Okta Bundle

How Does Okta Secure the Digital World?

In an era dominated by digital interactions, understanding how companies secure their data is paramount. Okta, Inc. stands at the forefront of this critical need, providing cloud-based identity and access management (IAM) solutions. With a remarkable 15.3% revenue increase to US$2.61 billion in fiscal year 2025, Okta's influence is undeniable, showcasing the growing demand for robust Okta SWOT Analysis in an increasingly security-conscious world.

This exploration will delve into how Okta works, from its core Okta features to its comprehensive Okta security measures. We'll uncover the mechanics behind Okta's single sign-on capabilities, multi-factor authentication, and user provisioning, providing insights into Okta's platform overview and how it addresses the evolving needs of businesses. Discover the power of Okta, and how it is shaping the future of identity management, including its Okta pricing plans and API integration.

What Are the Key Operations Driving Okta’s Success?

At its core, the Okta company provides a cloud-based identity and access management (IAM) platform. This platform is designed to secure and streamline how businesses manage and protect access to their applications and data. It offers solutions for both workforce and customer identity, ensuring secure and efficient connectivity for employees, contractors, and customers alike.

The Okta company operates through two main segments: Workforce Identity and Customer Identity. Workforce Identity focuses on managing access for employees, contractors, and partners, while Customer Identity manages and secures user identities in customer-facing applications. This dual approach allows Okta to address a broad range of identity management needs for businesses of all sizes.

The core value proposition of Okta is to simplify security infrastructure, increase efficiency, and enhance user productivity. By providing secure and seamless access to applications, Okta helps businesses improve their security posture while also making it easier for users to access the resources they need. This results in faster product releases for developers and a better overall user experience.

Okta's operational processes are centered around its cloud-based platform. This platform offers single sign-on (SSO), multi-factor authentication (MFA), API access management, and user lifecycle management. The Universal Directory is a key component, providing a consolidated view of user identities.

Key Okta features include SSO, MFA, and user lifecycle management. These features enhance security and streamline access. Okta also emphasizes self-service, automation, and 24/7 customer support to improve its offerings.

Okta offers simplified security infrastructure, increased efficiency, and enhanced user productivity. It provides secure and seamless access to applications, leading to faster product releases and a better user experience. The company's commitment to 'Always secure. Always on.' ensures reliability and continuous protection.

Okta expands its market reach through strategic partnerships. These partnerships with resellers, system integrators, and other distribution partners are crucial for onboarding and deprovisioning suppliers and partners securely. This is especially important in sectors like retail.

The main benefits of using Okta include streamlined security, improved efficiency, and enhanced user experience. This leads to better productivity and faster development cycles. For instance, Okta's platform has over 5,000 pre-built integrations, making it highly adaptable for various business needs.

- Simplified Security: Centralized identity management reduces the complexity of securing applications and data.

- Increased Efficiency: SSO and automation streamline access, saving time and resources.

- Enhanced User Productivity: Seamless access to applications improves user experience and productivity.

- Faster Product Releases: Simplified access management enables faster development cycles.

Okta SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Okta Make Money?

The Okta company primarily generates revenue through a subscription-based Software-as-a-Service (SaaS) model. This approach involves charging customers recurring fees for access to its cloud-based identity management platform and related services. The subscription fees are typically determined by the number of users and the specific features availed.

Subscription sales are the primary revenue driver for Okta, accounting for a significant portion of its total revenue. This revenue model allows Okta to provide scalable identity solutions while offering predictable revenue streams. The company's focus on subscription services reflects its strategic direction and market positioning.

In fiscal year 2025, subscription revenue reached US$2.556 billion, representing approximately 98% of the total revenue of US$2.610 billion. This indicates a 16% year-over-year increase in subscription revenue. This growth highlights the success of Okta's monetization strategies and the increasing demand for its services.

Besides subscriptions, Okta also generates revenue from professional services, including consulting, implementation, training, and customer support. However, professional services and other revenues have seen a slight decline, from US$64 million in 2023 to US$58 million in 2024, and further to US$54 million in 2025. This shift might be due to Okta's emphasis on scalable, self-service solutions. The Okta platform offers various features and services, contributing to its revenue generation.

- Tiered Pricing: Okta uses tiered pricing for its various services.

- Upselling and Cross-selling: The company focuses on upselling and cross-selling additional products to existing customers.

- Auth0 Free Plan: The Auth0 Free Plan has been expanded to include 25,000 monthly active users, passwordless features, and unlimited social and Okta connections.

- Paid Plans: Paid plans offer enterprise-grade identity security with multi-factor authentication and enhanced log retention.

Okta PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Okta’s Business Model?

The Okta company has achieved several key milestones, significantly impacting its operations and financial results. A notable strategic move was the acquisition of Auth0, which expanded its capabilities in the Customer Identity Cloud, particularly for developers. In fiscal year 2025, the company demonstrated strong financial performance, with substantial revenue and profit growth.

The company's strategic focus includes adapting to macroeconomic pressures and enhancing operational efficiencies. This involves concentrating on securing large customer wins and restructuring to allocate resources effectively. The company's ability to innovate and integrate emerging technologies like AI further strengthens its market position.

The company's competitive advantages stem from its brand recognition and technology leadership in the identity-as-a-service (IDaaS) sector. Its extensive network of integrations and continuous adaptation to new trends position it well for future growth. This includes a focus on securing non-human identities and extending identity security to GenAI applications.

In fiscal year 2025, total revenue reached US$2.610 billion, a 15% year-over-year increase. Subscription revenue was US$2.556 billion, up 16% year-over-year. The company achieved a GAAP net income of US$28 million, a significant improvement from a loss of US$355 million in fiscal year 2024.

The company is focusing on large customer wins, particularly those with annual contract values exceeding US$100,000. Restructuring efforts included layoffs of 180 jobs in February 2025. These moves aim to reallocate resources and improve operational efficiencies.

The company benefits from its brand strength as a leading independent identity provider. It has an extensive network of over 5,000 pre-built integrations, creating a robust ecosystem. The company is integrating AI into its products, such as Okta AI, to offer advanced security features.

The company is focused on securing non-human identities, including AI agents, and extending identity security to GenAI applications. This focus demonstrates its commitment to addressing emerging threats and maintaining a competitive edge in the evolving cybersecurity landscape.

Okta offers a range of features, including single sign-on, multi-factor authentication, and identity management. The company's platform provides robust security features to protect against evolving cyber threats, including advanced identity security posture management.

- Okta single sign-on (SSO) simplifies access to applications.

- Multi-factor authentication (MFA) adds an extra layer of security.

- Identity management streamlines user provisioning and access control.

- Okta API integration enables customization and integration with other systems.

Okta Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Okta Positioning Itself for Continued Success?

The Okta company holds a strong position as a leading independent identity partner globally, serving a diverse customer base across various industries. In the third quarter of fiscal year 2025, the company served 19,450 customers, with 4,705 having an Annual Contract Value (ACV) exceeding US$100,000. Okta's dollar-based net retention rate for the trailing 12-month period was 111% in Q1 fiscal year 2025, indicating strong customer loyalty. The company's total addressable market (TAM) for its products is estimated at US$80 billion, with a US$41 billion market for Employee Access Management solutions.

Key risks and headwinds for Okta include the evolving cybersecurity threat landscape, regulatory changes, and competition. The company has experienced past security incidents, which underscores the importance of fortifying digital supply chains. Looking forward, Okta is focused on reigniting growth, securing its own operations, and scaling to become a US$5 billion, and then US$10 billion-plus company.

Okta is a leading independent identity partner, serving a diverse range of customers. It caters to large enterprises, mid-market enterprises, small businesses, and more across various industries. The company's strong market position is supported by its customer base and high retention rates.

Evolving cybersecurity threats, regulatory changes, and competition pose risks for Okta. Cybersecurity predictions for 2025 include more sophisticated phishing kits and AI-driven attacks. Past security incidents highlight the importance of continuous improvements in security measures.

Okta aims to achieve significant revenue growth, focusing on innovation and customer base expansion. Strategic initiatives include product innovation on the Okta and Auth0 platforms. The company expects total revenue growth of 12% for full year fiscal year 2025.

Okta is investing in research and development, with US$642 million spent in 2025. The company plans to monetize Okta AI through new products and by enhancing existing products. Expanding its customer base and leveraging its partner ecosystem are key strategies.

Okta anticipates a non-GAAP operating margin of 19% to 20% and a free cash flow margin of approximately 22% for fiscal year 2025. For fiscal year 2026, revenue is expected to climb modestly by 7%, with a non-GAAP operating margin of at least 22%. The company's commitment to innovation is evident in its significant investment in R&D.

- Total revenue growth of 12% for full year fiscal year 2025.

- Non-GAAP operating margin of 19% to 20% and a free cash flow margin of approximately 22% for fiscal year 2025.

- Revenue is expected to climb modestly by 7% for fiscal year 2026.

- Non-GAAP operating margin of at least 22% for fiscal year 2026.

For more details on the company's ownership and financial aspects, you can read the article about Owners & Shareholders of Okta.

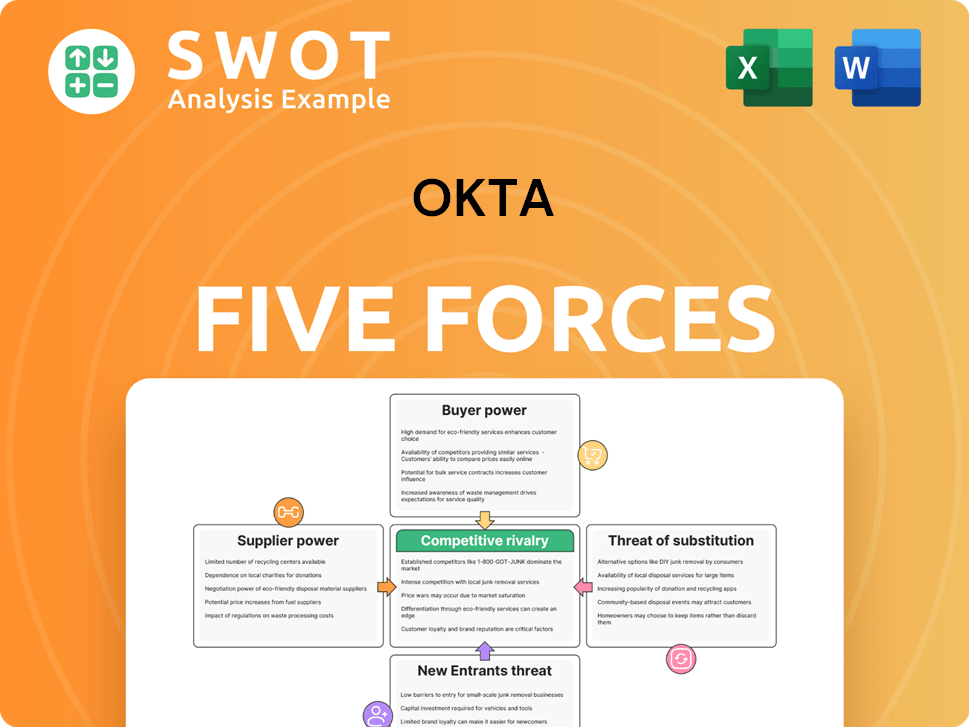

Okta Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Okta Company?

- What is Competitive Landscape of Okta Company?

- What is Growth Strategy and Future Prospects of Okta Company?

- What is Sales and Marketing Strategy of Okta Company?

- What is Brief History of Okta Company?

- Who Owns Okta Company?

- What is Customer Demographics and Target Market of Okta Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.