NetEase Cloud Music Bundle

How Does NetEase Cloud Music Thrive in China's Music Market?

NetEase Cloud Music, a leading cloud music platform in China, has captivated millions with its innovative approach to music streaming. With a reported 200 million monthly active users and 50 million subscribers as of March 2025, this online music service is reshaping how people consume and interact with music. But how does this platform, owned by NetEase, generate its impressive revenue and maintain its competitive edge?

This deep dive into NetEase Cloud Music will explore its unique features, including its strong social component and personalized recommendations, which have fueled its popularity in the Chinese music landscape. Furthermore, we'll analyze its diverse revenue streams, from subscription plans to other monetization strategies, providing a comprehensive understanding of how NetEase Music has become a major player. For a detailed look at its strengths and weaknesses, consider the NetEase Cloud Music SWOT Analysis.

What Are the Key Operations Driving NetEase Cloud Music’s Success?

NetEase Cloud Music operates as a vibrant cloud music platform, delivering value through its interactive music streaming services. The platform is particularly popular among younger users in China, offering a rich experience that goes beyond simple music playback. Its core offerings include a comprehensive music library, personalized recommendation systems, and robust social features, all designed to enhance user engagement.

The platform's value proposition centers on providing a deeply engaging music experience. Users can stream music, create and share playlists, and interact through comments and by following other users. This interactive approach, combined with the platform's extensive music catalog, fosters a strong sense of community and user loyalty. The platform also offers long-form audio content, which saw a significant increase in average listening time per user by 35.8% year-over-year in 2024.

The platform's focus on community and social interaction is a key differentiator. This 'music-centric community' is evident in its iconic comment section, where users share personal stories and emotions related to music, fostering deep engagement and user stickiness. This, combined with a strong emphasis on independent artists, helps to create a unique and immersive user experience. This unique approach sets it apart from competitors like Spotify, as discussed in Brief History of NetEase Cloud Music.

NetEase Cloud Music continuously expands its music catalog through partnerships with major labels. Recent agreements include collaborations with K-Pop labels like JYP Entertainment, Kakao Entertainment, and CJ ENM, and a strategic partnership with RBW as of June 2025. This strategy addresses historical challenges related to music copyright.

Technology development is focused on enhancing personalized recommendations. AI tools such as NetEase Tianyin and Cloud Music X Studio play a role in content creation and discovery. These tools help to improve the user experience and increase engagement on the cloud music platform.

The platform fosters a thriving independent artist ecosystem. As of December 2024, over 773,500 registered independent artists contributed approximately 4.4 million music tracks. This focus on user-generated content and community features enhances music discovery and user engagement.

NetEase Music emphasizes community and social interaction, with its iconic comment section fostering deep engagement. Users share personal stories, creating a strong sense of community. These features contribute to user stickiness and enhance the overall user experience.

NetEase Cloud Music's success stems from its unique features and strong community focus. These elements differentiate it from competitors and drive user engagement and loyalty. The platform offers a variety of features designed to enhance the music streaming experience.

- Vast Music Library: Access to a wide range of music tracks, including both domestic and international content.

- Personalized Recommendations: AI-driven systems that suggest music based on user preferences.

- Social Interaction: Features like comments, playlists, and following other users to create a community.

- Independent Artist Support: A platform for independent artists to showcase their music.

- Long-Form Audio Content: Podcasts and other audio content to increase user engagement.

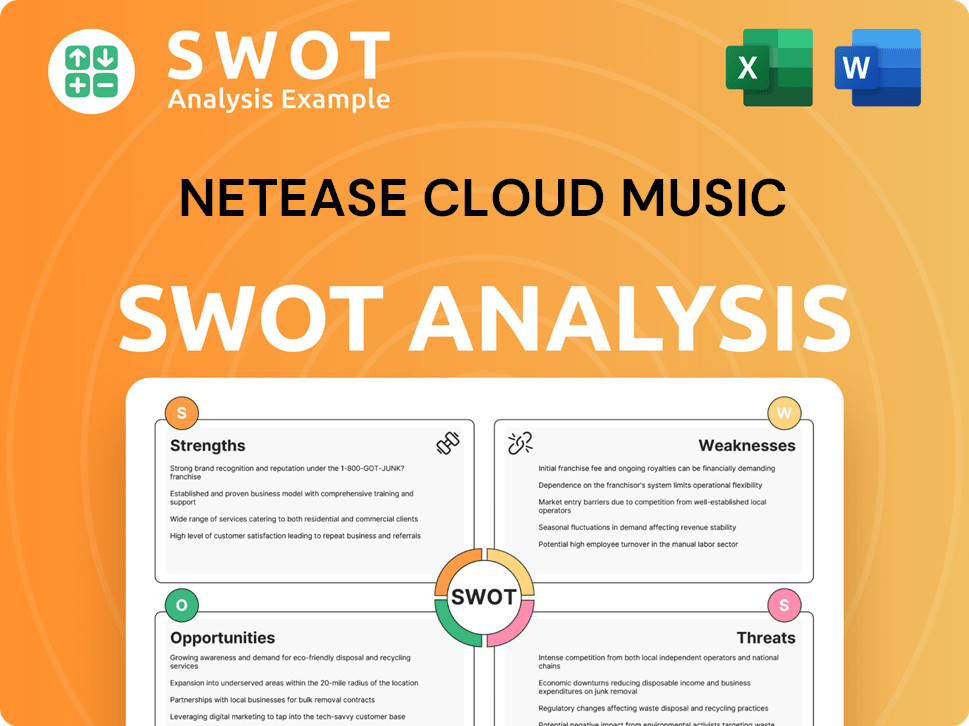

NetEase Cloud Music SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NetEase Cloud Music Make Money?

The revenue model of NetEase Cloud Music, a leading cloud music platform, centers on two primary revenue streams: online music services and social entertainment services. In 2024, the company demonstrated a strong financial performance, with total revenue reaching RMB 8.0 billion, equivalent to approximately US$1.1 billion.

The company's financial strategy focuses on maximizing revenue from its core music services while carefully managing its social entertainment offerings. This approach is designed to capitalize on the growing demand for online music and enhance the overall user experience. Understanding how NetEase Cloud Music makes money provides insight into its strategic direction and market positioning.

The primary driver of growth for NetEase Cloud Music is its online music services segment. This sector includes subscription-based memberships, digital album sales, and advertising. The company's success in this area is a testament to its ability to attract and retain users through a combination of content offerings and user experience.

Online music services are the cornerstone of NetEase Music's revenue. This segment saw substantial growth in 2024, increasing by 23.1% year-over-year to RMB 5.4 billion (about US$737.85 million). This growth is largely driven by subscription revenue, which increased by 22.2% year-over-year, reaching RMB 4.5 billion (approximately US$614.45 million).

NetEase Cloud Music employs a freemium model. Basic music streaming is free, but premium features are available through subscriptions. The company focuses on increasing the willingness of users to pay for a premium experience by enhancing content, improving music distribution, expanding membership benefits, and refining its pricing strategy. The company is also focused on understanding its target market to better tailor its offerings.

Revenue from social entertainment services and others decreased in 2024, reaching RMB 2.6 billion (approximately US$357.67 million), a 26.2% year-over-year decrease. These services include live streaming, virtual items, and online karaoke. The decline reflects a more cautious approach to these services, with a greater emphasis on the core music business.

As of 2024, NetEase Cloud Music had a subscriber/user ratio of 25%. The average monthly subscription price was CNY 7, indicating potential for growth through price adjustments and increased subscriber conversions. This suggests that the company has room to grow by converting more free users into paying subscribers.

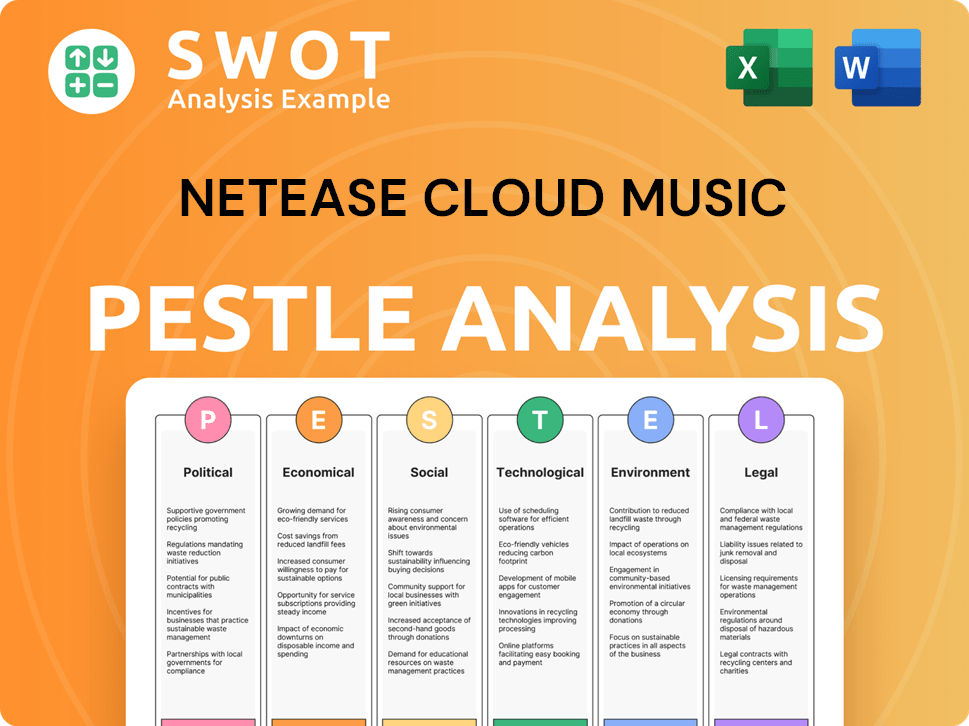

NetEase Cloud Music PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped NetEase Cloud Music’s Business Model?

NetEase Cloud Music, a prominent cloud music platform in China, has achieved several significant milestones that have shaped its operations and financial performance. These achievements highlight its strategic moves and competitive edge in the dynamic music streaming market. The platform's evolution showcases its ability to adapt to changing market demands and maintain a strong position in the Chinese music industry.

A crucial strategic move has been the continuous expansion of its content library through strategic partnerships with major domestic and international music labels. This approach addresses historical challenges related to copyright limitations and strengthens its appeal, particularly to the Gen Z audience. The company has also focused on fostering its independent artist ecosystem, which strengthens its unique content offering.

Operationally, NetEase Cloud Music has faced intense competition, particularly from Tencent Music. In response, the company has emphasized refining personalized recommendations and introducing innovative features, including AI music creation tools. These efforts have deepened user engagement, with membership retention rates and time spent on the platform increasing.

NetEase Cloud Music celebrated the 10th anniversary of its independent musician platform in 2024. As of December 2024, the platform hosted over 773,500 registered independent artists. These artists contributed approximately 4.4 million music tracks.

In 2024, NetEase Cloud Music expanded its content library through partnerships with major labels. This included new agreements with prominent K-Pop labels such as JYP Entertainment, Kakao Entertainment, and CJ ENM. A partnership with RBW in June 2025 provided exclusive access to their music catalogs.

NetEase Cloud Music's competitive advantages include its strong brand image and community-oriented platform. The platform's iconic comment section fosters a loyal user base. Collaborations with NetEase games and Youdao dictionary have boosted brand awareness. The company demonstrated improved profitability in 2024.

In 2024, NetEase Cloud Music's gross margins reached 33.7%, up from 26.7% in 2023. Adjusted net profit more than doubled to RMB 1,700.1 million. This reflects effective cost control and monetization of its core online music business.

To adapt to new trends and competitive threats, NetEase Cloud Music is focusing on strengthening its core music business and enriching premium offerings. The company is also broadening its long-form audio offerings, with listening time for such content increasing significantly in 2024.

- Emphasis on copyright collaborations with Western artists across various genres.

- Focus on personalized recommendations and innovative features, including AI music creation tools.

- The platform's unique community-oriented features, like the comment section, differentiate it from competitors.

- For more insights, consider reading about the Growth Strategy of NetEase Cloud Music.

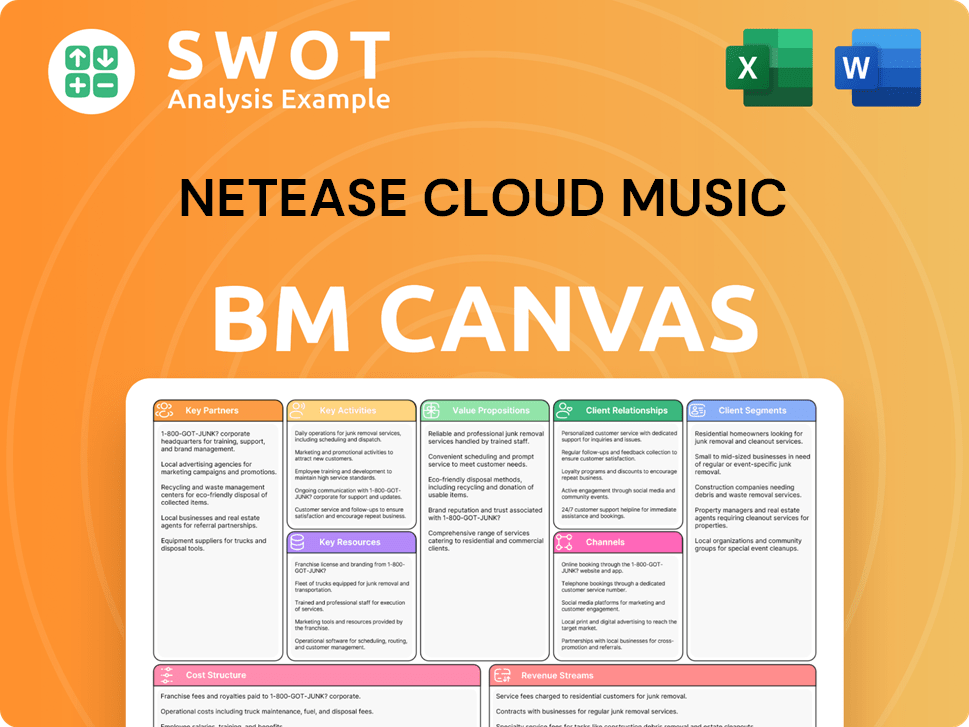

NetEase Cloud Music Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is NetEase Cloud Music Positioning Itself for Continued Success?

As of March 2025, NetEase Cloud Music holds a significant position in the Chinese music streaming industry, ranking as the second-largest cloud music platform. It boasts an estimated 200 million monthly active users and 50 million subscribers. Despite facing strong competition, particularly from Tencent Music, NetEase Cloud Music differentiates itself through its community focus and personalized recommendations, which drive high user engagement.

Several risks and opportunities influence NetEase Cloud Music's trajectory. Key challenges include intense market competition, potential regulatory changes in China's entertainment sector, and the ongoing need to secure comprehensive music copyrights. However, strategic initiatives and a healthy financial position support its growth outlook. For more insights, consider reading about the Growth Strategy of NetEase Cloud Music.

NetEase Cloud Music is the second-largest music streaming service in China. Its strong community features and personalized recommendations set it apart. The platform consistently maintains a high DAU/MAU ratio, indicating strong user engagement.

The company faces intense competition in the music streaming market. Regulatory changes in China's entertainment sector pose a risk. Securing comprehensive music copyrights remains a challenge, impacting content availability.

NetEase Cloud Music aims for long-term growth by enhancing user experience and community engagement. Strategic initiatives include enriching the content library and improving operational efficiency. The company's strong financial position supports future investments.

Prioritizing user experience and fostering a strong music-centric community. Investing in original Chinese music and in-house content. Expanding collaborations with global music companies and long-form audio offerings.

The company's online music services revenue is projected to grow by 15% year-over-year in fiscal year 2025. NetEase Cloud Music had nearly CNY 12 billion in net cash by the end of 2024, providing resources for future investments and organic growth. The average listening time per user for long-form audio increased by 35.8% in 2024, indicating growing user engagement with this content type.

- Subscriber growth is a key driver for the revenue increase.

- Investments will likely focus on content, technology, and user experience.

- The company aims to strengthen its position in the competitive music streaming market.

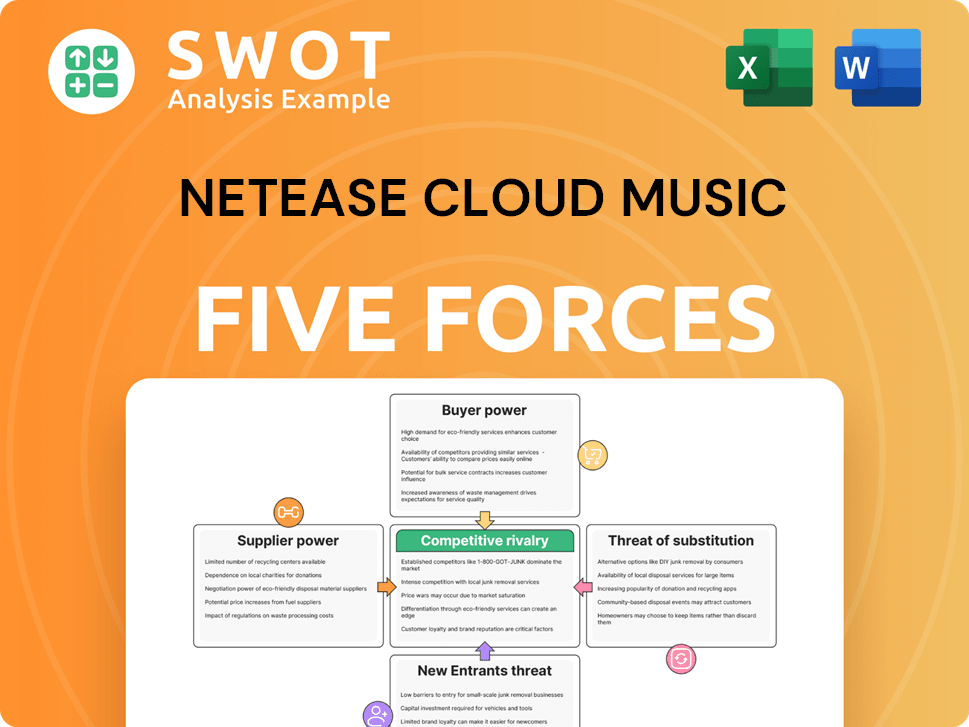

NetEase Cloud Music Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NetEase Cloud Music Company?

- What is Competitive Landscape of NetEase Cloud Music Company?

- What is Growth Strategy and Future Prospects of NetEase Cloud Music Company?

- What is Sales and Marketing Strategy of NetEase Cloud Music Company?

- What is Brief History of NetEase Cloud Music Company?

- Who Owns NetEase Cloud Music Company?

- What is Customer Demographics and Target Market of NetEase Cloud Music Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.