Patterson-UTI Bundle

How Does Patterson-UTI Thrive in the Volatile Energy Market?

Patterson-UTI Energy, Inc. is a key player in North America's oil and gas sector, specializing in drilling and pressure pumping. As a leading provider of onshore contract drilling services, it's crucial for anyone tracking the exploration and production of hydrocarbons. Understanding how this Patterson-UTI SWOT Analysis operates is essential for investors and industry watchers alike.

Patterson-UTI (PTEN) offers essential well services, including high-performance drilling rigs and specialized directional drilling, making it a significant Drilling Company. Its robust pressure pumping capabilities are vital for enhancing well productivity, especially in the context of fracking operations. This examination is critical for comprehending its competitive advantages, its ability to navigate market challenges, and its future growth trajectory within the Oil and Gas Drilling landscape.

What Are the Key Operations Driving Patterson-UTI’s Success?

Patterson-UTI (PTEN) generates value through its core segments: Contract Drilling, Pressure Pumping, and Downhole Technology. The company provides onshore contract drilling services using advanced rigs designed for efficiency and safety. These services are crucial for exploration and production companies, optimizing drilling times and reducing overall well costs. The company serves a diverse customer base across major shale plays in North America.

The Pressure Pumping segment offers hydraulic fracturing and other well completion services, enhancing oil and natural gas flow. This involves injecting fluids at high pressure to fracture rock formations. The Downhole Technology segment supports these operations by providing directional drilling and measurement services, optimizing well trajectories. This integrated approach, from rig deployment to completion services, is a key component of the company's value proposition.

The company's operational efficiency and focus on high-spec rigs differentiate it from competitors. Continuous investment in technology and fleet modernization translates into faster drilling times and improved well economics. This strategy is designed to provide tangible benefits to customers, making PTEN a key player in the Oil and Gas Drilling industry. To learn more about the company's growth strategy, you can read Growth Strategy of Patterson-UTI.

PTEN's Contract Drilling segment offers onshore drilling services to exploration and production companies. The fleet includes advanced rigs with features like walking systems and automated controls. These rigs are designed to enhance drilling performance and reduce costs for clients, serving major shale plays.

The Pressure Pumping segment provides hydraulic fracturing and well completion services. This involves using high-pressure fluids to fracture rock formations. The goal is to maximize well productivity and recovery rates, which is essential for extracting oil and natural gas efficiently.

PTEN's Downhole Technology segment offers directional drilling and measurement services. These services are crucial for navigating complex geological formations. They help optimize well trajectories, enhancing the efficiency of drilling operations.

PTEN's operations are highly integrated, from rig maintenance to logistics. This integrated approach ensures efficient deployment of equipment and personnel. The focus on operational efficiency and safety is a key part of the company's strategy.

PTEN's focus on high-spec rigs and integrated services sets it apart in the Drilling Company market. The company is actively upgrading its fleet to super-spec rigs. This continuous investment in technology translates into customer benefits, such as faster drilling times and improved well economics.

- High-Spec Rigs: Super-spec rigs offer significant cost savings.

- Integrated Services: Streamlined operations from drilling to completion.

- Operational Efficiency: Focus on safety and efficiency to reduce costs.

- Technology Investment: Continuous upgrades for better performance.

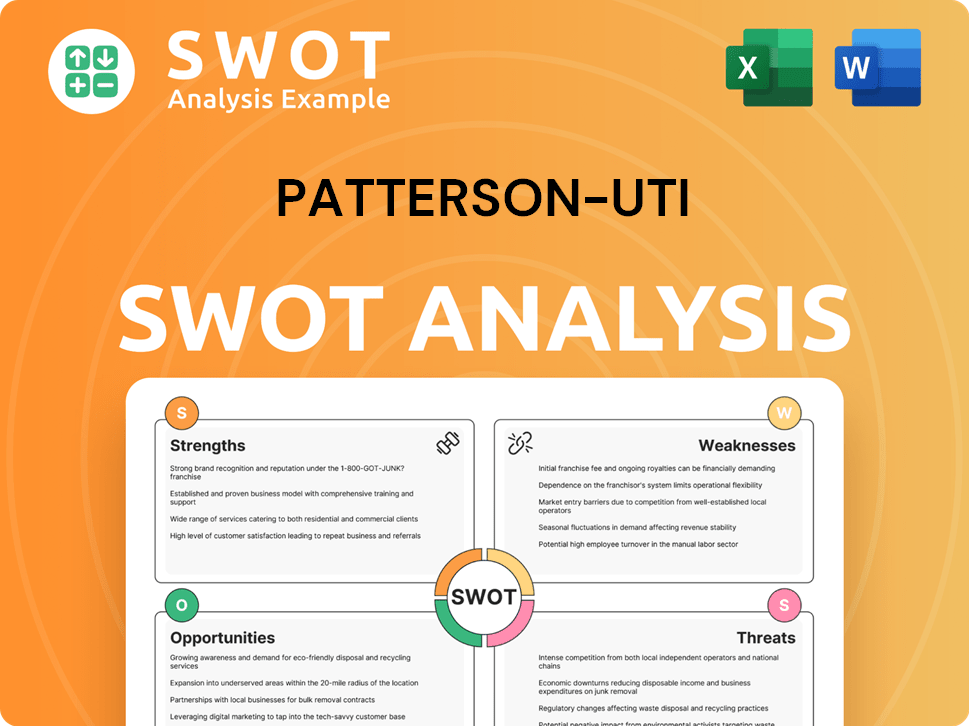

Patterson-UTI SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Patterson-UTI Make Money?

The revenue streams and monetization strategies of the Patterson-UTI (PTEN) are centered around providing essential services to the oil and gas industry. As a leading drilling company, PTEN generates income through its diverse service offerings, which include contract drilling, pressure pumping, and downhole technology. These services are crucial for oil and gas exploration and production activities, making PTEN's financial performance closely tied to the overall health of the energy market.

The company's ability to generate revenue is heavily influenced by the demand for oil and gas, particularly in North America, where the majority of its operations are concentrated. PTEN leverages its high-spec rig fleet and advanced equipment to command premium rates, ensuring consistent revenue streams. This strategic approach allows the company to adapt to evolving industry demands and maximize profitability.

Understanding how Patterson-UTI makes money involves examining its primary revenue streams and how it monetizes its services. The company's financial success is directly linked to its operational segments and its ability to adapt to market dynamics. PTEN's strategic focus on advanced services positions it well to capitalize on the increasing complexity of drilling operations.

The Contract Drilling segment provides onshore contract drilling services. This is the largest revenue contributor for PTEN. Revenue is generated through dayrate contracts.

This segment offers hydraulic fracturing and well completion services. Revenue is based on the volume of proppant used, horsepower deployed, and specific services rendered. It is a significant revenue driver for the company.

The Downhole Technology segment provides directional drilling, downhole performance motors, and specialized measurement services. Revenue is based on the complexity of the well, service duration, and tools utilized.

Contract Drilling segment revenues are primarily generated through dayrate contracts. The daily rates vary based on the rig's specifications, contract duration, and market conditions. This method provides a predictable revenue stream.

Pressure Pumping and Downhole Technology segments generate revenue through service charges. These charges are based on the specific services provided, such as proppant volume, horsepower, and specialized tools.

PTEN employs long-term contracts to secure consistent revenue streams. These contracts help improve fleet utilization. This strategy enhances financial stability and predictability.

In the first quarter of 2024, PTEN reported key financial figures that highlight its revenue streams and operational performance. The Contract Drilling segment generated revenues of $443.9 million, while the Pressure Pumping segment brought in $331.3 million. The Downhole Technology segment contributed $81.7 million to the total revenue. These figures demonstrate the relative importance of each segment in PTEN's overall financial structure.

- The Contract Drilling segment's revenue is driven by dayrate contracts, with rates varying based on rig specifications and market conditions.

- Pressure Pumping revenue is determined by proppant volume, horsepower, and specific services during well completion.

- Downhole Technology revenue is based on well complexity, service duration, and the tools used.

- PTEN's monetization strategies focus on premium dayrates and service charges, particularly with its high-spec rig fleet.

- The company aims to optimize its fleet and service offerings to align with industry demands, such as longer lateral wells.

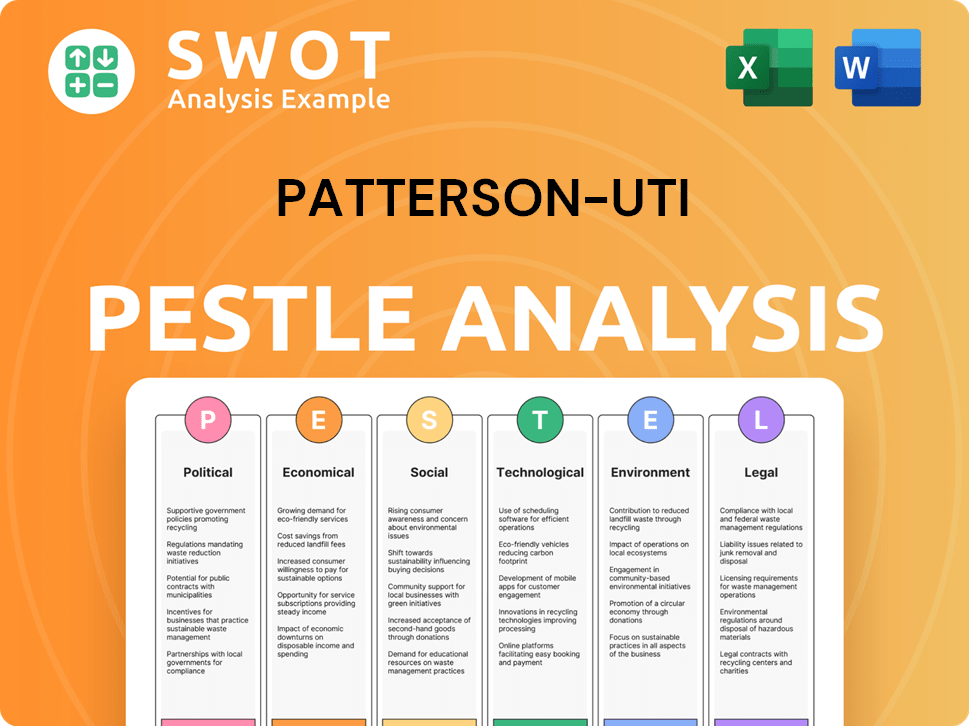

Patterson-UTI PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Patterson-UTI’s Business Model?

The journey of Patterson-UTI (PTEN) has been marked by significant milestones and strategic moves, shaping its operational and financial performance. A key strategic move has been the continuous investment in upgrading its drilling rig fleet to 'super-spec' rigs. These rigs are designed for drilling longer lateral wells, a trend increasingly prevalent in North American shale plays, and they offer enhanced efficiency and safety. This ongoing modernization has allowed Patterson-UTI to maintain a competitive edge by meeting the evolving demands of its customers and improving drilling economics.

The company has also faced operational and market challenges, including the inherent cyclicality of the oil and gas industry, characterized by volatile commodity prices and fluctuating demand for drilling and completion services. During market downturns, Patterson-UTI has responded by optimizing its cost structure, idling less efficient equipment, and focusing on maintaining relationships with key clients. The company's ability to navigate these downturns and emerge stronger highlights its operational resilience.

Patterson-UTI's competitive advantages stem from several factors. Its technologically advanced fleet of drilling rigs and pressure pumping equipment provides a significant operational edge. The company's super-spec rigs, in particular, offer superior performance, which translates into faster drilling times and lower costs for its clients. Its integrated service offering, combining drilling, pressure pumping, and downhole technology, allows for a more streamlined and efficient well development process for customers. This bundling of services can lead to cost efficiencies and improved project execution.

Patterson-UTI's history includes strategic acquisitions and expansions that have broadened its service offerings and geographic reach. The company has consistently invested in upgrading its rig fleet, focusing on 'super-spec' rigs designed for enhanced drilling efficiency. These investments have been crucial in maintaining a competitive position within the Oil and Gas Drilling industry.

A core strategy involves continuous fleet modernization to meet evolving industry demands. Patterson-UTI has focused on integrating drilling, pressure pumping, and downhole technology services. The company has adapted to market downturns by optimizing costs and maintaining client relationships, demonstrating operational resilience. As of Q1 2024, the company was actively deploying additional super-spec rigs, showing a commitment to its strategy.

Patterson-UTI’s advanced rig fleet and integrated services offer a significant operational advantage. The company benefits from economies of scale as a major onshore drilling contractor in North America. Strong customer relationships built on reliable service contribute to its sustained business model. The company is adapting to new trends, such as increasing demand for ESG-compliant operations, by investing in technologies that reduce emissions and improve environmental performance.

While specific financial figures can fluctuate, understanding Patterson-UTI financial performance is crucial. The company’s ability to manage costs during downturns and capitalize on upturns showcases its financial agility. Investors often look at metrics like revenue, operating income, and debt levels to gauge financial health. For detailed insights, refer to the latest quarterly reports and investor presentations.

Patterson-UTI's competitive advantages are multifaceted, contributing to its strong market position. The company's advanced fleet of super-spec rigs offers superior performance, reducing drilling times and costs. Its integrated service model streamlines well development, enhancing efficiency and customer satisfaction. As one of the largest onshore Drilling Company contractors, it benefits from economies of scale.

- Technologically Advanced Rig Fleet: Super-spec rigs for enhanced efficiency.

- Integrated Services: Drilling, pressure pumping, and downhole technology.

- Economies of Scale: Large onshore drilling contractor.

- Strong Customer Relationships: Built on reliable and efficient service.

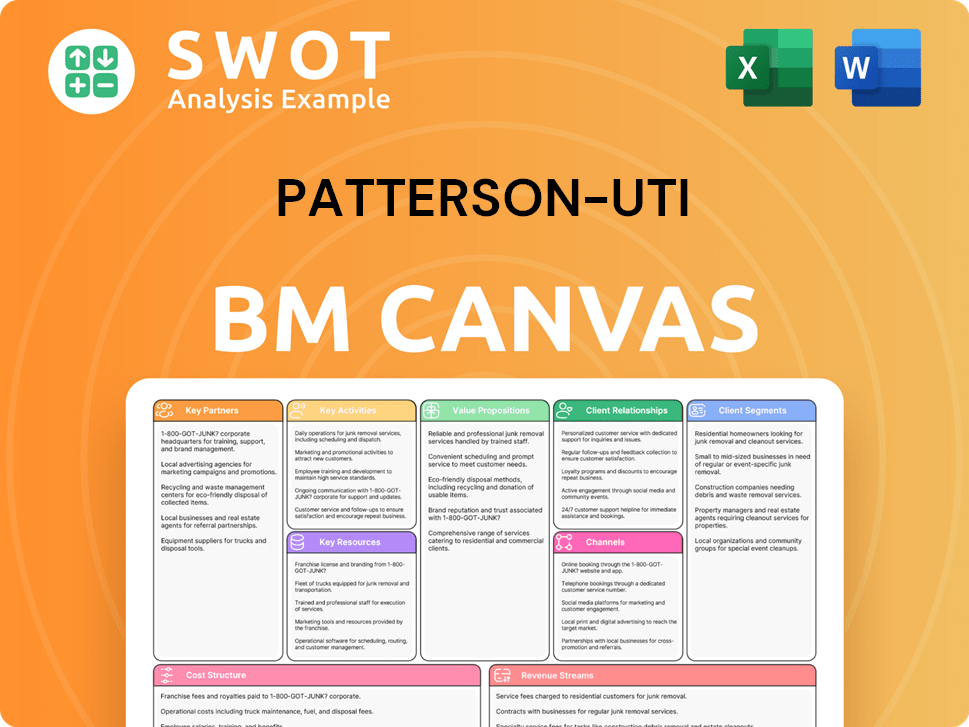

Patterson-UTI Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Patterson-UTI Positioning Itself for Continued Success?

In the competitive landscape of the North American onshore contract drilling and pressure pumping sectors, Patterson-UTI (PTEN) holds a significant position. It is consistently ranked among the top service providers. The company's strong market presence is particularly notable in the super-spec rig segment, where its investments in advanced drilling technology have given it a competitive edge.

Despite its strengths, Patterson-UTI faces several challenges, including the cyclical nature of the oil and gas industry and regulatory pressures. The company's future outlook involves strategic initiatives aimed at sustaining and expanding its revenue generation capabilities. These include fleet upgrades and technological innovations to improve operational efficiency and reduce environmental impact.

Patterson-UTI is a leading Drilling Company in North America, known for its strong market share, especially in the super-spec rig market. It maintains long-standing relationships with major exploration and production companies across key basins. The company's focus is primarily on onshore drilling and completion services for unconventional resources, with a strong presence in the Permian, Marcellus, and Eagle Ford.

The company faces risks tied to the volatile oil and gas market, which is sensitive to commodity price fluctuations. Regulatory changes, especially those related to hydraulic fracturing and emissions, could also pose operational challenges. Competition and supply chain disruptions are additional factors that could affect the company's performance. The cyclical nature of the industry can significantly impact demand for its services.

Patterson-UTI is focused on fleet upgrades to super-spec rigs to meet the demand for high-efficiency drilling. It is also exploring technological innovation to improve operational efficiency and reduce environmental impact. The company emphasizes operational excellence, disciplined capital allocation, and maximizing shareholder returns. The company aims to sustain profitability by leveraging its advanced fleet and operational expertise.

Patterson-UTI continues to invest in its fleet, focusing on super-spec rigs to enhance its competitive advantage. The company is also exploring technological advancements in drilling and completion services. Leadership is committed to operational excellence, strategic capital allocation, and increasing shareholder value. The company aims to sustain its profitability by leveraging its advanced fleet, operational expertise, and strong customer relationships within the dynamic North American energy landscape.

The oil and gas industry is subject to cyclical downturns, which can impact the demand for services from companies like Patterson-UTI. The company's financial performance is closely tied to oil and gas prices and the level of drilling activity. For a deeper understanding of the company's value, consider reading this article about Owners & Shareholders of Patterson-UTI.

- Patterson-UTI has a significant presence in the Permian Basin, which is a key area for drilling activity.

- The company's focus on super-spec rigs allows it to target more profitable contracts and improve operational efficiency.

- Technological innovation, particularly in areas that improve operational efficiency, is a key focus.

- The company's success depends on its ability to adapt to market conditions and maintain strong customer relationships.

Patterson-UTI Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Patterson-UTI Company?

- What is Competitive Landscape of Patterson-UTI Company?

- What is Growth Strategy and Future Prospects of Patterson-UTI Company?

- What is Sales and Marketing Strategy of Patterson-UTI Company?

- What is Brief History of Patterson-UTI Company?

- Who Owns Patterson-UTI Company?

- What is Customer Demographics and Target Market of Patterson-UTI Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.