LivePerson Bundle

How Does LivePerson Revolutionize Customer Engagement?

LivePerson (NASDAQ: LPSN) is at the forefront of the customer experience revolution, leveraging conversational AI to transform how businesses interact with their customers. Powering nearly a billion monthly interactions for giants like HSBC and Burberry, LivePerson is reshaping digital communication. Recognized as the #1 Most Innovative AI Company by Fast Company, LivePerson's impact is undeniable.

In Q1 2025, LivePerson demonstrated resilience, securing 50 deals despite market fluctuations, highlighting ongoing customer trust in the LivePerson SWOT Analysis. This analysis explores the LivePerson platform, its core operations, and its strategic positioning within the dynamic landscape of customer experience and LivePerson customer service. Understanding LivePerson's AI capabilities and its role in digital transformation is key for anyone evaluating the future of customer engagement and the role of live chat software.

What Are the Key Operations Driving LivePerson’s Success?

The core operations of the company revolve around its AI-powered Conversational Cloud platform. This platform allows businesses to connect with customers through messaging and other digital channels. The company focuses on providing real-time communication, leveraging AI-powered chatbots, and supporting human agents to enhance customer experiences. They serve a diverse customer base, including Fortune 500 companies and organizations in sectors like financial services and retail.

The value proposition of the company lies in its ability to transform customer interactions. By offering personalized service at scale, the platform improves customer engagement and optimizes business outcomes. The company's approach, termed 'innovation without disruption,' allows customers to adopt AI and digital capabilities within a single platform. This approach is particularly beneficial for regulated industries, offering compliance-focused AI tools.

Operational processes include continuous technology development, especially in conversational AI and generative AI. The platform offers tools for building chatbots, managing conversations, and analyzing customer interactions. It integrates large language models (LLMs) to enhance customer experiences across various digital channels. The company also partners with system integrators like Salesforce and others to expand its reach and enhance sales efforts.

The primary product is the Conversational Cloud platform, which facilitates real-time communication. It uses AI-powered chatbots and supports human agents. This platform is designed to improve customer experiences across various digital channels.

AI agents automate routine inquiries, reduce response times, and free up human agents. These agents also provide real-time suggestions and information to human agents. This improves accuracy and resolution times during customer interactions.

The company collaborates with system integrators and technology providers. These partnerships, such as with Salesforce, help expand reach and enhance sales efforts. This collaborative approach is crucial for market penetration and service delivery.

The company's approach allows customers to adopt AI and digital capabilities seamlessly. This 'innovation without disruption' model avoids costly rip-and-replace processes. This approach is especially beneficial for regulated industries.

Customers benefit from personalized service at scale, improved customer engagement, and optimized business outcomes. The company's solutions are designed to enhance customer satisfaction and streamline operations. For example, the company’s AI can handle up to 80% of routine customer inquiries, freeing up human agents for more complex issues.

- Personalized Customer Service: Tailored interactions improve customer satisfaction.

- Improved Customer Engagement: Enhanced communication channels increase interaction rates.

- Optimized Business Outcomes: Efficiency gains lead to better business results.

- Scalability: The cloud-native solution allows for dynamic scaling.

LivePerson SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does LivePerson Make Money?

LivePerson's revenue model centers on two main streams: hosted services and professional services. Hosted services, which include subscriptions to its Conversational Cloud platform, form the bulk of its revenue. Professional services contribute to the revenue, although to a lesser extent.

In the first quarter of 2025, LivePerson's recurring revenue was at $60.4 million, representing 93% of its total revenue. This signifies the importance of its subscription-based model. Professional services brought in $9.6 million during the same period.

For the full year of 2025, LivePerson anticipates total revenue to fall between $240 million and $255 million, with recurring revenue expected to make up about 93% of that total. This highlights the company's focus on stable, predictable income through its hosted services.

LivePerson's monetization strategies are built around its Conversational Cloud platform, which offers solutions for businesses of all sizes. Pricing is determined by several factors, including message volume, the number of users, and integrations. LivePerson also uses a contingent pricing model, where revenue is linked to the achievement of customer objectives. The company's focus on customer experience and conversational AI is key to its pricing and service offerings.

- Subscriptions to the Conversational Cloud platform: This is the primary revenue generator, offering tailored solutions for businesses.

- Pricing based on usage: Factors like message volume, user count, and integrations influence the cost.

- Contingent pricing: Revenue can be tied to the attainment of specific customer goals.

- ARPC Growth: The trailing-twelve-months average revenue per enterprise and mid-market customer (ARPC) increased by 2.4% for the first quarter of 2025 to $640,000, up from approximately $625,000 in the comparable prior-year period, indicating stronger recurring revenue from existing clients.

LivePerson PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped LivePerson’s Business Model?

The strategic journey of LivePerson has been marked by significant milestones, especially in its embrace of AI and digital transformation. A key strategic move has been the continuous innovation in its product offerings, including the strong adoption of its Generative AI features and the launch of its voice and digital strategy in 2024. The company has emphasized integrating AI and digital capabilities within a single platform, aiming for an 'innovation without disruption' approach that allows customers to seamlessly adopt new technologies.

Operational and market challenges faced by LivePerson include customer cancellations and downsells, which led to a 24.0% decrease in total revenue for Q1 2025 compared to the previous year. The company has responded by reinvigorating its go-to-market capabilities and focusing on improving customer retention, evidenced by three consecutive quarters of bookings increases by the end of 2024. LivePerson's competitive advantages stem from its technology leadership in conversational AI, particularly its deep expertise built from billions of real customer interactions.

The company's focus on regulated industries, where its compliance-focused AI tools gain traction, also provides a competitive edge. LivePerson continues to adapt to new trends and technology shifts by advancing strategic partnerships, such as the planned integration with Amazon Connect in Q2 2025, and by continually evolving its AI-driven chatbot and voice/digital orchestration tools. To understand the specific customer base, you can explore the Target Market of LivePerson.

LivePerson has consistently innovated its product offerings, with significant adoption of Generative AI features. The launch of its voice and digital strategy in 2024 marked a pivotal moment. The company aims for 'innovation without disruption' in its approach to integrating AI and digital capabilities.

The company is reinvigorating its go-to-market capabilities to improve customer retention. LivePerson is focusing on strategic partnerships, including a planned integration with Amazon Connect in Q2 2025. It is evolving its AI-driven chatbot and voice/digital orchestration tools.

LivePerson's technology leadership in conversational AI, built from billions of customer interactions, is a key differentiator. Its platform offers robust scalability, multi-channel reach, and integration capabilities. The focus on regulated industries, where compliance-focused AI tools gain traction, provides a competitive advantage.

Customer cancellations and downsells led to a 24.0% revenue decrease in Q1 2025. The company responded by improving go-to-market strategies and focusing on customer retention. Bookings increased for three consecutive quarters by the end of 2024.

The LivePerson platform's robust scalability and multi-channel reach across SMS, web chat, social media, and messaging apps are significant advantages. Integration capabilities with CRM, marketing automation, and other enterprise systems enhance its value. The company's AI capabilities and customer service features are constantly evolving.

- Conversational AI: Deep expertise from billions of interactions.

- Multi-Channel Reach: SMS, web chat, social media, and messaging apps.

- Integration: Seamless integration with CRM and marketing automation.

- Industry Focus: Strong presence in regulated industries.

LivePerson Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is LivePerson Positioning Itself for Continued Success?

LivePerson holds a prominent position as a leader in the conversational AI and digital transformation space, serving leading global brands. The LivePerson platform processes nearly a billion conversational interactions monthly, demonstrating its substantial reach and influence within the industry. Its ability to secure significant renewals and expansions with major clients highlights its strong customer loyalty.

Despite its market position, LivePerson faces several challenges. These include customer cancellations and downsells, which negatively impact revenue. Macroeconomic pressures, customer retention issues, and regulatory scrutiny of AI also pose risks. The company is also dealing with ongoing cash burn and substantial debt obligations.

LivePerson is a key player in the conversational AI market. Its LivePerson customer service is used by many global brands. The company's focus on enterprise and mid-market segments allows it to secure significant renewals, showing its strong position within the sector.

The company faces risks from customer cancellations and macroeconomic pressures. They also have challenges with customer retention and regulatory scrutiny of AI. As of April 2025, the company has $527.23 million in convertible notes, adding to its financial risks.

LivePerson is investing in AI agents and orchestration, particularly in regulated industries. The company aims to improve its cost structure and expects adjusted EBITDA to range from $(14) million to $0 million for 2025. They anticipate positive net new annual recurring revenue in the second half of 2025.

LivePerson is focused on innovation, strategic partnerships, and enhancing its Generative AI suite. The company aims to drive better business outcomes for its enterprise customers. For a deeper dive into their strategies, you can read about the Growth Strategy of LivePerson.

LivePerson's future hinges on navigating current challenges while capitalizing on growth opportunities. The company is working to improve its cost structure. They are also focused on innovation to remain competitive in the market. The company aims to achieve breakeven by the end of 2025.

- Continued investment in AI agents and orchestration.

- Focus on highly regulated industries like financial services.

- Transitioning towards positive net new annual recurring revenue in H2 2025.

- Enhancing Generative AI suite to drive better business outcomes.

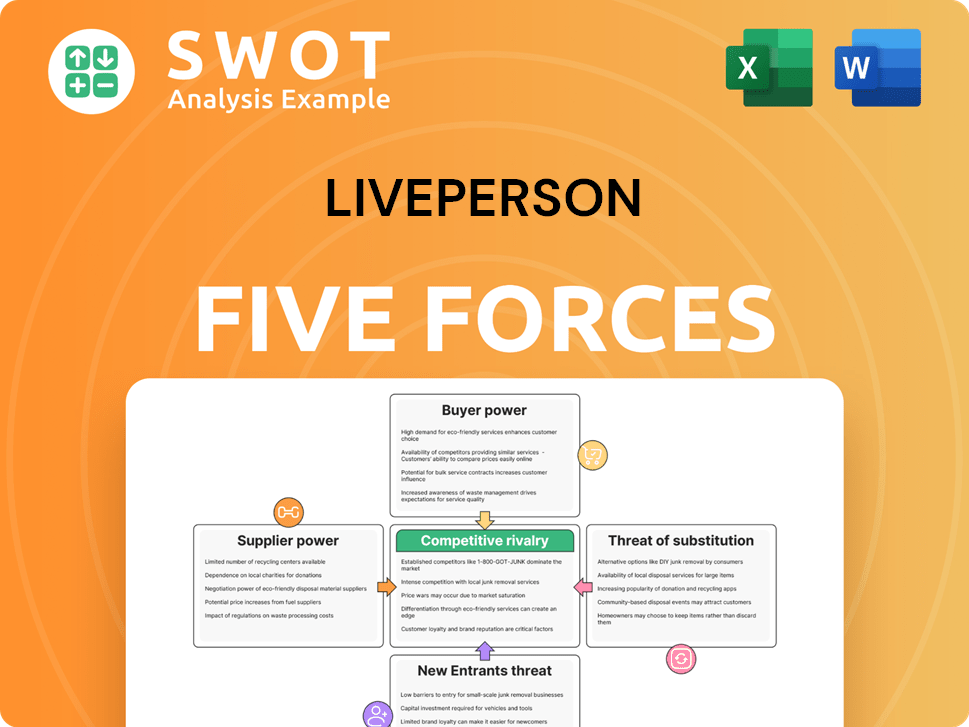

LivePerson Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LivePerson Company?

- What is Competitive Landscape of LivePerson Company?

- What is Growth Strategy and Future Prospects of LivePerson Company?

- What is Sales and Marketing Strategy of LivePerson Company?

- What is Brief History of LivePerson Company?

- Who Owns LivePerson Company?

- What is Customer Demographics and Target Market of LivePerson Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.