LLYC Bundle

How Does LLYC Thrive in the Global Communications Arena?

LLYC, a leading global communications and public affairs consulting firm, has consistently demonstrated impressive financial growth and a commitment to innovation. In 2024, the LLYC SWOT Analysis would reveal the company's strengths. With a proven track record and a global presence, understanding how LLYC operates is key.

This deep dive into the LLYC company will explore its core operations, revenue streams, and strategic initiatives. We will examine how the LLYC agency leverages its expertise in LLYC communications and consulting to maintain its competitive edge in a dynamic market. Furthermore, we'll analyze LLYC's recent financial performance, including its impressive growth in revenue and operating income, to understand its position within the industry and its future outlook.

What Are the Key Operations Driving LLYC ’s Success?

The LLYC company creates and delivers value through comprehensive communication and public affairs consulting. They offer services including corporate communication, financial communication, crisis management, public affairs, and digital engagement. These services help clients build and protect their reputations, make strategic decisions, and achieve their business goals. The firm serves a diverse range of clients, including global and regional companies.

The operational processes at LLYC business are multifaceted, combining human expertise with advanced technology. They have invested heavily in innovation, with a 95% increase in their innovation budget to €2.5 million in 2024, leading 34 projects. This investment has led to the development of AI-driven solutions and automation tools. Their global footprint, with offices across multiple countries, enables them to deliver global expertise with local insights.

The LLYC agency also utilizes a professional partnership model, established in 2007, which contributes to its unique operations. This model attracts and retains top talent, with 23 partners ensuring a long-term strategic vision. The company's Deep Digital services, which include digital marketing and AI solutions, played a significant role in the 2023 results, growing by 21% and accounting for 34.5% of operating income.

The core services offered by LLYC communications include corporate communication, financial communication, crisis management, public affairs, and digital engagement. These services are designed to help clients navigate complex communication challenges and achieve their business objectives. They leverage both traditional and digital channels to deliver effective communication strategies.

The value proposition of LLYC consulting lies in its ability to build and protect client reputations, make strategic decisions, and achieve business goals. They provide tailored solutions that address specific client needs, leveraging a deep understanding of various industries and markets. Their approach combines strategic thinking with innovative technology.

Key operational highlights include a significant investment in innovation, with a 95% increase in the innovation budget. This has led to the development of AI-driven solutions like AI Legislab and AI Media Gen. Deep Digital services grew by 21% in 2023, accounting for 34.5% of operating income. Their global presence, with offices in multiple countries, supports their ability to deliver global expertise.

The company serves a diverse range of clients, including leading global and regional companies. Their client list includes prominent brands across various sectors. They tailor their services to meet the specific needs of each client, ensuring effective communication strategies. To learn more about how the company is growing, you can read about the Growth Strategy of LLYC .

The operational model of LLYC company is supported by its global footprint and investment in technology. They focus on integrating AI to improve efficiency and effectiveness. Their professional partnership model also plays a critical role in attracting and retaining top talent.

- Innovation Budget: Increased by 95% to €2.5 million in 2024.

- Deep Digital Growth: Increased by 21% in 2023, accounting for 34.5% of operating income.

- Global Presence: Offices in Spain, Portugal, Brussels, eight Latin American countries, and the United States.

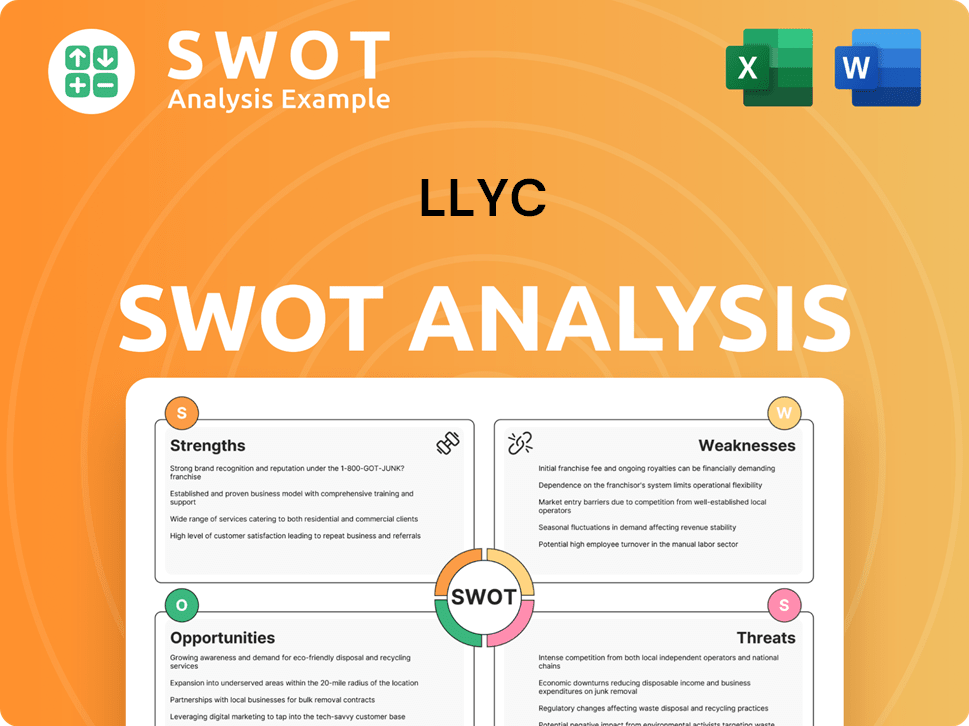

LLYC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does LLYC Make Money?

The primary revenue streams for the LLYC company are derived from its comprehensive communications and public affairs consulting services. The LLYC business model focuses on providing expert advice and strategic solutions across various areas, including corporate affairs, marketing, and digital services. In 2024, the firm demonstrated strong financial performance, with total revenue reaching €115.5 million.

The LLYC agency generates revenue through two main business areas: Corporate Affairs and Marketing. This dual approach allows the company to offer a wide range of services, catering to different client needs and market demands. This strategy has proven effective, contributing to the firm's robust financial results and market position.

The company's financial performance in 2024 showed significant growth. Operating income reached €93.1 million, marking a 19% increase over 2023. Corporate Affairs accounted for 59% of operating revenues and 75% of recurring EBITDA, while Marketing contributed 41% of operating revenues and 25% of recurring EBITDA. This demonstrates the importance of both segments in the company's overall financial health.

The geographic distribution of LLYC's revenue and EBITDA in 2024 highlights its global presence and strategic focus on key markets. Europe contributed 38% of operating revenue and 25% of EBITDA, Latin America accounted for 40% of operating revenue and 28% of EBITDA, and the United States emerged as a significant and fast-growing market, contributing 22% of operating revenue and 43% of EBITDA. The expansion into the U.S. market, along with the growth in other regions, showcases the company's ability to adapt and thrive in diverse environments. For a deeper dive into their marketing strategies, consider reading about the Marketing Strategy of LLYC .

- Deep Digital Services: Deep Digital services, including digital marketing, performance and paid media, and digital transformation and artificial intelligence solutions, are a growing contributor to revenue, accounting for 34.5% of operating income in 2023.

- Strategic Acquisitions: LLYC has expanded its revenue sources through strategic acquisitions, investing over €30 million in three key acquisitions in 2024: Lambert by LLYC in the United States, Dattis by LLYC in Colombia, and Zeus by LLYC in Spain.

- Service Diversification: These acquisitions strengthen the firm's capabilities in areas such as data visualization, public relations, investor relations, and integrated marketing, contributing to service diversification and growth.

- Revenue Growth: The combination of organic growth and strategic acquisitions has positioned LLYC favorably in the competitive landscape.

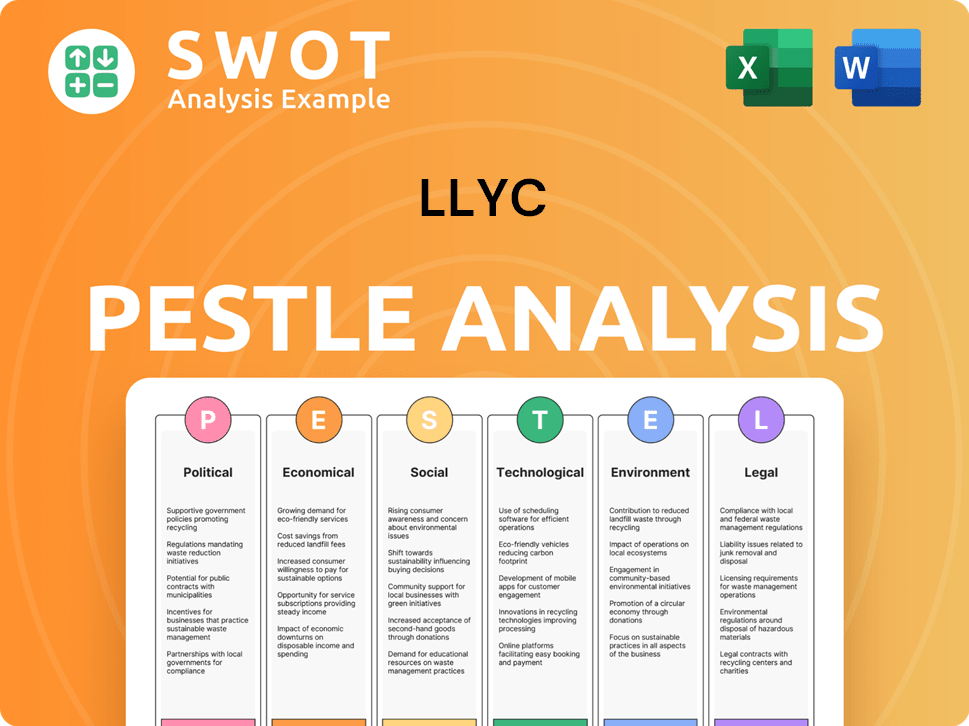

LLYC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped LLYC ’s Business Model?

The LLYC company has consistently demonstrated strategic agility and a commitment to growth, marked by significant milestones and strategic shifts. Key moves in 2024 included a new matrix business model, integrating Marketing and Corporate Affairs. This restructuring aimed to boost both efficiency and responsiveness to market demands. The LLYC business model has been evolving to meet new challenges and opportunities.

A pivotal aspect of LLYC's strategy involves substantial investments in acquisitions, particularly in key markets. In 2024, the company allocated over €30 million to acquire strategic assets. These acquisitions, including Lambert by LLYC in the United States, Dattis by LLYC in Colombia, and Zeus by LLYC in Spain, have been instrumental in expanding its service offerings and geographical footprint. The sale of BAM in December 2024 for $9 million further streamlined its portfolio, aligning with consolidation goals.

Operationally, LLYC services have been enhanced by a focus on innovation and technology. The company increased its innovation investment by 95% in 2024, reaching €2.5 million, which facilitated 34 innovation projects. These initiatives, such as AI Legislab and AI Media Gen, are designed to improve efficiency and effectiveness in public affairs and content creation. These strategic moves underscore LLYC's commitment to adapting to the evolving needs of its clients and the broader market.

In 2024, LLYC adopted a new matrix business model. The company invested over €30 million in strategic acquisitions. Sold its 80% stake in BAM for $9 million.

The acquisitions of Lambert, Dattis, and Zeus expanded service offerings. Increased innovation investment by 95% to €2.5 million. Focus on AI-driven solutions for content generation and crisis management.

Ranked among the 35 largest firms globally. Named Best Consultancy in Europe and Consultancy of the Year in Latin America. Strong global presence across Europe, Latin America, and the U.S.

The sale of BAM recovered the initial investment. Increased investment in innovation, reaching €2.5 million. Strategic acquisitions aimed at expanding market share and service capabilities.

LLYC's competitive advantages are rooted in its brand strength and technological leadership. The company's global footprint and professional partnership model also contribute to its success. LLYC's ability to adapt to new trends, such as leveraging AI, further strengthens its market position.

- Brand Strength: Ranked among the top firms globally.

- Technology Leadership: Focused on AI-driven solutions for impactful campaigns.

- Global Footprint: Presence in Europe, Latin America, and the U.S.

- Professional Partnership Model: Attracts top talent and provides integrated solutions.

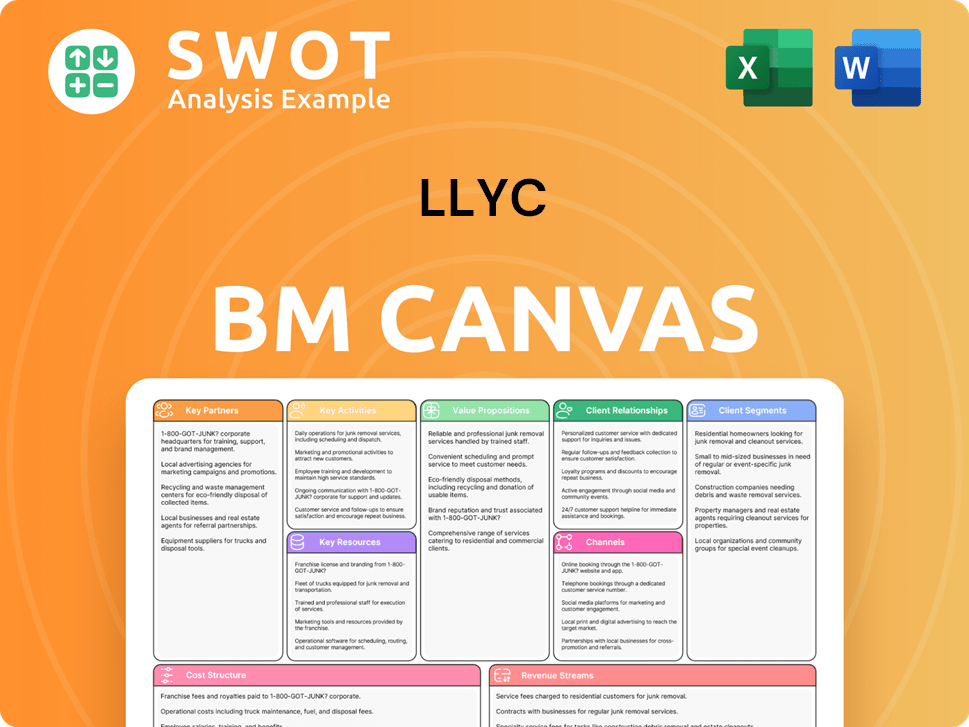

LLYC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is LLYC Positioning Itself for Continued Success?

Understanding the operational dynamics of the LLYC company involves examining its industry standing, inherent risks, and future prospects. LLYC's position within the global communications and public affairs consulting sector is robust, consistently ranking among the top firms worldwide. Its widespread presence across Europe, Latin America, and the United States, coupled with a diverse client base, underscores its market strength.

Despite its strong market position, the LLYC business faces several challenges. The public relations (PR) market is highly competitive, necessitating continuous innovation. Technological advancements, especially in AI, present both opportunities and hurdles. Regulatory changes and evolving consumer preferences could also impact operations and revenue streams.

LLYC's strong market position is reflected in its global presence and diverse client portfolio. The company consistently ranks among the top 35 largest firms globally. This is supported by its operational reach across Europe, Latin America, and the United States.

The LLYC agency operates within a highly competitive PR market. Rapid technological changes, especially in AI, pose a significant risk. Regulatory shifts and changing consumer behaviors could also affect its business.

LLYC is focused on sustained growth and service integration, with continued investment in innovation. The company aims to leverage AI to automate up to 30% of its processes by the end of 2025. The firm's future outlook is centered on becoming a larger, more tech-driven, international, and equitable firm.

LLYC aims to close 2025 with an operating income of €120 million and recurring EBITDA of €25 million. Operating income increased by 19% in 2024, demonstrating customer loyalty and growth. The company has invested nearly €5 million in innovation initiatives over the last five years.

LLYC's strategic initiatives emphasize innovation and technological integration. The company is increasing its investment in AI to streamline processes and enhance service delivery. Leadership focuses on sustained growth driven by client trust and strategic acquisitions.

- Continued investment in innovation, with nearly €5 million invested in innovation initiatives over the past five years.

- Leveraging AI to automate up to 30% of its processes by the end of 2025.

- Focus on becoming a larger, more tech-driven, international, and equitable firm.

- Focus on client trust, talent, and strategic acquisitions.

For further insights into the target market of LLYC, you can refer to this article: Target Market of LLYC . The LLYC consulting firm's approach to public relations and its digital marketing strategies are key to its continued success. The company's evolution involves adapting to market dynamics and leveraging technological advancements to enhance its services. The LLYC communications strategies are geared towards maintaining and expanding its market position.

LLYC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LLYC Company?

- What is Competitive Landscape of LLYC Company?

- What is Growth Strategy and Future Prospects of LLYC Company?

- What is Sales and Marketing Strategy of LLYC Company?

- What is Brief History of LLYC Company?

- Who Owns LLYC Company?

- What is Customer Demographics and Target Market of LLYC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.