Nicolás Correa SA Bundle

How is Nicolás Correa SA Redefining Precision Manufacturing?

Founded in 1947, Nicolás Correa S.A. has become a global leader in advanced milling machines. Recent financial results, including record-breaking sales of €121.49 million and a net income of €13.7 million for 2024, highlight its success. This success is driven by its commitment to innovation and quality, serving critical industries like aerospace and automotive.

Understanding the inner workings of Nicolás Correa SA SWOT Analysis is crucial for anyone looking to understand the machine tool industry. This in-depth analysis will explore the company's operations, from its core CNC milling technology to its global market presence. By examining its strategic milestones and competitive advantages, we can gain insights into how Nicolás Correa SA continues to thrive in a competitive landscape, providing high-precision solutions with their Correa milling machines.

What Are the Key Operations Driving Nicolás Correa SA’s Success?

Nicolás Correa S.A. focuses on designing, manufacturing, and selling CNC milling machines. Their product range includes bed type, gantry type, and floor type milling machines, along with milling centers and automation systems. These machines are designed for various industries, such as aeronautics, automotive, and energy.

The company's operations are vertically integrated, covering design, production, and distribution. Manufacturing takes place in Spain, specifically in Burgos and Itziar. They emphasize precision in their machine designs, using unique technologies in their milling heads. Nicolás Correa also has a strong R&D department involved in internal projects and collaborations.

Beyond manufacturing, Nicolás Correa provides applications engineering and after-sales services, ensuring technical assistance and maintenance. This comprehensive approach, from design to after-sales support, allows them to deliver specialized solutions. With over 70 years in the market, they offer a wide range of milling machines with a 5-year warranty, showcasing their product quality and reliability.

Nicolás Correa S.A. offers a diverse range of CNC milling machines. These include bed type, gantry type, floor type, and column type milling machines. They also provide milling centers and automation systems to meet various industrial needs.

Their machines serve critical customer segments across several demanding industries. These include aeronautics, automotive, railway, wind energy, capital goods, energy, defense, general machining, and oil & gas. This diversification highlights their market adaptability.

The company's manufacturing operations are based in Spain. Production facilities are located in Burgos and Itziar. This strategic positioning allows for efficient production and quality control of their Correa milling machines.

Nicolás Correa S.A. provides specialized solutions with significant customer benefits. They offer a 5-year warranty, a testament to their product quality. Their focus on after-sales support enhances customer satisfaction and fosters long-term relationships.

Nicolás Correa S.A. distinguishes itself through its comprehensive approach to CNC milling. They combine advanced technology with extensive industry experience. This results in high-precision machines and robust customer support.

- Vertical Integration: Controls design, production, and distribution.

- Precision Engineering: Focus on minimizing electronic compensations.

- R&D Focus: Strong investment in research and development.

- Customer Service: Comprehensive after-sales support and maintenance.

For further insights into the company's strategic direction, consider reading about the Growth Strategy of Nicolás Correa SA. This provides additional context on how the company is positioned within the machine tools market.

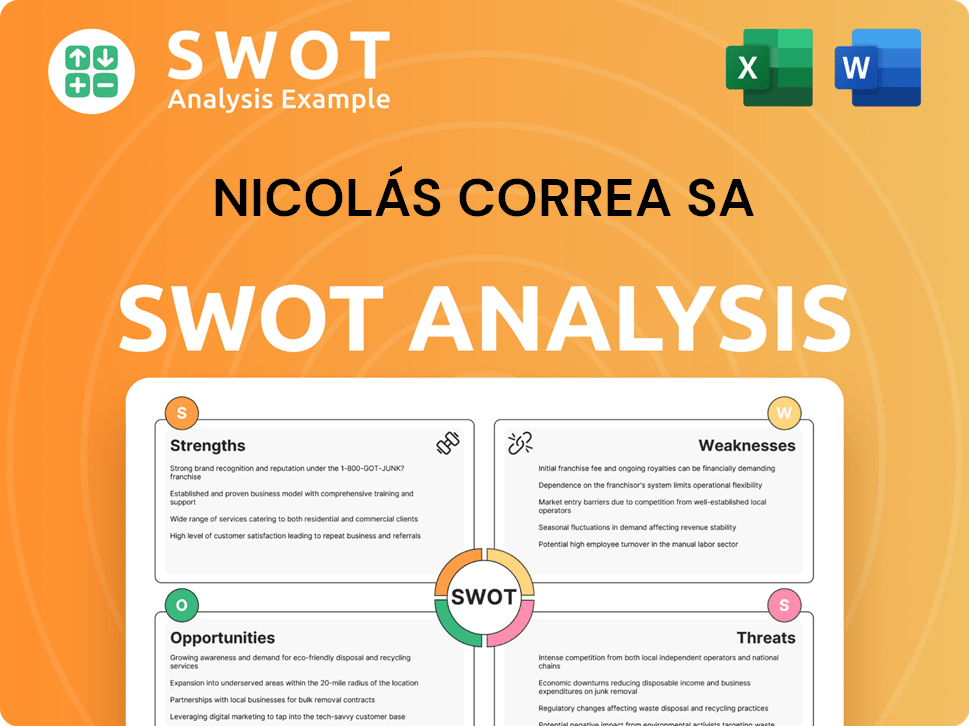

Nicolás Correa SA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nicolás Correa SA Make Money?

Nicolás Correa S.A. generates revenue primarily through the sale of its specialized Correa milling machines. These high-value machines are crucial for sectors demanding precision, such as aerospace and energy. The company's financial strategy is designed to maximize value from its advanced solutions.

In addition to direct sales, the company monetizes through applications engineering and after-sales services. This approach ensures customer satisfaction and fosters repeat business, contributing significantly to overall revenue. The company's dual distribution strategy, combining direct and indirect sales channels, optimizes market penetration across key global markets.

The company's financial performance in 2024 demonstrates its ability to balance competitiveness with profitability. The company's focus on value-based pricing, given the specialized nature of its products, allows it to capture the significant value it provides to customers.

The main revenue streams for Nicolás Correa S.A. are direct sales of CNC milling machines and related services. The company's strategy includes a dual distribution model and value-based pricing to maximize profitability. The company's growth strategy is detailed in the Growth Strategy of Nicolás Correa SA article.

- Product Sales: Direct sales of bed type, gantry type, floor type, and column type machines, milling centers, and automation systems.

- After-Sales Services: Applications engineering and after-sales services, which accounted for approximately 15% of total revenue in 2024.

- Distribution Strategy: Direct sales through subsidiaries (40%) and indirect channels via agents and distributors (60%) in 2024.

- Market Focus: Key markets include Germany, China, and the USA, with the USA representing 25% of revenue in 2024.

- Pricing Strategy: Value-based pricing, reflecting the high precision and specialized nature of the machines.

- Financial Performance (2024): Total sales of €121.49 million, an 11% increase; net income of €13.7 million, a 30% increase; EBITDA of €18.3 million, a 30% increase; and an EBITDA margin of 15.0%.

- Shareholder Remuneration: Proposed dividend of €0.30 per share for the 2024 financial year, payable on June 9, 2025.

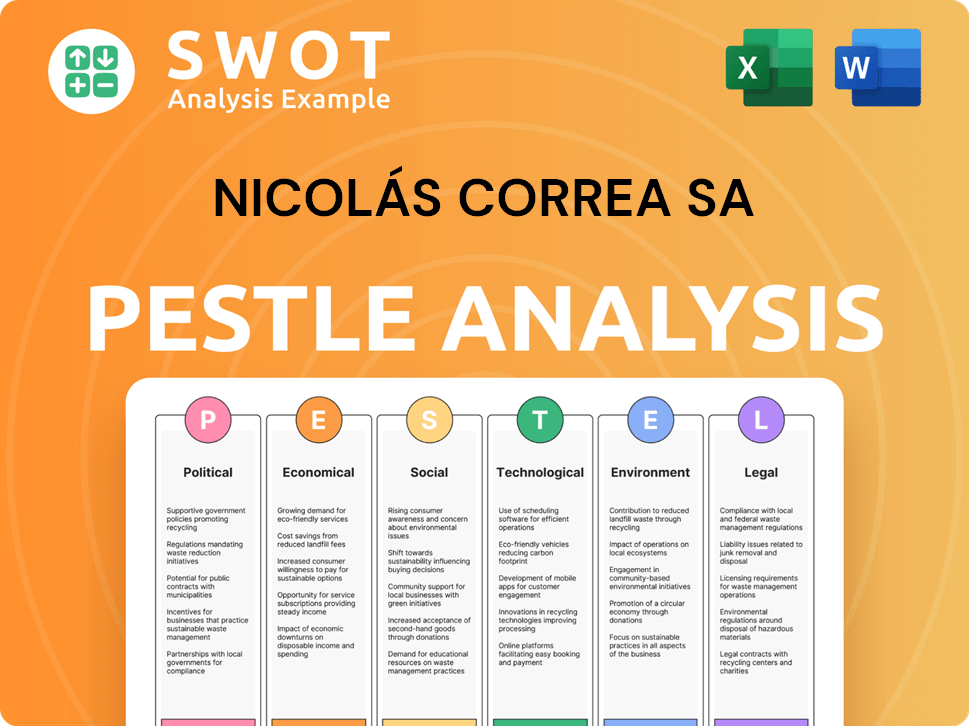

Nicolás Correa SA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Nicolás Correa SA’s Business Model?

Nicolás Correa S.A. has achieved significant milestones, reflecting its growth and strategic focus. The company has consistently invested in modernizing its production facilities to enhance output and efficiency. This commitment is crucial as it aims to meet increasing demand, particularly from the defense and aeronautics sectors.

A key strategic move has been the company's consistent investment in modernizing its production facilities to boost output and efficiency. In 2024, the company committed €8 million in capital expenditures, targeting a 15% increase in production by the end of 2025. This expansion is essential, especially since the company reached 100% utilization of its production capacity in 2024, driven by robust demand.

The company has successfully navigated market challenges, such as economic slowdowns in key markets like Germany, by diversifying its geographical reach and focusing on high-growth sectors. Exports accounted for approximately 90% of its production in 2024, reaching 17 different countries. This diversification strategy has been pivotal in maintaining its market position and driving growth.

The company's journey is marked by strategic investments and market adaptation. Reaching full production capacity in 2024 highlights its operational efficiency. The focus on high-growth sectors like defense and aeronautics has been a key driver of its success.

Significant capital expenditures, such as the €8 million investment in 2024, demonstrate a commitment to growth. Diversifying its geographical presence, with exports reaching 17 countries, has mitigated risks. Launching multitasking machines and integrating smart factory features show its adaptability to industry trends.

A broad product range, technological leadership, and a strong warranty position the company favorably. Continuous R&D investment, representing 8% of revenue in 2024, drives innovation. The robust EBITDA margin of 15.0% in 2024, exceeding competitors, highlights its operational efficiency.

The company's financial health is reflected in its strong EBITDA margin. The ability to maintain rigorous cost control and generate economies of scale has contributed to its profitability. The strategic focus on high-growth sectors and geographical diversification supports its financial stability.

The company's competitive advantages stem from several key factors. These advantages include a wide range of Correa milling machines, technological leadership, and a strong warranty. The company's ability to innovate and adapt to market demands further strengthens its position.

- A broad selection of Correa milling machines, offering the widest range on the market.

- Technological leadership through in-house developed milling heads and continuous R&D investment (8% of revenue in 2024).

- A 5-year warranty on its entire machine range, underscoring product quality and reliability.

- Strong brand strength and a reputation for precision engineering.

- Adaptation to new trends by launching multitasking machines and integrating smart factory features.

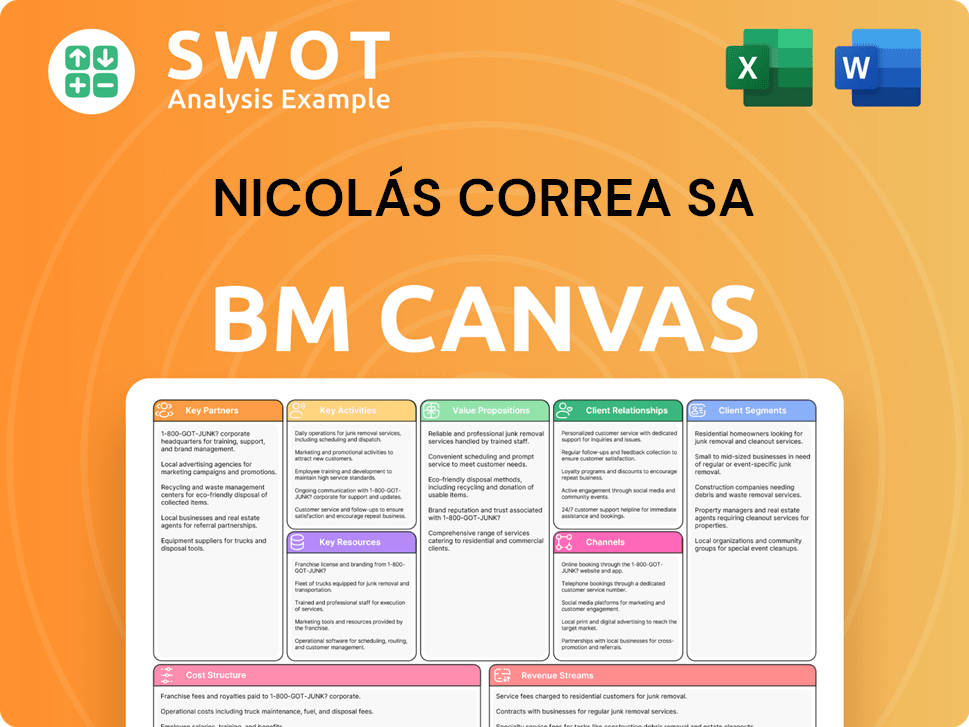

Nicolás Correa SA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Nicolás Correa SA Positioning Itself for Continued Success?

Nicolás Correa S.A. is a prominent player in the industrial machinery sector, specifically known for its Correa milling machines. The company holds a strong position as a European leader in manufacturing large milling machines and has a global presence, exporting to over 20 countries, including key markets like Germany, China, and the USA. This widespread reach is supported by strong customer loyalty, attributed to its reputation for high-quality, precise, and reliable milling solutions, which are backed by a 5-year warranty.

Despite its strong market position, Nicolás Correa faces several risks. Economic uncertainties and potential market slowdowns in major economies could impact demand and profitability. The industrial machinery sector is highly competitive, with global manufacturers potentially affecting pricing and market share. Geopolitical risks, such as rising trade barriers, could also hinder exports and increase costs. Technological advancements by competitors also pose a threat, requiring continuous investment in research and development.

Nicolás Correa S.A. is a leading European manufacturer of large milling machines. It has a global presence with exports to over 20 countries. The company benefits from strong customer loyalty and a reputation for quality.

Economic uncertainties and market slowdowns pose risks. The sector is highly competitive, potentially affecting pricing. Geopolitical issues and technological advancements also present challenges.

The company plans to increase production capacity. It is developing multitasking machines and smart factory features. A strong order backlog provides good visibility for 2025.

Projected revenue growth is 10% per annum over the next two years. The Spanish Machinery industry is forecast to grow by 4.2%. The company's order backlog was €78 million as of 2024.

Looking ahead, Nicolás Correa is focused on strategic initiatives to sustain and expand its profitability. The company plans to increase production capacity by 15% by the end of 2025 through €8 million in capital expenditures in 2024. It is also actively developing multitasking machines that integrate turning, milling, and drilling, and equipping its machines with smart factory features, including advanced digital monitoring and automation capabilities. The company's order backlog of €78 million as of 2024 provides good visibility for 2025. With a projected revenue growth of 10% per annum over the next two years, compared to a 4.2% forecast for the Spanish Machinery industry, Nicolás Correa aims to continue its profitable growth trajectory, driven by its focus on innovation, product quality, and strategic market diversification. For more insights, check out the Marketing Strategy of Nicolás Correa SA.

Nicolás Correa is concentrating on innovation and market diversification to drive growth. The company is investing in new product development and expanding its production capabilities. Key metrics include order backlog and projected revenue growth.

- Increase production capacity by 15% by the end of 2025.

- Capital expenditures of €8 million in 2024.

- Projected revenue growth of 10% per annum for the next two years.

- Order backlog of €78 million as of 2024.

Nicolás Correa SA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nicolás Correa SA Company?

- What is Competitive Landscape of Nicolás Correa SA Company?

- What is Growth Strategy and Future Prospects of Nicolás Correa SA Company?

- What is Sales and Marketing Strategy of Nicolás Correa SA Company?

- What is Brief History of Nicolás Correa SA Company?

- Who Owns Nicolás Correa SA Company?

- What is Customer Demographics and Target Market of Nicolás Correa SA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.