PZ Cussons Bundle

Unveiling the Inner Workings of PZ Cussons: How Does It Thrive?

PZ Cussons, a global powerhouse in consumer goods, has a fascinating story of growth and adaptation. From its humble beginnings, the company has evolved into a household name, offering a diverse portfolio of PZ Cussons SWOT Analysis brands that resonate with consumers worldwide. But how does this century-old company maintain its competitive edge and ensure sustained profitability? This exploration dives deep into the PZ Cussons business model.

This analysis will dissect PZ Cussons operations, revealing the strategies behind its success. We'll explore how the company manages its PZ Cussons products and navigates the complexities of the FMCG industry. Understanding the PZ Cussons history and current market position is key for anyone seeking insights into this established company's enduring influence and future prospects. We will also explore its PZ Cussons brands and their impact on consumer demographics.

What Are the Key Operations Driving PZ Cussons’s Success?

The core of the PZ Cussons business model lies in its integrated approach to manufacturing and distributing consumer goods. This strategy focuses on personal care, home care, and food products, targeting diverse markets across Europe, Asia, and Africa. The company's operational model emphasizes regional focus and vertical integration to manage its supply chain and distribution networks effectively.

PZ Cussons creates value by offering a wide range of essential consumer products. This includes well-known brands in personal care, such as Imperial Leather and Carex. In the home care sector, brands like Morning Fresh and Joy provide essential cleaning solutions. Furthermore, the food segment, particularly in Africa, features products like Mamador and Devon King's, catering to local consumer needs.

The company's operations are supported by a robust supply chain, encompassing raw material sourcing, in-house manufacturing, and extensive distribution networks. PZ Cussons prioritizes local production where feasible to tailor products to specific markets and optimize supply chain efficiency. This approach allows for greater responsiveness to regional demands and consumer preferences.

PZ Cussons' operations cover a broad spectrum, from sourcing raw materials to delivering finished products. Manufacturing facilities are strategically located to support regional markets. Distribution is managed through both direct sales teams and partnerships with local distributors.

The company's product portfolio includes personal care items like soaps and shower gels, home care products such as detergents, and food products like edible oils. These offerings are tailored to meet the diverse needs of consumers across different regions.

PZ Cussons offers value through trusted brands and essential products. The company focuses on innovation and sustainability to meet evolving consumer demands. This includes eco-friendly options and responsible brand practices.

PZ Cussons has been focusing on sustainability to improve its brand image and meet consumer demands. This includes eco-friendly options for its products. These initiatives are designed to resonate with environmentally conscious consumers.

PZ Cussons emphasizes brand building and continuous product innovation to stay competitive. The company's focus on sustainability is a key differentiator. This approach helps attract and retain consumers.

- Localized Production: Manufacturing close to target markets for efficiency.

- Brand Building: Strong marketing to build brand loyalty.

- Sustainability: Initiatives to meet consumer demand for eco-friendly products.

- Distribution: Wide distribution networks, including direct sales and partnerships.

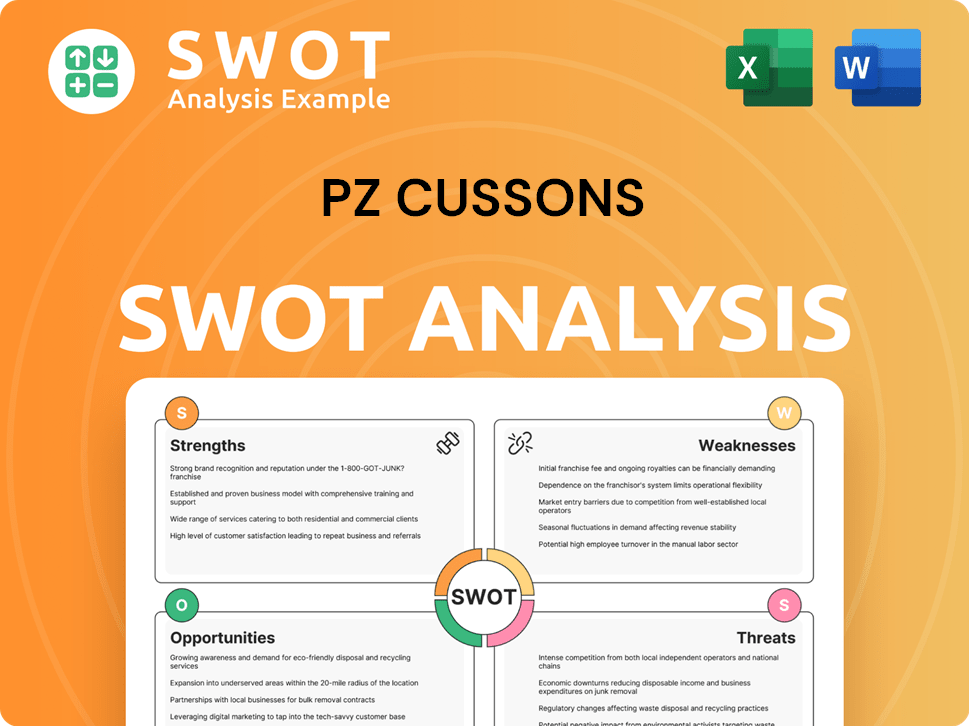

PZ Cussons SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does PZ Cussons Make Money?

The primary revenue stream for PZ Cussons comes from selling its consumer goods. These products span personal care, home care, and food categories. Product sales make up the vast majority of its income.

PZ Cussons' financial reports categorize revenue by geographic region and product segment. For the fiscal year ending May 31, 2024, the company reported a challenging trading environment. Revenue was impacted by macroeconomic factors and currency headwinds in key markets.

The company's full-year revenue for 2024 was expected to be around £580 million, a decrease from the previous year. This reflects the impact of various market conditions on PZ Cussons' sales.

PZ Cussons uses premium pricing for its established brands. This strategy leverages the trust consumers have in their products.

Extensive retail partnerships support volume-based sales. This approach helps PZ Cussons distribute its products widely.

PZ Cussons expands into high-growth developing economies. This strategy aims to capture new market opportunities.

Cross-selling is used within its product portfolio. Consumers are encouraged to purchase complementary items.

Licensing agreements for brand extensions or regional distribution contribute to income. This diversifies revenue streams.

PZ Cussons focuses on higher-margin categories and divests non-core assets. This streamlines the portfolio.

PZ Cussons employs several monetization strategies to generate revenue. These include premium pricing for its trusted brands, volume-based sales through retail partnerships, and strategic market expansion. The company also uses cross-selling and licensing agreements. To learn more about the company's structure, consider reading about the Owners & Shareholders of PZ Cussons.

PZ Cussons adapts its revenue mix. This is done by focusing on higher-margin categories. The company also divests non-core assets.

- Premium pricing for established PZ Cussons brands.

- Volume-based sales through extensive retail partnerships.

- Strategic market expansion into high-growth economies.

- Cross-selling opportunities within the product portfolio.

- Licensing agreements for brand extensions.

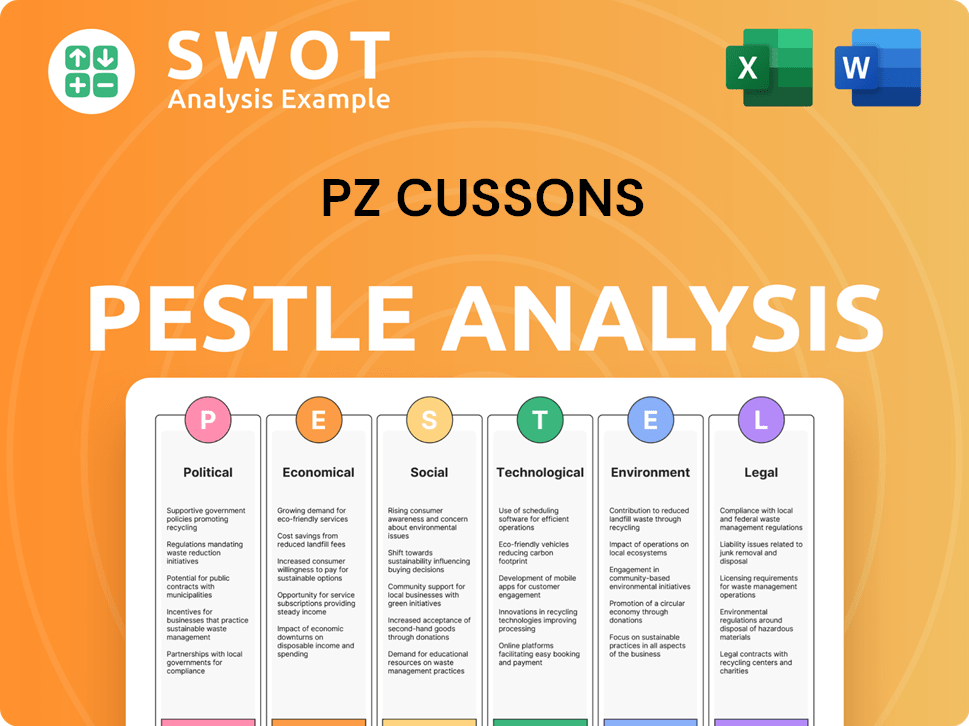

PZ Cussons PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped PZ Cussons’s Business Model?

PZ Cussons has navigated a dynamic market landscape, marked by strategic shifts and operational adjustments. The company's journey includes significant milestones that have shaped its business model and financial outcomes. Recent strategic moves reflect a focus on core strengths and adaptability to evolving consumer preferences and global economic conditions. Understanding these elements is crucial for assessing the company's performance and future prospects.

A key aspect of PZ Cussons' evolution has been its strategic portfolio optimization. This involves divesting non-core businesses to concentrate on personal care, home care, and baby product categories. Such actions have allowed the company to streamline operations and allocate resources to higher-growth segments. Furthermore, PZ Cussons has addressed operational challenges, including supply chain disruptions and fluctuating raw material costs, through efficiency programs and localized sourcing strategies.

The company's competitive edge stems from its strong brand equity, extensive distribution networks, and deep understanding of local markets. Brands like Imperial Leather and Carex benefit from decades of consumer trust, providing a significant barrier to entry for new competitors. PZ Cussons continues to adapt to new trends, such as the growing demand for sustainable and ethically sourced products, by investing in product innovation and reformulating its offerings. For a detailed look at the company's strategic growth, consider reading about the Growth Strategy of PZ Cussons.

PZ Cussons' history includes significant milestones that have shaped its current operations. These include market entries, acquisitions, and divestitures. The company's expansion into various markets, particularly in Africa and Asia, has been a critical factor in its growth.

Recent strategic moves have focused on portfolio optimization and operational efficiency. Divestitures of non-core businesses, such as the Nigerian milk business in 2023, have allowed PZ Cussons to concentrate on its core segments. Efficiency programs have been implemented to mitigate the impact of supply chain disruptions.

PZ Cussons' competitive advantages include strong brand equity, extensive distribution networks, and localized market knowledge. Brands like Imperial Leather and Carex benefit from decades of consumer trust. The company's presence in diverse markets provides economies of scale and deep insights into regional consumer preferences.

The company is adapting to the growing demand for sustainable and ethically sourced products. PZ Cussons is investing in product innovation and reformulating its offerings to meet evolving consumer expectations. This includes launching products with more natural ingredients and recyclable packaging.

In recent financial reports, PZ Cussons has demonstrated resilience in the face of economic challenges. The company's focus on core categories has yielded positive results, with strategic moves aimed at improving operational efficiency. The divestiture of the Nigerian milk business in 2023 is an example of portfolio optimization.

- The company's revenue streams are primarily from personal care, home care, and baby products.

- PZ Cussons has a significant presence in Africa and Asia, contributing substantially to its revenue.

- Efficiency programs and local sourcing initiatives have helped mitigate supply chain disruptions.

- The company continues to invest in product innovation to meet evolving consumer demands.

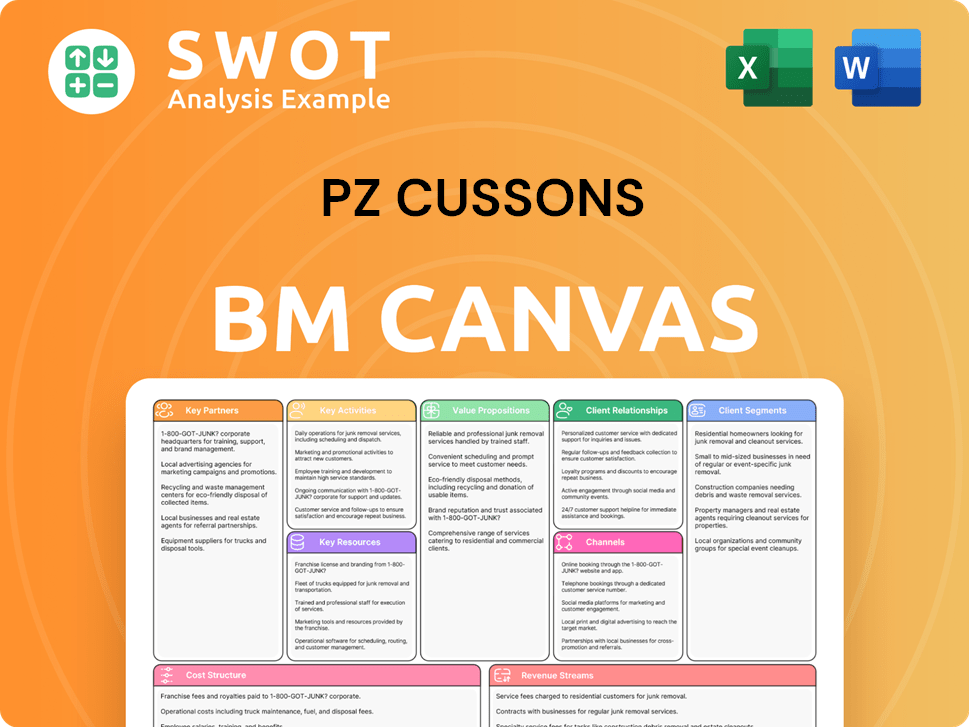

PZ Cussons Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is PZ Cussons Positioning Itself for Continued Success?

PZ Cussons maintains a strong industry position, particularly in the consumer goods sector. Its presence is notable in regions like the UK, Australia, and parts of Africa and Asia. The company competes with major players such as Unilever and Procter & Gamble, while also leveraging its strong brand recognition and distribution networks in key markets. This helps PZ Cussons maintain a competitive edge, as highlighted in analyses of its Growth Strategy of PZ Cussons.

Several risks could affect PZ Cussons' operations and profitability. These include fluctuating raw material prices, currency exchange rate volatility, and intense competition. Additional challenges arise from evolving consumer preferences and geopolitical instability in some markets. Regulatory changes also pose potential risks to the company's operations.

PZ Cussons has a solid position in the global consumer goods market. It competes with large multinational companies and local players, with strong brand loyalty in key markets. Its localized strength is demonstrated by its market share in specific categories, like hand wash with Carex in the UK.

The company faces risks from volatile raw material costs and currency fluctuations. Intense competition and shifts in consumer preferences towards niche brands are also challenges. Regulatory changes and geopolitical instability in key markets, particularly in Africa, further pose risks.

PZ Cussons is focused on brand building and product innovation. It plans to expand in high-growth emerging markets. The company is committed to digital transformation for enhanced consumer engagement and operational efficiency, strengthening its supply chain and making selective acquisitions.

The company aims to achieve sustainable growth through brand building and product innovation. It is focused on expanding its presence in emerging markets. Emphasis is placed on digital transformation, supply chain resilience, and strategic acquisitions.

PZ Cussons is concentrating on premiumization, cost efficiencies, and leveraging its brand portfolio. This strategy is designed to capitalize on long-term consumer trends in personal care and hygiene. Key areas of focus include innovation in the health, hygiene, and wellness categories.

- Continued investment in brand building.

- Product innovation in health, hygiene, and wellness.

- Expansion into high-growth emerging markets.

- Digital transformation for consumer engagement.

PZ Cussons Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of PZ Cussons Company?

- What is Competitive Landscape of PZ Cussons Company?

- What is Growth Strategy and Future Prospects of PZ Cussons Company?

- What is Sales and Marketing Strategy of PZ Cussons Company?

- What is Brief History of PZ Cussons Company?

- Who Owns PZ Cussons Company?

- What is Customer Demographics and Target Market of PZ Cussons Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.