Skylark Bundle

How Does Skylark Company Thrive in Japan's Restaurant Scene?

Skylark Holdings Co., Ltd. dominates Japan's family restaurant landscape, operating over 3,000 eateries under diverse brands like Gusto and Bamiyan. Its strategic acquisitions and expansion efforts, including moves in 2024 and 2025, highlight its dynamic approach to market growth. With a focus on affordable dining experiences, Skylark caters to a broad customer base with a variety of cuisines.

Understanding Skylark SWOT Analysis is crucial for investors and industry observers seeking to understand the company's resilience and future potential. Skylark's robust financial performance, including a significant increase in operating profit in fiscal year 2024, showcases its ability to navigate challenges. This analysis will explore How Skylark Works, examining its operational model, revenue streams, and strategic initiatives that drive its sustained growth within the competitive restaurant industry. The Skylark platform's success is a testament to its effective business model.

What Are the Key Operations Driving Skylark’s Success?

The Skylark Company operates a vast network of approximately 3,000 restaurants, primarily within Japan, offering a diverse range of dining experiences. Its business model centers around providing affordable and accessible meals across various cuisines, catering to a broad customer base. The company's success is rooted in its ability to efficiently manage operations and adapt to evolving customer preferences.

The Skylark platform ensures operational efficiency through an integrated supply chain, spanning from food procurement to home delivery. This strategic approach allows the company to control costs and maintain quality, which is crucial for offering competitive pricing. Furthermore, the company leverages technology to enhance the customer experience, including digital menus and AI-driven services.

The Skylark services extend beyond traditional dining, embracing digital innovations to streamline operations and improve customer convenience. The company's ability to adapt its business formats and integrate technology highlights its commitment to providing value and maintaining a competitive edge in the restaurant industry.

The company operates nearly two dozen brands, including well-known names such as Gusto, Bamiyan, and Syabu-Yo. Gusto alone accounts for almost half of the total sales. This diverse portfolio allows Skylark Company to cater to a wide range of customer preferences and market segments.

A key aspect of how Skylark works is its integrated supply chain. This system manages food procurement, production, logistics, preparation, and home delivery. This integration helps maintain quality and control costs, contributing to the company's ability to offer competitive pricing.

The company utilizes technology to enhance customer experience and streamline operations. This includes digital menus introduced in 2020 and the deployment of cat-shaped delivery robots in 2022. In September 2024, they began testing an AI-powered system to interact with customers.

While primarily focused in Japan, Skylark has expanded internationally. By March 2025, it operated 80 stores in Taiwan, and had a presence in Malaysia and the United States. This expansion strategy supports its growth and market diversification.

The Skylark business model is built on its core capabilities, including a diverse brand portfolio, an efficient supply chain, and technological innovation. These capabilities translate into tangible benefits for customers.

- Diverse Dining Options: Offering a wide variety of cuisines to cater to different tastes.

- Affordability: Providing accessible and competitively priced meals.

- Improved Service: Enhancing customer experience through digital innovations and efficient operations.

- Adaptability: Flexibility in adapting business formats to meet changing market demands.

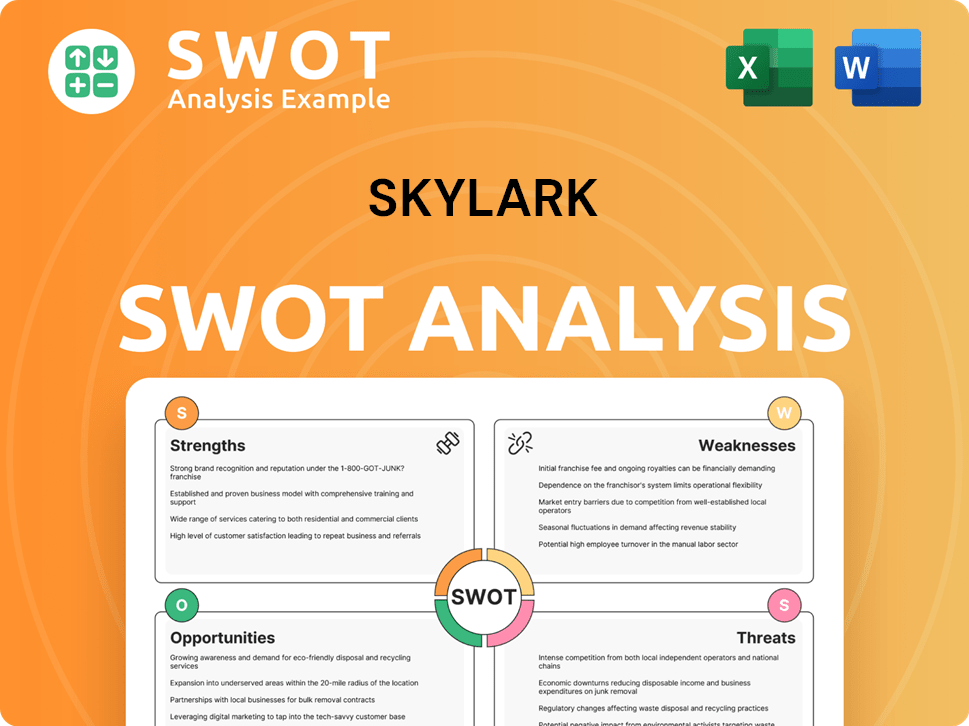

Skylark SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Skylark Make Money?

The core of the Skylark Company's revenue generation revolves around its extensive restaurant operations. This includes sales from a diverse portfolio of brands. The company's financial performance shows a strong revenue stream, with a substantial increase year-over-year.

As of March 31, 2025, the trailing 12-month revenue reached $2.74 billion. For the fiscal year ending December 31, 2024, total revenue was 401,130 million yen, marking an increase of 46,299 million yen compared to the previous year. The company's operating profit for FY2024 reached 24.1 billion yen, and is projected to rise to 25.0 billion yen in FY2025. For the three-month period ended March 31, 2025, revenue was 111,670 million yen, a significant increase of 16.8% year-on-year.

The primary revenue stream comes from in-store dining across its numerous restaurant brands, such as Gusto, Bamiyan, and Syabu-Yo. Gusto alone accounts for nearly half of the company's total sales. Beyond direct product sales, Skylark services also include food delivery, contributing to overall revenue. This demonstrates how the Skylark business model is structured to optimize earnings.

The company employs several monetization strategies to boost revenue. Price revisions, implemented in 2024, contributed to income growth through increased same-store sales. Furthermore, Skylark features a three-tiered delivery service model to enhance efficiency. This model includes orders taken and delivered by Skylark, orders taken by Skylark and delivered by a third party, and orders taken and delivered by a third party.

- As of December 2024, 732 stores had implemented the third-party delivery scheme.

- The company focuses on new store openings, brand conversions, and store renovations, especially for successful specialty brands.

- Acquisitions, such as Sukesan Udon noodle shops in 2024 and a Malaysian restaurant operator in 2025, also contribute to expanding revenue sources and business scale.

- For more information on the company's financial performance, you can read about the Owners & Shareholders of Skylark.

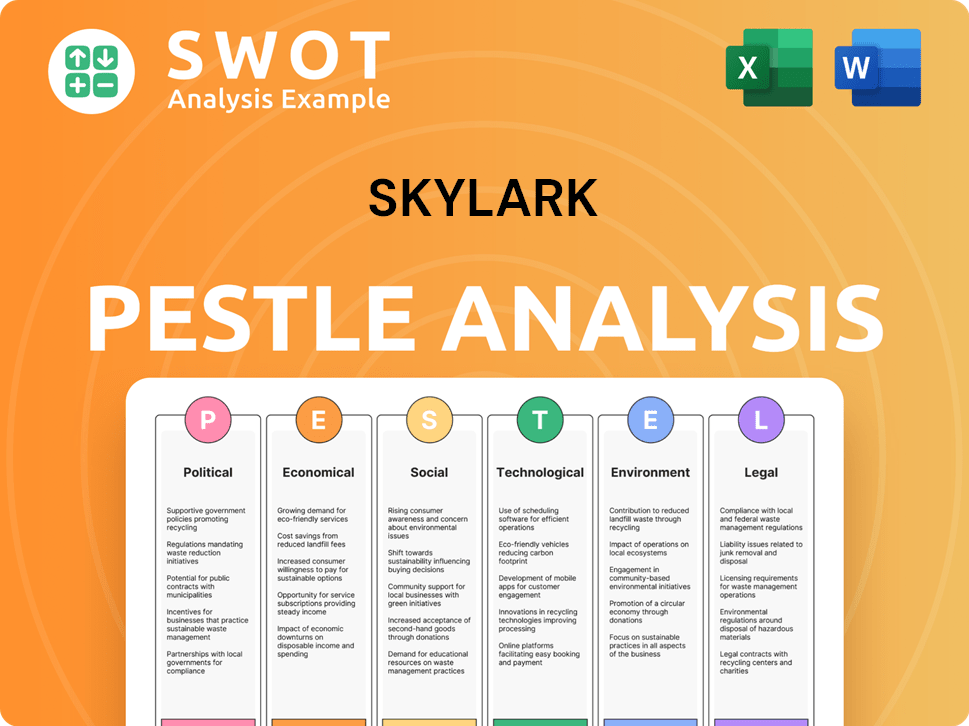

Skylark PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Skylark’s Business Model?

The operational and financial trajectory of Skylark Holdings, a prominent player in the restaurant industry, has been marked by significant milestones and strategic maneuvers. A notable achievement was the substantial recovery in fiscal year 2024, with operating profit increasing dramatically. Furthermore, the company's revenue for the three-month period ending March 31, 2025, showed a robust year-on-year increase, signaling strong growth.

Skylark's strategic moves, particularly in acquisitions, have been pivotal in expanding its business. The acquisitions of Sukesan, K.K., and Createries Consultancy Sdn. Bhd. (CC Group) are prime examples of this strategy. These moves not only broaden the company's operational scope but also open doors to new markets and opportunities, enhancing its overall business scale. These actions highlight how the Growth Strategy of Skylark is unfolding.

Addressing operational challenges and maintaining a competitive edge are central to Skylark's approach. Initiatives like price revisions, productivity enhancements through personnel training, and digital transformation efforts demonstrate the company's commitment to adapting to market dynamics. These efforts, combined with its strong market position and efficient operations, solidify Skylark's competitive advantage.

Skylark's operating profit grew 2.1 times to 24.1 billion yen in fiscal year 2024. Revenue for the three months ending March 31, 2025, reached 111,670 million yen, a 16.8% year-on-year increase. In FY2025, a 3.4% increase to 25.0 billion yen in operating profit is projected.

Acquisition of Sukesan, K.K. in October 2024 for ¥24.0 billion. Acquisition of Createries Consultancy Sdn. Bhd. (CC Group) in January 2025, entering the Halal restaurant market. These acquisitions are aimed at expanding the company's overall business scale.

Japan's largest family restaurant chain operator with over 3,000 restaurants. Efficient, integrated supply chain from food procurement to home delivery. Flexibility in changing business formats and focus on digital initiatives. Commitment to ESG initiatives, including being selected as a component of the Dow Jones Sustainability Asia/Pacific Index in December 2024.

Price revisions in 2024 to address rising costs. Focus on improving productivity through personnel training. Digital transformation initiatives, including digital menus and AI Robo trials, to enhance customer experience.

Skylark has actively embraced digital transformation to improve customer experience and operational efficiency. The introduction of digital menus in 2020 and cat-shaped robot waiters in 2022 are examples of this. A trial of an AI Robo was conducted in September 2024 to further enhance customer service.

- Digital menus enhance order accuracy and speed.

- Robotic waiters improve service efficiency.

- AI Robo trials aim to personalize customer interactions.

- These initiatives contribute to Skylark's competitive advantage.

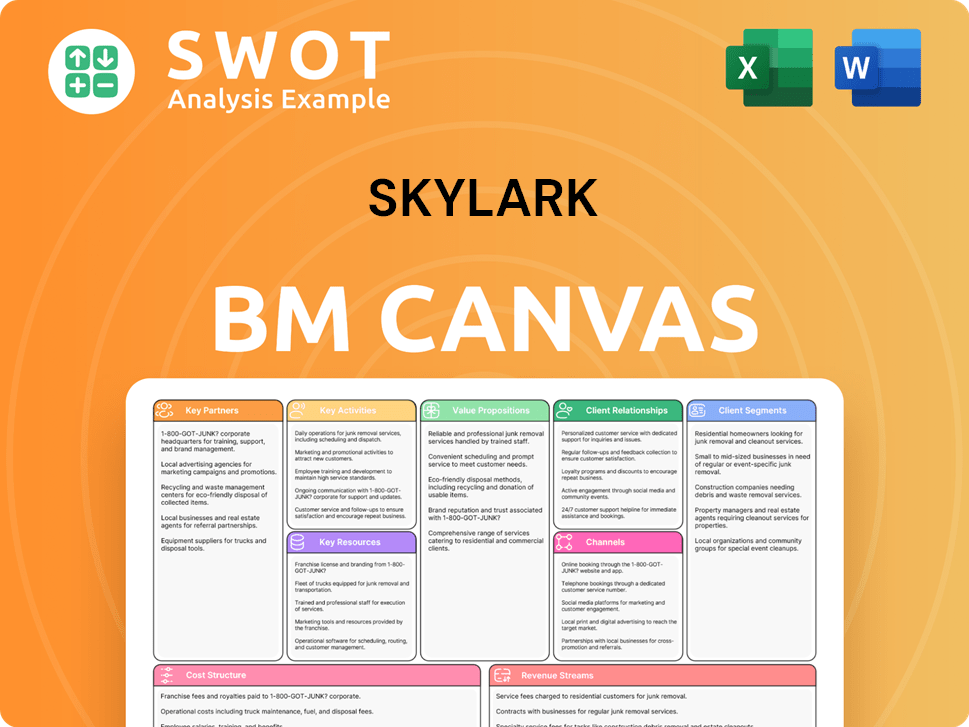

Skylark Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Skylark Positioning Itself for Continued Success?

As of December 31, 2024, Skylark Holdings Co., Ltd. stands as Japan's largest family restaurant chain operator, a testament to its robust industry position. With over 3,000 restaurants across Japan and internationally, the company's extensive network and diverse brand portfolio, including Gusto and Bamiyan, cater to a wide array of consumer preferences.

The company's financial performance underscores its market dominance; its revenue for the trailing 12 months as of March 31, 2025, reached $2.74 billion. Furthermore, the company's ability to maintain and grow same-store sales, which were 109.7% compared to the previous year for the three-month period ended March 31, 2025, indicates strong customer loyalty and operational efficiency.

Skylark faces several risks common to the restaurant industry, including rising food prices and personnel expenses, which can impact profitability. These challenges require ongoing price adjustments and cost-reduction efforts. The company must also adapt to new competitors and shifting consumer preferences to remain competitive. Regulatory changes, particularly in food safety and labor laws, present additional operational challenges.

The restaurant industry is highly competitive, with new entrants and evolving consumer tastes posing continuous threats to Skylark's market share. Competitors may offer similar dining experiences or leverage innovative technologies to attract customers. The company identifies 31 types of risks that are addressed by its Group Risk and Compliance Committee, including emerging risks such as water shortages due to population growth and climate change.

Skylark's medium-term management plan, established in May 2024 and extending to fiscal year 2027, outlines key growth strategies. These include new store growth in Japan, expansion of existing stores, international expansion, and strategic mergers and acquisitions (M&A). The company plans to open 65 to 75 new stores in Japan in fiscal year 2025.

The company aims to open 300 stores in Japan between 2025 and 2027. Internationally, Skylark intends to open 12 stores in Taiwan and 6 stores in Malaysia (3 Syabu-Yo and 3 SUKI-YA) in 2025, with a goal of 100 international store openings from 2025 to 2027. Furthermore, Skylark continues to actively pursue M&A opportunities to expand its business scale.

Skylark Company is focused on strategic initiatives to ensure sustained growth and profitability. The company emphasizes improving productivity through personnel training and digital transformation. Additionally, its commitment to ESG initiatives reflects a forward-looking perspective on sustainable growth.

- New store growth (domestic)

- Existing store growth

- Overseas expansion

- Pursuit of M&A

For more details on the company's history and development, you can refer to Brief History of Skylark.

Skylark Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Skylark Company?

- What is Competitive Landscape of Skylark Company?

- What is Growth Strategy and Future Prospects of Skylark Company?

- What is Sales and Marketing Strategy of Skylark Company?

- What is Brief History of Skylark Company?

- Who Owns Skylark Company?

- What is Customer Demographics and Target Market of Skylark Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.