Nutrien Bundle

How Does Nutrien Company Thrive in the Agricultural Sector?

Nutrien, a leading Nutrien SWOT Analysis, is a global powerhouse in crop inputs and services, playing a critical role in feeding a growing world. The company's 2024 performance, with $700 million in net earnings and a $5.4 billion adjusted EBITDA, highlights its strategic progress. Despite a revenue dip to $25.972 billion, Nutrien's resilience and operational efficiency are evident, making it a key player to watch.

Understanding the

What Are the Key Operations Driving Nutrien’s Success?

The core operations of the Nutrien Company center on the production and distribution of essential crop inputs. These include potash, nitrogen, and phosphate products, serving agricultural, industrial, and feed customers globally. The Nutrien business model is built on an integrated approach, combining upstream production with a leading downstream retail channel. This structure allows the company to efficiently meet the needs of farmers worldwide.

Nutrien's value proposition lies in its ability to offer a comprehensive suite of products and services. It supports farmers through its extensive network of production, distribution, and agricultural retail facilities. This includes agronomic advice and application services, helping growers increase productivity and profitability. The company also emphasizes sustainable practices, aiming to reduce its environmental footprint while supporting global food production.

Operationally, Nutrien leverages a vast network to ensure the efficient delivery of products. Its supply chain is optimized, supported by strategic investments in technology and automation. In 2024, for instance, approximately 35% of its potash ore was mined using automation. This contributed to record annual production levels and a reduction in controllable cash costs. The company's retail locations provide products, agronomic advice, and application services, delivered by approximately 4,000 agronomists.

Nutrien operates a global network of production facilities, including potash mines, nitrogen plants, and phosphate operations. This network is crucial for producing and distributing crop inputs efficiently. Strategic locations ensure products reach farmers across various regions, supporting global food production. The company's extensive supply chain is designed to optimize the delivery of these essential products.

Nutrien's retail network provides farmers with products, agronomic advice, and application services. Approximately 4,000 agronomists offer tailored solutions, including proprietary products like Loveland Products and TERRAMAR. These services help farmers optimize crop yields and improve return on investment. This direct engagement with farmers is a key component of Nutrien's integrated business model.

Nutrien is committed to sustainable practices to reduce its environmental footprint. This includes initiatives to decrease greenhouse gas emissions intensity and freshwater use. These efforts are designed to support growers in increasing productivity while minimizing environmental impact. Sustainability is a key focus of Nutrien's long-term strategy.

Nutrien offers financial programs through Nutrien Financial to support farmers' crop input needs. These programs enable timely purchases and help farmers avoid yield loss due to cash flow timing. This support is crucial for ensuring that farmers can access the necessary inputs to maximize their crop yields. These financial programs are a key part of Nutrien's value proposition.

Nutrien's unique blend of large-scale production and localized retail presence sets it apart. Its direct engagement with farmers through its retail network allows for tailored solutions and agronomic support. The company's focus on sustainability and financial programs further enhances its value proposition.

- Integrated business model combining production and retail.

- Extensive retail network providing agronomic advice.

- Commitment to sustainability and reducing environmental impact.

- Financial programs to support farmers' input needs.

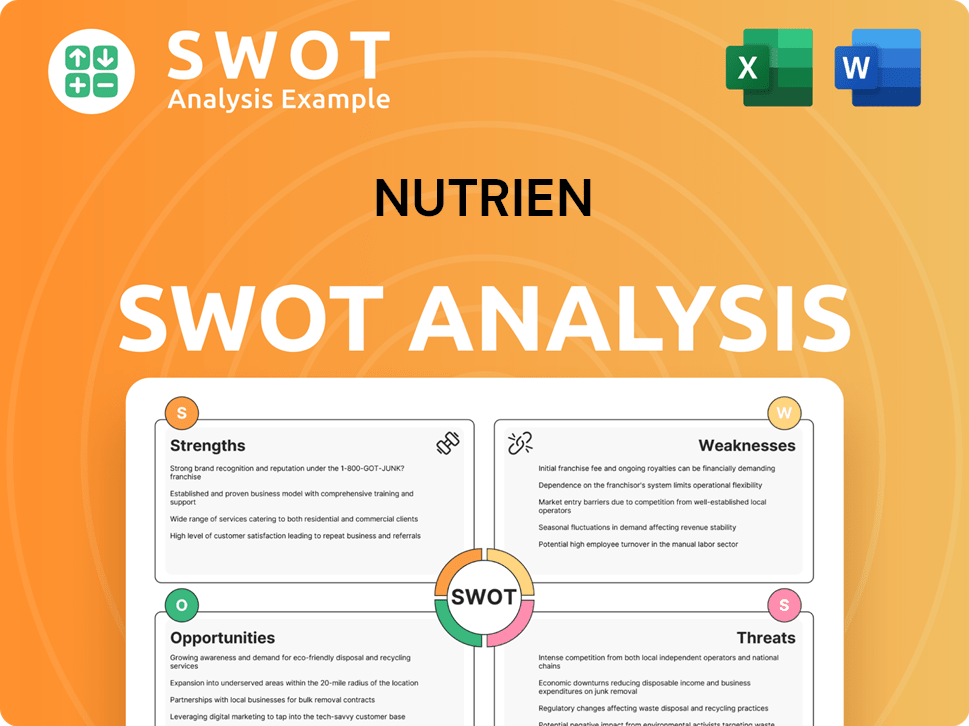

Nutrien SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nutrien Make Money?

The Nutrien Company generates revenue from its core operations in the agricultural sector. Its main sources of income include the sale of crop inputs such as potash, nitrogen, and phosphate, as well as its extensive retail network. This diversified approach allows the Nutrien business to serve a broad customer base and maintain a strong market position.

The company's financial performance reflects its strategic focus on these key areas. For the twelve months ending March 31, 2025, Nutrien reported revenue of $25.683 billion, a 9.37% decrease year-over-year. In 2024, the annual revenue was $25.972 billion, representing a 10.61% decline from 2023.

The retail segment is a significant contributor to overall revenue, providing a wide array of agricultural solutions. This includes seed, crop protection products, and various services to farmers, supporting the company's revenue streams and its role in agriculture. The Nutrien Company continues to adapt its strategies to maintain profitability and drive growth.

The Nutrien business model focuses on several key strategies to generate revenue and maintain profitability. These strategies are essential for understanding how the Nutrien Company operates and achieves its financial goals. For more information on its marketing approach, you can read about the Marketing Strategy of Nutrien.

- Crop Input Sales: The primary revenue source comes from selling potash, nitrogen, and phosphate fertilizers.

- Retail Operations: The retail segment offers agricultural solutions, including seed, crop protection products, and services. The retail segment's adjusted EBITDA increased to $1.7 billion in 2024.

- Nutrien Financial: This segment provides credit programs for crop input purchases, contributing to revenue.

- Proprietary Products: Leveraging higher-margin proprietary product offerings is a key monetization strategy.

- Cost Optimization: Implementing cost-saving initiatives is crucial, with a target of approximately $200 million in annual consolidated savings by 2025.

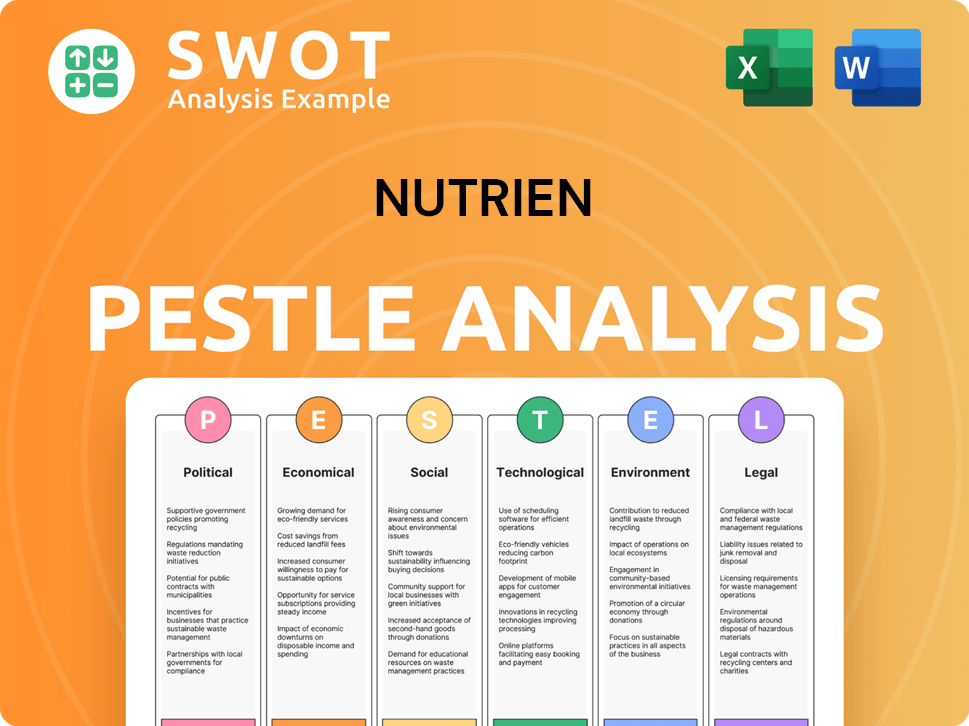

Nutrien PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Nutrien’s Business Model?

The Nutrien Company has strategically navigated the agricultural landscape, achieving key milestones and implementing strategic moves to strengthen its position. In 2024, the company made significant strides toward its 2026 performance targets, focusing on operational efficiency and cost-saving initiatives. These efforts have been crucial in maintaining its competitive edge in the global fertilizer market.

A major focus for Nutrien has been reducing operational costs. The company aimed for $200 million in annual savings by 2025, a target it achieved ahead of schedule. Despite facing challenges like weather-related events and plant outages, Nutrien demonstrated resilience by adjusting strategies and optimizing production, particularly for potash, to capitalize on higher prices.

This agricultural company's competitive advantages are rooted in its extensive assets and global reach. Its commitment to innovation and sustainability further solidifies its market position. Nutrien’s focus on sustainable practices and innovative products positions it well for future growth and market leadership.

Achieved significant progress towards 2026 performance targets in 2024. Accelerated operational efficiency and cost-saving initiatives. Reduced total controllable costs, aiming for $200 million in annual savings by 2025, ahead of schedule.

Focused on reducing unit production costs to mitigate operational challenges. Adjusted production volumes to support higher prices, especially for potash. Continued investment in research and development for innovative products.

World's largest provider of crop nutrients with extensive potash production assets. Strong global supply chain capabilities and leading downstream retail channel. Commitment to sustainable practices, including a 15% reduction in GHG emissions intensity by 2024 compared to 2018.

Achieved its 2025 freshwater reduction target, reducing annual freshwater use by three million cubic meters in 2024 compared to 2018. Continued success of TERRAMAR in 2024 for addressing heat, drought, and water stress.

In 2024, Nutrien focused on optimizing its operations and achieving cost efficiencies. The company's ability to adapt to market dynamics and operational challenges underscores its strategic agility and resilience. The company continues to innovate and invest in sustainable practices to maintain its competitive edge.

- Reduced total controllable costs across operations and corporate functions.

- Focused on reducing unit production costs and temporarily adjusting volumes.

- Continued investment in research and development for innovative products and technologies.

- Achieved its 2025 freshwater reduction target in 2024.

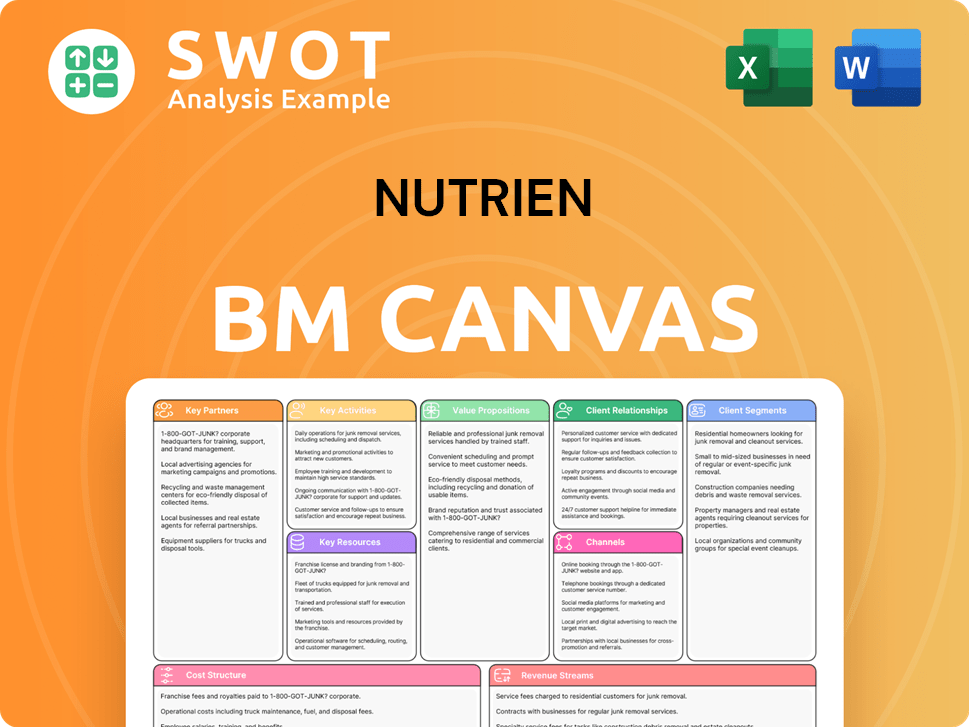

Nutrien Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Nutrien Positioning Itself for Continued Success?

The Nutrien Company holds a leading global position in the crop inputs and services sector. It operates a vast network for production, distribution, and agricultural retail. The company is the world's largest provider of crop nutrients and serves over 500,000 growers worldwide through its retail network. In 2024, global potash shipments rebounded to approximately 72.5 million tonnes.

Key risks for Nutrien include the cyclical nature of the agricultural industry. Earnings can fluctuate significantly with volatile agricultural commodity prices. Fertilizer prices are sensitive to supply/demand balances, weather patterns, trade policies, and geopolitics. Regulatory changes in global fertilizer markets could also impact margins.

Nutrien is a leading global provider of crop inputs and services, holding a significant market share in fertilizer production and agricultural retail. Its extensive network includes production facilities, distribution centers, and retail locations. The company's strong position is supported by its diverse product offerings and global reach.

The agricultural industry's cyclical nature poses a key risk, with earnings fluctuating due to commodity price volatility. Fertilizer prices are sensitive to supply/demand, weather, and geopolitical factors. Regulatory changes in global fertilizer markets could also impact margins. Understanding these risks is crucial for investors and stakeholders.

Nutrien's 2025 outlook is supported by strong crop input demand and firming potash fundamentals. Management anticipates profit growth driven by higher fertilizer volumes and margins. Strategic initiatives include supply chain optimization, expanded fertilizer production, and retail segment growth. Further insights can be found in the Competitors Landscape of Nutrien.

The company is focused on strategic initiatives to strengthen its core business. Nutrien plans to reduce controllable costs by approximately $200 million by 2025. As of February 18, 2025, Nutrien repurchased 1.9 million shares for $96 million. A quarterly dividend of US$0.545 per share was declared in May 2025.

Nutrien is actively pursuing strategic initiatives to strengthen its core business and drive future growth. These initiatives include optimizing its supply chain, expanding fertilizer production capacity, and growing its high-margin retail segment. The company is also investing in proprietary products and mine automation.

- Supply chain optimization

- Fertilizer production expansion

- Retail network optimization

- Investments in proprietary products

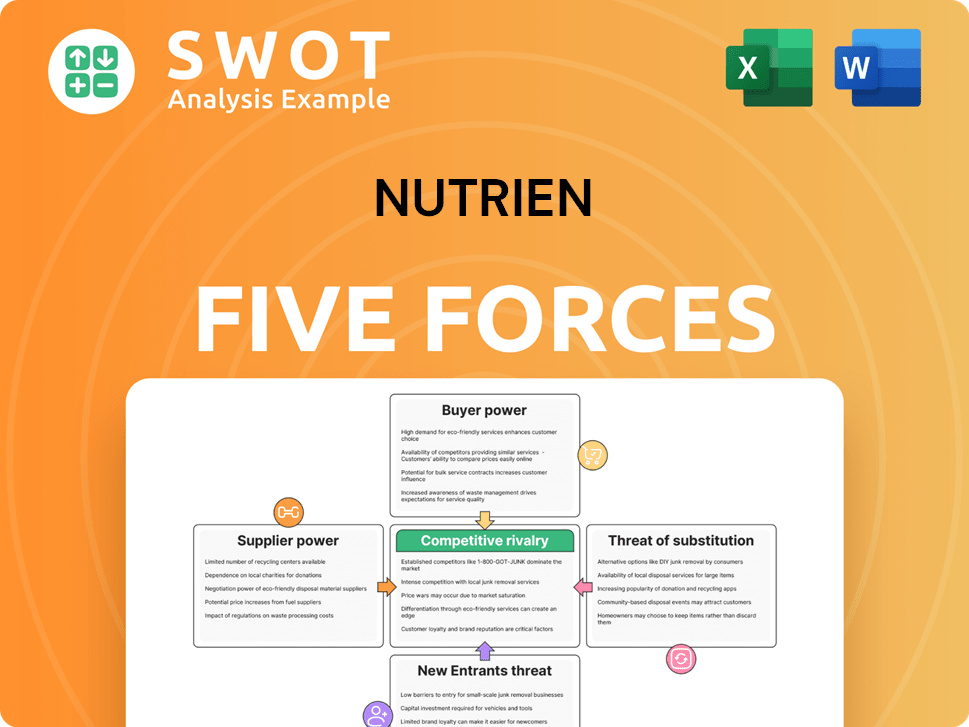

Nutrien Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nutrien Company?

- What is Competitive Landscape of Nutrien Company?

- What is Growth Strategy and Future Prospects of Nutrien Company?

- What is Sales and Marketing Strategy of Nutrien Company?

- What is Brief History of Nutrien Company?

- Who Owns Nutrien Company?

- What is Customer Demographics and Target Market of Nutrien Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.