Kweichow Moutai Bundle

How Does Kweichow Moutai Dominate the Spirits World?

Kweichow Moutai, the world's most valuable drinks brand, isn't just a company; it's a cultural icon. Its flagship product, Feitian Moutai, is synonymous with prestige and celebration in China. But how does this Kweichow Moutai SWOT Analysis show the company's path to success?

Delving into the operations of the Moutai Company reveals a fascinating blend of tradition and strategic prowess. From the meticulous Moutai production process to its impressive financial performance, understanding Kweichow Moutai provides valuable insights. This exploration will uncover the secrets behind its enduring appeal and market dominance, offering a comprehensive look at this influential player in the Chinese liquor industry.

What Are the Key Operations Driving Kweichow Moutai’s Success?

The core operation of the Kweichow Moutai Company centers on the meticulous production of Maotai, a premium baijiu. The company's value proposition is deeply rooted in the exceptional quality and cultural significance of its product. This is often referred to as 'liquid gold' due to its high value and unique characteristics. The Moutai production process is deeply traditional, adhering to ancient methods.

The production process relies on the specific climate, water source, and locally sourced sorghum and wheat in Maotai Town, Guizhou province. This geographical exclusivity and adherence to traditional distillery techniques contribute to the liquor's distinctive soy-sauce-like aroma and taste. The company's commitment to quality is unwavering. This is demonstrated through comprehensive, chain-wide, and company-wide quality control. The company emphasizes maintaining a balanced and unique production area ecosystem.

Moutai Company controls its entire supply chain, including growing its own sorghum, to ensure quality and security of supply. This also helps to protect the local environment. While deeply traditional, Moutai has incorporated modern data analytics to optimize production. This has helped reduce waste from approximately 35% to as low as 5%, and monitor ground and weather conditions. The company's focus on quality over productivity gains is a key differentiator.

The customer segment primarily consists of wealthy and aspirational Chinese consumers. They associate Moutai with status and celebration. This has allowed Moutai to maintain a strong brand value.

The distribution network plays a critical role in delivering value. Direct sales channels, including the 'i Moutai' digital marketing platform, contribute significantly to its revenue. Moutai's market share continues to be dominant in the Chinese liquor market.

Moutai's core capabilities include an unwavering commitment to quality, natural supply constraints, and deep cultural integration in China. This gives it formidable pricing power. The brand's value is consistently high.

These core capabilities translate into customer benefits through a product that symbolizes prestige. The market differentiation is difficult for competitors to match. For more insights, explore the Competitors Landscape of Kweichow Moutai.

In recent years, Kweichow Moutai has shown strong financial performance. In 2024, the company's revenue exceeded 150 billion yuan, with net profit margins consistently above 50%. The Moutai price has remained high due to strong demand and limited supply.

- Moutai production volume in 2024 was approximately 50,000 tons.

- The company's market capitalization is among the highest in the global alcoholic beverage industry.

- Distribution channels include direct sales, e-commerce platforms, and a network of distributors.

- The company's brand value continues to grow, reflecting its strong market position.

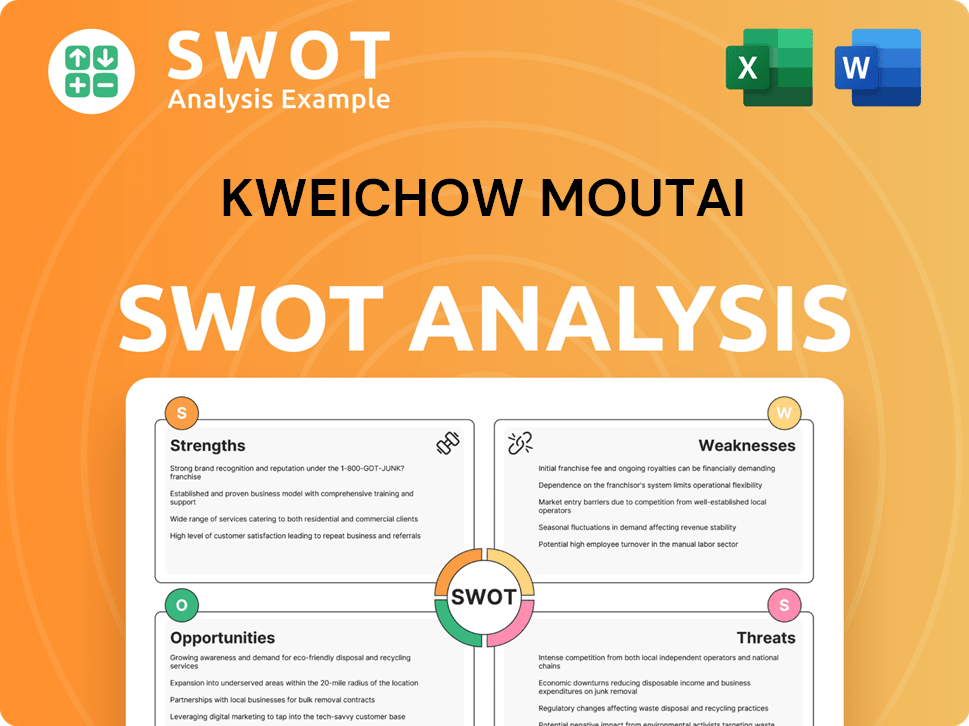

Kweichow Moutai SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kweichow Moutai Make Money?

The core of the Moutai Company's revenue generation revolves around the sale of its premium baijiu products, with Feitian Moutai leading the charge. This focus on high-end offerings allows the company to maintain strong demand and command premium pricing. In 2024, the company's operating revenue exceeded 174.14 billion yuan, demonstrating its financial strength.

Kweichow Moutai has successfully monetized its brand through a combination of direct sales, digital marketing, and strategic collaborations. The 'i Moutai' platform and other digital channels play a crucial role in sales. Furthermore, the company's expansion into international markets and innovative product collaborations further diversify its revenue streams.

Understanding the Moutai Company's revenue streams and monetization strategies is vital for investors and anyone interested in the Chinese liquor market. The company's ability to sustain high prices and expand its market reach highlights its successful business model. To learn more about the company's origins, you can read the Brief History of Kweichow Moutai.

Kweichow Moutai employs several key strategies to generate revenue and maintain its market position. These strategies include a focus on premium products, direct sales channels, and strategic collaborations.

- Premium Baijiu Sales: The primary revenue source is the sale of high-end baijiu products, with Feitian Moutai being the flagship. In the fourth quarter of 2024, core Moutai liquor products saw a 14% year-over-year sales growth.

- Direct Sales and Digital Marketing: The 'i Moutai' digital marketing platform is a significant direct sales channel. Sales from this channel for medium- and high-grade liquor reached 2,002,366.62 (Monetary Unit: Yuan) in the 2024 annual report. Other digital marketing platforms contributed 209,561.85 (Monetary Unit: Yuan) during the same period.

- Tiered Pricing and Brand Positioning: Moutai uses a tiered pricing strategy to cater to different price points while maintaining a luxury brand image.

- Innovative Collaborations: The company has expanded its appeal through collaborations, such as alcohol-infused products like lattes with Luckin Coffee and chocolates with Mars Inc.'s Dove brand, targeting younger consumers.

- International Expansion: Export revenue exceeded 5 billion yuan in 2024, indicating growth in international markets.

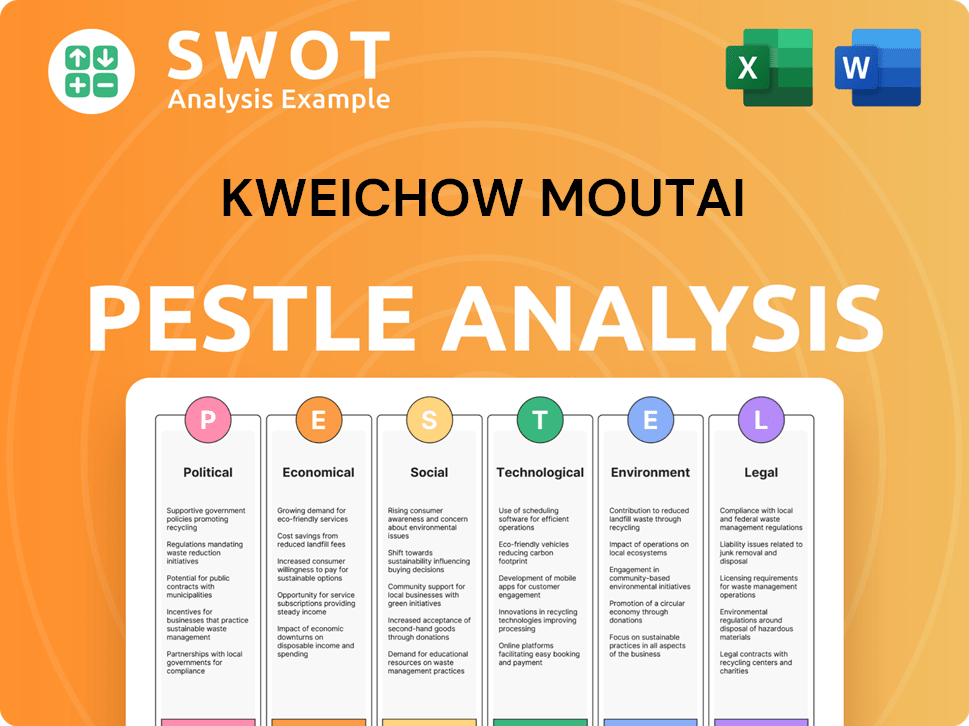

Kweichow Moutai PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Kweichow Moutai’s Business Model?

The journey of the Moutai Company is marked by significant achievements that have shaped its operations and financial success. A key milestone was surpassing Diageo in 2017, which positioned it as the world's most valuable drinks brand. The company has consistently shown strong financial performance, with yearly increases in revenue and profit, even during economic challenges. In 2024, Moutai achieved a historic breakthrough, with its core product's revenue exceeding 100 billion yuan in the first three quarters.

Strategic moves have been crucial for the company's growth and adaptation to market dynamics. The company announced a dividend plan for 2024-2026, establishing a long-term return mechanism for investors, and initiated a share repurchase plan of 3 billion to 6 billion yuan. Operationally, the company has responded to market fluctuations, such as the drop in Feitian Moutai's market price, by prioritizing consumer needs and strengthening channel collaborations. These initiatives, including the 'Three Transformations,' aim to enhance consumer reach and adapt to changing market conditions.

The competitive edge of the Moutai Company is defined by its brand strength, cultural significance, and operational efficiency. Its brand consistently ranks high in both China and the global spirits industry. The rarity of Moutai, due to its specific geographical origin and traditional production methods, gives it significant pricing power. Furthermore, the company's commitment to quality and the use of modern data analytics contribute to its operational effectiveness. Moutai has also ventured into new areas, such as investing in semiconductor chips, seeking new growth engines beyond its core liquor business. For more insights, explore the Growth Strategy of Kweichow Moutai.

Moutai's rise to become the world's most valuable drinks brand is a testament to its strong market position. The company has shown consistent financial growth, even in challenging economic times. In 2024, Moutai's core product revenue surpassed 100 billion yuan in the first three quarters.

The company has implemented a dividend plan for 2024-2026 and initiated a share repurchase plan. Moutai has focused on strengthening consumer reach through initiatives like the 'Three Transformations'. In late 2023, the company increased its factory gate prices for Feitian by 20%.

Moutai's brand strength and cultural significance are major competitive advantages. The rarity of Moutai, due to its production methods, provides pricing power. The company's commitment to quality and the use of data analytics also contribute to its success.

Moutai's financial results have been consistently strong, with revenue and profit growth year after year. The company's strategic moves, such as dividend plans and share repurchases, reflect its commitment to shareholder value. The market price of Feitian Moutai saw a drop from early 2024 levels to around 2,250 RMB per bottle.

Moutai's competitive advantages are rooted in its strong brand, cultural significance, and operational efficiency. Its brand strength is consistently recognized in China and globally. The company's production methods and geographical origin contribute to its pricing power.

- Brand Strength: Consistently ranks as a top valuable brand.

- Rarity: Due to specific geographical origin and traditional production methods.

- Quality Commitment: Uncompromising commitment to quality.

- Data Analytics: Application of modern data analytics to optimize traditional processes.

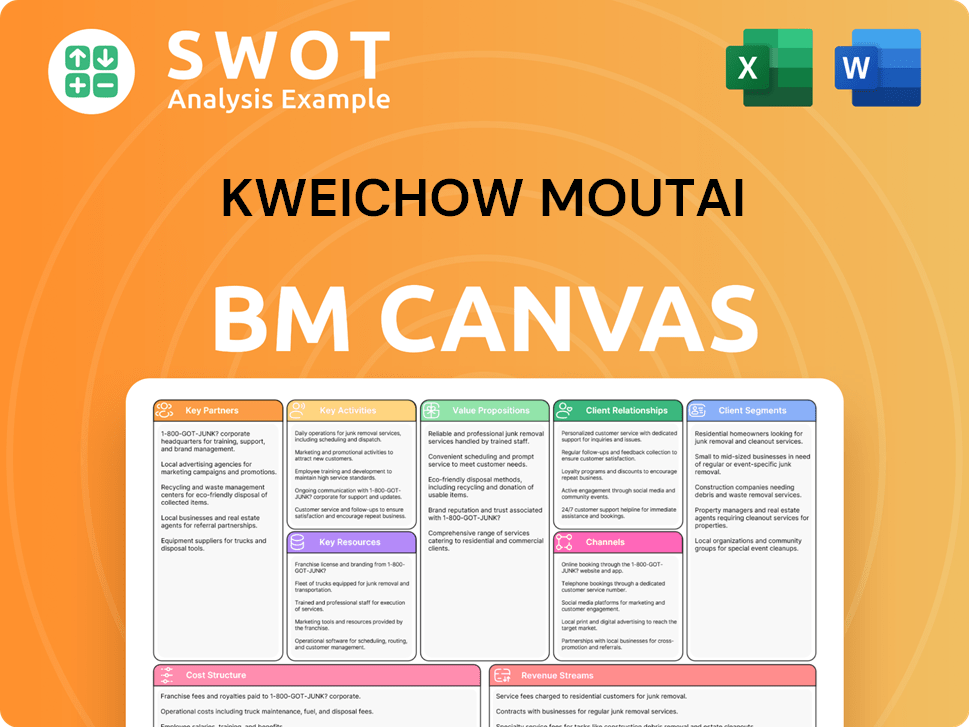

Kweichow Moutai Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Kweichow Moutai Positioning Itself for Continued Success?

Kweichow Moutai, a leading player in the Chinese liquor industry, holds a strong position globally. As of June 2025, the company's market capitalization reached A$405.41 billion. Its brand value was estimated at US$50.1 billion in 2024, making it the most valuable spirits brand worldwide and ranking 7th in China's Most Valuable Brand List.

Despite its strong standing, the company faces several risks, including economic challenges, regulatory pressures, and changing consumer preferences. These factors can influence the Moutai price and overall market performance. The company is actively pursuing strategic initiatives to adapt and grow in a dynamic market.

Kweichow Moutai dominates the Chinese liquor market, recognized globally as the most valuable spirits brand. It has a strong brand reputation, deeply ingrained in Chinese culture. The company is expanding its global presence with strategic events across Asia, Europe, and North America.

The company faces challenges from China's property sector struggles and subdued consumer confidence. Changing consumer preferences, especially among younger generations, pose a long-term risk. Regulatory pressures and high in-market inventory also create uncertainties for Moutai production.

The company aims for a 9% year-over-year sales growth in 2025, focusing on consumer-centric strategies. Investments in green technology and diversification into new sectors, such as semiconductors, are planned. New product launches, including zodiac wines, are expected to maintain momentum.

The 'Three Transformations' strategy strengthens channel collaboration and consumer reach. The company is focused on green technological innovation to improve efficiency. Furthermore, Kweichow Moutai is exploring diversification, including investments in the semiconductor chip sector.

Kweichow Moutai's success is deeply rooted in its strong brand and market position within the Chinese liquor market. However, it is crucial to understand the risks and strategic initiatives the company is undertaking to sustain growth. For more insights on how the company is approaching its marketing, you can explore the Marketing Strategy of Kweichow Moutai.

- The company's focus on green technology aims to enhance its Moutai production processes.

- Strategic initiatives include a 9% sales growth target for 2025 and a focus on consumer engagement.

- Diversification into sectors like semiconductors aims to create new growth engines.

- Ongoing expansion into global markets is a key part of its strategy.

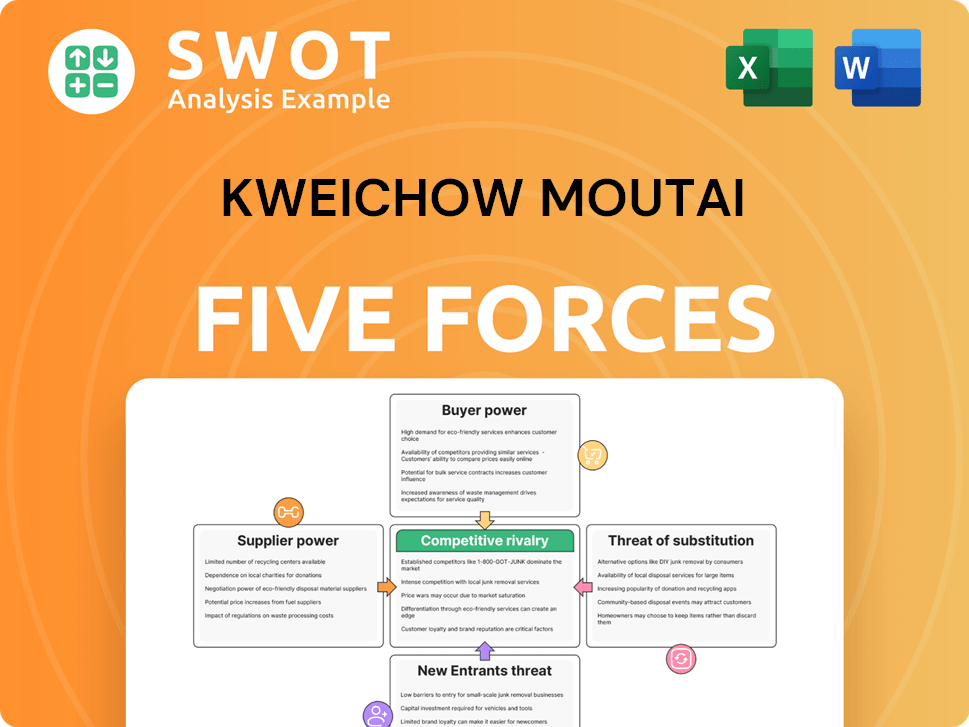

Kweichow Moutai Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kweichow Moutai Company?

- What is Competitive Landscape of Kweichow Moutai Company?

- What is Growth Strategy and Future Prospects of Kweichow Moutai Company?

- What is Sales and Marketing Strategy of Kweichow Moutai Company?

- What is Brief History of Kweichow Moutai Company?

- Who Owns Kweichow Moutai Company?

- What is Customer Demographics and Target Market of Kweichow Moutai Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.