, and integrated device manufacturers' products.

The company invests significantly in technology development and research and development (R&D). In recent years, Lam Research has allocated nearly $2 billion to R&D, focusing on refining these critical chip architecture processes. This commitment to innovation is central to their operations, ensuring they remain at the forefront of semiconductor technology.

Lam Research's global supply chain and distribution networks serve a worldwide customer base, including leading semiconductor memory, foundry, and integrated device manufacturers. They strategically expand their global supply chain and establish R&D centers and manufacturing facilities near their customers to enhance operational effectiveness. This approach allows them to respond quickly to market demands and technological advancements.

Lam Research specializes in etch and deposition technologies, which are increasingly complex and crucial for next-generation semiconductors. These technologies are essential for creating the intricate patterns and thin films required in modern chip manufacturing. Their expertise in these areas sets them apart in the semiconductor equipment market.

Lam Research continually introduces new products to meet the evolving needs of the semiconductor industry. Recent innovations include the Akara etch system and the Altus Halo deposition tool. These advancements improve performance and enable the production of more complex and efficient semiconductors.

Lam Research's innovations enable the production of more complex and efficient semiconductors, accelerating innovation in areas like AI, data centers, and mobile devices. The company's solutions help customers improve chip performance and reduce costs. This focus on innovation helps Lam Research maintain a strong position in the competitive semiconductor equipment market, as highlighted in Competitors Landscape of Lam Research.

- Advanced etch and deposition technologies.

- Improved chip performance and efficiency.

- Support for AI, data centers, and mobile devices.

- Strong market position in semiconductor equipment.

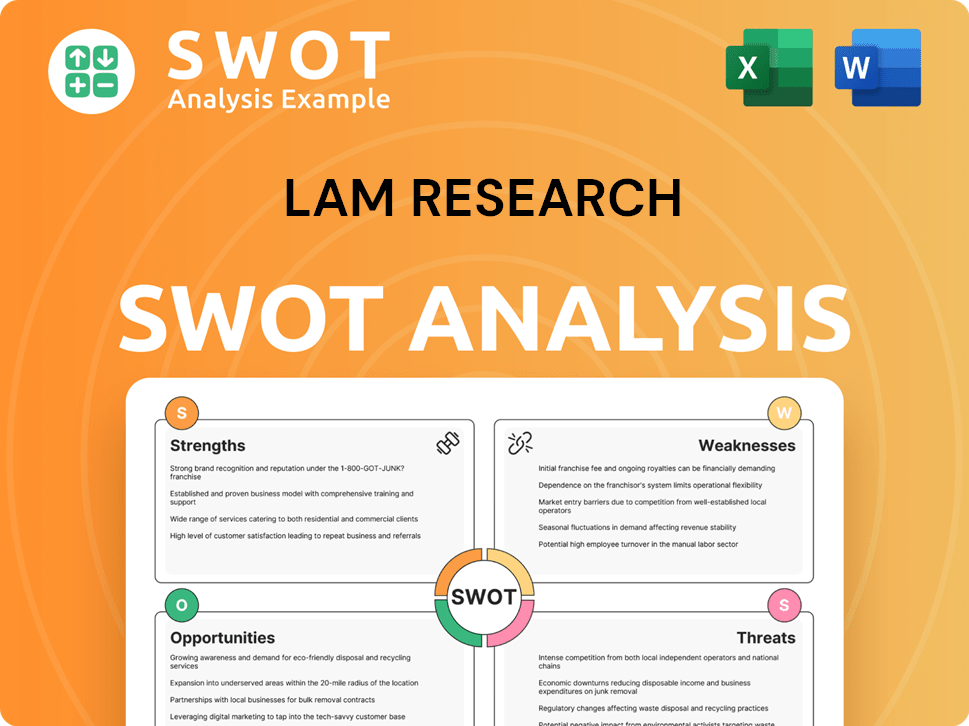

Lam Research SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lam Research Make Money?

Lam Research Corporation, a key player in the semiconductor equipment industry, generates revenue through two main channels: systems revenue and customer support-related revenue. Systems revenue comes from selling new equipment used in the deposition, etch, and clean markets. Customer support revenue is derived from services, spare parts, upgrades, and sales of non-leading-edge equipment, such as the Reliant® product line.

In the December 2024 quarter, Lam Research reported total revenue of $4.38 billion. Systems revenue accounted for $2.63 billion, while customer support-related revenue contributed $1.75 billion. This highlights the significance of new equipment sales within the company's financial structure. For the March 2025 quarter, the Customer Support Business Group (CSBG) generated $1.68 billion in revenue. The total revenue for fiscal year 2024 was $14.91 billion.

The company's monetization strategies are closely tied to the increasing demand for advanced semiconductor technologies. This drives the need for equipment upgrades and services. For example, the SABRE 3D platform, essential for 3D package production, saw its revenue more than double in 2024. This growth was fueled by the rise in 2.5D and 3D package production and the increase in metal layer counts. Lam Research expects this upward trend to continue into 2025. Additionally, the company benefits from upgrade cycles in NAND memory chips, anticipating further growth in 2025 and beyond as manufacturers adopt advanced technologies like molybdenum. If you want to learn more about the company's marketing approach, check out the Marketing Strategy of Lam Research.

Geographically, Lam Research's revenue distribution is noteworthy. For the December 2024 quarter, China accounted for 31% of Lam Research's revenue, with Korea at 25% and Taiwan at 17%. The remaining revenue came from other regions. While China has been a significant market, the company anticipates its revenue contribution from China to stabilize around 30% in Q4 2024.

- Systems Revenue: Sales of new leading-edge equipment.

- Customer Support Revenue: Revenue from services, spares, and upgrades.

- SABRE 3D Platform: A key product driving revenue growth in 3D packaging.

- China Revenue: A significant market, with anticipated normalization to around 30%.

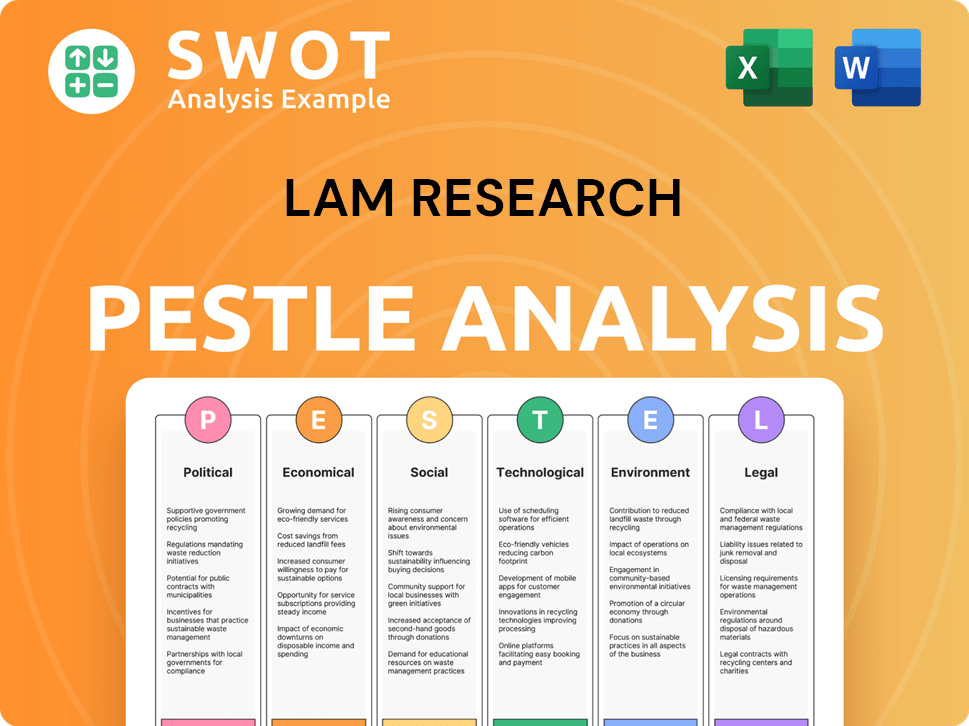

Lam Research PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Lam Research’s Business Model?

Lam Research Corporation has consistently demonstrated its importance in the semiconductor industry through strategic moves and technological advancements. The company's focus on innovation, especially in deposition and etch technologies, has been a key driver of its success. This commitment is evident in the launch of advanced products like the Akara etch system in February 2025, which is designed for next-generation semiconductor manufacturing, and the Altus Halo, which utilizes molybdenum in leading-edge production.

The company has also shown resilience in navigating industry challenges, including the cyclical nature of the semiconductor market and geopolitical tensions. Despite a downturn in global semiconductor sales in 2023, Lam Research reported strong financial results, with revenue nearing $15 billion in fiscal year 2024. They have adapted to export controls and trade disputes, particularly with China, by focusing on advanced manufacturing and packaging as growth areas and diversifying their customer base. This adaptability is critical for maintaining their market position.

Lam Research's competitive edge is rooted in its technological leadership in deposition and etch processes, strong customer relationships, and a comprehensive product portfolio. Their investment in research and development, which saw over a 10% spending increase in fiscal year 2024 compared to 2023, highlights their dedication to staying ahead. The company's strategic focus on AI and advanced memory underscores its ability to adapt to emerging trends and the increasing demand for advanced computing capabilities. The outperformance in the wafer fabrication equipment (WFE) market is expected to continue in 2025, driven by its strategic positioning in key technology inflections.

Lam Research has achieved several key milestones, including the launch of the Akara etch system in February 2025 and the Altus Halo. These advancements demonstrate the company's dedication to innovation in the semiconductor equipment sector. These innovations are crucial for supporting advanced chip architectures and meeting the evolving demands of the industry.

Lam Research has strategically responded to market challenges and geopolitical tensions. The company has focused on advanced manufacturing and packaging to drive growth and diversified its customer base. This approach has allowed the company to maintain strong financial performance, with revenue of nearly $15 billion in fiscal year 2024, even during industry downturns.

Lam Research's competitive advantages include technological leadership in deposition and etch processes. Their strong customer relationships and comprehensive product portfolio further enhance their position. Investments in R&D, with over 10% spending growth in fiscal year 2024, underscore their commitment to innovation and maintaining a competitive edge in the Growth Strategy of Lam Research.

Lam Research demonstrated robust financial performance, with revenue of nearly $15 billion in fiscal year 2024. The company's ability to navigate industry downturns and geopolitical challenges has contributed to its strong financial results. This financial strength supports continued investment in R&D and strategic initiatives.

Lam Research's success is built on innovation, strategic adaptability, and strong financial performance. The company continues to invest heavily in research and development to maintain its technological leadership in the semiconductor equipment market. Their focus on advanced manufacturing and packaging, along with a diversified customer base, positions them well for future growth.

- Technological Leadership: Strong in deposition and etch processes.

- Strategic Adaptability: Navigating market cycles and geopolitical challenges.

- Financial Strength: Nearly $15 billion in revenue in fiscal year 2024.

- Innovation: Continuous investment in R&D for future growth.

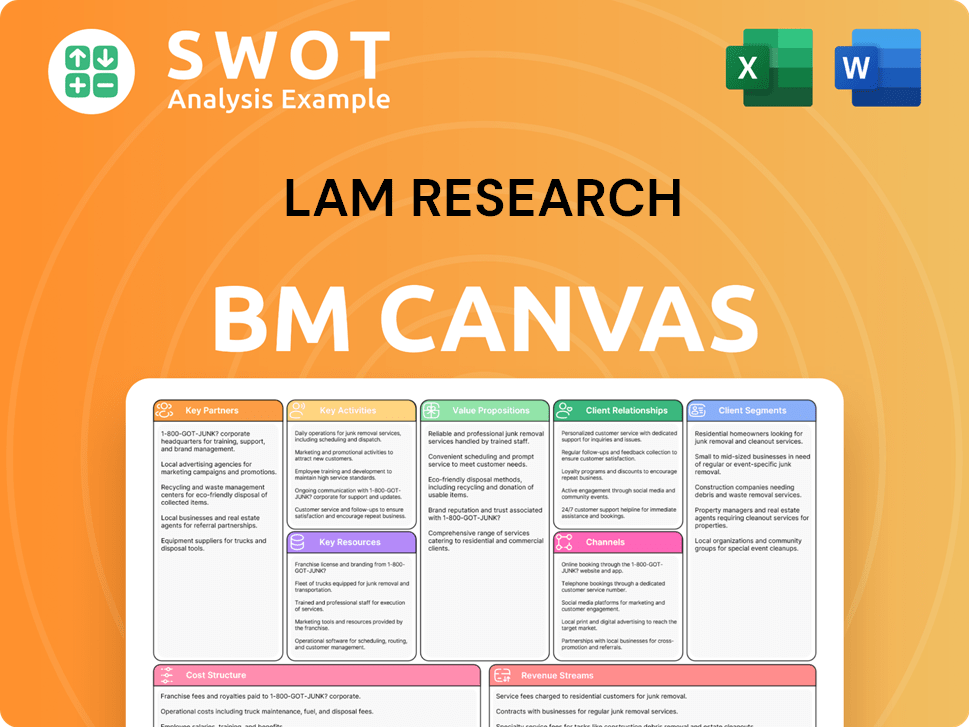

Lam Research Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Lam Research Positioning Itself for Continued Success?

Lam Research Corporation (LRCX) holds a leading position in the semiconductor equipment industry, particularly in wafer fabrication processes such as deposition and etching. The company's global presence and customer base, including major memory, foundry, and integrated device manufacturers, underscore its significant standing in the market. Lam semiconductor differentiates itself through its specialized focus on etching and deposition technologies.

Despite its strong market position, Lam Research faces several risks. The cyclical nature of the semiconductor industry can lead to fluctuations in demand, impacting revenue and profitability. Geopolitical tensions and evolving trade regulations, especially U.S. export controls, pose challenges. Supply chain disruptions and inflationary pressures also present ongoing risks to operations and profitability.

Lam Research is a key player in the semiconductor equipment market, specializing in deposition and etch processes. It competes with companies like Applied Materials, ASML, and Tokyo Electron. Its focus on advanced technology and customer relationships supports its strong market position.

The company faces risks from industry cycles, geopolitical tensions, and supply chain issues. Fluctuations in demand, trade regulations, and inflationary pressures can impact financial performance. These factors require strategic adaptability and risk management.

Lam Research anticipates a strong rebound in the semiconductor market, with growth projected for 2024 and 2025. The company is investing in R&D to capitalize on technology inflections. Innovation and adaptation are key to sustaining and expanding profitability.

Lam Research focuses on technology inflections such as gate-all-around (GAA) nodes and advanced packaging. The company is strategically investing in R&D to meet increasing demand for advanced chips. These initiatives support long-term growth and market leadership.

Lam Research expects to outperform overall wafer fabrication equipment (WFE) growth in 2025, with WFE spending projected to be around $100 billion. The company is driving innovation in areas such as plasma etching and deposition to meet the needs of the AI, cloud computing, and automotive markets. Strategic investments in R&D are crucial for maintaining its competitive edge. For more details on the company's growth strategy, you can read about the Growth Strategy of Lam Research.

- Focus on advanced chip manufacturing.

- Investments in R&D for technology inflections.

- Adaptation to market changes.

- Strategic initiatives for long-term growth.

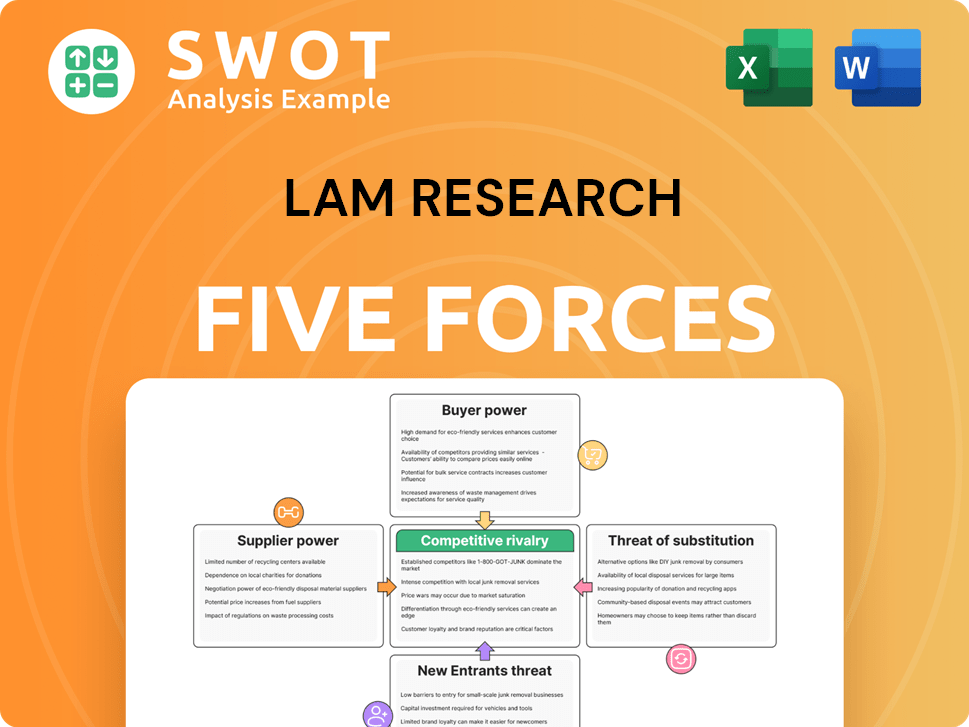

Lam Research Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lam Research Company?

- What is Competitive Landscape of Lam Research Company?

- What is Growth Strategy and Future Prospects of Lam Research Company?

- What is Sales and Marketing Strategy of Lam Research Company?

- What is Brief History of Lam Research Company?

- Who Owns Lam Research Company?

- What is Customer Demographics and Target Market of Lam Research Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.