Shenzhen Mindray Bio-Medical Electronics Bundle

How Does Mindray Shenzhen Revolutionize Healthcare?

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. stands as a global powerhouse in the medical device industry, reshaping healthcare delivery worldwide. Its innovative spirit and strategic market expansion have solidified its position as a key player in patient monitoring, in-vitro diagnostics, and medical imaging. With its products touching lives in hospitals and clinics across the globe, Mindray's influence is undeniable.

Mindray's commitment to research and development fuels its impressive growth trajectory, offering a comprehensive portfolio of Shenzhen Mindray Bio-Medical Electronics SWOT Analysis that caters to diverse clinical needs. Understanding how Mindray operates and generates revenue is vital for investors, customers, and industry analysts alike, particularly when assessing the impact of this Mindray on the healthcare technology sector. This in-depth analysis will explore the core operations, value proposition, and monetization strategies that define Mindray Shenzhen.

What Are the Key Operations Driving Shenzhen Mindray Bio-Medical Electronics’s Success?

The core operations of Mindray Bio-Medical are centered around the design, production, and distribution of cutting-edge medical devices and solutions. This focus allows the company to deliver significant value to healthcare providers around the globe. Mindray's primary offerings are segmented into patient monitoring and life support, in-vitro diagnostics (IVD), and medical imaging systems.

These products serve a wide array of customers, including hospitals, clinics, and other healthcare facilities. Its reach spans across various regions, encompassing both developed markets and emerging economies. The company's commitment to innovation and quality has solidified its position in the healthcare technology sector.

The operational processes are highly integrated and efficient. Mindray employs a vertically integrated manufacturing model, which ensures stringent quality control and cost optimization throughout the production cycle. Its robust research and development (R&D) capabilities are crucial, with substantial investments in innovation to develop cutting-edge technologies and improve existing product lines.

In 2023, Mindray's R&D expenditure reached approximately RMB 4.09 billion, representing 10.4% of its operating revenue. This significant investment underscores its dedication to technological advancement. This commitment helps them stay ahead in the competitive medical device market.

The supply chain is meticulously designed to ensure the timely sourcing of high-quality components. It also focuses on the efficient distribution of finished products. Mindray leverages a global sales and service network, including direct sales teams and strategic partnerships with distributors.

The company's customer service infrastructure provides comprehensive support, from installation and training to maintenance and technical assistance. This ensures optimal product performance and customer satisfaction. This commitment enhances the overall customer experience.

With a strong global presence, Mindray effectively reaches diverse customer segments. The company's ability to combine innovation with cost-effectiveness makes advanced medical solutions accessible to a wider range of healthcare institutions. This strategy supports its sustained growth.

What sets Mindray apart is its ability to integrate technological innovation with cost-effectiveness. This approach makes advanced medical solutions accessible to a broader range of healthcare institutions. This focus on localized R&D and manufacturing, especially in emerging markets, allows it to tailor products to specific regional needs and regulatory requirements.

- Technological Innovation: Continuous investment in R&D for cutting-edge medical devices.

- Cost-Effectiveness: Making advanced solutions accessible to a wider audience.

- Localized Manufacturing: Tailoring products to meet regional needs and regulations.

- Customer Benefits: Improved diagnostic accuracy, enhanced patient safety, and increased operational efficiency.

Shenzhen Mindray Bio-Medical Electronics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Shenzhen Mindray Bio-Medical Electronics Make Money?

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. generates revenue primarily through the sale of its medical devices and solutions. These sales are the main source of income for the company. In 2023, the company reported a significant increase in operating revenue.

The company's monetization strategy involves direct sales, a global sales network, and partnerships with distributors. This approach frequently combines upfront equipment sales with recurring revenue from consumables and service contracts. The sale of instruments often leads to sustained revenue streams from subsequent purchases.

Mindray has a global reach, with international markets contributing significantly to its revenue. The company uses tiered pricing to cater to different market segments. Over time, Mindray has broadened its product range and expanded its market presence, leading to diversified revenue streams.

Mindray's revenue comes primarily from selling medical devices and solutions. These include patient monitoring, in-vitro diagnostics (IVD), and medical imaging systems. Product sales are the main source of income.

In 2023, Mindray's operating revenue was approximately RMB 34.93 billion, a 14.50% increase year-on-year. The IVD segment grew by 21.78%, reaching RMB 13.06 billion. Patient monitoring and life support systems saw a 10.74% increase, with revenue at RMB 14.80 billion.

The company uses direct sales, a global sales network, and distributors. Sales often include upfront equipment sales and recurring revenue from consumables. The IVD segment benefits from sustained revenue from reagent sales.

The international market contributed RMB 15.42 billion in 2023, a 20.45% year-on-year increase, accounting for 44.15% of total revenue. This expansion into international markets is a key growth strategy for Mindray.

Mindray uses tiered pricing models to cater to different market segments and healthcare budgets. This strategy ensures competitiveness across various economic landscapes. The company has expanded its product portfolio and market penetration.

Medical imaging systems generated RMB 6.77 billion, growing by 13.92%. The strong performance across segments highlights Mindray's diversified and resilient business model. The company continues to innovate in the healthcare technology sector.

Mindray's revenue model is built on a combination of product sales, recurring revenue, and global expansion. The company's focus on innovation and market penetration drives its financial performance. To learn more, read about the Growth Strategy of Shenzhen Mindray Bio-Medical Electronics.

- Product sales are the primary revenue source, with strong growth in IVD and patient monitoring.

- The monetization strategy includes direct sales, distributors, and recurring revenue from consumables.

- International markets are a key growth area, contributing significantly to overall revenue.

- Tiered pricing and product diversification support market competitiveness and resilience.

- Mindray's commitment to medical devices and healthcare technology continues to drive its success.

Shenzhen Mindray Bio-Medical Electronics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Shenzhen Mindray Bio-Medical Electronics’s Business Model?

The journey of Mindray has been marked by significant milestones and strategic moves, profoundly shaping its operations and financial performance. A key aspect of its growth has been its relentless focus on research and development, leading to numerous new product launches that have expanded its market reach and technological capabilities. Mindray Shenzhen has strategically expanded its global footprint, entering new markets and solidifying its presence in existing ones. This internationalization has been a key driver of revenue growth.

The company has also engaged in strategic partnerships and acquisitions to enhance its technological portfolio and market share. Mindray Bio-Medical has faced operational challenges, including global supply chain disruptions and intense competition in the medical device sector. The company has responded by strengthening its supply chain resilience and optimizing its manufacturing processes to mitigate external shocks. Its competitive advantages are multifaceted.

Mindray's commitment to innovation and expansion is evident in its financial performance and strategic initiatives. The company's ability to adapt to market changes and maintain a strong competitive position highlights its resilience and forward-thinking approach. This focus on innovation and global expansion has allowed Mindray to maintain a strong position in the medical devices market.

In 2023, Mindray invested approximately RMB 4.09 billion in R&D, representing 10.4% of its operating revenue. This investment enabled the launch of advanced medical devices in patient monitoring, in-vitro diagnostics, and medical imaging. The company's focus on R&D has consistently driven innovation, resulting in a robust product pipeline and enhanced market competitiveness.

International revenue reached RMB 15.42 billion in 2023, marking a 20.45% year-on-year increase. This growth highlights the success of Mindray's global expansion strategy. The company's strategic partnerships and acquisitions have further strengthened its technological capabilities and market position, although specific recent acquisitions in 2024-2025 were not highlighted.

Mindray's strong brand recognition, especially in emerging markets, is built on delivering high-quality, reliable, and cost-effective medical solutions. Its technological leadership, fueled by consistent R&D investment, allows for the introduction of innovative products to meet evolving healthcare needs. Economies of scale from large-scale manufacturing and a global distribution network provide a significant cost advantage.

Mindray continuously adapts to new trends, such as digitalization in healthcare and the growing demand for point-of-care solutions. The company invests in relevant technologies and expands its product offerings to maintain its competitive edge. This proactive approach ensures Mindray remains at the forefront of the medical device market.

Mindray's integrated business model, encompassing R&D, manufacturing, sales, and service, creates a strong ecosystem effect, enhancing customer loyalty and market penetration. This integrated approach allows for better quality control and responsiveness to market needs. The company's commitment to innovation and global expansion underscores its long-term growth strategy.

- Strong brand recognition and reputation for quality.

- Technological leadership through consistent R&D investment.

- Economies of scale from large-scale manufacturing and global distribution.

- Integrated business model enhancing customer loyalty.

Shenzhen Mindray Bio-Medical Electronics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Shenzhen Mindray Bio-Medical Electronics Positioning Itself for Continued Success?

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. holds a significant position in the global medical device industry, competing with major international firms. The company has demonstrated substantial market share growth, particularly in emerging markets, while also expanding its presence in developed economies. Its diverse product range, including patient monitoring systems, in-vitro diagnostics, and medical imaging equipment, provides a solid foundation for customer loyalty and market penetration. For example, in 2023, Mindray's international revenue increased by 20.45%, reaching RMB 15.42 billion, indicating its expanding global reach.

Despite its strong market position, Mindray faces several key risks. These include regulatory changes across different countries that can affect product approvals and market access. Intense competition from both established global corporations and emerging local players necessitates continuous innovation and competitive pricing. Technological disruptions, such as advancements in artificial intelligence and personalized medicine, require Mindray to adapt and integrate new technologies into its offerings. Geopolitical tensions and economic downturns could also affect its global supply chain and market demand.

Mindray is a leading player in the medical devices and healthcare technology sectors. It competes with established global companies and has a strong presence in both emerging and developed markets. The company's diverse product portfolio supports its market penetration and customer loyalty.

Mindray faces risks such as regulatory changes, intense competition, and technological disruptions. Geopolitical tensions and economic downturns could also impact its operations. The company must continuously innovate and adapt to maintain its market position.

Mindray plans to continue investing in R&D and expand its product pipeline, including surgical robotics and advanced IVD solutions. It aims to grow its presence in international markets by strengthening its sales and service networks. The company is also focused on leveraging digitalization and smart healthcare solutions.

Mindray is committed to innovation, global expansion, and operational excellence. These strategies are designed to solidify its market leadership and ensure sustained financial performance. The company's focus on digitalization and smart healthcare solutions is key to its future success.

To sustain and expand revenue, Mindray is investing in research and development, focusing on new medical technologies. The company is also expanding internationally, particularly in high-growth regions. Mindray is committed to leveraging digitalization and smart healthcare solutions to enhance its offerings and operational efficiency. Explore more about Growth Strategy of Shenzhen Mindray Bio-Medical Electronics.

- Aggressive R&D investment.

- Expansion into international markets.

- Leveraging digitalization and smart healthcare.

- Focus on operational excellence.

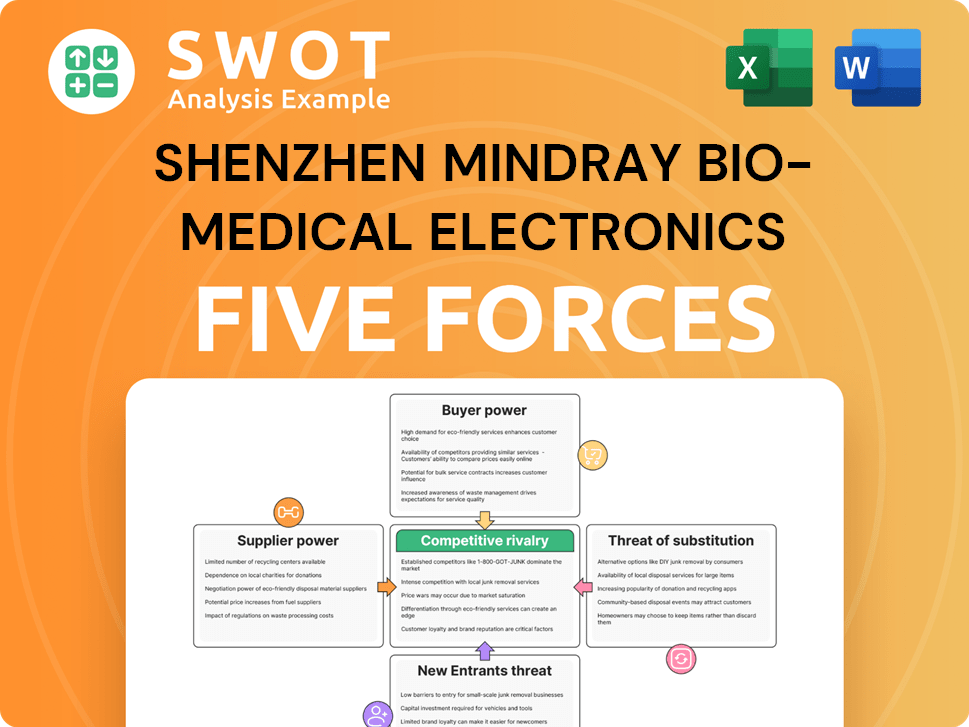

Shenzhen Mindray Bio-Medical Electronics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Shenzhen Mindray Bio-Medical Electronics Company?

- What is Competitive Landscape of Shenzhen Mindray Bio-Medical Electronics Company?

- What is Growth Strategy and Future Prospects of Shenzhen Mindray Bio-Medical Electronics Company?

- What is Sales and Marketing Strategy of Shenzhen Mindray Bio-Medical Electronics Company?

- What is Brief History of Shenzhen Mindray Bio-Medical Electronics Company?

- Who Owns Shenzhen Mindray Bio-Medical Electronics Company?

- What is Customer Demographics and Target Market of Shenzhen Mindray Bio-Medical Electronics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.